Carborundum structures play a pivotal role across diverse industrial applications, from abrasive tools and cutting equipment to advanced electronics and thermal systems. For international B2B buyers, especially those operating in dynamic markets such as Africa, South America, the Middle East, and Europe, understanding the nuances of carborundum materials and their structural variants is essential to secure competitive advantages and ensure product reliability.

This guide offers a comprehensive exploration of carborundum structures, detailing the various types and material compositions that define performance characteristics. It covers critical manufacturing processes and quality control standards that influence durability and efficiency, providing buyers with the insights needed to evaluate supplier capabilities rigorously. Additionally, the guide analyzes global market trends and cost factors, enabling businesses to benchmark pricing and identify optimal sourcing strategies.

Key benefits for B2B buyers include:

By leveraging this resource, buyers from Kenya, the UAE, Brazil, Germany, and other global hubs can confidently navigate the complexities of the carborundum supply chain. This empowers them to make informed, data-driven decisions that enhance operational efficiency and foster long-term supplier partnerships in an increasingly competitive global market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Hexagonal Carborundum | Layered hexagonal crystal lattice, strong covalent bonds | Abrasives, cutting tools, high-temp ceramics | Pros: Exceptional hardness, thermal stability; Cons: Higher cost, machining difficulty |

| Cubic Carborundum | Three-dimensional cubic lattice, isotropic properties | Electronic substrates, semiconductors | Pros: Uniform properties, good electrical insulation; Cons: Complex synthesis, limited availability |

| Polycrystalline Form | Aggregates of small crystals, variable grain orientation | Industrial grinding, polishing | Pros: Cost-effective, versatile; Cons: Lower mechanical strength, inconsistent performance |

| Doped Variants | Carborundum with intentional impurity atoms for property tuning | Sensors, optoelectronics, specialty coatings | Pros: Tailored electrical/optical properties; Cons: Requires precise control, higher production complexity |

| Porous Carborundum | Controlled porosity within structure for lightweight and filtration | Filtration media, lightweight composites | Pros: Low density, enhanced surface area; Cons: Reduced mechanical strength, limited load-bearing use |

Hexagonal Carborundum

This variant features a layered hexagonal lattice with strong covalent bonding, granting it exceptional hardness and thermal stability. It is ideally suited for high-performance abrasives, cutting tools, and components exposed to extreme temperatures. For B2B buyers in manufacturing or heavy industry sectors, prioritizing suppliers who can guarantee purity and consistent lattice quality is crucial to ensure product reliability and longevity.

Cubic Carborundum

Characterized by a three-dimensional cubic lattice, this type exhibits isotropic mechanical and electrical properties. It is predominantly used in electronic substrates and semiconductor applications where uniformity is vital. Buyers should consider the complexity and cost of synthesis, focusing on vendors with advanced production capabilities and certifications for electronic-grade materials.

Polycrystalline Form

Comprising numerous small crystals with varying grain orientations, polycrystalline carborundum offers versatility and cost-efficiency. It is widely employed in industrial grinding and polishing applications. While it may have lower mechanical strength compared to single-crystal forms, its economic advantages make it attractive for bulk industrial use. Buyers should assess consistency in grain size and bonding to avoid performance variability.

Doped Variants

These are engineered by introducing specific impurity atoms to tailor electrical, optical, or chemical properties. They find applications in sensors, optoelectronics, and specialty coatings. For B2B procurement, ensuring precise doping levels and stable production processes is critical, as these affect the functional performance of the end products. Collaboration with suppliers offering customization and quality assurance is recommended.

Porous Carborundum

Designed with controlled porosity, this type provides lightweight characteristics and enhanced surface area, beneficial for filtration media and lightweight composite materials. However, its reduced mechanical strength limits use in load-bearing applications. Buyers should evaluate the balance between porosity and strength based on application requirements and seek suppliers with expertise in pore size control and reproducibility.

| Industry/Sector | Specific Application of carborundum structure | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Abrasives & Cutting Tools | High-performance grinding wheels and cutting discs | Enhanced durability and cutting precision reduce downtime | Ensure consistent particle size and purity; verify supplier quality certifications |

| Electronics & Semiconductors | Substrate materials for high-temperature and high-power devices | Improved thermal conductivity and electrical insulation | Source from suppliers with strict quality control and compliance to international standards |

| Automotive & Aerospace | Heat-resistant coatings and components for engines and turbines | Increased component lifespan under extreme conditions | Prioritize suppliers offering customization and traceability |

| Industrial Manufacturing | Wear-resistant linings and seals in heavy machinery | Extended equipment life and reduced maintenance costs | Confirm chemical stability and mechanical strength specifications |

| Renewable Energy | Thermal management components in solar panels and wind turbines | Enhanced efficiency and longevity of energy systems | Evaluate supplier capacity to meet volume demands and delivery timelines |

The abrasives and cutting tools industry heavily relies on the carborundum structure for manufacturing grinding wheels and cutting discs that demand exceptional hardness and wear resistance. Businesses in regions such as South America and Africa benefit from these tools’ enhanced durability, which reduces machine downtime and operational costs. International buyers should focus on suppliers who provide consistent particle size distribution and maintain rigorous quality certifications to ensure product reliability.

In the electronics and semiconductor sector, carborundum structures serve as substrates for devices operating under high temperature and power loads. Their excellent thermal conductivity paired with electrical insulation supports device stability and performance. Buyers in the Middle East and Europe must prioritize sourcing from manufacturers with stringent quality control processes and adherence to international standards to mitigate risks associated with component failure.

The automotive and aerospace industries utilize carborundum-based coatings and components to withstand extreme heat and mechanical stress in engines and turbines. This application significantly extends component lifespan, reducing replacement frequency and improving safety margins. For B2B buyers in markets like the UAE and Kenya, securing suppliers who offer customization options and traceability of materials is crucial for compliance with local and international regulations.

Within industrial manufacturing, carborundum’s wear resistance is leveraged in linings and seals for heavy machinery, helping to minimize maintenance intervals and prolong equipment service life. Buyers should verify chemical stability and mechanical strength data from suppliers to ensure compatibility with harsh industrial environments, especially when sourcing from diverse regions with varying climate conditions.

Lastly, in the renewable energy sector, carborundum structures contribute to thermal management in solar panels and wind turbines, enhancing operational efficiency and durability. For international buyers, particularly in Europe and South America, evaluating supplier capacity to meet large-scale orders and strict delivery schedules is essential to maintain project timelines and cost-effectiveness.

Related Video: Carborundum Mezzotype: Dark Field/Reductive Techniques with Akua Carborundum Gel

Key Properties: Silicon carbide is a highly durable ceramic material known for its exceptional hardness, thermal conductivity, and resistance to high temperatures (up to 1600°C). It offers excellent corrosion resistance against acids and alkalis, making it suitable for aggressive chemical environments. Its mechanical strength and wear resistance are superior, supporting high-pressure applications.

Pros & Cons: SiC's durability and thermal stability make it ideal for long-lasting carborundum structures, especially in abrasive or high-temperature conditions. However, it is relatively expensive and requires sophisticated manufacturing processes, including sintering and precision machining. The material’s brittleness can pose challenges during handling and installation.

Impact on Application: Silicon carbide is well-suited for media involving abrasive slurries, corrosive chemicals, and high-temperature gases. Its resistance to thermal shock and chemical attack ensures reliability in harsh industrial environments such as chemical processing and power generation.

International B2B Considerations: Buyers from regions like Africa (Kenya), the Middle East (UAE), and Europe should verify compliance with ASTM C799 or DIN EN standards for silicon carbide ceramics. Due to its higher cost, evaluating supplier certifications and supply chain reliability is critical. In South America, where cost sensitivity may be higher, bulk purchasing or regional sourcing could optimize expenses.

Key Properties: Boron carbide is one of the hardest known materials, with excellent wear resistance and a melting point above 2700°C. It exhibits good chemical inertness and moderate thermal conductivity. Its low density compared to other carbides makes it advantageous for applications requiring lightweight yet strong materials.

Pros & Cons: The extreme hardness and chemical resistance of boron carbide make it suitable for highly abrasive environments. However, its brittleness and higher manufacturing complexity increase production costs. It is less common than silicon carbide, which may affect availability and lead times.

Impact on Application: Boron carbide is ideal for carborundum structures exposed to severe abrasion and corrosive media, such as in mining or heavy chemical industries. Its lightweight nature benefits applications where weight reduction is critical without compromising strength.

International B2B Considerations: Compliance with ASTM C799 or ISO 13590 standards is essential. Buyers in Europe and the Middle East should ensure suppliers provide detailed material certifications and traceability. In Africa and South America, where infrastructure for advanced manufacturing may be limited, partnering with experienced international suppliers is advisable to mitigate risks.

Key Properties: Aluminum oxide, or alumina, is a widely used ceramic with excellent hardness, good thermal stability (up to 1700°C), and strong corrosion resistance. It offers moderate toughness and is chemically inert in most environments except strong alkalis.

Pros & Cons: Alumina is cost-effective relative to silicon and boron carbides and easier to manufacture using conventional ceramic processing techniques. While not as hard as boron carbide or silicon carbide, it provides a good balance of durability and affordability. Its lower thermal conductivity can be a limitation in heat-intensive applications.

Impact on Application: Alumina is suitable for carborundum structures in moderate abrasion and chemical exposure scenarios, such as water treatment or food processing industries. It performs well in environments where chemical inertness and mechanical strength are required without extreme thermal demands.

International B2B Considerations: Alumina typically meets ASTM C799 and ISO 6484 standards. Buyers from Africa and South America often prefer alumina due to its lower cost and local availability. In the Middle East and Europe, alumina’s compatibility with existing industrial standards and easier sourcing make it a practical choice for many applications.

Key Properties: Zirconium oxide is a tough ceramic with high fracture toughness, excellent wear resistance, and thermal stability up to around 2400°C. It has superior resistance to crack propagation compared to other ceramics and good chemical inertness.

Pros & Cons: Zirconia’s toughness reduces the risk of catastrophic failure, making it more durable under mechanical stress. However, it is more expensive than alumina and requires advanced sintering techniques. Its lower corrosion resistance relative to silicon carbide limits use in highly acidic or alkaline environments.

Impact on Application: Zirconium oxide is advantageous for carborundum structures subjected to mechanical shock and wear, such as in automotive or aerospace components. It is less suitable for highly corrosive chemical environments but excels where toughness and thermal resistance are priorities.

International B2B Considerations: Compliance with ASTM C1424 or ISO 13356 is important. European and Middle Eastern buyers often require detailed quality assurance documentation due to stringent industry standards. For African and South American buyers, assessing local supplier capabilities for zirconia-based products is crucial to ensure consistent quality.

| Material | Typical Use Case for carborundum structure | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | High-temperature, abrasive, and corrosive environments | Exceptional hardness and thermal stability | High cost and brittleness | High |

| Boron Carbide | Severe abrasion and lightweight structural needs | Extreme hardness and low density | Manufacturing complexity and limited availability | High |

| Aluminum Oxide | Moderate abrasion and chemical resistance applications | Cost-effective and widely available | Lower thermal conductivity and toughness | Low |

| Zirconium Oxide | Applications requiring toughness and thermal resistance | Superior fracture toughness | Higher cost and limited chemical resistance | Medium |

Carborundum structures, prized for their exceptional hardness and thermal stability, are widely used in industries such as abrasives, refractories, and electronics. For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding the manufacturing and quality assurance processes behind these materials is crucial for making informed procurement decisions. Below is a detailed exploration of the typical production stages, quality control protocols, and verification methods that ensure high-performance carborundum structures.

The production of carborundum structures involves a sequence of carefully controlled stages designed to maximize material integrity and functional performance. These stages typically include:

The initial phase focuses on sourcing and preparing raw materials, primarily silicon carbide (SiC) powders. The purity, particle size distribution, and chemical composition of these powders critically influence the final product quality. Advanced suppliers often employ:

For B2B buyers, verifying the raw material specifications and supplier consistency at this stage is essential, especially when sourcing from regions with variable raw material quality.

Forming transforms the prepared powder mix into the desired shapes and sizes using techniques such as:

The choice of forming method impacts mechanical properties, porosity, and dimensional accuracy. Buyers should inquire about the forming techniques used, as these affect performance under operational stresses.

In cases where carborundum structures are part of composite or layered systems, assembly involves:

Understanding assembly processes is important for buyers who require complex or custom-configured products, ensuring compatibility and reliability.

Post-forming finishing enhances surface properties and dimensional tolerances through:

These finishing steps often define the suitability of the carborundum structure for specific industrial environments.

Robust quality assurance (QA) is vital for guaranteeing that carborundum structures meet stringent performance and safety criteria. International B2B buyers must be familiar with the typical QA stages, relevant standards, and verification approaches.

B2B buyers should verify that suppliers hold certifications applicable to their target markets and industries, as this impacts regulatory acceptance and operational reliability.

Quality control (QC) is typically segmented into three main checkpoints:

Buyers should request documentation of QC results at each stage to ensure traceability and accountability.

To validate the quality of carborundum structures, suppliers employ a range of testing methods such as:

Understanding these tests helps buyers specify product requirements and interpret supplier quality reports accurately.

For buyers in regions such as Kenya, UAE, Brazil, or Germany, verifying supplier QC processes is critical to mitigate risks associated with quality variability and regulatory compliance. Recommended verification strategies include:

Buyers should also consider regional nuances such as local regulatory requirements, import restrictions, and certification recognition differences. For example, while CE marking is mandatory in Europe, buyers in the Middle East might prioritize API or other region-specific certifications.

By thoroughly understanding the manufacturing processes and quality assurance protocols for carborundum structures, international B2B buyers can mitigate risks, ensure product reliability, and build long-term supplier partnerships that support their operational success.

Understanding the cost and pricing dynamics of sourcing carborundum structures is essential for international B2B buyers aiming to optimize procurement strategies and achieve cost efficiency. This analysis breaks down key cost components, price influencers, and actionable buyer tips tailored to markets in Africa, South America, the Middle East, and Europe.

Raw Materials

Carborundum structures primarily rely on silicon carbide and bonding materials, whose costs fluctuate based on global commodity prices and purity grades. High-grade raw materials ensure superior durability but increase base costs.

Labor Costs

Labor expenses vary significantly depending on the manufacturing location. Regions with advanced automation may have lower labor costs per unit despite higher wages, while manual-intensive processes in emerging economies might incur variable quality risks.

Manufacturing Overhead

This includes utilities, equipment depreciation, factory maintenance, and indirect labor. Overhead rates can vary with factory efficiency, production scale, and local regulatory compliance costs.

Tooling and Equipment

Initial tooling for molding or machining carborundum components represents a significant upfront investment, particularly for customized designs. Amortizing tooling costs over large volumes reduces per-unit expenses.

Quality Control and Certification

Rigorous QC processes, including dimensional inspections and material testing, are vital for meeting international standards. Certifications such as ISO or industry-specific approvals add to costs but enhance buyer confidence.

Logistics and Freight

Transporting carborundum structures internationally involves freight charges, customs duties, insurance, and handling fees. Costs are influenced by shipment size, weight, mode (air, sea, or land), and destination port infrastructure.

Supplier Margin

Suppliers incorporate profit margins based on market demand, competition, and negotiation outcomes. Margins can be optimized through strategic sourcing and long-term partnerships.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically attract volume discounts, reducing per-unit costs. However, MOQ requirements may be a barrier for smaller buyers or those testing new suppliers.

Specifications and Customization

Tailored dimensions, finishes, or composite structures increase manufacturing complexity and cost. Standardized products usually command lower prices and faster delivery.

Material Grade and Quality Certifications

Premium material grades and certifications for safety or environmental compliance raise prices but mitigate risks of failure and non-compliance.

Supplier Location and Capabilities

Suppliers located near raw material sources or with advanced manufacturing technologies can offer better pricing and lead times.

Incoterms and Payment Terms

Terms like FOB, CIF, or DDP affect total landed cost. Buyers should carefully evaluate Incoterms to understand responsibility shifts and hidden costs.

Negotiate Based on Total Cost of Ownership (TCO)

Look beyond unit price to factors like durability, maintenance, and replacement frequency. Investing in higher-quality carborundum structures may lower lifecycle costs.

Leverage Volume Consolidation

Buyers from regions such as Kenya, UAE, or Brazil can collaborate with industry peers or use aggregators to meet MOQ thresholds and secure bulk discounts.

Understand Local Import Regulations and Duties

Customs tariffs and import compliance vary widely. Engaging local customs brokers or consultants can avoid unexpected charges and delays.

Request Detailed Cost Breakdowns

Transparency from suppliers on cost components enables targeted negotiations, especially for labor or logistics cost reductions.

Assess Supplier Financial Stability and Capacity

Long-term reliability is critical. Vet suppliers’ production capacity and financial health to avoid supply disruptions.

Consider Alternative Incoterms

For buyers with strong logistics capabilities, taking control earlier in the supply chain (e.g., EXW or FOB terms) may reduce costs.

The prices for carborundum structures vary widely depending on raw material market conditions, supplier location, and customization requirements. The information provided here is indicative and intended to guide strategic sourcing decisions rather than serve as exact price quotations.

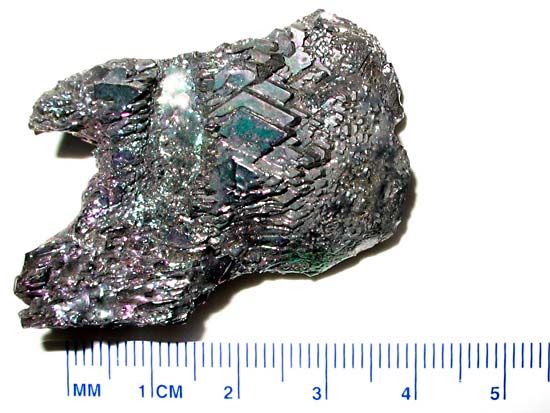

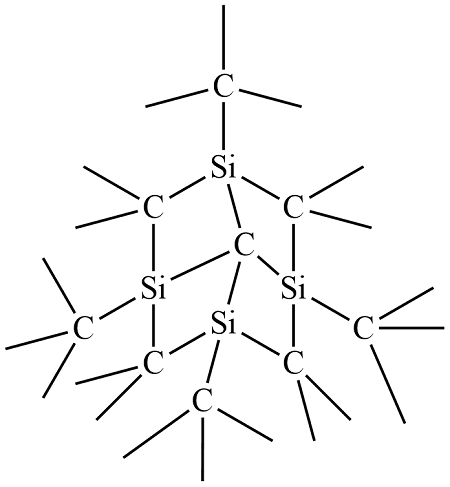

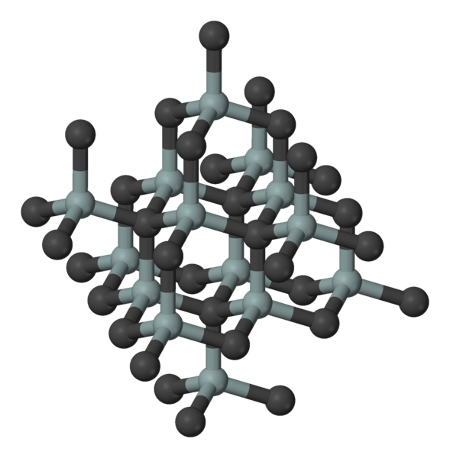

Illustrative Image (Source: Google Search)

By carefully analyzing these cost components and price influencers, and applying strategic negotiation and sourcing tactics, international B2B buyers can achieve more cost-effective procurement of carborundum structures while maintaining quality and compliance.

Understanding the critical technical properties and trade terminology associated with carborundum structure is essential for international B2B buyers aiming to optimize procurement decisions and supplier negotiations. This knowledge ensures clarity in specifications, quality expectations, and commercial terms, ultimately reducing risks and improving supply chain efficiency.

Material Grade

Carborundum is primarily composed of silicon carbide (SiC), with various grades indicating purity, grain size, and bonding agents. Higher grades offer superior hardness and thermal stability, crucial for applications requiring abrasion resistance or high-temperature endurance. For buyers in industries like manufacturing or construction, specifying the correct grade ensures product performance aligns with operational demands.

Dimensional Tolerance

This defines the allowable deviation from specified dimensions (length, width, thickness). Tight tolerances are critical in applications where precision fits are necessary, such as in mechanical seals or heat exchangers. Understanding tolerance levels helps buyers avoid costly rework or assembly issues downstream.

Illustrative Image (Source: Google Search)

Hardness (Mohs Scale)

Carborundum’s hardness typically ranges around 9 to 9.5 on the Mohs scale, indicating exceptional resistance to scratching and wear. For B2B buyers, hardness impacts the lifespan and maintenance costs of components, directly influencing total cost of ownership.

Thermal Conductivity

A key property for heat dissipation, high thermal conductivity in carborundum structures makes them suitable for electronic components and heat sinks. Buyers should assess this property to ensure thermal management needs are met, especially in high-temperature environments common in Middle Eastern or South American industries.

Chemical Stability and Corrosion Resistance

Carborundum’s inert nature means it resists chemical attack from acids and alkalis, making it ideal for harsh industrial environments. This property is vital for buyers sourcing materials for chemical processing plants or outdoor applications in humid or saline conditions.

Porosity and Density

These affect the mechanical strength and weight of the structure. Low porosity and high density generally indicate better durability and resistance to mechanical stress. Buyers evaluating structural components or abrasives should consider these parameters to match product specifications with application requirements.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or components used in another company’s final product. Understanding whether a supplier is OEM-certified can assure buyers of quality compliance and compatibility with existing systems.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. For international buyers, especially from emerging markets like Kenya or UAE, knowing the MOQ helps in planning inventory and cash flow, preventing overstocking or under-ordering.

RFQ (Request for Quotation)

A formal document sent to suppliers to obtain price quotations and terms for specific products. Crafting clear RFQs with detailed technical specs and delivery requirements helps buyers receive accurate and comparable offers, streamlining supplier selection.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers for delivery, risk, and cost. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Familiarity with Incoterms enables buyers to negotiate favorable shipping and payment conditions, reducing logistical uncertainties.

Lead Time

The period from order placement to delivery. Shorter lead times are often critical in fast-moving industries. Buyers should clarify lead times upfront to align procurement schedules with production needs.

Batch Certification

Documentation verifying that a specific batch of carborundum meets agreed technical and quality standards. For buyers requiring traceability and quality assurance, batch certification is a valuable tool to ensure product consistency.

For international B2B buyers, especially in Africa, South America, the Middle East, and Europe, mastering these technical and trade aspects of carborundum structure empowers smarter sourcing decisions. Clear specification of material properties combined with understanding trade terminology improves negotiation leverage, reduces supply chain risks, and ultimately drives better operational outcomes.

The global carborundum structure market is witnessing robust growth, driven primarily by its extensive applications across industrial sectors such as abrasives, refractories, semiconductors, and automotive components. For international B2B buyers, particularly those operating in Africa, South America, the Middle East, and Europe, understanding the key market drivers is essential. Rapid industrialization in emerging economies like Kenya and Brazil is increasing demand for durable and heat-resistant materials, positioning carborundum as a critical input. Additionally, the rise of electric vehicles and renewable energy technologies in Europe and the UAE is expanding opportunities for carborundum-based components, especially in battery manufacturing and power electronics.

From a sourcing perspective, buyers are increasingly prioritizing suppliers who can provide consistent quality and scalability. The market is seeing a shift toward digitalized procurement platforms, enabling real-time inventory tracking and transparent pricing, which is vital for buyers managing complex supply chains across continents. Suppliers from China and India remain dominant, but there is a growing interest in regional sourcing hubs within Africa and South America to reduce lead times and logistics costs.

Emerging B2B trends also include the integration of advanced material engineering in carborundum products, offering enhanced thermal stability and mechanical strength. This innovation is particularly relevant for high-performance industrial applications. For buyers in regions like the Middle East, where infrastructure projects are booming, partnering with suppliers who offer customized carborundum solutions can provide a competitive advantage.

Sustainability has become a pivotal consideration in the carborundum structure sector, driven by increasing regulatory pressures and corporate responsibility commitments globally. The production of carborundum involves energy-intensive processes, often associated with significant carbon emissions and environmental impact due to the mining of raw materials like silicon carbide. For international B2B buyers, especially in environmentally conscious markets such as Europe and parts of South America, selecting suppliers who demonstrate green manufacturing practices is critical.

Ethical sourcing is equally important, particularly for buyers in Africa and the Middle East, where supply chain transparency can be challenging. Establishing partnerships with suppliers who comply with international labor and environmental standards reduces risks related to supply disruptions and reputational damage. Certifications such as ISO 14001 (Environmental Management) and Responsible Minerals Assurance Process (RMAP) are increasingly used as benchmarks to verify sustainable and ethical sourcing in the carborundum supply chain.

Furthermore, the adoption of recycled materials and energy-efficient production technologies is gaining traction. Buyers can leverage these trends by requesting detailed sustainability reports and lifecycle assessments from suppliers, ensuring that their procurement aligns with broader ESG (Environmental, Social, and Governance) goals. This approach not only mitigates environmental risks but also enhances corporate value in global markets.

The use of carborundum, or silicon carbide, dates back to the late 19th century when it was first developed as a synthetic abrasive. Its unique combination of hardness, thermal conductivity, and chemical stability quickly made it indispensable for industrial applications. Over the decades, advancements in synthesis techniques and material engineering have expanded its utility from abrasive powders to sophisticated structural components in electronics and high-temperature environments.

For B2B buyers today, understanding this evolution highlights the sector's trajectory towards high-performance, technologically advanced materials. This historical context underscores why carborundum remains a cornerstone material for industries demanding durability and efficiency, reinforcing its strategic importance in global supply chains.

How can I effectively vet suppliers of carborundum structure materials in international markets?

Thorough supplier vetting is essential to mitigate risks in international B2B transactions. Start by verifying the supplier’s business license, export certifications, and references from previous clients, especially those within your region (Africa, Middle East, Europe, South America). Request detailed product specifications and samples for quality evaluation. Utilize third-party inspection services or audits to confirm manufacturing capabilities and compliance with international standards. Additionally, assess the supplier’s financial stability and responsiveness to communication to ensure long-term reliability.

Is customization of carborundum structures feasible, and how should I approach it with suppliers?

Customization is often possible to meet specific industrial requirements such as size, grain size, bonding material, or shape. Clearly communicate your technical specifications and intended application to the supplier upfront. Request technical drawings or prototypes before full-scale production. Discuss lead times and any additional costs associated with customization. Establish clear agreements on quality standards and testing procedures to avoid misunderstandings. Collaboration on R&D can also be explored for innovative or unique applications.

What are typical minimum order quantities (MOQ) and lead times for carborundum structure orders, especially for buyers in emerging markets?

MOQs vary widely depending on the supplier’s production scale and the complexity of the product. For standard carborundum structures, MOQs can range from a few hundred kilograms to several tons. Lead times typically span 4 to 12 weeks, factoring in production, quality checks, and shipping. Buyers in regions like Kenya or UAE should factor in additional time for customs clearance. Negotiate flexible MOQs or phased deliveries if your initial demand is uncertain or budget-constrained.

What payment terms are advisable for international B2B purchases of carborundum structures?

Common payment terms include letters of credit (LC), advance payments, or open account with credit insurance. Letters of credit provide security to both parties and are widely accepted in international trade. For new suppliers, consider partial advance payments combined with milestone-based payments after quality inspections. Always clarify currency terms and include provisions for currency fluctuations. Utilize escrow services or trade finance solutions to mitigate payment risks, especially when dealing across regions with different banking practices.

Which quality assurance certifications should I look for when sourcing carborundum structures?

Look for internationally recognized certifications such as ISO 9001 (Quality Management Systems) and product-specific standards like ASTM or equivalent national standards. Certifications related to environmental management (ISO 14001) or occupational health and safety (ISO 45001) may also indicate a supplier’s commitment to sustainable and safe production practices. Request third-party test reports for properties such as hardness, thermal stability, and chemical resistance to ensure compliance with your technical requirements.

Illustrative Image (Source: Google Search)

What logistics considerations are critical when importing carborundum structures into Africa, South America, or the Middle East?

Carborundum structures are typically heavy and abrasive, requiring secure packaging to prevent damage during transit. Choose suppliers experienced in international shipping with knowledge of incoterms (e.g., FOB, CIF). Plan for potential customs delays by working with reliable freight forwarders familiar with your destination countries’ import regulations. Consider multimodal transport options for cost efficiency and faster delivery. Ensure clear documentation (commercial invoice, packing list, certificates of origin) to avoid clearance issues.

How can I manage disputes or quality issues after receiving carborundum structure shipments?

Establish clear contracts with defined quality parameters, inspection procedures, and dispute resolution clauses before purchase. Upon receipt, perform immediate quality inspections or engage third-party inspectors. Document any discrepancies with photos and reports. Communicate issues promptly with the supplier, providing evidence and requesting corrective actions such as replacement or compensation. Utilize mediation or arbitration mechanisms specified in the contract to resolve conflicts amicably, avoiding lengthy litigation.

What are best practices for building long-term partnerships with carborundum structure suppliers in international markets?

Focus on transparent communication, timely payments, and mutual understanding of market demands. Regularly share forecasts and feedback to help suppliers optimize production and quality. Consider joint development projects or bulk purchase agreements to secure better pricing and priority service. Attend industry trade fairs or arrange site visits to strengthen relationships. Respect cultural differences and adapt negotiation styles accordingly, especially when dealing with suppliers from Africa, the Middle East, South America, or Europe.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The strategic sourcing of carborundum structures presents a compelling opportunity for international B2B buyers seeking durable, efficient, and innovative materials. Key takeaways emphasize the importance of evaluating supplier capabilities, ensuring compliance with regional standards, and leveraging technological advancements to optimize procurement. Buyers from Africa, South America, the Middle East, and Europe should prioritize partnerships that offer not only competitive pricing but also reliable supply chains and technical support tailored to their specific industrial needs.

Strategic sourcing is more than cost management; it’s about building resilient supply networks that can adapt to market fluctuations and evolving technological demands. For regions like Kenya and the UAE, where infrastructure development and industrial growth are accelerating, sourcing carborundum structures from reputable manufacturers with global reach and local responsiveness is critical. This approach minimizes risk and maximizes long-term value.

Looking ahead, international buyers are encouraged to deepen collaboration with suppliers who invest in sustainability, innovation, and quality assurance. Embracing digital sourcing platforms and data-driven decision-making will further enhance transparency and efficiency. By adopting a forward-thinking sourcing strategy, businesses can secure a competitive edge in their markets while contributing to sustainable industrial advancement worldwide.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina