The global demand for advanced semiconductor materials is rapidly reshaping industries from automotive to aerospace, making the 4H SiC (silicon carbide) crystal structure a pivotal component in cutting-edge technology solutions. Renowned for its superior thermal conductivity, high breakdown electric field, and exceptional electron mobility, 4H SiC stands out as a key enabler for high-power, high-frequency, and high-temperature electronic devices. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding the nuances of 4H SiC is essential to securing competitive advantage and driving innovation.

This comprehensive guide delves deeply into the types of 4H SiC crystals, their unique material properties, and the latest manufacturing and quality control processes that ensure reliability and performance. Buyers will gain critical insights into the global supplier landscape, cost structures, and market trends to make informed purchasing decisions. Additionally, the guide addresses common challenges and provides answers to frequently asked questions, helping businesses navigate complexities with confidence.

Whether sourcing for high-precision industrial applications or exploring new technological frontiers, this resource empowers international buyers to optimize their procurement strategies. By bridging technical understanding with practical market intelligence, it supports the identification of trustworthy partners and cost-effective solutions tailored to diverse regional needs, including those of Italy, the UK, and beyond. Engaging with this guide positions your enterprise to thrive in the evolving semiconductor ecosystem powered by 4H SiC technology.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 4H-SiC (Hexagonal) | Four-layer hexagonal stacking sequence, wide bandgap | Power electronics, high-frequency devices | + High thermal conductivity, + Excellent breakdown voltage; - Higher cost compared to some polytypes |

| 4H-SiC with Doping | Controlled impurity introduction (N, Al, B) for conductivity tuning | Semiconductor devices, sensors | + Customizable electrical properties, + Enhanced device performance; - Requires precise manufacturing controls |

| 4H-SiC Epitaxial Layers | Thin, high-purity layers grown on 4H-SiC substrates | High-power transistors, RF amplifiers | + Superior surface quality, + Reduced defects; - Complex and costly growth processes |

| 4H-SiC Bulk Crystals | Large single crystals with uniform 4H stacking | Substrate for epitaxial growth, high-power devices | + Large wafer sizes available, + High mechanical strength; - Limited availability in some regions |

| Modified 4H-SiC | Variants with engineered defects or strain for specific properties | Specialized sensors, optoelectronic components | + Tailored electronic/optical characteristics; - Niche applications, potentially higher cost |

4H-SiC (Hexagonal):

This is the most common and commercially significant polytype of silicon carbide, characterized by a four-layer hexagonal stacking order. It offers a wide bandgap (~3.26 eV), high thermal conductivity, and excellent breakdown voltage, making it ideal for power electronics and high-frequency applications. B2B buyers should consider its higher cost relative to other SiC polytypes but justify it by the superior performance and reliability in demanding industrial environments.

4H-SiC with Doping:

Doping introduces specific impurities such as nitrogen or aluminum to modulate electrical conductivity and carrier concentration. This variation is crucial for semiconductor device manufacturing and sensor applications where precise electrical characteristics are required. Buyers should evaluate suppliers’ doping precision capabilities and quality control processes to ensure consistent device performance.

4H-SiC Epitaxial Layers:

Epitaxial growth involves depositing thin, high-purity 4H-SiC layers on bulk substrates, resulting in superior surface quality and reduced crystal defects. These layers are essential for manufacturing high-power transistors and RF amplifiers. For B2B procurement, attention must be paid to the epitaxial growth technology used, as it impacts wafer uniformity, defect density, and ultimately device yield and reliability.

4H-SiC Bulk Crystals:

Bulk 4H-SiC crystals serve as substrates for epitaxial growth and are prized for their large wafer sizes and mechanical robustness. They enable scaling of power device production and are critical for high-power industrial applications. Buyers should assess availability, wafer size options, and regional supply chain stability, especially when sourcing for large-scale manufacturing in Africa, South America, the Middle East, or Europe.

Modified 4H-SiC:

These are engineered variants of 4H-SiC where defects or strain are intentionally introduced to tailor electronic or optical properties for specialized sensors and optoelectronic devices. While offering unique performance advantages, these variations are often niche and may come at a premium. B2B buyers should carefully align product specifications with end-use requirements and consider supplier expertise in advanced material engineering.

Related Video: SiC Crystal Structure setup

| Industry/Sector | Specific Application of 4H SiC Crystal Structure | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-voltage, high-frequency power devices such as MOSFETs and diodes | Enhanced efficiency and thermal management in power conversion | Purity and defect density of 4H SiC crystals; supplier reliability; wafer size |

| Aerospace & Defense | Radiation-hardened sensors and high-temperature electronics | Increased durability under extreme environmental conditions | Compliance with aerospace standards; traceability; long-term supply contracts |

| Renewable Energy | Inverters and converters for solar and wind energy systems | Improved energy conversion efficiency and system longevity | Consistency in crystal quality; scalability of supply; cost-effectiveness |

| Automotive | Electric vehicle (EV) powertrain components | Higher power density and extended component lifespan | Quality certifications; supplier proximity for logistics; customization options |

| Industrial Automation | High-frequency RF and microwave devices for industrial control | Precision and reliability in harsh industrial environments | Technical support availability; customization capabilities; compliance with regional regulations |

The power electronics industry heavily leverages the 4H SiC crystal structure in manufacturing high-voltage MOSFETs and Schottky diodes. Its wide bandgap and superior thermal conductivity allow devices to operate at higher voltages and temperatures than traditional silicon. This translates into more efficient power conversion and reduced cooling costs, critical for businesses aiming to optimize operational expenses. For international buyers, especially in Africa and South America where infrastructure modernization is underway, sourcing high-purity 4H SiC wafers with low defect densities is paramount to ensure device reliability and performance.

In aerospace and defense, 4H SiC’s radiation hardness and thermal stability make it ideal for sensors and electronics exposed to harsh environments. Components built with 4H SiC can withstand extreme temperatures and cosmic radiation, enhancing mission success rates. Buyers from the Middle East and Europe must prioritize suppliers that comply with stringent aerospace quality standards and provide full traceability and certification. Establishing long-term agreements with trusted vendors can mitigate supply chain risks in this strategic sector.

The renewable energy sector benefits from 4H SiC-based inverters and converters that handle high power levels with minimal losses. This leads to higher energy yield and system reliability in solar and wind farms. African and South American markets, rapidly expanding renewable installations, require consistent crystal quality and scalable wafer supply to meet growing demand. Cost-effectiveness combined with technical support during integration is a key consideration for these buyers.

In the automotive industry, particularly electric vehicles, 4H SiC components enable higher power density and efficiency in powertrains. This improves vehicle range and reduces cooling system complexity. European and Middle Eastern manufacturers seek suppliers with robust quality certifications and the ability to customize wafers to specific automotive-grade standards. Proximity to suppliers also plays a role in reducing lead times for just-in-time manufacturing processes.

Finally, industrial automation employs 4H SiC in high-frequency RF and microwave devices critical for precision control in manufacturing. The material’s robustness supports reliable operation in high-temperature and electrically noisy environments. Buyers from all targeted regions must assess the technical support capabilities of suppliers and ensure compliance with local industrial regulations to optimize integration and maintenance of these critical components.

Related Video: Uses of Metals - Science 9

Key Properties: High-purity 4H SiC wafers exhibit exceptional thermal conductivity (up to 490 W/m·K), wide bandgap (~3.26 eV), and outstanding chemical inertness. They maintain structural integrity at temperatures exceeding 600°C and resist oxidation and corrosion in harsh chemical environments.

Pros & Cons: These wafers offer superior electronic performance, making them ideal for high-power and high-frequency semiconductor devices. However, manufacturing high-purity 4H SiC wafers is complex and costly due to stringent crystal growth and defect control requirements. The yield rates can be lower compared to other semiconductor materials, impacting overall cost-efficiency.

Impact on Application: Their robustness in extreme environments suits aerospace, automotive, and power electronics sectors, especially where reliability under thermal stress is critical.

International B2B Considerations: Buyers in Europe (Italy, UK) and the Middle East often require compliance with ASTM F1479 and IEC standards for semiconductor materials. African and South American markets may prioritize cost-effective sourcing but still demand certification for quality assurance. Reliable supply chains and vendor transparency are crucial for these regions due to import regulations and logistical challenges.

Key Properties: Nitrogen doping enhances n-type conductivity in 4H SiC, improving electron mobility and device switching speeds. The material retains high thermal and chemical stability, withstanding aggressive environments such as acidic or basic media.

Pros & Cons: Nitrogen-doped 4H SiC enables efficient power device fabrication with improved electrical characteristics. However, doping uniformity can be challenging to control, affecting device consistency. The doping process adds complexity and cost to manufacturing.

Impact on Application: Ideal for power electronics, high-voltage diodes, and MOSFETs used in energy conversion and industrial automation. Its resistance to harsh chemical exposure makes it suitable for Middle Eastern oil and gas applications.

International B2B Considerations: Buyers from Europe and the Middle East often require adherence to semiconductor doping standards such as JEDEC JESD22 and IEC 60747. African and South American buyers should assess suppliers’ capability to provide traceability and batch testing to ensure doping quality.

Illustrative Image (Source: Google Search)

Key Properties: Aluminum doping introduces p-type conductivity in 4H SiC, enabling complementary device architectures. This material maintains high mechanical strength and thermal stability, withstanding pressures and temperatures typical in industrial environments.

Pros & Cons: Aluminum-doped 4H SiC expands the range of electronic devices, including bipolar and complementary MOS devices. However, p-type doping efficiency is generally lower than n-type, and aluminum incorporation can introduce defects that impact device performance. Production costs are moderate to high due to doping precision requirements.

Impact on Application: Suitable for power modules and sensors in automotive and renewable energy sectors, where durability and efficiency are paramount.

International B2B Considerations: European buyers often require compliance with DIN EN standards for semiconductor doping, while Middle Eastern and South American markets focus on product robustness and long-term supplier support. African buyers may prioritize cost-effective solutions with flexible order volumes and local technical support.

Key Properties: Composite materials combining 4H SiC crystals with ceramic matrices offer enhanced fracture toughness and thermal shock resistance. These composites maintain chemical inertness and high-temperature stability, suitable for structural applications.

Pros & Cons: Composites provide improved mechanical durability and resistance to wear and corrosion, ideal for harsh industrial environments. However, manufacturing complexity increases, and material costs are higher due to multi-phase processing and quality control.

Impact on Application: Widely used in aerospace components, high-performance cutting tools, and chemical processing equipment requiring long service life under extreme conditions.

International B2B Considerations: Buyers in Europe and the Middle East demand compliance with ISO 9001 and ASTM C142 standards for ceramic composites. South American and African buyers should evaluate supplier capabilities in customization and after-sales technical support to optimize integration into existing systems.

| Material | Typical Use Case for 4H SiC Crystal Structure | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| High-Purity 4H SiC Wafers | High-power, high-frequency semiconductor devices | Exceptional thermal conductivity and chemical stability | High manufacturing complexity and cost | High |

| Nitrogen-Doped 4H SiC | Power electronics, high-voltage diodes, industrial automation | Enhanced n-type conductivity and electron mobility | Doping uniformity challenges and increased cost | Medium |

| Aluminum-Doped 4H SiC | Complementary MOS devices, power modules, automotive sensors | Enables p-type conductivity for device versatility | Lower doping efficiency and potential defect issues | Medium to High |

| 4H SiC Composite Materials | Aerospace components, cutting tools, chemical processing equipment | Superior mechanical toughness and thermal shock resistance | Complex manufacturing and higher material cost | High |

This guide equips international B2B buyers with actionable insights for selecting 4H SiC materials tailored to their application needs and regional compliance requirements, optimizing both performance and procurement strategy.

Manufacturing and quality assurance of 4H Silicon Carbide (SiC) crystal structures demand precision and adherence to stringent standards to meet the high-performance requirements of semiconductor and power electronics industries. For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding the detailed manufacturing stages, quality control practices, and verification methods is crucial for selecting reliable suppliers and ensuring product excellence.

The production of 4H SiC crystals involves several critical stages, each requiring specialized techniques to maintain crystal integrity and optimize material properties:

Illustrative Image (Source: Google Search)

Illustrative Image (Source: Google Search)

Robust quality assurance frameworks are imperative for ensuring that 4H SiC crystals meet international standards and customer specifications.

For buyers from Africa, South America, the Middle East, and Europe, verifying supplier quality systems and product consistency is essential to mitigate risks in the supply chain.

Actionable Insights for B2B Buyers:

By mastering these manufacturing and quality assurance intricacies, international buyers can confidently procure high-quality 4H SiC crystal structures that meet stringent application demands and regional compliance standards.

Sourcing 4H Silicon Carbide (SiC) crystal structures involves multiple cost elements that international B2B buyers must carefully evaluate to optimize purchasing decisions:

Several factors heavily influence the pricing dynamics for 4H SiC crystals, requiring buyers to understand and negotiate effectively:

For buyers from Africa, South America, the Middle East, and Europe, navigating the cost and pricing landscape of 4H SiC crystal structures requires tailored strategies:

All cost and pricing insights provided here are indicative and subject to change based on supplier, market conditions, and geographic factors. Buyers should conduct direct supplier consultations and market research tailored to their specific sourcing needs and regions to obtain accurate quotations.

This detailed analysis equips international B2B buyers with the knowledge to make informed sourcing decisions, ensuring cost-effectiveness and supply chain resilience in acquiring 4H SiC crystal structures.

Understanding the technical specifications of 4H Silicon Carbide (4H SiC) is essential for B2B buyers to ensure optimal material performance and compatibility in high-tech applications such as power electronics, aerospace, and automotive sectors.

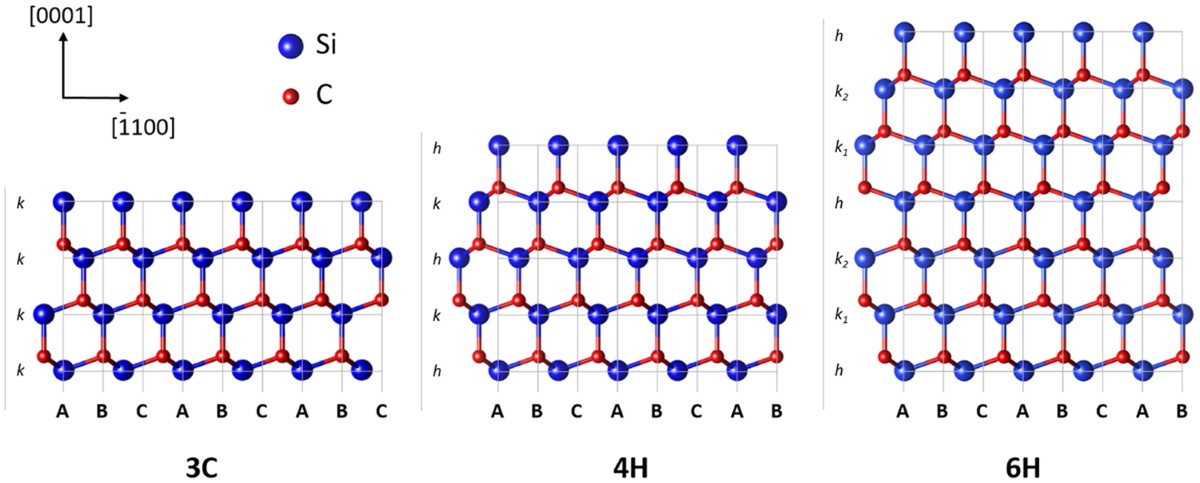

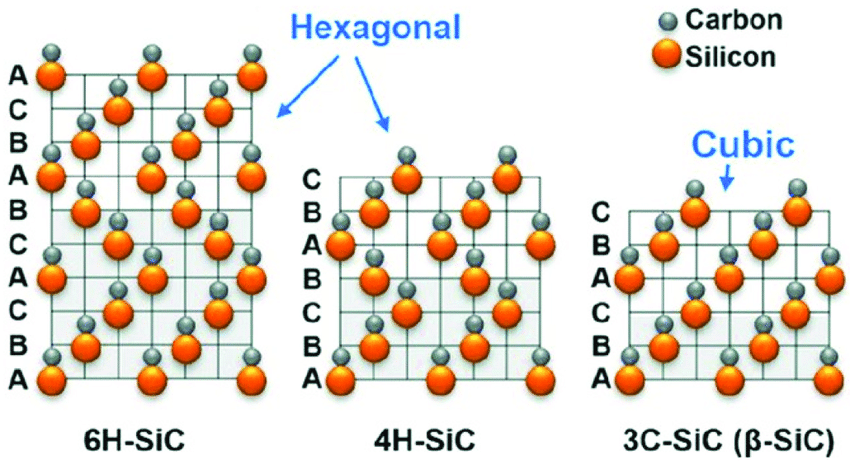

Polytype and Crystal Structure

4H SiC refers to a hexagonal polytype characterized by a four-layer stacking sequence. This structure directly influences its electronic properties, including a wider bandgap (~3.26 eV) compared to other SiC polytypes. For buyers, this means higher thermal stability and superior performance in high-voltage, high-temperature environments.

Material Purity and Grade

The purity level (often 4N to 6N, representing 99.99% to 99.9999% purity) affects the electrical and mechanical quality of the crystal. High-purity 4H SiC wafers minimize defects and improve device yield, critical for OEMs demanding consistency and reliability in semiconductor manufacturing.

Surface Orientation and Tolerance

Common surface orientations include (0001) Si-face and C-face, each influencing epitaxial growth and device fabrication. Surface flatness and roughness tolerances (e.g., Ra < 0.5 nm) are crucial for ensuring uniform thin-film deposition, impacting device performance and yield.

Electrical Properties: Carrier Mobility and Breakdown Voltage

4H SiC exhibits higher electron mobility (~900 cm²/V·s) and a high critical breakdown field (~3 MV/cm), enabling devices to operate efficiently at high voltages and frequencies. Buyers in power electronics should prioritize these specs to enhance energy efficiency and thermal management.

Thermal Conductivity

With thermal conductivity around 4.9 W/cm·K, 4H SiC efficiently dissipates heat, reducing the risk of thermal failure in power devices. This property is vital for applications requiring sustained operation under heavy electrical loads.

Wafer Diameter and Thickness

Available wafer sizes typically range from 50 mm to 150 mm diameter, with thicknesses optimized for different device applications. Larger diameters reduce cost per device but require precise handling and quality control.

Navigating international B2B transactions involving 4H SiC requires familiarity with industry-standard terms to streamline communication and negotiations.

OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products that are used in another company’s end product. Many buyers source 4H SiC wafers directly from OEMs or their authorized distributors to guarantee authenticity and quality assurance.

MOQ (Minimum Order Quantity)

The smallest quantity of 4H SiC wafers or components a supplier is willing to sell. MOQs vary depending on wafer size, grade, and customization. Understanding MOQ helps buyers plan procurement budgets and inventory management effectively.

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers requesting pricing, delivery terms, and technical specifications. For 4H SiC, an RFQ typically includes wafer specifications, quantities, and delivery schedules, enabling suppliers to provide accurate offers.

Incoterms (International Commercial Terms)

Globally recognized trade terms defining responsibilities between buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Clarity on Incoterms prevents disputes and ensures smooth logistics.

Epi-ready

Indicates that the 4H SiC wafer surface is prepared for epitaxial layer deposition, a critical step in semiconductor device fabrication. Buyers in the semiconductor industry must specify epi-ready wafers to meet manufacturing requirements.

Traceability

The ability to track the wafer’s production history, including batch number, manufacturing conditions, and quality control data. Traceability is increasingly demanded by buyers in regulated industries to ensure compliance and quality assurance.

For international buyers across Africa, South America, the Middle East, and Europe, understanding these technical properties and trade terms facilitates informed decision-making, reduces procurement risks, and optimizes supply chain efficiency when sourcing 4H SiC crystal materials.

The global market for 4H SiC (silicon carbide) crystal structures is experiencing robust growth driven by increasing demand in high-power electronics, automotive, aerospace, and renewable energy sectors. For international B2B buyers from Africa, South America, the Middle East, and Europe—including key industrial hubs like Italy and the UK—understanding these market dynamics is critical for strategic sourcing and supply chain optimization.

Key Market Drivers:

- Electrification and Energy Efficiency: The shift towards electric vehicles (EVs) and energy-efficient power devices is pushing demand for 4H SiC due to its superior thermal conductivity, high breakdown voltage, and efficiency at high frequencies.

- Renewable Energy Expansion: Growing investments in solar and wind energy infrastructures globally increase the need for power electronics based on 4H SiC substrates, especially in regions like the Middle East and Europe where renewable targets are ambitious.

- Aerospace and Defense Applications: The aerospace sector’s pursuit of lightweight, high-performance materials bolsters demand for high-quality 4H SiC crystals with excellent mechanical and thermal properties.

Emerging B2B Sourcing Trends:

- Localization of Supply Chains: Buyers are increasingly seeking regional suppliers to mitigate geopolitical risks and logistics complexities, particularly relevant for African and South American markets where infrastructure challenges persist.

- Strategic Partnerships: Collaborative agreements between crystal growers, device manufacturers, and end-users are becoming common to ensure supply stability and joint R&D efforts for advanced 4H SiC technologies.

- Digital Procurement Platforms: Adoption of advanced e-procurement tools enhances transparency and efficiency in sourcing 4H SiC crystals, facilitating better price discovery and supplier vetting for buyers in Europe and the Middle East.

Market Dynamics:

- Supply Constraints and Capacity Expansion: Limited global production capacity of high-quality 4H SiC wafers creates a seller’s market, with lead times extending. However, capacity expansions in Asia and Europe aim to address this bottleneck.

- Price Volatility: Fluctuations in raw material costs and technology upgrades impact pricing structures, necessitating flexible procurement strategies.

- Quality and Certification: Buyers prioritize suppliers with stringent quality certifications (e.g., ISO, SEMI standards) to ensure crystal purity and defect minimization, crucial for high-reliability applications.

Sustainability considerations are increasingly integral in the procurement of 4H SiC crystal structures, reflecting broader corporate responsibility mandates and regulatory pressures across global markets.

Environmental Impact:

- The production of 4H SiC crystals involves high-energy consumption processes such as physical vapor transport and chemical vapor deposition, which can contribute significantly to carbon emissions if powered by non-renewable sources.

- Waste management and the use of hazardous chemicals during crystal growth require stringent environmental controls to prevent soil and water contamination.

Importance of Ethical Supply Chains:

- Buyers from Europe and the UK are especially attuned to ethical sourcing, demanding transparency in the origin of raw materials and labor practices.

- In regions like Africa and South America, where supply chain complexities include artisanal mining and geopolitical risks, verifying supplier compliance with labor laws and environmental standards is paramount.

- Ethical sourcing reduces reputational risks and aligns with international frameworks such as the OECD Guidelines for Multinational Enterprises.

Green Certifications and Materials:

- Suppliers offering 4H SiC crystals with certifications such as ISO 14001 (Environmental Management) or adherence to Responsible Minerals Initiative (RMI) standards provide buyers with assurance of sustainable practices.

- Increasingly, manufacturers invest in renewable energy-powered production facilities and closed-loop recycling systems for scrap SiC material, contributing to lower environmental footprints.

- Buyers should prioritize partners actively reporting sustainability metrics and engaging in continuous improvement programs, as these factors enhance long-term supply chain resilience and compliance with emerging green regulations.

The development of the 4H SiC crystal structure as a commercially viable semiconductor substrate dates back to advancements in the late 20th century, when researchers identified its superior electronic and thermal properties compared to silicon. Initial production techniques focused on small-diameter wafers with limited uniformity. However, breakthroughs in crystal growth methods such as physical vapor transport (PVT) enabled larger, high-purity 4H SiC wafers suitable for power electronics.

Over the past two decades, the evolution of 4H SiC has been driven by the growing demand for high-performance devices in automotive and industrial applications. This has led to continuous improvements in wafer size (now exceeding 150 mm diameter), defect density reduction, and doping control. For B2B buyers, understanding this history highlights the importance of selecting suppliers with proven technological expertise and manufacturing maturity to meet increasingly stringent quality requirements.

How can I effectively vet suppliers of 4H SiC crystal structure for international B2B transactions?

Vetting suppliers is crucial to ensure quality and reliability. Start by verifying their certifications such as ISO 9001 and industry-specific standards. Request detailed technical datasheets and samples for quality assessment. Check their production capacity and previous client references, especially those from your region (Africa, South America, Middle East, Europe). Utilize third-party audit services or request virtual factory tours to confirm manufacturing capabilities. Also, review their financial stability through credit reports to avoid supply disruptions.

Is customization of 4H SiC crystal structures commonly available, and how should I approach it?

Yes, many manufacturers offer customization in terms of wafer size, doping levels, and defect density to suit specific applications. Clearly define your technical specifications upfront and communicate them precisely. Engage suppliers early to understand their customization capabilities and associated costs. For international buyers, particularly from diverse markets like Europe or the Middle East, ensure that customization requests comply with local standards and that the supplier can deliver consistent quality at scale.

What are typical minimum order quantities (MOQs), lead times, and payment terms for 4H SiC crystals in international trade?

MOQs vary widely depending on the supplier and customization level but typically range from small batches (10-50 wafers) to larger volumes for bulk orders. Lead times can span from 4 to 12 weeks due to complex manufacturing processes and quality checks. Payment terms often include a 30-50% upfront deposit with the balance on delivery or within 30 days after shipment. Negotiating flexible payment terms and MOQs is advisable, especially for first-time buyers or those from emerging markets.

What quality assurance measures and certifications should I expect from reputable 4H SiC crystal suppliers?

Reputable suppliers maintain stringent QA protocols including defect density analysis, X-ray diffraction (XRD), and photoluminescence testing. Certifications to look for include ISO 9001 for quality management and sometimes ISO 14001 for environmental standards. Industry-specific certifications or compliance with standards like JEDEC can further validate quality. Request documented QA reports and batch traceability to ensure product consistency for critical applications.

How should I handle logistics and shipping for 4H SiC crystals to regions like Africa, South America, or the Middle East?

Due to the fragile and high-value nature of 4H SiC crystals, use specialized packaging that prevents contamination and mechanical damage. Opt for reliable freight forwarders experienced in handling sensitive semiconductor materials. Understand import regulations, tariffs, and customs clearance procedures specific to your country to avoid delays. Consider shipping insurance and real-time tracking to mitigate risks. Collaborate closely with your supplier to coordinate timing and documentation.

What strategies can help resolve disputes or quality issues with international 4H SiC crystal suppliers?

Establish clear contractual terms covering quality standards, inspection rights, and dispute resolution mechanisms before purchase. In case of quality issues, document discrepancies with photos and lab reports, and communicate promptly with the supplier. Employ third-party inspection or certification bodies to mediate objectively. Arbitration clauses specifying neutral venues can facilitate smoother conflict resolution. Maintaining transparent communication and building strong supplier relationships is key to long-term success.

Are there regional considerations for sourcing 4H SiC crystals from Europe versus suppliers in Asia or the Middle East?

European suppliers often emphasize high environmental and quality standards but may have higher costs and longer lead times. Asian suppliers might offer competitive pricing and larger production volumes but require thorough vetting to ensure quality. Middle Eastern suppliers are emerging with strategic logistics advantages for regional buyers. Evaluate suppliers based on your priorities: cost, quality, delivery time, and compliance with local regulations to optimize your supply chain.

How can I ensure compliance with international trade regulations when importing 4H SiC crystal structures?

Familiarize yourself with export controls, dual-use regulations, and import tariffs applicable to semiconductor materials in both exporting and importing countries. Work with customs brokers knowledgeable in your region’s trade policies (e.g., EU’s REACH, Middle East’s free trade zones). Maintain accurate and complete documentation including commercial invoices, certificates of origin, and material safety data sheets. Proactive compliance minimizes customs delays and legal risks, facilitating smoother cross-border transactions.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The strategic sourcing of 4H SiC crystal structure materials presents a compelling opportunity for international B2B buyers seeking cutting-edge semiconductor solutions. Key considerations include prioritizing suppliers with proven expertise in crystal purity, defect control, and scalability to ensure optimal device performance and reliability. For buyers in Africa, South America, the Middle East, and Europe, aligning sourcing strategies with regional market demands and supply chain resilience is critical to mitigating risks and capitalizing on growth in automotive, aerospace, and power electronics sectors.

Value-driven sourcing hinges on forging partnerships with manufacturers who demonstrate technological innovation and compliance with global standards, facilitating long-term collaboration and cost efficiency. Leveraging advanced analytics and supplier intelligence can further enhance decision-making and supplier evaluation processes.

Looking ahead, the increasing adoption of 4H SiC in high-power and high-frequency applications signals robust demand growth. International buyers are encouraged to adopt a proactive sourcing approach—engaging early with specialized suppliers, investing in supply chain transparency, and exploring flexible contract models to navigate market fluctuations. By doing so, businesses across diverse regions can secure a competitive edge in the evolving semiconductor landscape and drive sustainable growth through strategic 4H SiC crystal structure procurement.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina