The global landscape for aluminum and alumina is both complex and critical for industries spanning automotive, construction, packaging, and aerospace. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the distinct characteristics and supply chain nuances of these two materials is essential to securing competitive advantage and operational resilience.

Aluminum, a lightweight and highly versatile metal, serves as a final product in countless applications. Alumina, its primary raw material derived from bauxite ore, plays a foundational role in the aluminum production process. Navigating the differences between these materials—including their sourcing, quality standards, cost structures, and manufacturing intricacies—empowers buyers to make strategic procurement decisions that optimize both cost-efficiency and product performance.

This guide offers a comprehensive exploration tailored to the needs of international buyers, covering:

By equipping procurement professionals with deep insights and actionable intelligence, this guide facilitates informed sourcing strategies that align with regional market conditions and long-term business goals. Whether negotiating contracts in Turkey, assessing supply risks in South America, or optimizing logistics from the UAE, buyers will gain the clarity needed to confidently navigate the aluminum and alumina markets.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Primary Aluminum | High purity aluminum produced by electrolytic reduction; typically 99.7%+ purity | Automotive, aerospace, packaging, construction | + High malleability and conductivity – Higher cost, energy-intensive production |

| Secondary Aluminum | Recycled aluminum scrap melted and refined | Manufacturing, casting, extrusions | + Cost-effective and eco-friendly – Variable impurity levels affecting quality |

| Activated Alumina | Porous, high surface area form of alumina (Al2O3) | Water purification, desiccants, catalysis | + Excellent adsorption properties – Limited structural use, specialized applications |

| Alumina Trihydrate (ATH) | Hydrated aluminum oxide used as flame retardant filler | Plastics, rubber, paints, coatings | + Improves fire resistance and smoke suppression – Adds weight, may affect material properties |

| Alpha Alumina | Crystalline form of alumina with high hardness and thermal stability | Abrasives, ceramics, electronics | + Superior hardness and wear resistance – Higher cost, niche industrial use |

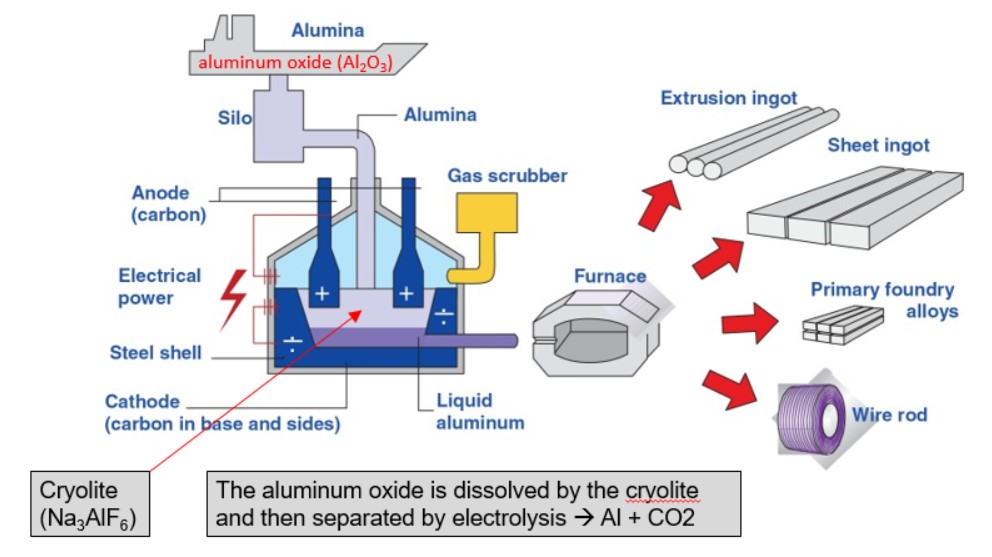

Primary Aluminum is the purest form of aluminum, produced mainly through the Hall-Héroult electrolytic process. Its high purity makes it ideal for applications requiring excellent electrical conductivity and corrosion resistance, such as automotive and aerospace components. For B2B buyers, the main considerations include the premium price due to energy-intensive production and the need for reliable supply chains, especially in regions with fluctuating energy costs.

Secondary Aluminum originates from recycled scrap, offering a sustainable and cost-effective alternative to primary aluminum. It suits industries focused on casting and extrusion where slight variations in purity are acceptable. Buyers should assess the scrap source quality and supplier certifications to ensure consistent alloy properties, critical for manufacturing reliability.

Activated Alumina is a specialized porous form of alumina used primarily for adsorption in water treatment and gas drying applications. Its high surface area makes it valuable for B2B buyers in environmental and chemical sectors. When sourcing, buyers must consider particle size distribution and regeneration capabilities to optimize operational efficiency and lifecycle costs.

Alumina Trihydrate (ATH) serves as an important flame retardant filler in plastics and coatings, enhancing fire resistance and reducing smoke generation. This makes it attractive for manufacturers in construction and automotive industries. However, buyers should evaluate the trade-off between improved safety and potential impacts on material weight and mechanical properties.

Alpha Alumina is a dense, crystalline alumina prized for its hardness and thermal stability, making it suitable for abrasive tools, advanced ceramics, and electronic substrates. B2B purchasers need to factor in its higher cost and specialized manufacturing requirements, ensuring that the material’s superior wear resistance justifies the investment for high-performance applications.

| Industry/Sector | Specific Application of aluminum vs alumina | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transportation | Aluminum: Lightweight vehicle frames and body panels; Alumina: Ceramic components for engine parts | Reduces vehicle weight to improve fuel efficiency and emissions; alumina enhances engine durability and thermal resistance | Ensure aluminum alloys meet regional vehicle standards; alumina purity for thermal stability; logistics for timely delivery |

| Aerospace & Defense | Aluminum: Aircraft structural components; Alumina: Insulating materials for electronics and sensors | High strength-to-weight ratio lowers fuel consumption; alumina provides electrical insulation and heat resistance | Compliance with aerospace quality certifications; traceability of material origin; supplier reliability in volatile markets |

| Construction & Infrastructure | Aluminum: Window frames, roofing, and cladding; Alumina: Abrasives and refractory linings | Corrosion resistance and lightweight reduce maintenance costs; alumina improves durability in high-wear environments | Confirm alloy corrosion resistance for local climates; alumina grain size and hardness for abrasives; import tariffs and standards |

| Electrical & Electronics | Aluminum: Conductive wiring and heat sinks; Alumina: Substrates for electronic circuits | Efficient electrical conductivity and heat dissipation; alumina offers excellent electrical insulation and mechanical strength | Sourcing from suppliers with consistent electrical grade quality; alumina dielectric properties; certification for electronic applications |

| Chemical & Metallurgical | Aluminum: Heat exchangers and chemical reactors; Alumina: Catalyst supports and adsorbents | Aluminum’s thermal conductivity enhances process efficiency; alumina’s chemical inertness supports catalyst longevity | Material compatibility with chemicals used; alumina surface area and porosity specifications; customs clearance for hazardous materials |

Automotive & Transportation

Aluminum’s lightweight nature is crucial for manufacturing vehicle frames and body panels, significantly reducing overall vehicle weight. This leads to better fuel efficiency and lower emissions, essential for markets with stringent environmental regulations like the EU and UAE. Alumina, used in ceramic engine components, provides superior thermal resistance and wear durability, extending engine life. Buyers should prioritize aluminum alloys that conform to regional automotive standards and alumina with high purity for thermal stability. Timely supply chain coordination is critical to avoid production delays.

Aerospace & Defense

In aerospace, aluminum’s high strength-to-weight ratio is vital for structural components, helping reduce fuel consumption and operational costs. Alumina is indispensable as an insulating material in sensitive electronics and sensor systems, offering excellent heat resistance and electrical insulation. Buyers, especially in Europe and the Middle East, must ensure materials meet strict aerospace certifications such as AS9100 and maintain full traceability. Supplier reliability is paramount due to the critical nature of aerospace components and geopolitical market fluctuations.

Construction & Infrastructure

Aluminum is widely used for window frames, roofing, and cladding due to its corrosion resistance and lightweight properties, which lower installation and maintenance costs in diverse climates across Africa and South America. Alumina’s application in abrasives and refractory linings enhances durability in harsh, high-wear construction environments. Buyers should verify aluminum alloys’ corrosion resistance tailored to local environmental conditions and alumina’s grain hardness for effective abrasion. Understanding import tariffs and local building codes is essential for cost-effective sourcing.

Electrical & Electronics

Aluminum is essential for conductive wiring and heat sinks, facilitating efficient electrical conductivity and thermal management in devices. Alumina serves as a substrate for electronic circuits, providing mechanical strength and excellent electrical insulation. For buyers in technologically advancing markets like Turkey and the UAE, sourcing from suppliers with consistent electrical-grade aluminum and alumina quality is critical. Certification for electronic applications and maintaining dielectric property standards are key to ensuring component reliability.

Chemical & Metallurgical

Aluminum’s high thermal conductivity is leveraged in heat exchangers and chemical reactors to improve process efficiency. Alumina’s chemical inertness and high surface area make it ideal as catalyst supports and adsorbents in refining and chemical processes. Buyers must assess material compatibility with specific chemicals and ensure alumina meets porosity and surface area requirements. Additionally, understanding customs regulations for hazardous materials is crucial for smooth cross-border transactions in regions with evolving chemical industries.

Related Video: Uses of metals - IGCSE Chemistry

Key Properties:

Aluminum is a lightweight, highly malleable metal with excellent thermal and electrical conductivity. It has moderate corrosion resistance, especially when anodized, and performs well under temperatures up to approximately 200°C in most industrial applications. Its strength-to-weight ratio makes it ideal for structural components.

Pros & Cons:

* Pros include ease of manufacturing, good machinability, and recyclability. Aluminum’s relatively low density reduces transportation costs and energy consumption during processing. However, cons* involve lower wear resistance compared to ceramics and susceptibility to galvanic corrosion when in contact with dissimilar metals, which can be a concern in harsh environments.

Impact on Application:

Aluminum is widely used in applications requiring lightweight structural parts, heat exchangers, and electrical components. It suits environments with moderate chemical exposure but is less ideal for highly abrasive or extremely high-temperature conditions.

Considerations for International B2B Buyers:

Buyers in regions like the Middle East and Europe should verify compliance with ASTM B209 or EN 573 standards for aluminum alloys, ensuring quality and consistency. In Africa and South America, sourcing aluminum with certification aligned to ISO or DIN standards can facilitate smoother import/export processes. Cost sensitivity in emerging markets often favors aluminum over alumina due to lower raw material and processing costs.

Key Properties:

Alumina is a ceramic material known for exceptional hardness, high melting point (~2072°C), and excellent electrical insulation. It offers outstanding wear resistance and chemical inertness, making it suitable for aggressive environments and high-temperature applications.

Pros & Cons:

* Pros include superior durability, resistance to corrosion and abrasion, and excellent thermal stability. However, cons* are its brittleness, higher manufacturing complexity, and cost compared to metals. Alumina components require precision machining and often specialized handling to avoid fracture.

Impact on Application:

Ideal for applications such as cutting tools, insulators, and chemical processing equipment where high temperature and chemical resistance are critical. Alumina is less suited for load-bearing parts subject to impact due to its brittleness.

Considerations for International B2B Buyers:

Compliance with ASTM C799 or ISO 18754 standards is essential for alumina ceramics, ensuring performance consistency. Buyers in Turkey and UAE should also consider local import regulations and certifications, as well as availability of technical support for ceramic components. Given the higher cost and technical demands, alumina is often selected for high-value, precision applications in these markets.

Key Properties:

Aluminum alloys combine aluminum with elements like magnesium, silicon, and zinc to enhance strength, corrosion resistance, and machinability. Alloys like 6061 offer good weldability and moderate strength, while 7075 is known for high strength but lower corrosion resistance.

Pros & Cons:

* Pros include tailored mechanical properties, improved durability over pure aluminum, and versatility across industries. Cons* involve varying corrosion resistance depending on alloy composition and sometimes more complex heat treatment requirements.

Impact on Application:

These alloys are preferred in aerospace, automotive, and structural applications where specific strength and corrosion profiles are needed. Alloy selection depends on environmental exposure and mechanical load requirements.

Considerations for International B2B Buyers:

Buyers should ensure alloys meet standards such as ASTM B221 or EN 573 to guarantee material properties. In regions like South America and Africa, availability and certification of specific alloys can vary, so partnering with reputable suppliers is critical. Cost differences among alloys should be weighed against performance benefits for the intended application.

Key Properties:

Alumina composites integrate alumina with other ceramic materials (like zirconia) to improve toughness and reduce brittleness while maintaining high hardness and chemical resistance. These composites offer enhanced fracture toughness and thermal shock resistance.

Pros & Cons:

* Pros include improved mechanical reliability over pure alumina, excellent wear resistance, and suitability for harsh chemical environments. Cons* are higher production costs and more complex manufacturing processes, requiring advanced sintering and machining techniques.

Impact on Application:

Used in cutting tools, biomedical implants, and high-performance wear parts where alumina’s brittleness is a limitation. These composites expand the usability of ceramic materials in dynamic or impact-prone environments.

Considerations for International B2B Buyers:

Compliance with ISO 13356 or ASTM standards for ceramic composites is important. Buyers in technologically advanced markets like Europe and the UAE may prioritize these materials for innovation-driven applications. In emerging markets, cost and supplier expertise are key factors influencing adoption.

| Material | Typical Use Case for aluminum vs alumina | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum (Metallic) | Lightweight structural parts, heat exchangers | Lightweight, good machinability | Moderate corrosion resistance, lower wear resistance | Low |

| Alumina (Aluminum Oxide Ceramic) | High-temp insulators, wear-resistant components | Exceptional hardness and chemical resistance | Brittleness, high manufacturing complexity | High |

| Aluminum Alloys (6061, 7075) | Aerospace, automotive, structural components | Tailored strength and corrosion resistance | Variable corrosion resistance, complex heat treatment | Medium |

| Alumina Composites | Cutting tools, biomedical implants, high-wear parts | Improved toughness over pure alumina | Higher cost, complex manufacturing | High |

Aluminum and alumina (aluminum oxide), while closely related, undergo distinctly different manufacturing processes tailored to their end uses in industrial applications. Understanding these processes is crucial for B2B buyers to assess supplier capabilities and product suitability.

Material Preparation

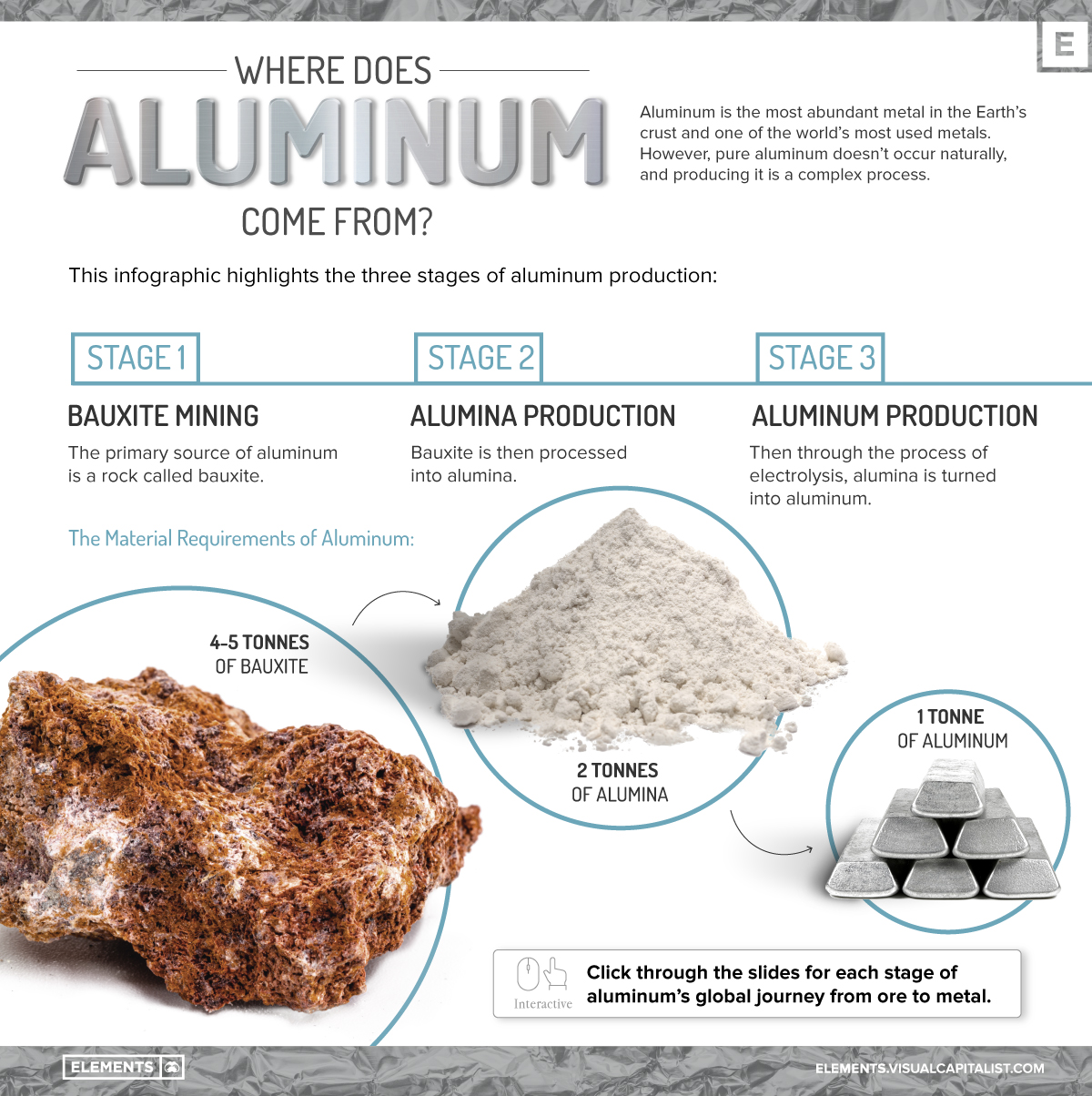

- Bauxite Mining: Aluminum production begins with the extraction of bauxite ore, the primary source of alumina.

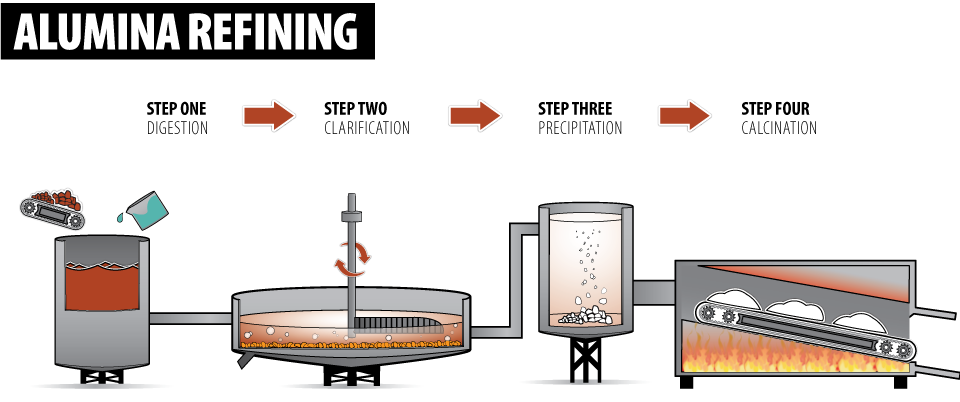

- Refining to Alumina: The Bayer Process refines bauxite into alumina powder by dissolving impurities and precipitating pure aluminum oxide.

- Smelting to Aluminum: The Hall-Héroult process electrolytically reduces alumina to molten aluminum metal in large cells.

Forming and Shaping

- Casting: Molten aluminum is cast into ingots, billets, slabs, or other shapes depending on the application.

- Rolling and Extrusion: These techniques convert cast forms into sheets, plates, foils, and profiles. Rolling is common for thin sheets, while extrusion forms complex cross-sections.

- Forging and Machining: For high-strength applications, forging and CNC machining tailor aluminum components to precise dimensions.

Assembly

- Aluminum parts may be assembled into subcomponents or final products using welding, riveting, or adhesive bonding, especially in automotive, aerospace, and construction sectors.

Finishing

- Surface treatments like anodizing, powder coating, or painting enhance corrosion resistance, aesthetics, and durability.

- Heat treatment processes improve mechanical properties such as strength and hardness.

Extraction and Refining

- Alumina production starts with bauxite ore, similar to aluminum, but the focus is on producing high-purity aluminum oxide powder rather than metallic aluminum.

- The Bayer Process is the cornerstone, producing white alumina powder after removing impurities.

Shaping and Forming

- Alumina powder is shaped through pressing (uniaxial or isostatic) into desired forms such as ceramics, refractory bricks, or catalyst supports.

- Sintering: High-temperature sintering densifies the pressed shapes, imparting mechanical strength and thermal stability.

Assembly and Fabrication

- Alumina components are often assembled into larger structures or integrated with metals or composites for specialized industrial applications.

- Precision machining or grinding may be applied to achieve tight tolerances in high-tech industries.

Finishing

- Surface polishing or coating can be applied to enhance wear resistance or electrical insulation properties.

For international B2B buyers, especially those operating across Africa, South America, the Middle East, and Europe, rigorous quality assurance (QA) is critical to ensure compliance, performance, and reliability.

Incoming Quality Control (IQC)

- Verification of raw materials (bauxite, alumina powder, aluminum billets) for chemical composition, moisture content, and contamination.

- Ensures suppliers source high-quality inputs, reducing downstream defects.

In-Process Quality Control (IPQC)

- Monitoring key manufacturing stages such as casting temperature, rolling thickness, extrusion speed, and sintering conditions.

- Use of inline sensors and statistical process control (SPC) to detect deviations early.

Final Quality Control (FQC)

- Comprehensive testing of finished products including dimensional accuracy, surface finish, mechanical properties, and purity.

- Visual inspection and packaging checks to ensure product integrity during transit.

Supplier Audits

- Conduct on-site or virtual audits focusing on manufacturing process controls, equipment calibration, and employee training.

- Prioritize suppliers with demonstrated adherence to international quality standards.

Review of Quality Documentation

- Request certificates of analysis (CoA), material test reports (MTR), and compliance certificates (e.g., ISO 9001, CE).

- Analyze batch-specific data to confirm consistency.

Third-Party Inspection and Testing

- Engage independent inspection agencies for sampling, testing, and certification before shipment.

- This is particularly critical for new suppliers or large-volume contracts.

Sample Evaluation

- Obtain pre-production or production samples to validate material properties and manufacturing quality.

- Conduct independent lab testing if necessary, especially for critical applications.

By thoroughly evaluating manufacturing processes and quality assurance practices, B2B buyers from Africa, South America, the Middle East, and Europe can confidently source aluminum and alumina products that meet stringent performance and compliance demands.

When sourcing aluminum or alumina, understanding the detailed cost components is critical for effective procurement and budgeting. The primary cost drivers for both materials include:

Several factors dynamically influence the final pricing structure in B2B transactions:

To optimize sourcing costs and ensure supply chain resilience, buyers should consider the following actionable strategies:

Prices for aluminum and alumina are subject to frequent changes driven by global commodity markets, geopolitical events, energy costs, and supplier capacity. The figures and trends discussed are indicative and should be validated with direct supplier quotations and market analysis before finalizing procurement decisions.

Understanding the fundamental technical properties of aluminum and alumina is crucial for international buyers aiming to optimize procurement and manufacturing processes. Each property influences product performance, cost, and suitability for specific applications.

Material Grade

Aluminum: Grades indicate alloy composition and mechanical properties (e.g., 1000 series for pure aluminum, 6000 series for alloyed types). The grade affects strength, corrosion resistance, and machinability.

Alumina: Purity levels (typically 99%+ for industrial use) dictate its electrical insulation and thermal properties. Higher purity alumina is essential for electronics or refractory applications.

B2B Insight: Specifying the correct grade ensures compatibility with production standards and reduces costly rejections or performance failures.

Tolerance and Dimensional Accuracy

This refers to the permissible limits of variation in dimensions. For aluminum products like sheets or extrusions, tight tolerances are critical for assembly precision. Alumina powders and ceramics require controlled particle size and shape for consistent sintering and final product quality.

B2B Insight: Clear tolerance specifications prevent delays caused by rework and ensure interoperability with other materials or components.

Thermal Conductivity

Aluminum is prized for its excellent thermal conductivity (~205 W/mK), making it ideal for heat exchangers and electronics cooling. Alumina, with much lower conductivity (~30 W/mK), serves better as a thermal insulator or substrate.

B2B Insight: Understanding thermal properties aids in selecting materials that meet operational temperature requirements, enhancing product reliability.

Density and Weight

Aluminum’s low density (~2.7 g/cm³) contributes to lightweight constructions, a key factor in automotive and aerospace sectors. Alumina’s higher density (~3.9 g/cm³) affects handling and transport costs.

B2B Insight: Weight considerations impact shipping expenses and structural design choices, important for cost optimization in global supply chains.

Chemical Stability and Corrosion Resistance

Aluminum naturally forms a protective oxide layer, offering good corrosion resistance, especially in marine or humid environments. Alumina is chemically inert and highly resistant to wear and corrosion, making it suitable for harsh industrial settings.

B2B Insight: Selecting the right material based on environmental exposure extends product lifespan and reduces maintenance costs.

Familiarity with trade terminology empowers buyers to negotiate effectively and streamline transactions across diverse markets.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or materials to be used in another company’s final product. For aluminum and alumina suppliers, partnering with OEMs often means adhering to strict quality and delivery standards.

Tip: Clarify if your supplier is an OEM or authorized distributor to assess reliability and compliance.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs vary widely depending on product type and manufacturing processes. For international buyers, understanding MOQ helps in budgeting and inventory planning.

Tip: Negotiate MOQ terms to align with your demand forecasts, especially when testing new materials.

RFQ (Request for Quotation)

A formal document sent to suppliers to request pricing, availability, and delivery details. Precise RFQs specifying grades, tolerances, and quantities lead to accurate and comparable quotes.

Tip: Include all relevant technical specs to avoid misunderstandings and streamline supplier evaluation.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight).

Tip: Select Incoterms that minimize risk and cost based on your logistics capabilities and destination regulations.

Lead Time

The period from order placement to delivery. Lead times for aluminum and alumina can vary due to production complexity or raw material availability.

Tip: Factor lead times into your project schedules to prevent supply chain disruptions.

Batch Number / Lot Number

Identification codes for production batches, critical for traceability and quality control. Particularly important in alumina ceramics where consistency affects performance.

Tip: Request batch documentation to ensure compliance with quality standards and facilitate audits.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, optimize procurement strategies, and foster stronger supplier relationships across regions such as Africa, South America, the Middle East, and Europe. Clear communication of specifications and terms reduces risks and supports successful long-term partnerships.

The global aluminum and alumina markets are shaped by complex, interrelated factors that international B2B buyers must navigate carefully. Aluminum, as a finished or semi-finished metal, is critical for industries ranging from automotive and aerospace to construction and packaging. Alumina, the intermediate product derived from bauxite refining, serves as the essential feedstock for aluminum smelting. Buyers in Africa, South America, the Middle East, and Europe—regions with diverse industrial profiles and resource bases—face unique sourcing challenges and opportunities influenced by geopolitical dynamics, trade policies, and technological innovation.

Key Market Drivers:

Emerging B2B Trends:

For buyers in Africa, South America, Turkey, and the UAE, understanding these dynamics is crucial to aligning sourcing strategies with market realities and competitive positioning.

Sustainability is rapidly becoming a decisive factor in aluminum and alumina sourcing decisions. Aluminum production is energy-intensive and traditionally associated with significant greenhouse gas emissions, primarily from the smelting stage. Alumina refining also consumes substantial energy and water resources, raising environmental concerns.

Environmental Impact Considerations:

Ethical Supply Chain Importance:

For B2B buyers in the Middle East and Europe, aligning procurement with sustainability standards not only meets regulatory and stakeholder expectations but also enhances brand value and market access.

The aluminum-alumina value chain has evolved significantly since aluminum’s commercial viability in the late 19th century. Early aluminum production was limited by costly smelting processes until the Hall-Héroult process enabled large-scale extraction from alumina in the late 1880s. Alumina refining, primarily through the Bayer process, became the industry standard, enabling mass production.

Historically, alumina production was concentrated near bauxite mines, but global trade and energy cost considerations have shifted refining and smelting locations. This geographic dispersion has created a complex global supply chain that today spans raw material-rich regions like Guinea and Brazil, refining hubs in the Middle East and Asia, and consumption centers in Europe and North America.

Understanding this historical context helps B2B buyers appreciate the interplay of resource availability, technological innovation, and geopolitical factors that continue to shape sourcing strategies in aluminum and alumina markets.

What are the key differences between aluminum and alumina that impact international sourcing decisions?

Aluminum is a finished metal used widely in manufacturing, while alumina (aluminum oxide) is a raw material primarily used for producing aluminum and ceramics. For B2B buyers, understanding this distinction is crucial: alumina suppliers focus on raw material quality and purity, whereas aluminum suppliers emphasize product form (sheets, coils, extrusions) and mechanical properties. This affects lead times, pricing, and logistics. Buyers from Africa, South America, the Middle East, and Europe should align their sourcing strategy with their production needs—raw material procurement versus ready-to-use aluminum products—to optimize supply chain efficiency.

How should I vet suppliers of aluminum and alumina to ensure reliability and compliance?

Effective supplier vetting involves verifying certifications such as ISO 9001 for quality management and ISO 14001 for environmental compliance, which are critical in global trade. Request recent test reports for alumina purity or aluminum alloy composition. For regions like the UAE or Turkey, consider suppliers’ experience in exporting to your market and their compliance with local import regulations. Utilize third-party audits or inspection services and review trade references. Prioritize suppliers with transparent supply chains and documented sustainability practices, as these factors increasingly influence procurement decisions and risk management.

Can aluminum and alumina products be customized to meet specific industrial requirements?

Yes, customization is common and often necessary. Aluminum can be tailored in alloy composition, temper, thickness, and surface treatment to suit automotive, aerospace, or construction sectors. Alumina can be supplied with varying purity levels, particle sizes, and granulation to match specific smelting or ceramic manufacturing processes. When negotiating with suppliers, clarify technical specifications upfront and request samples or prototypes. Buyers in emerging markets should also discuss scalability and batch consistency to avoid production disruptions, especially when sourcing from distant regions with complex logistics.

Illustrative Image (Source: Google Search)

What are typical minimum order quantities (MOQs) and lead times for international orders of aluminum and alumina?

MOQs vary significantly based on product form and supplier capacity. For aluminum, MOQs might range from a few tons for standard sheets to larger volumes for specialized alloys. Alumina MOQs often start at several metric tons due to bulk handling and shipping economies. Lead times depend on production cycles and logistics; aluminum products may require 4–8 weeks, alumina 3–6 weeks. Buyers should negotiate flexible MOQs and staggered deliveries when possible, especially if dealing with new suppliers or volatile demand. Early communication on lead times helps manage inventory and cash flow in international transactions.

What payment terms are standard when purchasing aluminum or alumina internationally?

Common payment terms include letters of credit (LC), advance payment, or open account with credit insurance. Letters of credit are preferred for first-time or high-value transactions, offering security to both buyer and seller. Established buyers in regions like Europe or the Middle East may negotiate net 30–60 day terms. Always clarify currency and incoterms (e.g., FOB, CIF) to avoid unexpected costs. To optimize cash flow, consider partial payments aligned with production milestones. Due diligence on supplier financial stability and legal recourse options is essential to mitigate payment risks in cross-border deals.

Which quality assurance certifications and testing protocols should international buyers demand?

Buyers should insist on certifications such as ISO 9001 for quality management systems and ASTM or EN standards compliance for material specifications. For alumina, certificates of analysis (CoA) detailing chemical composition and impurity levels are critical. Aluminum shipments should come with mill test certificates (MTC) confirming mechanical properties and alloy grades. Third-party laboratory testing or inspection reports can provide additional assurance. In regions with strict environmental or safety regulations, compliance with REACH or RoHS may be necessary. Robust QA documentation reduces the risk of non-conformance and supports regulatory approvals.

How can buyers effectively manage logistics and shipping challenges for aluminum and alumina?

Aluminum and alumina shipments require careful planning due to weight, volume, and handling sensitivity. Alumina, often shipped as powder or granules, demands secure packaging to prevent moisture contamination. Aluminum products vary from coils to large extrusions needing specialized freight. Buyers should partner with freight forwarders experienced in handling metals and familiar with customs regulations in Africa, South America, the Middle East, and Europe. Use incoterms that clearly define responsibilities and risks. Implement tracking systems and plan for potential delays due to port congestion or geopolitical factors to maintain supply chain continuity.

Illustrative Image (Source: Google Search)

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complex landscape of aluminum and alumina sourcing, international B2B buyers must prioritize strategic procurement that balances cost, quality, and supply chain resilience. Aluminum offers versatility and direct applicability in manufacturing, while alumina serves as the critical raw material underpinning aluminum production, making both indispensable yet distinct in sourcing strategy. Buyers from Africa, South America, the Middle East, and Europe should leverage regional strengths—such as Africa’s rich bauxite reserves or Europe’s advanced refining capabilities—to optimize supply partnerships and reduce risk exposure.

Key takeaways for effective sourcing include:

Looking ahead, the aluminum and alumina markets are poised for transformation driven by sustainability imperatives, technological innovation, and shifting trade dynamics. Buyers who adopt a proactive, informed sourcing approach will not only secure supply but also gain competitive advantage in evolving global value chains. Act now to build resilient, future-ready procurement strategies that align with both regional opportunities and global market trends.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina