Coated abrasives are indispensable tools across diverse industrial sectors, from automotive manufacturing and aerospace to metal fabrication and woodworking. For international B2B buyers, especially those operating in dynamic markets such as Africa, South America, the Middle East, and Europe, sourcing the right coated abrasive products is pivotal to ensuring operational efficiency, product quality, and cost-effectiveness. Understanding the nuances of coated abrasives—ranging from abrasive types and backing materials to manufacturing standards and quality control—is essential for making informed purchasing decisions.

This comprehensive guide delves deeply into the coated abrasive landscape, offering a detailed exploration of:

By synthesizing technical knowledge with market intelligence, this guide empowers B2B buyers to navigate the complexities of international sourcing confidently. Whether you are procuring for industrial workshops in Johannesburg, manufacturing plants in São Paulo, construction firms in Cairo, or precision engineering companies in Paris, this resource equips you with actionable insights to select the most suitable coated abrasives that meet your operational requirements and compliance standards. Harnessing this knowledge will not only streamline your supply chain but also enhance product performance and competitive advantage in your local and global markets.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Aluminum Oxide | Durable, versatile abrasive grain; commonly used; available in various grit sizes | Metal fabrication, woodworking, automotive refinishing | Pros: Cost-effective, widely available, good for general use. Cons: Not ideal for very hard materials. |

| Silicon Carbide | Sharp, hard abrasive with fast cutting action; brittle grain | Glass, ceramics, stone, non-ferrous metals | Pros: Excellent for hard, brittle materials; high precision. Cons: Shorter lifespan on softer metals. |

| Ceramic Alumina | Advanced synthetic abrasive; high durability and heat resistance | Aerospace, heavy industry, high-performance metalworking | Pros: Long-lasting, fast cutting, high efficiency. Cons: Higher cost, specialized use. |

| Zirconia Alumina | Self-sharpening abrasive with toughness and durability | Heavy metal grinding, stainless steel, weld blending | Pros: Great for aggressive grinding, long life. Cons: Heavier wear on soft materials, premium price. |

| Garnet | Natural abrasive with moderate hardness; eco-friendly option | Wood sanding, finishing, polishing | Pros: Environmentally friendly, good surface finish. Cons: Less aggressive, limited lifespan. |

Aluminum Oxide

Aluminum oxide coated abrasives are the most commonly used type due to their balance of durability and cost-effectiveness. They excel in metal fabrication and woodworking, offering consistent performance across a wide range of materials, especially ferrous metals. For B2B buyers in sectors like automotive refinishing or general manufacturing in regions such as Europe and South America, this type offers reliable supply and economical pricing. When purchasing, consider grit size variety and backing material compatibility with your machinery.

Silicon Carbide

Silicon carbide abrasives are characterized by their sharp, hard grains that provide fast cutting on brittle and hard materials such as glass, ceramics, and stone. They are ideal for specialized applications requiring precision, common in industries like electronics and stone fabrication. Buyers from the Middle East and Africa should evaluate the abrasive’s lifespan relative to the specific materials processed, as it wears faster on softer metals. Supply chain stability and quality certification are critical when sourcing this type.

Ceramic Alumina

Ceramic alumina coated abrasives represent a premium, high-performance option favored in aerospace and heavy industrial metalworking. Their synthetic grains resist heat buildup and maintain cutting efficiency under high pressure, making them suitable for continuous heavy-duty operations. B2B purchasers in advanced manufacturing hubs in Europe and South America should weigh the higher upfront cost against the long-term productivity gains and reduced tool change downtime.

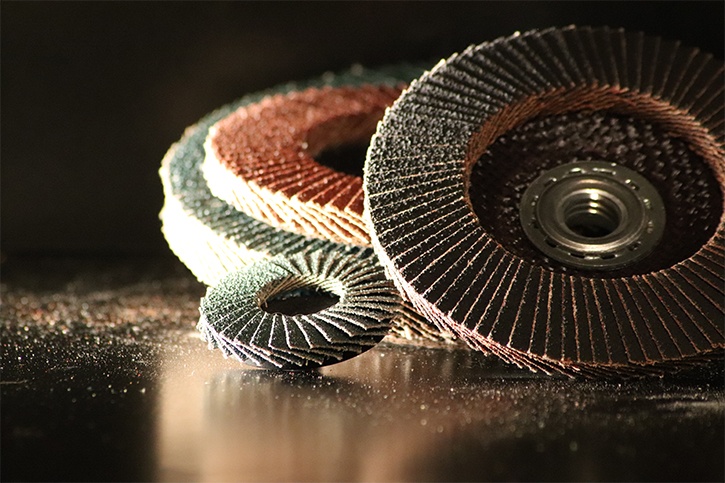

Zirconia Alumina

Zirconia alumina abrasives offer a self-sharpening feature that enhances durability and grinding speed, particularly on tough metals like stainless steel and for weld blending. This type is preferred in heavy metalworking and fabrication industries where aggressive material removal is required. Buyers from all targeted regions should consider the abrasive’s compatibility with their grinding equipment and the potential premium price, which is often offset by longer service life.

Garnet

Garnet abrasives are a natural, environmentally friendly option with moderate hardness, commonly used for wood sanding and surface finishing. They provide a fine surface finish but are less aggressive than synthetic abrasives, making them suitable for industries focused on quality craftsmanship and sustainability, such as furniture manufacturing in Europe and artisanal sectors in Africa. B2B buyers should factor in the shorter lifespan and ensure consistent quality from suppliers.

Related Video: Common Abrasive Grain Types: Ceramic Alumina, Zirconia Alumina, Aluminum Oxide - Cascade Abrasives

| Industry/Sector | Specific Application of Coated Abrasive | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Surface finishing and paint preparation on metal panels | Ensures smooth, defect-free surfaces for painting and assembly | Abrasive grit size, durability under high-volume use, compliance with environmental standards |

| Metal Fabrication | Deburring, grinding, and polishing of steel components | Enhances product quality and reduces post-processing time | Consistent abrasive quality, resistance to heat and wear, availability of various backing materials |

| Woodworking & Furniture | Sanding of wood surfaces for finishing and smoothing | Improves finish quality and reduces labor costs | Abrasive type suited for different wood species, flexibility of abrasive sheets, dust control features |

| Aerospace & Defense | Precision grinding of aerospace alloys and composites | Maintains tight tolerances and surface integrity for safety | High-performance abrasives with fine grit, certification for aerospace standards, reliable supply chain |

| Construction & Stone | Grinding and polishing of stone and concrete surfaces | Achieves desired surface texture and durability | Abrasive hardness, bonding type, compatibility with wet and dry applications, local supplier support |

In the automotive manufacturing sector, coated abrasives play a crucial role in surface finishing and paint preparation. The abrasive materials are used to smooth metal panels, removing imperfections and ensuring a defect-free surface for subsequent painting. This improves the overall aesthetic and durability of the vehicle finish. Buyers from regions such as Europe and the Middle East must prioritize abrasives that comply with strict environmental regulations and demonstrate consistent performance under high-volume production conditions.

Within metal fabrication, coated abrasives are essential for deburring, grinding, and polishing steel components. These processes enhance the quality of metal parts by removing sharp edges and surface irregularities, which is vital for both safety and aesthetics. For international buyers, especially in Africa and South America, sourcing abrasives with high heat resistance and durability is important to maximize tool life and reduce downtime, considering the often variable power supply and workshop conditions.

The woodworking and furniture industry benefits significantly from coated abrasives in sanding operations. Abrasives designed for wood help achieve smooth, even surfaces, improving the final finish and reducing manual labor. B2B buyers in countries like France and Egypt should seek abrasives tailored to different wood species and ensure the abrasives offer dust control features to maintain a clean work environment and comply with health standards.

In aerospace and defense, coated abrasives are used for precision grinding of advanced alloys and composite materials. These abrasives must meet stringent quality and certification standards to maintain safety and performance in critical components. Buyers from Europe and the Middle East should focus on high-performance abrasives with fine grit sizes and reliable supply chains to avoid production delays and ensure compliance with aerospace regulations.

For the construction and stone industry, coated abrasives are applied in grinding and polishing stone and concrete surfaces. This application requires abrasives with high hardness and specific bonding types to withstand abrasive wear and deliver the desired surface texture. International buyers, particularly in Africa and South America, should consider suppliers who provide abrasives compatible with both wet and dry use and offer local support to address logistical challenges and ensure timely delivery.

Aluminum oxide is one of the most widely used abrasive materials in coated abrasives due to its excellent balance of hardness and durability. It offers high temperature resistance, making it suitable for high-speed grinding applications where heat generation is significant. This material exhibits good corrosion resistance, which is beneficial for environments with moderate humidity or exposure to chemicals.

Pros: Aluminum oxide abrasives are durable and cost-effective, providing a long service life in a variety of applications such as metal fabrication, woodworking, and automotive refinishing. They are relatively easy to manufacture, ensuring consistent availability and competitive pricing.

Cons: While versatile, aluminum oxide may wear faster on extremely hard materials like stainless steel or ceramics compared to more specialized abrasives. It can also generate more heat during use, which might affect heat-sensitive substrates.

Application Impact: Aluminum oxide is ideal for general-purpose grinding and finishing on ferrous metals and wood. It performs well with standard grinding machines and is compatible with most backing materials.

International B2B Considerations: Buyers from Africa, South America, the Middle East, and Europe should note that aluminum oxide abrasives typically comply with ASTM and DIN standards, ensuring quality and interchangeability. In regions like France and Egypt, suppliers often provide certification aligned with ISO standards. Aluminum oxide abrasives are widely accepted and preferred due to their cost-efficiency and reliable performance, making them a practical choice for diverse industrial sectors.

Silicon carbide is a very hard and sharp abrasive material known for its superior cutting ability and thermal conductivity. It withstands high pressure and temperature but is more brittle than aluminum oxide. This makes it suitable for grinding non-ferrous metals, plastics, glass, and ceramics.

Pros: Silicon carbide abrasives provide fast cutting action and excellent surface finish on hard, brittle materials. They are effective in precision grinding and polishing applications where a fine finish is required.

Cons: The brittleness of silicon carbide can lead to faster breakdown under heavy-duty grinding or impact conditions. It is generally more expensive than aluminum oxide and requires careful handling during manufacturing.

Application Impact: Silicon carbide is preferred for applications involving non-metallic substrates or softer metals, such as aluminum and brass. It is also used in industries like electronics and automotive for finishing hard plastics and composites.

International B2B Considerations: Buyers in emerging markets such as Africa and South America should consider the availability and cost of silicon carbide abrasives, as import tariffs and logistics may impact pricing. Compliance with JIS (Japanese Industrial Standards) and DIN standards is common, particularly in European markets. For Middle Eastern buyers, certification of abrasive grit size and bonding quality is critical to meet local industrial regulations.

Ceramic alumina is a premium abrasive material engineered for high-performance grinding. It features a microcrystalline structure that provides self-sharpening properties and exceptional toughness. This abrasive maintains cutting efficiency under extreme heat and pressure.

Pros: Ceramic alumina abrasives offer superior durability and faster material removal rates, making them ideal for heavy-duty applications such as aerospace, automotive, and tool manufacturing. Their self-sharpening nature extends product life and reduces downtime.

Cons: The manufacturing process is complex, resulting in higher costs compared to traditional abrasives. Ceramic alumina is also less effective on softer materials and can be overkill for simple finishing tasks.

Application Impact: This material excels in precision grinding of hardened steels and superalloys. It is well-suited for automated grinding systems and high-speed machinery requiring consistent abrasive performance.

International B2B Considerations: European buyers, especially in countries like France, often demand ceramic alumina abrasives that meet stringent EN and ISO standards. Middle Eastern and African buyers should verify supplier adherence to ASTM and DIN certifications to ensure product reliability. The higher initial investment is justified by improved productivity and reduced abrasive replacement frequency, making it attractive for industries focused on quality and efficiency.

Zirconia alumina is a tough, long-lasting abrasive known for its resilience under heavy grinding conditions. It combines zirconium oxide with alumina to enhance strength and heat resistance. This material is particularly effective for grinding hard metals and stainless steel.

Pros: Zirconia alumina abrasives deliver excellent durability and resistance to heat and wear, resulting in extended service life. They provide aggressive cutting action and maintain sharpness over prolonged use.

Cons: The cost is higher than aluminum oxide but generally lower than ceramic alumina. Zirconia alumina is heavier and may require more robust backing materials, which can increase manufacturing complexity.

Application Impact: Ideal for metal fabrication, weld grinding, and heavy stock removal, zirconia alumina is favored in industries requiring robust abrasive performance, such as shipbuilding and heavy machinery manufacturing.

International B2B Considerations: Buyers from South America and Africa should assess supplier capabilities for consistent zirconia alumina quality, as regional manufacturing standards vary. Compliance with ASTM and ISO standards is essential for European markets. In the Middle East, where abrasive demand is growing in oil and gas sectors, zirconia alumina’s durability aligns well with operational needs, though cost considerations remain important.

| Material | Typical Use Case for coated abrasive | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Oxide | General-purpose grinding on ferrous metals and wood | Durable, cost-effective, widely available | Generates heat, less effective on very hard materials | Low |

| Silicon Carbide | Grinding non-ferrous metals, plastics, glass, ceramics | Sharp cutting, excellent for brittle materials | Brittle, faster wear under heavy load | Medium |

| Ceramic Alumina | Heavy-duty grinding of hardened steels and superalloys | Self-sharpening, high durability, fast material removal | High cost, complex manufacturing | High |

| Zirconia Alumina | Metal fabrication, weld grinding, heavy stock removal | Long-lasting, heat and wear resistant | Heavier, higher cost than aluminum oxide | Medium |

Manufacturing coated abrasives involves a complex series of carefully controlled processes designed to produce durable, high-performance products. For international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe, understanding these processes and the quality assurance measures is critical to selecting reliable suppliers and ensuring product consistency.

The production of coated abrasives typically follows four main stages: material preparation, forming, assembly, and finishing. Each stage incorporates specific techniques to achieve the desired abrasive properties.

Illustrative Image (Source: Google Search)

Robust quality assurance (QA) is essential to maintain product consistency and meet international buyer expectations. The following outlines key standards, checkpoints, and testing methodologies relevant for coated abrasive suppliers.

To mitigate supply risks and ensure product quality, buyers should implement thorough supplier verification protocols.

By understanding the detailed manufacturing steps and implementing stringent quality assurance practices, B2B buyers across Africa, South America, the Middle East, and Europe can confidently select coated abrasive suppliers who deliver consistent, high-quality products tailored to their operational needs. This knowledge empowers buyers to reduce supply chain risks, ensure compliance with local and international regulations, and achieve long-term value from their coated abrasive investments.

When sourcing coated abrasives, it is critical for B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—to grasp the multifaceted cost structure that underpins pricing. The primary cost components include:

Pricing for coated abrasives is not static and depends on several dynamic factors:

To optimize procurement costs and ensure value in coated abrasive sourcing, consider the following actionable insights:

Prices for coated abrasives vary widely depending on specifications, order size, supplier, and market conditions. The figures and factors discussed herein are indicative and should be used as a framework for negotiation and cost analysis rather than definitive price quotes. Buyers are encouraged to conduct thorough supplier evaluations and request tailored quotations to align costs with their operational requirements.

By carefully analyzing these cost drivers and strategic considerations, international B2B buyers can make informed sourcing decisions that balance price, quality, and supply chain resilience in the coated abrasive market.

Understanding the technical specifications and trade terminology associated with coated abrasives is crucial for international B2B buyers, especially those sourcing from diverse markets such as Africa, South America, the Middle East, and Europe. This knowledge ensures precise communication, optimal product selection, and smoother procurement processes.

Abrasive Material Grade

The abrasive grains (e.g., aluminum oxide, silicon carbide, ceramic) determine the cutting efficiency and durability of the coated abrasive. Different grades suit various applications, from metal grinding to wood sanding. Selecting the appropriate grade is essential to meet performance requirements and extend tool life, impacting cost-effectiveness.

Backing Material

The base layer, often paper, cloth, or polyester film, provides support and flexibility. Its choice affects the abrasive’s strength, flexibility, and suitability for specific tools or surfaces. For example, cloth backings offer durability for heavy-duty use, while paper backings are cost-effective for lighter tasks.

Grit Size (Mesh Size)

Grit size indicates the coarseness of abrasive particles, typically ranging from very coarse (24 grit) to ultra-fine (1200 grit). Coarse grits remove material quickly, while fine grits provide smooth finishes. Understanding grit size helps buyers specify abrasives that match their machining or finishing needs.

Bonding Agent Type

The adhesive bonding the abrasive grains to the backing can be resin, glue, or vitrified bonds. This influences heat resistance, wear rate, and flexibility. Resin bonds, for example, are common for high-performance abrasives and offer good heat resistance, important for industrial applications.

Tolerance and Dimensions

Consistency in size (length, width, thickness) and tolerance levels ensures compatibility with machinery and reduces waste. Buyers should confirm that suppliers adhere to international standards to avoid operational disruptions and ensure interchangeability of products.

Coating Density and Structure

This refers to how densely abrasive grains are packed and the pattern of coating (open or closed coat). Open coat abrasives prevent clogging in softer materials, while closed coats provide a smoother finish on harder surfaces. This property directly affects productivity and finish quality.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or products used in another company’s finished goods. For buyers, sourcing OEM-grade abrasives guarantees quality and compatibility with specific machinery or production lines.

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier is willing to sell in one order. Understanding MOQ is vital for budgeting and inventory planning, especially for buyers in emerging markets or smaller enterprises where capital and storage may be limited.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, availability, and terms for specific coated abrasives. Crafting precise RFQs with technical specifications helps buyers receive accurate and competitive offers, facilitating better decision-making.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities and risks between buyers and sellers during shipping (e.g., FOB, CIF, DDP). Clarity on Incoterms is crucial for international buyers to understand cost allocation, customs duties, and delivery logistics.

Batch/Lot Number

Identifies a specific production run, allowing traceability for quality control. For large-scale buyers, tracking batch numbers ensures consistent product quality and facilitates recalls or warranty claims if issues arise.

Lead Time

The time between placing an order and receiving the product. Accurate lead time expectations help buyers plan production schedules and manage supply chain risks, particularly when dealing with long-distance shipments.

By mastering these technical properties and trade terms, international B2B buyers can negotiate more effectively, ensure product suitability, and streamline procurement of coated abrasives. This foundational knowledge supports informed sourcing decisions that align with operational goals and regional market dynamics.

The global coated abrasive market is experiencing steady growth, driven by expanding industrialization, automotive production, and construction activities across regions such as Africa, South America, the Middle East, and Europe. Key market drivers include increasing demand for precision surface finishing, automation in manufacturing processes, and the rising adoption of advanced materials in sectors like aerospace, automotive, and metal fabrication. For B2B buyers, understanding regional nuances is crucial: Africa and South America are witnessing infrastructural development and increased manufacturing investments, while Europe, particularly countries like France, emphasizes high-quality standards and innovation in abrasive technologies. The Middle East’s market growth is propelled by oil & gas sector maintenance and construction booms.

Emerging sourcing trends include the integration of digital platforms and Industry 4.0 technologies, enabling real-time inventory management, supplier transparency, and streamlined procurement processes. Buyers are increasingly leveraging data analytics and AI-powered tools to optimize supplier selection and demand forecasting. Additionally, the shift towards customized coated abrasives tailored to specific applications is gaining momentum, driven by advances in abrasive grain technology and bonding agents.

Market dynamics are also shaped by competitive pricing pressures and the need for reliable supply chains amid global disruptions. International buyers should prioritize suppliers who demonstrate agility in logistics and robust after-sales support. Strategic partnerships and long-term contracts are becoming more prevalent to mitigate risks. Furthermore, regional trade agreements and tariff regulations influence sourcing decisions, especially for import-dependent markets in Africa and South America.

Sustainability is increasingly pivotal in the coated abrasive sector, driven by growing environmental regulations and corporate responsibility initiatives worldwide. The production of coated abrasives traditionally involves energy-intensive processes and the use of synthetic resins and mineral abrasives, which can impact air quality, waste generation, and resource depletion. Consequently, B2B buyers must assess suppliers based on their environmental footprint, including energy efficiency, waste reduction practices, and the use of renewable or recycled materials.

Ethical sourcing extends beyond environmental concerns to encompass labor practices, transparency, and supply chain integrity. Buyers from Europe and other regions with strict regulatory frameworks are particularly focused on compliance with international standards such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and ISO 14001 for environmental management. Partnering with suppliers who hold certifications like FSC (Forest Stewardship Council) for paper backing materials or use bio-based resins can significantly enhance sustainability credentials.

Illustrative Image (Source: Google Search)

Green certifications and eco-labels for coated abrasives are emerging as differentiators in the marketplace. Products designed for reduced dust emissions, longer service life, and lower energy consumption during use align with sustainable procurement goals. For buyers in Africa, South America, and the Middle East, emphasizing sustainability can support market access to Europe and other environmentally conscious regions, while also contributing to local environmental stewardship.

The coated abrasive industry has evolved significantly since its inception in the early 20th century, initially focused on simple sandpaper products. Innovations in abrasive grains—from natural materials like garnet to synthetic aluminum oxide and silicon carbide—have dramatically improved performance and application scope. The development of advanced bonding technologies, including resin and polymer-based coatings, enabled enhanced durability and precision.

Historically, the industry’s growth paralleled the rise of mass manufacturing and automotive assembly lines, necessitating consistent and high-quality abrasive materials. Over time, globalization expanded supply chains and diversified sourcing options, allowing international buyers to access a broader range of products tailored to specific industrial needs. Today’s coated abrasives reflect a blend of traditional expertise and cutting-edge technology, with sustainability and digital integration shaping their future trajectory.

How can I effectively vet suppliers of coated abrasives for international B2B purchases?

Begin by verifying the supplier’s business licenses and certifications relevant to coated abrasives, such as ISO 9001 for quality management. Request product samples to assess abrasive quality and consistency. Check references or reviews from other international buyers, especially those within your region (Africa, South America, Middle East, Europe). Confirm the supplier’s experience with international shipping and customs processes to avoid delays. Utilize third-party inspection services if necessary to audit manufacturing facilities and quality controls prior to placing large orders.

Is customization of coated abrasives available for specific industrial applications, and how should I approach this with suppliers?

Yes, many manufacturers offer customization in terms of abrasive grain type, backing material, grit size, and coating adhesive to suit different applications such as metal finishing, woodworking, or automotive. Clearly communicate your technical requirements and intended use cases upfront. Provide detailed specifications or samples of existing products you want to improve upon. Negotiate minimum order quantities (MOQs) for custom batches, as customization often requires larger orders or tooling investments. Always request prototyping or trial runs before committing to full production.

What are typical minimum order quantities (MOQs) and lead times for coated abrasive products in international trade?

MOQs vary widely depending on the supplier and product type but typically range from a few hundred to several thousand units per SKU. Lead times usually span from 3 to 8 weeks, factoring in production and international shipping. For buyers in Africa, South America, the Middle East, and Europe, it’s critical to confirm lead times that include customs clearance and inland transport. Negotiate flexible MOQs if you are testing a new supplier or product line. Build lead times into your procurement planning to avoid stockouts.

What payment terms are standard when sourcing coated abrasives internationally, and how can I secure favorable terms?

Common international payment methods include Letters of Credit (L/C), Telegraphic Transfers (T/T), and escrow services. L/Cs offer the most security for both parties but may involve higher bank fees. T/T payments are faster but riskier for buyers if the supplier is unproven. To negotiate better terms, establish a long-term relationship and demonstrate a solid payment history. Request partial payments upfront with balance on delivery or inspection. Consider trade finance options available in your region to ease cash flow.

Which quality assurance certifications should I expect from coated abrasive suppliers to ensure product reliability?

Look for ISO 9001 certification as a baseline, indicating consistent quality management processes. Other relevant certifications include OHSAS 18001 or ISO 45001 for occupational health and safety, and environmental certifications like ISO 14001 if sustainability is a concern. Suppliers should provide detailed product datasheets, batch testing reports, and compliance with international standards such as ANSI or FEPA for abrasive materials. Insist on third-party testing or factory audits if quality is critical to your application.

How do I manage logistics and shipping challenges when importing coated abrasives from international suppliers?

Work closely with suppliers to select appropriate packaging that protects abrasive products from moisture and damage during long transit. Confirm Incoterms (e.g., FOB, CIF, DDP) to clarify responsibilities and costs. Choose reliable freight forwarders experienced in your region’s import regulations, especially for Africa, South America, and the Middle East where customs can be complex. Plan for potential delays and customs inspections by building buffer time. Track shipments actively and maintain communication with all parties involved to resolve issues promptly.

What steps should I take if there is a quality dispute or product non-conformance after receiving coated abrasives?

Immediately document the issue with photos and detailed descriptions. Notify the supplier within the agreed warranty or claim period, referencing contract terms. Request a root cause analysis and corrective action plan. If possible, arrange for independent third-party inspection to support your claim. Negotiate remedies such as product replacement, refund, or credit note. Maintain professional communication and keep all correspondence written. If disputes escalate, consider mediation or arbitration clauses included in the contract to resolve conflicts efficiently.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of coated abrasives is pivotal for businesses aiming to optimize operational efficiency, cost-effectiveness, and product quality. For international B2B buyers across Africa, South America, the Middle East, and Europe, understanding supplier capabilities, material innovations, and regional market dynamics is essential. Prioritizing partnerships with reliable manufacturers who demonstrate consistent quality and compliance with international standards can significantly reduce supply chain risks.

Key takeaways include the importance of assessing abrasive grit types, bonding agents, and backing materials in relation to your specific industrial applications. Leveraging strategic sourcing enables buyers to negotiate better terms, secure favorable lead times, and gain access to cutting-edge abrasive technologies that enhance productivity. Furthermore, embracing sustainability trends and supplier transparency will increasingly influence purchasing decisions and brand reputation.

Looking ahead, buyers should actively cultivate supplier relationships that offer agility and innovation, particularly as global demand for advanced coated abrasives grows. Markets like France and Egypt are witnessing rising industrial modernization, presenting new sourcing opportunities. To stay competitive, international buyers must adopt a proactive sourcing approach—integrating market intelligence, quality assurance, and cost management—to unlock long-term value and drive business growth in the evolving coated abrasive landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina