Crystal carborundum stands as a cornerstone material in numerous industrial applications, prized for its exceptional hardness, thermal stability, and electrical conductivity. For international B2B buyers across Africa, South America, the Middle East, and Europe—including dynamic markets such as Thailand and Saudi Arabia—understanding the nuances of sourcing this critical compound is essential to maintaining competitive advantage and operational excellence.

This guide offers a comprehensive exploration of crystal carborundum, tailored to empower procurement professionals and industrial buyers with actionable insights. It delves into the various types and grades of crystal carborundum, highlighting how material composition influences performance in sectors ranging from abrasives and refractories to electronics and automotive manufacturing.

Manufacturing processes and quality control protocols are examined in detail to help buyers assess supplier reliability and product consistency. Additionally, the guide provides an in-depth overview of the global supplier landscape, spotlighting reputable manufacturers and distributors who adhere to stringent standards and sustainable practices.

Cost analysis and market trends are included to assist buyers in negotiating favorable terms and anticipating shifts in supply and demand. A dedicated FAQ section addresses common challenges and clarifies technical considerations, reducing uncertainty in complex international transactions.

By synthesizing technical knowledge with market intelligence, this guide equips B2B buyers with the tools needed to make informed, strategic sourcing decisions—ensuring access to high-quality crystal carborundum that meets precise industrial requirements while optimizing cost-efficiency and supply chain resilience.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Monocrystalline Carborundum | Single crystal structure, high purity, uniform grain size | Precision grinding, semiconductor manufacturing | Pros: Superior hardness and consistency; excellent for high-precision tasks. Cons: Higher cost; limited availability in large sizes. |

| Polycrystalline Carborundum | Composed of multiple crystallites, varied grain sizes | General abrasives, cutting tools, refractory linings | Pros: Cost-effective; good toughness. Cons: Lower precision; may wear unevenly. |

| Fused Crystal Carborundum | Manufactured by fusing raw materials at high temperatures | High-strength abrasives, polishing, refractory materials | Pros: High thermal stability and strength; versatile. Cons: Slightly lower purity; heavier than monocrystalline. |

| Coated Crystal Carborundum | Base carborundum particles coated with bonding or functional layers | Specialized abrasives, enhanced wear resistance tools | Pros: Enhanced durability and specific functional properties. Cons: Higher production complexity and cost. |

| Electrolytic Crystal Carborundum | Produced via electrolytic refining for ultra-high purity | Electronics, optics, ultra-precision machining | Pros: Exceptional purity and surface finish. Cons: Very high cost; niche applications only. |

Monocrystalline carborundum features a uniform crystal lattice that delivers superior hardness and wear resistance, making it ideal for precision grinding and semiconductor manufacturing. For B2B buyers in industries such as electronics or fine machining, this type offers unparalleled performance but comes at a premium price. Buyers should assess the cost-to-performance ratio carefully, especially when large quantities or sizes are required.

This variation consists of many small crystals bonded together, offering a balance between performance and cost. It is widely used in general-purpose abrasives, cutting tools, and refractory linings. B2B buyers targeting bulk industrial applications will appreciate its toughness and affordability, though it may not meet the stringent precision needs of high-tech sectors. Evaluating the end-use environment is critical to ensure suitability.

Produced by melting raw materials at extremely high temperatures, fused crystal carborundum boasts excellent thermal stability and mechanical strength. This makes it well-suited for high-strength abrasives, polishing compounds, and refractory applications. Buyers from regions with heavy manufacturing or metallurgical industries should consider this type for its versatility and durability, bearing in mind its slightly lower purity compared to monocrystalline forms.

Coated variants involve carborundum particles layered with specialized coatings to enhance wear resistance or add functional properties such as chemical stability. These are favored in industries requiring extended tool life or specific abrasive characteristics, such as automotive or aerospace manufacturing. While the cost is higher due to added processing, the enhanced performance can justify the investment for buyers focused on long-term operational efficiency.

This ultra-pure form is created through electrolytic refining, delivering exceptional surface finish and purity. Its applications are mostly niche, including electronics, optics, and ultra-precision machining where contamination must be minimized. B2B buyers in advanced technology sectors should weigh the high procurement costs against the critical quality demands of their products, ensuring alignment with their precision manufacturing standards.

Related Video: The Genius Behind Bach's Goldberg Variations: CANONS

| Industry/Sector | Specific Application of crystal carborundum | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Abrasives & Grinding | High-performance grinding wheels and abrasive tools | Enhanced durability and cutting precision reduce downtime | Consistent grain size, purity, and hardness; supplier reliability |

| Electronics & Semiconductors | Substrate and heat sink materials for high-power electronic devices | Superior thermal conductivity improves device performance and longevity | Material purity, thermal properties, and compatibility with manufacturing processes |

| Metallurgy & Foundry | Refractory linings and crucibles for high-temperature processes | Increased resistance to thermal shock and wear extends equipment life | Chemical stability, thermal resistance, and supplier certification |

| Automotive & Aerospace | Wear-resistant coatings and components for engines and machinery | Improved component lifespan and performance under extreme conditions | Quality assurance, particle size distribution, and compliance with industry standards |

| Construction & Stone Cutting | Cutting and polishing of hard stones and ceramics | Faster cutting speeds and longer tool life reduce operational costs | Abrasive quality, grain uniformity, and supply chain consistency |

Abrasives & Grinding

Crystal carborundum is widely used in the manufacturing of grinding wheels and abrasive tools, providing exceptional hardness and sharpness. This application addresses the need for efficient material removal and surface finishing in metalworking and other industries. Buyers in Africa, South America, the Middle East, and Europe should prioritize suppliers that guarantee consistent grain size and purity to ensure performance and reduce tool wear, which is critical for maintaining productivity and lowering operational costs.

Electronics & Semiconductors

In electronics, crystal carborundum serves as a substrate and heat sink material due to its excellent thermal conductivity and electrical insulation properties. This application is vital for high-power devices where heat dissipation is crucial for reliability and performance. B2B buyers must focus on material purity and compatibility with semiconductor fabrication processes. Regions with growing electronics manufacturing, such as parts of Europe and the Middle East, benefit greatly from sourcing high-grade crystal carborundum with certified thermal properties.

Metallurgy & Foundry

The refractory nature of crystal carborundum makes it ideal for linings and crucibles in metallurgical operations that require extreme thermal resistance. It helps withstand thermal shocks and corrosive environments, extending the service life of equipment used in steelmaking and other metal processing industries. International buyers should evaluate chemical stability and thermal resistance certifications, ensuring suppliers meet stringent quality standards to avoid costly downtime and maintenance.

Automotive & Aerospace

Crystal carborundum is employed in wear-resistant coatings and precision components exposed to high stress and temperature, such as engine parts and turbine blades. Its use improves durability and operational efficiency under harsh conditions. For B2B buyers in these sectors, especially in Europe and the Middle East, sourcing considerations include particle size distribution and adherence to automotive/aerospace industry standards to maintain safety and performance benchmarks.

Construction & Stone Cutting

In construction, crystal carborundum is utilized for cutting, grinding, and polishing hard stones and ceramics. Its high hardness enables faster processing and longer-lasting tools, reducing operational costs. Buyers from emerging markets in Africa and South America should seek suppliers offering consistent abrasive quality and grain uniformity to maximize cutting efficiency and tool life, supporting large-scale infrastructure and development projects.

Related Video: Carborundum Mezzotype: Dark Field/Reductive Techniques with Akua Carborundum Gel

Key Properties: Silicon carbide is renowned for its exceptional hardness, thermal conductivity, and chemical inertness. It withstands temperatures up to 1600°C and exhibits excellent corrosion resistance against acids and alkalis. Its high mechanical strength and thermal shock resistance make it ideal for harsh industrial environments.

Pros & Cons: SiC offers outstanding durability and wear resistance, which translates to long service life in abrasive or high-temperature applications. However, it tends to be more expensive and requires specialized manufacturing processes like sintering or chemical vapor deposition, which can increase lead times. Its brittleness may pose challenges in impact-prone applications.

Impact on Application: SiC crystal carborundum is widely used in high-performance abrasives, refractory linings, and semiconductor substrates. It performs well in corrosive media and high-temperature processes, making it suitable for chemical processing, metallurgy, and electronics industries.

International Buyer Considerations: Buyers from Africa, South America, the Middle East, and Europe should verify compliance with ASTM C12 or DIN EN standards for silicon carbide abrasives. Regions with high ambient temperatures or corrosive industrial environments, such as Saudi Arabia or Brazil, will benefit from SiC’s robustness. Importers should also consider local manufacturing capabilities and supply chain logistics due to the material’s specialized processing.

Key Properties: Aluminum oxide is a hard, wear-resistant ceramic with a melting point around 2072°C. It offers good electrical insulation, moderate thermal conductivity, and excellent chemical stability in neutral and acidic environments. It is less thermally conductive than SiC but more resistant to oxidation.

Pros & Cons: Al2O3 is generally more cost-effective than silicon carbide and easier to manufacture using conventional sintering techniques. It is less brittle and offers better toughness, which is advantageous for impact resistance. However, it has lower thermal conductivity and can degrade in highly alkaline conditions.

Impact on Application: This material is commonly used in grinding wheels, cutting tools, and protective coatings. Its chemical resistance suits applications involving acidic media, such as in chemical plants or water treatment facilities. It is also favored in electrical insulation components.

International Buyer Considerations: Aluminum oxide products typically conform to ASTM C799 or DIN EN 60672 standards. Buyers in regions like Europe and the Middle East should ensure certifications for industrial safety and environmental compliance. The material’s moderate cost and versatility make it attractive for emerging markets in Africa and South America, where cost-efficiency is critical.

Key Properties: Boron carbide is one of the hardest known materials, with high neutron absorption capabilities and excellent resistance to abrasion and chemical attack. It tolerates temperatures up to about 2450°C and has low density, making it lightweight yet extremely durable.

Pros & Cons: The superior hardness and chemical resistance make boron carbide ideal for ballistic armor, nuclear applications, and abrasive media. However, it is costly and difficult to process due to its hardness and brittleness. Manufacturing complexity can lead to longer lead times and higher minimum order quantities.

Impact on Application: Boron carbide crystal carborundum is suited for specialized industrial applications requiring extreme wear resistance and chemical inertness, such as in nuclear reactors or high-performance cutting tools. Its neutron absorption property is critical for shielding in nuclear energy sectors.

International Buyer Considerations: Compliance with ASTM C799 and ISO 9001 quality management standards is essential. Buyers from technologically advanced markets in Europe and the Middle East will find boron carbide valuable for high-tech industries. For African and South American buyers, cost and supply chain reliability should be carefully evaluated.

Key Properties: Zirconium oxide offers excellent fracture toughness, high melting point (~2700°C), and outstanding chemical stability. It has superior thermal insulation properties and is resistant to corrosion in acidic and alkaline environments.

Pros & Cons: ZrO2 is tougher than most ceramics, reducing the risk of cracking under mechanical stress. It is biocompatible and used in medical and dental applications, as well as industrial ceramics. However, it is more expensive than aluminum oxide and has lower thermal conductivity than silicon carbide.

Impact on Application: Zirconium oxide crystal carborundum is ideal for high-stress applications requiring toughness and chemical resistance, such as in cutting tools, wear parts, and thermal barrier coatings. Its biocompatibility also opens niche markets in medical device manufacturing.

International Buyer Considerations: Buyers should ensure compliance with ISO 13356 for biocompatibility and ASTM standards for industrial ceramics. European and Middle Eastern markets often demand stringent quality certifications. For buyers in Africa and South America, the premium cost is justified in applications where durability and toughness are paramount.

| Material | Typical Use Case for crystal carborundum | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) | High-temperature abrasives, refractory linings, semiconductors | Exceptional hardness and thermal resistance | Brittle, higher cost, complex manufacturing | High |

| Aluminum Oxide (Al2O3) | Grinding wheels, cutting tools, electrical insulation | Cost-effective, good toughness, chemical stability | Lower thermal conductivity, less alkaline resistance | Medium |

| Boron Carbide (B4C) | Ballistic armor, nuclear shielding, abrasive media | Extreme hardness, neutron absorption | Very costly, difficult to process | High |

| Zirconium Oxide (ZrO2) | Wear parts, cutting tools, medical devices | High fracture toughness, chemical stability | Higher cost, lower thermal conductivity | High |

Crystal carborundum, a highly durable and thermally stable abrasive material, is produced through a sequence of precise manufacturing stages designed to ensure optimal crystalline structure and performance. Understanding these stages helps B2B buyers evaluate supplier capabilities and product consistency.

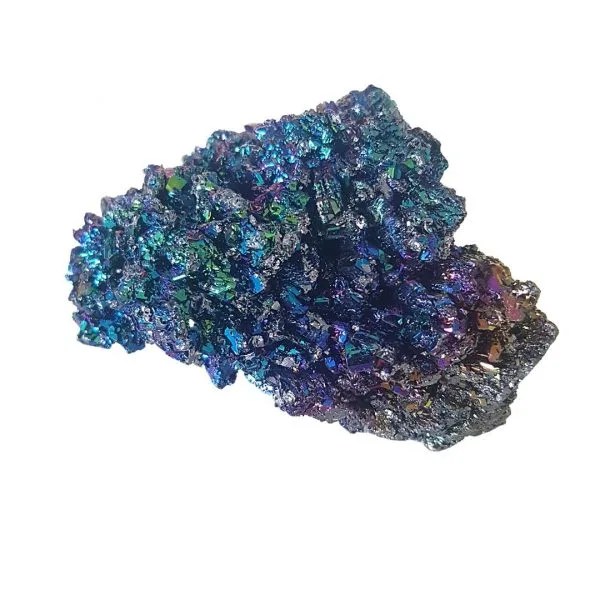

Illustrative Image (Source: Google Search)

Forming and Sintering

The prepared powders are then shaped into the desired form—often blocks, grains, or specific geometries—using methods like cold pressing or isostatic pressing. Following forming, the material is sintered at extremely high temperatures (typically above 2000°C) in an inert or reducing atmosphere. This step facilitates the growth of a dense, crystalline structure with enhanced mechanical strength and thermal conductivity.

Annealing and Crystal Growth Optimization

Post-sintering, the material may undergo annealing processes to relieve internal stresses and optimize the crystalline lattice. Controlled cooling rates are critical to avoid defects such as cracks or unwanted grain boundaries.

Cutting, Shaping, and Finishing

The sintered crystal blocks are then precision-cut into specified sizes using diamond wire saws or laser cutting. Subsequent finishing processes include grinding, polishing, and sometimes coating, to meet dimensional tolerances and surface quality requirements.

Assembly (if applicable)

For composite or assembled components (e.g., abrasive tools incorporating crystal carborundum), the crystal parts are integrated into the final product via bonding agents or mechanical fixtures. Assembly is performed under cleanroom conditions to prevent contamination.

International B2B buyers must prioritize suppliers adhering to robust quality assurance (QA) systems to guarantee product reliability and compliance with global standards.

ISO 9001:2015

This is the foundational quality management standard that ensures suppliers maintain consistent production quality, process control, and continuous improvement. Buyers should verify that their suppliers are ISO 9001 certified with scope covering crystal carborundum manufacturing.

Industry-Specific Certifications

Depending on application sectors, additional certifications may be relevant:

A comprehensive quality control (QC) system is segmented into critical checkpoints, ensuring defects are caught early and product integrity is maintained throughout the manufacturing cycle:

Incoming Quality Control (IQC)

Raw materials are rigorously inspected for purity, particle size, and contamination. Spectroscopy and X-ray fluorescence (XRF) are common techniques used to verify chemical composition.

In-Process Quality Control (IPQC)

During sintering and forming stages, parameters such as temperature profiles, pressure, and atmosphere composition are continuously monitored. Non-destructive testing (NDT) methods like ultrasonic inspection detect internal flaws early.

Final Quality Control (FQC)

Finished products undergo dimensional verification, hardness testing (e.g., Vickers or Mohs hardness scale), and surface integrity assessments. Optical microscopy and scanning electron microscopy (SEM) may be employed to inspect crystal morphology.

Performance Testing

Functional tests such as thermal shock resistance, abrasion resistance, and fracture toughness are conducted to ensure the crystal carborundum meets specific application requirements.

For international buyers, particularly from Africa, South America, the Middle East, and Europe, verifying supplier QC practices is essential to mitigate risks associated with product quality and supply chain disruptions.

Supplier Audits

Conduct on-site or virtual audits focusing on manufacturing processes, QC procedures, equipment calibration, and personnel training. Audits help validate supplier claims and identify potential gaps.

Request for Quality Documentation

Buyers should obtain and review quality manuals, ISO certificates, test reports, and batch traceability records. Transparent documentation indicates supplier commitment to quality.

Third-Party Inspection and Testing

Engaging independent inspection agencies to perform random batch sampling and testing provides unbiased assurance. This is particularly critical when dealing with new suppliers or high-value orders.

Sample Evaluation

Prior to large-scale procurement, requesting product samples for in-house or third-party lab testing allows buyers to confirm material properties and compatibility with their applications.

International buyers must consider regional regulatory environments, logistics challenges, and cultural factors influencing QC practices:

Africa and South America

Infrastructure variability may affect timely quality inspections and shipping conditions. Buyers should emphasize robust packaging standards and insist on comprehensive testing to avoid damage during transit.

Middle East (e.g., Saudi Arabia)

Compliance with local industrial standards and certifications (such as SASO in Saudi Arabia) is critical. Additionally, climatic conditions necessitate checks for thermal stability and moisture resistance.

Europe and Thailand

European buyers often require stringent environmental and chemical safety compliance (REACH, RoHS). Thai buyers may focus on supplier flexibility and certifications aligned with ASEAN standards.

For B2B buyers sourcing crystal carborundum internationally, a deep understanding of the manufacturing processes and rigorous quality assurance protocols is indispensable. Evaluating suppliers through documented certifications, on-site audits, and independent testing ensures procurement of high-performance, reliable materials. Tailoring verification strategies to regional considerations further strengthens supply chain resilience and product excellence.

Understanding the cost and pricing dynamics of crystal carborundum is essential for international B2B buyers aiming to optimize procurement strategies and ensure competitive advantage. This analysis breaks down key cost components, price influencers, and practical buyer tips tailored for markets in Africa, South America, the Middle East, and Europe, including countries like Thailand and Saudi Arabia.

Raw Materials: The primary cost driver is the quality and source of raw silicon carbide crystals. Purity levels and the cost of precursor materials (silicon and carbon) significantly impact pricing. Variations in mineral origin and processing methods can cause price fluctuations.

Labor: Skilled labor costs affect production expenses, especially where precision crystal growth and finishing processes are required. Labor-intensive steps like slicing, polishing, and quality inspection add to total costs.

Manufacturing Overhead: Includes utilities, facility maintenance, and indirect labor. High-tech manufacturing environments with clean rooms or controlled atmospheres elevate overhead costs.

Tooling and Equipment: Specialized crystal growth furnaces, cutting tools, and polishing equipment require substantial capital investment and periodic maintenance, contributing to the amortized tooling costs.

Quality Control (QC): Rigorous inspection protocols, including optical and structural analysis, add operational costs but ensure product reliability, which is critical for high-end industrial applications.

Logistics and Handling: Packaging to prevent damage during transit, freight charges, customs duties, and insurance costs form a significant portion of the landed cost, particularly for buyers importing from distant suppliers.

Profit Margin: Suppliers include a margin to cover business risks and ensure sustainability, which varies based on market competition and order scale.

Order Volume and Minimum Order Quantity (MOQ): Larger orders typically receive volume discounts. However, MOQs can be restrictive for smaller buyers, impacting unit price competitiveness.

Specifications and Customization: Custom crystal sizes, shapes, doping levels, or surface treatments increase costs. Standardized products are generally more affordable.

Material Quality and Certifications: Certified grades with documented purity and performance standards command premium prices, especially for applications in aerospace, electronics, and automotive sectors.

Supplier Location and Reputation: Established suppliers with proven track records may charge more but reduce risks of quality issues and delivery delays.

Incoterms and Payment Terms: The choice of Incoterms (e.g., FOB, CIF, DDP) affects who bears logistics and customs costs, influencing total procurement expenditure. Favorable payment terms can also improve cash flow management.

Negotiate Based on Total Cost of Ownership (TCO): Look beyond the unit price to consider shipping, customs, storage, and potential rework costs. For buyers in Africa or South America, port handling and inland transportation can notably increase costs.

Leverage Volume Consolidation: Pooling orders with partners or scheduling larger but less frequent shipments can reduce per-unit logistics costs, especially for buyers in regions with high freight tariffs.

Assess Supplier Certifications and Quality Assurance: Prioritize suppliers offering traceability and compliance certificates to minimize downstream quality risks and warranty claims, which can be costlier than initial price savings.

Understand Regional Pricing Nuances: Middle Eastern buyers, such as in Saudi Arabia, should consider local import regulations and tariffs, while European buyers benefit from intra-EU trade agreements reducing customs overhead.

Clarify Incoterms Early: Define responsibilities clearly to avoid unexpected expenses. For example, opting for DDP (Delivered Duty Paid) can simplify procurement but may come at a higher price compared to FOB (Free On Board).

Request Samples and Pilot Orders: Before committing to large volumes, validate product quality and supplier reliability with samples or pilot runs, preventing costly mistakes.

Prices for crystal carborundum vary widely based on market conditions, supplier capabilities, and customization requirements. The analysis provided is indicative and should be supplemented with direct supplier quotations and up-to-date market research tailored to your specific sourcing context.

This comprehensive understanding empowers international B2B buyers to make informed decisions, optimize procurement costs, and build resilient supply chains for crystal carborundum sourcing.

When sourcing crystal carborundum for industrial applications, understanding its key technical properties is essential to ensure product performance, consistency, and cost-efficiency. Below are the primary specifications buyers should evaluate:

Material Grade (Purity Level)

This refers to the percentage of silicon carbide (SiC) in the crystal carborundum. Higher purity grades (e.g., 99.5%+) offer superior hardness and thermal conductivity, making them ideal for precision grinding and high-temperature applications. Lower grades may be suitable for less demanding tasks but can affect product lifespan.

Grain Size and Distribution

Crystal carborundum is available in various grain sizes, from coarse to fine. Grain size impacts surface finish and cutting efficiency. For example, finer grains provide smoother finishes, while coarser grains enable aggressive material removal. Consistency in grain size distribution ensures uniformity in production processes.

Tolerance and Dimensional Accuracy

Tolerance defines the allowable deviation in crystal dimensions or particle sizes. Tight tolerances (e.g., ±5 microns) are crucial for applications requiring high precision, such as semiconductor manufacturing. Looser tolerances may be acceptable for general abrasives but can lead to variability in performance.

Thermal Stability and Resistance

Crystal carborundum’s ability to maintain structural integrity under high temperatures is vital, especially in metalworking and machining environments. High thermal stability prevents degradation or phase changes during use, ensuring consistent abrasive properties.

Hardness (Mohs Scale)

With a hardness typically around 9-9.5 on the Mohs scale, crystal carborundum is one of the hardest abrasives available. This property determines its effectiveness in cutting, grinding, and polishing hard materials like glass, ceramics, and metals.

Bulk Density

Bulk density affects handling, shipping costs, and packing volume. Buyers should verify bulk density specifications to optimize logistics and storage, especially when ordering large quantities.

Understanding these properties allows B2B buyers to specify the right crystal carborundum grade tailored to their industrial needs, reducing waste and improving operational efficiency.

Navigating international B2B purchases of crystal carborundum requires familiarity with common industry terms that impact pricing, delivery, and contract negotiations:

OEM (Original Equipment Manufacturer)

Refers to suppliers who produce crystal carborundum components that other companies incorporate into their final products. Buyers looking for OEM partnerships can secure customized grades or packaging tailored to their production lines.

MOQ (Minimum Order Quantity)

The smallest amount a supplier is willing to sell per order. MOQ affects pricing and inventory management. For buyers in emerging markets like Africa or South America, negotiating MOQs that align with demand and cash flow is critical to avoid overstocking.

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers requesting detailed pricing, delivery times, and product specifications. Crafting precise RFQs with technical requirements and volume estimates helps ensure accurate and competitive quotes.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Understanding Incoterms is vital to control costs and manage risk across borders.

Lead Time

The period from order placement to delivery. Lead times for crystal carborundum can vary based on production capacity and shipping routes. Buyers should factor lead time into production planning to avoid delays.

Batch Number / Lot Number

A unique identifier assigned to a production batch of crystal carborundum. This enables traceability for quality control and compliance purposes, which is especially important for industries with strict certification requirements.

By mastering these technical specifications and trade terms, international B2B buyers—from Africa, the Middle East, Europe, and South America—can make informed purchasing decisions, negotiate better contracts, and ensure seamless supply chain operations for crystal carborundum.

Crystal carborundum, a synthetic silicon carbide compound renowned for its exceptional hardness and thermal conductivity, is a critical industrial material used extensively in abrasive, refractory, and semiconductor applications. The global market for crystal carborundum is shaped by several key drivers, including the rising demand for high-performance abrasives in manufacturing, the expansion of the electronics and automotive sectors, and the growing emphasis on energy-efficient materials.

For B2B buyers in Africa, South America, the Middle East, and Europe, understanding regional market dynamics is crucial. Emerging economies in Africa and South America are increasingly investing in infrastructure and industrialization, driving demand for durable abrasives and refractory materials. The Middle East, with its expanding petrochemical and construction industries, also represents a significant growth market. Meanwhile, European buyers emphasize advanced quality standards and innovation, often prioritizing suppliers who integrate cutting-edge production technologies and sustainable practices.

Current sourcing trends highlight a shift towards customized product solutions tailored to specific industrial applications, such as precision grinding and high-temperature insulation. Digital transformation in procurement processes is enabling buyers to engage directly with manufacturers for real-time inventory management and quality assurance. Additionally, supply chain resilience has become a top priority amid global disruptions, prompting buyers to diversify sourcing from multiple geographic regions to mitigate risks.

Technological advancements, such as enhanced crystal growth techniques and doping methods, are improving the performance characteristics of crystal carborundum, enabling new applications in electronics and renewable energy sectors. Buyers should monitor developments in nano-structured carborundum materials, which promise superior mechanical and thermal properties.

Sustainability is increasingly a decisive factor in B2B procurement of crystal carborundum. The production process, typically energy-intensive due to high-temperature synthesis, has a notable environmental footprint. Buyers are encouraged to prioritize suppliers committed to reducing carbon emissions through energy-efficient manufacturing and the use of renewable energy sources.

Ethical sourcing extends beyond environmental concerns to include responsible labor practices and transparent supply chains. International buyers, especially from regions with stringent regulatory frameworks like Europe, are demanding certifications such as ISO 14001 (Environmental Management) and Responsible Minerals Assurance Process (RMAP) compliance to ensure that crystal carborundum is sourced without human rights violations or environmental degradation.

Moreover, the adoption of "green" materials and processes, including recycled silicon carbide feedstock and low-waste production methods, is gaining momentum. Suppliers investing in circular economy principles not only reduce environmental impact but also enhance supply security by minimizing raw material dependency. For buyers in the Middle East and Africa, where regulatory frameworks may still be developing, partnering with certified suppliers can provide competitive advantages and future-proof procurement strategies.

Transparency through blockchain-enabled traceability platforms is an emerging trend, allowing buyers to verify the origin and sustainability credentials of crystal carborundum batches, thus aligning procurement with corporate social responsibility goals.

The development of crystal carborundum dates back to the late 19th century when Edward G. Acheson first synthesized silicon carbide as a synthetic abrasive. Initially produced primarily for grinding and cutting applications, the material’s unique combination of hardness and thermal properties spurred rapid adoption across various industries.

Over the decades, advancements in crystal growth techniques, such as the sublimation and chemical vapor deposition methods, have refined the quality and size of crystal carborundum crystals, expanding their utility into high-tech sectors like semiconductors and LED manufacturing. This evolution underscores the material’s transition from a commoditized abrasive to a sophisticated industrial component, highlighting the importance of sourcing suppliers with advanced technological capabilities.

For international B2B buyers, understanding this historical progression provides insight into the material’s value proposition and the critical role of innovation in supplier selection and product application.

How can I effectively vet suppliers of crystal carborundum for international B2B trade?

Vetting suppliers requires a multi-step approach: first, verify their business licenses, export certifications, and ISO or equivalent quality management accreditations. Request samples to assess product quality and consistency. Check references or client testimonials, especially from buyers in your region (Africa, South America, Middle East, Europe). Use third-party inspection services to audit manufacturing facilities if possible. Also, evaluate their communication responsiveness and ability to meet your technical specifications, which indicates reliability for long-term partnerships.

Is customization of crystal carborundum available, and how should I specify my requirements?

Many manufacturers offer customization in terms of particle size, purity, shape, and packaging. Clearly define your technical needs with detailed specifications, including grit size, crystal form (e.g., fused or synthetic), and any coatings or treatments required. Provide samples or technical drawings if possible. Engage suppliers early to confirm feasibility, minimum order quantities for custom batches, and potential cost implications. Precise communication reduces risks of production errors and ensures the product fits your application requirements.

What are typical minimum order quantities (MOQs) and lead times when ordering crystal carborundum internationally?

MOQs vary widely based on supplier capacity and customization level but typically range from 500 kg to several tons for standard grades. Lead times depend on stock availability and customization but usually span 3 to 8 weeks. For buyers in Africa, South America, and the Middle East, factor in additional shipping and customs clearance time. Negotiate MOQs and lead times upfront, especially if you require smaller trial orders or faster delivery. Establishing a forecast with your supplier can help secure priority production slots.

Which payment terms are standard, and how can I mitigate financial risks in international transactions?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and Escrow services. LCs offer strong security by ensuring funds are released only upon compliance with shipping and product documentation. T/T is faster but riskier, especially with new suppliers. To reduce risks, start with smaller orders under secure payment methods, request supplier bank references, and consider trade credit insurance. Clear contract terms on payment schedules, penalties, and dispute resolution are essential to protect your investment.

What quality assurance certifications and testing should I expect from crystal carborundum suppliers?

Reputable suppliers provide certificates such as ISO 9001 for quality management, and product-specific certificates confirming chemical composition and physical properties. Request third-party lab test reports verifying particle size distribution, purity, hardness, and contamination levels. For applications requiring compliance with environmental or safety standards (e.g., REACH in Europe), confirm relevant certifications. Regular batch testing and traceability protocols demonstrate consistent product quality, which is critical for industrial users relying on crystal carborundum’s abrasive properties.

Illustrative Image (Source: Google Search)

How should I plan logistics and shipping for crystal carborundum imports?

Crystal carborundum is typically shipped in bulk bags or drums, requiring careful handling to avoid contamination or moisture exposure. Coordinate with suppliers to confirm packaging standards suitable for long-distance transport. Choose reliable freight forwarders experienced in handling abrasives and customs clearance in your country. Understand import regulations, duties, and taxes applicable in your region (Africa, South America, Middle East, Europe). Consider shipping modes balancing cost and speed—sea freight is cost-effective for large volumes, while air freight suits urgent smaller shipments.

What steps can I take to resolve disputes or quality issues with international crystal carborundum suppliers?

Establish clear contractual terms covering product specifications, inspection rights, and remedies for non-conformance before ordering. If issues arise, document all discrepancies with photos, lab reports, and communication records. Engage suppliers promptly to negotiate solutions such as replacement shipments, partial refunds, or discounts. If informal negotiations fail, use mediation or arbitration clauses stipulated in the contract to avoid costly litigation. Building strong relationships and clear communication channels minimizes conflict and supports faster resolution.

Are there regional considerations for sourcing crystal carborundum in Africa, South America, the Middle East, and Europe?

Yes, regional factors influence supplier choice and trade logistics. In Africa and South America, port infrastructure and customs efficiency can affect delivery times and costs. The Middle East’s demand for high-purity grades often requires suppliers with advanced production capabilities. Europe has strict environmental and safety regulations, so ensure suppliers comply with EU standards. Also, consider currency volatility and local import regulations. Partnering with suppliers experienced in your region ensures smoother transactions and tailored support for your market’s unique challenges.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In conclusion, crystal carborundum represents a critical material for diverse industrial applications, offering unmatched durability and thermal resistance. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, strategic sourcing of crystal carborundum is essential to secure consistent quality, optimize costs, and ensure supply chain resilience. Prioritizing suppliers with robust certifications, sustainable practices, and proven delivery capabilities will mitigate risks and enhance operational efficiency.

Key takeaways include:

Looking ahead, the growing demand for advanced materials in emerging markets and industrial innovation underscores the importance of proactive sourcing strategies. Buyers are encouraged to deepen supplier collaborations, invest in market intelligence, and embrace digital tools for supply chain transparency. By doing so, businesses will not only secure competitive advantages but also foster long-term growth in a dynamic global marketplace.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina