Boron carbide stands as one of the most critical advanced ceramics in global industrial applications, prized for its exceptional hardness, thermal stability, and neutron absorption capabilities. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the complexities of sourcing high-quality boron carbide is essential to maintaining competitive edge in sectors ranging from defense and nuclear energy to abrasives and armor manufacturing.

This comprehensive guide is designed to empower procurement professionals and technical buyers with a thorough understanding of boron carbide’s diverse forms and grades. You will gain insights into raw material characteristics, manufacturing processes, and quality control measures that directly influence product performance and reliability. Additionally, the guide covers critical aspects such as global supplier landscapes, cost drivers, and market dynamics that impact availability and pricing.

Key features include:

- Detailed breakdown of boron carbide types and their industrial applications

- Examination of manufacturing techniques and stringent quality assurance protocols

- Analysis of leading suppliers and regional market trends relevant to your location

- Transparent cost factors and practical sourcing strategies

- Frequently asked questions addressing common challenges and technical considerations

By leveraging this resource, international buyers from diverse regions such as Germany and Mexico to Nigeria and Saudi Arabia will be equipped to make informed, strategic procurement decisions. The guide facilitates risk mitigation, cost optimization, and supplier evaluation, ensuring your investments in boron carbide align with operational goals and quality standards in an increasingly competitive global marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Boron Carbide (B4C) | High hardness, excellent chemical stability, low density | Abrasives, armor plating, nuclear industry | Pros: Cost-effective, widely available; Cons: Brittle, machining challenges |

| Nano-Structured Boron Carbide | Ultra-fine grain size, enhanced mechanical properties | Advanced ceramics, cutting tools, ballistic materials | Pros: Superior strength and toughness; Cons: Higher cost, limited suppliers |

| Boron Carbide Composite | Boron carbide combined with metals or ceramics for improved toughness | Armor systems, wear-resistant coatings, structural components | Pros: Improved impact resistance; Cons: Complex manufacturing, increased price |

| Sintered Boron Carbide | Densified through sintering, improved density and mechanical strength | High-performance armor, abrasives, refractory materials | Pros: Better durability and performance; Cons: Longer lead times, higher cost |

| Boron Carbide Powder | Fine powder form, variable particle size distribution | Raw material for ceramics, coatings, and composites | Pros: Versatile for manufacturing; Cons: Handling requires care, dust control needed |

Standard Boron Carbide (B4C) is the most commonly used form, characterized by its exceptional hardness and chemical resistance. Its low density makes it ideal for lightweight armor and abrasive applications. For B2B buyers, it offers a balance between performance and cost, making it suitable for large-scale industrial use in Africa, South America, and Europe. However, its brittleness can pose challenges in machining and impact resistance, requiring careful handling and processing considerations.

Nano-Structured Boron Carbide features ultra-fine grains that significantly enhance mechanical strength and toughness. This variation is highly sought after for advanced cutting tools and ballistic protection systems where superior performance is critical. Buyers from technologically advanced markets such as Germany and the Middle East should consider the premium pricing and limited availability, but benefit from the material’s enhanced durability and lifespan.

Boron Carbide Composite materials combine boron carbide with metals or ceramics to improve toughness and impact resistance. These composites are particularly valuable in high-stress environments such as military armor and wear-resistant coatings. International buyers should weigh the advantages of improved performance against the complexities of sourcing and manufacturing, which can affect lead times and cost.

Sintered Boron Carbide undergoes a densification process that enhances its mechanical strength and durability. This type is preferred in applications requiring high-performance armor and refractory components. B2B purchasers should anticipate longer production lead times and higher costs but gain from the superior material properties that sintering imparts, making it a strategic investment for demanding industrial applications.

Boron Carbide Powder serves as a versatile raw material for producing ceramics, coatings, and composite materials. Its particle size and purity can vary, impacting its suitability for different manufacturing processes. Buyers must ensure proper handling and dust control measures due to its fine particulate nature. This form is essential for manufacturers requiring flexibility in tailoring boron carbide-based products to specific technical requirements.

Related Video: [765] How Tough are Master Lock's Boron Carbide Shackles?

| Industry/Sector | Specific Application of Boron Carbide | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Defense & Security | Armor plating for military vehicles and personal body armor | Exceptional hardness and lightweight properties enhance protection while maintaining mobility | Ensure consistent quality with certified ballistic standards; compliance with export controls and import regulations in target countries |

| Abrasives & Cutting Tools | Manufacturing of grinding wheels, sandpapers, and cutting tools | High wear resistance and thermal stability increase tool life and efficiency | Verify particle size distribution and purity; secure reliable supply chains to avoid production downtime |

| Nuclear Industry | Neutron absorber in control rods and radiation shielding | High neutron absorption cross-section improves reactor safety and efficiency | Source material with nuclear-grade purity and certification; consider logistics for hazardous material handling |

| Electronics & Semiconductors | Substrate material for high-power, high-frequency electronic devices | High thermal conductivity and chemical stability improve device performance and longevity | Confirm material consistency and compatibility with semiconductor manufacturing standards |

| Automotive Industry | Wear-resistant components in engines and braking systems | Reduces wear and extends component life, leading to lower maintenance costs | Assess material grade and mechanical properties; prioritize suppliers with proven automotive industry experience |

Boron carbide's exceptional hardness and lightweight nature make it a preferred choice in the defense sector, particularly for armor plating used in military vehicles and personal protective gear. It provides superior ballistic protection without compromising mobility, which is critical for operational effectiveness. International buyers, especially from regions like Africa and the Middle East, should prioritize suppliers who meet stringent ballistic certification standards and ensure compliance with local and international export-import regulations.

In the abrasives and cutting tools industry, boron carbide is valued for its extreme wear resistance and thermal stability. It is commonly used in grinding wheels and cutting tools where durability and consistent performance are critical. Buyers from South America and Europe must focus on particle size uniformity and purity to optimize tool life and maintain production efficiency. Establishing partnerships with reliable suppliers is essential to prevent supply interruptions that could affect manufacturing schedules.

The nuclear industry relies on boron carbide as a neutron absorber in control rods and radiation shielding due to its high neutron absorption cross-section. This application directly contributes to reactor safety and operational efficiency. For B2B buyers in Europe and other regions with nuclear facilities, sourcing nuclear-grade boron carbide with appropriate purity certifications is paramount. Additionally, logistics planning must account for the safe handling and transportation of materials classified as hazardous.

In electronics and semiconductor manufacturing, boron carbide serves as a substrate material in high-power and high-frequency devices. Its high thermal conductivity and chemical stability enable improved device performance and longevity. Buyers from technology-driven markets like Germany need to verify material consistency and ensure compatibility with semiconductor fabrication processes to meet stringent industry standards.

The automotive industry benefits from boron carbide in wear-resistant components such as engine parts and braking systems. Incorporating boron carbide enhances component durability, reducing maintenance costs and downtime. International buyers, particularly in emerging markets like Mexico and South America, should evaluate material grades and mechanical properties carefully, selecting suppliers with proven expertise in automotive applications to ensure product reliability and compliance with industry norms.

Related Video: Boron Carbide: Hardness Unleashed

Boron carbide (B4C) is a highly versatile ceramic material widely used in advanced industrial applications due to its exceptional hardness, low density, and chemical stability. When selecting boron carbide materials for B2B procurement, especially across diverse international markets such as Africa, South America, the Middle East, and Europe, understanding the specific grades and forms available is crucial to optimize performance, cost, and compliance.

Key Properties:

Sintered boron carbide ceramics exhibit outstanding hardness (second only to diamond and cubic boron nitride), excellent wear resistance, and high melting point (~2763°C). They offer good chemical inertness and moderate fracture toughness.

Pros & Cons:

- Pros: Exceptional abrasion resistance, lightweight compared to metals, and excellent performance under high-velocity impact and erosion.

- Cons: Brittle nature limits use in high-impact shock without proper design; manufacturing is complex and costly due to sintering processes requiring high temperatures and pressures.

Impact on Application:

Ideal for ballistic armor, abrasive nozzles, and wear-resistant coatings. Suitable for environments with abrasive media and moderate chemical exposure.

International Buyer Considerations:

European buyers, particularly in Germany, often require compliance with DIN standards for ceramics, emphasizing mechanical testing and purity. Buyers in South America and Africa should verify availability of sintered grades with consistent quality and consider logistics for fragile ceramic parts. Middle Eastern buyers must ensure materials meet ASTM C799 for ceramic hardness and wear resistance, especially for defense and oilfield applications.

Key Properties:

Boron carbide powders are characterized by particle size distribution, purity, and surface area. Nano-sized powders offer enhanced sintering activity and improved mechanical properties in composites.

Pros & Cons:

- Pros: Versatile for composite manufacturing, coatings, and additive manufacturing; allows customization of final product properties.

- Cons: Handling nano powders requires strict safety protocols; powders can be expensive and require specialized storage to prevent contamination.

Impact on Application:

Used primarily as a raw material for producing composites, coatings, and advanced ceramics. Enables tailored properties for aerospace, nuclear, and defense sectors.

International Buyer Considerations:

Buyers in Europe and Mexico often require compliance with ISO 9001 quality management for powders. African and South American buyers should ensure suppliers provide detailed material safety data sheets (MSDS) and comply with local hazardous material regulations. Middle Eastern buyers benefit from sourcing powders with certifications for nuclear-grade purity if used in radiation shielding.

Key Properties:

Coatings of boron carbide on metals or ceramics provide surface hardness, chemical resistance, and thermal stability without compromising substrate toughness.

Pros & Cons:

- Pros: Enhances wear and corrosion resistance of base materials; cost-effective compared to bulk ceramics; adaptable to complex geometries.

- Cons: Coating adhesion and uniformity can be challenging; limited thickness achievable; requires specialized deposition techniques such as CVD or PVD.

Impact on Application:

Widely used in cutting tools, armor plating, and chemical processing equipment where surface protection is critical.

International Buyer Considerations:

European buyers prioritize coatings meeting EN standards for surface hardness and adhesion. Buyers in South America and Africa should assess local supplier capabilities for coating technology and after-sales support. Middle Eastern buyers engaged in petrochemical industries need coatings resistant to corrosive hydrocarbons and high temperatures.

Key Properties:

Composites combine boron carbide’s hardness with metal or ceramic matrices, improving toughness, thermal shock resistance, and machinability.

Pros & Cons:

- Pros: Improved fracture toughness and impact resistance; easier to machine than pure boron carbide; tailored properties for specific applications.

- Cons: Higher density than pure B4C; complex manufacturing processes; cost varies depending on composite constituents.

Impact on Application:

Used in armor systems, wear parts, and structural components requiring a balance of hardness and toughness.

International Buyer Considerations:

German and European buyers often require compliance with ASTM F2652 for composite armor materials. South American and African buyers should verify composite homogeneity and mechanical testing reports. Middle Eastern buyers involved in defense procurement should ensure composites meet MIL-STD specifications for ballistic performance.

| Material | Typical Use Case for boron carbide | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Sintered Boron Carbide Ceramics | Ballistic armor, abrasive nozzles, wear parts | Exceptional hardness and wear resistance | Brittle, costly manufacturing | High |

| Boron Carbide Powder | Composite manufacturing, coatings, additive mfg | Versatile raw material for tailored products | Handling safety and contamination risks | Medium |

| Boron Carbide-Coated Components | Cutting tools, armor plating, chemical equipment | Surface hardness and corrosion resistance | Limited coating thickness and adhesion issues | Medium |

| Boron Carbide Composites | Armor systems, wear parts, structural components | Improved toughness and machinability | Higher density and complex production | Medium to High |

This guide equips international B2B buyers with critical insights on selecting the optimal boron carbide material form tailored to their application, regional standards, and supply chain considerations. Proper material choice ensures performance reliability, regulatory compliance, and cost-effectiveness in demanding industrial environments.

Boron carbide (B4C) is a highly durable ceramic material prized for its exceptional hardness, chemical stability, and neutron absorption capabilities. Its manufacturing involves several critical stages to ensure the final product meets stringent performance requirements for industrial applications such as abrasives, armor, and nuclear reactors.

The process begins with the synthesis of boron carbide powder, typically produced by carbothermal reduction of boron oxide with carbon at high temperatures (around 2000°C). Quality raw materials—boron oxide and carbon sources such as graphite or petroleum coke—are carefully selected for purity. Impurities can adversely affect the material's hardness and thermal stability, so sourcing from reputable suppliers with documented quality assurance is essential.

The boron carbide powder undergoes milling to achieve uniform particle size and distribution, which is critical for consistent sintering and mechanical properties. Forming methods vary based on the final application:

Illustrative Image (Source: Google Search)

Each forming technique requires precise control of parameters such as pressure, temperature, and binder composition to minimize defects like cracks or porosity.

Sintering densifies the formed bodies at temperatures typically between 2100°C and 2300°C in inert or vacuum atmospheres to prevent oxidation. This step is crucial for achieving the required mechanical strength and hardness. Advanced methods like hot pressing or spark plasma sintering (SPS) offer enhanced densification and finer microstructures, translating into superior performance characteristics.

Post-sintering heat treatments may be applied to relieve internal stresses or tailor microstructural features, optimizing the material for specific applications.

Due to boron carbide’s extreme hardness, conventional machining is challenging. Specialized techniques such as diamond grinding, ultrasonic machining, or laser cutting are employed to achieve precise dimensions and surface finishes. Finishing processes may include:

Consistent dimensional accuracy and surface quality are vital for components used in high-precision environments.

B2B buyers must ensure their suppliers adhere to rigorous QA/QC protocols to guarantee product reliability, especially when sourcing internationally from regions like Africa, South America, the Middle East, and Europe.

Buyers should verify that suppliers maintain valid certifications and compliance documentation, which can be audited periodically.

For buyers in Africa, South America, the Middle East, and Europe, understanding how to verify supplier quality is crucial to mitigate risks associated with cross-border procurement.

Performing on-site or remote audits helps assess the supplier’s manufacturing capabilities, quality management systems, and compliance with relevant standards. Key focus areas include:

For European buyers, audits may also include verification of CE marking compliance and adherence to EU regulations.

Request detailed quality control reports, including:

Transparent and timely access to these documents is a strong indicator of supplier reliability.

Engaging independent inspection agencies to perform product verification adds an extra layer of assurance. These services can include:

This is especially recommended for buyers in emerging markets where local QC infrastructure may vary.

By implementing these strategies, international B2B buyers can secure high-quality boron carbide products that meet their exacting application demands and regulatory requirements.

When sourcing boron carbide for industrial applications, understanding the detailed cost structure is critical for informed procurement decisions. The primary cost components include:

Several factors influence the final pricing of boron carbide in the international B2B context:

Prices for boron carbide vary widely based on quality, quantity, and market conditions. The information provided here serves as a guideline for understanding cost drivers and pricing influencers but should not be taken as fixed or universally applicable. Buyers are advised to request detailed quotations and conduct thorough supplier assessments tailored to their specific needs and regions.

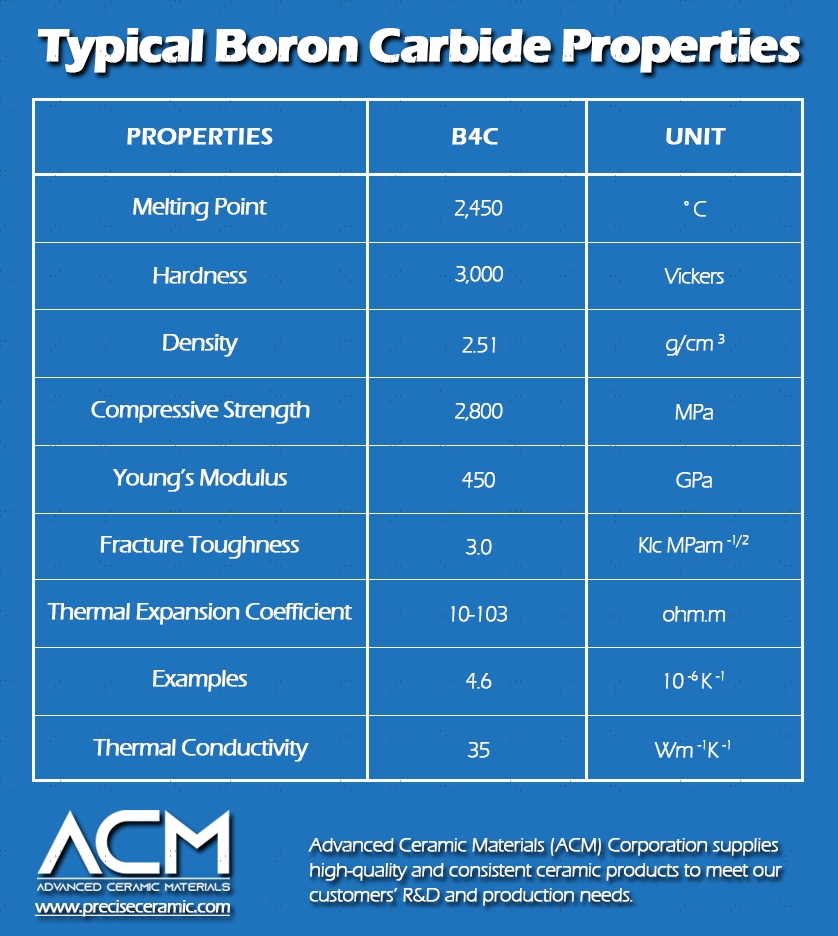

Understanding the critical technical properties of boron carbide is essential for international B2B buyers aiming to select the right material for their applications, such as abrasives, armor plating, or nuclear components. Here are the most relevant specifications to consider:

Material Grade

Boron carbide is available in various grades depending on purity and particle size distribution. Higher purity grades (above 99%) offer superior hardness and chemical resistance, essential for high-performance applications. Buyers should verify the grade to match the end-use requirements, as lower-grade material might not meet durability or safety standards.

Particle Size and Distribution

This property affects the material’s behavior during processing and final product performance. Finer particle sizes improve sintering and uniformity in composites, while coarser grains may be preferred for abrasive blasting. Specifying the particle size range is crucial for quality control and process optimization.

Density and Porosity

Density impacts mechanical strength and resistance to wear. Boron carbide typically has a density around 2.52 g/cm³, but actual values may vary with manufacturing processes. Porosity affects toughness and durability; lower porosity indicates better structural integrity, important for ballistic and industrial applications.

Hardness (Mohs Scale)

Boron carbide ranks around 9.5 on the Mohs hardness scale, making it one of the hardest materials available. This property underpins its use in cutting tools and armor. Buyers should confirm hardness values from suppliers to ensure conformity with application demands.

Tolerance and Dimensional Stability

Precise dimensional tolerance (e.g., ±0.01 mm) is vital for components that must fit exact assemblies. Boron carbide parts can experience minimal thermal expansion, but buyers should request detailed tolerance data to prevent assembly issues, especially in aerospace or defense sectors.

Chemical Stability and Corrosion Resistance

Boron carbide is chemically inert and resistant to acids and alkalis, making it suitable for harsh environments. Buyers in chemical processing or nuclear industries should ensure the material’s certification for specific environmental resistances.

Navigating international boron carbide procurement involves understanding key trade terms. These terms facilitate clear communication and smooth transactions between suppliers and buyers across Africa, South America, the Middle East, and Europe.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment that may be marketed by another manufacturer. For buyers, OEM-grade boron carbide means material meeting strict quality and compatibility requirements for integration into branded products.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs for boron carbide can vary widely, impacting inventory costs and supply chain planning. Buyers should negotiate MOQ terms that align with their project scale and storage capabilities.

RFQ (Request for Quotation)

A formal process where buyers solicit detailed price and delivery information from suppliers. An effective RFQ includes specifications like grade, particle size, and tolerance, enabling suppliers to provide accurate and comparable offers.

Incoterms (International Commercial Terms)

Standardized trade terms that define the responsibilities of buyers and sellers regarding shipping, insurance, and customs duties. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding these terms helps buyers from different regions manage costs and risks effectively.

Lead Time

The period between placing an order and receiving the goods. Boron carbide production can involve complex manufacturing steps, so buyers should confirm lead times to ensure project timelines are met.

Certification and Compliance

Certifications such as ISO 9001 or specific nuclear-grade approvals provide assurance of product quality and regulatory compliance. Buyers should request relevant certifications to meet industry standards and legal requirements in their countries.

By focusing on these technical properties and trade terms, B2B buyers can make informed decisions, negotiate better contracts, and ensure the boron carbide procured meets their precise operational and quality needs. This knowledge is especially valuable when dealing with diverse markets across Africa, South America, the Middle East, and Europe, where supplier capabilities and regulatory frameworks may vary.

Boron carbide (B4C) stands as one of the hardest ceramic materials globally, prized for its exceptional hardness, low density, and high neutron absorption capability. These properties drive demand across diverse industries such as defense (armor plating), abrasives, nuclear reactors, and automotive components. For international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe, understanding the evolving market dynamics is crucial for strategic sourcing.

Illustrative Image (Source: Google Search)

Global Drivers:

The expanding defense budgets in emerging economies, including countries in the Middle East and Africa, fuel demand for boron carbide-based armor solutions. Additionally, the push for lightweight, durable materials in automotive and aerospace sectors across Europe (notably Germany) and Mexico propels growth. The nuclear industry's sustained interest in boron carbide for neutron shielding also underpins steady demand.

Sourcing Trends:

- Regional Supply Chains: While China remains a dominant supplier due to its rich boron mineral reserves and established processing infrastructure, buyers in Europe and the Americas increasingly seek diversified sources to mitigate geopolitical risks and supply disruptions. Countries in South America, such as Chile and Argentina, are emerging as alternative raw material providers.

- Technological Advancements: Powder synthesis and sintering technologies are evolving, leading to higher purity and more consistent boron carbide products, which is critical for high-performance applications. Buyers are prioritizing suppliers who invest in R&D and quality certifications.

- Customization and Integration: There is a growing trend for tailored boron carbide grades to meet specific application requirements, such as varying grain sizes or composite formulations. B2B buyers benefit from partnerships with manufacturers offering design collaboration and just-in-time delivery.

Market Dynamics:

Price volatility in boron carbide raw materials, driven by fluctuating boron ore extraction and processing costs, requires buyers to adopt flexible procurement strategies. Forward contracts and strategic stockpiling are common among European and Middle Eastern buyers to ensure supply continuity. Moreover, trade regulations and tariffs, especially impacting imports into South America and Europe, necessitate due diligence and robust supplier relationships.

Sustainability considerations are increasingly shaping procurement decisions in the boron carbide sector. The environmental footprint of boron carbide production primarily stems from energy-intensive mining and processing of boron ores, as well as chemical treatments used during synthesis.

Environmental Impact:

Mining boron minerals can lead to land degradation and water resource depletion if not managed responsibly. The high-temperature sintering processes consume significant energy, often sourced from fossil fuels. B2B buyers must evaluate suppliers on their environmental management systems and carbon footprint reduction efforts.

Importance of Ethical Supply Chains:

For international buyers, especially those in Europe and the Middle East, adherence to ethical sourcing standards is non-negotiable. Transparency in labor practices, compliance with local environmental regulations, and conflict-free sourcing are critical. Ethical certifications and third-party audits enhance supplier credibility.

Green Certifications & Materials:

- ISO 14001 Environmental Management: Many leading boron carbide producers now maintain ISO 14001 certification, demonstrating systematic environmental stewardship.

- Sustainability Reporting: Suppliers providing detailed sustainability reports on resource use, emissions, and waste management enable buyers to align purchases with corporate social responsibility goals.

- Innovative ‘Green’ Boron Carbide: Research into boron carbide production using renewable energy sources and recycled raw materials is underway, offering future avenues for sustainable procurement.

By integrating sustainability criteria into supplier selection, B2B buyers from Africa to Europe can reduce environmental risks, meet regulatory requirements, and enhance their brand reputation.

Boron carbide was first synthesized in the late 19th century, but it was not until the mid-20th century that its industrial potential was fully realized. Initially developed for abrasive applications due to its extreme hardness, boron carbide's role expanded with the advent of advanced ceramics technology. The Cold War era accelerated its use in military armor, while nuclear applications grew with the development of neutron absorbers.

Over the decades, improvements in powder processing and sintering have enhanced boron carbide's mechanical properties and manufacturability. Today, it remains a critical high-performance material, with its evolution closely tied to advancements in materials science and global industrial demands. For B2B buyers, understanding this history underscores the material’s reliability and the continuous innovation shaping its future applications.

How can I effectively vet boron carbide suppliers for international B2B purchases?

To vet suppliers, start by verifying their certifications such as ISO 9001 and compliance with international standards like REACH or RoHS. Request detailed technical datasheets and samples to assess product quality. Check their production capacity to ensure they can meet your volume needs. Also, review their export experience, especially with your region (Africa, South America, Middle East, Europe). Engage in direct communication to evaluate responsiveness and transparency. Utilize third-party audits or inspections if possible to validate claims and ensure reliability.

Is customization of boron carbide grades or particle sizes commonly available from suppliers?

Yes, many boron carbide suppliers offer customization of particle size distribution, purity levels, and granule shapes to suit specific industrial applications such as abrasives, armor, or refractory materials. When negotiating, clarify your technical requirements upfront and confirm the supplier’s capability to meet these specifications. Custom orders may affect minimum order quantities (MOQ) and lead times, so ensure these details are explicitly agreed upon in contracts to avoid delays or misalignment.

What are typical minimum order quantities (MOQs) and lead times for boron carbide shipments internationally?

MOQs can vary widely depending on the supplier’s scale and production process, but typically range from 500 kg to several tons. Lead times usually span 4 to 8 weeks, factoring in production, quality checks, and shipping. Buyers from regions with longer shipping durations, such as Africa or South America, should negotiate lead times that accommodate transit times and customs clearance. Early order placement and clear scheduling help mitigate risks of supply disruption.

What payment terms are standard for international boron carbide transactions, and how can buyers protect themselves?

Common payment terms include 30-50% advance with the balance paid upon shipment or delivery. Letters of credit (LC) are widely used to secure transactions and reduce risk, especially in new supplier relationships. Buyers should request clear payment milestones aligned with production and shipment progress. Escrow services or trade finance solutions can also add protection. Always confirm currency arrangements and be aware of potential fluctuations affecting cost.

What quality assurance measures and certifications should I expect from boron carbide suppliers?

Suppliers should provide certificates of analysis (CoA) confirming chemical composition, purity, and particle size. Quality management system certifications like ISO 9001 indicate consistent manufacturing standards. For buyers in regulated industries or regions, compliance with environmental and safety standards (e.g., REACH in Europe) is crucial. Insist on product traceability and batch testing reports to ensure product reliability and adherence to specifications.

What logistics challenges are common in shipping boron carbide internationally, and how can they be mitigated?

Key challenges include customs clearance delays, handling hazardous material classifications, and transportation damage due to improper packaging. To mitigate, partner with freight forwarders experienced in industrial minerals shipping and ensure all documentation (HS codes, MSDS) is accurate. Use robust packaging to protect against moisture and contamination. Buyers should also consider incoterms carefully to define responsibilities and risks during transit.

How should disputes over product quality or delivery issues be handled in international boron carbide trade?

Establish clear contractual terms covering quality standards, inspection procedures, and dispute resolution methods before purchase. In case of disputes, initiate communication promptly with the supplier to negotiate a resolution. Utilize third-party inspection or arbitration services if necessary. Including arbitration clauses specifying neutral venues and governing law in contracts helps protect buyer interests and expedites conflict resolution.

Are there region-specific considerations for buyers in Africa, South America, the Middle East, and Europe when sourcing boron carbide?

Yes, buyers should consider regional import regulations, tariffs, and certification requirements that vary significantly. For instance, Europe enforces strict REACH compliance, while some African countries may have complex customs procedures. Logistics infrastructure differs, impacting delivery reliability and cost. Building relationships with suppliers familiar with your region’s trade environment is advantageous. Additionally, currency exchange fluctuations and political stability in your region should be factored into procurement planning.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of boron carbide is pivotal for international B2B buyers aiming to optimize supply chain resilience, cost efficiency, and product quality. Given boron carbide’s critical applications—from advanced armor systems to high-performance abrasives—buyers must prioritize suppliers with proven reliability, compliance with international standards, and the capacity to scale with evolving demand.

Illustrative Image (Source: Google Search)

Key takeaways include:

Looking ahead, market dynamics and technological advances will continue to shape boron carbide sourcing. Buyers from regions like Germany and Mexico are uniquely positioned to leverage emerging supplier ecosystems and digital procurement platforms to secure competitive advantages. Embracing strategic sourcing now will not only safeguard operational continuity but also unlock opportunities in high-growth sectors dependent on boron carbide.

International buyers are encouraged to proactively assess their sourcing strategies, engage with trusted global suppliers, and invest in supply chain intelligence to stay ahead in this critical materials market.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina