Carborundum, a vital industrial material known for its exceptional hardness and thermal conductivity, plays a crucial role across numerous sectors including manufacturing, automotive, electronics, and construction. For international B2B buyers, particularly those operating in dynamic markets such as Africa, South America, the Middle East, and Europe, understanding the complexities of sourcing high-quality carborundum is essential to maintaining competitive advantage and ensuring operational excellence.

This comprehensive guide delves deeply into the global carborundum landscape, offering actionable insights tailored for decision-makers in countries like Nigeria and Spain. It covers the diverse types of carborundum available—ranging from powders and grains to bonded and sintered forms—alongside detailed analysis of raw materials and advanced manufacturing processes. Emphasis is placed on stringent quality control standards that guarantee product consistency, durability, and performance.

Moreover, the guide provides a thorough overview of the leading global suppliers and pricing trends, enabling buyers to benchmark costs effectively and negotiate favorable terms. It also addresses key market dynamics, including regional supply chain considerations and emerging demand patterns that impact availability and lead times.

By navigating this guide, B2B buyers will be empowered to make informed sourcing decisions, optimize procurement strategies, and mitigate risks associated with international trade. Whether seeking to establish new supplier partnerships or streamline existing supply chains, this resource equips buyers with the knowledge to secure reliable, cost-effective carborundum solutions that align with their specific industrial needs.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Carborundum | High purity silicon carbide, sharp crystalline edges | Abrasive blasting, grinding wheels, polishing | Pros: Cost-effective, widely available; Cons: Limited high-temperature resistance |

| Electrically Conductive Carborundum | Doped with conductive elements, enhanced electrical properties | Electrodes, semiconductor manufacturing | Pros: Enables specialized electronic uses; Cons: Higher cost, niche demand |

| Fused Carborundum | Produced by fusing raw materials, coarse grain size | Heavy-duty grinding, refractory linings | Pros: Durable under harsh conditions; Cons: Heavier, less precise for fine work |

| Black Carborundum | Contains higher carbon content, darker appearance | Metal cutting, surface finishing | Pros: Stronger abrasive action; Cons: Can cause more wear on tools |

| Green Carborundum | Contains added chromium oxide for toughness | High-performance grinding, precision machining | Pros: Superior toughness and wear resistance; Cons: Premium pricing |

Standard Carborundum is the most common form, characterized by its high purity silicon carbide and sharp crystalline edges. It is ideal for general abrasive applications like blasting and polishing, making it a cost-effective choice for buyers seeking versatile materials. However, it offers limited resistance to extreme temperatures, which should be considered for high-heat industrial processes. For B2B buyers in regions like Nigeria and Spain, availability and price competitiveness make this type a practical option for bulk procurement.

Electrically Conductive Carborundum is doped with elements such as nitrogen or boron to enhance its electrical conductivity. This variation is essential for industries involved in semiconductor manufacturing and electrode production. Although it commands a higher price and serves a niche market, its unique properties justify investment for buyers targeting electronics or energy sectors in markets like the Middle East and Europe, where advanced manufacturing is growing.

Fused Carborundum is produced by melting raw materials at high temperatures, resulting in a coarser grain size. Its robustness makes it suitable for heavy-duty grinding and refractory linings in industries such as steel manufacturing. Buyers should note its heavier weight and less precision compared to finer grades, which may impact shipping costs and application specificity. This type is favored in industrial hubs with demand for durable abrasive materials.

Black Carborundum contains a higher carbon content, giving it a darker appearance and stronger abrasive action. It excels in metal cutting and surface finishing applications, offering enhanced performance but potentially increasing wear on cutting tools. For B2B buyers, especially those in automotive or metal fabrication sectors across South America and Europe, this type provides an effective balance between cutting efficiency and cost.

Green Carborundum includes added chromium oxide, significantly boosting its toughness and wear resistance. This makes it suitable for high-performance grinding and precision machining tasks where durability is critical. Despite its premium price, it is a strategic investment for buyers prioritizing long-term tool life and precision, particularly in advanced manufacturing environments in Europe and the Middle East.

| Industry/Sector | Specific Application of carborundom | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Abrasives Manufacturing | Production of grinding wheels and cutting tools | Enhances durability and cutting precision, reducing downtime and tool replacement costs | Quality grade consistency, particle size distribution, and supplier reliability |

| Electronics & Semiconductors | Heat sinks and electronic substrates | Superior thermal conductivity improves device performance and longevity | Purity levels, thermal conductivity specifications, and compliance with electronic standards |

| Automotive Industry | Brake pads and clutches manufacturing | High wear resistance and thermal stability improve safety and product lifespan | Material uniformity, resistance to thermal degradation, and cost-effectiveness |

| Metallurgy & Foundry | Refractory linings and casting molds | Enhances heat resistance and extends service life of molds and furnaces | Thermal shock resistance, chemical stability, and supplier support for bulk orders |

| Construction & Ceramics | Abrasive blasting and kiln furniture | Improves surface finishing quality and kiln durability, reducing maintenance frequency | Particle hardness, size distribution, and logistics for large volume shipments |

Abrasives Manufacturing

Carborundom is extensively used in the production of grinding wheels and cutting tools due to its exceptional hardness and wear resistance. For businesses in Africa, South America, the Middle East, and Europe, sourcing high-quality carborundom ensures precision in metalworking and reduces downtime caused by frequent tool replacements. Buyers should prioritize consistent particle size and grade to maintain product uniformity and work closely with suppliers who can guarantee reliable delivery schedules to avoid production bottlenecks.

Electronics & Semiconductors

In the electronics sector, carborundom's excellent thermal conductivity makes it ideal for heat sinks and electronic substrates. This application is critical for manufacturers aiming to enhance device performance and longevity, particularly in regions with high ambient temperatures like the Middle East and parts of Africa. International buyers must focus on purity levels and compliance with industry standards such as RoHS to ensure compatibility and safety in electronic components.

Automotive Industry

Carborundom is a key component in brake pads and clutch systems, where its thermal stability and wear resistance improve safety and extend product lifespan. Automotive manufacturers and suppliers in markets like Nigeria and Spain benefit from sourcing materials that withstand high friction and temperature fluctuations. Buyers should evaluate material uniformity and thermal degradation resistance to ensure consistent performance and regulatory compliance.

Metallurgy & Foundry

The refractory properties of carborundom make it indispensable for lining furnaces and creating casting molds that endure extreme heat. This application is vital for foundries in Europe and South America where operational efficiency and mold longevity directly impact profitability. Buyers should seek suppliers offering materials with proven thermal shock resistance and chemical stability, alongside support for large-volume procurement to optimize costs.

Construction & Ceramics

In construction and ceramics, carborundom is used for abrasive blasting and kiln furniture, improving surface finishing and kiln durability. This reduces maintenance frequency and enhances product quality, which is particularly valuable for manufacturers in emerging markets with limited access to frequent replacements. Key sourcing factors include particle hardness and size distribution, as well as logistics capabilities to handle bulky shipments efficiently.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

Key Properties: Silicon carbide, the primary component of carborundum, offers exceptional hardness, high thermal conductivity, and excellent resistance to thermal shock. It withstands temperatures up to 1600°C and exhibits strong chemical inertness, particularly against acids and alkalis.

Pros & Cons: SiC is highly durable and abrasion-resistant, making it ideal for harsh industrial environments. However, its manufacturing complexity is higher due to the need for precise sintering processes, which can increase costs. The material’s brittleness can pose challenges in applications requiring impact resistance.

Impact on Application: Silicon carbide is suitable for high-temperature and corrosive media, including chemical reactors and abrasive slurry handling. Its resistance to oxidation and wear makes it a prime choice for cutting tools and mechanical seals in aggressive environments.

Considerations for International Buyers: Buyers from regions like Nigeria and Spain should ensure compliance with ASTM C799 or DIN EN 60672 standards for SiC ceramics. In the Middle East and South America, sourcing from suppliers with ISO 9001 certification ensures consistent quality. Additionally, logistics considerations such as transport conditions to prevent micro-cracks are critical for maintaining material integrity.

Key Properties: Boron carbide is one of the hardest known materials, with excellent neutron absorption capabilities and high resistance to wear and corrosion. It performs well under pressures exceeding 3000 MPa and temperatures up to 1400°C.

Pros & Cons: Its extreme hardness and low density make it suitable for lightweight armor and abrasive applications. However, boron carbide is more expensive and difficult to machine than silicon carbide, which can affect production timelines and costs.

Impact on Application: Ideal for applications requiring high wear resistance and chemical stability, such as ballistic armor, abrasive nozzles, and nuclear industry components. Its neutron absorption also makes it valuable in radiation shielding applications.

Considerations for International Buyers: European buyers, especially in Spain, should verify compliance with EN ISO 9001 and relevant nuclear industry standards if applicable. African and Middle Eastern buyers must consider import regulations for materials with nuclear applications and ensure suppliers provide detailed material certifications to facilitate customs clearance.

Key Properties: Aluminum oxide, or alumina, is a widely used ceramic material known for its high hardness, excellent electrical insulation, and good chemical resistance. It can operate effectively at temperatures up to 1700°C and withstand moderate mechanical stresses.

Pros & Cons: Alumina is cost-effective and easier to manufacture compared to carbides, with good availability worldwide. However, it has lower thermal conductivity and toughness than silicon carbide, which may limit its use in extreme thermal cycling or high-wear scenarios.

Impact on Application: Commonly used in electrical insulators, wear-resistant parts, and chemical processing equipment. It is suitable for media that are not highly abrasive or corrosive but require stable thermal and electrical properties.

Considerations for International Buyers: Buyers from South America and Africa should check for ASTM C799 and ISO 9001 certifications to ensure material consistency. Alumina’s widespread use means local sourcing options may be available, reducing lead times and shipping costs. Compliance with RoHS and REACH regulations is also important for European markets.

Key Properties: Zirconium oxide offers high fracture toughness, excellent wear resistance, and good chemical stability. It can tolerate temperatures up to 1200°C and has superior resistance to crack propagation compared to other ceramics.

Pros & Cons: Its toughness makes it less brittle than silicon carbide and alumina, reducing failure risk in impact-prone applications. However, zirconia is more expensive and less thermally conductive, which may limit its use in high-heat dissipation roles.

Impact on Application: Suitable for precision components, cutting tools, and biomedical devices where toughness and wear resistance are critical. It performs well in chemical processing and abrasive environments but is less common in extremely high-temperature applications.

Considerations for International Buyers: For buyers in the Middle East and Europe, adherence to ISO 13356 and ASTM F2187 standards is essential, especially for biomedical-grade zirconia. Importers in Africa and South America should consider supplier traceability and quality assurance documentation to meet local industrial standards and certification requirements.

| Material | Typical Use Case for carborundom | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | High-temperature wear parts, abrasives | Excellent thermal shock resistance | Brittle, higher manufacturing complexity | Medium |

| Boron Carbide | Ballistic armor, abrasive nozzles | Extreme hardness and low density | Expensive, difficult to machine | High |

| Aluminum Oxide | Electrical insulators, wear-resistant parts | Cost-effective and widely available | Lower toughness and thermal conductivity | Low |

| Zirconium Oxide | Precision tools, biomedical devices | High fracture toughness | Higher cost, limited high-temp use | High |

Carborundum, also known as silicon carbide (SiC), is a highly durable and heat-resistant abrasive material widely used in industrial applications. Understanding its manufacturing process is crucial for B2B buyers to assess supplier capabilities and product quality.

Illustrative Image (Source: Google Search)

1. Raw Material Preparation

The manufacturing begins with sourcing high-purity silica sand and petroleum coke. These raw materials undergo precise weighing and mixing to achieve the desired chemical composition. Consistent raw material quality is essential to ensure the final product’s performance, making initial material inspection (IQC) a critical step.

2. Forming and Synthesis

The mixture is fed into an electric resistance furnace operating at temperatures exceeding 2000°C. This high-temperature process, known as the Acheson process, synthesizes carborundum by reacting silica with carbon. Key techniques include controlled temperature ramp-up and maintaining an inert atmosphere to prevent contamination.

3. Crushing and Milling

Post-synthesis, the solidified carborundum blocks are crushed into coarse particles. These are then milled to produce various grain sizes depending on application requirements. Particle size distribution is controlled rigorously here to meet precise specifications.

4. Shaping and Assembly

Depending on the final use—such as grinding wheels, cutting tools, or refractory components—the carborundum grains are formed into shapes using pressing, molding, or sintering techniques. Assembly may involve bonding grains with resin or metal matrices. This stage demands exacting control over pressure, temperature, and bonding agents to ensure structural integrity.

5. Finishing and Surface Treatment

The final products undergo finishing processes like grinding, polishing, or coating to achieve desired surface qualities and dimensional tolerances. Surface treatments may include anti-corrosive coatings for enhanced durability in harsh environments.

For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, understanding the quality assurance (QA) systems behind carborundum manufacturing is vital to mitigate risks and ensure product reliability.

Illustrative Image (Source: Google Search)

Relevant International and Industry Standards

- ISO 9001: The cornerstone for quality management systems, ISO 9001 certification demonstrates that the supplier maintains consistent processes for product quality and customer satisfaction.

- CE Marking: For buyers in Europe, CE compliance indicates conformity with EU safety and environmental directives, particularly for carborundum products used in machinery or consumer-facing applications.

- API Standards: For oil and gas applications common in the Middle East and parts of Africa, adherence to American Petroleum Institute (API) standards ensures suitability for demanding environments.

- Other Industry-Specific Certifications: Depending on use, certifications such as ASTM, JIS (Japanese Industrial Standards), or REACH (for chemical safety in Europe) may apply.

Quality Control (QC) Checkpoints

- Incoming Quality Control (IQC): Verification of raw materials and components before entering production. This includes chemical composition analysis and physical property testing.

- In-Process Quality Control (IPQC): Continuous monitoring during synthesis, forming, and finishing. Techniques include temperature tracking, particle size analysis, and mechanical property tests.

- Final Quality Control (FQC): Comprehensive testing of finished products before shipment, focusing on dimensional accuracy, hardness, purity, and surface quality.

Common Testing Methods

- Chemical Composition Analysis: Using X-ray fluorescence (XRF) or spectroscopy to verify SiC purity.

- Particle Size Distribution: Laser diffraction or sieving to ensure grain size meets specifications.

- Hardness and Abrasion Testing: Mohs hardness tests and wear resistance evaluations to confirm durability.

- Thermal Stability Tests: Assessing performance at elevated temperatures, crucial for refractory applications.

- Surface Roughness and Dimensional Inspection: Using profilometers and coordinate measuring machines (CMM) to guarantee precision.

For buyers in diverse markets such as Nigeria, Brazil, Saudi Arabia, or Spain, due diligence on supplier QC practices safeguards investment and operational continuity.

1. Conduct Supplier Audits

Request on-site or virtual audits focusing on manufacturing processes, QC procedures, and certification validity. Audits should review documentation, process controls, and equipment calibration status.

2. Review Quality Documentation

Obtain and scrutinize QC reports, including raw material certificates, in-process inspection records, and final test results. Verify traceability of batches and consistency across production runs.

3. Employ Third-Party Inspection Services

Engage independent inspection agencies to perform pre-shipment inspections and laboratory testing. This impartial verification is particularly valuable for international transactions where direct oversight is limited.

4. Assess Certification Authenticity and Scope

Confirm that certifications are current and relevant to the product type and application. Understand regional nuances—for example, CE marking is mandatory in Europe but may not hold the same regulatory weight in African or South American markets.

5. Establish Clear Quality Agreements

Define acceptance criteria, sampling plans, and non-conformance handling in contracts. For international buyers, clauses addressing local regulatory compliance and documentation requirements (e.g., customs or import permits) are essential.

Navigating Regional Standards and Regulations

- Africa: Many African countries rely on ISO standards but may have specific import regulations. Nigerian buyers should verify compliance with SON (Standards Organization of Nigeria) requirements in addition to international certifications.

- South America: Countries like Brazil emphasize INMETRO certification for products entering their market. Buyers must ensure suppliers meet both international and local standards.

- Middle East: Gulf Cooperation Council (GCC) countries often require SASO (Saudi Standards, Metrology and Quality Organization) certification. Additionally, buyers should consider API and ISO certifications for industrial-grade carborundum.

- Europe: Compliance with CE marking, REACH chemical safety regulations, and ISO standards is mandatory. Spanish buyers, for example, must also consider EU directives on environmental impact and worker safety.

Cultural and Communication Considerations

Understanding the supplier’s approach to quality culture and responsiveness is critical. Buyers should prioritize suppliers with transparent communication channels, clear documentation practices, and willingness to accommodate regional compliance needs.

By thoroughly understanding the manufacturing processes and embedding rigorous quality assurance practices into supplier evaluation, B2B buyers across Africa, South America, the Middle East, and Europe can confidently source carborundum products that meet stringent performance and regulatory requirements. This proactive approach reduces risks, enhances supply chain reliability, and supports long-term industrial success.

Understanding the cost structure and pricing dynamics of carborundum is essential for international B2B buyers aiming to optimize procurement strategies across regions such as Africa, South America, the Middle East, and Europe. This analysis breaks down the key cost components, pricing influencers, and strategic buyer tips to navigate the complexities of sourcing carborundum effectively.

Raw Materials

The primary input for carborundum production is silicon carbide powder, whose price fluctuates based on global supply-demand dynamics and raw material quality. Variations in raw material purity and granule size directly affect the final product’s performance and cost.

Labor Costs

Labor costs vary significantly by manufacturing location. Facilities in Europe and the Middle East generally incur higher wages compared to those in parts of Africa and South America. Skilled labor is critical for precision processing and quality control, impacting overall manufacturing efficiency.

Manufacturing Overhead

This includes energy consumption, plant maintenance, and indirect labor costs. Carborundum production is energy-intensive, so regions with higher electricity tariffs will see increased overhead costs, influencing the final price.

Tooling and Equipment Depreciation

Specialized machinery used in shaping and finishing carborundum components requires substantial investment. Depreciation and maintenance of this equipment are factored into pricing, especially for customized or low-volume orders.

Quality Control (QC)

Stringent QC processes ensure product consistency and certification compliance. Expenses related to testing, inspection, and certification (e.g., ISO, REACH) add to the cost but are crucial for buyers requiring high-grade or certified materials.

Logistics and Freight

Shipping costs depend on the distance, transport mode (air, sea, land), and regional infrastructure. For buyers in Nigeria or remote South American locations, additional inland transportation and customs clearance fees can significantly impact landed costs.

Supplier Margin

Profit margins vary based on supplier positioning, market competition, and order volume. Established suppliers with strong reputations may command premium pricing, whereas newer entrants might offer competitive rates to gain market share.

Order Volume / Minimum Order Quantity (MOQ)

Larger orders typically yield unit price reductions due to economies of scale. Buyers should negotiate MOQ terms carefully, balancing inventory costs against price benefits.

Specifications and Customization

Tailored carborundum grades, sizes, or shapes require additional tooling and QC efforts, leading to price premiums. Standardized products are generally more cost-effective.

Material Grade and Purity

Higher-grade silicon carbide with fewer impurities commands higher prices but delivers better performance and durability.

Quality Certifications

Products certified to international standards (ISO, RoHS, REACH) often cost more but reduce risk for buyers needing regulatory compliance in their markets.

Supplier Location and Reputation

Proximity to manufacturing hubs can reduce logistics costs. Trusted suppliers with proven quality histories may price higher, reflecting reliability and service levels.

Incoterms

Terms like FOB, CIF, or DDP influence who bears shipping and insurance costs. Buyers should understand these terms thoroughly to assess true landed costs.

Negotiate Beyond Price

Engage suppliers in discussions about payment terms, lead times, and after-sales support. Volume discounts, flexible MOQs, and bundled service agreements can yield better overall value.

Focus on Total Cost of Ownership (TCO)

Consider not just the unit price but also logistics, storage, handling, and potential wastage costs. For example, sourcing from a closer supplier might reduce freight time and cost, offsetting a higher unit price.

Leverage Regional Trade Agreements

Buyers in Africa and Europe should explore benefits from trade blocs like the African Continental Free Trade Area (AfCFTA) or the European Union customs arrangements to reduce tariffs.

Assess Quality vs. Cost Trade-offs

In markets like Nigeria or the Middle East, where operational conditions may be harsh, investing in higher-quality carborundum can reduce replacement frequency and downtime.

Understand Pricing Nuances by Region

South American buyers might face higher logistics costs and longer lead times; proactive inventory planning and supplier diversification can mitigate risks.

Verify Supplier Credentials and Certifications

Ensure suppliers comply with international standards to avoid costly rejections or compliance issues, especially in regulated European markets.

Prices for carborundum products vary widely depending on specifications, order size, supplier, and market conditions. The figures discussed here are indicative and should be validated through direct supplier quotations and market research tailored to specific sourcing scenarios.

By thoroughly understanding these cost drivers and pricing factors, international B2B buyers can negotiate more effectively, optimize procurement decisions, and secure competitive, high-quality carborundum supplies aligned with their operational needs and market demands.

Understanding the essential technical properties of carborundum (silicon carbide) is crucial for making informed purchasing decisions. These properties directly impact product performance, cost-efficiency, and suitability for specific industrial applications.

Material Grade

Carborundum is available in various grades determined by purity, particle size, and crystal structure. Higher purity grades offer superior hardness and thermal conductivity, essential for precision machining or high-temperature environments. For buyers in industries like automotive or aerospace manufacturing, specifying the correct grade ensures product reliability and operational efficiency.

Particle Size / Grit

This refers to the size of individual carborundum particles, typically measured in microns or grit numbers. Coarser grits are suited for aggressive material removal, while finer grits provide smooth finishes. Selecting the appropriate particle size is vital to optimize machining speed, surface quality, and tool life.

Tolerance and Consistency

Tolerance indicates the allowable variation in particle size or shape. Tight tolerances mean more uniform particles, resulting in consistent performance during grinding or abrasive processes. For international buyers, requesting suppliers with certified quality control systems helps avoid batch-to-batch variability that can disrupt production.

Hardness (Mohs Scale)

Carborundum ranks around 9-9.5 on the Mohs hardness scale, making it one of the hardest abrasive materials. This property is critical when selecting abrasives for cutting or grinding hard metals and ceramics. Buyers must ensure the hardness aligns with their application to prevent premature wear or damage.

Thermal Stability

The ability of carborundum to withstand high temperatures without degradation is important for applications like refractory linings or high-speed cutting tools. Thermal stability affects both performance and safety, especially in industries such as metallurgy or chemical processing.

Electrical Conductivity

Some grades of carborundum exhibit semiconducting properties. This can be relevant for specialized industrial applications like electronic components or sensors. Buyers in tech-driven sectors should clarify electrical properties to match their product specifications.

Navigating the global carborundum market requires familiarity with standard trade and technical terminology. Here are essential terms that international B2B buyers should know to streamline communication and negotiation.

OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products used in another company’s final product. Understanding if a carborundum supplier serves OEMs can indicate product quality standards and volume capabilities, important for buyers seeking long-term partnerships.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQ impacts inventory management and pricing. Buyers from emerging markets or smaller enterprises should negotiate MOQs that align with their budget and storage capacity to avoid overstocking or cash flow issues.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specific carborundum products. Preparing detailed RFQs with technical specifications reduces misunderstandings and accelerates the procurement process.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define the responsibilities of buyers and sellers regarding shipping, insurance, and customs. Common terms include FOB (Free on Board) and CIF (Cost, Insurance, Freight). Clear agreement on Incoterms helps avoid disputes and unexpected costs.

Lead Time

The total time from order placement to product delivery. Knowing lead times is critical for production planning and inventory control, especially for buyers in regions with longer shipping durations like Africa or South America.

Certificate of Analysis (CoA)

A document provided by the supplier verifying that the carborundum batch meets specified technical standards, such as particle size distribution and purity. Requesting a CoA ensures product compliance and builds trust in supplier reliability.

By mastering these technical properties and trade terms, buyers from Africa, South America, the Middle East, and Europe can enhance procurement efficiency, reduce risks, and secure optimal value in their carborundum sourcing.

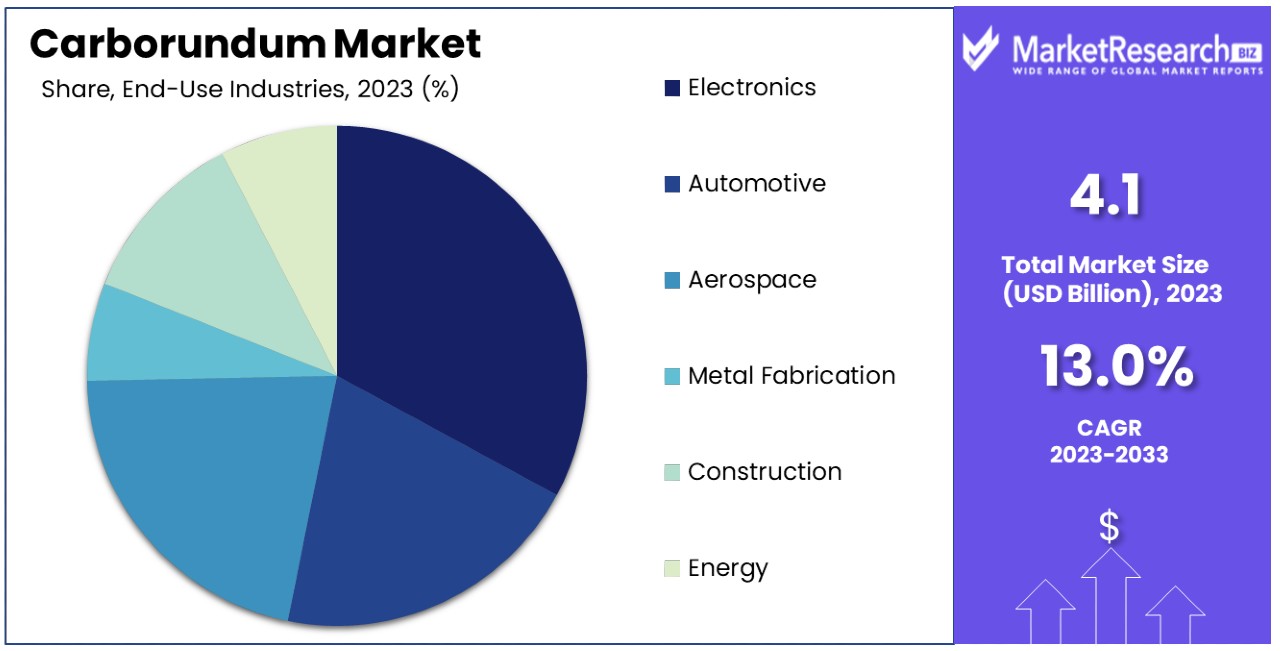

The carborundum sector is experiencing robust growth driven by its critical applications in industries such as automotive, electronics, construction, and renewable energy. Global demand is fueled by the material’s superior hardness, thermal conductivity, and chemical stability, making it indispensable for abrasives, semiconductors, and high-performance ceramics. For B2B buyers in regions like Africa, South America, the Middle East, and Europe, understanding the shifting supply-demand dynamics and emerging sourcing trends is essential for strategic procurement.

Key Market Drivers:

- Industrial Expansion: Rapid industrialization in emerging economies such as Nigeria and Brazil is increasing demand for carborundum-based components.

- Technological Advancements: Innovations in semiconductor and electric vehicle manufacturing are elevating carborundum’s role as a critical raw material.

- Infrastructure Development: Projects across the Middle East and Europe focusing on sustainable infrastructure are driving demand for durable materials like carborundum.

Sourcing Trends:

- Diversification of Supply Chains: Buyers are increasingly seeking suppliers beyond traditional hubs like China and the US to mitigate geopolitical risks and supply disruptions.

- Digital Procurement Platforms: Adoption of e-sourcing and blockchain technologies is enhancing transparency and efficiency in global carborundum transactions.

- Customization and Value-Added Services: Suppliers offering tailored carborundum grades and technical support are gaining preference among industrial buyers aiming for optimized performance.

Market Dynamics for International Buyers:

- Price Volatility: Fluctuations in raw material costs and energy prices can impact carborundum pricing, necessitating flexible contract terms.

- Regulatory Compliance: Import-export regulations and quality standards vary by region; buyers must align procurement strategies with local compliance requirements.

- Logistics & Lead Times: Given carborundum’s weight and bulk, optimizing logistics and establishing reliable supply routes is critical, especially for buyers in landlocked or infrastructure-challenged areas.

Sustainability is becoming a pivotal factor in carborundum procurement as industries worldwide commit to reducing environmental footprints. The production of carborundum involves energy-intensive processes and generates emissions, prompting buyers to prioritize suppliers with robust environmental management systems.

Environmental Impact Considerations:

- Energy Consumption: The synthesis of carborundum typically requires high-temperature furnaces, which can contribute significantly to carbon emissions.

- Waste Management: Proper handling of by-products and recycling of scrap materials can reduce environmental burdens.

- Water Usage: Sustainable water management practices during manufacturing help mitigate resource depletion.

Ethical Supply Chains:

- Buyers from Africa, South America, the Middle East, and Europe increasingly demand transparency in sourcing to avoid associations with conflict minerals or labor violations.

- Partnering with suppliers who adhere to international labor standards and provide traceability throughout the supply chain is becoming a non-negotiable criterion.

Green Certifications and Sustainable Materials:

- Certifications such as ISO 14001 (Environmental Management) and adherence to Responsible Minerals Initiatives provide assurance of sustainable practices.

- Some suppliers are innovating with lower-carbon production methods or using renewable energy sources to produce carborundum, aligning with corporate sustainability goals.

- Incorporating recycled carborundum or by-products into new manufacturing cycles is an emerging trend that reduces raw material dependency.

For international B2B buyers, embedding sustainability criteria into procurement policies not only mitigates risks but also enhances brand reputation and compliance with increasingly stringent environmental regulations.

Carborundum was first synthesized in the late 19th century as a revolutionary abrasive material, replacing natural minerals like emery and corundum. Its industrial adoption surged in the early 20th century with the rise of mass manufacturing and automotive industries. Over time, the material’s applications expanded into electronics and high-tech sectors, driven by its unique thermal and electrical properties.

Understanding this evolution helps B2B buyers appreciate how the carborundum supply chain has matured, with advancements in production technology and global distribution networks. This historical perspective underscores the material’s transformation from a simple abrasive to a strategic industrial commodity, emphasizing the need for sophisticated sourcing strategies aligned with modern market demands.

1. How can I effectively vet carborundum suppliers in international markets like Africa and Europe?

To vet suppliers, start with comprehensive due diligence: verify business licenses, check export history, and request client references, especially from buyers in similar regions such as Nigeria or Spain. Utilize third-party inspection services and request product samples to assess quality firsthand. Digital platforms like Alibaba or Global Sources can provide verified supplier badges. Additionally, confirm compliance with international standards (ISO, REACH) and inspect their production capabilities to ensure they can meet your volume and customization needs reliably.

2. What customization options are typically available for carborundum products, and how should I communicate these with suppliers?

Customization often includes particle size, shape, grit grade, bonding materials, and packaging formats. Clearly define your technical specifications upfront, supported by industry standards or samples, to avoid misunderstandings. Use detailed technical datasheets and maintain open communication channels, preferably with a dedicated account manager. For markets like the Middle East or South America, consider local regulatory requirements that might impact product formulation or packaging. Early discussions on customization can reduce lead times and ensure the product fits your application precisely.

3. What are typical minimum order quantities (MOQs), lead times, and payment terms when sourcing carborundum internationally?

MOQs vary widely depending on supplier scale and product type, but expect ranges from 500 kg to several tons for bulk orders. Lead times typically span 3-8 weeks, influenced by production capacity and shipping routes. Payment terms often include a 30%-50% upfront deposit with the balance paid before shipment or upon delivery via letters of credit. Negotiate terms considering your cash flow, especially when dealing with suppliers from emerging markets in Africa or South America, where flexibility may differ from European suppliers.

4. How can I ensure the quality of carborundum products meets international standards?

Request quality assurance documentation such as ISO 9001 certification, material safety data sheets (MSDS), and test reports from accredited labs. Insist on batch-wise inspection reports covering hardness, purity, and grain size. Conduct pre-shipment inspections through third-party agencies to verify compliance. For stringent markets in Europe or the Middle East, confirm adherence to environmental and safety regulations like REACH or RoHS. Establish clear quality benchmarks in your contract to facilitate dispute resolution if standards are not met.

5. What certifications should I look for when selecting a carborundum supplier for international trade?

Key certifications include ISO 9001 for quality management, ISO 14001 for environmental management, and possibly ISO 45001 for occupational health and safety. For chemical safety and environmental compliance, check for REACH (Europe) or local equivalents in Africa and South America. Suppliers with CE marking demonstrate conformity to EU standards, beneficial for European buyers. Certifications not only indicate product quality but also supplier commitment to sustainable and ethical practices, reducing risks in your supply chain.

6. What are the best logistics strategies for importing carborundum from Asia or Europe to regions like Nigeria or the Middle East?

Optimize logistics by choosing between sea freight for cost-efficiency and air freight for urgent deliveries. Partner with freight forwarders experienced in handling abrasive materials to ensure proper packaging and handling. Understand import regulations, customs duties, and documentation requirements specific to your country to prevent delays. Consolidate shipments where possible to reduce costs. Establish clear Incoterms (e.g., FOB, CIF) to define responsibility for shipping risks and costs, tailoring terms to your operational capabilities and risk appetite.

7. How should I handle disputes or quality issues with international carborundum suppliers?

Document all agreements, specifications, and communications in writing. If quality issues arise, initiate a formal complaint referencing your contract terms and provide evidence like inspection reports or photos. Engage in amicable negotiations first; many suppliers will offer replacements or refunds. If unresolved, escalate through arbitration clauses or international trade dispute mechanisms such as ICC arbitration. Maintaining good relationships and clear contracts upfront minimizes the risk of disputes, which is particularly important when dealing across different legal jurisdictions.

8. Are there specific considerations for sourcing carborundum in emerging markets compared to established European suppliers?

Emerging markets may offer competitive pricing but can pose challenges like less stringent regulatory oversight, variable quality, and longer lead times. Conduct more rigorous supplier audits and insist on third-party quality verification. Payment terms may be less flexible, so secure transactions through letters of credit or escrow services. Conversely, European suppliers often provide stronger compliance guarantees and faster logistics but at higher costs. Balancing cost, quality, and reliability is key; consider hybrid sourcing strategies combining suppliers from both regions to mitigate risks.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of sourcing carborundum, international B2B buyers must prioritize strategic partnerships, supplier reliability, and market intelligence. Key takeaways emphasize the importance of leveraging regional expertise—particularly from emerging markets in Africa, South America, the Middle East, and Europe—to optimize supply chain resilience and cost-effectiveness. Understanding the nuances of local regulations, logistics infrastructure, and quality certifications can significantly enhance procurement outcomes.

Strategic sourcing goes beyond price negotiation; it is about building long-term, transparent relationships with manufacturers and distributors that ensure consistent quality and innovation. For buyers in Nigeria, Spain, and similar markets, aligning sourcing strategies with sustainability and technological advancements in carborundum production will unlock competitive advantages.

Illustrative Image (Source: Google Search)

Looking ahead, buyers should actively engage in market trend monitoring and invest in supplier development programs to stay ahead of fluctuations in raw material availability and geopolitical shifts. Embracing digital sourcing platforms and data analytics will further empower smarter decision-making. Now is the time for proactive collaboration and informed sourcing to secure a robust supply of carborundum that supports growth and operational excellence across diverse industries worldwide.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina