Alumina carbide stands at the forefront of advanced industrial materials, prized for its exceptional hardness, thermal stability, and chemical inertness. These properties make it indispensable across a range of high-demand applications, including refractory linings, wear-resistant components, and cutting tools. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the nuances of alumina carbide sourcing is critical to maintaining competitive advantage and ensuring operational excellence.

This guide provides a comprehensive roadmap to the global alumina carbide market, delivering actionable insights tailored for discerning procurement professionals. It covers the full spectrum of material types and grades, delves into manufacturing processes and quality control standards, and highlights key supplier landscapes relevant to diverse regional needs. Additionally, it offers transparent analysis of pricing factors and market trends, empowering buyers to negotiate effectively and optimize cost-efficiency.

With targeted FAQs and strategic sourcing advice, this resource demystifies complex technical and commercial considerations, enabling buyers from regions such as Kenya, Brazil, the UAE, and Germany to make informed, risk-mitigated decisions. Whether you are establishing new supplier relationships or seeking to enhance supply chain resilience, this guide equips you with the expertise to navigate challenges and capitalize on opportunities in the alumina carbide market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| High Purity Alumina Carbide | Ultra-high alumina content with minimal impurities | Electronics, precision ceramics, aerospace components | Pros: Superior thermal stability and hardness. Cons: Higher cost and specialized sourcing. |

| Sintered Alumina Carbide | Manufactured through sintering for dense, uniform structure | Wear-resistant parts, cutting tools, mechanical seals | Pros: Excellent wear resistance and strength. Cons: Limited flexibility in shapes, higher energy input in production. |

| Reaction Bonded Alumina Carbide | Produced by reacting carbon with alumina at high temperatures | Automotive parts, refractory linings, chemical reactors | Pros: Good mechanical strength, cost-effective. Cons: Porosity can affect corrosion resistance. |

| Composite Alumina Carbide | Alumina carbide combined with other ceramics or metals | High-performance coatings, armor, tooling | Pros: Enhanced toughness and tailored properties. Cons: Complex manufacturing, variable cost. |

| Nano-structured Alumina Carbide | Alumina carbide with nano-scale grain size for improved properties | Advanced electronics, cutting-edge coatings, aerospace | Pros: Exceptional hardness and strength at nano scale. Cons: Emerging technology with limited suppliers and higher prices. |

High Purity Alumina Carbide is characterized by its ultra-high alumina content and minimal impurities, making it ideal for applications demanding exceptional thermal stability and hardness, such as aerospace and electronics manufacturing. For B2B buyers, the premium quality justifies the higher cost, especially when reliability and performance are critical. Sourcing from reputable suppliers with certification is essential to ensure purity levels meet industry standards.

Sintered Alumina Carbide offers a dense and uniform structure achieved through sintering, providing outstanding wear resistance and mechanical strength. This type suits industries requiring durable cutting tools and mechanical seals. Buyers should evaluate the shape and dimensional requirements upfront, as sintering limits complex geometries, and consider the energy costs embedded in production when negotiating prices.

Reaction Bonded Alumina Carbide is manufactured by high-temperature reactions between carbon and alumina, resulting in a cost-effective product with good mechanical properties. It is widely used in automotive components and refractory linings. However, its inherent porosity can reduce corrosion resistance, so B2B buyers should assess the operational environment carefully and consider post-processing treatments to enhance durability.

Composite Alumina Carbide integrates alumina carbide with other ceramics or metals to create materials with tailored toughness and performance, ideal for tooling, armor, and high-performance coatings. This variation demands close collaboration with suppliers to customize material properties according to application needs. Buyers should be prepared for potentially higher costs and longer lead times due to manufacturing complexity.

Nano-structured Alumina Carbide features nano-scale grain sizes, resulting in superior hardness and strength, making it suitable for advanced electronics and aerospace coatings. This cutting-edge material is still emerging in the market, often commanding premium pricing and limited availability. B2B purchasers should prioritize suppliers with proven nano-fabrication capabilities and verify material consistency through third-party testing.

| Industry/Sector | Specific Application of Alumina Carbide | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Metallurgical Industry | Refractory linings for furnaces and reactors | Enhances durability and thermal resistance, reducing downtime and maintenance costs | Consistent high purity and particle size for optimal thermal stability; supplier reliability for bulk supply |

| Abrasives Manufacturing | High-performance abrasive grains and grinding wheels | Provides superior hardness and wear resistance, improving product lifespan and efficiency | Quality certification, uniform grain size distribution, and compliance with international standards |

| Electronics & Semiconductors | Substrates and insulating components | Excellent electrical insulation and thermal conductivity improve device performance | Material purity and defect-free structure critical; sourcing from certified producers with traceability |

| Chemical Processing | Catalyst supports and wear-resistant components | Increases chemical resistance and mechanical strength, extending equipment life | Chemical inertness and mechanical integrity under harsh environments; verified material specs required |

| Automotive & Aerospace | Wear-resistant coatings and composite materials | Reduces component wear and weight, enhancing fuel efficiency and durability | Consistent quality, adherence to aerospace-grade standards, and supply chain transparency |

Alumina carbide is extensively utilized in the metallurgical industry as refractory linings for high-temperature furnaces and reactors. Its exceptional thermal stability and resistance to chemical attack help maintain furnace integrity under extreme conditions, minimizing operational interruptions. International buyers from Africa and South America, where metallurgical plants face harsh operational environments, must prioritize sourcing alumina carbide with consistent purity and particle size to ensure long-lasting performance.

In the abrasives manufacturing sector, alumina carbide serves as a critical material for producing high-performance grinding wheels and abrasive grains. Its superior hardness and wear resistance translate to longer-lasting abrasives, reducing replacement frequency and improving operational efficiency. Buyers in Europe and the Middle East should focus on suppliers offering quality certifications and uniform grain size to meet stringent industrial standards.

The electronics and semiconductor industries leverage alumina carbide for substrates and insulating components due to its excellent electrical insulation combined with high thermal conductivity. This balance supports device miniaturization and heat dissipation. For B2B buyers in technologically advanced markets such as Europe and Australia, sourcing defect-free, high-purity alumina carbide from certified manufacturers is essential to maintain product reliability.

In chemical processing, alumina carbide is used as catalyst supports and in wear-resistant components exposed to corrosive environments. Its chemical inertness and mechanical strength extend equipment lifespan, reducing downtime. Buyers from regions like the Middle East, with extensive petrochemical industries, should verify chemical resistance properties and mechanical specifications when selecting suppliers.

Lastly, in the automotive and aerospace sectors, alumina carbide is incorporated into wear-resistant coatings and composite materials to improve component durability while reducing weight. This contributes to enhanced fuel efficiency and longer service intervals. International buyers must ensure compliance with aerospace-grade standards and demand transparency in the supply chain to meet rigorous industry requirements.

Related Video: How Is Carbide Made?

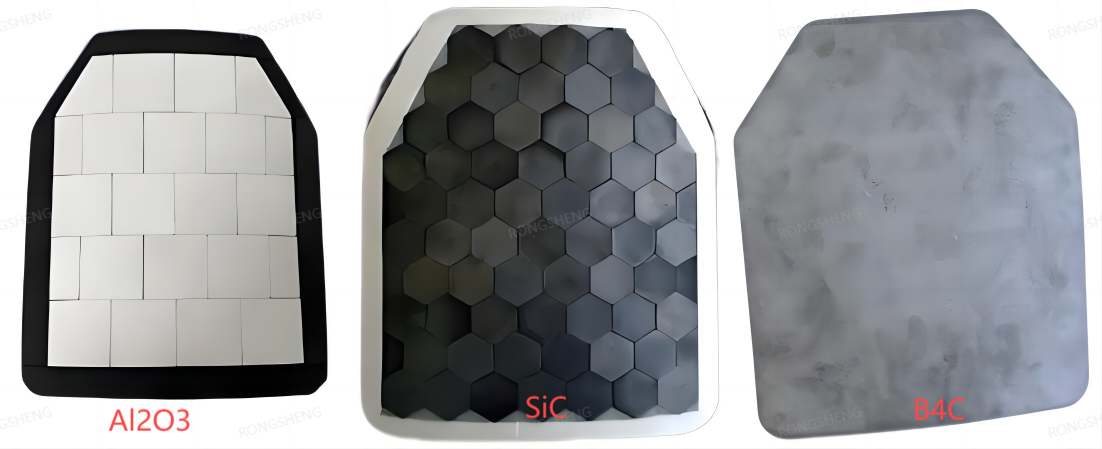

When selecting materials for alumina carbide applications, international B2B buyers must consider performance characteristics, manufacturing feasibility, and regional compliance standards. Below is an analysis of four common materials used in alumina carbide composites or coatings, focusing on their suitability for diverse industrial contexts, including markets in Africa, South America, the Middle East, and Europe.

Key Properties:

High-purity alumina offers excellent hardness, high melting point (~2050°C), and outstanding chemical inertness. It exhibits superior wear resistance and thermal stability, making it ideal for high-temperature and corrosive environments.

Pros & Cons:

- Pros: Exceptional durability, high corrosion resistance, and excellent electrical insulation.

- Cons: High manufacturing cost due to purity requirements and energy-intensive sintering processes. Brittle nature can limit impact resistance.

Impact on Application:

Ideal for abrasive wear parts, kiln furniture, and chemical processing equipment exposed to aggressive media. Its chemical inertness ensures compatibility with acidic and basic environments, common in mining and chemical industries prevalent in Africa and South America.

Regional Considerations:

Buyers in Europe and the Middle East often require compliance with ASTM C799 or DIN EN 60672 standards for alumina ceramics. African and South American markets may prioritize cost-effective grades but benefit from sourcing materials certified to international standards to ensure longevity and performance.

Key Properties:

This composite combines alumina's hardness with silicon carbide's thermal conductivity and fracture toughness. It withstands temperatures up to 1600°C and offers enhanced mechanical strength.

Pros & Cons:

- Pros: Improved toughness over pure alumina, better thermal shock resistance, and good corrosion resistance.

- Cons: More complex manufacturing process, higher cost than pure alumina, and potential for grain boundary weaknesses.

Impact on Application:

Widely used in mechanical seals, pump components, and wear-resistant linings where thermal cycling and mechanical stresses are significant. Suitable for oil & gas and petrochemical sectors, which are growing in the Middle East and South America.

Regional Considerations:

Compliance with JIS R 1601 or ASTM C1245 is common for SiC composites. Buyers in Australia and Kenya may focus on materials that balance cost and performance, favoring composites with proven durability in harsh environmental conditions.

Key Properties:

Incorporating zirconia enhances fracture toughness and impact resistance without significantly compromising alumina’s hardness and chemical stability. Operating temperatures typically max out around 1500°C.

Pros & Cons:

- Pros: Superior toughness and resistance to crack propagation, improved wear resistance.

- Cons: Slightly reduced chemical resistance compared to pure alumina, moderate cost increase due to zirconia addition.

Impact on Application:

Ideal for cutting tools, grinding media, and components subjected to mechanical shock. Particularly beneficial in industries like mining and manufacturing in Africa and South America, where equipment reliability is critical.

Regional Considerations:

European buyers may require adherence to EN ISO 13356 for bioceramics or equivalent standards for industrial use. Middle Eastern and African markets often seek materials that can endure abrasive conditions with minimal maintenance.

Key Properties:

These hybrid materials combine alumina’s hardness with the extreme wear resistance of carbides. They operate effectively under high pressure and abrasive conditions.

Pros & Cons:

- Pros: Exceptional wear and abrasion resistance, enhanced surface hardness, and prolonged service life.

- Cons: High production complexity and cost, potential challenges in coating adhesion and thermal expansion mismatch.

Impact on Application:

Used in heavy-duty industrial machinery parts, cutting tools, and wear plates. Particularly relevant for industries in Europe and the Middle East where high-performance and longevity justify higher upfront costs.

Regional Considerations:

Buyers must ensure coatings meet ASTM B760 or ISO 20502 standards for thermal spray coatings. In regions like Australia and Kenya, the trade-off between cost and performance must be carefully evaluated, favoring coatings that reduce downtime and maintenance.

| Material | Typical Use Case for alumina carbide | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| High-Purity Alumina (Al₂O₃) | Abrasive wear parts, chemical processing | High hardness and chemical inertness | Brittle, high manufacturing cost | High |

| Silicon Carbide Reinforced Alumina Composite | Mechanical seals, pump components, thermal shock applications | Improved toughness and thermal shock resistance | Complex manufacturing, higher cost | High |

| Alumina-Zirconia Toughened Ceramics | Cutting tools, grinding media, impact-resistant parts | Superior toughness and crack resistance | Slightly reduced chemical resistance | Medium |

| Alumina Coated with Carbide Layers | Heavy-duty machinery parts, cutting tools | Exceptional wear resistance and surface hardness | High production complexity and cost | High |

This guide empowers international buyers to align material selection with operational demands and regional standards, optimizing cost-efficiency and performance in alumina carbide applications.

Alumina carbide (Al4C3) is a high-performance ceramic material valued for its hardness, thermal stability, and chemical resistance, making it ideal for abrasive, refractory, and wear-resistant applications. Understanding its manufacturing process is crucial for B2B buyers aiming to source high-quality products that meet stringent industrial requirements.

The manufacturing journey begins with raw material selection and preparation. High-purity alumina powder and carbon sources (usually graphite or carbon black) are carefully weighed and blended. The purity and particle size distribution of these raw materials directly impact the final product’s performance. Suppliers typically use advanced milling techniques to achieve uniform particle sizes and homogenous mixing.

After mixing, the alumina carbide powder undergoes forming processes to shape it into desired forms such as powders, pellets, or bulk components.

These techniques influence the density and microstructure, critical for the mechanical properties of alumina carbide.

The shaped parts are sintered at high temperatures (typically 1600–1800°C) in inert or vacuum atmospheres to induce solid-state diffusion, bonding particles and enhancing mechanical integrity.

In some cases, reaction bonding is employed where alumina and carbon react at elevated temperatures to form alumina carbide in situ, enhancing material homogeneity.

Key Insight for Buyers: Understand the sintering environment and parameters used, as these affect porosity, grain size, and ultimately product durability.

Post-sintering, components may require machining, grinding, or surface treatments to meet dimensional tolerances and surface finish requirements.

Coating or impregnation to improve corrosion resistance.

Key Insight for Buyers: Confirm finishing capabilities with suppliers, especially if tight tolerances or specific surface properties are critical for your application.

Robust QA/QC is vital to ensure alumina carbide products meet international standards and functional expectations, particularly for complex industrial uses spanning Africa, South America, the Middle East, and Europe.

Regional Compliance: Buyers should verify if the supplier complies with local import regulations and quality mandates relevant to their market (e.g., SABS in South Africa, INMETRO in Brazil).

Key Insight for Buyers: Request copies of certification documents and confirm their validity through official registries.

Incoming Quality Control (IQC):

Inspection and testing of raw materials to verify purity, particle size, moisture content, and absence of contaminants before production.

In-Process Quality Control (IPQC):

Continuous monitoring during forming, sintering, and finishing stages, including dimensional checks, density measurements, and visual inspections.

Final Quality Control (FQC):

Comprehensive testing of finished products, including mechanical, chemical, and physical properties to ensure compliance with specifications.

Mechanical Strength Testing: Flexural strength and fracture toughness assessments.

Key Insight for Buyers: Specify required test methods and acceptance criteria upfront; request detailed test reports with statistical data.

Given the diverse geographic sourcing landscapes and varying regulatory environments, buyers from regions such as Africa, South America, the Middle East, and Europe should take proactive steps to verify supplier QC rigor.

By understanding the manufacturing intricacies and quality assurance frameworks of alumina carbide, B2B buyers can secure reliable, high-performance materials tailored to their industrial needs across diverse global markets.

Understanding the detailed cost structure behind alumina carbide products is critical for international B2B buyers aiming to optimize procurement budgets. The key cost components typically include:

Several factors can significantly affect the final price offered to buyers:

To achieve cost-effective sourcing of alumina carbide while maintaining quality and supply reliability, consider the following:

Prices for alumina carbide are highly variable and depend on numerous factors including raw material market conditions, supplier capabilities, order size, and delivery terms. The cost insights provided here are indicative and should serve as a guide. Buyers are encouraged to request formal quotations tailored to their specific requirements and conduct thorough due diligence before contract finalization.

Illustrative Image (Source: Google Search)

Understanding the key technical specifications of alumina carbide is essential for international buyers to ensure product suitability and optimize supply chain decisions. Here are the primary properties to focus on:

Material Grade (Purity Level)

Alumina carbide’s grade indicates its purity and phase composition, typically expressed as a percentage of Al₂O₃ and carbide phases. Higher grades (e.g., 85% Al₂O₃) offer superior hardness and corrosion resistance, crucial for applications like refractory linings or wear-resistant parts. For B2B buyers, specifying the correct grade ensures performance consistency and minimizes production downtime.

Particle Size and Distribution

The particle size affects the sintering behavior and mechanical strength of the final product. Fine particles allow for denser packing and better bonding, while coarser grains may improve toughness. Buyers must align particle size specifications with their manufacturing processes to optimize product quality and cost-efficiency.

Density and Porosity

Bulk density and porosity directly impact the mechanical strength and thermal conductivity of alumina carbide components. Lower porosity means better durability and resistance to thermal shock. For buyers in heavy industries, verifying these parameters helps in selecting materials that withstand harsh operating conditions.

Tolerance and Dimensional Accuracy

The tolerance refers to allowable deviations in size and shape during manufacturing. Tight tolerances are critical for parts used in precision machinery or OEM components. Buyers should negotiate tolerance requirements upfront to avoid compatibility issues and additional machining costs.

Thermal Stability and Conductivity

Alumina carbide exhibits excellent thermal stability, maintaining structural integrity at high temperatures. Thermal conductivity values guide buyers in applications such as heat exchangers or insulation materials, influencing energy efficiency and safety.

Chemical Resistance

Resistance to acids, alkalis, and molten metals is a key property, especially for buyers in chemical processing or metallurgy. Knowing the chemical compatibility ensures longevity and reduces maintenance frequency.

Familiarity with standard trade terms and industry jargon enables smoother communication and negotiation between international buyers and suppliers. Below are key terms every alumina carbide buyer should know:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or components used in another company’s end product. If you are sourcing alumina carbide for OEM use, specifying OEM standards ensures compliance with product quality and certification requirements.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in a single order. Understanding MOQ helps buyers, especially SMEs or those in emerging markets like Kenya or South America, to plan inventory and cash flow efficiently.

RFQ (Request for Quotation)

A formal process where buyers ask suppliers to provide pricing, lead times, and technical details. A well-prepared RFQ with clear technical specs reduces misunderstandings and expedites the procurement cycle.

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) that define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Knowing Incoterms is vital for buyers across Africa, the Middle East, and Europe to control logistics costs and risks effectively.

Lead Time

The total time from placing an order to receiving the product. This affects production schedules and inventory management. Buyers should negotiate realistic lead times considering supplier capacity and shipping routes.

Certification and Compliance

Documents like ISO, ASTM, or REACH compliance that validate product quality and safety. For international trade, especially in regulated markets, requesting certifications protects buyers from substandard materials and legal issues.

By focusing on these technical properties and trade terms, international B2B buyers can make informed decisions, mitigate risks, and establish strong supplier relationships in the alumina carbide market. Clear specifications combined with a solid understanding of trade language streamline procurement and support long-term operational success.

Alumina carbide, a critical advanced ceramic material, plays an essential role in industries such as aerospace, automotive, electronics, and refractory manufacturing. Its unique properties—high hardness, thermal stability, and chemical inertness—make it indispensable for wear-resistant components, cutting tools, and high-temperature applications. Globally, demand is driven by increasing industrial automation, rising infrastructure investments, and the push for higher-performance materials.

Illustrative Image (Source: Google Search)

For international B2B buyers, particularly in Africa, South America, the Middle East, and Europe, several market dynamics are shaping sourcing decisions:

Supply Chain Localization: Regions like Africa and South America are increasingly exploring local sourcing opportunities to reduce dependency on traditional Asian suppliers. This trend aligns with broader initiatives to develop regional industrial clusters and secure supply chains amid global disruptions.

Technological Advancements: Emerging production techniques such as reactive sintering and additive manufacturing are improving alumina carbide quality and cost-efficiency. Buyers should monitor suppliers investing in these technologies for better performance and scalability.

Price Volatility & Raw Material Availability: The cost of raw materials like bauxite and carbon influences alumina carbide pricing. Political stability and mining policies in resource-rich countries (e.g., Australia, Brazil, Kenya) directly impact supply reliability and pricing structures.

Customization & Technical Support: Increasingly, buyers demand tailored material grades and comprehensive technical support to optimize end-use performance. Suppliers offering collaborative R&D and application-specific solutions hold competitive advantages.

Digital Procurement Platforms: The rise of digital marketplaces and e-sourcing tools facilitates transparent pricing and supplier vetting, particularly benefiting buyers in developing markets aiming to access global suppliers efficiently.

Sustainability is becoming a decisive factor in alumina carbide procurement. The production process involves energy-intensive steps and the use of raw materials whose extraction can have significant environmental footprints. Buyers must prioritize suppliers that demonstrate commitment to reducing carbon emissions and minimizing waste.

Key sustainability considerations include:

Environmental Impact Reduction: Leading manufacturers are adopting renewable energy sources and optimizing kiln efficiency to lower greenhouse gas emissions. Water recycling and waste valorization in processing alumina carbide are also gaining traction.

Ethical Supply Chains: Transparency in sourcing raw materials is critical. Buyers should verify suppliers’ adherence to responsible mining practices, avoiding materials linked to environmental degradation or social conflicts, especially relevant in regions with complex regulatory environments.

Green Certifications: Certifications such as ISO 14001 (Environmental Management) and adherence to international standards like the Responsible Minerals Initiative (RMI) provide assurance of sustainable practices. Buyers should seek these credentials to mitigate reputational and compliance risks.

Circular Economy Initiatives: Some suppliers are innovating with recycled alumina carbide or developing products designed for easier recycling at end-of-life, aligning with global circular economy goals.

By integrating sustainability criteria into procurement strategies, B2B buyers not only contribute to environmental stewardship but also future-proof their supply chains against tightening regulatory and market demands.

Alumina carbide’s commercial relevance has grown significantly since its initial development in the mid-20th century. Initially used primarily in refractory linings and abrasive tools, advances in material science expanded its applications into high-precision engineering and electronics. The evolution of manufacturing techniques, including powder metallurgy and advanced sintering, has enhanced its availability and material consistency.

Illustrative Image (Source: Google Search)

For B2B buyers, understanding this evolution underscores the importance of partnering with suppliers that combine historical expertise with innovation capabilities. This blend ensures access to high-performance materials adapted to contemporary industrial challenges, supporting long-term operational excellence.

How can I effectively vet alumina carbide suppliers for international B2B purchases?

To vet suppliers, start by verifying their business licenses, certifications (ISO, REACH), and manufacturing capabilities. Request product samples to assess quality firsthand. Check references and client testimonials, especially from regions similar to yours (Africa, Middle East, Europe). Use third-party inspection services for factory audits if possible. Ensure the supplier has experience in international shipping and compliance with your country's import regulations to avoid delays.

Is it possible to customize alumina carbide products for specific industrial applications?

Yes, many manufacturers offer customization in terms of grain size, purity, shape, and packaging to meet your operational requirements. Discuss your technical specifications clearly and request technical data sheets or material safety data sheets (MSDS). Customization can improve performance and reduce waste, but it may affect lead times and pricing, so negotiate terms upfront.

What are the typical minimum order quantities (MOQs) and lead times for alumina carbide shipments?

MOQs vary widely depending on the supplier, product grade, and customization level. Standard MOQs often start from 500 kg to several tons. Lead times generally range from 2 to 6 weeks, influenced by order size, customization, and shipping mode. For buyers in Africa or South America, factor in additional time for customs clearance. Establish clear communication on MOQs and lead times early to align with your production schedules.

Which payment terms are commonly accepted in international alumina carbide transactions?

Common payment methods include Letters of Credit (L/C), Telegraphic Transfers (T/T), and Escrow services. L/Cs offer security for both parties but can be more complex and costly. T/T is faster but requires trust. Negotiate payment milestones such as deposits and balance payments upon shipment or delivery. For new suppliers, consider smaller initial orders or escrow to mitigate risks.

What quality assurance standards and certifications should I expect from reputable alumina carbide suppliers?

Look for ISO 9001 certification as a baseline quality management indicator. Suppliers should provide Certificates of Analysis (CoA) for each batch, detailing chemical composition and physical properties. Compliance with environmental and safety standards such as REACH or RoHS is essential for European buyers. Request third-party lab test results if needed to verify quality consistency.

How can I optimize logistics and shipping for alumina carbide imports to regions like Africa and the Middle East?

Choose suppliers with experience in international freight forwarding and customs clearance in your target region. Consider containerized sea freight for cost efficiency, but air freight can be faster for urgent needs. Work with reliable freight forwarders familiar with your local ports to reduce delays. Clarify Incoterms (e.g., FOB, CIF) to understand who bears transportation and insurance risks.

What steps should I take if there is a dispute regarding alumina carbide quality or delivery?

Document all communications, contracts, and inspection reports meticulously. Initiate a discussion with the supplier promptly to seek amicable resolution. If unresolved, engage third-party arbitration or mediation services specified in your contract. Having clear contractual terms on dispute resolution and warranties beforehand is crucial to protect your interests.

How can I ensure sustainable and ethical sourcing when purchasing alumina carbide internationally?

Request transparency on the supplier’s sourcing of raw materials and manufacturing processes. Prefer suppliers who adhere to environmental regulations and social responsibility standards. Certifications such as ISO 14001 for environmental management and SA8000 for social accountability are positive indicators. Sustainable sourcing can enhance your brand reputation and reduce supply chain risks.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complex landscape of alumina carbide procurement, strategic sourcing emerges as an indispensable practice for international B2B buyers. Key considerations such as supplier reliability, quality assurance, cost optimization, and supply chain resilience must be meticulously balanced. For buyers in Africa, South America, the Middle East, and Europe, leveraging regional supplier networks alongside global partnerships can unlock competitive advantages and mitigate risks associated with geopolitical and logistical uncertainties.

Prioritizing partnerships with manufacturers who demonstrate consistent product quality and adherence to international standards will safeguard operational efficiency in high-performance applications. Additionally, integrating sustainable sourcing criteria aligns with growing regulatory and market demands, enhancing corporate reputation and long-term viability.

Looking ahead, the alumina carbide market is poised for innovation driven by evolving industrial needs and technological advancements. Buyers are encouraged to adopt a proactive sourcing strategy that incorporates market intelligence, flexible contract structures, and collaborative supplier engagement. By doing so, businesses across diverse regions—from Australia to Kenya—can secure reliable access to premium alumina carbide, fueling growth and competitive differentiation in their respective industries.

Take decisive action now: evaluate your current sourcing framework, explore emerging supplier ecosystems, and invest in strategic partnerships to future-proof your alumina carbide supply chain.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina