Carbide cladding stands at the forefront of industrial innovation, delivering unmatched wear resistance and durability across sectors such as mining, construction, and manufacturing. For international B2B buyers, especially those operating in diverse and dynamic markets like Africa, South America, the Middle East, and Europe, understanding the nuances of carbide cladding is essential to optimize asset longevity and operational efficiency.

This guide offers a comprehensive exploration of carbide cladding, designed to equip procurement professionals and technical decision-makers with actionable insights. It covers critical aspects including:

By integrating technical knowledge with market intelligence, this guide empowers buyers from Brazil to Botswana, Saudi Arabia to Spain, to make informed sourcing decisions that balance quality, cost, and delivery. Whether upgrading existing equipment or launching new projects, mastering the global carbide cladding market is crucial for sustaining competitive advantage in challenging environments.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Thermal Spray Carbide Cladding | Uses high-velocity spray to deposit carbide particles on substrate | Mining equipment, wear-resistant parts | + High wear resistance, adaptable to complex shapes – Requires specialized equipment, moderate adhesion strength |

| Weld Overlay Carbide Cladding | Carbide particles embedded via welding process | Heavy machinery, earth-moving tools | + Strong metallurgical bond, durable under impact – Heat-affected zones may cause distortion, slower process |

| Brazed Carbide Cladding | Carbide particles joined to substrate using a brazing alloy | Cutting tools, precision components | + Minimal heat distortion, excellent hardness – Limited to smaller parts, less suitable for large surfaces |

| Laser Cladding Carbide | Laser melts carbide and substrate for metallurgical bonding | Aerospace parts, tooling | + Precise control, minimal dilution, high bond strength – High capital cost, requires skilled operators |

| Detonation Gun Cladding | Uses explosive force to propel carbide particles onto surface | Oil & gas drilling tools, industrial blades | + Dense, hard coatings, excellent adhesion – Safety concerns, limited to flat or simple shapes |

Thermal Spray Carbide Cladding

Thermal spray cladding involves propelling carbide particles at high velocity to coat surfaces, creating a wear-resistant layer. It is especially suited for components with complex geometries common in mining and heavy industry sectors across Africa and South America. Buyers should consider the availability of local service providers with the right equipment and the coating’s moderate bond strength. This method offers flexibility but may require post-processing for optimal adhesion.

Weld Overlay Carbide Cladding

This traditional method fuses carbide particles into a substrate through welding, producing a metallurgically bonded, durable layer ideal for heavy-duty applications such as earth-moving and construction equipment. It is favored in regions with established welding expertise like Europe and the Middle East. Buyers should weigh the risk of heat-induced distortion and longer production times against the superior impact resistance and longevity of the coating.

Brazed Carbide Cladding

Brazing attaches carbide particles with a filler metal at lower temperatures, minimizing heat damage. This technique is common for cutting tools and precision parts requiring high hardness without substrate distortion, making it attractive for manufacturers in precision-driven markets like Europe and Brazil. However, it is less effective for large or heavily loaded surfaces, so buyers should assess part size and application demands carefully.

Laser Cladding Carbide

Laser cladding offers high precision by melting carbide powders and the substrate simultaneously, ensuring a strong bond with minimal dilution. This cutting-edge technology is suitable for aerospace and tooling industries, where exacting standards prevail. While the upfront investment and need for skilled operators may be significant, buyers in advanced manufacturing sectors can benefit from superior coating quality and reduced rework costs.

Detonation Gun Cladding

Using explosive force to deposit carbide particles, detonation gun cladding produces dense, hard coatings with exceptional adhesion, ideal for oil & gas drilling tools and industrial blades. This method is predominantly used in regions with stringent safety protocols and industrial capacity, such as Europe and parts of the Middle East. Buyers must consider safety implications and shape limitations but gain from coatings that deliver outstanding wear resistance in harsh environments.

Related Video: What Is Cladding And Types Of Cladding?

| Industry/Sector | Specific Application of carbide cladding | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Mining and Quarrying | Wear-resistant linings for crushers and grinding mills | Extends equipment life, reduces downtime and maintenance costs | Ensure cladding thickness and carbide quality meet abrasion levels; verify supplier’s experience with mining-grade materials |

| Oil & Gas | Corrosion and wear protection on drilling tools and pipelines | Enhances durability under harsh conditions, prevents costly failures | Confirm compatibility with local environmental standards; assess supplier’s ability to deliver customized cladding for extreme environments |

| Manufacturing & Tooling | Surface enhancement of cutting tools and dies | Improves cutting performance and tool longevity | Prioritize precise cladding uniformity; consider lead times and logistics for international delivery |

| Power Generation | Protection of turbine blades and boiler components | Increases operational efficiency and reduces repair frequency | Check thermal stability of cladding; evaluate supplier’s certifications and past project references |

| Agricultural Machinery | Cladding on plowshares and tillage equipment | Minimizes wear from soil abrasion, extends equipment service life | Assess wear resistance grade; confirm availability of after-sales support and technical guidance |

Carbide cladding plays a pivotal role in the mining and quarrying sector by providing wear-resistant linings for crushers and grinding mills. These components face extreme abrasive forces, and applying carbide cladding significantly extends their operational life. For international buyers in regions like Africa and South America, where mining activities are intensive, selecting cladding with the right thickness and carbide grade is crucial to withstand local ore hardness. Working with suppliers experienced in mining applications ensures tailored solutions that reduce costly downtime.

In the oil and gas industry, carbide cladding is essential for protecting drilling tools and pipelines from corrosion and wear, especially in aggressive environments such as offshore rigs common in the Middle East and Europe. This application demands cladding materials that can endure high pressures and corrosive fluids, enhancing equipment durability and preventing failures. Buyers should verify that suppliers comply with regional environmental and safety standards and can customize cladding to specific operational conditions.

For manufacturing and tooling, carbide cladding is applied to cutting tools and dies to boost cutting efficiency and extend tool life. This is particularly valuable for manufacturers in Europe and Thailand seeking to optimize production while controlling tooling costs. Buyers must focus on the uniformity and precision of the cladding layer, ensuring it meets the tight tolerances required for high-performance tooling. Additionally, sourcing from suppliers who can manage international logistics and provide timely delivery is a key consideration.

In power generation, carbide cladding protects turbine blades and boiler components from wear and thermal degradation. This application is vital for energy producers in Europe and South America aiming to maximize operational uptime and reduce maintenance. The cladding must exhibit excellent thermal stability and resistance to erosion. International buyers should evaluate supplier certifications and request case studies demonstrating successful application in similar power generation environments.

Finally, in agricultural machinery, carbide cladding is used on plowshares and tillage equipment to reduce wear caused by soil abrasion. This extends the service life of machinery critical to farming operations in regions like Brazil and Africa. When sourcing cladding for agricultural tools, buyers should consider the wear resistance grade appropriate to the soil conditions and confirm the availability of technical support to optimize cladding performance in the field.

Related Video: How Is Carbide Made?

When selecting materials for carbide cladding, international B2B buyers must carefully evaluate the specific properties and performance characteristics that align with their operational environments and industry standards. This is especially critical for buyers in regions such as Africa, South America, the Middle East, and Europe, where diverse industrial applications and regulatory frameworks influence material choice.

Key Properties: Tungsten carbide is renowned for its exceptional hardness, wear resistance, and high melting point (around 2,870°C). It offers excellent resistance to abrasion and erosion, making it suitable for high-impact and high-temperature environments. It also withstands moderate corrosion but is less resistant to strong acids.

Pros & Cons: The durability of WC cladding is outstanding, ensuring long service life in abrasive conditions. However, tungsten carbide is relatively expensive and requires sophisticated manufacturing processes such as powder metallurgy and precise welding techniques. Its brittleness can be a limitation under heavy impact shock.

Impact on Application: WC cladding is ideal for mining equipment, cutting tools, and wear-resistant surfaces exposed to abrasive slurries or particulate media. It performs well in dry and moderately corrosive environments but is less suitable for highly acidic or highly oxidizing conditions.

International Buyer Considerations: Buyers in Brazil, South Africa, and the Middle East should verify compliance with ASTM B760 or DIN EN standards for carbide coatings. The high cost may require balancing budget constraints with performance benefits. European buyers often prefer suppliers who provide certification and traceability aligned with ISO 9001 quality management systems.

Key Properties: Chromium carbide offers excellent corrosion resistance, particularly against acidic and alkaline media, and good wear resistance. It has a melting point around 1,800°C and maintains hardness at elevated temperatures.

Pros & Cons: Cr3C2 cladding is more corrosion-resistant than tungsten carbide and moderately priced. It is less brittle and easier to apply via thermal spray or welding overlay methods. However, it has lower abrasion resistance compared to WC and can be susceptible to cracking if improperly applied.

Impact on Application: This material is suitable for chemical processing equipment, valves, and pumps where corrosion and moderate wear are concerns. It is effective in environments with acidic or alkaline fluids, making it relevant for oil & gas and chemical industries prevalent in the Middle East and South America.

International Buyer Considerations: Compliance with ASTM A262 or DIN EN ISO 12944 standards is common for corrosion-resistant claddings. Buyers in Europe and Africa should consider local environmental regulations impacting chemical resistance requirements. The moderate cost and ease of application make it attractive for refurbishment projects.

Key Properties: Titanium carbide is characterized by high hardness, good corrosion resistance, and excellent thermal stability. It has a melting point near 3,160°C and resists oxidation better than tungsten carbide.

Pros & Cons: TiC cladding offers a balance of wear and corrosion resistance with less brittleness than WC. It is more costly than chromium carbide but can outperform it in aggressive environments. Manufacturing complexity is moderate, often requiring advanced welding or plasma spray techniques.

Impact on Application: TiC is well-suited for aerospace, automotive, and chemical processing industries where both wear and corrosion resistance are critical. It handles high-temperature oxidizing environments better, making it applicable in European and Middle Eastern markets with stringent performance demands.

International Buyer Considerations: Buyers should ensure compliance with JIS or DIN standards for titanium-based coatings. In regions like Europe and the Middle East, where environmental and safety regulations are strict, TiC’s superior oxidation resistance is a key advantage. Cost considerations may limit its use in price-sensitive markets in Africa and South America.

Key Properties: Nickel-based alloys combined with carbides provide excellent corrosion resistance, toughness, and wear resistance. These claddings maintain integrity under thermal cycling and high-pressure conditions.

Pros & Cons: The nickel matrix offers ductility, reducing cracking risk compared to pure carbide claddings. This makes it suitable for complex geometries and dynamic loads. However, nickel-based claddings are generally more expensive and require skilled application techniques like laser cladding or high-velocity oxygen fuel (HVOF) spraying.

Impact on Application: Ideal for oil & gas pipelines, chemical reactors, and marine environments where corrosion, wear, and thermal stresses coexist. This material is favored in European and Middle Eastern markets with rigorous durability and compliance requirements.

International Buyer Considerations: ASTM F75 and ISO 15156 standards often govern nickel-based claddings. Buyers in Africa and South America should assess supplier capabilities for certified application methods. The higher cost is offset by longer service life and reduced maintenance in demanding applications.

| Material | Typical Use Case for carbide cladding | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Tungsten Carbide (WC) | Mining equipment, cutting tools, abrasive surfaces | Exceptional hardness and wear resistance | High cost and brittleness under shock | High |

| Chromium Carbide (Cr3C2) | Chemical processing equipment, valves, pumps | Superior corrosion resistance | Lower abrasion resistance, potential cracking | Medium |

| Titanium Carbide (TiC) | Aerospace, automotive, chemical processing | Balanced wear and corrosion resistance | Higher cost, moderate manufacturing complexity | High |

| Nickel-Based Carbide | Oil & gas pipelines, chemical reactors, marine parts | Combines toughness with corrosion resistance | Expensive, requires skilled application | High |

This guide enables B2B buyers to strategically select carbide cladding materials that best fit their operational demands and regional standards, optimizing performance and cost-efficiency across diverse industrial sectors.

Carbide cladding involves bonding a carbide layer—commonly tungsten carbide or titanium carbide—to a substrate material, typically steel, to enhance surface hardness, wear resistance, and corrosion protection. For international B2B buyers, understanding the core manufacturing stages and techniques is essential to evaluate supplier capabilities and product quality.

Robust quality assurance (QA) and quality control (QC) frameworks are vital for carbide cladding suppliers to meet stringent international standards and buyer expectations. B2B buyers from diverse regions—Africa, South America, the Middle East, and Europe—must be aware of these standards and verification methods.

For buyers in Africa, South America, the Middle East, and Europe, ensuring supplier QC integrity is crucial, particularly when dealing with remote or unfamiliar manufacturers.

Understanding the intricate manufacturing stages and rigorous quality assurance practices behind carbide cladding empowers international B2B buyers to make informed sourcing decisions. Prioritizing suppliers with certified processes, robust QC systems, and transparent documentation will minimize risk, ensure product performance, and foster long-term partnerships across global markets.

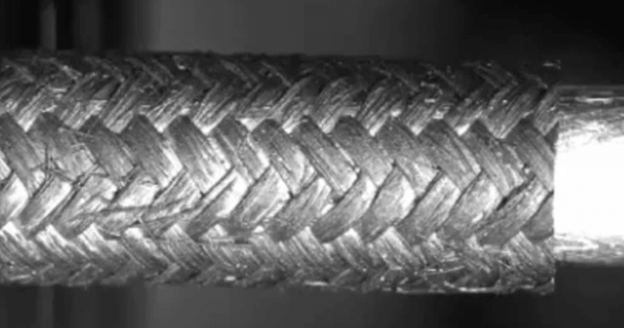

Illustrative Image (Source: Google Search)

When sourcing carbide cladding, understanding the detailed cost structure is essential for international B2B buyers to make informed purchasing decisions. The primary cost components include:

Several factors influence the price quotations you receive from carbide cladding suppliers:

To optimize cost-efficiency and ensure value in carbide cladding procurement, consider the following actionable insights:

The pricing and cost components outlined are indicative and can vary widely based on market conditions, supplier capabilities, and order specifics. Buyers are encouraged to obtain multiple quotes and conduct thorough due diligence tailored to their region and application requirements.

Understanding the critical technical specifications of carbide cladding is essential for international B2B buyers to ensure product performance and compatibility with their applications. Here are the most important properties to consider:

Material Grade

Carbide cladding typically uses tungsten carbide or titanium carbide particles embedded in a metal matrix. The grade indicates the hardness, wear resistance, and toughness of the carbide used. Higher grades with finer carbide particles offer superior abrasion resistance but may be more brittle. Selecting the right grade balances durability with application-specific demands such as impact resistance or corrosion tolerance.

Cladding Thickness

This refers to the thickness of the carbide layer applied to the substrate. Thickness affects the lifespan and performance of the cladding under wear conditions. Thicker cladding generally provides longer service life but increases material cost and can affect dimensional tolerances. Buyers must align thickness with operational conditions and cost considerations.

Bonding Method

The process used to affix the carbide to the base metal—commonly thermal spraying, welding, or hardfacing—impacts adhesion strength and overall durability. Proper bonding prevents delamination during heavy use. Understanding the bonding technique helps buyers assess product quality and suitability for harsh environments.

Dimensional Tolerance

This indicates the permissible variation in the cladding’s dimensions and is critical for applications requiring precise fits, such as tooling or machinery parts. Tight tolerances reduce the need for additional machining and ensure seamless integration, saving time and costs in manufacturing.

Hardness (HV or HRC scale)

Hardness measures the cladding’s resistance to surface deformation and scratching. A high hardness value correlates with enhanced wear resistance, essential for abrasive or erosive environments. Buyers should specify hardness levels appropriate for their operational wear challenges.

Corrosion Resistance

Depending on the metal matrix and carbide type, claddings can offer various degrees of resistance to chemical and environmental corrosion. This property is especially important for buyers in regions with aggressive climates or chemical exposures, such as mining in Africa or oil & gas in the Middle East.

For effective communication and negotiation in international B2B transactions, familiarity with key trade terms is vital. Here are widely used terms buyers should know:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment that may be branded and sold by another company. In carbide cladding, OEMs often specify cladding requirements for replacement parts or machinery components. Buyers sourcing from OEMs can expect standardized quality and compatibility assurances.

MOQ (Minimum Order Quantity)

The smallest quantity of a product that a supplier is willing to sell. MOQs impact pricing and inventory decisions. Buyers from emerging markets or smaller businesses should negotiate MOQs to avoid overstocking or high upfront costs.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specific products. An RFQ should include detailed technical specifications to get accurate and comparable bids. This is a critical step for buyers to evaluate suppliers and manage costs.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding Incoterms helps buyers control logistics costs and risks, especially when importing from different continents.

Lead Time

The total time from order placement to product delivery. Shorter lead times can improve operational efficiency but may come at higher cost. Buyers should balance urgency with cost-effectiveness, particularly when coordinating international shipping.

Batch Traceability

Refers to the supplier’s ability to track and document the production batch of cladding materials. This ensures quality control and accountability, which is crucial for industries with strict compliance standards like mining or heavy machinery manufacturing.

By mastering these technical properties and trade terms, international buyers from Africa, South America, the Middle East, and Europe can make informed purchasing decisions, negotiate effectively, and ensure the carbide cladding meets their operational and commercial requirements.

The global carbide cladding market is experiencing robust growth driven by the rising demand for enhanced wear resistance and durability across industries such as mining, oil & gas, construction, and manufacturing. For international B2B buyers, particularly in regions like Africa, South America, the Middle East, and Europe, understanding the supply chain complexities and technological advancements is crucial for securing competitive advantages.

Key Market Drivers:

- Industrial Expansion: Rapid industrialization in emerging economies, such as Brazil and South Africa, is fueling demand for carbide cladding to extend equipment lifespan in harsh environments.

- Technological Advancements: Innovations in cladding techniques, including automated welding processes and laser cladding, improve coating uniformity and bonding strength, reducing downtime and maintenance costs.

- Customization and Precision: B2B buyers increasingly seek suppliers offering tailored cladding solutions that meet specific operational parameters, particularly for heavy machinery and cutting tools.

Emerging Sourcing Trends:

- Global Supplier Diversification: Buyers are expanding their supplier base beyond traditional markets like Europe and North America to include manufacturers in Asia and the Middle East, aiming to balance cost, quality, and delivery times.

- Digital Procurement Platforms: Adoption of digital marketplaces and e-sourcing tools facilitates transparent price comparisons, supplier evaluations, and streamlined order management.

- Focus on Long-Term Partnerships: Emphasis on establishing strategic relationships with suppliers who can provide technical support, timely logistics, and consistent quality assurance.

Regional Market Dynamics:

- Africa: Infrastructure projects and mining activities drive demand; however, buyers face challenges related to logistics and supplier reliability, making local partnerships and robust supply chain management vital.

- South America: Countries like Brazil benefit from domestic production capabilities but require imported advanced cladding materials for high-performance applications.

- Middle East: Oil and gas sector investments sustain demand for corrosion-resistant cladding, with buyers favoring suppliers who comply with regional standards and certifications.

- Europe: Mature markets focus on high-precision, environmentally compliant cladding solutions, with a strong push towards sustainability and lifecycle cost reduction.

Sustainability is becoming a decisive factor in procurement decisions within the carbide cladding sector. The environmental footprint of carbide production, which involves mining of tungsten and cobalt, raises concerns about resource depletion, energy consumption, and hazardous waste.

Environmental Impact Considerations:

- Resource Efficiency: Leading suppliers are adopting more efficient manufacturing processes that reduce raw material waste and energy use, such as powder recycling and optimized cladding methods.

- Emission Controls: Minimizing emissions of dust and harmful gases during cladding operations aligns with global environmental regulations and protects worker health.

Ethical Sourcing Imperatives:

- Conflict-Free Materials: Buyers increasingly require documentation and certifications ensuring that cobalt and tungsten are sourced from conflict-free zones, particularly important for companies operating in or sourcing from Africa.

- Supply Chain Transparency: Traceability tools and blockchain technologies are emerging to verify origin and ethical compliance, enhancing buyer confidence and compliance with international standards.

Green Certifications and Materials:

- ISO 14001: Environmental management certification is becoming a baseline requirement for suppliers, ensuring systematic efforts to reduce environmental impact.

- Eco-friendly Alternatives: Research into alternative binder materials and less toxic carbide composites is underway, offering potential for greener cladding solutions without compromising performance.

For B2B buyers, integrating sustainability criteria into supplier selection not only mitigates regulatory and reputational risks but also supports the global transition toward responsible industrial practices.

Carbide cladding technology has evolved significantly since its inception in the mid-20th century. Initially developed to enhance the wear resistance of industrial tools, the process involved manual application of tungsten carbide coatings via hardfacing welding techniques. Over the decades, advancements such as thermal spraying, laser cladding, and automated welding have vastly improved coating quality and repeatability.

This evolution reflects broader industrial trends emphasizing equipment longevity and operational efficiency. For B2B buyers, understanding this history underscores the importance of selecting suppliers who leverage modern, validated cladding technologies to deliver consistent, high-performance coatings tailored to diverse industrial applications.

Today’s carbide cladding solutions represent a convergence of material science innovation, precision engineering, and sustainability, positioning them as indispensable components in the global industrial supply chain.

Illustrative Image (Source: Google Search)

Is customization of carbide cladding available for specific industrial applications?

Yes, most reputable carbide cladding manufacturers offer customization options including thickness, alloy composition, and cladding patterns. Clearly communicate your application requirements and operating conditions to ensure the product meets performance needs. Customized solutions may require additional lead time and minimum order quantities (MOQs), so plan accordingly. Request detailed technical drawings and performance guarantees before confirming orders.

What are typical minimum order quantities (MOQs) and lead times for carbide cladding shipments?

MOQs vary by supplier but generally range from a few hundred to several thousand kilograms, depending on customization and cladding method. Lead times typically span 4 to 8 weeks, factoring in production and quality testing. For buyers in the Middle East or Europe, consider additional shipping time and customs clearance. Negotiate terms upfront, especially if you require smaller batches or expedited delivery, to align with your project timelines.

Which payment methods are safest and most common for international carbide cladding purchases?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and escrow services. Letters of Credit provide strong protection for both parties and are favored in high-value transactions. T/T payments are faster but riskier without established trust. For new suppliers, consider partial upfront payment with balance upon delivery. Always confirm payment terms in contracts and use secure banking channels to mitigate fraud risks.

What quality assurance certifications should I look for when sourcing carbide cladding?

Look for suppliers with ISO 9001 certification to ensure a quality management system is in place. Additional certifications such as ASTM standards compliance or specific metallurgical test reports (e.g., hardness, microstructure) demonstrate product reliability. Request third-party inspection certificates or mill test reports (MTRs) for each batch. These documents are crucial for regulatory compliance and internal quality audits, especially for buyers in regulated industries or regions.

How can I manage logistics and shipping challenges when importing carbide cladding internationally?

Partner with suppliers experienced in international logistics who can handle packaging, labeling, and export documentation. Choose reliable freight forwarders familiar with your destination country’s customs regulations to avoid delays. Discuss Incoterms clearly to define responsibilities for shipping costs and risks. For bulk shipments to regions like Africa or South America, plan for longer transit times and potential customs inspections. Tracking and insurance are recommended to safeguard your shipment.

Illustrative Image (Source: Google Search)

What steps should I take if I encounter product quality disputes after receiving carbide cladding?

Immediately document all issues with photographs and detailed descriptions. Notify the supplier within the agreed warranty or dispute period and provide evidence. Request a root cause analysis and propose corrective actions such as replacement, repair, or refund. Use contractual terms on dispute resolution, which may include mediation or arbitration. Maintain clear communication and keep records of all correspondence to support claims, especially when dealing with cross-border legal frameworks.

Are there regional considerations for sourcing carbide cladding from manufacturers in Europe, the Middle East, or Asia?

Yes, regional factors such as material standards, lead times, and supplier reliability differ. European suppliers often provide high-quality, certified products but at higher costs and longer lead times. Asian manufacturers, including those in Thailand, offer competitive pricing and customization but require thorough vetting for quality consistency. Middle Eastern suppliers may provide faster delivery within the region but may have limited product ranges. Understand regional trade agreements, tariffs, and logistical infrastructure to optimize sourcing strategies.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of carbide cladding presents a pivotal opportunity for international B2B buyers to enhance operational durability and cost-efficiency across industries such as mining, manufacturing, and construction. Key takeaways emphasize the importance of evaluating supplier expertise, material quality, and customization capabilities to meet specific application demands. Buyers in Africa, South America, the Middle East, and Europe should prioritize partnerships that offer robust technical support and compliance with international standards to ensure long-term reliability.

Embracing strategic sourcing means:

- Leveraging global supplier networks to access advanced carbide cladding technologies.

- Conducting thorough supplier audits and quality assessments to mitigate risks.

- Focusing on total cost of ownership rather than upfront price alone, incorporating maintenance and lifecycle benefits.

Looking ahead, the carbide cladding market is poised for innovation driven by evolving material science and sustainability pressures. International buyers are encouraged to adopt a proactive sourcing strategy that integrates emerging trends such as eco-friendly coatings and digital supply chain management. By doing so, businesses can secure competitive advantages, foster resilience, and drive sustainable growth in an increasingly complex global marketplace.

Act now: Engage with trusted suppliers, invest in supplier development, and align sourcing decisions with your strategic business objectives to fully capitalize on the transformative potential of carbide cladding.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina