Carborundum, also known as silicon carbide, stands as a cornerstone material in diverse industrial applications ranging from abrasives and cutting tools to semiconductors and high-performance ceramics. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding the multifaceted uses of carborundum is critical to sourcing the right materials that meet stringent quality and performance standards.

This guide delivers a comprehensive exploration of carborundum uses, addressing everything from the various types and grades of carborundum products to the materials and manufacturing processes that define their quality. Buyers will gain insight into essential quality control measures, enabling them to evaluate supplier reliability and product consistency effectively. Additionally, the guide provides a detailed overview of the global supplier landscape, highlighting key sourcing hubs and market trends relevant to regions like Argentina and the UK.

Beyond product knowledge, this resource offers strategic guidance on cost considerations, helping buyers balance price competitiveness with technical requirements. An extensive FAQ section anticipates common queries and challenges, empowering procurement professionals to make informed decisions confidently.

By leveraging this guide, international B2B buyers can streamline their sourcing processes, mitigate risks, and capitalize on market opportunities. Whether you are seeking to optimize supply chains or enhance product performance, this in-depth analysis equips you with actionable intelligence tailored to your regional market context and industry needs.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Silicon Carbide Abrasive | Extremely hard, sharp crystalline structure | Grinding wheels, sandpapers, cutting tools | Pros: High durability, efficient cutting; Cons: Higher cost, brittle under impact |

| Recrystallized Silicon Carbide | Larger grain size, improved toughness | Heavy-duty grinding, metal finishing | Pros: Better toughness, longer tool life; Cons: Less sharp than raw abrasive |

| Sintered Silicon Carbide | Uniform grain distribution, high density | Precision machining, semiconductor industry | Pros: High precision, consistent quality; Cons: More expensive manufacturing process |

| Black Carborundum | High thermal conductivity, electrical conductivity | Heat sinks, electronic substrates | Pros: Excellent heat dissipation; Cons: Limited mechanical strength |

| Green Carborundum | Higher purity, greater hardness | High-performance grinding, ceramic processing | Pros: Superior hardness and chemical resistance; Cons: Higher price point |

Silicon Carbide Abrasive

This raw form of carborundum is characterized by its exceptional hardness and sharp edges, making it ideal for aggressive material removal. It is widely used in manufacturing grinding wheels and cutting tools. B2B buyers should consider its cost-effectiveness against its brittleness, especially in industries requiring high wear resistance but careful handling to avoid breakage.

Recrystallized Silicon Carbide

Produced by fusing raw silicon carbide grains, this variant offers improved toughness and durability. It suits heavy-duty grinding and metal finishing where tool longevity is critical. Buyers from sectors like automotive or metal fabrication should evaluate its balance between sharpness and toughness, ensuring extended operational life reduces replacement frequency.

Sintered Silicon Carbide

Known for its uniform grain distribution and density, sintered carborundum is preferred for precision machining tasks, including semiconductor wafer processing. This type demands higher investment but guarantees consistent quality and precision, essential for high-tech industries in Europe and the Middle East focused on electronics manufacturing.

Black Carborundum

With high thermal and electrical conductivity, black carborundum is predominantly used in heat dissipation applications such as heat sinks and electronic substrates. B2B purchasers in electronics and power sectors should weigh its thermal management benefits against its comparatively lower mechanical strength.

Green Carborundum

This variation is prized for its purity and superior hardness, making it suitable for high-performance grinding and processing of hard ceramics. Buyers targeting advanced ceramics or aerospace components will benefit from its chemical resistance and durability, though they must factor in its premium pricing in procurement decisions.

Related Video: GERUNDS: 11 Different uses of the Gerund in English. EASY GUIDE to improve your GRAMMAR

| Industry/Sector | Specific Application of carborundum uses | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing & Metalworking | Abrasive grinding wheels and cutting tools | Enhances precision machining, reduces tool wear, and improves surface finish quality | Consistent grit size, durability, and compliance with international safety standards |

| Construction & Building Materials | Surface preparation and concrete cutting | Speeds up construction processes, ensures cleaner cuts, and extends tool life | Availability of different grit grades, compatibility with local machinery, and cost-effectiveness |

| Automotive & Aerospace | Precision polishing and deburring of metal parts | Improves component performance and longevity, reduces defects in high-tolerance parts | High purity carborundum with uniform particle distribution, supply chain reliability |

| Electronics & Semiconductor | Wafer slicing and polishing | Enables ultra-fine finishes critical for semiconductor performance | Ultra-fine grit specifications, contamination-free supply, and traceability of materials |

| Renewable Energy & Solar Panel Manufacturing | Surface texturing and cutting of photovoltaic materials | Enhances efficiency of solar cells by improving surface properties | Specialized grades for delicate materials, consistent quality, and adherence to environmental standards |

Carborundum is extensively used in manufacturing for producing abrasive grinding wheels and cutting tools. Its hardness and thermal conductivity allow businesses to achieve precise machining with minimal tool wear, leading to longer service life and better surface finishes. For B2B buyers in regions like South America and Europe, it is crucial to source carborundum with consistent grit size and durability to maintain production standards and comply with stringent safety regulations. Reliable supply chains ensure uninterrupted manufacturing processes.

In construction, carborundum is applied for surface preparation and concrete cutting, significantly accelerating workflows while delivering cleaner cuts and reducing tool replacement frequency. Buyers from Africa and the Middle East should prioritize suppliers offering a range of grit grades tailored to local machinery and construction demands. Cost-effectiveness combined with product reliability is essential for large-scale infrastructure projects common in these regions.

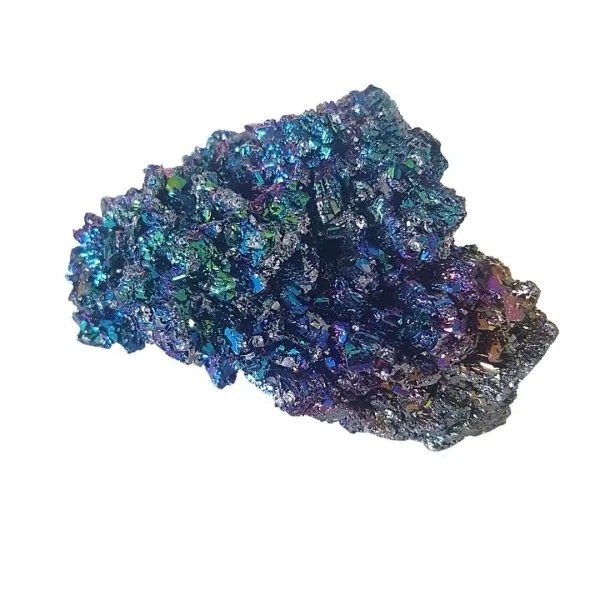

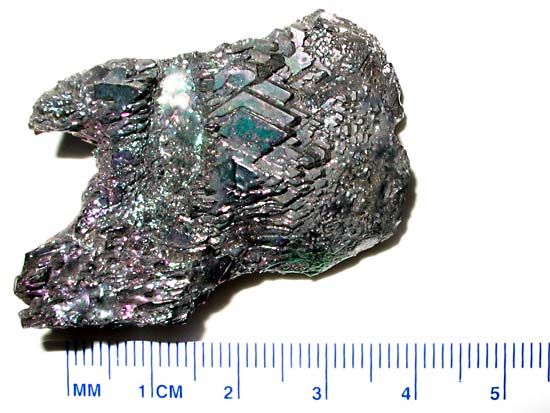

Illustrative Image (Source: Google Search)

The automotive and aerospace sectors rely on carborundum for precision polishing and deburring of metal components, which is critical for parts requiring tight tolerances and high durability. Businesses in the UK and Europe must ensure the carborundum used has high purity and uniform particle distribution to avoid defects and enhance component performance. A dependable supply chain with quality certifications supports high-value manufacturing and compliance with industry standards.

Carborundum plays a vital role in the electronics industry, especially in wafer slicing and polishing, where ultra-fine finishes are mandatory for optimal semiconductor function. International buyers should focus on ultra-fine grit specifications and contamination-free materials to prevent defects in sensitive electronic components. Traceability and adherence to quality standards are critical for maintaining product integrity in competitive markets.

In renewable energy, carborundum is used for surface texturing and cutting photovoltaic materials, improving solar cell efficiency by enhancing surface properties. Buyers from emerging solar markets in Africa and South America need specialized grades suitable for delicate materials and consistent quality to support scalable production. Additionally, sourcing from environmentally responsible suppliers aligns with the sustainability goals prevalent in the renewable energy sector.

Related Video: CNTs | Carbon Nanotubes | Structure, Properties & Applications of CNT

Key Properties: Silicon carbide ceramics exhibit exceptional hardness, high thermal conductivity, and excellent resistance to thermal shock. They maintain structural integrity at temperatures exceeding 1600°C and resist most chemical corrosion, making them ideal for abrasive and high-temperature applications.

Pros & Cons: The durability and wear resistance of silicon carbide make it a top choice for abrasive media and mechanical seals. However, manufacturing complexity is high due to the material’s brittleness and the precision required in sintering processes. Cost is moderate to high but justified by performance in demanding environments.

Impact on Application: Silicon carbide’s chemical inertness suits it well for use in corrosive media, including acids and alkalis, common in chemical processing industries. Its thermal stability ensures reliability in high-temperature environments like kiln linings or heat exchangers.

Considerations for International Buyers: Buyers in regions such as Europe and the Middle East should ensure compliance with ASTM C799 and DIN EN 60672 standards, which govern ceramic materials’ properties and testing. African and South American buyers, particularly in industrializing sectors, may prioritize suppliers who provide clear certification and technical support for integration into local manufacturing systems.

Key Properties: Alumina offers high hardness, excellent electrical insulation, and good corrosion resistance. It withstands temperatures up to approximately 1700°C and has moderate thermal conductivity, making it suitable for electrical and wear-resistant applications.

Pros & Cons: Alumina is widely available and relatively cost-effective compared to other advanced ceramics. Its manufacturing processes are well-established, allowing for scalable production. However, alumina is less resistant to thermal shock than silicon carbide and can be prone to cracking under rapid temperature changes.

Impact on Application: Alumina is commonly used in abrasive tools, electrical insulators, and protective coatings. It performs well in dry abrasive environments but may be less optimal in highly corrosive or fluctuating temperature conditions.

Considerations for International Buyers: Compliance with ISO 18757 and ASTM C799 standards is critical for ensuring product consistency. European buyers often require adherence to stringent RoHS and REACH regulations, while buyers in South America and Africa should verify supplier capabilities in meeting local import and quality standards to avoid supply chain disruptions.

Key Properties: Boron carbide is one of the hardest known materials after diamond and cubic boron nitride, with excellent abrasion resistance and low density. It maintains stability at temperatures up to 1500°C and offers good chemical resistance, especially against acids.

Pros & Cons: Its extreme hardness makes boron carbide ideal for ballistic armor and wear-resistant coatings. The downside includes very high material and processing costs and challenges in machining due to brittleness. Production volumes are typically lower, which can affect lead times and pricing.

Impact on Application: Boron carbide is preferred for high-wear environments requiring lightweight, durable materials, such as in aerospace and defense sectors. It is less commonly used in general abrasive applications due to cost constraints but excels where performance outweighs expense.

Considerations for International Buyers: Buyers in Europe and the Middle East should verify compliance with ASTM B892 and DIN standards for boron carbide powders and components. African and South American buyers might face supply chain challenges due to limited regional production, so establishing reliable logistics and inventory strategies is essential.

Key Properties: Silicon nitride boasts high fracture toughness, excellent thermal shock resistance, and good chemical inertness. It performs well at temperatures up to 1400°C and offers superior mechanical strength compared to many ceramics.

Pros & Cons: The material’s toughness and resistance to wear make it suitable for high-speed machining tools and bearings. However, silicon nitride is more expensive and requires advanced manufacturing techniques such as hot isostatic pressing, which can limit availability.

Impact on Application: Silicon nitride is ideal for dynamic applications where mechanical stress and thermal cycling occur, such as in engine components and precision bearings. It is less suitable for highly corrosive environments compared to silicon carbide.

Considerations for International Buyers: Compliance with JIS R 1601 and ASTM C1499 standards is important, especially for buyers in Japan, Europe, and the Middle East. Buyers in Africa and South America should focus on suppliers offering technical training and after-sales support to maximize material performance in local industrial contexts.

| Material | Typical Use Case for carborundum uses | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | Abrasive tools, high-temp kiln linings | Exceptional hardness and thermal stability | Brittle, complex manufacturing | High |

| Aluminum Oxide | Electrical insulators, abrasive media | Cost-effective, scalable production | Lower thermal shock resistance | Medium |

| Boron Carbide | Ballistic armor, wear-resistant coatings | Extreme hardness and low density | Very high cost, machining difficulty | High |

| Silicon Nitride | High-speed tools, engine components | High fracture toughness and thermal shock resistance | Expensive, limited availability | High |

Carborundum, or silicon carbide (SiC), is a versatile abrasive and refractory material widely used in industries such as automotive, electronics, metallurgy, and construction. Understanding its manufacturing process is crucial for B2B buyers aiming to procure high-quality carborundum products tailored to their specific industrial applications.

The manufacturing process begins with the selection and preparation of raw materials. Key inputs include high-purity silica sand and petroleum coke. These materials are carefully measured and blended to achieve the desired chemical composition and properties. The precise ratio impacts the grain size, hardness, and thermal stability of the final product.

The blended raw materials undergo carbothermal reduction in electric resistance furnaces at temperatures ranging from 2000°C to 2500°C. This high-temperature process converts silica and coke into silicon carbide crystals.

Sintering densifies the formed carborundum shapes, enhancing mechanical strength and thermal resistance. Controlled heat treatment cycles are applied to optimize crystalline structure and eliminate internal stresses. This stage is vital for applications requiring durability under extreme conditions, such as furnace linings or high-performance abrasives.

Illustrative Image (Source: Google Search)

Finishing processes include grinding, lapping, or surface polishing to achieve precise dimensions and surface quality. In some cases, coatings may be applied to improve oxidation resistance or bonding characteristics, especially for carborundum used in composite materials or electronic substrates.

For international B2B buyers, especially from Africa, South America, the Middle East, and Europe, ensuring supplier adherence to rigorous quality standards is paramount. Quality assurance (QA) not only guarantees product performance but also reduces risks related to import regulations and operational failures.

A comprehensive QC regime for carborundum production involves multiple checkpoints to detect defects early and maintain product consistency.

B2B buyers must actively engage in quality verification to mitigate risks related to substandard products and supply chain disruptions.

International buyers should be aware of regional considerations that impact QC and certification acceptance:

By thoroughly understanding carborundum manufacturing and quality assurance processes, international B2B buyers can make informed sourcing decisions that optimize supply chain reliability and product performance.

Understanding the cost and pricing dynamics of sourcing carborundum for industrial applications is critical for international B2B buyers, especially those operating across diverse regions such as Africa, South America, the Middle East, and Europe. This section breaks down the essential cost components, key price influencers, and strategic buyer considerations to optimize procurement outcomes.

Raw Materials

The primary cost driver is the raw materials used in carborundum production, typically silicon carbide and carbon sources. Fluctuations in global commodity prices, availability of high-purity inputs, and sourcing region impact this component significantly.

Labor Costs

Labor expenses vary depending on the manufacturing country’s wage standards and automation levels. Facilities in regions with lower labor costs may offer competitive pricing but must be balanced with quality considerations.

Manufacturing Overhead

Overhead includes utilities, equipment depreciation, maintenance, and plant management. Highly automated plants may reduce overhead per unit but require higher upfront capital investment.

Tooling and Equipment

Specialized tooling for shaping, grinding, or sintering carborundum adds to cost, especially for customized or precision applications. Tool wear and replacement frequency also influence ongoing expenses.

Quality Control (QC)

Stringent QC processes ensure product consistency and compliance with international standards. Certifications such as ISO or specific industry approvals (e.g., automotive or aerospace) can increase costs but also add value.

Logistics and Transportation

Shipping costs vary by destination, mode (sea, air, land), and Incoterms chosen. For buyers in remote or landlocked regions, logistics can form a substantial part of total costs.

Supplier Margin

The supplier’s profit margin reflects market competition, brand reputation, and service levels. Negotiation can influence this but is often constrained by market dynamics.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically unlock volume discounts, reducing per-unit costs. Buyers should assess their consumption patterns to leverage economies of scale.

Product Specifications and Customization

Higher grades, tailored grain sizes, or composite formulations drive up prices. Customization requires additional tooling and QC, impacting lead times and cost.

Material Quality and Certification

Products certified for specialized industrial uses (e.g., high-purity grades for electronics) command premium prices. Verification of certificates and third-party testing is essential.

Supplier Location and Reliability

Proximity affects shipping costs and lead times. Established suppliers with proven track records may charge a premium but reduce risk.

Incoterms and Payment Terms

Terms such as FOB, CIF, or DDP shift cost and risk responsibilities. Understanding these is critical to avoid hidden costs and manage cash flow efficiently.

Negotiate Beyond Price

Engage suppliers on payment terms, delivery schedules, and after-sales support. Flexibility in these areas can provide significant indirect cost savings.

Evaluate Total Cost of Ownership (TCO)

Consider not only purchase price but also logistics, customs duties, inventory holding, and potential quality-related rework costs. TCO analysis helps identify truly cost-effective sourcing options.

Leverage Local and Regional Trade Agreements

Buyers in Africa, South America, the Middle East, and Europe should explore preferential trade agreements to reduce tariffs and expedite customs clearance.

Plan for Currency Fluctuations

Currency volatility can affect final costs. Locking in prices with forward contracts or choosing suppliers who invoice in stable currencies (e.g., USD, EUR) can mitigate risk.

Assess Supplier Certifications and Quality Assurance

Prioritize suppliers with recognized certifications to reduce risks of substandard products, which can cause costly downtime or compliance issues.

Understand Pricing Nuances by Region

For example, buyers in Argentina may face higher import duties and logistical challenges compared to UK buyers, who benefit from established supply chains and trade frameworks.

Prices for carborundum products can vary widely based on the factors discussed and market conditions. The figures presented in this guide are indicative and meant to provide a framework for cost analysis rather than definitive quotes. Buyers should request detailed proposals and quotations from multiple suppliers to ensure competitive and transparent pricing.

By thoroughly analyzing these cost components and price influencers, international B2B buyers can make informed sourcing decisions, negotiate effectively, and optimize their procurement strategies for carborundum-based products across diverse global markets.

Understanding the critical technical properties and common trade terminology associated with carborundum is essential for making informed purchasing decisions in international B2B markets. This knowledge enables buyers across Africa, South America, the Middle East, and Europe to effectively evaluate suppliers, negotiate contracts, and ensure product suitability for their specific industrial applications.

Material Grade

Carborundum is available in various grades defined by purity and grain size. High-grade carborundum typically contains a higher percentage of silicon carbide with minimal impurities, ensuring superior hardness and thermal conductivity. For buyers, selecting the correct grade affects product performance, especially in abrasive and refractory applications.

Grain Size (Mesh Size)

Grain size determines the particle size distribution of carborundum. Finer grains provide smoother finishes for polishing, while coarser grains are suited for heavy-duty grinding. Understanding mesh size helps buyers specify the right abrasive characteristics to match their production requirements.

Hardness (Mohs Scale)

Carborundum scores about 9-9.5 on the Mohs hardness scale, making it one of the hardest materials available. This property is crucial for applications needing durable abrasives and wear-resistant components. Buyers should verify hardness specifications to ensure longevity and efficiency in end-use.

Tolerance and Purity Levels

Tolerance refers to the acceptable variance in particle size and chemical composition. High purity (above 98%) carborundum ensures consistent performance with minimal contamination risks. Accurate tolerance specifications help in maintaining product quality and compatibility with OEM equipment.

Thermal Stability

The ability of carborundum to maintain structural integrity at high temperatures is vital for refractory uses. Buyers involved in high-heat industrial processes should prioritize thermal stability to avoid material degradation and maintain operational safety.

Bulk Density

Bulk density affects packaging, shipping costs, and the efficiency of handling systems. Buyers must consider this when negotiating freight terms and planning storage or automated dispensing systems.

Illustrative Image (Source: Google Search)

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier is willing to sell. International buyers, especially SMEs in emerging markets, need to negotiate MOQs that balance cost efficiency with inventory management, avoiding overstocking or excessive capital tie-up.

RFQ (Request for Quotation)

An RFQ is a formal invitation to suppliers to provide pricing and terms for specific quantities and specifications. Crafting clear RFQs with detailed technical requirements ensures accurate, comparable bids and streamlines supplier evaluation.

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Familiarity with terms like FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid) allows buyers to optimize logistics costs and reduce supply chain risks.

Lead Time

Lead time is the duration from order placement to delivery. Understanding typical lead times for carborundum products helps buyers plan production schedules and manage customer expectations effectively.

Certificate of Analysis (CoA)

A CoA is a document provided by suppliers detailing the chemical and physical properties of a batch of carborundum. It assures buyers of product compliance with agreed specifications, critical for quality control and regulatory adherence.

By mastering these technical properties and trade terms, B2B buyers can enhance their procurement strategies, ensure product quality, and build stronger supplier partnerships in the competitive global carborundum market.

The carborundum sector, primarily known for its abrasive and refractory applications, is experiencing dynamic shifts driven by evolving industrial demands and technological advancements. Globally, demand is fueled by the growth in automotive manufacturing, electronics, and construction industries—sectors that heavily utilize carborundum for cutting, grinding, polishing, and heat-resistant components. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe, understanding these drivers is crucial for strategic sourcing.

Key market drivers include:

For European buyers, such as those in the UK, the emphasis is on integrating high-quality, certified products that comply with stringent industrial standards. Meanwhile, Middle Eastern businesses are leveraging carborundum in expanding infrastructure projects, demanding bulk yet customized solutions.

Sustainability is becoming a decisive factor in carborundum procurement. The production of carborundum involves energy-intensive processes and the use of raw materials like silicon carbide, which can have significant environmental footprints if not responsibly sourced.

Environmental and ethical considerations include:

For B2B buyers across Africa, South America, and the Middle East, partnering with suppliers who prioritize sustainability not only mitigates risks related to regulatory compliance and reputational damage but also meets the growing demand from end consumers for environmentally responsible products.

Carborundum, or silicon carbide, was first synthesized in the late 19th century as a revolutionary abrasive material, offering superior hardness and thermal resistance compared to traditional abrasives. Initially used in grinding and cutting applications, its role has expanded with industrial innovation.

Over the decades, the development of synthetic production methods, such as the Acheson process, enabled large-scale manufacturing, driving down costs and broadening its industrial use. The transition from purely abrasive applications to roles in semiconductors, LED lighting, and high-temperature components marks a significant evolution.

For B2B buyers, understanding this history underscores the maturity and reliability of carborundum as a material, while highlighting ongoing innovation that can provide competitive advantages in diverse industries. This context aids in evaluating supplier expertise and product suitability for specific applications.

1. How can I effectively vet suppliers of carborundum products for international B2B transactions?

To vet suppliers, start by verifying their business licenses, certifications (ISO, REACH), and export history. Request detailed product specifications and samples to assess quality. Use third-party inspection services to validate manufacturing capabilities and compliance with international standards. Check references and customer reviews, particularly from buyers in your region (Africa, South America, Middle East, Europe). Ensure the supplier has experience handling international logistics and understands customs regulations relevant to your country to avoid shipment delays.

2. Is customization of carborundum products available, and how should I approach this with suppliers?

Many suppliers offer customization in grain size, bonding agents, shapes, and packaging to meet specific industrial needs. Clearly communicate your technical requirements and intended applications upfront. Request technical datasheets and prototypes for approval before bulk ordering. Negotiate minimum order quantities (MOQs) for customized batches, as they are often higher than standard products. Establish a clear agreement on lead times and potential additional costs for custom specifications to ensure alignment and avoid misunderstandings.

3. What are the typical minimum order quantities (MOQs), lead times, and payment terms I should expect?

MOQs vary widely depending on the supplier and product type, ranging from small sample lots to several tons for bulk orders. Lead times usually span 3-8 weeks, influenced by customization, production schedules, and shipping routes. Payment terms often include 30% upfront deposit with balance upon shipment or letter of credit (L/C) for larger orders. Negotiate terms that balance your cash flow needs and supplier trust. For first-time orders, consider escrow services or trade assurance platforms to mitigate risks.

4. Which quality assurance certifications should I require to ensure product reliability and compliance?

Request certifications like ISO 9001 (quality management), ISO 14001 (environmental management), and product-specific standards such as REACH for chemical safety compliance. Suppliers should provide detailed test reports confirming abrasive properties, purity, and particle size distribution. Certifications from recognized third-party labs add credibility. For EU buyers, compliance with CE marking and RoHS directives may be necessary. Always verify the authenticity of certificates and audit reports to prevent counterfeit documentation.

5. How can I optimize logistics and shipping for international procurement of carborundum?

Work with suppliers who have established freight forwarding partnerships and experience with your target ports. Choose incoterms (e.g., FOB, CIF) that align with your logistics capabilities and risk tolerance. Consolidate shipments when possible to reduce costs and customs clearance complexity. Plan for customs duties, import taxes, and documentation requirements specific to your country. Consider warehousing options near major transport hubs for efficient distribution. Early communication with freight forwarders and customs brokers helps avoid delays.

6. What are common dispute scenarios in carborundum B2B trades, and how can I proactively manage them?

Disputes often arise from quality discrepancies, delayed deliveries, or miscommunication on product specifications. To manage risks, document all agreements in detailed contracts covering specifications, delivery schedules, payment terms, and penalties. Use inspection certificates and third-party quality checks as part of acceptance criteria. Maintain open communication channels and escalate issues promptly. Consider arbitration clauses or choosing jurisdictions favorable for dispute resolution in your contracts, especially when trading across continents.

7. How do geopolitical factors affect sourcing carborundum from regions like Africa, South America, or the Middle East?

Political instability, trade sanctions, and fluctuating tariffs can impact supply reliability and costs. Stay informed on regional trade agreements (e.g., Mercosur for South America, AfCFTA for Africa) that may offer tariff benefits or streamlined customs. Diversify your supplier base across multiple countries to mitigate risks. Engage local trade experts or chambers of commerce to navigate regulatory changes. Flexibility in sourcing and proactive risk assessment are essential for maintaining supply chain resilience.

8. What payment methods are safest and most efficient for international carborundum purchases?

Common secure payment options include letters of credit (L/C), escrow services, and verified bank transfers. Letters of credit provide assurance by involving banks to guarantee payment upon meeting shipment terms. Escrow platforms offer neutral holding of funds until contract conditions are fulfilled, ideal for new supplier relationships. Avoid full upfront payments unless you have established trust. Digital payment platforms with buyer protection can be useful but verify their acceptance in your supplier’s country. Always confirm bank details independently to prevent fraud.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Carborundum’s versatility and robustness position it as a critical material across multiple industrial sectors, from abrasives and refractories to electronics and automotive components. For B2B buyers in Africa, South America, the Middle East, and Europe, recognizing the diverse applications of carborundum enables strategic alignment with industry demands and innovation trends.

Key takeaways for sourcing carborundum include:

- Prioritizing suppliers with proven quality certifications and consistent delivery performance to mitigate supply chain risks.

- Leveraging regional trade agreements and logistics hubs to optimize cost-efficiency and lead times, especially relevant for markets like Argentina and the UK.

- Evaluating emerging suppliers in growing industrial regions to diversify sourcing portfolios and capitalize on competitive pricing.

- Emphasizing sustainable sourcing practices, as environmental regulations tighten globally and buyers increasingly seek eco-conscious partners.

The value of strategic sourcing lies in balancing cost, quality, and reliability while anticipating market shifts driven by technological advancements and regulatory changes. By adopting a proactive sourcing approach, international buyers can strengthen their supply chains and maintain competitive advantages.

Looking ahead, the rising demand for high-performance materials in sectors such as renewable energy and advanced manufacturing will likely expand carborundum’s market footprint. Buyers are encouraged to deepen supplier relationships, invest in market intelligence, and explore innovative applications to fully harness carborundum’s potential in their operations.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina