The global marketplace for 3c sic presents vast opportunities and challenges for international B2B buyers aiming to source high-quality materials efficiently and cost-effectively. As industries across Africa, South America, the Middle East, and Europe — including emerging markets such as Vietnam and Kenya — continue to expand, understanding the intricacies of 3c sic becomes essential for securing competitive advantages. This guide serves as a definitive resource to demystify the complex landscape of 3c sic procurement.

3c sic is a critical component in numerous industrial applications, valued for its unique properties and performance characteristics. Buyers must navigate diverse product types, material grades, and manufacturing processes, all of which directly impact quality and price. Moreover, the global supply chain for 3c sic involves a variety of suppliers with differing standards, making rigorous quality control and supplier vetting indispensable.

This comprehensive guide covers:

By leveraging the insights and actionable intelligence provided here, international B2B buyers will be empowered to make informed sourcing decisions, minimize risks, and maximize value. Whether you represent a growing enterprise in Nairobi, a manufacturing hub in São Paulo, or a trading company in Dubai, this guide equips you to confidently engage with the global 3c sic market and drive sustainable business growth.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 3C SIC Standard | Core classification with broad industry categories | Market segmentation, compliance, and reporting | + Widely recognized, easy integration – May lack granularity |

| 3C SIC Enhanced | Detailed subcategories with expanded codes | Targeted marketing, niche analysis | + High specificity – More complex to implement |

| 3C SIC Regional Adaptation | Customized for regional economic structures | Local market entry, regulatory alignment | + Tailored to local markets – Limited cross-region comparability |

| 3C SIC Digital Index | Incorporates digital economy and tech sectors | E-commerce, tech supply chains | + Reflects modern industries – Rapidly evolving, may require frequent updates |

| 3C SIC Sustainability Focus | Emphasizes environmental and social governance sectors | ESG reporting, sustainable sourcing | + Supports CSR initiatives – May not cover all traditional sectors |

3C SIC Standard

This is the foundational classification system widely used for categorizing industries into broad sectors. It suits companies aiming for straightforward market segmentation and compliance reporting. For B2B buyers, its main advantage is universal recognition, facilitating communication and data exchange across borders. However, it may not provide the detailed granularity needed for highly specialized procurement decisions, which could limit its effectiveness in nuanced supply chain analysis.

3C SIC Enhanced

An advanced version of the standard system, the Enhanced 3C SIC includes more detailed subcategories that allow businesses to drill down into niche markets and specific industry segments. This is particularly useful for B2B buyers looking to identify highly specialized suppliers or partners. While it offers precision, the increased complexity requires more sophisticated data management and may pose challenges in integration with existing systems.

3C SIC Regional Adaptation

This variation tailors the classification to reflect the unique economic and industrial landscapes of specific regions such as Africa, South America, the Middle East, and Europe. It is ideal for international B2B buyers focusing on local market entry or regulatory compliance. Although it improves relevance and accuracy for regional sourcing, it can complicate cross-regional benchmarking and requires understanding of local classification nuances.

3C SIC Digital Index

Designed to incorporate emerging digital and technology sectors, this type addresses the growing importance of e-commerce, IT services, and digital supply chains. It benefits B2B buyers engaged in tech-driven industries by providing a current and relevant classification framework. The downside is the fast-paced evolution of digital sectors, which demands frequent updates to maintain accuracy and applicability.

3C SIC Sustainability Focus

This variant highlights companies and industries based on environmental, social, and governance (ESG) criteria, supporting sustainable sourcing and corporate social responsibility initiatives. B2B buyers committed to sustainability can leverage this classification for ESG reporting and supplier evaluation. However, it may not comprehensively cover traditional industries, and buyers should complement it with other classifications for a full market view.

Related Video: Sicilian Defense ALL Variations Explained [Chess Opening Crash Course]

| Industry/Sector | Specific Application of 3c sic | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-performance power semiconductor devices | Enhanced efficiency, thermal management, and reliability | Ensure certification standards (e.g., ISO, RoHS), supplier traceability, and material purity |

| Automotive Industry | Electric vehicle (EV) power modules and inverters | Improved energy density and durability under harsh conditions | Source from suppliers with automotive-grade quality and long-term supply capability |

| Renewable Energy | Solar inverters and wind turbine converters | Increased conversion efficiency and reduced system losses | Prioritize suppliers offering custom SiC solutions and global logistics support |

| Industrial Automation | Motor drives and robotics control systems | Higher switching frequencies leading to compact, energy-saving designs | Verify compliance with industrial standards and availability of technical support |

| Telecommunications | RF and microwave components | Superior thermal conductivity and frequency performance | Focus on suppliers with advanced fabrication technology and scalability options |

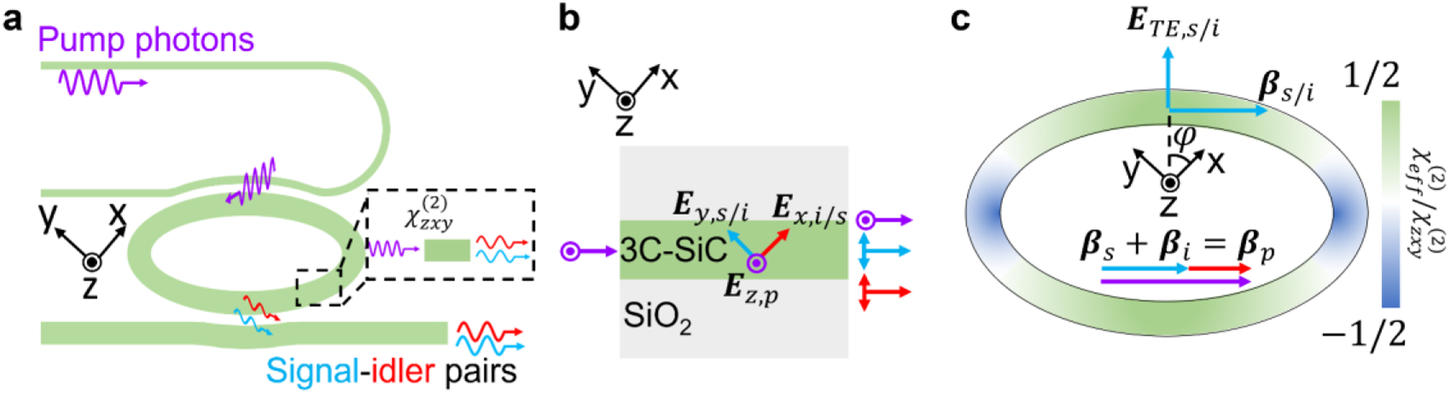

3c SiC is widely used in power semiconductor devices such as diodes and MOSFETs, critical for power electronics applications. It offers superior thermal conductivity and higher breakdown voltage compared to traditional silicon, enabling devices to operate efficiently at higher temperatures and voltages. For international buyers, especially in emerging markets like Kenya and Vietnam, it is crucial to select suppliers who provide materials meeting international certifications and can guarantee consistent quality to ensure long-term device reliability.

In the automotive sector, particularly for electric vehicles, 3c SiC is essential for power modules and inverters that convert and control electrical energy. Its robustness under high temperature and stress conditions improves vehicle efficiency and extends battery life. Buyers from regions such as South America and the Middle East should focus on sourcing from suppliers who comply with automotive industry standards (e.g., IATF 16949) and offer stable supply chains to support production scaling.

The renewable energy sector benefits from 3c SiC in solar inverters and wind turbine converters, where high power conversion efficiency is critical. 3c SiC’s ability to reduce energy losses translates directly into higher system output and lower operational costs. International B2B buyers should prioritize vendors capable of providing tailored SiC components that meet specific environmental conditions and offer global shipping solutions to minimize lead times.

In industrial automation, 3c SiC enhances motor drives and robotics control systems by enabling higher switching frequencies and more compact power electronics. This results in lower energy consumption and improved system responsiveness. Buyers from Europe and Africa should consider suppliers with proven industrial compliance and who provide technical support for integration into complex automation systems.

3c SiC is increasingly used in RF and microwave components for telecommunications infrastructure, offering superior thermal management and frequency performance. This leads to more reliable and efficient signal transmission in base stations and satellite communications. For B2B buyers in diverse markets, it is important to select suppliers with advanced fabrication capabilities and the ability to scale production according to network expansion demands.

Related Video: Uses and Gratifications Theory

Silicon carbide is a premier material in the 3c sic category due to its exceptional hardness, thermal conductivity, and chemical inertness. It withstands high temperatures (up to 1600°C) and aggressive chemical environments, making it ideal for high-performance mechanical seals and wear parts. SiC offers excellent corrosion resistance against acids and alkalis, which is critical for chemical processing industries.

Pros: Outstanding durability and wear resistance; excellent thermal shock resistance; low friction coefficient.

Cons: Higher manufacturing complexity and cost compared to traditional ceramics; brittle nature requires careful handling.

Application Impact: Perfect for abrasive and corrosive media, including slurries and acids.

International Buyer Considerations: Compliance with ASTM C799 and DIN EN 60672 standards is common. Buyers in Africa and the Middle East should verify local import regulations for ceramics and ensure suppliers provide certification for chemical purity and mechanical strength. European buyers often demand adherence to ISO 9001 quality management systems, while South American buyers may prioritize cost-effective sourcing with reliable performance.

Alumina is a widely used ceramic material in 3c sic applications due to its excellent hardness, electrical insulation, and moderate thermal conductivity. It operates effectively up to 1700°C and offers good corrosion resistance, especially in neutral and mildly acidic environments.

Illustrative Image (Source: Google Search)

Pros: Cost-effective; good wear resistance; well-established manufacturing processes; excellent electrical insulation.

Cons: Less resistant to strong alkalis and hydrofluoric acid compared to SiC; lower thermal conductivity.

Application Impact: Suitable for general-purpose seals and insulating components in less aggressive chemical environments.

International Buyer Considerations: ASTM C799 and JIS R1601 standards apply frequently. Buyers from Vietnam and Kenya should consider local supplier capabilities for consistent alumina quality and verify compliance with international standards. European buyers may require RoHS and REACH compliance for environmental safety, while Middle Eastern clients focus on material traceability and performance under high-temperature conditions.

Zirconia stands out for its exceptional toughness and resistance to crack propagation, making it a preferred choice for components requiring high mechanical strength and impact resistance. It performs well up to about 1200°C and has good chemical resistance, particularly in acidic environments.

Pros: Superior fracture toughness; excellent wear resistance; good corrosion resistance in acidic media.

Cons: Higher cost than alumina; lower thermal conductivity than SiC; limited use in highly alkaline environments.

Application Impact: Ideal for dynamic seals and components subject to mechanical shock and impact.

International Buyer Considerations: ASTM F2094 and ISO 13356 standards are relevant. Buyers in South America and Africa should assess supplier capability for consistent zirconia stabilization and verify certifications. European buyers often require compliance with CE marking and environmental regulations, while Middle Eastern buyers prioritize durability under fluctuating temperature and pressure conditions.

Silicon nitride is valued for its excellent mechanical strength, thermal shock resistance, and chemical stability. It operates reliably up to 1400°C and offers superior fracture toughness compared to traditional ceramics.

Pros: High strength and toughness; excellent thermal shock resistance; good corrosion resistance in oxidizing environments.

Cons: Complex and costly manufacturing process; limited availability compared to SiC and alumina.

Application Impact: Best suited for high-stress mechanical components and seals exposed to rapid temperature changes.

International Buyer Considerations: Compliance with ASTM C1275 and JIS R1607 is typical. Buyers in Europe and the Middle East should ensure suppliers provide detailed material data sheets and traceability. African and South American buyers may focus on balancing performance with cost, negotiating long-term supply contracts to mitigate price volatility.

| Material | Typical Use Case for 3c sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | High-performance mechanical seals, wear parts in corrosive environments | Exceptional hardness and corrosion resistance | Brittle, high manufacturing complexity | High |

| Alumina | General-purpose seals and electrical insulators in mild chemical conditions | Cost-effective with good wear resistance | Less resistant to strong alkalis and acids | Low |

| Zirconia | Dynamic seals and impact-resistant components | Superior fracture toughness and wear resistance | Higher cost, limited alkaline resistance | Medium |

| Silicon Nitride | High-stress mechanical components with thermal shock exposure | Excellent toughness and thermal shock resistance | Complex manufacturing, limited availability | High |

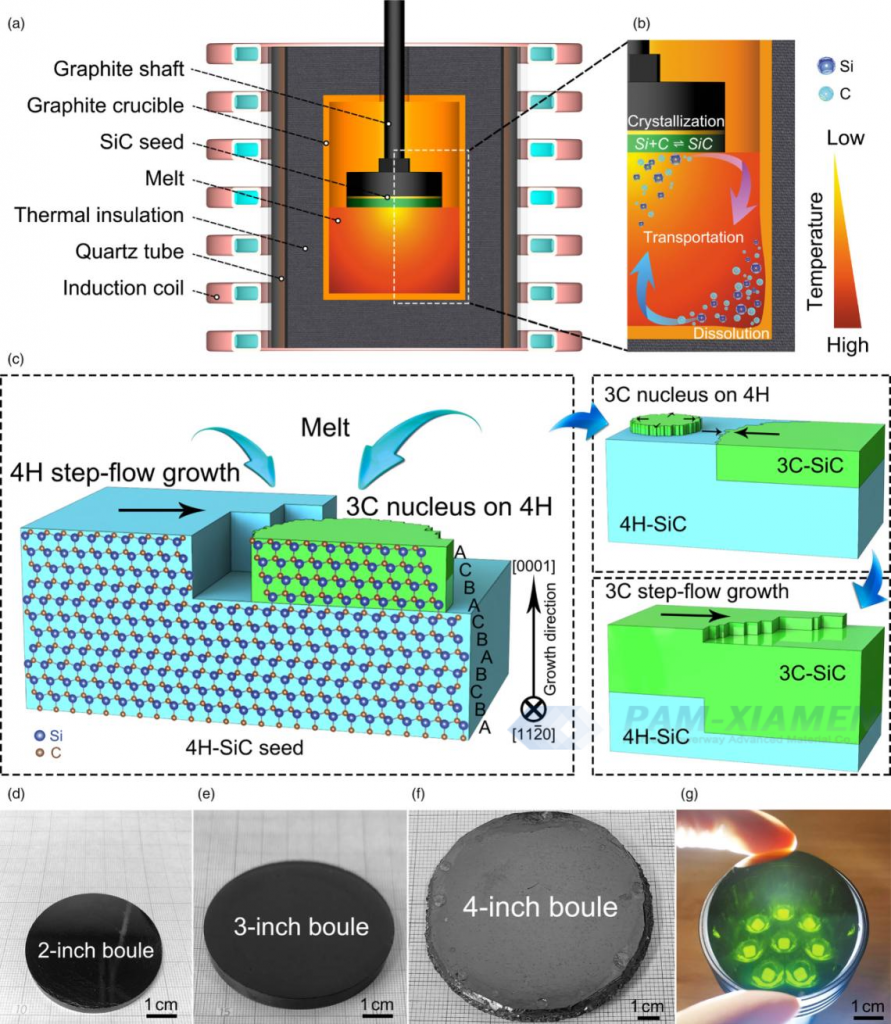

The production of 3C Silicon Carbide (3C SiC) components involves a series of precise and technologically advanced manufacturing stages. Understanding these stages can help B2B buyers from diverse markets—including Africa, South America, the Middle East, and Europe—evaluate suppliers’ capabilities effectively.

The initial phase focuses on raw material selection and preparation. High-purity silicon and carbon sources are carefully processed to form the 3C SiC polytype, which is the cubic crystalline form of silicon carbide. This involves:

Forming 3C SiC typically involves epitaxial growth techniques such as:

Each method requires tightly controlled temperature, pressure, and gas flow parameters to ensure crystalline quality, uniform thickness, and minimal defects.

Once the 3C SiC material is formed, it undergoes assembly processes depending on the end product:

Finishing ensures that the components meet functional and aesthetic specifications:

Quality assurance (QA) is paramount in 3C SiC manufacturing, given the material’s critical role in high-performance electronics and power devices. International B2B buyers should scrutinize suppliers’ QA systems to mitigate risks and ensure compliance.

Suppliers typically implement multi-level QC checkpoints throughout the manufacturing cycle:

International buyers must employ strategic approaches to verify and validate supplier QA capabilities:

When sourcing 3C SiC components internationally, buyers should consider regional and regulatory nuances:

By thoroughly understanding the manufacturing processes and quality assurance mechanisms for 3C SiC, B2B buyers across diverse international markets can make informed sourcing decisions that mitigate risk, ensure product reliability, and support strategic business growth.

When sourcing 3c sic products for international B2B transactions, understanding the detailed cost structure and pricing dynamics is essential for making informed purchasing decisions. This section breaks down the key cost components, price influencers, and actionable buyer tips tailored for markets in Africa, South America, the Middle East, and Europe.

All pricing insights provided are indicative and subject to change based on market fluctuations, supplier negotiations, and geopolitical factors. Buyers are encouraged to conduct thorough due diligence and obtain multiple quotes to ensure competitive and transparent pricing.

By carefully analyzing these cost components and pricing influencers, international B2B buyers can optimize their sourcing strategy for 3c sic products, achieving cost-efficiency while maintaining quality and supply chain reliability.

Understanding the technical specifications of 3c sic is crucial for international B2B buyers to ensure product quality, compatibility, and compliance with regional standards. Here are the key properties to consider:

Material Grade

The grade of 3c sic refers to its purity and composition, which affects performance characteristics such as thermal conductivity and mechanical strength. Higher grades typically offer better durability and efficiency but may come at a premium cost. For buyers in Africa, South America, the Middle East, and Europe, specifying the correct grade ensures product longevity and suitability for local operating conditions.

Dimensional Tolerance

This indicates the allowable deviation from the specified dimensions during manufacturing. Tight tolerances are essential for applications requiring precise fitting, such as in electronics or automotive parts. International buyers should clarify tolerance requirements upfront to avoid compatibility issues and costly reworks.

Thermal Stability

3c sic’s ability to maintain performance under varying temperature ranges is vital, especially in industries like aerospace or heavy machinery. Buyers should request detailed thermal stability data to ensure the material withstands the environmental conditions of their target market.

Electrical Conductivity

For buyers sourcing 3c sic for electronic applications, understanding its electrical conductivity or resistivity is key. This property affects signal integrity and power efficiency. Sellers should provide standardized test results to facilitate comparison and decision-making.

Surface Finish

The surface texture and finish impact assembly, adhesion, and wear resistance. Buyers should specify surface finish standards relevant to their application to minimize downstream processing and ensure optimal performance.

Chemical Resistance

Depending on the end-use, chemical resistance may be critical to prevent degradation. Buyers operating in harsh chemical environments, such as mining or oil & gas sectors, must verify this property to ensure product reliability.

Navigating international B2B trade requires familiarity with certain key terms that streamline communication and negotiation:

OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products used in another company's final product. Buyers often seek OEM-certified 3c sic to guarantee authenticity and quality assurance.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. Understanding MOQ is essential for budgeting and inventory management, especially for smaller buyers or those testing new markets.

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers asking for price and terms. A clear and detailed RFQ accelerates the procurement process and reduces misunderstandings.

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities regarding shipping, insurance, and tariffs. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Buyers should negotiate Incoterms carefully to manage risk and control costs.

Lead Time

The period from order placement to delivery. Accurate lead time information helps buyers plan production schedules and manage supply chains effectively.

Quality Certification

Certifications such as ISO, CE, or RoHS indicate compliance with international quality and safety standards. Buyers should require relevant certifications to meet local regulations and customer expectations.

For B2B buyers from diverse regions like Africa, South America, the Middle East, and Europe, mastering these technical properties and trade terms empowers smarter sourcing decisions, fosters better supplier relationships, and mitigates risks in cross-border transactions. Clear specification and terminology alignment are foundational steps toward successful procurement of 3c sic materials.

Illustrative Image (Source: Google Search)

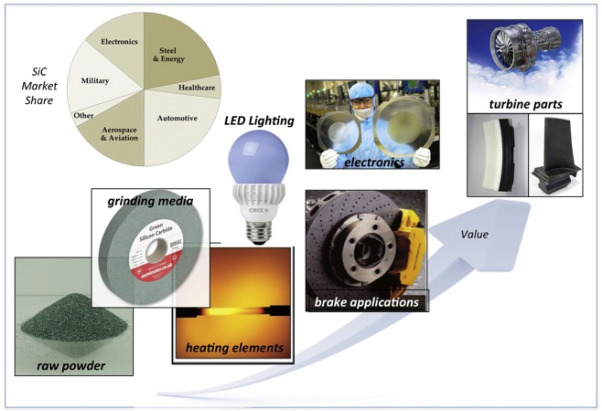

The 3C SIC sector, encompassing critical components such as ceramics, composites, and silicon carbide materials, is experiencing significant growth driven by its wide-ranging industrial applications—from automotive and aerospace to electronics and energy storage. Global demand is propelled by technological advancements requiring materials with exceptional thermal stability, wear resistance, and electrical properties. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding these dynamics is essential for strategic sourcing.

Emerging trends highlight a shift towards customized material solutions tailored to specific industrial needs, with suppliers increasingly leveraging advanced manufacturing techniques like additive manufacturing and precision sintering. This is particularly relevant for markets such as Kenya and Vietnam, where industrial modernization is accelerating. Additionally, the integration of Industry 4.0 technologies, including IoT-enabled quality control and real-time supply chain analytics, is reshaping procurement strategies, enabling buyers to optimize inventory and reduce lead times.

Market dynamics also reflect a growing preference for regional sourcing hubs to mitigate geopolitical risks and supply chain disruptions. Africa and South America are emerging as promising sourcing bases due to increasing investments in raw material extraction and processing facilities. Meanwhile, European buyers are prioritizing suppliers with strong compliance records and technological innovation capabilities. Across the Middle East, demand is driven by infrastructure development and the expansion of high-tech manufacturing sectors.

For international B2B buyers, leveraging these insights means prioritizing partnerships with suppliers who demonstrate agility, technological competence, and regional presence. Establishing long-term relationships with manufacturers capable of co-developing materials can deliver competitive advantages in performance and cost-efficiency.

Sustainability in the 3C SIC sector is no longer optional but a critical business imperative. The production of ceramics and silicon carbide materials is energy-intensive and can have a significant environmental footprint if not managed responsibly. B2B buyers must therefore focus on suppliers committed to reducing carbon emissions, minimizing waste, and optimizing resource use throughout the supply chain.

Ethical sourcing involves ensuring transparency and accountability in raw material procurement, particularly for minerals and precursor chemicals. Buyers from regions such as Europe and the Middle East increasingly demand certifications like ISO 14001 (Environmental Management) and adherence to frameworks such as the Responsible Minerals Initiative (RMI). These certifications validate that suppliers maintain sustainable practices, including responsible mining and fair labor standards.

The adoption of green materials—for example, bio-based binders or recycled silicon carbide powders—is gaining traction as companies seek to lower their environmental impact. Additionally, closed-loop manufacturing processes that recycle scrap materials contribute to circular economy goals and reduce dependency on virgin resources.

For B2B buyers, integrating sustainability criteria into vendor evaluation not only aligns with global regulatory trends but also strengthens brand reputation and meets the growing expectations of end customers. Collaborative efforts with suppliers to innovate eco-friendly materials and processes will be key to long-term sector viability.

The 3C SIC sector has evolved from traditional ceramic manufacturing into a high-tech domain driven by advances in material science and engineering. Historically, silicon carbide was valued mainly for its abrasive qualities, but recent decades have seen its transformation into a critical material for semiconductors, power electronics, and high-performance composites.

Illustrative Image (Source: Google Search)

This evolution has been fueled by rising demand for materials that withstand extreme conditions, such as high temperatures and corrosive environments. Innovations in processing technologies, including chemical vapor deposition and hot pressing, have expanded the functional applications of silicon carbide and related ceramics.

For B2B buyers, this historical context underscores the importance of sourcing from suppliers who not only provide standard products but also offer cutting-edge material solutions tailored to evolving industrial challenges. Recognizing the sector’s trajectory helps buyers anticipate future trends and invest in partnerships that drive innovation and competitive advantage.

How can I effectively vet suppliers of 3c sic to ensure reliability and quality?

Conduct thorough due diligence by requesting company certifications, client references, and production capacity details. Verify supplier legitimacy through trade platforms, official registries, and third-party audits. For buyers in Africa, South America, the Middle East, and Europe, it’s essential to confirm compliance with international standards and local regulations. Additionally, request samples for quality assessment and consider visiting the supplier’s facility or hiring local inspection agents to perform on-site audits before finalizing contracts.

Is customization of 3c sic products available, and what should I consider when requesting it?

Yes, many suppliers offer customization to meet specific technical or regulatory requirements. When requesting customization, clearly specify your product standards, dimensions, and performance criteria. Discuss minimum order quantities (MOQs) and lead times associated with customized orders, as these often differ from standard products. Ensure intellectual property and design rights are protected in your contract, and verify the supplier’s capability to deliver consistent quality for customized batches.

What are the typical minimum order quantities (MOQ) and lead times for 3c sic, especially for international buyers?

MOQs vary widely depending on the supplier and product complexity but typically range from a few hundred to several thousand units. Lead times depend on production schedules, customization needs, and shipping logistics, usually spanning 4 to 12 weeks. International buyers should factor in additional time for customs clearance and potential delays. Early communication with suppliers about order volume and delivery deadlines helps optimize scheduling and reduces risks of supply chain disruptions.

What payment terms are standard when purchasing 3c sic internationally, and how can I mitigate risks?

Common payment terms include a 30% upfront deposit with the balance paid upon shipment or delivery. Letters of credit (LCs) and escrow services provide additional security for international transactions. To mitigate risks, negotiate payment terms aligned with delivery milestones, verify supplier bank details independently, and avoid full upfront payments unless dealing with highly trusted partners. Using trade finance options or working with export credit agencies can also protect buyers in emerging markets.

Which quality assurance certifications should I look for when sourcing 3c sic?

Look for suppliers certified under ISO 9001 for quality management systems, and industry-specific certifications relevant to 3c sic products, such as RoHS, REACH, or CE marking for compliance with environmental and safety standards. Certifications from recognized testing bodies (e.g., SGS, TÜV) add credibility. Request documentation for batch testing, material traceability, and performance validation to ensure the product meets both international standards and local regulatory requirements.

What are the best logistics practices for shipping 3c sic internationally to regions like Africa, South America, and the Middle East?

Choose reliable freight forwarders experienced in handling specialized industrial goods. Opt for consolidated shipments if volumes are low to reduce costs, but ensure proper packaging to avoid damage. Understand customs regulations and import duties in your country to prevent delays. Use trackable shipping methods and secure cargo insurance. Collaborate closely with suppliers on documentation (e.g., commercial invoice, packing list, certificates) to facilitate smooth customs clearance.

How should disputes regarding quality or delivery issues of 3c sic be handled in international trade?

Establish clear dispute resolution clauses in your contract, including arbitration venues and applicable law. Document all communications, inspections, and deviations. If quality issues arise, request independent third-party inspections and negotiate corrective actions such as replacements, refunds, or discounts. Engage local trade chambers or export promotion agencies if necessary. Proactive communication and maintaining professional relationships often help resolve disputes amicably and preserve long-term partnerships.

Are there specific considerations for buyers from emerging markets like Kenya or Vietnam when sourcing 3c sic?

Buyers from emerging markets should prioritize suppliers familiar with export to these regions, as they understand local import regulations and market dynamics. Currency fluctuations and payment security are critical considerations; negotiate flexible payment terms or use hedging options. Additionally, ensure suppliers provide clear product certifications to meet local standards. Building strong communication channels and leveraging local trade support organizations can improve negotiation outcomes and supply chain reliability.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing in the context of 3c sic presents a compelling opportunity for international B2B buyers to optimize supply chains, enhance cost efficiency, and drive innovation. By focusing on comprehensive supplier evaluation, leveraging regional strengths, and embracing digital tools, businesses can secure competitive advantages in rapidly evolving markets. Buyers from Africa, South America, the Middle East, and Europe—regions with diverse economic landscapes—stand to benefit significantly by tailoring sourcing strategies that align with local capabilities and global standards.

Key takeaways include the importance of building resilient supplier relationships, prioritizing transparency and compliance, and adopting agile sourcing models that respond to market fluctuations. Strategic sourcing is not merely a cost-saving exercise but a vital component of sustainable growth and long-term value creation.

Looking ahead, international buyers should proactively invest in collaborative partnerships and data-driven decision-making to navigate complexities and seize emerging opportunities within the 3c sic ecosystem. Embracing innovation and regional integration will be crucial to unlocking new potential and maintaining competitiveness in the global arena. Now is the time to act decisively—transform your sourcing approach to drive success across borders and industries.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina