Guide to Carbide Sintering

Understanding the intricacies of carbide sintering is vital for B2B buyers seeking reliable, high-quality solutions across diverse industries such as cutting tools, mining, and manufacturing. As a critical process in the production of cemented carbides, sintering directly influences the performance, durability, and cost-effectiveness of end products. For international buyers—particularly from Africa, South America, the Middle East, and Europe—navigating this complex global market offers both opportunities and challenges, including fluctuating raw material prices, varying supplier standards, and regional trade dynamics.

This comprehensive guide is designed to equip you with the essential knowledge needed to make informed sourcing decisions. It covers key aspects such as the different types of carbide sintering, the materials involved, manufacturing processes, quality control standards, and the leading suppliers worldwide. Additionally, it offers insights into cost considerations, market trends, and frequently asked questions, ensuring you are well-prepared to optimize your procurement strategies.

By leveraging this guide, international B2B buyers can identify reputable suppliers, understand regional market nuances, and mitigate risks associated with global sourcing. Whether you are expanding your supply chain in emerging markets or seeking to improve product quality, this resource empowers you to navigate the global carbide sintering landscape with confidence and strategic foresight.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Hot Isostatic Pressing (HIP) | Uses high pressure and temperature uniformly; densifies carbide powders | Cutting tools, wear parts, industrial machinery | Pros: Produces high-density, defect-free components; excellent mechanical properties. Cons: Higher production costs and longer lead times. |

| Sinter-HIP (Sintering + HIP) | Combines conventional sintering with HIP treatment for enhanced density | Cutting inserts, drilling tools, high-stress components | Pros: Improved toughness and wear resistance; suitable for complex shapes. Cons: Increased processing complexity and cost. |

| Liquid Phase Sintering | Incorporates a liquid binder or phase during sintering to aid densification | Wear-resistant coatings, cutting tools | Pros: Faster densification, finer microstructure. Cons: Potential for residual liquid phases affecting properties. |

| Spark Plasma Sintering (SPS) | Uses pulsed electric currents for rapid, localized heating | High-performance cutting tools, micro-components | Pros: Rapid processing, fine grain sizes, superior mechanical properties. Cons: Limited scalability and higher initial equipment investment. |

| Conventional Powder Sintering | Traditional method involving pressing and furnace sintering | Standard carbide tools, general industrial parts | Pros: Cost-effective, well-understood process. Cons: Lower density and toughness compared to advanced methods. |

HIP involves subjecting carbide powders to high pressure and temperature simultaneously, ensuring uniform densification. This method produces components with minimal porosity, leading to superior strength and wear resistance. It is ideal for high-performance applications such as cutting tools and wear-resistant parts. For B2B buyers, HIP offers consistent quality and enhanced durability, though it comes with higher costs and longer lead times. Suitable for bulk orders where performance justifies investment, especially in sectors demanding high reliability.

This variation combines traditional sintering with a subsequent HIP process, achieving higher density and improved mechanical properties. It is particularly effective for complex geometries and high-stress applications like industrial machinery parts or advanced cutting tools. Buyers benefit from superior toughness and wear resistance, making it suitable for critical components. However, the added processing step increases production costs and complexity, which should be factored into procurement strategies, especially when sourcing from regions with advanced manufacturing capabilities.

In this process, a liquid phase is introduced during sintering to facilitate particle bonding and densification. It allows for faster processing and finer microstructures, which can enhance cutting performance and wear resistance. Ideal for applications requiring rapid production cycles, such as coatings or small tools. B2B buyers should consider potential residual phases that might affect long-term stability and should evaluate supplier quality controls. Cost-effective and scalable, it suits high-volume manufacturing needs.

SPS uses pulsed electric currents to rapidly heat powders, enabling sintering at lower temperatures and shorter times. This results in fine grain sizes and superior mechanical properties, making it suitable for high-performance cutting tools and micro-components. While offering excellent quality, SPS equipment is expensive and less common in emerging markets, making supplier selection critical. Buyers should consider the availability of SPS technology and the potential for customized solutions to meet specific performance criteria.

The most traditional method involves pressing carbide powders followed by furnace sintering. It remains widely used due to its simplicity and cost-effectiveness, especially for standard carbide tools and parts. While it may produce components with lower density and toughness compared to advanced methods, it offers reliable, scalable solutions for mass production. B2B buyers from regions with limited access to advanced equipment may prefer this approach for its proven track record and lower upfront investment, provided performance requirements are within achievable ranges.

| Industry/Sector | Specific Application of carbide sintering | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Mining & Drilling | Tungsten carbide drill bits and cutting tools | Enhanced wear resistance, longer tool lifespan, improved productivity | Material purity, consistent quality, reliable supply chain, cost competitiveness |

| Construction & Heavy Machinery | Carbide wear parts such as crusher liners and cutting edges | Increased durability, reduced downtime, lower replacement costs | Customization options, technical support, adherence to industry standards |

| Oil & Gas | Sintered carbide components for drilling equipment and valves | High temperature and pressure resistance, corrosion protection | Certification requirements, compatibility with aggressive media |

| Aerospace & Defense | Precision sintered carbide components for cutting and shaping | Superior hardness, dimensional stability, lightweight components | Strict quality controls, traceability, compliance with aerospace standards |

| Automotive Manufacturing | Carbide inserts for metal cutting and machining tools | High precision, tool longevity, cost efficiency in high-volume production | Consistent performance, scalability, supplier reliability |

Carbide sintering is critical in manufacturing high-performance drill bits and cutting tools used in mineral extraction. These tools benefit from the exceptional hardness and wear resistance achieved through sintering, enabling them to withstand abrasive conditions underground or in open-pit mines. For international buyers from Africa, South America, or the Middle East, sourcing high-quality carbide components ensures operational efficiency and reduces downtime in challenging environments. Buyers should prioritize suppliers with proven quality control and reliable logistics to maintain continuous supply.

In construction, carbide sintered wear parts such as crusher liners, cutting edges, and grinding media are essential for heavy-duty machinery. These components are designed to endure extreme mechanical stress and abrasive wear, significantly extending service life. For B2B buyers in regions like Brazil or Indonesia, where infrastructure development is booming, sourcing durable carbide parts reduces maintenance costs and improves project timelines. Key considerations include customization options, technical support, and adherence to industry standards for safety and performance.

Carbide sintering plays a vital role in producing components for drilling equipment, valves, and seals used in oil and gas exploration and production. These parts must withstand high pressures, elevated temperatures, and corrosive environments. International buyers from the Middle East or South America should focus on sourcing sintered carbide components that meet strict certification standards and are compatible with aggressive media. Reliable supply chains and material traceability are critical to ensure operational safety and compliance.

Precision sintered carbide components are used in aerospace for cutting tools, wear-resistant parts, and structural elements requiring high strength-to-weight ratios. Sintered carbides provide dimensional stability and exceptional hardness, essential for manufacturing high-precision aerospace parts. Buyers from Europe or Indonesia should seek suppliers with stringent quality control, traceability, and compliance with aerospace standards. Investing in high-quality materials minimizes risk and enhances the longevity of aerospace components.

Carbide inserts for machining and metal cutting are integral to automotive production lines, especially for high-volume, precision manufacturing. Sintered carbides enable faster machining cycles, longer tool life, and reduced tooling costs. For automotive suppliers in South America or Africa, sourcing high-performance carbide inserts from reputable manufacturers ensures consistent quality, scalability, and cost efficiency. A focus on supplier reliability and technical support is vital for maintaining continuous production and meeting tight quality standards.

Illustrative Image (Source: Google Search)

Selecting the appropriate raw materials for carbide sintering is crucial for achieving desired product performance, cost efficiency, and compliance with international standards. Different materials offer unique properties that influence durability, corrosion resistance, manufacturing complexity, and suitability for specific applications. For B2B buyers from regions such as Africa, South America, the Middle East, and Europe, understanding these nuances can facilitate better procurement decisions, ensure compliance with local standards, and optimize supply chain reliability.

Key Properties:

Tungsten carbide is renowned for its exceptional hardness, high wear resistance, and good thermal stability. It typically withstands temperatures up to 1,200°C and exhibits excellent chemical stability, making it ideal for cutting tools, mining equipment, and wear parts.

Pros & Cons:

* Pros:*

- Superior hardness and wear resistance extend tool life.

- Good chemical inertness reduces corrosion risk.

- Well-established manufacturing processes ensure consistent quality.

Impact on Application:

Ideal for applications involving abrasive media or high-pressure environments. Its corrosion resistance makes it suitable for chemical and mining industries, especially in regions with aggressive media.

International Considerations:

Buyers from regions like Brazil or Indonesia should verify compliance with standards such as ASTM B532 or DIN 8580. Importing tungsten carbide may involve tariffs or restrictions on tungsten raw materials, requiring thorough supplier vetting.

Key Properties:

This composite material combines tungsten carbide grains with a cobalt binder, offering a balance of hardness and toughness. It typically withstands temperatures up to 600°C and provides good machinability.

Pros & Cons:

* Pros:*

- Enhanced toughness reduces chipping and breakage.

- Suitable for high-impact applications like drilling and mining tools.

- Easier to machine and grind compared to pure tungsten carbide.

Impact on Application:

Preferred for applications requiring impact resistance, such as rock drilling or metal cutting in regions with variable media conditions. Buyers should ensure supplier compliance with environmental standards like RoHS or REACH.

International Considerations:

Cobalt sourcing can be sensitive; buyers from Africa or South America should verify supply chain transparency. Additionally, adherence to standards like ISO 9001 for quality management is recommended to ensure consistency.

Key Properties:

Titanium carbide offers high hardness, excellent wear resistance, and good chemical stability. It withstands temperatures up to 1,300°C and exhibits superior corrosion resistance in acidic environments.

Pros & Cons:

* Pros:*

- Exceptional corrosion resistance, ideal for chemical processing.

- High melting point and thermal stability.

- Generally less expensive than tungsten carbide.

Impact on Application:

Suitable for chemical industry components, wear-resistant coatings, and high-temperature applications. Its corrosion resistance makes it attractive for regions with aggressive media, such as Middle Eastern chemical plants.

International Considerations:

Buyers should verify compliance with international standards like JIS or ASTM for chemical resistance and thermal properties. Sourcing from regions with established TiC suppliers ensures product quality and supply stability.

| Material | Typical Use Case for carbide sintering | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Tungsten Carbide (WC) | Cutting tools, wear parts, mining equipment | High hardness and wear resistance | High cost, brittle under impact | High |

| Cobalt Cemented Carbide | Impact tools, drilling, machining | Toughness and impact resistance | Cobalt toxicity concerns, environmental regulations | Med |

| Titanium Carbide (TiC) | Chemical processing, high-temp wear parts | Corrosion resistance, high thermal stability | Less mature manufacturing, availability issues | Med |

For buyers in diverse regions, understanding material properties and regional standards is essential. Regions like Africa and South America often face supply chain challenges; establishing relationships with reputable suppliers who comply with international standards (e.g., ASTM, DIN, ISO) can mitigate risks. Additionally, considering environmental regulations, such as restrictions on cobalt or tungsten, is crucial for long-term procurement stability. Cost considerations should balance material performance with supply reliability, especially in markets where raw material prices fluctuate significantly.

By aligning material choices with specific application needs and regional compliance requirements, international B2B buyers can optimize their carbide sintering investments, ensuring durability, performance, and regulatory adherence across diverse markets.

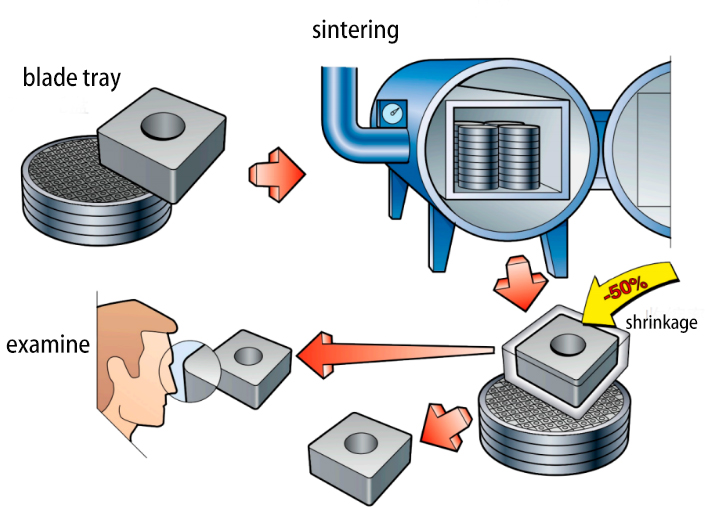

The manufacturing of carbide components through sintering is a complex, multi-stage process that demands precision, control, and adherence to international standards. For B2B buyers, understanding these stages aids in evaluating supplier capabilities and ensuring product quality.

The process begins with the selection and preparation of raw materials, primarily tungsten carbide powder, often blended with cobalt or other binders. Suppliers must source powders that meet specific particle size distributions, purity levels, and chemical compositions, often verified through certificates of analysis (CoA). Advanced milling techniques, such as jet milling or ball milling, are employed to achieve uniform particle sizes, which influence densification and final properties.

Next is the shaping phase, where powders are compacted into desired forms. Common techniques include:

- Hot Isostatic Pressing (HIP): Provides uniform density and minimizes porosity, suitable for high-precision tools.

- Press and Sinter: Powder is pressed in molds under high pressure, then sintered in a furnace.

- Additive Manufacturing: Emerging methods like binder jetting or selective laser sintering (SLS) are gaining traction for complex geometries.

Forming parameters—pressure, temperature, and dwell time—are critical, affecting dimensional accuracy and mechanical integrity.

For multi-component or complex assemblies, parts may undergo pre-assembly or infiltration processes before sintering. This ensures proper bonding and reduces defects such as warping or cracking during firing.

The core step involves heating the shaped compact in a controlled atmosphere (usually vacuum or inert gases) at temperatures around 1300°C–1600°C. Sintering densifies the material by facilitating atomic diffusion, resulting in a hard, wear-resistant carbide. Precise control of temperature ramp rates, holding times, and cooling rates is essential to optimize properties and minimize residual stresses.

Post-sintering processes include grinding, lapping, polishing, and coating. These steps refine dimensions, improve surface finish, and enhance performance characteristics such as corrosion resistance or lubricity. For high-precision applications, tolerances are maintained within microns, necessitating advanced finishing techniques.

Robust quality assurance (QA) mechanisms are vital for international B2B transactions, especially when buyers from regions like Africa, South America, the Middle East, and Europe seek consistent, reliable suppliers.

Suppliers should adhere to recognized standards, including:

- ISO 9001: Ensures a quality management system emphasizing continuous improvement and customer satisfaction.

- ISO 2768 & ISO 6507: Pertinent for dimensional tolerances and hardness testing.

- Industry-specific standards: For example, CE marking (Europe), API standards (oil and gas), or ASTM specifications for materials.

Compliance with these standards facilitates smoother import processes, reduces risks, and enhances product trustworthiness.

Effective QC encompasses multiple inspection stages:

- Incoming Quality Control (IQC): Raw materials are tested upon receipt for purity, particle size, and chemical composition. Suppliers should provide detailed reports and certificates.

- In-Process Quality Control (IPQC): During forming and sintering, parameters like density, dimensional stability, and temperature profiles are monitored using gauges, thermocouples, and non-destructive testing (NDT) tools.

- Final Quality Control (FQC): Post-production testing includes:

- Hardness Testing: Using Vickers or Rockwell methods.

- Density Measurement: Archimedes' principle or helium pycnometry.

- Microstructure Analysis: Via optical microscopy or scanning electron microscopy (SEM) to detect porosity or grain size.

- Surface Finish & Tolerance Checks: Using coordinate measuring machines (CMM).

Illustrative Image (Source: Google Search)

To mitigate risks and ensure supplier compliance, international buyers should adopt rigorous verification methods:

- Supplier Audits: Conduct on-site audits or rely on third-party inspection agencies specializing in manufacturing processes for carbide components. Audits should review raw material sourcing, process controls, and documentation procedures.

- Certification Review: Request copies of ISO 9001 certification, industry-specific approvals, and test reports. Confirm validity through issuing bodies when possible.

- Sample Testing: Obtain and test samples independently or through third-party labs to verify dimensions, hardness, and microstructure against specifications.

- Ongoing Quality Monitoring: Establish a schedule for periodic audits and inspections, especially if ordering in bulk or over long-term contracts.

- Third-Party Inspection Services: Engage inspectors during production, packing, and before shipment to ensure compliance with agreed standards and specifications.

Buyers from regions such as Africa, South America, the Middle East, and Europe face unique challenges and opportunities:

- Regulatory Compliance: Ensure that suppliers meet regional standards (e.g., CE in Europe, API in oil & gas sectors). This can streamline import procedures and reduce certification delays.

- Language and Cultural Barriers: Use clear, detailed specifications and consider engaging local agents or third-party inspectors familiar with regional requirements.

- Logistics & Lead Times: Account for longer shipping times and customs clearance processes; select suppliers with proven track records for timely deliveries and reliable documentation.

- Payment & Contract Terms: Negotiate clear quality clauses, penalties for non-conformance, and warranties to protect investment.

A comprehensive understanding of manufacturing stages and rigorous quality assurance practices empowers B2B buyers to select reliable carbide sintering suppliers. Emphasizing adherence to international standards, diligent QC checkpoints, and verification through audits and testing enhances confidence and minimizes risks. For regions like Africa, South America, the Middle East, and Europe, aligning supplier capabilities with regional compliance requirements and establishing transparent communication channels are key to successful, long-term partnerships.

A thorough grasp of the cost components involved in carbide sintering is essential for international buyers aiming to optimize procurement strategies. The primary cost elements include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and profit margins. Each component varies based on supplier location, production scale, and customization requirements.

Materials constitute the largest share of costs, typically driven by tungsten carbide powders and binding agents. Premium grades with specific particle sizes or enhanced properties command higher prices. Labor costs differ significantly—manufacturers in regions like Southeast Asia or Eastern Europe may offer competitive rates compared to North America or Western Europe, influencing overall pricing.

Manufacturing overheads encompass factory utilities, equipment depreciation, and maintenance. These are generally lower in regions with cheaper energy and operational costs, translating into more competitive pricing. Tooling expenses are often fixed but can escalate with complex molds or custom designs, especially if high precision or unique geometries are required.

Quality control (QC) processes, including certification and testing, add to costs but are vital for ensuring product reliability. Suppliers with advanced QC systems or ISO certifications may charge a premium, but this can mitigate risks associated with quality failures.

Logistics costs are highly variable and depend on sourcing location, shipping method, and delivery timelines. Buyers should evaluate Incoterms (FOB, CIF, DDP) carefully, as freight and insurance can significantly impact the total landed cost. Margins are typically negotiated and influenced by order volume, supplier relationships, and market competitiveness.

Several factors influence carbide sintering prices, making it crucial for buyers to understand and leverage them effectively:

To optimize costs and ensure value, international buyers should adopt strategic approaches:

While prices vary based on the factors above, as of late 2023, typical FOB prices for standard tungsten carbide sintered parts range between $20 to $50 per kilogram. Premium grades or highly customized products can exceed this range. Buyers from Africa, South America, the Middle East, and Europe should also factor in import duties, taxes, and potential tariffs, which can add 10-30% to the total landed cost depending on the destination country.

Disclaimer: These figures serve as general benchmarks; actual prices depend on specific product specs, supplier negotiations, and market conditions at the time of sourcing.

By understanding these core cost drivers and leveraging strategic sourcing practices, international B2B buyers can make more informed decisions, reduce costs, and secure reliable supply chains for carbide sintering products.

1. Material Grade

Material grade specifies the composition and quality of carbide powders used in sintering. Common grades include tungsten carbide (WC) with varying cobalt (Co) binder content, such as 6% Co or 12% Co. For B2B buyers, selecting the appropriate grade ensures the final product meets specific wear resistance, toughness, or cutting performance requirements. It also influences cost and processing parameters.

2. Tolerance and Dimensional Accuracy

Tolerance defines the permissible deviation from specified dimensions, usually expressed in millimeters or as a percentage. Tight tolerances (e.g., ±0.02 mm) are crucial for applications requiring precision, such as cutting tools or molds. Understanding tolerance levels helps buyers coordinate with manufacturers for quality assurance and compatibility with existing machinery.

3. Density

Density indicates how compacted the carbide material is after sintering. Higher density (e.g., above 14.5 g/cm³) correlates with enhanced hardness and wear resistance. For international B2B transactions, consistent density levels are vital for ensuring product performance and longevity in demanding industrial environments.

4. Hardness

Hardness, typically measured on the Rockwell or Vickers scale, reflects the material’s resistance to deformation and wear. Sintered carbides often exhibit hardness values above HRC 85. Buyers should specify minimum hardness requirements to match application needs, such as high-speed cutting or abrasion resistance.

5. Grain Size

Grain size impacts toughness and cutting performance. Fine grain carbides (less than 1 micron) offer superior hardness and surface finish, while coarser grains provide better toughness. Clear communication of grain size ensures the supplier delivers a product optimized for the intended industrial use.

6. Coating and Surface Finish

Additional coatings (e.g., TiN, Al2O3) or surface treatments can enhance properties like corrosion resistance or reduce friction. Surface finish specifications, such as Ra (roughness average), are also critical for applications where surface integrity influences performance.

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce equipment or components under their own brand or for other brands. Understanding whether a carbide supplier is an OEM helps buyers gauge product customization capabilities and quality standards.

2. MOQ (Minimum Order Quantity)

The smallest order size a supplier is willing to accept. Knowing the MOQ assists buyers in planning procurement budgets and production schedules, especially in markets with fluctuating demand like Africa or South America.

3. RFQ (Request for Quotation)

A formal process where buyers solicit price and delivery terms from multiple suppliers. Proper RFQ preparation with detailed specifications ensures competitive pricing and clear communication of technical requirements.

4. Incoterms

International Commercial Terms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs. Familiarity with Incoterms (e.g., FOB, CIF) helps B2B buyers manage logistics costs and compliance across different regions.

5. Lead Time

The duration from order placement to delivery. Shorter lead times are advantageous for urgent projects, especially in industries like mining or manufacturing in emerging markets where supply chain disruptions are common.

6. Quality Certifications

Standards such as ISO or ASTM certifications verify supplier quality management and product consistency. For international buyers, especially from regions with strict import regulations, verified certifications streamline customs clearance and reduce risks.

Understanding these technical properties and trade terms empowers buyers to specify precise requirements, negotiate effectively, and select reliable suppliers. Clear communication about material grade, tolerances, and certifications ensures product quality aligns with application demands, reducing costly rework or failures. Familiarity with trade terminology like Incoterms and MOQ allows for smoother logistics planning and cost management, critical factors in competitive markets such as Brazil, Indonesia, or Middle Eastern industries. Ultimately, mastering these technical and trade concepts enhances decision-making, fosters supplier relationships, and secures optimal value in the global carbide sintering supply chain.

The global carbide sintering industry is driven by increasing demand across manufacturing sectors such as cutting tools, mining, construction, and automotive applications. Key drivers include the rapid industrialization in emerging markets like Africa and South America, coupled with technological advancements that enhance sintering precision and efficiency. For international B2B buyers from regions like Indonesia, Brazil, and Middle Eastern countries, understanding regional market dynamics is crucial, as supply chains are often influenced by local mineral availability, geopolitical stability, and infrastructure development.

Emerging sourcing trends focus on diversification and vertical integration. Many buyers are now seeking to establish direct relationships with raw material producers, reducing dependency on intermediaries and ensuring supply chain stability. Digital platforms and industry-specific marketplaces facilitate easier access to suppliers from diverse regions, promoting transparency and competitive pricing.

Technological innovation is also shaping market dynamics—advanced sintering techniques improve product quality and reduce energy consumption, aligning with sustainability goals. Additionally, regional shifts—such as increased production capacity in Southeast Asia and South America—are creating new sourcing hubs, offering buyers more flexible options. For buyers in Africa, leveraging local or nearby suppliers can minimize logistics costs and lead times, while also supporting regional economic development.

Understanding these trends allows B2B buyers to optimize sourcing strategies, negotiate better terms, and anticipate market shifts—crucial for maintaining competitiveness in a volatile global market.

Sustainability is increasingly a non-negotiable criterion in the carbide sintering supply chain. The environmental impact of extracting raw materials like tungsten and cobalt—key components in carbide production—raises concerns about ecological degradation and resource depletion. Buyers are now prioritizing suppliers with robust environmental management practices, including waste reduction, energy efficiency, and responsible mineral sourcing.

Certifications such as ISO 14001, Responsible Minerals Initiative (RMI), and Fairmined are gaining prominence as benchmarks for ethical sourcing. These certifications verify that suppliers adhere to environmentally responsible practices and uphold human rights standards, reducing risks associated with supply chain disruptions and reputational damage.

For international buyers, especially from regions like Europe and the Middle East, integrating green procurement policies can provide competitive advantages—such as access to eco-conscious markets and compliance with stringent regulations. Developing partnerships with suppliers committed to green materials and transparent supply chains also encourages continuous improvement and innovation in sustainable practices.

Furthermore, adopting sustainability-focused sourcing strategies aligns with global efforts to reduce carbon footprints and promote circular economy principles. This shift not only benefits the environment but can also lead to cost savings through energy efficiencies and waste minimization, creating long-term value for B2B stakeholders.

The carbide sintering sector has evolved significantly over the past century, transitioning from rudimentary manufacturing processes to highly sophisticated, technology-driven operations. Initially driven by basic powder metallurgy, the industry has incorporated advanced sintering techniques, including hot isostatic pressing and microwave sintering, to improve product quality and consistency.

This evolution has been influenced by global demand for high-performance tools and the need for materials that withstand extreme conditions. The integration of automation, real-time monitoring, and data analytics has further optimized production efficiency and quality control.

For B2B buyers, understanding this progression highlights the importance of selecting suppliers with modern, technologically advanced facilities. It also underscores the value of transparency regarding manufacturing processes and quality assurance measures, which are critical for ensuring product reliability and compliance with international standards. Recognizing the sector’s evolution helps buyers navigate complex supply chains and identify innovative partners committed to continuous improvement.

This comprehensive understanding of market dynamics, sourcing trends, and sustainability practices will empower international B2B buyers to make strategic decisions that enhance competitiveness, resilience, and ethical responsibility within the carbide sintering industry.

Effective vetting begins with verifying supplier certifications such as ISO 9001, ISO 14001, or industry-specific standards. Request detailed product datasheets, test reports, and quality control procedures. Conduct virtual or on-site audits when possible, especially for large orders or long-term partnerships. Seek references from other international buyers, particularly in your region, to gauge supplier reputation. Additionally, evaluate their production capacity, lead times, and after-sales support. Establish clear communication channels to clarify expectations upfront, reducing risks of misunderstandings or substandard products.

Carbide sintering suppliers often offer customization in grain size, binder content, shape, and dimensions. Some may also provide tailored formulations for specific applications, such as tooling or wear-resistant components. To communicate your needs effectively, provide detailed technical specifications, sample references, and intended use cases. Engage with suppliers who demonstrate flexibility and R&D capabilities. Clear communication ensures the supplier can recommend suitable modifications, reducing lead times and avoiding costly rework. Consider requesting prototypes or small batches for validation before large-scale production.

MOQs vary depending on supplier size and production capacity but generally range from 50 kg to several tons. Lead times typically span 4–12 weeks, influenced by order complexity and logistics. Common payment terms include 30% advance payment with the balance upon shipment, or letters of credit for larger transactions, especially across borders. Negotiate terms that balance supplier confidence with your cash flow needs. Building strong relationships often facilitates more flexible terms, shorter lead times, and better pricing, particularly when committing to regular orders.

Key certifications include ISO 9001 for quality management, ISO 14001 for environmental standards, and industry-specific certificates such as RoHS or REACH compliance. Request Material Test Reports (MTRs), Certificate of Conformance (CoC), and inspection reports from third-party labs. These documents verify material composition, mechanical properties, and adherence to standards. For critical applications, consider requesting test data from independent labs or third-party audits. Having comprehensive QA documentation reduces risks of receiving substandard products and facilitates compliance with import regulations in your region.

Start by choosing suppliers experienced in international shipping and familiar with your region’s import regulations. Clarify incoterms (e.g., FOB, CIF) upfront to define responsibilities and costs. Work with freight forwarders who specialize in chemical or industrial materials and can handle customs clearance efficiently. Consider shipping methods like sea freight for cost-effectiveness or air freight for urgent needs. Ensure proper packaging to prevent damage during transit. Track shipments diligently, and maintain open communication with suppliers and logistics providers to anticipate delays or issues, ensuring timely delivery.

First, document all communications, agreements, and quality issues thoroughly. Review the contract for clauses related to quality assurance, warranties, and dispute resolution. Engage the supplier promptly to address concerns, requesting re-inspections or testing if necessary. If resolution stalls, consider involving third-party inspectors or laboratories to verify quality. Dispute resolution clauses such as arbitration or mediation should be prioritized in contracts. Maintaining professional, transparent communication often leads to amicable solutions. If unresolved, be aware of your legal options based on international trade laws and seek legal counsel familiar with cross-border disputes.

Illustrative Image (Source: Google Search)

Trade restrictions, tariffs, and sanctions can significantly influence procurement options. Research current trade policies affecting your country and supplier locations—especially for regions like the Middle East, Africa, or South America. Engage with suppliers who have experience navigating import-export regulations in your jurisdiction. Consider diversifying suppliers across regions to mitigate risks. Also, stay informed about potential changes in trade agreements that could affect costs or delivery timelines. Working with freight forwarders and customs brokers who understand regional nuances ensures compliance and smooth logistics flow.

Focus on supplier reliability, quality consistency, and capacity for innovation. Long-term partnerships benefit from regular communication, transparent pricing, and shared quality expectations. Evaluate their ability to scale production as your demand grows and their flexibility to accommodate customization or process improvements. Building trust through consistent performance and mutual understanding reduces procurement risks. Additionally, consider suppliers’ sustainability practices and compliance with regional regulations. Establishing clear contractual terms, including quality standards, lead times, and dispute resolution processes, lays a strong foundation for sustainable, mutually beneficial collaborations.

Effective strategic sourcing is essential for international B2B buyers seeking to optimize quality, cost-efficiency, and supply chain resilience in carbide sintering. Key takeaways include prioritizing supplier diversification, leveraging regional manufacturing hubs, and maintaining rigorous quality standards to mitigate risks associated with geopolitical or logistical disruptions. Understanding local market dynamics and fostering strong supplier relationships can unlock competitive advantages and ensure consistent supply.

As the industry evolves, technological advancements—such as automation and innovative sintering techniques—will further influence sourcing strategies. Buyers should stay informed about emerging suppliers and sustainable practices to meet increasing environmental expectations and regulatory requirements.

Looking ahead, proactive engagement with reliable partners across Africa, South America, the Middle East, and Europe will be crucial. These regions present unique opportunities for cost-effective sourcing, innovative materials, and strategic collaborations. International buyers are encouraged to invest in comprehensive market research, develop flexible sourcing frameworks, and build long-term partnerships to secure a competitive edge in the dynamic carbide sintering landscape. Staying adaptable and forward-thinking will be vital to capitalizing on future industry developments.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina