Carbure de bore stands as a critical component across various industrial sectors, including manufacturing, metallurgy, and chemical processing. Its unique properties—such as high hardness, thermal stability, and chemical resistance—make it indispensable for applications requiring durability and performance under extreme conditions. For B2B buyers operating in diverse markets like Africa, South America, the Middle East, and Europe, understanding the intricacies of sourcing high-quality carbure de bore is essential to maintaining competitive advantage and operational efficiency.

This comprehensive guide is designed to empower international buyers with a deep understanding of carbure de bore, covering its different types and material grades to help identify the best fit for specific industrial needs. It delves into manufacturing processes and quality control standards that ensure product reliability, helping buyers mitigate risks associated with substandard materials. Additionally, the guide evaluates key global suppliers and pricing trends, offering actionable insights into cost-effective procurement strategies tailored to regional market dynamics.

By addressing frequently asked questions and common challenges faced in the global sourcing landscape, this resource provides clarity and confidence to decision-makers from countries such as Mexico and Poland, who navigate complex supply chains and regulatory environments. Ultimately, this guide equips you with the knowledge needed to make informed, strategic purchasing decisions—maximizing value while minimizing risk in the fast-evolving global market for carbure de bore.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Crystalline Carbure de Bore | High purity, well-defined crystal structure | Electronics, aerospace, precision engineering | Pros: Superior consistency and purity; Cons: Higher cost and limited bulk availability |

| Amorphous Carbure de Bore | Non-crystalline, more reactive surface | Chemical catalysis, advanced composites | Pros: Enhanced reactivity, versatile; Cons: Less stable, shorter shelf life |

| Doped Carbure de Bore | Modified with additives to alter electrical/thermal properties | Semiconductors, high-performance coatings | Pros: Tailored properties for specific needs; Cons: Complex sourcing and quality variability |

| Nano-structured Carbure de Bore | Ultra-fine particles with high surface area | Nanotechnology, medical devices, energy storage | Pros: Exceptional performance in niche applications; Cons: Higher production cost, requires specialized handling |

| Composite Carbure de Bore | Integrated with other materials for improved durability | Industrial machinery, wear-resistant components | Pros: Enhanced mechanical strength; Cons: Potential compatibility issues, higher price point |

Crystalline Carbure de Bore is characterized by its high purity and uniform crystal lattice, making it ideal for industries requiring precise material properties, such as aerospace and electronics. Buyers should prioritize suppliers with stringent quality controls to ensure batch consistency. Though more expensive, the reliability in performance often justifies the investment for critical applications.

Amorphous Carbure de Bore lacks long-range order, resulting in a more chemically reactive surface. This variation suits chemical catalysis and composite manufacturing where enhanced interaction is beneficial. B2B buyers should consider storage conditions carefully, as amorphous forms may degrade faster, impacting shelf life and performance.

Doped Carbure de Bore is engineered by introducing specific elements to modify its electrical or thermal characteristics, making it invaluable in semiconductor fabrication and specialized coatings. Procurement requires a thorough evaluation of doping levels and uniformity, as variability can affect end-product quality. Buyers must work closely with manufacturers to specify and verify doping parameters.

Nano-structured Carbure de Bore involves particles at the nanometer scale, offering a large surface area and unique physical properties. This type is increasingly important in cutting-edge fields like nanotechnology and medical devices. However, its higher production cost and handling complexity mean buyers should assess their capability for safe storage and use, as well as cost-benefit alignment.

Composite Carbure de Bore combines carbure de bore with other materials to enhance mechanical strength and wear resistance, fitting for heavy industrial applications. Buyers should evaluate the compatibility of composite materials with their existing systems and consider potential trade-offs in cost and material behavior under operational stresses. Reliable supplier partnerships are essential to ensure consistent composite quality.

Related Video: The Genius Behind Bach's Goldberg Variations: CANONS

| Industry/Sector | Specific Application of carbure de bore | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Defense | High-performance composite materials for aircraft parts | Enhances strength-to-weight ratio, durability, and heat resistance, reducing maintenance costs and improving safety | Ensure consistent purity and particle size; reliable supply chain for just-in-time manufacturing; compliance with international aerospace standards |

| Electronics & Semiconductors | Boron carbide as a neutron absorber in nuclear reactors and semiconductor doping | Improves neutron shielding and semiconductor performance, leading to safer nuclear operations and advanced electronic components | Verify material certification for nuclear-grade quality; traceability and documentation; consider import regulations and tariffs in target regions |

| Abrasives & Cutting Tools | Manufacture of grinding wheels, sandpaper, and cutting tools | Provides exceptional hardness and wear resistance, extending tool life and reducing downtime | Confirm particle size distribution and hardness; supplier capacity for bulk orders; packaging that preserves material integrity during shipment |

| Automotive | Brake pads and clutches incorporating boron carbide additives | Enhances thermal stability and friction performance, improving safety and durability in vehicles | Focus on material consistency and compatibility with automotive standards; supply reliability to match production schedules; cost competitiveness |

| Chemical Industry | Catalyst support and chemical inertness in harsh environments | Offers chemical resistance and thermal stability, increasing catalyst lifespan and process efficiency | Ensure chemical purity and stability; supplier expertise in handling hazardous materials; compliance with environmental regulations |

Aerospace & Defense

In aerospace manufacturing, carbure de bore is integral to producing composite materials that require high strength combined with low weight. Its exceptional hardness and thermal resistance help create aircraft components that withstand extreme conditions, reducing maintenance frequency and enhancing safety. For international buyers in regions like Africa or Europe, it’s crucial to source materials that meet stringent aerospace certifications and come from suppliers capable of reliable, timely delivery to align with complex manufacturing schedules.

Electronics & Semiconductors

Carbure de bore plays a critical role as a neutron absorber in nuclear reactors and as a doping agent in semiconductor fabrication. Its neutron-absorbing properties improve reactor safety, while its doping capabilities enhance semiconductor performance. Buyers from South America or the Middle East must prioritize suppliers who can provide nuclear-grade certification and full traceability, ensuring compliance with local regulations and global safety standards, particularly for sensitive nuclear applications.

Abrasives & Cutting Tools

The abrasives industry relies on carbure de bore for manufacturing grinding wheels, sandpapers, and cutting tools due to its extreme hardness and durability. This extends tool life and reduces operational downtime in industrial machining processes. B2B buyers, especially in industrial hubs like Poland or Mexico, should focus on suppliers offering consistent particle size and hardness, with robust packaging to prevent contamination or degradation during international transport.

Automotive

In automotive applications, carbure de bore is used as an additive in brake pads and clutches to improve thermal stability and friction performance. This leads to safer braking systems and longer-lasting components. For automotive manufacturers and suppliers in emerging markets across Africa and South America, sourcing consistent quality material that aligns with automotive industry standards and ensuring supply chain reliability are vital to maintaining production efficiency.

Chemical Industry

Within chemical processing, carbure de bore serves as a catalyst support material due to its chemical inertness and thermal stability, enhancing catalyst lifespan and overall process efficiency. International buyers must verify the chemical purity and stability of supplied materials and work with vendors experienced in handling hazardous substances. Compliance with environmental and safety regulations in regions like the Middle East and Europe is also a key consideration to avoid operational disruptions.

Related Video: Where does all our sawdust go? 5 uses for sawdust that you haven't thought of

When selecting materials for carbure de bore (boron carbide) components, international B2B buyers must carefully evaluate the properties and trade-offs of common material options to optimize performance, cost, and regulatory compliance. This section examines four prevalent materials used in carbure de bore applications, focusing on their key properties, advantages, limitations, and regional considerations relevant to buyers from Africa, South America, the Middle East, and Europe.

Key Properties:

Pure boron carbide ceramics exhibit exceptional hardness (third hardest after diamond and cubic boron nitride), high melting point (~2763°C), excellent chemical inertness, and good neutron absorption capabilities. They maintain structural integrity under high temperature and pressure, making them ideal for wear-resistant and nuclear applications.

Pros & Cons:

- Pros: Outstanding abrasion resistance, lightweight, excellent corrosion resistance, and thermal stability.

- Cons: High manufacturing complexity due to brittleness and difficulty in sintering; relatively high cost compared to alternative ceramics.

Impact on Application:

Ideal for ballistic armor, abrasives, and neutron shielding where durability and chemical stability are paramount. Not suitable for applications requiring high tensile strength or impact toughness due to brittleness.

International Buyer Considerations:

Buyers in Europe and the Middle East often demand compliance with ASTM C799 (standard test methods for boron carbide) and ISO 9001 quality management certification. African and South American markets may prioritize cost-effective sourcing, balancing material purity with price. Import regulations and customs duties on advanced ceramics should be reviewed, especially for bulk shipments to Mexico and Poland.

Key Properties:

Composite materials combine boron carbide particles with metal (e.g., aluminum, titanium) or polymer matrices to enhance toughness and reduce brittleness. These composites maintain good hardness and corrosion resistance while improving impact resistance and machinability.

Pros & Cons:

- Pros: Improved toughness and flexibility, easier to machine, and customizable mechanical properties.

- Cons: Reduced hardness compared to pure boron carbide, potential chemical reactivity depending on matrix material, and moderate manufacturing complexity.

Impact on Application:

Suitable for applications requiring a balance between hardness and toughness such as wear plates, cutting tools, and protective coatings. The composite nature allows better shock absorption, extending component life in dynamic environments.

International Buyer Considerations:

Compliance with DIN EN standards (common in Europe) for composite materials is often required. Buyers from South America and Africa should verify the availability of local testing facilities for composite quality assurance. Middle Eastern buyers may focus on corrosion resistance in harsh environments, favoring composites with polymer matrices that resist chemical degradation.

Key Properties:

This approach involves applying a thin boron carbide layer onto metal substrates (steel, titanium) via physical vapor deposition (PVD) or chemical vapor deposition (CVD). The coating imparts surface hardness and chemical resistance while retaining the ductility and toughness of the metal core.

Pros & Cons:

- Pros: Combines hardness with structural toughness, cost-effective compared to bulk ceramics, and versatile for complex shapes.

- Cons: Coating thickness limitations, potential delamination under extreme stress, and requires specialized deposition equipment.

Impact on Application:

Ideal for cutting tools, wear-resistant machine parts, and components exposed to abrasive media where surface protection is critical but bulk brittleness is undesirable.

International Buyer Considerations:

Buyers in Europe and Mexico must ensure coatings meet ASTM B487 standards for coating adhesion and thickness. African and Middle Eastern markets may require coatings resistant to sand abrasion and chemical exposure, influencing coating process selection.

Key Properties:

Nanostructured boron carbide powders offer enhanced sinterability and potentially superior mechanical properties due to grain size refinement. They enable the production of finer, more uniform ceramics with improved toughness and wear resistance.

Pros & Cons:

- Pros: Enhanced mechanical properties, lower sintering temperatures, and potential for innovative composite formulations.

- Cons: Higher production costs, complex handling due to powder reactivity, and limited large-scale availability.

Impact on Application:

Best suited for high-performance, precision applications such as aerospace components, advanced armor systems, and specialized abrasives where material performance justifies cost.

International Buyer Considerations:

European and Middle Eastern buyers often require compliance with REACH regulations and detailed material safety data sheets (MSDS). South American and African buyers should assess supplier reliability and logistics for nanomaterials, considering import restrictions and transportation safety.

| Material | Typical Use Case for carbure de bore | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Pure Boron Carbide Ceramics | Ballistic armor, abrasives, neutron shielding | Exceptional hardness and chemical inertness | Brittleness and high manufacturing complexity | High |

| Boron Carbide Composite Materials | Wear plates, cutting tools, protective coatings | Improved toughness and machinability | Reduced hardness compared to pure B4C | Medium |

| Boron Carbide-Coated Metals | Cutting tools, wear-resistant machine parts | Combines hardness with metal toughness | Coating thickness limits and delamination risk | Medium |

| Boron Carbide Nanostructured Powders | Aerospace components, advanced armor, precision abrasives | Enhanced mechanical properties and sinterability | High cost and complex handling | High |

This guide equips international B2B buyers with critical insights to select the most suitable carbure de bore material based on application requirements, cost constraints, and regional compliance standards. Careful consideration of these factors will ensure optimized product performance and supply chain efficiency.

The production of carbure de bore (boron carbide) involves several critical manufacturing stages designed to ensure high purity, precise particle size, and consistent quality. Understanding these stages helps B2B buyers evaluate supplier capabilities and product suitability for industrial applications.

The process begins with sourcing high-purity raw materials, typically boron oxide (B2O3) and carbon (graphite or activated carbon). These are carefully weighed and blended to achieve the desired stoichiometric ratio. Material purity directly impacts the performance characteristics of the final carbure de bore product, making supplier raw material sourcing transparency vital for buyers.

The mixed powders undergo high-temperature synthesis, usually in an electric or induction furnace, at temperatures between 1800°C and 2200°C. This step, often referred to as carbothermic reduction, converts the boron oxide and carbon into boron carbide. The resulting product is typically in the form of large lumps or chunks.

Post-synthesis, the boron carbide lumps are crushed and milled to achieve the required particle size distribution. Milling methods include ball milling, jet milling, or attrition milling, depending on the target particle size and application requirements. Uniform particle size ensures consistent performance, especially in abrasive or refractory uses.

The milled powder is classified by size using sieves or air classifiers to separate out-of-spec particles. This step is essential to meet strict size distribution specifications demanded by end-users, especially in advanced ceramics and armor applications.

Final assembly involves blending batches if needed to maintain uniformity, followed by packaging in moisture-proof, anti-contamination containers. Packaging must comply with international shipping standards to preserve product integrity during transport, an important consideration for buyers in Africa, South America, the Middle East, and Europe facing varied climatic conditions.

Robust QA/QC processes are indispensable to guarantee the performance and reliability of carbure de bore products. International B2B buyers should prioritize suppliers with well-documented and transparent QC systems aligned with global standards.

Given the technical complexity and critical application of carbure de bore, buyers should employ a multi-pronged approach to QC verification.

Conducting on-site or virtual audits allows buyers to assess the entire manufacturing process, QC laboratories, and documentation practices. Key audit focus areas include raw material traceability, equipment calibration, and adherence to documented procedures.

Request detailed QC reports including certificates of analysis (CoA), batch traceability, and testing data. Buyers should verify that these documents align with international standards and their own specifications.

Engaging independent inspection agencies to perform random sampling and lab testing provides an unbiased assessment of product quality. This is especially critical for first-time purchases or large-volume contracts.

International B2B buyers from Africa, South America, the Middle East, and Europe face unique challenges and considerations when sourcing carbure de bore:

By thoroughly understanding the manufacturing and quality assurance landscape of carbure de bore, international B2B buyers can secure high-performance products that meet stringent industrial demands and regulatory requirements.

Understanding the cost and pricing dynamics of carbure de bore is crucial for international B2B buyers aiming to optimize procurement strategies. This analysis breaks down key cost components, pricing influencers, and actionable buyer tips tailored for markets in Africa, South America, the Middle East, and Europe.

Raw Materials

The primary cost driver is the quality and source of raw boron carbide powders and additives. Variations in purity and particle size directly affect the material costs. Suppliers using higher-grade raw materials typically command premium pricing but offer better performance and longevity.

Labor and Manufacturing Overhead

Labor costs vary significantly by region, impacting the overall manufacturing expense. Advanced manufacturing facilities with automation may reduce labor input but increase overhead costs related to machinery maintenance and energy consumption. Overhead also includes utilities, factory rent, and administrative expenses.

Tooling and Equipment Depreciation

The production of carbure de bore requires specialized tooling and machinery, which represent a fixed cost amortized over production volume. Frequent tooling updates for customization or tighter tolerances can raise per-unit costs.

Quality Control and Certification

Rigorous QC processes, including particle size analysis, hardness testing, and certification (e.g., ISO, REACH compliance), are essential for ensuring product consistency. These activities add to cost but are critical for buyers requiring high reliability and traceability.

Logistics and Freight

Transport costs depend on the shipment size, mode (air, sea, road), and destination port or warehouse. For buyers in Africa, South America, and the Middle East, longer transit times and customs complexities may increase logistics expenses.

Supplier Margin

Suppliers factor in profit margins based on market demand, competition, and contractual terms. Volume commitments and long-term relationships can influence margin flexibility.

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically reduce the per-unit cost due to economies of scale. However, buyers from emerging markets should balance MOQ against inventory carrying costs.

Specifications and Customization

Tailored particle sizes, shapes, or composite blends will increase costs. Custom packaging or additional certifications requested by buyers also add premiums.

Material Quality and Certifications

Products certified to international standards or with enhanced purity attract higher prices but reduce downstream risks and improve product performance.

Supplier Location and Reputation

Suppliers in regions with advanced manufacturing capabilities may charge higher prices but offer better reliability and after-sales support. Conversely, emerging market suppliers might offer competitive pricing but require thorough due diligence.

Incoterms and Payment Terms

Pricing varies significantly based on Incoterms (e.g., FOB, CIF, DDP), which determine who bears shipping and customs costs. Favorable payment terms can improve cash flow and reduce financing costs.

Negotiate Based on Total Cost of Ownership (TCO)

Look beyond unit price; factor in shipping, customs duties, storage, and quality-related rework costs. A supplier offering a slightly higher price but reliable delivery and certification can yield better value.

Leverage Volume and Long-Term Contracts

Use forecasted demand to negotiate volume discounts or flexible MOQs. Long-term contracts may secure better pricing and priority production slots.

Understand Regional Pricing Nuances

Buyers in Africa and South America should anticipate higher logistics costs and longer lead times, so early ordering and buffer inventory are advisable. European buyers, such as in Poland, might face stricter regulatory compliance costs but benefit from proximity to suppliers.

Focus on Supplier Due Diligence

Evaluate supplier certifications, production capacity, and financial stability. Request samples and conduct independent testing to validate quality before large-scale procurement.

Clarify Incoterms and Payment Conditions Early

Ensure clarity on who bears freight, insurance, and customs clearance responsibilities to avoid unexpected costs. Favor terms that align with your company’s import capabilities and risk appetite.

Prices for carbure de bore can fluctuate based on global raw material availability, geopolitical factors, and currency exchange rates. The figures discussed are indicative and should be validated with multiple suppliers. Always conduct a comprehensive cost-benefit analysis tailored to your specific sourcing context and market conditions.

By carefully dissecting the cost structure and negotiating strategically, B2B buyers across diverse regions can optimize their procurement of carbure de bore, ensuring competitive pricing without compromising on quality or supply reliability.

When sourcing carbure de bore (boron carbide) for industrial applications, understanding its critical technical properties and common trade terminology is essential for making informed purchasing decisions. This knowledge helps international B2B buyers—from Africa, South America, the Middle East, and Europe—ensure product quality, negotiate effectively, and streamline supply chain operations.

Material Grade (Purity Level)

Carbure de bore is available in various purity grades, typically ranging from 90% to over 99%. Higher purity levels mean fewer impurities, which translate to better hardness, thermal stability, and chemical resistance. For industries such as abrasives, armor, or refractory manufacturing, specifying the right grade ensures optimal performance and longevity of the end product.

Particle Size Distribution

The particle size, often measured in microns, affects the material’s reactivity, sintering behavior, and surface finish in downstream applications. Fine powders (below 10 microns) are preferred for precision ceramics and coatings, while coarser particles suit abrasive or refractory uses. Buyers should clarify the acceptable size range to match their production processes.

Density

Bulk density (g/cm³) indicates the compactness of the powder or granules. Higher density materials typically pack better and provide consistent performance in molding and sintering processes. Understanding density helps buyers estimate volume requirements and optimize shipping costs.

Tolerance and Consistency

Tolerance refers to the allowable variation in particle size, purity, or chemical composition. Tight tolerances ensure repeatability and uniformity in manufacturing, crucial for OEMs producing high-spec components. Requesting detailed certificates of analysis (CoA) from suppliers can confirm adherence to these standards.

Chemical Composition

Besides boron carbide (B4C), trace elements like carbon, oxygen, and metallic impurities can influence performance. Buyers should specify maximum allowable impurity levels to avoid issues like brittleness or corrosion in final products.

Hardness and Thermal Stability

Boron carbide is known for its extreme hardness (approximately 9.5 on the Mohs scale) and high melting point (over 2700°C). These properties make it suitable for ballistic armor, cutting tools, and refractory linings. Verifying these specifications ensures the material meets the operational demands of your industry.

OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts or products used in another company’s end product. Understanding if your supplier works with OEMs can signal product quality and compliance with stringent manufacturing standards.

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier will accept for a single order. This is crucial for budget planning and inventory management, especially for buyers in emerging markets where capital and storage may be limited.

RFQ (Request for Quotation)

An RFQ is a formal document sent to suppliers asking for price quotes and terms based on specified product requirements. Clear and detailed RFQs reduce misunderstandings and speed up the procurement process.

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipment, risk, and costs. Common terms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Familiarity with Incoterms helps buyers negotiate favorable delivery terms and manage logistics efficiently.

CoA (Certificate of Analysis)

A CoA is a quality document provided by suppliers detailing the chemical and physical properties of the batch supplied. Requesting CoAs helps verify that the carbure de bore meets your technical specifications before shipment.

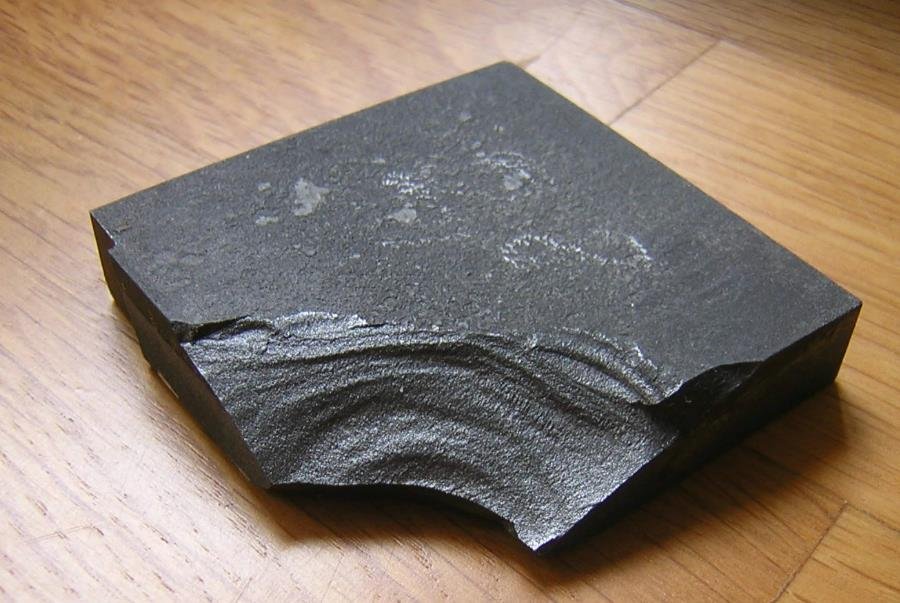

Illustrative Image (Source: Google Search)

Illustrative Image (Source: Google Search)

By focusing on these key technical properties and trade terms, B2B buyers can confidently evaluate suppliers, ensure product quality, and optimize procurement strategies for carbure de bore. This approach supports smoother transactions and stronger supplier relationships across diverse global markets.

The global carbure de bore (boron carbide) market is experiencing steady growth driven by its critical applications in industries such as defense, abrasives, nuclear technology, and advanced ceramics. International buyers from regions like Africa, South America, the Middle East, and Europe are increasingly focused on securing reliable and high-purity supplies to meet rising demand. Economic growth in emerging markets, particularly in sectors like automotive and electronics manufacturing in Mexico and Poland, is intensifying the need for advanced materials like carbure de bore.

Key market drivers include the expanding use of boron carbide in lightweight armor solutions and cutting-edge industrial applications. Technological advancements are enabling higher performance grades, prompting B2B buyers to seek suppliers offering tailored material specifications. Additionally, digital procurement platforms and blockchain-based traceability systems are gaining traction, enhancing transparency and efficiency in sourcing carbure de bore globally.

For B2B buyers, understanding regional supply chain nuances is crucial. African and Middle Eastern markets often rely on imports from Asia and Europe, while South American companies are exploring local mining partnerships to reduce dependency. Strategic sourcing now involves a mix of long-term supplier relationships and agile procurement models that can adapt to fluctuating market conditions and geopolitical factors. Furthermore, the push towards automation and smart manufacturing in Europe encourages the integration of carbure de bore with IoT-enabled quality control, elevating product consistency and reducing waste.

Sustainability has become a pivotal consideration in the carbure de bore sector, driven by growing environmental regulations and corporate responsibility commitments. The extraction and processing of boron compounds can have significant ecological impacts, including energy-intensive operations and potential water contamination. Hence, international buyers are prioritizing suppliers who adopt cleaner production methods and demonstrate compliance with environmental standards.

Ethical sourcing is equally critical. Buyers from Africa, South America, the Middle East, and Europe are increasingly demanding supply chain transparency to avoid associations with conflict minerals or exploitative labor practices. Certifications such as ISO 14001 (Environmental Management), Responsible Minerals Initiative (RMI), and third-party sustainability audits provide assurance of ethical procurement.

Green innovation is also influencing sourcing decisions. Some suppliers now offer boron carbide produced with renewable energy inputs or recycled raw materials, reducing carbon footprints. Additionally, lifecycle assessments (LCAs) and eco-labeling schemes help buyers evaluate the environmental impact of carbure de bore products. Integrating sustainability criteria into procurement strategies not only mitigates risk but also aligns with the growing expectations of end customers and regulatory bodies.

Carbure de bore has evolved from a niche abrasive material to a critical high-tech component over the past several decades. Initially developed in the mid-20th century for industrial grinding and polishing, its exceptional hardness and thermal stability soon attracted defense and nuclear industry interest. The Cold War era spurred innovations in lightweight armor, where boron carbide’s superior ballistic resistance became invaluable.

Illustrative Image (Source: Google Search)

Over time, advancements in synthesis methods and particle engineering have expanded its applications into electronics, automotive parts, and even medical devices. For B2B buyers, understanding this evolution underscores the importance of partnering with suppliers who keep pace with technological progress and can offer customized solutions tailored to modern industrial demands. This historical perspective also highlights the material’s strategic significance, which influences pricing dynamics and supply chain security considerations today.

How can I effectively vet suppliers of carbure de bore for international B2B transactions?

To vet suppliers, start by verifying their business licenses, export certifications, and industry memberships relevant to carbure de bore. Request references and review previous client feedback, especially from buyers in your region (Africa, South America, Middle East, Europe). Conduct factory audits if feasible or use third-party inspection services to assess production capabilities and quality controls. Evaluate their responsiveness, communication clarity, and willingness to provide samples or technical documentation. This due diligence minimizes risks and ensures you partner with reliable, compliant suppliers.

What customization options are typically available for carbure de bore, and how do I request them?

Carbure de bore suppliers often offer customization in particle size, purity grades, and packaging to meet specific industrial needs. To request customization, clearly specify your technical requirements and intended application upfront. Confirm if the supplier can tailor formulations or batch sizes accordingly. Always ask for sample batches to validate the customized product before committing to large orders. Clear communication on customization reduces misunderstandings and ensures the product fits your operational needs.

What are the common minimum order quantities (MOQs) and lead times for carbure de bore shipments internationally?

MOQs vary widely depending on the supplier’s production scale and product grade, often ranging from 500 kg to several tons. Lead times typically span 3 to 8 weeks, factoring in production, quality checks, and international shipping. Buyers from Africa, South America, the Middle East, and Europe should confirm MOQs and lead times early to align with their inventory and project timelines. Negotiating flexible MOQs or staggered shipments can help manage cash flow and storage constraints.

Which payment terms and methods are most secure and convenient for international buyers of carbure de bore?

Letters of credit (LC) remain the gold standard for secure international payments, balancing risk between buyer and supplier. Other common methods include telegraphic transfers (T/T) with partial upfront deposits and escrow services for added security. Always negotiate clear payment schedules linked to delivery milestones or quality inspections. Using internationally recognized banks and confirming currency exchange stability can prevent payment disputes and protect your financial interests.

What quality assurance certifications should I expect from reputable carbure de bore suppliers?

Reliable suppliers usually provide ISO 9001 certification for quality management systems and specific product test reports confirming purity and particle size. Certifications such as REACH compliance for Europe or local chemical safety standards may also apply. Request third-party lab analysis reports to verify product consistency. Ensuring suppliers meet recognized international standards guarantees safer handling, regulatory compliance, and consistent product performance.

How can I optimize logistics and shipping for carbure de bore imports to regions like Africa and South America?

Plan shipments with suppliers who have experience exporting to your region and understand local customs regulations. Choose freight options balancing cost and delivery speed, such as sea freight for bulk orders and air freight for urgent smaller shipments. Coordinate with freight forwarders familiar with hazardous material handling if applicable. Confirm packaging meets international shipping standards to prevent contamination or damage. Early communication with customs brokers helps avoid clearance delays and unexpected fees.

What steps should I take if there is a quality dispute upon receiving carbure de bore shipments?

Immediately document the issue with photographs and detailed descriptions. Notify the supplier within the agreed inspection period, referencing your purchase contract’s quality clauses. Request a joint investigation or third-party inspection to objectively assess the product. Maintain clear communication and seek amicable resolution through replacement, refund, or discount. Establishing a well-defined dispute resolution process in your contract protects your interests and preserves supplier relationships.

Are there specific regulatory considerations for importing carbure de bore into Europe and the Middle East?

Yes, imports into Europe require compliance with REACH regulations and proper classification under the CLP (Classification, Labelling and Packaging) regulation. The Middle East may have varying chemical import restrictions depending on the country; some require registration with local authorities or additional documentation for hazardous materials. Engage local regulatory consultants or customs experts to ensure all permits, safety data sheets (SDS), and labeling meet destination country requirements, avoiding customs delays or penalties.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of sourcing carbure de bore, international buyers must prioritize a strategic approach that balances cost efficiency, quality assurance, and supply chain resilience. Understanding regional market dynamics—from Africa’s emerging supplier networks to Europe’s stringent quality standards—empowers businesses to optimize procurement decisions. Key considerations include vetting suppliers for compliance, leveraging long-term partnerships to secure stable pricing, and incorporating risk mitigation strategies such as diversified sourcing and inventory buffers.

For B2B buyers in markets like Mexico, Poland, and the Middle East, aligning sourcing strategies with local regulatory frameworks and logistical capabilities is crucial. Additionally, embracing digital tools for supplier evaluation and contract management can enhance transparency and operational agility. This holistic perspective not only reduces procurement risks but also drives sustainable value creation throughout the supply chain.

Looking ahead, the carbure de bore market is poised for innovation and increased global integration. Buyers who proactively invest in strategic sourcing capabilities will be well-positioned to capitalize on emerging opportunities, adapt to market shifts, and forge resilient supplier ecosystems. Now is the time for international B2B buyers to deepen their market intelligence, cultivate strategic alliances, and embed flexibility into their sourcing models to ensure long-term competitiveness and growth.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina