The carborundum disc stands as a cornerstone in industrial cutting, grinding, and polishing operations worldwide. For businesses across Africa, South America, the Middle East, and Europe, particularly in emerging manufacturing hubs like Mexico and Colombia, sourcing the right carborundum disc is critical to ensuring operational efficiency, product quality, and cost-effectiveness. As industries scale and diversify, understanding the nuances of carborundum disc varieties, manufacturing standards, and supplier reliability becomes indispensable.

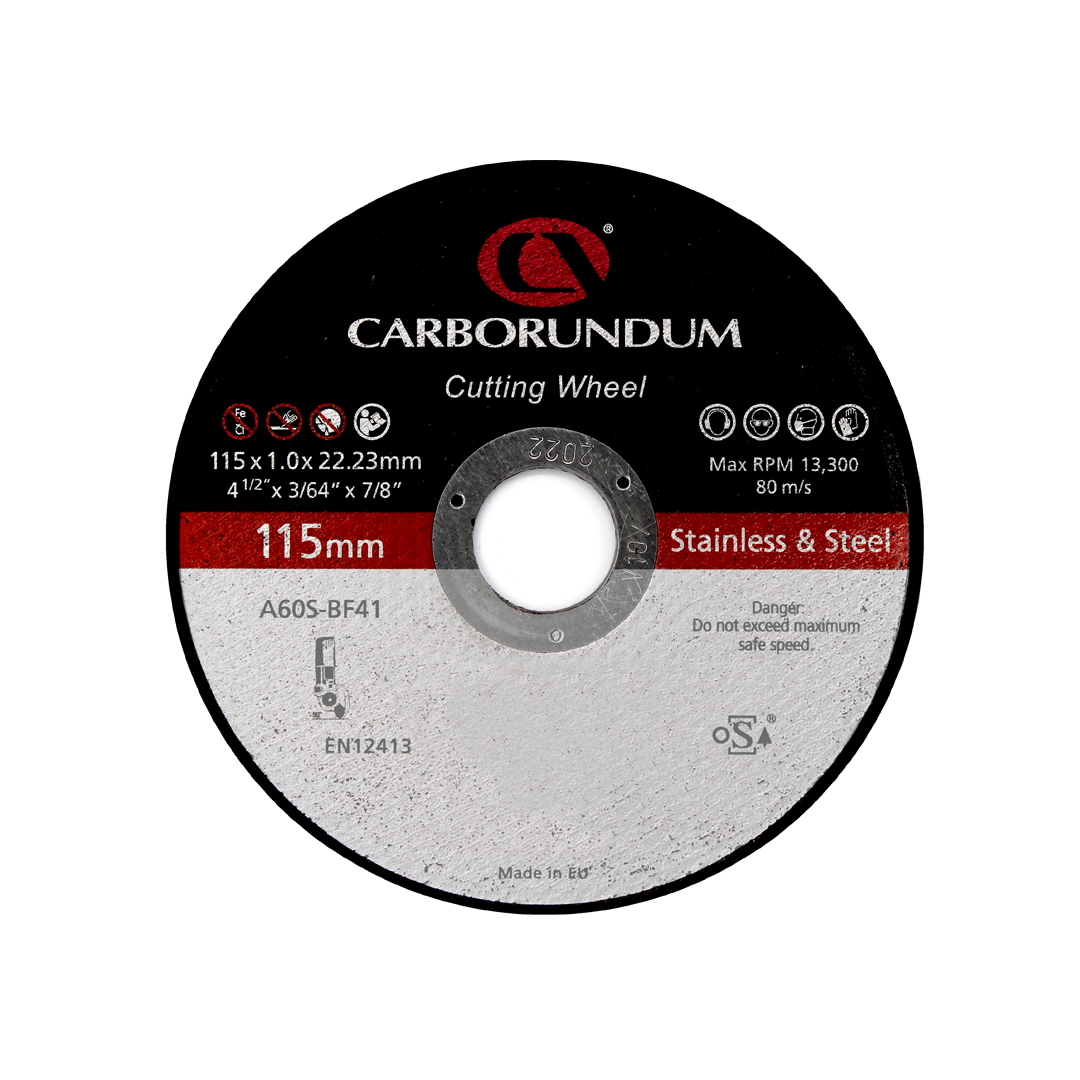

Illustrative Image (Source: Google Search)

This guide offers a comprehensive roadmap tailored to international B2B buyers seeking to optimize their procurement strategy. It covers essential aspects including types of carborundum discs, material compositions, and the latest manufacturing and quality control practices that impact disc performance and longevity. Additionally, it provides insights into identifying trustworthy suppliers, evaluating cost structures, and navigating market dynamics across diverse regions.

By exploring practical considerations and answering frequently asked questions, this resource empowers buyers to make well-informed decisions that minimize risk and maximize value. Whether you are upgrading your current supply chain or entering new markets, this guide helps you align your sourcing approach with global best practices and regional market realities.

In an increasingly competitive global marketplace, leveraging detailed product knowledge and market intelligence is key to gaining a strategic advantage. This guide equips B2B buyers from Africa, South America, the Middle East, and Europe with actionable insights to confidently navigate the complexities of procuring high-quality carborundum discs tailored to their unique industrial needs.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Cutting Disc | Medium grit size, balanced hardness, general-purpose | Metal cutting, construction, fabrication | Pros: Versatile, cost-effective; Cons: Not specialized for hard materials |

| Thin-Segment Disc | Thin profile, high precision, fast cutting | Automotive, sheet metal work, precision cutting | Pros: Minimal material wastage, clean cuts; Cons: Lower durability on tough materials |

| Resin-Bonded Disc | Resin-bonded abrasive grains, flexible, shock-resistant | Woodworking, plastics, composite materials | Pros: Good surface finish, less vibration; Cons: Limited lifespan under heavy use |

| Turbo Rim Disc | Serrated edge, enhanced cooling, high-speed cutting | Concrete, masonry, stone cutting | Pros: Faster cutting, reduced heat buildup; Cons: Higher initial cost, requires powerful tools |

| Ceramic Grain Disc | Ceramic alumina abrasive, self-sharpening, high durability | Heavy metal fabrication, stainless steel, aerospace | Pros: Long life, aggressive cutting; Cons: Higher price, may require operator skill |

Standard Cutting Disc

This type is the most widely used carborundum disc, featuring medium grit and hardness suitable for a broad range of materials including mild steel and general construction metals. For B2B buyers, its versatility makes it a reliable choice for diverse industrial applications without needing multiple disc types. When purchasing, consider the compatibility with existing cutting equipment and evaluate cost-effectiveness for bulk orders, especially in markets like South America and Africa where budget constraints are common.

Thin-Segment Disc

Characterized by its slender profile, the thin-segment disc excels in precision cutting with minimal material loss. This makes it highly suitable for industries requiring fine cuts, such as automotive manufacturing and sheet metal processing. Buyers from regions with advanced manufacturing sectors like Europe or the Middle East should prioritize this type for its precision benefits, while also assessing the trade-off in durability when cutting tougher metals.

Resin-Bonded Disc

Resin-bonded discs provide a softer, more flexible cutting experience with reduced vibration, making them ideal for woodworking, plastics, and composites. For B2B buyers in sectors like furniture manufacturing or plastic goods production, these discs offer improved surface finish and operator comfort. When sourcing, consider the expected workload and ensure that the resin bond quality meets durability needs, especially in hot climates common in Africa and the Middle East.

Turbo Rim Disc

Designed with serrated edges for enhanced cooling and faster cutting speeds, turbo rim discs are preferred in heavy-duty applications such as concrete and masonry work. B2B buyers involved in infrastructure projects or stone fabrication will benefit from their efficiency and reduced heat buildup. However, they require more powerful cutting tools and come at a higher price point, so buyers should assess tool compatibility and project scale before procurement.

Ceramic Grain Disc

These discs incorporate ceramic alumina abrasives that self-sharpen during use, delivering aggressive cutting performance and extended lifespan. They are ideal for high-demand industries like aerospace, stainless steel fabrication, and heavy metalworking. For buyers in technologically advanced markets, investing in ceramic grain discs can yield long-term cost savings despite the premium price. Attention should be given to operator training and tool matching to maximize the disc’s potential.

Related Video: The Genius Behind Bach's Goldberg Variations: CANONS

| Industry/Sector | Specific Application of carborundum disc | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Metal Fabrication | Precision cutting and grinding of steel and alloys | Enhances cutting speed and surface finish, reduces downtime | Disc grit size, bond type, durability under high RPM, supplier reliability |

| Automotive Manufacturing | Cutting and shaping brake components and engine parts | Improves component accuracy and extends tool life | Compliance with safety standards, consistent quality, availability of bulk supply |

| Construction & Infrastructure | Cutting concrete, bricks, and tiles | Enables efficient on-site material shaping, reduces labor costs | Abrasion resistance, disc diameter options, compatibility with handheld tools |

| Aerospace & Defense | Machining of composite materials and hard metals | Ensures precision and minimal material wastage | High-performance bonding, heat resistance, certifications for aerospace use |

| Electronics & Electrical | Cutting and trimming of circuit boards and semiconductor wafers | Delivers fine cuts with minimal chipping, supports high-volume production | Ultra-fine grit discs, dust control features, consistency in thickness and diameter |

Metal Fabrication

In metal fabrication, carborundum discs are essential for cutting and grinding tough metals such as stainless steel, carbon steel, and various alloys. They address challenges like maintaining precision while minimizing heat generation, which can affect metal properties. For international buyers in regions like Africa and South America, selecting discs with the right grit and bond type is critical to ensure durability and compatibility with local cutting machines. Reliable supply chains and consistent product quality are vital to avoid costly production delays.

Automotive Manufacturing

Automotive plants use carborundum discs to cut and shape brake pads, engine components, and chassis parts. These discs must withstand high rotational speeds and deliver precise cuts to meet strict industry tolerances. Buyers from the Middle East and Europe should prioritize discs certified for safety and performance standards, as well as suppliers capable of providing large volumes with uniform quality to support mass production cycles.

Construction & Infrastructure

Carborundum discs are widely used on construction sites for cutting concrete slabs, bricks, and ceramic tiles. Their abrasive strength reduces manual labor and accelerates project timelines. For B2B buyers in emerging markets such as Mexico and Colombia, sourcing discs that offer high abrasion resistance and are compatible with common handheld grinders is essential. Availability of various disc diameters can also provide flexibility for different construction applications.

Aerospace & Defense

In aerospace manufacturing, carborundum discs are utilized for machining composite materials and hard metals like titanium alloys. The discs must provide clean cuts without compromising material integrity, which is crucial for safety-critical components. Buyers in Europe and the Middle East should focus on high-performance bonding agents and heat resistance properties, alongside necessary certifications that comply with aerospace industry regulations.

Electronics & Electrical

Precision cutting of circuit boards and semiconductor wafers demands ultra-fine grit carborundum discs. These discs enable smooth trimming with minimal chipping, essential for maintaining electrical performance and yield rates. International buyers from tech hubs in Europe and South America must ensure that discs meet stringent quality control standards and feature dust control capabilities to maintain clean manufacturing environments and reduce equipment wear.

Related Video: Akua Carborundum Gel with Wax Mediums

Key Properties: Silicon carbide is the foundational abrasive material for carborundum discs, known for its exceptional hardness and thermal conductivity. It maintains structural integrity at high temperatures (up to 1600°C) and exhibits excellent corrosion resistance against most acids and alkalis. Its high fracture toughness makes it suitable for cutting and grinding applications under significant mechanical stress.

Pros & Cons: Silicon carbide discs offer outstanding durability and cutting efficiency, especially on non-ferrous metals, ceramics, and stone. However, they can be brittle, posing risks of chipping under improper handling or excessive pressure. Manufacturing complexity is moderate, with established production processes globally. Cost-wise, SiC discs are generally mid-range, balancing performance and affordability.

Impact on Application: Ideal for abrasive cutting and grinding of materials like aluminum, brass, and glass. The thermal stability allows use in high-speed operations without rapid wear. However, they are less effective on hardened steel due to lower toughness compared to alternatives.

International B2B Considerations: Buyers in Africa, South America, the Middle East, and Europe should ensure compliance with ASTM F1004 or DIN EN 12413 standards for safety and performance. Regions with high ambient temperatures benefit from SiC’s thermal resilience. Local preferences may lean towards SiC discs with specific grit sizes tailored to regional industrial needs, such as mining in South America or metal fabrication in Europe.

Key Properties: Aluminum oxide is another prevalent abrasive material, characterized by high hardness and excellent wear resistance. It performs well under moderate to high temperatures (up to 1200°C) and offers good chemical stability, though less corrosion resistance than silicon carbide.

Pros & Cons: Aluminum oxide discs are highly durable and versatile, suitable for grinding ferrous metals and alloys. They tend to be less brittle than SiC, reducing breakage risk. Manufacturing is well-established, often resulting in lower costs. However, they may wear faster when used on non-ferrous metals or very hard materials.

Impact on Application: Best suited for steel and iron-based materials, aluminum oxide discs provide efficient material removal and surface finishing. Their moderate thermal tolerance means they are less ideal for extremely high-speed cutting but excel in general-purpose grinding.

International B2B Considerations: Compliance with DIN EN 12413 and JIS B 2242 is critical for buyers in Europe and Asia-Pacific markets. In Africa and the Middle East, where steel fabrication is common, aluminum oxide discs are preferred for their balance of cost and performance. Buyers should verify supplier adherence to regional safety certifications and consider grit size variations for specific applications.

Key Properties: Ceramic abrasive grains are engineered for high hardness and self-sharpening capabilities. They withstand elevated temperatures (up to 1400°C) and maintain sharp cutting edges longer than traditional abrasives. Ceramic grains also exhibit superior fracture toughness and resistance to wear.

Pros & Cons: Ceramic grain discs offer exceptional durability and cutting speed, significantly extending tool life. They are more expensive and complex to manufacture, requiring advanced sintering processes. Their brittleness can be a concern if not handled properly.

Impact on Application: These discs are optimal for high-precision grinding and cutting of hardened steels and superalloys. Their self-sharpening feature reduces downtime, enhancing productivity in demanding industrial environments.

International B2B Considerations: For buyers in Europe and the Middle East, ceramic grain discs often meet stringent ISO and ASTM standards, ensuring high quality. In South America and Africa, the higher upfront cost may be offset by longer tool life, especially in mining and heavy machinery sectors. Buyers should assess total cost of ownership rather than initial price alone.

Key Properties: These discs combine silicon carbide abrasives with a resin binder, offering flexibility and shock resistance. They operate effectively at moderate temperatures (up to 150°C) and provide good vibration damping during cutting.

Pros & Cons: Resin-bonded discs are lightweight and less prone to cracking, making them safer for high-speed cutting. They are easier and cheaper to manufacture but have a shorter lifespan compared to vitrified or ceramic-bonded alternatives. Their cutting efficiency may be lower on very hard materials.

Impact on Application: Best suited for cutting softer metals, plastics, and composites. Their shock absorption makes them ideal for handheld power tools and applications requiring operator comfort.

International B2B Considerations: Buyers in regions with strict occupational safety regulations, such as Europe, must ensure discs comply with EN 12413 and OSHA standards. In markets like Mexico and Colombia, resin-bonded discs are popular for light industrial use due to cost-effectiveness. Importers should verify resin quality and bonding consistency to avoid premature failure.

| Material | Typical Use Case for carborundum disc | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) | Cutting/grinding non-ferrous metals, ceramics, stone | High hardness and thermal stability | Brittle, risk of chipping | Medium |

| Aluminum Oxide (Al2O3) | Grinding ferrous metals and alloys | Versatile, durable, less brittle than SiC | Faster wear on non-ferrous metals | Low |

| Ceramic Grain | High-precision grinding of hardened steels | Self-sharpening, superior durability | Higher cost, manufacturing complexity | High |

| Resin-Bonded Carborundum | Cutting softer metals, plastics, composites | Shock absorption, lightweight, safer | Shorter lifespan, lower cutting efficiency | Low |

The production of carborundum discs involves a series of carefully controlled stages to ensure optimal performance, durability, and safety. Understanding these manufacturing steps is crucial for B2B buyers aiming to select reliable suppliers who meet rigorous industrial demands.

1. Material Preparation

Raw materials primarily include silicon carbide (carborundum) grains, bonding agents (resin, vitrified, or metal bonds), fillers, and reinforcement fibers. The quality of these inputs directly affects the disc’s cutting efficiency and lifespan. Suppliers typically source high-purity silicon carbide, which is then graded by grain size and toughness to match specific application requirements.

2. Forming the Disc

The prepared materials are mixed thoroughly to create a homogeneous compound. This mixture is then shaped using one of the following techniques:

Precision in forming ensures uniform density and abrasive distribution, critical for consistent cutting performance.

3. Assembly and Reinforcement

After forming, discs may be reinforced with fiber layers (glass or synthetic fibers) to enhance mechanical strength and reduce breakage risk during high-speed operation. Reinforcement layers are bonded to the disc under controlled conditions, ensuring structural integrity.

4. Finishing and Curing

The discs undergo curing or baking processes to solidify the bond and achieve desired mechanical properties. Resin-bonded discs are cured at controlled temperatures to harden the resin, while vitrified bonds require firing in kilns. Post-curing, discs are trimmed, balanced, and inspected for surface defects.

A robust QC system is indispensable in the manufacturing of carborundum discs to meet international safety and performance standards. B2B buyers should focus on suppliers that implement comprehensive QA/QC frameworks aligned with globally recognized standards.

International and Industry-Specific Standards

- ISO 9001: The baseline for quality management systems, ensuring consistent manufacturing processes and continuous improvement.

- EN 12413: European safety standard specifically for bonded abrasive products, crucial for buyers in Europe and those exporting to the EU.

- CE Marking: Mandatory for products sold in the European Economic Area, demonstrating conformity with health, safety, and environmental protection standards.

- API Standards: Relevant for discs used in oil and gas sectors, ensuring suitability for demanding industrial environments.

QC Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials for compliance with technical specifications before production begins.

- In-Process Quality Control (IPQC): Monitoring during mixing, forming, and curing stages to detect defects early. This includes checking material homogeneity, molding pressures, and curing temperatures.

- Final Quality Control (FQC): Comprehensive testing of finished discs covering dimensional accuracy, bonding strength, surface finish, and dynamic balancing.

Common Testing Methods

- Hardness Testing: Ensures the abrasive grains and bonding matrix meet performance criteria.

- Bond Strength Test: Measures the adhesion between abrasive grains and the bond material, critical for disc durability.

- Dynamic Balance Test: Prevents vibrations by ensuring even mass distribution.

- Speed and Safety Tests: Verifies the disc withstands maximum operating speeds without failure.

- Cutting Performance Trials: Simulated or real-world testing to validate efficiency and wear rate.

For buyers from Africa, South America (e.g., Mexico, Colombia), the Middle East, and Europe, verifying supplier QC processes is essential to mitigate risks related to product quality, regulatory compliance, and supply chain reliability.

1. Conduct Supplier Audits

On-site audits allow buyers to assess manufacturing practices, QC processes, and compliance with international standards firsthand. When direct audits are not feasible, third-party audit services specializing in industrial abrasives can provide reliable assessments.

2. Request Comprehensive QC Documentation

Ensure suppliers provide:

This documentation supports due diligence and helps meet regulatory requirements in your country.

3. Employ Third-Party Inspection and Testing

Independent labs can verify product conformity before shipment. This is particularly valuable for buyers importing into markets with strict customs and safety verification processes.

4. Understand Regional QC and Certification Nuances

- Africa & Middle East: Regulatory frameworks may vary, with some countries requiring local certification or additional documentation for customs clearance. Partnering with suppliers familiar with these local requirements streamlines import processes.

- South America: Countries like Mexico and Colombia often recognize ISO and CE certifications but may also require compliance with local standards (e.g., NOM in Mexico). Confirming supplier familiarity with these is vital.

- Europe: Strict adherence to EN standards and CE marking is mandatory. Non-compliant products may face rejection or penalties.

Selecting a carborundum disc supplier with stringent manufacturing and quality assurance processes is critical to ensure product reliability, safety, and compliance across diverse international markets. Buyers should:

By integrating these insights into supplier evaluation and procurement strategies, international B2B buyers can secure high-quality carborundum discs tailored to their operational needs and regional requirements.

Understanding the detailed cost structure behind carborundum discs is essential for international B2B buyers aiming to optimize procurement expenses. The primary cost components include:

Several factors influence the final price offered by suppliers, which buyers should carefully evaluate:

For buyers in Africa, South America, the Middle East, and Europe, particularly in markets like Mexico and Colombia, the following actionable insights can enhance sourcing outcomes:

Prices for carborundum discs vary widely based on supplier location, order size, product specifications, and prevailing market conditions. The figures referenced in this analysis serve as indicative benchmarks only. Buyers are encouraged to request detailed quotations and conduct supplier audits to obtain accurate, up-to-date pricing tailored to their specific procurement contexts.

Understanding the essential technical specifications of carborundum discs is vital for international B2B buyers to ensure product suitability, performance, and compliance with industry standards. Here are the key properties to consider:

Material Grade (Abrasive Composition):

Carborundum discs are primarily made from silicon carbide (SiC), known for its hardness and sharpness. The grade indicates the purity and crystalline structure of the abrasive, affecting cutting efficiency and lifespan. For buyers, selecting the correct grade ensures optimal performance for specific materials such as metals, ceramics, or composites.

Disc Diameter and Thickness:

These dimensions must match the machinery and application requirements. Diameter affects cutting depth and speed, while thickness influences durability and precision. Precision in size also ensures safety compliance and reduces operational downtime.

Grit Size:

Grit size refers to the size of the abrasive particles on the disc surface. Lower grit numbers (e.g., 24-60) indicate coarser abrasives for aggressive cutting, while higher grit numbers (e.g., 80-120) are finer for finishing work. Selecting the right grit size impacts the quality of the cut and material finish.

Bond Type:

The bonding material holds abrasive particles together. Common bonds include resin, vitrified, or metal. Each bond type affects disc flexibility, heat resistance, and wear rate. Buyers should align bond choice with the cutting environment and material hardness for longevity and safety.

Tolerance and Balance:

Tolerance specifies allowable deviations in disc dimensions, while balance refers to even weight distribution. Strict adherence to tolerance and balance reduces vibration, ensuring smoother operation, increased safety, and prolonged equipment life.

Maximum Operating Speed (RPM):

This indicates the highest safe rotational speed for the disc. Exceeding this can cause failure or accidents. Buyers must verify compatibility with their equipment’s speed to maintain operational safety and compliance with international safety standards.

Navigating the procurement process for carborundum discs involves familiarity with key industry terms that streamline communication and contractual clarity:

OEM (Original Equipment Manufacturer):

Refers to manufacturers producing carborundum discs either under their brand or for other companies. OEM products often guarantee higher quality and compliance with original machine specifications, an important factor when sourcing reliable components.

MOQ (Minimum Order Quantity):

The smallest quantity a supplier is willing to sell in a single order. Understanding MOQ helps buyers plan inventory and cash flow, especially when dealing with suppliers in different regions where bulk orders may reduce unit costs but increase upfront investment.

RFQ (Request for Quotation):

A formal document buyers send to suppliers to obtain pricing and terms for specific carborundum disc specifications. A well-prepared RFQ expedites comparison of offers and clarifies technical requirements, crucial for efficient supplier selection.

Incoterms (International Commercial Terms):

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Clarity on Incoterms protects buyers from unexpected costs and logistical issues.

Certification and Compliance:

Terms such as ISO, CE, or ANSI indicate adherence to international safety and quality standards. Verification of certifications ensures product reliability and legal compliance, especially critical when importing to regulated markets in Europe or the Middle East.

Lead Time:

The period between order placement and delivery. Accurate knowledge of lead times assists buyers in planning production schedules and inventory management, reducing risk of delays in supply chains across continents.

By mastering these technical properties and trade terms, international buyers can make informed decisions, negotiate effectively, and optimize their procurement strategies for carborundum discs tailored to their operational and market needs.

The global carborundum disc market is experiencing steady growth driven by increasing industrialization, infrastructure development, and the rising demand for high-precision cutting and grinding tools. Key sectors such as automotive, aerospace, metal fabrication, and construction are fueling demand, especially in emerging markets across Africa, South America, the Middle East, and Europe. Countries like Mexico and Colombia are seeing growth due to expanding manufacturing bases and government investments in industrial modernization.

For international B2B buyers, understanding regional supply chain nuances is critical. Africa’s growing mining and construction sectors create demand for durable abrasives, while South America’s expanding automotive industry pushes for discs with superior wear resistance. The Middle East’s focus on oil & gas infrastructure maintenance requires highly specialized cutting tools, and Europe’s mature manufacturing landscape prioritizes innovation, quality, and regulatory compliance.

Emerging trends include the integration of advanced materials such as nano-structured abrasives, which enhance disc longevity and cutting precision. Digital sourcing platforms and Industry 4.0 technologies enable better supplier transparency and faster procurement cycles. Additionally, buyers increasingly prioritize suppliers offering customized solutions to meet specific industrial applications, from heavy-duty grinding to precision cutting.

Strategic sourcing is shifting towards multi-tier supplier partnerships to mitigate risks from geopolitical disruptions and fluctuating raw material prices. Leveraging local distributors or manufacturers in target regions can reduce lead times and shipping costs, a crucial factor for buyers in geographically dispersed markets.

Sustainability has become a cornerstone for B2B procurement in the carborundum disc sector, with buyers demanding transparency and eco-conscious practices throughout the supply chain. Manufacturing carborundum discs involves energy-intensive processes and the use of abrasive materials that can generate significant waste and emissions if unmanaged.

Leading suppliers now emphasize environmentally friendly production techniques, such as recycling abrasive materials, minimizing hazardous waste, and optimizing energy consumption. The adoption of green certifications—including ISO 14001 (Environmental Management Systems) and adherence to REACH regulations in Europe—demonstrates commitment to reducing environmental impact and ensures compliance with international standards.

Ethical sourcing is equally important, especially for buyers in regions like Africa and South America where raw material origins may be complex. Ensuring that suppliers adhere to responsible mining practices and fair labor conditions mitigates reputational risks and aligns with corporate social responsibility goals. Buyers should request full supply chain audits and certifications like the Responsible Minerals Assurance Process (RMAP) to validate ethical claims.

Furthermore, innovation in alternative abrasives—such as synthetic or recycled silicon carbide—offers greener options without compromising performance. Investing in suppliers who prioritize sustainability can enhance long-term value, improve stakeholder trust, and future-proof operations against tightening environmental regulations.

Illustrative Image (Source: Google Search)

The carborundum disc traces its origins back to the late 19th century when silicon carbide (carborundum) was first synthesized as an abrasive material. Initially used for simple grinding tasks, the technology evolved rapidly alongside industrial growth, with improvements in bonding agents and manufacturing methods enabling more durable and specialized discs.

Over the decades, carborundum discs transitioned from rudimentary tools to precision-engineered products capable of meeting the stringent demands of modern manufacturing. The rise of automation and computer numerical control (CNC) machining in the late 20th century further pushed suppliers to innovate discs that offer consistent performance and longer service life.

Today, the sector balances traditional abrasive expertise with cutting-edge materials science and digital manufacturing technologies. This evolution reflects the increasing complexity of global industrial needs and the necessity for B2B buyers to align sourcing strategies with both historical reliability and future-oriented innovation.

How can I effectively vet suppliers of carborundum discs for international trade?

When sourcing carborundum discs globally, prioritize suppliers with verifiable certifications such as ISO 9001 or relevant industry-specific standards. Request samples to assess product quality and consistency. Investigate their production capacity, export experience, and client references, particularly from your region. Utilize third-party inspection services or audits to verify manufacturing practices. Additionally, consider suppliers with robust after-sales support and transparent communication channels, which are crucial for long-term partnerships in Africa, South America, the Middle East, and Europe.

Is it possible to customize carborundum discs to meet specific industrial needs?

Yes, many manufacturers offer customization options including size, grit size, bonding material, and hardness to suit particular applications like cutting, grinding, or polishing different materials. When negotiating, clearly specify your technical requirements and intended use. Custom orders may require minimum order quantities (MOQs) and longer lead times, so plan accordingly. Collaborate closely with your supplier’s technical team to ensure the product matches your operational demands, especially when sourcing from diverse markets such as Mexico or the Middle East.

What are typical minimum order quantities (MOQs) and lead times for carborundum discs in international B2B transactions?

MOQs vary widely depending on the supplier and customization level but typically range from 500 to 2,000 units per order. Standard lead times for off-the-shelf products are usually 2-4 weeks, while customized orders can take 6-12 weeks due to tooling and production adjustments. Always confirm these details before finalizing contracts, and factor in additional time for customs clearance and inland logistics in your target region. Negotiating flexible MOQs with suppliers can be advantageous for buyers in emerging markets.

What payment terms are standard when purchasing carborundum discs internationally?

Common payment terms include a 30% advance deposit with the balance paid before shipment or upon receipt of documents under a Letter of Credit (L/C). For trusted, established partners, Net 30 or Net 60 terms may be negotiated. Always use secure payment methods such as L/Cs or escrow services to mitigate risks. In regions with fluctuating currencies, consider contracts in stable currencies like USD or EUR to avoid exchange rate volatility. Clear payment terms protect both parties and facilitate smoother transactions.

Illustrative Image (Source: Google Search)

Which quality assurance certifications should I look for in carborundum disc suppliers?

Look for suppliers who comply with internationally recognized standards such as ISO 9001 for quality management and OHSAS 18001 for occupational health and safety. Specific certifications related to abrasive materials, such as ANSI or FEPA standards, indicate adherence to industry benchmarks. For European buyers, CE marking may be required to confirm compliance with EU regulations. Request certificates of conformity and test reports for each batch to ensure consistent product performance and safety.

What logistical considerations should I be aware of when importing carborundum discs?

Carborundum discs are classified as abrasive products and may require special packaging to prevent damage during transit. Confirm the supplier’s compliance with international shipping standards, including proper labeling and documentation for customs clearance. Choose freight options balancing cost and speed—sea freight is economical for large volumes, while air freight suits urgent orders. Also, evaluate inland transport infrastructure in your country to avoid delays. Engage experienced freight forwarders familiar with your target regions (e.g., Africa or South America) to optimize the supply chain.

How can I handle disputes or quality issues with international suppliers of carborundum discs?

Establish clear contractual terms covering product specifications, inspection rights, and dispute resolution mechanisms such as arbitration or mediation. Request third-party quality inspections before shipment to catch defects early. In case of non-compliance, document issues thoroughly with photos and reports. Communicate promptly with suppliers to seek amicable resolutions like replacements or refunds. Maintaining a professional and documented approach reduces risk and preserves business relationships across continents.

Are there specific regulatory or environmental compliance issues to consider when importing carborundum discs?

Yes, some countries enforce strict regulations on abrasive materials concerning hazardous substances and waste management. Verify that your supplier adheres to RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) standards, especially for European markets. Additionally, ensure that packaging materials comply with local environmental laws to avoid import restrictions or penalties. Staying informed about import regulations in your country helps prevent shipment delays and supports sustainable sourcing practices.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of carborundum discs demands a nuanced understanding of supplier capabilities, regional market dynamics, and product specifications tailored to diverse industrial applications. For buyers across Africa, South America, the Middle East, and Europe, aligning procurement strategies with reliable manufacturers who offer consistent quality and compliance with international standards is paramount. Emphasizing supplier diversification and long-term partnerships can mitigate risks related to supply chain disruptions and fluctuating raw material costs.

Key takeaways for international B2B buyers include:

Looking ahead, the carborundum disc market is poised for growth driven by expanding infrastructure projects and increasing industrial mechanization. Buyers who adopt a proactive sourcing approach—integrating digital tools for supplier evaluation and demand forecasting—will secure competitive advantages. Engage early with trusted suppliers and invest in strategic partnerships to navigate market fluctuations and harness emerging technological advancements. This approach will empower your business to meet evolving industrial needs with agility and confidence.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina