The global market for abrasive materials is a cornerstone of industrial manufacturing, maintenance, and precision engineering. For B2B buyers across Africa, South America, the Middle East, and Europe—including dynamic economies like South Africa and Colombia—understanding this market is essential to securing competitive advantages. Abrasive materials enable critical processes such as cutting, grinding, polishing, and surface finishing, directly influencing product quality and operational efficiency.

Illustrative Image (Source: Google Search)

This comprehensive guide offers an authoritative roadmap through the complex landscape of abrasives. It covers the full spectrum of abrasive types—from natural to synthetic—alongside detailed insights into raw materials, manufacturing methods, and rigorous quality control standards. Buyers will gain clarity on how to evaluate suppliers, navigate cost structures, and interpret market trends to optimize procurement strategies.

Key aspects addressed include:

By equipping international buyers with these insights, the guide empowers confident, data-driven decisions that reduce risk and enhance supply chain resilience. Whether sourcing abrasives for heavy industry in Africa or precision tools in Europe, readers will find actionable knowledge tailored to diverse market conditions and industrial demands. This resource is designed to transform abrasive material procurement into a strategic advantage in the global industrial arena.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Aluminum Oxide | Durable, sharp, and versatile; available in various grits | Metal fabrication, automotive, aerospace | + Long-lasting, cost-effective; – Not ideal for very soft metals |

| Silicon Carbide | Extremely hard and sharp; brittle; available as green or black | Glass, ceramics, stone cutting, electronics | + High cutting speed; – Brittle, less durable on metals |

| Ceramic Alumina | Synthetic, very tough, heat-resistant abrasive | High-precision grinding, aerospace, heavy industry | + High efficiency, long life; – Higher initial cost |

| Diamond | Hardest known abrasive; synthetic and natural forms | Precision cutting, stone, composites, electronics | + Superior hardness, precision; – Expensive, specialized usage |

| Garnet | Natural abrasive, eco-friendly, moderate hardness | Waterjet cutting, woodworking, sandblasting | + Environmentally friendly, reusable; – Lower hardness limits use |

Aluminum Oxide

Aluminum oxide is the most commonly used abrasive material, prized for its versatility and durability across a wide range of industrial applications. It is particularly effective for grinding and finishing metals such as steel and iron, making it a staple for automotive and aerospace manufacturing. For B2B buyers, aluminum oxide offers an excellent balance between performance and cost, but it is less effective on softer metals, which may require alternative abrasives.

Silicon Carbide

Known for its extreme hardness and sharpness, silicon carbide excels in cutting hard, brittle materials like glass, ceramics, and stone. It is frequently used in electronics manufacturing and precision cutting industries. Buyers should note its brittleness, which can lead to faster wear when used on metals, but its high cutting speed and efficiency make it suitable for specialized applications requiring rapid material removal.

Ceramic Alumina

A synthetic abrasive engineered for toughness and heat resistance, ceramic alumina is ideal for demanding environments such as aerospace and heavy industry. It maintains sharpness longer than conventional abrasives, improving productivity and reducing downtime. Although it involves a higher upfront cost, the longevity and precision it offers often result in better total cost of ownership for industrial buyers.

Diamond

Diamond abrasives are unmatched in hardness, providing superior precision for cutting and grinding extremely hard or composite materials. They are critical in high-tech sectors like electronics and advanced manufacturing. While diamond abrasives come at a premium price and require specific handling expertise, their efficiency and precision justify the investment for buyers targeting high-value or precision-critical applications.

Garnet

Garnet is a natural, eco-friendly abrasive with moderate hardness, commonly used in waterjet cutting, woodworking, and sandblasting. It offers a sustainable option for companies prioritizing environmental considerations without sacrificing performance. However, its lower hardness compared to synthetic abrasives limits its use in heavy metal grinding, making it more suitable for surface preparation and softer materials.

Related Video: Grit Blasting process Vs Sand Blasting process, Types of Grit Blasting abrasive materials

| Industry/Sector | Specific Application of abrasive materials | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Surface finishing and polishing of engine components | Enhances durability and performance of parts; reduces wear | Consistent grit size, high purity, and compatibility with automated production lines |

| Metal Fabrication | Grinding and cutting of steel and alloys | Improves precision and quality of metal parts; reduces rework | Abrasive hardness, bonding type, and resistance to heat generated during use |

| Construction & Mining | Cutting and shaping of concrete, stone, and aggregates | Accelerates project timelines; improves structural integrity | Abrasive toughness, size distribution, and resistance to abrasive wear |

| Aerospace Engineering | Precision polishing and deburring of turbine blades | Ensures aerodynamic efficiency and safety; extends component life | Ultra-fine abrasives, contamination-free materials, and compliance with industry standards |

| Electronics Manufacturing | Wafer slicing and surface planarization | Increases yield and performance of semiconductor devices | Extremely fine abrasives, chemical stability, and uniform particle size distribution |

In automotive manufacturing, abrasive materials play a crucial role in surface finishing and polishing engine components such as crankshafts and camshafts. These abrasives help achieve smooth surfaces that reduce friction and wear, directly impacting engine efficiency and longevity. For international buyers, especially in regions like South America and Africa where automotive industries are growing, sourcing abrasives with consistent grit size and high purity is vital to ensure compatibility with automated finishing processes and maintain quality standards.

Within the metal fabrication sector, abrasives are extensively used for grinding and cutting steel and various metal alloys. The precise removal of material improves the dimensional accuracy and surface quality of metal parts, which is essential for downstream assembly and welding operations. Buyers from Europe and the Middle East should prioritize abrasives with optimal hardness and bonding properties to withstand the high heat generated during metalworking, thereby reducing tool wear and operational costs.

In construction and mining, abrasive materials are indispensable for cutting and shaping hard materials like concrete, stone, and aggregates. This application accelerates construction project timelines by enabling efficient processing of raw materials while ensuring the structural integrity of finished elements. For companies in Africa and Colombia, selecting abrasives with excellent toughness and wear resistance is critical to cope with the harsh operating environments and maintain productivity.

The aerospace engineering industry demands ultra-precise polishing and deburring of turbine blades and other critical components to guarantee aerodynamic efficiency and safety. Abrasives used here must be ultra-fine and free from contaminants to avoid microscopic surface defects that could compromise performance. International buyers, particularly in Europe and the Middle East, should ensure their suppliers comply with stringent aerospace industry standards and provide traceable quality certifications.

In electronics manufacturing, abrasive materials are essential for wafer slicing and surface planarization processes. These abrasives enable the production of semiconductor devices with high yield and performance by delivering uniform and defect-free surfaces. Buyers from all targeted regions must focus on sourcing abrasives with extremely fine and chemically stable particles, as well as uniform size distribution, to meet the demanding precision requirements of the electronics sector.

Key Properties:

Aluminum oxide is a hard, chemically stable abrasive with excellent thermal resistance up to about 1200°C. It offers good corrosion resistance and high compressive strength, making it suitable for high-pressure applications. Its crystalline structure provides consistent cutting performance.

Pros & Cons:

Alumina is highly durable and widely available, making it cost-effective for large-scale industrial use. It is relatively easy to manufacture and shape into various abrasive forms. However, it can be less effective on very hard metals compared to superabrasives and may wear faster under extreme conditions.

Impact on Application:

Aluminum oxide abrasives are ideal for grinding, sanding, and polishing ferrous and non-ferrous metals. They perform well in dry and wet environments, which is beneficial for applications involving coolant media. Their chemical stability ensures compatibility with a broad range of industrial chemicals.

Considerations for International B2B Buyers:

Buyers in Africa, South America, the Middle East, and Europe should verify compliance with ASTM B74 or DIN 325 standards for abrasive grains to ensure quality consistency. Alumina abrasives are commonly accepted globally, but buyers should consider local supplier certifications and availability. In regions like South Africa and Colombia, alumina products are often preferred due to their balance of cost and performance in mining and manufacturing sectors.

Key Properties:

Silicon carbide is an extremely hard abrasive with a Mohs hardness of 9-9.5, offering excellent thermal conductivity and resistance to oxidation up to 1600°C. It is chemically inert and has excellent sharpness retention.

Pros & Cons:

SiC abrasives provide superior cutting speed and are effective on non-ferrous metals, ceramics, and glass. They are relatively brittle, which can lead to faster wear in heavy-duty grinding of ferrous metals. Manufacturing SiC abrasives is more complex and costly compared to alumina.

Impact on Application:

Silicon carbide is preferred for precision grinding and finishing of hard, brittle materials and non-metallic surfaces. It excels in high-speed abrasive machining and is compatible with water-based coolants, making it suitable for applications in electronics and automotive industries.

Considerations for International B2B Buyers:

Compliance with JIS R 6001 or ISO 9001 standards is critical for quality assurance, especially in technologically advanced markets in Europe and the Middle East. Buyers in emerging markets like Colombia and South Africa should assess supplier reliability and product traceability. SiC abrasives may attract higher import tariffs in some regions, so cost planning is essential.

Key Properties:

Garnet abrasives are natural, crystalline materials with moderate hardness (Mohs 6.5-7.5) and excellent fracture toughness. They resist chemical degradation and have moderate thermal stability, suitable for temperatures up to 600°C.

Pros & Cons:

Garnet is eco-friendly, recyclable, and less dusty compared to synthetic abrasives. It offers good cutting efficiency for waterjet cutting and sandblasting but has lower durability in high-pressure or high-temperature applications. Manufacturing is simpler but dependent on natural deposits, which can affect supply consistency.

Impact on Application:

Garnet is widely used in waterjet cutting, abrasive blasting, and filtration media. Its natural origin makes it preferred for environmentally sensitive projects. It performs well with water-based media but is less suitable for dry, high-speed grinding.

Considerations for International B2B Buyers:

Regions like South America and Africa benefit from proximity to garnet mining areas, potentially reducing costs and lead times. Buyers should ensure garnet complies with ASTM G96 or equivalent regional standards. European and Middle Eastern buyers often require certification regarding environmental impact and sustainability of garnet sourcing.

Key Properties:

CBN is a synthetic superabrasive with extreme hardness second only to diamond. It maintains stability at temperatures exceeding 1400°C and has excellent chemical inertness, especially against ferrous materials.

Pros & Cons:

CBN abrasives offer unmatched durability and cutting precision for hard ferrous metals and alloys. They have a higher upfront cost and require specialized manufacturing processes. Their longevity and performance justify the investment in high-value industrial applications.

Impact on Application:

CBN is ideal for precision grinding in automotive, aerospace, and tool manufacturing industries. It excels in high-speed, high-temperature environments and is compatible with oil-based coolants. Its resistance to chemical wear makes it suitable for aggressive machining tasks.

Considerations for International B2B Buyers:

Compliance with ISO 9001 and ASTM F1854 is essential to ensure product reliability. Buyers in Europe and the Middle East often demand traceability and certification due to stringent quality standards. For African and South American markets, cost-benefit analysis is critical, as CBN abrasives represent a significant capital investment but can reduce downtime and tooling costs.

| Material | Typical Use Case for abrasive materials | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Oxide | Grinding and sanding of metals | High durability and thermal resistance | Less effective on very hard metals | Low |

| Silicon Carbide | Precision grinding of ceramics, glass, non-ferrous metals | Superior cutting speed and sharpness | Brittle, higher manufacturing complexity | Medium |

| Garnet | Waterjet cutting, abrasive blasting, filtration | Eco-friendly, recyclable, low dust | Lower durability in high-pressure use | Low |

| Cubic Boron Nitride (CBN) | High-speed grinding of hard ferrous alloys | Exceptional hardness and thermal stability | High cost and specialized manufacturing | High |

Manufacturing abrasive materials involves a combination of precise material handling, advanced forming technologies, and stringent quality control to ensure performance and safety. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, understanding these processes and quality assurance practices is critical for selecting reliable suppliers and ensuring compliance with global standards.

The production of abrasive materials, such as grinding wheels, abrasive belts, and coated abrasives, generally follows these key stages:

Maintaining stringent quality standards is essential to ensure abrasive materials meet performance, safety, and regulatory requirements. QA/QC processes typically include:

For buyers operating internationally, especially in emerging and diverse markets, verifying a supplier’s quality assurance system is vital to mitigate risks:

By thoroughly understanding manufacturing and quality assurance processes, international B2B buyers can make informed decisions, reduce risk, and secure abrasive materials that deliver consistent, high-performance results tailored to their markets and applications.

Understanding the cost and pricing dynamics behind abrasive materials is crucial for international B2B buyers aiming to optimize procurement strategies, particularly when operating across diverse markets such as Africa, South America, the Middle East, and Europe. This analysis breaks down the essential cost components, pricing influencers, and actionable buyer tips to navigate complex pricing structures effectively.

Raw Materials:

The primary cost driver is the base abrasive substance—commonly aluminum oxide, silicon carbide, or diamond grit. Variability in raw material quality, source country, and market demand directly impacts pricing.

Labor Costs:

Labor expenses vary significantly depending on the manufacturing location. Countries with higher wage standards, such as in parts of Europe, will have elevated labor costs compared to some regions in Africa or South America.

Manufacturing Overhead:

This includes utilities, plant maintenance, equipment depreciation, and administrative costs. Overhead rates tend to be higher in countries with stringent environmental regulations or advanced manufacturing processes.

Tooling and Equipment:

Abrasive production often requires specialized machinery and tooling, particularly for customized or precision products. Tool wear and replacement frequency add to ongoing costs.

Quality Control and Certifications:

Ensuring product consistency and compliance with international standards (e.g., ISO, ANSI) involves rigorous testing and certification processes, which can increase costs but add value through reliability assurance.

Logistics and Freight:

Shipping abrasive materials internationally requires careful handling due to weight and packaging requirements. Transportation modes, fuel costs, customs duties, and import taxes significantly influence final landed costs.

Supplier Margin:

Profit margins vary by supplier scale, market positioning, and competition. Established suppliers with global reach may charge premium prices for reliability and service, whereas smaller regional suppliers may offer competitive pricing but with trade-offs on lead times or certifications.

Order Volume and Minimum Order Quantities (MOQ):

Bulk purchases typically lower unit costs. However, buyers from emerging markets should balance volume discounts against storage and working capital constraints.

Product Specifications and Customization:

Tailored abrasives with specific grit sizes, bonding agents, or shapes command higher prices due to complex manufacturing and tooling requirements.

Material Grade and Quality Certifications:

Higher-grade abrasives certified for industrial or aerospace applications come at premium prices but ensure performance and durability.

Supplier Location and Economic Factors:

Exchange rates, local inflation, and geopolitical stability impact pricing. For example, sourcing from Europe may offer product quality advantages but at higher costs compared to suppliers in South America or the Middle East.

Incoterms and Payment Terms:

Terms such as FOB, CIF, or DDP affect who bears shipping and customs costs. Buyers should clarify terms to avoid unexpected expenses.

Negotiate Beyond Price:

Engage suppliers on payment terms, delivery schedules, and after-sales support. Flexibility in these areas can yield cost savings and operational benefits.

Evaluate Total Cost of Ownership (TCO):

Consider not only unit price but also factors like product lifespan, replacement frequency, and downtime costs. A higher upfront price may be justified by longer-lasting abrasives.

Leverage Local and Regional Suppliers:

Suppliers closer to your market can reduce logistics complexity and tariffs. For example, South African buyers might explore intra-continental options to minimize lead times.

Understand Pricing Nuances by Region:

Be aware of potential import duties, certification requirements, and currency fluctuations that affect final costs in Africa, South America, or the Middle East.

Request Transparent Cost Breakdowns:

Insist on detailed pricing components from suppliers to identify negotiation levers and assess cost drivers critically.

Plan for MOQ and Inventory Management:

Align order quantities with demand forecasts to avoid excessive inventory costs, especially when dealing with customized abrasives.

Prices for abrasive materials vary widely depending on quality, specifications, supplier, and regional factors. The figures discussed here serve as indicative guidance to assist in strategic sourcing decisions. Buyers should conduct due diligence and obtain multiple quotations to secure competitive and reliable supply arrangements.

By comprehensively analyzing cost components and pricing influencers, international B2B buyers can make informed sourcing decisions that optimize value, quality, and supply chain efficiency in abrasive materials procurement.

Understanding the technical specifications of abrasive materials is crucial for international B2B buyers to ensure product performance, cost efficiency, and supply chain reliability. Here are the key properties to consider:

Material Grade (Grit Size)

This defines the size of abrasive particles and directly affects the finish quality and cutting speed. Finer grits (higher numbers) yield smoother finishes, while coarser grits remove material faster. Selecting the correct grade optimizes productivity and product quality in applications ranging from metal fabrication to stone polishing.

Hardness

Hardness measures an abrasive’s resistance to wear and deformation. Higher hardness abrasives last longer and perform better on tough materials but may be more brittle. Buyers should match hardness to the workpiece to avoid premature abrasive failure or inefficient material removal.

Bond Type

The bond holds abrasive grains together and influences durability and application suitability. Common bonds include resin, vitrified, and metal. For example, vitrified bonds excel in precision grinding with heat resistance, while resin bonds are preferred for high-speed cutting. Knowing bond types helps buyers specify abrasives for specific machinery and process conditions.

Tolerance (Dimensional Accuracy)

Tolerance refers to the permissible variation in abrasive dimensions such as thickness or diameter. Tight tolerance is essential in precision grinding or finishing operations to maintain consistency and product quality. Buyers should clarify tolerance requirements to avoid costly rework or machine downtime.

Porosity

Porosity affects the abrasive’s ability to clear debris and cool the workpiece during operation. Higher porosity abrasives are beneficial for softer materials or processes requiring heat dissipation, reducing the risk of surface damage. This property is important for buyers targeting specific industrial processes.

Shape and Size

Abrasives come in various shapes (discs, belts, wheels) and sizes tailored to different machines and tasks. Correct sizing ensures compatibility with equipment and optimal operational efficiency. Buyers should verify shape and size specifications alongside machine requirements.

Familiarity with industry jargon and trade terms empowers buyers to negotiate effectively, streamline procurement, and avoid misunderstandings:

OEM (Original Equipment Manufacturer)

Refers to companies that produce machines or equipment that use abrasives. Buying OEM-approved abrasives often guarantees compatibility and quality compliance, which is important for maintaining warranties and performance standards.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. Understanding MOQ helps buyers balance inventory costs and order size, especially when dealing with multiple suppliers or introducing new abrasive types to their operations.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, lead time, and terms for specific abrasive products. RFQs are critical for comparing offers and securing competitive pricing in international trade.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs clearance between buyer and seller. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Clear agreement on Incoterms prevents costly disputes and clarifies logistics responsibilities.

Lead Time

The period between placing an order and receiving the goods. In abrasive procurement, shorter lead times are often critical to avoid production delays. Buyers should confirm lead times upfront, especially when sourcing from overseas suppliers.

Batch Consistency

Refers to uniformity of abrasive quality across production batches. Consistent batches ensure reliable performance and reduce variability in manufacturing processes. Buyers should request quality certifications or samples to verify batch consistency.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed purchasing decisions, optimize their supply chains, and enhance operational efficiency in their abrasive materials procurement.

The global abrasive materials market is shaped by diverse industrial demands, technological advancements, and regional growth dynamics. Abrasives are fundamental in sectors such as automotive, aerospace, construction, and metal fabrication, driving steady demand across continents including Africa, South America, the Middle East, and Europe. For B2B buyers in emerging markets like South Africa and Colombia, the key drivers include infrastructure development, increasing manufacturing capabilities, and a rising focus on precision engineering.

Key Market Drivers:

Regional Market Dynamics:

For B2B buyers, understanding these trends facilitates strategic sourcing decisions that balance cost, quality, and supply continuity.

Sustainability has become a decisive factor in the abrasive materials sector, especially for international buyers committed to responsible procurement. Abrasive production and usage traditionally involve energy-intensive processes and generate waste, making environmental impact a critical concern.

Environmental Impact Considerations:

Ethical Supply Chains:

Green Certifications & ‘Eco-Abrasives’:

For buyers from Europe, the Middle East, Africa, and South America, integrating sustainability criteria into supplier selection not only mitigates risks but also enhances brand reputation and meets growing regulatory expectations.

Abrasive materials have evolved from natural stones and minerals used since antiquity to highly engineered synthetic compounds tailored for modern industrial needs. Historically, natural abrasives such as emery and garnet dominated, but limitations in consistency and performance led to the development of synthetic abrasives in the early 20th century.

The introduction of synthetic aluminum oxide and silicon carbide revolutionized the industry by offering uniformity and superior cutting performance. Later, superabrasives like synthetic diamonds and cubic boron nitride emerged, enabling precision grinding and finishing in high-tech sectors.

For B2B buyers today, this evolution underscores the importance of selecting abrasives not only based on cost but also on application-specific performance, durability, and environmental impact. Understanding the historical shift to synthetic and engineered abrasives helps buyers appreciate the technological value embedded in modern products and supports more informed procurement strategies.

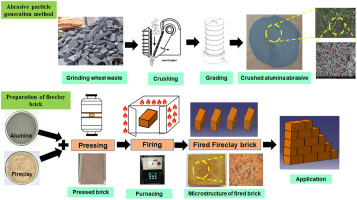

Illustrative Image (Source: Google Search)

Is it possible to customize abrasive materials to fit specific industrial requirements, and how should I approach this with suppliers?

Yes, many manufacturers offer customization in grit size, bonding agents, and shapes to suit your application. Clearly communicate your technical specifications, end-use environment, and performance expectations. Request technical datasheets and prototype samples to validate performance before bulk ordering. Establish clear agreements on tolerances, testing procedures, and adjustments to ensure the final product meets your operational needs.

What are typical minimum order quantities (MOQs) and lead times for abrasive materials in international B2B trade, especially for buyers from emerging markets?

MOQs vary widely depending on the material type and supplier scale but typically range from 500 to 2,000 units or kilograms. Lead times usually span 3 to 8 weeks, factoring production and international shipping. Buyers from emerging markets should negotiate MOQs aligned with their storage and cash flow capabilities and confirm lead times upfront. Building a strong relationship can sometimes secure more flexible terms or trial orders.

Which payment terms are most common and secure for international purchases of abrasive materials?

Letters of Credit (LC) and Documentary Collections are widely used to secure payments, balancing risk between buyer and supplier. Advance payments or deposits are common for first orders or customized products. For trusted partners, Net 30 or Net 60 terms may be negotiated. Using escrow services or payment platforms with buyer protection can mitigate risk, especially when dealing with new suppliers from different regions.

What quality assurance measures should I insist on to ensure abrasive materials meet international standards?

Request comprehensive quality documentation including material certificates, batch traceability, and compliance with international abrasive standards (e.g., ISO 8486). Insist on pre-shipment inspections or third-party testing laboratories to verify grit size, hardness, and bonding strength. Establish clear quality control checkpoints in your purchase contracts, and consider ongoing supplier performance reviews to maintain consistent quality.

How can I optimize logistics and shipping for abrasive materials sourced internationally, particularly for buyers in Africa or South America?

Plan shipments well in advance considering port infrastructure, customs regulations, and regional import duties. Consolidate orders to reduce freight costs and choose reliable freight forwarders experienced in your target markets. Use Incoterms (e.g., FOB, CIF) that clearly define responsibilities and risks. For bulky or hazardous abrasives, ensure proper packaging and compliance with international transport regulations to avoid delays or penalties.

What steps should I take if there is a dispute regarding product quality or delivery delays with an international abrasive materials supplier?

First, document all communications and product discrepancies thoroughly with photos and reports. Refer to the contract terms on quality standards, delivery schedules, and dispute resolution clauses. Engage in direct negotiation or mediation with the supplier to seek amicable solutions. If unresolved, escalate through trade arbitration bodies or legal channels specified in your agreement. Maintaining clear contracts and open communication reduces the likelihood and impact of disputes.

Are there specific certifications or compliance requirements that buyers from Europe, the Middle East, or Africa should verify when importing abrasive materials?

Yes, ensure suppliers comply with regional regulations such as REACH in Europe for chemical safety and local import certifications in the Middle East or Africa. Verify environmental and safety standards relevant to abrasive materials, including hazardous substance restrictions. Request certificates of conformity and Material Safety Data Sheets (MSDS) to ensure compliance. This not only ensures legal import but also helps maintain workplace safety and environmental responsibility.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing in abrasive materials is pivotal for businesses aiming to optimize costs, ensure consistent quality, and enhance supply chain resilience. For international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—leveraging a well-structured sourcing strategy can unlock access to diverse suppliers, innovative product technologies, and sustainable materials that meet evolving industry demands.

Key takeaways include:

Looking ahead, the abrasive materials market will continue to evolve with advancements in material science and increasing emphasis on sustainability. Buyers who proactively adopt strategic sourcing principles will be well-positioned to capitalize on emerging opportunities, reduce operational risks, and build long-term partnerships.

Illustrative Image (Source: Google Search)

For B2B buyers in Colombia, South Africa, the Middle East, and Europe, the call to action is clear: Invest in comprehensive supplier assessments, foster collaborative relationships, and stay informed on market trends to maintain a competitive edge in abrasive materials procurement.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina