Chemical vapour deposition (CVD) ceramics represent a pivotal advancement in materials engineering, offering unparalleled performance in industries demanding exceptional durability, thermal resistance, and chemical stability. For B2B buyers operating across Africa, South America, the Middle East, and Europe, understanding the nuances of CVD ceramics is essential to harness their full potential—whether for aerospace, automotive, electronics, or energy sectors.

This guide delivers a comprehensive roadmap to sourcing CVD ceramics with confidence and precision. It covers critical topics including the diverse types of CVD ceramics, key raw materials, and the manufacturing and quality control processes that ensure product reliability. Additionally, it offers insights into evaluating global suppliers, navigating cost structures, and understanding market dynamics shaped by regional demands and supply chain considerations.

By integrating these insights, international buyers—such as those in the UAE’s advanced manufacturing hubs or France’s high-tech industries—can make strategic purchasing decisions that optimize performance and cost-effectiveness. The guide also addresses frequently asked questions, helping demystify complex technical and commercial aspects for a more streamlined procurement process.

Key benefits for B2B buyers include:

Equipped with this knowledge, buyers can confidently navigate the global CVD ceramics market, securing high-quality materials that drive innovation and competitive advantage across their industries.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Silicon Carbide (SiC) | High hardness, excellent thermal conductivity, chemical inertness | Aerospace components, semiconductor industry, wear-resistant coatings | Pros: Exceptional durability and thermal resistance. Cons: Higher cost and requires specialized handling. |

| Titanium Nitride (TiN) | Golden metallic finish, high hardness, corrosion resistance | Cutting tools, decorative coatings, medical devices | Pros: Enhances tool life and aesthetics. Cons: Limited to thin coatings, moderate cost. |

| Boron Nitride (BN) | High thermal stability, electrical insulation, lubricity | Electronics, high-temperature insulators, lubricants | Pros: Excellent electrical insulation and thermal shock resistance. Cons: Fragile in bulk form, niche applications. |

| Alumina (Al2O3) | High hardness, chemical stability, electrical insulation | Wear-resistant parts, electrical insulators, biomedical implants | Pros: Cost-effective, widely available. Cons: Brittle, moderate thermal conductivity. |

| Zirconium Nitride (ZrN) | Metallic luster, corrosion resistance, hardness | Decorative coatings, cutting tools, automotive parts | Pros: Good wear resistance and aesthetics. Cons: Less common, moderate cost. |

Silicon Carbide (SiC)

Silicon Carbide ceramics deposited via CVD are prized for their outstanding hardness and thermal conductivity, making them ideal for industries requiring extreme durability such as aerospace and semiconductor manufacturing. Their chemical inertness ensures longevity in aggressive environments. For B2B buyers, investing in SiC-coated components means higher upfront costs but significant long-term savings through reduced wear and maintenance. Buyers should evaluate supplier capabilities to deliver consistent quality and consider logistical factors for handling these specialized materials.

Titanium Nitride (TiN)

TiN coatings are widely used to extend the life of cutting tools and provide a visually appealing golden finish for decorative applications. Its corrosion resistance adds value in medical device manufacturing. B2B purchasers should weigh the benefits of improved tool performance against the moderate cost and thickness limitations inherent to TiN coatings. Ensuring supplier adherence to precise coating specifications is critical for achieving desired performance outcomes.

Boron Nitride (BN)

Known for its excellent thermal stability and electrical insulation, Boron Nitride ceramics are essential in electronics and high-temperature insulators. Its lubricious properties also find niche applications in specialized lubricants. For buyers, BN ceramics offer unique advantages but require careful consideration of their mechanical fragility and the specialized nature of their applications. Partnering with suppliers experienced in BN processing can mitigate risks associated with handling and integration.

Alumina (Al2O3)

Alumina is a versatile and cost-effective ceramic coating with high hardness and chemical stability, often used in wear-resistant parts and electrical insulators. Its widespread availability makes it attractive to a broad range of industries, including biomedical implants. Buyers should be aware of its brittleness and moderate thermal conductivity when selecting alumina for high-stress or thermal management applications. Evaluating supplier quality and certification is essential to ensure consistency.

Zirconium Nitride (ZrN)

Zirconium Nitride offers a combination of metallic luster and corrosion resistance, making it suitable for decorative coatings and automotive components requiring wear resistance. While less common than TiN, it provides a balance between aesthetics and functionality. B2B buyers should consider the relative scarcity and moderate cost of ZrN coatings and verify supplier expertise to ensure coating uniformity and performance tailored to specific industrial needs.

Related Video: Chemical Vapour Deposition Method (CVD)

| Industry/Sector | Specific Application of chemical vapour deposition ceramics | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Defense | Protective coatings on turbine blades and engine components | Enhances thermal resistance and extends component lifespan | Compliance with international aerospace standards; high purity and uniformity; reliable supply chain for critical parts |

| Semiconductor & Electronics | Insulating and passivation layers on microelectronic devices | Improves device reliability and miniaturization | Precision in layer thickness; compatibility with existing fabrication processes; certification for electronic-grade materials |

| Energy & Power Generation | Coatings for gas turbines and nuclear reactors | Increases corrosion resistance and operational efficiency | Material performance under extreme conditions; long-term durability; certification for safety and environmental standards |

| Medical Devices | Biocompatible coatings on implants and surgical tools | Enhances biocompatibility and wear resistance | Compliance with medical regulatory requirements (e.g., CE, FDA); traceability and quality assurance; customization options |

| Automotive | Wear-resistant coatings on engine parts and sensors | Improves fuel efficiency and component durability | Compatibility with automotive manufacturing processes; cost-effectiveness; ability to meet emission and safety regulations |

Chemical vapour deposition (CVD) ceramics are widely utilized in the aerospace and defense industry to apply protective coatings on turbine blades and engine components. These coatings significantly enhance thermal resistance and extend the lifespan of parts exposed to extreme temperatures and mechanical stress. For international buyers, especially from regions with emerging aerospace sectors like the UAE and South America, sourcing must ensure compliance with stringent aerospace quality standards and a reliable supply chain to avoid costly downtime.

In the semiconductor and electronics sector, CVD ceramics serve as insulating and passivation layers on microelectronic devices. This application improves device reliability and allows for further miniaturization, critical for advancing technology. Buyers from Europe and Africa should prioritize suppliers that can deliver precise layer thickness control and materials fully compatible with existing fabrication processes, ensuring seamless integration and high yields.

The energy and power generation industry leverages CVD ceramics for coatings on gas turbines and nuclear reactors, where corrosion resistance and operational efficiency are paramount. For businesses in regions like the Middle East and South America, where energy infrastructure is rapidly expanding, it is vital to select materials that demonstrate long-term durability under extreme conditions and meet international safety and environmental certifications.

In the medical devices field, biocompatible CVD ceramic coatings are applied to implants and surgical tools to enhance wear resistance and biocompatibility. Buyers in Europe and Africa must ensure that suppliers comply with medical regulatory requirements such as CE marking or FDA approval. Traceability and quality assurance are critical for maintaining patient safety and meeting procurement standards in healthcare systems.

Finally, the automotive industry uses CVD ceramics for wear-resistant coatings on engine parts and sensors, improving fuel efficiency and component durability. For B2B buyers in Europe and South America, sourcing considerations include compatibility with existing automotive manufacturing processes, cost-effectiveness, and adherence to emission and safety regulations to support sustainable vehicle production.

Related Video: Chemical Vapour Deposition (CVD)

Silicon Carbide is a widely used material in chemical vapour deposition (CVD) ceramics due to its exceptional hardness, thermal stability, and chemical inertness. It can withstand temperatures exceeding 1600°C and offers excellent resistance to oxidation and corrosion, making it ideal for high-temperature and aggressive chemical environments. SiC's high thermal conductivity also aids in heat dissipation, enhancing product performance in demanding applications.

Pros: SiC ceramics are highly durable, resistant to wear and thermal shock, and suitable for harsh chemical media. They provide excellent mechanical strength and maintain structural integrity under extreme conditions.

Cons: Manufacturing SiC via CVD is complex and cost-intensive, requiring precise process control. The material is brittle, which can limit its use in applications requiring impact resistance. Additionally, its high cost may be a barrier for budget-sensitive projects.

Application Impact: SiC is preferred in industries such as aerospace, semiconductor manufacturing, and chemical processing, where media compatibility with corrosive gases and high-temperature stability is critical.

International Buyer Considerations: Buyers in Europe (e.g., France) and the UAE should verify compliance with ASTM C799 and DIN EN 60672 standards for ceramic materials. In Africa and South America, sourcing certified SiC ceramics with traceable quality documentation is essential to ensure performance and longevity. Import regulations and tariffs on advanced ceramics should be reviewed to optimize procurement costs.

Silicon Nitride ceramics deposited by CVD offer a unique combination of high strength, fracture toughness, and thermal shock resistance. It operates efficiently at temperatures up to 1400°C and exhibits excellent resistance to oxidation and chemical attack, particularly from alkalis and acids.

Pros: Si3N4 provides superior mechanical toughness compared to other ceramics, reducing the risk of catastrophic failure. It has good wear resistance and low thermal expansion, which minimizes deformation under thermal cycling.

Cons: The CVD process for Si3N4 is relatively slow and expensive, limiting scalability. Its chemical resistance is not as broad as SiC, particularly against molten metals and some aggressive chemicals.

Application Impact: Ideal for applications requiring mechanical reliability under thermal stress, such as turbine components, engine parts, and protective coatings in chemical reactors.

International Buyer Considerations: European buyers should ensure conformity with EN ISO 6872 and ASTM C1424 standards, which govern mechanical properties and testing methods. Buyers in the Middle East and South America must consider local environmental regulations affecting ceramic coatings and verify supplier certifications to mitigate risks related to material performance.

Alumina ceramics produced by CVD are valued for their excellent hardness, electrical insulation, and chemical inertness. They maintain stability up to approximately 1200°C and resist wear and corrosion in various chemical environments.

Pros: Alumina is cost-effective relative to other CVD ceramics, offers good dielectric properties, and is easier to manufacture at scale. It is highly compatible with a range of chemical media, including acids and alkalis.

Cons: It has lower thermal shock resistance and fracture toughness compared to SiC and Si3N4, which can limit its use in high-stress mechanical applications. The maximum operating temperature is also lower.

Application Impact: Alumina is frequently used in electrical insulators, wear-resistant coatings, and chemical processing equipment where moderate temperature and corrosion resistance are sufficient.

International Buyer Considerations: Compliance with ASTM C799 and DIN EN 60672 is common in Europe and the Middle East. Buyers in Africa and South America should assess local supplier capabilities for consistent alumina quality and consider logistics to minimize damage during transport due to its brittleness.

Boron Carbide is among the hardest known ceramics and is used in CVD applications requiring extreme abrasion resistance and neutron absorption capabilities. It withstands temperatures up to 2200°C and exhibits excellent chemical stability.

Pros: Exceptional hardness and wear resistance make B4C suitable for cutting tools and protective armor. It also offers neutron absorption properties, valuable in nuclear-related applications.

Cons: B4C is expensive and challenging to manufacture via CVD, with limited availability. Its brittleness and difficulty in machining can pose design and handling challenges.

Application Impact: Best suited for niche applications such as ballistic protection, nuclear reactors, and abrasive environments where other ceramics fail.

International Buyer Considerations: Buyers in Europe and the Middle East must ensure compliance with nuclear industry standards (e.g., ASTM C1670) when applicable. In Africa and South America, sourcing B4C requires careful supplier vetting due to limited global availability and the need for specialized handling and certification.

| Material | Typical Use Case for chemical vapour deposition ceramics | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) | High-temperature components, chemical reactors, semiconductor industry | Exceptional thermal stability and chemical resistance | Brittle, high manufacturing complexity and cost | High |

| Silicon Nitride (Si3N4) | Turbine parts, engine components, protective coatings | Superior fracture toughness and thermal shock resistance | Limited chemical resistance to some media, expensive | High |

| Alumina (Al2O3) | Electrical insulators, wear-resistant coatings, moderate chemical environments | Cost-effective, good dielectric properties | Lower thermal shock resistance, lower max temperature | Medium |

| Boron Carbide (B4C) | Abrasive environments, ballistic protection, nuclear applications | Extreme hardness and neutron absorption | Very expensive, brittle, limited availability | High |

Chemical vapour deposition (CVD) ceramics are engineered through highly specialized manufacturing processes that ensure exceptional material properties such as wear resistance, thermal stability, and chemical inertness. For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding these processes and the associated quality assurance mechanisms is critical to selecting reliable suppliers and ensuring product performance aligns with application requirements.

The production of CVD ceramics involves several meticulously controlled stages, each contributing to the final material quality and functionality:

Raw materials, typically gaseous precursors such as silane (SiH4), methane (CH4), or other metal-organic compounds, are selected based on the desired ceramic composition (e.g., silicon carbide, silicon nitride). Purity levels are crucial; impurities can adversely affect deposition quality and ceramic performance. Suppliers often employ gas purification systems and rigorous raw material screening to maintain consistency.

Before deposition, substrates (which can be metallic, ceramic, or composite) are precisely shaped and cleaned. Surface preparation techniques such as polishing, etching, or plasma cleaning remove contaminants and enhance adhesion of the ceramic layer. For complex geometries, fixtures and jigs are designed to ensure uniform coating thickness during CVD.

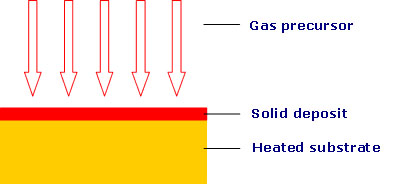

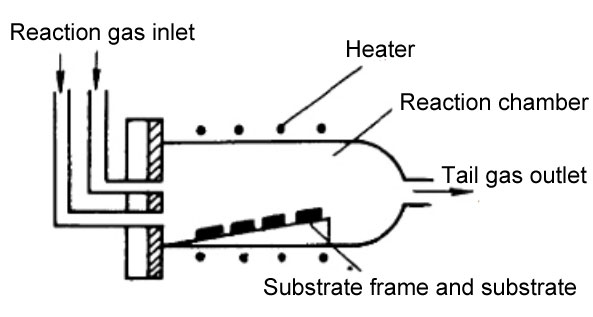

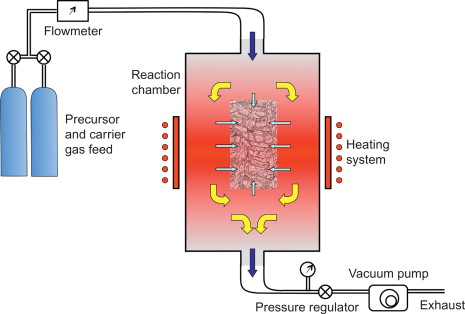

The core manufacturing step involves introducing reactive gases into a high-temperature reaction chamber where they decompose or react on the substrate surface, forming a dense, uniform ceramic layer. Key techniques include:

Illustrative Image (Source: Google Search)

Process parameters such as temperature, pressure, gas flow rates, and deposition time are tightly controlled to achieve desired microstructure and thickness, typically ranging from microns to millimeters.

After deposition, finishing operations may include machining, grinding, or polishing to meet dimensional tolerances and surface finish requirements. Depending on application demands, heat treatments or annealing processes can be applied to relieve internal stresses and enhance material properties.

In many cases, CVD ceramics are integrated into larger components or assemblies. Precision joining techniques such as brazing or mechanical fastening are employed, requiring compatibility assessments between ceramic and other materials to avoid thermal mismatch or mechanical failure.

Ensuring the quality and reliability of CVD ceramics is paramount, especially for international B2B buyers investing in high-value, critical applications like aerospace, energy, or chemical processing.

Buyers should verify that suppliers hold certifications aligned with their industry and regional regulatory requirements.

Illustrative Image (Source: Google Search)

To mitigate risks and ensure product compliance, buyers should adopt a proactive approach to supplier quality verification:

For B2B buyers in Africa, South America, the Middle East, and Europe, understanding regional certification expectations and harmonizing them with supplier capabilities is crucial:

By integrating these insights, international B2B buyers can confidently source high-quality chemical vapour deposition ceramics tailored to their industrial needs, ensuring reliability and performance across diverse applications.

Understanding the cost and pricing dynamics of chemical vapour deposition (CVD) ceramics is crucial for international B2B buyers aiming to optimize procurement strategies and total cost of ownership. This analysis breaks down key cost components, pricing influencers, and actionable buyer tips tailored for markets in Africa, South America, the Middle East, and Europe.

Raw Materials

The primary cost driver is the quality and type of precursor chemicals and ceramic substrates used in the CVD process. High-purity materials command premium prices but are essential for achieving superior performance and durability.

Labor

Skilled labor costs vary significantly by region. Manufacturing hubs with advanced technical expertise may have higher wages, impacting the unit cost. Automation levels in production can mitigate labor expenses.

Manufacturing Overhead

This includes energy consumption (CVD processes are energy-intensive), equipment depreciation, facility maintenance, and utilities. Regions with higher energy costs or less efficient infrastructure may see elevated overhead.

Tooling and Equipment

Specialized reactors and deposition chambers represent significant capital investments. Tooling amortization affects pricing, especially for small batch or customized orders.

Quality Control (QC)

Rigorous QC protocols, including in-line monitoring and post-production testing, ensure product reliability but add to overall costs. Certification costs for international standards (e.g., ISO, ASTM) are also factored in.

Logistics and Customs

Transportation costs, import duties, and customs clearance fees can be substantial, particularly for buyers outside major manufacturing regions. Packaging to prevent contamination or damage during transit adds to expenses.

Supplier Margin

Suppliers incorporate margins based on market demand, competitive positioning, and risk factors such as currency fluctuations and geopolitical stability.

Order Volume / Minimum Order Quantity (MOQ)

Larger volumes typically reduce per-unit costs due to economies of scale. However, buyers from emerging markets should evaluate storage and cash flow implications before committing to high MOQs.

Specifications and Customization

Tailored coatings or ceramic compositions increase complexity and cost. Standardized products are more cost-effective but may not meet all application needs.

Material Quality and Certification

Certified materials that comply with international standards often carry higher prices but reduce long-term risks related to failure or non-compliance.

Supplier Location and Reliability

Proximity to manufacturing centers can lower logistics costs. Established suppliers with proven track records may charge premiums but offer reliability and reduced supply chain risks.

Incoterms Selection

The choice of Incoterms (e.g., FOB, CIF, DDP) affects responsibility for shipping costs and risks. Buyers should carefully negotiate terms to optimize cost transparency and control.

Negotiate Based on Total Cost of Ownership (TCO)

Focus beyond unit price. Consider durability, warranty, after-sales service, and potential downtime costs. Higher upfront costs may be justified by longer service life and lower maintenance.

Leverage Volume Discounts with Caution

While bulk purchasing reduces unit costs, verify storage capabilities and forecast demand to avoid inventory obsolescence or cash flow strain.

Prioritize Suppliers Offering Certifications and Traceability

This is critical for compliance in regulated markets like the EU and UAE, and for maintaining quality standards in aerospace, automotive, or medical sectors.

Understand Regional Logistics and Customs Complexities

For buyers in Africa and South America, anticipate longer lead times and additional import duties. Partner with suppliers experienced in navigating these challenges or consider local distribution hubs.

Consider Currency and Payment Terms

Fluctuating exchange rates can impact final costs. Negotiate payment terms that mitigate currency risk, such as payments in stable currencies or using letters of credit.

Request Detailed Cost Breakdowns

Transparency enables better negotiation and identification of cost-saving opportunities, such as alternative materials or adjusted specifications.

Pricing for CVD ceramics varies widely based on product complexity, volume, and regional factors. The figures provided by suppliers should be considered indicative and subject to detailed quotation and contractual terms.

By understanding these cost structures and pricing influencers, international B2B buyers can make informed sourcing decisions that balance quality, cost-efficiency, and supply chain resilience in the competitive chemical vapour deposition ceramics market.

Understanding the technical specifications of CVD ceramics is essential for B2B buyers to ensure product performance aligns with industrial requirements. Here are the key properties to focus on:

Material Grade

This refers to the purity and composition of the ceramic coating or substrate. Higher-grade materials offer superior chemical resistance, thermal stability, and mechanical strength. For international buyers, specifying the correct grade ensures compatibility with intended industrial applications, such as semiconductor manufacturing or aerospace components.

Coating Thickness and Uniformity

Thickness, typically measured in microns, affects the durability and protective capabilities of the ceramic layer. Uniform coatings prevent weak spots that could lead to premature failure. Buyers should confirm thickness tolerances with suppliers to meet stringent quality standards.

Thermal Conductivity and Expansion

CVD ceramics often operate under extreme temperatures. Knowing the thermal conductivity helps in assessing heat dissipation, while thermal expansion coefficients indicate how the material will behave under temperature cycles. These properties are crucial for applications requiring high thermal stability, such as turbine parts.

Mechanical Hardness and Wear Resistance

Hardness, commonly measured on the Mohs or Vickers scale, determines resistance to abrasion and mechanical stress. High wear resistance extends component life in harsh environments, directly impacting maintenance costs and operational uptime.

Chemical Resistance

The ability to withstand corrosive chemicals without degradation is a key selling point for CVD ceramics. This property is vital for sectors like chemical processing and oil & gas, where exposure to aggressive substances is common.

Dimensional Tolerance

Precision in dimensions ensures that CVD ceramic components fit perfectly within assemblies, reducing the risk of leaks or mechanical failure. Buyers should request detailed tolerance specifications to align with engineering requirements.

Navigating the procurement process for CVD ceramics requires familiarity with industry jargon and trade terms. Here are essential terms that facilitate clearer communication and smoother transactions:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment that are purchased by another company and retailed under that purchasing company’s brand. Understanding if the supplier is an OEM or a third-party helps buyers evaluate quality control and warranty terms.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQ affects inventory planning and cost-efficiency, especially for buyers from emerging markets or smaller enterprises. Negotiating MOQ can lead to better cash flow management.

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers requesting pricing, lead times, and terms for specific products. A clear RFQ with detailed technical specifications minimizes misunderstandings and accelerates procurement cycles.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities for shipping, insurance, and tariffs between buyers and sellers. Familiarity with Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) is crucial for managing import/export logistics efficiently.

Lead Time

The period between placing an order and receiving the goods. Accurate lead time estimates help buyers in Africa, South America, the Middle East, and Europe plan production schedules and avoid costly delays.

Traceability

The ability to track the manufacturing history and quality assurance records of a ceramic product. Traceability ensures compliance with international standards and facilitates quality audits, which are often mandatory in regulated industries.

By focusing on these technical properties and trade terms, international B2B buyers can make informed decisions, mitigate risks, and establish stronger supplier relationships in the chemical vapour deposition ceramics market.

The global chemical vapour deposition (CVD) ceramics market is experiencing robust growth driven by increasing demand across aerospace, electronics, automotive, and energy sectors. For international B2B buyers, especially from Africa, South America, the Middle East, and Europe, understanding regional market dynamics is crucial to optimizing sourcing strategies. The Middle East, led by the UAE, is rapidly expanding its industrial base with significant investments in advanced materials, including CVD ceramics, to support sectors like oil & gas and renewable energy. Europe, with countries like France, is focusing heavily on innovation and high-performance materials for aerospace and semiconductor manufacturing, pushing the demand for tailored CVD ceramics with precise properties.

Key sourcing trends include a move towards customized ceramic coatings that enhance wear resistance and thermal stability, essential for cutting-edge applications. Additionally, digitalization and Industry 4.0 adoption among suppliers is transforming supply chain transparency and efficiency, enabling buyers to track production quality and delivery timelines in real-time. For African and South American buyers, partnerships with suppliers offering scalable solutions and technical support are becoming vital due to infrastructure and logistics challenges in these regions.

Emerging technologies, such as plasma-enhanced CVD and atomic layer deposition, are enabling finer control over coating thickness and composition, offering competitive advantages in product performance. International buyers are advised to prioritize suppliers who invest in R&D and demonstrate agility in adopting these innovations. Furthermore, geopolitical shifts and trade policies are influencing supply chain resilience, making diversification of sourcing partners across multiple regions a strategic imperative.

Sustainability is increasingly a key consideration in the procurement of chemical vapour deposition ceramics. The production process traditionally involves high energy consumption and the use of hazardous gases, which can have significant environmental impacts if not managed properly. International buyers are encouraged to assess suppliers based on their environmental management systems and commitment to reducing carbon footprints through energy-efficient technologies and waste minimization.

Ethical sourcing practices are also gaining prominence, particularly in regions with emerging regulatory frameworks. Buyers from Africa, South America, the Middle East, and Europe should seek suppliers who comply with internationally recognized standards such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety). Certifications like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) are critical indicators of a supplier’s commitment to chemical safety and sustainability.

The industry is witnessing a shift towards "green" CVD ceramics, which utilize less toxic precursor materials and implement closed-loop gas recycling systems to minimize emissions. Collaborating with suppliers who offer transparency in their supply chains and demonstrate adherence to ethical labor practices can mitigate reputational risks and align with corporate social responsibility goals. For B2B buyers, integrating sustainability criteria into supplier evaluation not only supports environmental stewardship but also enhances long-term operational resilience and compliance with evolving global regulations.

Chemical vapour deposition ceramics have evolved significantly since their inception in the mid-20th century. Initially developed for protective coatings in aerospace and cutting tools, the technology has expanded into numerous industrial applications due to its ability to produce ultra-thin, uniform ceramic layers with superior hardness and chemical resistance. Over the decades, advances in CVD processes—such as low-pressure and plasma-enhanced variants—have allowed for greater control over material properties, enabling applications in microelectronics, medical devices, and energy sectors.

For B2B buyers, understanding this evolution underscores the importance of partnering with suppliers who not only possess deep technical expertise but also keep pace with technological advancements. This ensures access to ceramics that meet increasingly stringent performance and regulatory requirements, positioning buyers competitively in their respective markets.

How can I effectively vet suppliers of chemical vapour deposition ceramics for international trade?

When vetting suppliers, prioritize those with a proven track record in chemical vapour deposition (CVD) ceramics and strong international trade experience. Verify certifications such as ISO 9001 for quality management and industry-specific standards. Request detailed technical datasheets and references from existing international clients, particularly in your region. Conduct virtual or on-site audits if possible. Evaluate their production capacity, compliance with environmental and safety regulations, and responsiveness to inquiries. This due diligence helps mitigate risks and ensures your supplier can meet your quality and delivery expectations.

What customization options are typically available for chemical vapour deposition ceramics?

CVD ceramics can be customized in terms of composition, thickness, substrate compatibility, and surface properties to suit specific industrial applications. Suppliers often provide tailored coatings for enhanced hardness, thermal resistance, or chemical inertness. Discuss your application requirements upfront to explore modifications like multilayer coatings or gradient structures. Ensure the supplier has R&D capabilities and flexible production processes. Customization agreements should clearly define technical specifications, testing protocols, and acceptance criteria to avoid misunderstandings and ensure the final product aligns with your operational needs.

What are common minimum order quantities (MOQs) and lead times when sourcing CVD ceramics internationally?

MOQs for CVD ceramics vary widely depending on the complexity and customization level but typically range from small prototype batches to several hundred units for standard coatings. Lead times can span from 4 to 12 weeks, factoring in production, quality control, and shipping. Buyers from Africa, South America, the Middle East, and Europe should account for additional time due to customs clearance and logistics. Clarify MOQs and lead times early in negotiations, and consider suppliers who offer flexible batch sizes or expedited production if your project timeline is tight.

What payment terms are standard in international B2B transactions for CVD ceramics?

International suppliers commonly require payment terms such as a 30-50% advance deposit with the balance due upon shipment or delivery. Letters of credit (LCs) and escrow services provide added security, especially for new partnerships. For trusted suppliers, net 30 to net 60 payment terms may be negotiated. Always confirm currency, payment method (wire transfer, PayPal, etc.), and any banking fees. Clear payment terms help maintain cash flow and avoid disputes, particularly when dealing with cross-border currency fluctuations and regulatory constraints in regions like Africa or the Middle East.

Which quality assurance certifications and testing standards should I expect for CVD ceramics?

Look for suppliers certified under ISO 9001 for quality management and ISO 14001 for environmental management. Additional industry-specific standards, such as ASTM or EN standards related to ceramic coatings, may apply. Quality assurance typically includes microstructural analysis, adhesion testing, hardness measurement, and thermal cycling tests. Request detailed quality control reports and batch traceability documentation. Third-party inspection or certification can further enhance confidence. Ensuring stringent QA protocols helps prevent defects, reduces downtime, and supports compliance with your own regulatory requirements.

What logistical challenges should I anticipate when importing chemical vapour deposition ceramics?

CVD ceramics are often delicate and require careful packaging to avoid damage during transit. Shipping by air may be faster but costlier, while sea freight offers volume advantages but longer lead times. Importers should be aware of customs regulations, tariffs, and import duties specific to their countries, which can vary significantly across Africa, South America, the Middle East, and Europe. Engage experienced freight forwarders familiar with hazardous material handling and cross-border documentation. Early coordination on Incoterms (e.g., FOB, CIF) clarifies responsibilities and minimizes delays.

How can disputes or quality issues be effectively managed with international CVD ceramic suppliers?

Establish clear contractual terms covering quality standards, inspection procedures, and remedies for non-conformance before placing orders. Use third-party quality inspections or independent labs to verify product compliance upon receipt. In case of disputes, prompt communication and documentation (photos, test results) are vital. Leverage dispute resolution clauses such as arbitration or mediation to avoid costly litigation. Maintaining good supplier relationships through transparency and mutual respect often facilitates quicker resolutions and continuous improvement.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Chemical vapour deposition (CVD) ceramics represent a transformative opportunity for industries seeking superior material performance, particularly in sectors like aerospace, electronics, and energy. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe, understanding the nuances of CVD ceramics—from supplier capabilities to regional market dynamics—is critical to unlocking their full potential.

Key takeaways include:

- Prioritize strategic partnerships with suppliers that demonstrate advanced process control and consistent quality assurance to mitigate risks associated with CVD ceramic procurement.

- Leverage regional hubs and emerging supply chains to optimize logistics, reduce lead times, and enhance cost efficiency.

- Invest in thorough technical due diligence to align material properties with specific application requirements, ensuring long-term performance and reliability.

Looking ahead, the market for CVD ceramics is poised for growth driven by innovation in material science and expanding industrial applications. Buyers who adopt a proactive, informed sourcing strategy will gain a competitive edge, securing supply continuity and benefiting from evolving technological advancements.

Actionable insight: Engage early with trusted manufacturers and explore collaborative development opportunities to tailor CVD ceramic solutions that meet your unique operational challenges and market demands. This approach will position your business at the forefront of material innovation and industrial excellence.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina