Alumina spheres play a pivotal role across diverse industrial applications, from catalysis and adsorption to advanced filtration and thermal insulation. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—including emerging hubs such as Vietnam and Turkey—understanding the complexities of sourcing high-quality alumina spheres is crucial to maintaining competitive advantage and operational efficiency.

Illustrative Image (Source: Google Search)

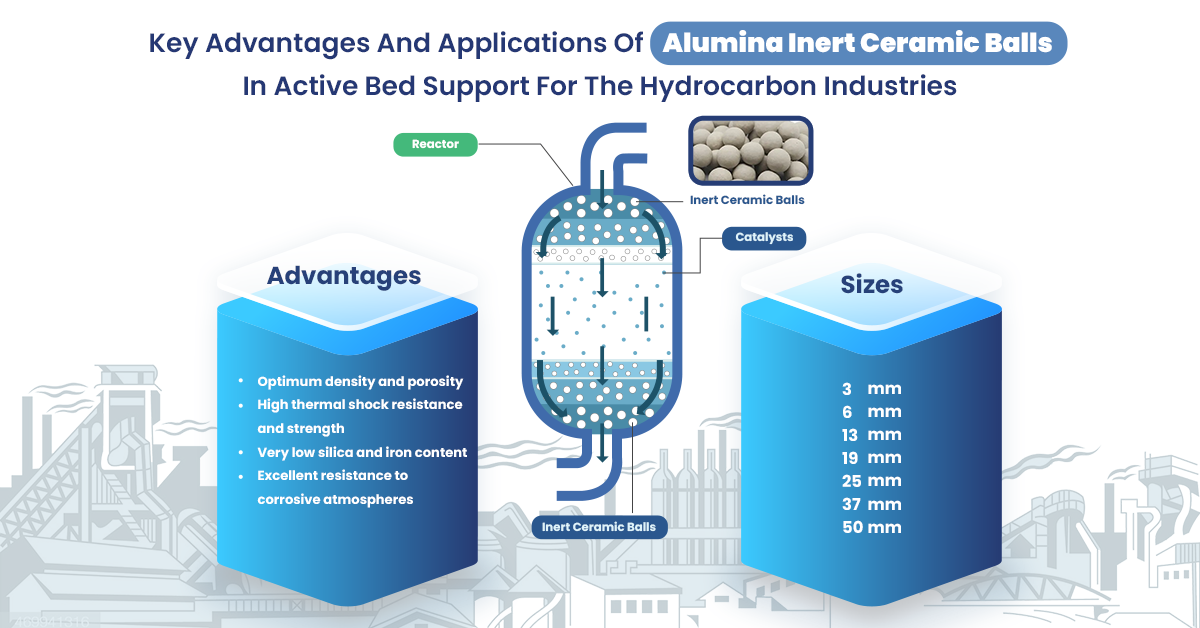

This guide delivers an authoritative roadmap to the global alumina spheres market, equipping procurement professionals and technical buyers with actionable insights. It covers the full spectrum of product types and material grades, highlighting how variations in alumina purity and sphere size impact performance in specialized industrial processes. Additionally, it delves into manufacturing techniques and rigorous quality control standards that ensure consistent product reliability, a key consideration when engaging with suppliers across diverse regions.

Buyers will also find detailed evaluations of supplier landscapes, cost factors, and market trends, enabling informed negotiation strategies and risk mitigation. The inclusion of frequently asked questions addresses common concerns, streamlining the decision-making process and reducing sourcing uncertainties.

Illustrative Image (Source: Google Search)

By synthesizing technical knowledge with market intelligence, this guide empowers international B2B buyers to confidently navigate supplier selections, optimize procurement workflows, and secure alumina spheres that meet stringent application requirements. Whether expanding into new territories or consolidating existing supply chains, readers will gain the tools necessary to drive value and operational excellence in a competitive global market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| High Purity Alumina Spheres | Alumina content > 99.5%, uniform spherical shape, high density | Catalyst carriers, adsorbents in chemical processing | + High thermal stability and chemical resistance – Higher cost, requires precise handling |

| Fused Alumina Spheres | Manufactured by melting and solidifying alumina, irregular microstructure | Grinding media, wear-resistant linings in mills | + Excellent mechanical strength and abrasion resistance – Less uniform size distribution |

| Activated Alumina Spheres | Porous structure, high surface area, often impregnated for specific adsorption | Water purification, desiccants, gas drying | + Superior adsorption capacity – Lower mechanical strength, sensitive to crushing |

| Ceramic Alumina Spheres | Produced via ceramic processing, customizable density and porosity | Fluidized bed reactors, thermal insulation | + Versatile properties tailored to application – Production lead times can be longer |

| Synthetic Alumina Spheres | Engineered with controlled particle size and purity, often doped | Electronics, refractory applications | + Consistent quality and performance – Premium pricing, specialized supply chains |

High Purity Alumina Spheres are prized for their exceptional alumina content (typically above 99.5%) and precise spherical form. These characteristics make them ideal for catalytic support and adsorption in high-end chemical industries. Buyers should prioritize suppliers with stringent quality control and certifications, especially when sourcing for sensitive processes in pharmaceuticals or petrochemicals. While the cost is higher, the durability and performance often justify the investment.

Fused Alumina Spheres are created by melting alumina and cooling it into solid spheres. Their robust mechanical properties make them suitable for abrasive environments such as grinding media or wear-resistant linings in mining and cement plants. Buyers from regions with heavy industrial sectors, like parts of South America and the Middle East, should assess particle size uniformity and hardness to optimize operational efficiency.

Activated Alumina Spheres feature a porous structure providing a large surface area, enhancing adsorption capabilities. Common in water treatment and gas drying, these spheres are effective for removing moisture and contaminants. However, their lower mechanical strength requires careful handling and storage. Buyers should evaluate the pore size distribution and impregnation treatment based on specific purification needs.

Ceramic Alumina Spheres offer flexibility in density and porosity through ceramic manufacturing techniques. This versatility suits applications in fluidized bed reactors or thermal insulation where tailored thermal and mechanical properties are critical. European and Turkish buyers might find local ceramic producers advantageous for customized solutions, balancing lead times and performance.

Synthetic Alumina Spheres are engineered for consistent particle size, purity, and often doped with additives to enhance specific properties. These are essential in electronics manufacturing and refractory applications demanding high precision. Buyers should focus on suppliers with robust R&D capabilities and reliable logistics to ensure supply chain stability, especially in competitive markets like Vietnam and Europe.

| Industry/Sector | Specific Application of alumina spheres | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Petrochemical | Catalyst support in refining and chemical synthesis | Enhances catalyst efficiency and lifespan, improving process yields and reducing downtime | Consistent purity and sphericity; thermal stability; availability of certifications for industrial standards |

| Environmental | Adsorbents in wastewater treatment and gas purification | Effective removal of contaminants, increasing compliance with environmental regulations and lowering operational costs | Particle size distribution; chemical inertness; supplier reliability for bulk orders |

| Ceramics & Refractories | High-performance filler and insulating media | Improves thermal resistance and mechanical strength of ceramic products, extending service life | Uniform particle size; thermal shock resistance; compatibility with ceramic matrices |

| Electronics & Electrical | Insulating beads and substrates for high-voltage equipment | Provides excellent electrical insulation and thermal management, enhancing product safety and durability | Dielectric properties; purity levels; supplier capability to meet tight tolerances |

| Pharmaceuticals & Cosmetics | Carrier beads in controlled release formulations and exfoliants | Enables controlled drug delivery and gentle exfoliation, improving product efficacy and user experience | Biocompatibility; surface treatment options; regulatory compliance documentation |

Alumina spheres serve as catalyst supports in the petrochemical industry, where their uniform shape and high thermal stability facilitate efficient chemical reactions. They help improve catalyst distribution and longevity, leading to higher yields and reduced operational interruptions. Buyers from regions like Africa and the Middle East should prioritize sourcing alumina spheres with consistent purity and certifications to meet stringent industrial standards.

In the environmental sector, alumina spheres are widely used as adsorbents for wastewater treatment and gas purification. Their chemical inertness and optimized particle size enable effective contaminant removal, helping businesses meet regulatory requirements while controlling costs. For B2B buyers in South America and Europe, ensuring reliable supplier capacity for large volumes and verifying chemical resistance is critical.

The ceramics and refractories industry benefits from alumina spheres as fillers and insulating media. Their excellent thermal shock resistance and mechanical strength contribute to durable ceramic products suitable for high-temperature applications. International buyers, including those in Turkey and Vietnam, should focus on sourcing spheres with uniform particle size and proven compatibility with their ceramic formulations.

In electronics and electrical manufacturing, alumina spheres are used as insulating beads and substrates in high-voltage equipment. Their superior dielectric properties and thermal management capabilities help improve safety and product lifespan. Buyers must ensure high purity and tight manufacturing tolerances, particularly when importing to technologically advanced markets in Europe and the Middle East.

Finally, in pharmaceuticals and cosmetics, alumina spheres function as carrier beads in controlled release formulations and as gentle exfoliants. Their biocompatibility and customizable surface treatments enhance product performance and consumer satisfaction. B2B buyers should request detailed regulatory compliance documentation and verify biocompatibility standards to align with health and safety requirements globally.

Related Video: Uses Of Metals - Gold, Copper, Aluminium, Steel | Properties of Matter | Chemistry | FuseSchool

When selecting alumina spheres for industrial applications, understanding the material variations is crucial for optimizing performance, cost, and compatibility. Below is an analysis of the most common alumina sphere materials, focusing on their properties, advantages, limitations, and considerations for international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe.

Key Properties:

High purity alumina spheres offer excellent mechanical strength, high thermal stability (up to ~1700°C), and outstanding chemical inertness. They exhibit superior corrosion resistance against acidic and basic environments and maintain structural integrity under high pressure.

Pros & Cons:

- Pros: Exceptional durability and wear resistance, making them suitable for harsh chemical reactors and high-temperature processes. Low contamination risk.

- Cons: Higher manufacturing complexity leads to elevated costs. Longer lead times may apply due to stringent quality controls.

Impact on Application:

Ideal for catalytic support, grinding media in fine chemical production, and high-temperature filtration. Their chemical inertness suits aggressive media like sulfuric acid or strong alkalis.

International B2B Considerations:

Buyers in Europe and the Middle East often require compliance with ASTM C799 or DIN EN standards for purity and mechanical properties. African and South American markets may prioritize cost-effectiveness but benefit from certification to ensure reliability. Vietnam and Turkey buyers should verify supplier adherence to ISO 9001 quality management systems to ensure consistency.

Key Properties:

This grade balances performance and cost, with moderate thermal resistance (~1400°C) and good mechanical strength. It offers reasonable corrosion resistance but is less inert than high-purity variants.

Pros & Cons:

- Pros: Cost-effective for general industrial use, easier to source globally, and suitable for moderate temperature and pressure conditions.

- Cons: Reduced lifespan in highly corrosive or abrasive environments. Slightly higher impurity levels can affect product quality in sensitive applications.

Impact on Application:

Commonly used in fluidized beds, catalyst carriers for less aggressive reactions, and as grinding media in mineral processing. Suitable for water treatment and petrochemical processes with moderate chemical exposure.

International B2B Considerations:

This material is widely accepted in emerging markets across Africa and South America due to affordability. Buyers should confirm compliance with local standards or equivalent ASTM/DIN norms. Importers in the Middle East and Europe may require traceability documentation and batch testing to ensure consistency.

Key Properties:

Produced by sintering fused alumina, tabular alumina spheres have a dense, angular structure with high abrasion resistance and thermal shock tolerance. They withstand temperatures up to 1750°C and exhibit excellent mechanical strength.

Pros & Cons:

- Pros: Superior wear resistance and thermal stability make them ideal for high-stress environments. They have low impurity content and high bulk density.

- Cons: Higher cost compared to standard alumina; manufacturing complexity can affect lead times. Angular shape may limit fluidization in some applications.

Impact on Application:

Preferred in high-temperature kilns, refractory linings, and as catalyst supports in petrochemical cracking. Their robustness suits abrasive slurries and high-pressure reactors.

International B2B Considerations:

European and Middle Eastern buyers often specify tabular alumina for critical applications requiring ASTM C799 or ISO 9001 compliance. African and South American buyers should weigh the cost-benefit ratio carefully, considering logistics and availability. Vietnam and Turkey markets may require customized sizing and certification for export compliance.

Key Properties:

Made by melting and rapid cooling of alumina, these spheres provide excellent hardness, high melting points (~2050°C), and outstanding abrasion resistance. They have a relatively uniform size distribution and high density.

Pros & Cons:

- Pros: Exceptional durability and resistance to wear and corrosion, suitable for extreme environments. Good thermal conductivity.

- Cons: Generally the most expensive alumina sphere type. Production is energy-intensive, potentially impacting supply chain sustainability.

Impact on Application:

Ideal for abrasive blasting, high-performance grinding media, and refractory applications in steel and glass manufacturing. Their hardness makes them suitable for heavy-duty industrial processes.

International B2B Considerations:

Buyers in Europe and the Middle East often demand strict adherence to ASTM and DIN standards for fused alumina spheres. African and South American importers should consider total landed cost, including tariffs and transportation. Vietnam and Turkey may require detailed technical datasheets and compliance certificates to meet local industrial regulations.

| Material | Typical Use Case for alumina spheres | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| High Purity Alumina | Catalytic supports, high-temp reactors, chemical processing | Superior chemical inertness and thermal stability | High cost and longer lead times | High |

| Standard Purity Alumina | Fluidized beds, mineral processing, moderate chemical exposure | Cost-effective and widely available | Lower corrosion resistance and durability | Low |

| Tabular Alumina | Refractory linings, petrochemical cracking, abrasive slurries | Excellent abrasion resistance and thermal shock tolerance | Higher cost; angular shape limits fluidization | Medium |

| Fused Alumina Spheres | Abrasive blasting, grinding media, steel and glass manufacturing | Exceptional hardness and wear resistance | Most expensive; energy-intensive production | High |

This guide assists international B2B buyers in selecting the optimal alumina sphere material based on application requirements, budget constraints, and regional standards. Engaging with suppliers who provide certification and technical support aligned with local regulations will ensure a successful procurement process.

The production of alumina spheres involves a series of precise and controlled manufacturing stages to ensure the final product meets the stringent requirements of industrial applications such as catalysis, adsorption, and filtration. Understanding these stages provides B2B buyers with insight into product quality, supplier capabilities, and potential customization options.

High-purity alumina powder serves as the primary raw material. The quality of this powder—characterized by its particle size distribution, chemical purity, and phase composition—is critical. Suppliers typically source alumina powders that comply with international standards such as ASTM or ISO for ceramic raw materials. The powder is often blended with binders, plasticizers, and additives to optimize the forming process and final properties.

The alumina powder mixture undergoes forming techniques to create spherical shapes. Common methods include:

Each forming method affects sphere density, porosity, and surface finish, impacting performance in applications.

Post-forming, the green (unfired) spheres are dried under controlled temperature and humidity to prevent cracking and deformation. This stage ensures dimensional stability before firing. In some cases, alumina spheres are assembled into catalyst beds or structured packs, requiring precise size grading and uniformity.

Sintering is a critical thermal process where green spheres are heated at temperatures typically between 1400°C and 1700°C in controlled atmospheres. This densifies the material, enhances mechanical strength, and develops the desired microstructure. Post-sintering finishing may include:

The sintering profile and finishing steps are tailored to meet specific customer requirements, such as abrasion resistance or thermal stability.

For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, ensuring supplier adherence to rigorous quality standards is essential to mitigate risks associated with product failure or non-compliance.

Buyers should verify that suppliers hold valid certifications and can demonstrate compliance through documentation.

Quality control is integrated at multiple stages to ensure product integrity:

For B2B buyers sourcing alumina spheres internationally, due diligence in quality verification is paramount. The following strategies are recommended:

Conducting on-site audits allows buyers to evaluate manufacturing facilities, observe production processes, and verify compliance with quality management systems firsthand. This is particularly valuable for buyers from regions like Africa, South America, and the Middle East, where logistics and communication may present challenges.

Request comprehensive quality documentation, including:

Transparent documentation helps establish trust and traceability.

Engaging independent inspection agencies to perform pre-shipment inspections or laboratory testing adds an unbiased layer of quality assurance. Third-party services can verify batch consistency, certify compliance with international standards, and detect potential deviations early.

Requesting product samples for in-house testing enables buyers to assess performance under actual operating conditions. Pilot testing reduces the risk of large-scale purchase failures and informs any necessary customization.

International buyers should be aware of regional regulatory and market expectations that influence QC requirements:

Understanding these nuances helps buyers tailor supplier selection criteria and negotiate terms that ensure compliance and operational success.

For international B2B buyers, a deep understanding of alumina spheres' manufacturing processes and quality assurance protocols is essential. By focusing on supplier capabilities in raw material control, forming techniques, sintering expertise, and multi-stage quality control, buyers can secure products that meet their exacting standards. Coupled with rigorous verification through audits, documentation review, and third-party inspections, this knowledge empowers buyers across Africa, South America, the Middle East, and Europe to make informed purchasing decisions, minimize risk, and foster long-term supplier partnerships.

When sourcing alumina spheres, international B2B buyers must carefully dissect the underlying cost components to negotiate effectively and optimize procurement budgets. The total cost is influenced by several key factors:

Raw Materials: Alumina spheres are primarily made from high-purity alumina powder. The cost of raw materials fluctuates based on alumina grade, availability, and global commodity prices. Buyers sourcing from regions with limited local alumina production, such as parts of Africa or South America, may face higher base material costs due to import dependency.

Labor Costs: Manufacturing labor varies widely by country. For example, producers in Vietnam may offer competitive labor rates compared to European manufacturers, impacting the final price. Labor intensity also increases with customization and tighter quality controls.

Manufacturing Overhead: This includes factory utilities, equipment depreciation, maintenance, and indirect labor. Advanced manufacturing technologies that improve sphere uniformity and density often increase overhead but enhance product performance.

Tooling and Equipment: Alumina spheres require precision molds and kilns. Initial tooling costs can be significant, especially for custom sizes or specifications, and are usually amortized over large production volumes.

Quality Control (QC): Stringent QC processes, including particle size distribution testing, density measurement, and certification (e.g., ISO, ASTM), add to the cost but are critical for applications in catalysts or refractory materials.

Logistics and Shipping: Transportation costs are especially relevant for buyers in Africa, the Middle East, and South America. Freight charges, customs duties, and import tariffs can substantially increase landed costs. Sourcing from geographically closer suppliers or negotiating Incoterms like FOB or CFR can mitigate expenses.

Supplier Margin: This includes profit margins and risk premiums. Established suppliers with certifications and proven track records might price higher but provide greater reliability and post-sale support.

Understanding what drives pricing variations can empower buyers to make strategic decisions:

Order Volume and Minimum Order Quantity (MOQ): Larger orders typically attract volume discounts. However, buyers from smaller enterprises or emerging markets should balance MOQ with storage and cash flow constraints.

Specifications and Customization: Higher alumina purity, specific grain sizes, and tailored sphere diameters command premium prices. Custom formulations for specialized industrial uses increase tooling and QC costs.

Material Quality and Certifications: Certified products that comply with international standards often carry higher costs but reduce risks associated with substandard materials.

Supplier Location and Reliability: Proximity affects shipping costs and lead times. Suppliers in Turkey or Vietnam might offer competitive pricing but vary in delivery reliability and quality consistency.

Incoterms: The choice of Incoterms (e.g., EXW, FOB, CIF) significantly influences the overall price and risk allocation. Buyers should negotiate terms that optimize their logistics capabilities and cost efficiency.

Negotiate Beyond Price: Engage suppliers in discussions about payment terms, lead times, and after-sales support to unlock additional value.

Evaluate Total Cost of Ownership (TCO): Consider not only the unit price but also transportation, customs fees, storage, and potential quality-related costs like rejects or reprocessing.

Leverage Local and Regional Suppliers: For buyers in Africa or the Middle East, sourcing from nearby countries or regional hubs can reduce lead times and logistics costs.

Understand Pricing Nuances: Market volatility in raw materials and fluctuating freight rates can cause price swings. Establish flexible contracts or periodic price reviews to manage risks.

Request Detailed Quotes: Ensure supplier quotes break down costs transparently—materials, labor, overheads, and logistics—enabling more informed negotiation.

Inspect Samples and Certifications: Prioritize suppliers offering product samples and verifiable quality certificates to avoid costly quality issues.

Prices for alumina spheres vary widely depending on the factors outlined above and prevailing market conditions. The figures discussed here are indicative and should be validated through direct supplier engagement and up-to-date market research tailored to your region and specific requirements.

When sourcing alumina spheres for industrial applications such as catalysis, grinding media, or thermal insulation, understanding the critical technical properties ensures optimal performance and cost-efficiency.

Material Grade (Purity Level): Alumina spheres are commonly available in grades ranging from 85% to 99.9% alumina content. Higher purity levels (e.g., 99.5%+) offer superior mechanical strength, chemical resistance, and thermal stability. For B2B buyers, selecting the correct grade depends on the application’s chemical environment and temperature requirements, directly affecting product longevity and process reliability.

Size and Size Tolerance: Sphere diameters typically range from sub-millimeter to several millimeters, with tight tolerances (e.g., ±0.05 mm). Precise sizing is crucial for applications requiring uniform packing density or consistent flow characteristics, such as in fluidized beds or catalytic reactors. Incorrect sizing can cause performance issues or damage to equipment.

Density and Porosity: Alumina spheres generally have high density (~3.5 g/cm³) and low porosity, impacting their wear resistance and mechanical strength. Buyers should verify these parameters to ensure the spheres can withstand operational stresses without degradation, especially in abrasive or high-pressure environments.

Mechanical Strength (Crush Strength): The ability to withstand compressive forces without fracture is vital for grinding media or catalyst supports. High crush strength reduces material loss and contamination in industrial processes, lowering maintenance costs and downtime.

Thermal Stability: Resistance to thermal shock and stability at elevated temperatures (up to 1700°C for high-grade alumina) is essential for applications in furnaces or reactors. Understanding thermal limits helps buyers avoid premature failure under cyclic heating conditions.

Surface Finish and Sphericity: High sphericity (close to perfect roundness) and smooth surface finish improve packing density and reduce friction in rotary or fluidized systems. This property enhances process efficiency and minimizes wear on adjacent components.

Navigating international alumina sphere procurement requires familiarity with key trade and industry terms that streamline communication and negotiations.

OEM (Original Equipment Manufacturer): Refers to companies that produce equipment or machinery requiring alumina spheres as components. Understanding if the supplier works with OEMs can assure buyers of product quality and compliance with industry standards.

MOQ (Minimum Order Quantity): The smallest quantity a supplier is willing to sell. For buyers in Africa, South America, or smaller enterprises, negotiating MOQ is critical to balance inventory costs with supply reliability.

RFQ (Request for Quotation): A formal document sent to suppliers asking for price and delivery terms. Crafting a detailed RFQ with specifications such as grade, size, and quantity helps buyers receive accurate and comparable offers.

Incoterms (International Commercial Terms): Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) influence cost calculation and risk management, especially important for cross-continental shipments.

Lead Time: The period between order placement and delivery. In global trade, longer lead times may affect production schedules, making it essential for buyers to confirm realistic timelines upfront.

Certification and Compliance: Documentation such as ISO certification or REACH compliance signals adherence to quality and safety standards. Buyers should verify certifications to meet local regulatory requirements and ensure product consistency.

By understanding these essential technical properties and trade terms, international B2B buyers can make informed decisions, optimize supply chain efficiency, and secure alumina spheres that meet precise operational needs.

The global alumina spheres market is experiencing steady growth driven primarily by the expanding industrial sectors such as petrochemicals, refining, and chemical manufacturing. Alumina spheres serve as critical catalyst supports and adsorbents, particularly in fluid catalytic cracking (FCC) units. For international B2B buyers from regions like Africa, South America, the Middle East, and Europe—including emerging markets such as Vietnam and Turkey—understanding these market dynamics is vital for strategic sourcing.

Key Drivers:

Sourcing Trends:

Market Dynamics:

Sustainability is increasingly shaping the alumina spheres sector as industrial buyers align procurement with environmental and social governance (ESG) goals. Alumina spheres production involves energy-intensive processes and raw material extraction, making environmental impact a critical consideration.

Environmental Impact:

Ethical Supply Chains:

Green Certifications and Materials:

By prioritizing sustainability and ethical sourcing, B2B buyers can mitigate risks, enhance brand reputation, and contribute to a more responsible alumina spheres supply chain.

Alumina spheres have evolved significantly since their introduction as catalyst supports in the mid-20th century. Initially, their role was confined to basic adsorption and mechanical support in refining processes. Over the decades, advances in materials science have enhanced their physical and chemical properties—improving thermal resistance, surface area, and pore structure.

This evolution has been driven by the increasing complexity of refining and petrochemical operations, which demand catalysts that deliver higher efficiency and longer service life. For international buyers, understanding this progression highlights the importance of selecting modern, technically advanced alumina spheres tailored to specific process conditions rather than generic products.

Regional manufacturing capabilities have also shifted, with production once concentrated in a few countries now expanding globally. This diversification offers buyers in emerging markets more sourcing options and competitive pricing, supporting the growing demand for high-quality alumina spheres worldwide.

How can I effectively vet suppliers of alumina spheres for international B2B trade?

To vet suppliers, start by verifying their business licenses and certifications such as ISO 9001 or industry-specific quality standards. Request product samples to assess quality and consistency. Check references or existing client testimonials, especially from your region (Africa, South America, Middle East, Europe). Evaluate their production capacity to ensure they can meet your volume requirements. Additionally, consider visiting their facilities or using third-party inspection services to verify manufacturing processes and compliance with environmental and safety standards.

Is customization of alumina spheres available, and what should I consider?

Many manufacturers offer customization in terms of size, purity, and packaging to suit specific industrial applications. When requesting customization, clearly specify technical parameters such as alumina content, sphericity, density, and tolerance levels. Confirm whether the supplier can provide material safety data sheets (MSDS) and certificates of analysis (CoA) for custom batches. Understand how customization impacts lead times and pricing, and negotiate terms accordingly. Custom packaging may also be important for logistics and regulatory compliance in your country.

What are typical minimum order quantities (MOQs) and lead times for alumina spheres?

MOQs vary widely depending on the supplier and product specification but typically range from 500 kg to several tons for standard grades. Custom grades may have higher MOQs due to production setup costs. Lead times often span 3 to 8 weeks, influenced by order size, customization, and supplier location. For international buyers, factor in additional shipping and customs clearance time. Early communication about your timeline and order volume helps suppliers plan production and avoid delays.

What payment terms are common in alumina spheres B2B transactions?

Standard payment terms include advance payment (30% upfront) with balance before shipment or after inspection. Letters of credit (LC) are widely used for international trade to secure both buyer and seller interests. Some suppliers may offer net payment terms (e.g., 30-60 days) for established clients. Negotiate terms based on your credit history and order size. Always ensure payment methods are secure and traceable; avoid cash transactions. Using escrow services or trade finance solutions can mitigate risks in new supplier relationships.

What quality assurance measures and certifications should I look for?

Quality assurance is critical; look for suppliers with ISO 9001 certification and adherence to ASTM or equivalent standards for alumina spheres. Request batch-specific quality reports including particle size distribution, alumina purity, and mechanical strength. Independent third-party testing certificates add credibility. Confirm that the supplier implements in-process quality controls and final inspection protocols. For applications in sensitive industries (e.g., pharmaceuticals, electronics), additional certifications like REACH or RoHS compliance may be required.

What logistics considerations are important when importing alumina spheres?

Alumina spheres are typically shipped in bulk bags or drums, requiring careful handling to avoid contamination or damage. Choose suppliers experienced in international shipping and familiar with export documentation (commercial invoice, packing list, certificate of origin). Understand customs regulations and import duties in your country, and consider working with freight forwarders who can manage multimodal transport efficiently. Insurance coverage for transit risks is advisable. Also, verify if temperature or humidity control is necessary during shipping to preserve product quality.

How should I handle disputes or quality issues with international suppliers?

Establish clear contract terms covering quality standards, inspection rights, and dispute resolution mechanisms before ordering. If quality issues arise, document discrepancies with photos and third-party inspection reports. Communicate promptly and professionally with the supplier to seek resolution such as replacement, refund, or discount. Use arbitration clauses specified in contracts, preferably under internationally recognized bodies like ICC, to resolve conflicts. Maintaining detailed records and open communication can often prevent escalation and preserve long-term business relationships.

Are there region-specific challenges I should be aware of when sourcing alumina spheres?

Yes, regional challenges include variable customs clearance times, differing regulatory standards, and logistical infrastructure limitations. For buyers in Africa and South America, port congestion and import tariffs can impact delivery schedules and costs. Middle Eastern buyers should verify compliance with local certification requirements and import restrictions. European buyers must consider REACH compliance and environmental regulations. Working with suppliers experienced in your region and engaging local agents or consultants can help navigate these challenges effectively.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of alumina spheres offers significant advantages to international B2B buyers seeking to optimize performance and cost-efficiency in their industrial applications. By prioritizing suppliers with proven quality certifications, flexible logistics, and robust technical support, businesses from Africa, South America, the Middle East, and Europe can secure consistent supply chains that mitigate risks associated with market volatility and geopolitical factors.

Key takeaways include the importance of assessing supplier capabilities beyond price—considering innovation in manufacturing processes, environmental compliance, and tailored product specifications. Leveraging strategic partnerships enables buyers to gain competitive advantage through improved product reliability and reduced total cost of ownership. Additionally, understanding regional market dynamics and demand trends empowers buyers to negotiate favorable contract terms and delivery schedules.

Looking ahead, alumina spheres will continue to play a critical role in sectors such as petrochemicals, catalysis, and advanced ceramics. Buyers are encouraged to adopt a proactive sourcing strategy that integrates sustainability and digital supply chain tools to enhance transparency and responsiveness. Engaging early with trusted suppliers in emerging and established markets will position businesses to capitalize on evolving technological advancements and global trade opportunities. Take decisive action now to future-proof your alumina spheres procurement and drive long-term value for your enterprise.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina