In today’s rapidly evolving industrial landscape, Chemical Vapor Deposition Silicon Carbide (CVD SiC) stands out as a critical material for high-performance applications. Its exceptional hardness, thermal stability, and chemical resistance make it indispensable across sectors such as electronics, aerospace, automotive, and energy. For international B2B buyers—especially those operating within Africa, South America, the Middle East, and Europe—understanding the nuances of CVD SiC is essential to sourcing the right products that meet stringent quality and performance standards.

This guide offers a comprehensive roadmap designed to empower procurement professionals and technical decision-makers with actionable insights. You will explore the diverse types and grades of CVD SiC, key raw materials, and state-of-the-art manufacturing and quality control processes that define product reliability. Additionally, the guide delves into global supplier landscapes, pricing dynamics, and market trends to help buyers from regions such as Turkey and Argentina navigate complex supply chains confidently.

By consolidating technical knowledge and market intelligence, this resource aims to reduce sourcing risks and optimize procurement strategies. Whether you seek to evaluate new suppliers, understand cost drivers, or clarify technical specifications, this guide provides a clear framework to make informed decisions that align with your operational goals. Embrace this opportunity to enhance your competitive edge through deeper market understanding and strategic supplier engagement in the CVD SiC sector.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Thermal CVD SIC | Uses heat to decompose gases, forming silicon carbide layers | Semiconductor wafers, high-power electronics | Pros: High purity, uniform layers; Cons: Energy-intensive, slower process |

| Plasma-Enhanced CVD SIC | Employs plasma to lower reaction temperatures and enhance deposition | Microelectromechanical systems (MEMS), sensors | Pros: Lower temp, better control; Cons: Equipment complexity, higher initial cost |

| Low-Pressure CVD SIC | Operates under reduced pressure to improve film quality | Coatings for cutting tools, wear-resistant parts | Pros: High film density, good adhesion; Cons: Requires vacuum systems, higher maintenance |

| Atmospheric Pressure CVD SIC | Deposits films at ambient pressure, suitable for large-area substrates | Large-scale industrial coatings, automotive parts | Pros: Cost-effective, scalable; Cons: Lower film uniformity, limited precision |

| Metal-Organic CVD SIC | Uses metal-organic precursors for precise composition control | Advanced optoelectronics, power devices | Pros: Excellent compositional control; Cons: Expensive precursors, safety concerns |

Thermal CVD SIC is the traditional method involving high temperatures to decompose gaseous precursors, forming high-purity silicon carbide layers. This type is highly suitable for semiconductor and high-power electronic applications where material uniformity and purity are critical. Buyers in regions like Europe and the Middle East should consider the energy costs and longer processing times, balanced against the superior quality that this method delivers.

Plasma-Enhanced CVD SIC introduces plasma to reduce the temperature required for deposition, enabling better control over film properties and compatibility with temperature-sensitive substrates. This variation is ideal for producing MEMS devices and sensors, important for emerging tech sectors in South America and Turkey. While initial capital investment is higher, the process efficiency and product quality gains often justify the cost.

Low-Pressure CVD SIC operates under vacuum conditions, which enhances film density and adhesion, making it a preferred choice for coating cutting tools and wear-resistant industrial parts. Buyers from Africa and Europe should weigh the benefits of improved durability against the need for specialized vacuum equipment and maintenance, which can impact operational expenses.

Atmospheric Pressure CVD SIC allows deposition at ambient pressure, making it highly scalable and cost-effective for large-area coatings such as automotive parts or industrial-scale applications. This method is attractive for buyers seeking volume production with moderate precision, especially in markets like South America and the Middle East where cost constraints are significant.

Metal-Organic CVD SIC uses metal-organic precursors to achieve precise control over film composition, essential for advanced optoelectronics and power devices. This type suits buyers focused on innovation and high-performance components, though the expense of precursors and stringent safety requirements must be factored into procurement decisions. This option is increasingly relevant for technologically advanced markets in Europe and Turkey.

Related Video: Chemical Vapor Deposition (CVD) Process (Steps by Step Processing in CVD)

| Industry/Sector | Specific Application of CVD SiC | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-performance semiconductor substrates | Enhanced device efficiency, thermal management, and durability | Quality certification, wafer size options, and supplier reliability |

| Automotive | Electric vehicle (EV) power modules and inverters | Improved power density and thermal stability for EV systems | Compliance with automotive standards, volume scalability, and lead times |

| Aerospace & Defense | High-temperature, high-frequency electronic devices | Superior performance in harsh environments, weight reduction | Traceability, material purity, and long-term supply contracts |

| Renewable Energy | Photovoltaic system components and power converters | Increased energy conversion efficiency and lifespan | Customization capabilities, cost-effectiveness, and delivery logistics |

| Industrial Manufacturing | Wear-resistant coatings and cutting tools | Extended tool life and reduced downtime | Consistency in coating quality, technical support, and after-sales service |

Chemical Vapor Deposition (CVD) Silicon Carbide (SiC) is extensively used as a substrate material for high-performance semiconductor devices in power electronics. Its exceptional thermal conductivity and electrical properties enable devices to operate at higher voltages and temperatures, which is critical for industries aiming to improve energy efficiency and reduce cooling costs. For international buyers, especially from regions like South America and Africa where infrastructure development is accelerating, sourcing from suppliers that offer wafers with consistent quality and reliable certifications is essential to ensure device performance and longevity.

In the automotive sector, particularly for electric vehicles (EVs), CVD SiC is used in power modules and inverters to enhance power density and thermal stability. This translates to longer driving ranges and improved reliability under demanding operating conditions. Buyers from emerging EV markets such as Turkey and the Middle East should prioritize suppliers capable of meeting stringent automotive quality standards (e.g., IATF 16949) and offering scalable production volumes to support growing demand. Lead time management is also crucial to align with automotive production cycles.

The aerospace and defense industries utilize CVD SiC for electronic components that must withstand extreme temperatures, high frequencies, and harsh environments. The material’s robustness contributes to weight reduction and improved performance in avionics and radar systems. For B2B buyers in Europe and the Middle East, ensuring traceability and material purity is paramount, along with securing long-term supply contracts to maintain consistent production capabilities and comply with rigorous regulatory requirements.

CVD SiC plays a vital role in renewable energy systems, particularly in photovoltaic inverters and power converters, where it enhances energy conversion efficiency and extends component lifespan. This application is critical for markets in Africa and South America, where maximizing energy output and minimizing maintenance are priorities. Buyers should focus on suppliers offering customization options to match specific system designs, competitive pricing, and reliable delivery logistics to support project timelines.

In industrial manufacturing, CVD SiC is applied as wear-resistant coatings on cutting tools and machinery parts, significantly extending tool life and reducing operational downtime. This benefit is crucial for sectors in Europe and South America that demand high productivity and cost efficiency. B2B buyers must assess the consistency of coating quality, the technical expertise of suppliers for application support, and the availability of after-sales services to optimize tool performance and maintenance cycles.

Related Video: Silicon Carbide Explained - SiC Basics

Key Properties:

Silicon Carbide substrates produced via Chemical Vapor Deposition (CVD) offer exceptional thermal conductivity (up to 490 W/m·K) and high mechanical strength. They exhibit excellent resistance to high temperatures (up to 1600°C) and aggressive chemical environments, including oxidation and corrosion. Their low thermal expansion coefficient makes them ideal for high-precision applications.

Pros & Cons:

SiC substrates provide outstanding durability and thermal stability, essential for power electronics and high-frequency devices. However, they can be costly due to complex manufacturing processes and require specialized equipment for handling and processing. Their brittleness may pose challenges during machining and integration.

Impact on Application:

Ideal for high-power, high-temperature semiconductor devices and harsh environment sensors. The substrate’s chemical inertness ensures compatibility with corrosive media, such as acidic or alkaline environments, making it suitable for chemical processing industries.

International Buyer Considerations:

Buyers in Africa, South America, the Middle East, and Europe should verify compliance with international standards like ASTM C663 for SiC ceramics and DIN EN 60672 for insulating materials. Regions with emerging semiconductor industries, such as Turkey and Argentina, may benefit from suppliers offering technical support for substrate customization and quality assurance aligned with ISO 9001 certifications.

Key Properties:

CVD SiC coatings are thin, dense layers deposited on various substrates to enhance surface hardness, wear resistance, and chemical stability. These coatings maintain integrity at temperatures exceeding 1200°C and resist oxidation and corrosion from aggressive chemicals.

Pros & Cons:

Coatings significantly extend the lifespan of base materials without the need for full SiC components, reducing overall costs. However, the coating process requires precise control to avoid defects, and adhesion issues may arise if substrates are incompatible. Coatings add complexity to manufacturing but improve product performance in demanding environments.

Impact on Application:

Widely used in mechanical seals, pump components, and valves exposed to abrasive or corrosive fluids. The coatings enable traditional metals or ceramics to perform under conditions that would otherwise degrade them rapidly.

International Buyer Considerations:

Compliance with ASTM B760 for CVD coatings and adherence to regional chemical resistance standards is crucial. Buyers in the Middle East and South America should focus on suppliers who provide detailed technical datasheets and testing results, ensuring coatings meet local operational demands and environmental regulations.

Key Properties:

Polycrystalline CVD SiC consists of multiple small SiC crystals, offering high hardness (Mohs ~9), excellent thermal shock resistance, and superior chemical inertness. It withstands pressures up to 300 bar and temperatures above 1400°C.

Pros & Cons:

This material balances cost and performance, providing robust mechanical properties and corrosion resistance at a moderate price point compared to single-crystal SiC. Its polycrystalline nature can lead to minor anisotropy in thermal and mechanical properties, which may affect uniformity in some applications.

Impact on Application:

Commonly used in mechanical components such as seals, bearings, and reactor linings where moderate to high mechanical stress and chemical exposure occur. Its versatility makes it suitable for chemical, petrochemical, and power generation sectors.

International Buyer Considerations:

Buyers should ensure material certification aligns with ASTM C799 and DIN EN 60672 standards. In Europe and Turkey, preference for suppliers with REACH compliance and RoHS certification is increasing. For African and South American markets, availability of local technical support and logistics efficiency are key for cost-effective procurement.

Key Properties:

Monocrystalline CVD SiC exhibits uniform crystal structure, resulting in superior electronic properties, high thermal conductivity, and exceptional mechanical strength. It can operate reliably at temperatures above 1600°C and withstands corrosive environments without degradation.

Pros & Cons:

Its homogeneity ensures predictable performance in high-precision electronic and optoelectronic devices. However, monocrystalline SiC is the most expensive form due to complex growth processes and limited production capacity. Manufacturing lead times can be longer, impacting project schedules.

Impact on Application:

Primarily used in high-performance semiconductor devices, high-frequency power electronics, and advanced sensors requiring minimal defects and high reliability. Its purity and uniformity make it indispensable for cutting-edge technological applications.

International Buyer Considerations:

International buyers should verify compliance with semiconductor-grade material standards such as ASTM F1530 and JIS C 1601. For markets like Europe and the Middle East, sourcing from suppliers with strong R&D capabilities and certification under ISO/IEC 17025 testing laboratories is advantageous. Buyers in emerging markets should consider partnerships that include training and after-sales technical support.

| Material | Typical Use Case for cvd sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) Substrate | Power electronics, high-temp sensors | Exceptional thermal conductivity and stability | High cost and brittleness | High |

| CVD SiC Coatings | Mechanical seals, pump components, valves | Enhances surface durability and corrosion resistance | Requires precise application, adhesion challenges | Medium |

| Polycrystalline CVD SiC | Seals, bearings, reactor linings | Balanced cost-performance, chemical inertness | Minor anisotropy affecting uniformity | Medium |

| Monocrystalline CVD SiC | High-performance semiconductors, sensors | Uniform crystal structure, superior electronic properties | Highest cost, longer lead times | High |

Chemical Vapor Deposition (CVD) Silicon Carbide (SiC) is a critical material widely used in high-performance electronics, power devices, and industrial applications due to its exceptional thermal, mechanical, and electrical properties. For international B2B buyers, understanding the manufacturing process of CVD SiC is vital to evaluate supplier capabilities, ensure product reliability, and optimize procurement decisions.

The manufacturing journey begins with substrate selection and preparation. High-purity silicon wafers or SiC substrates are meticulously cleaned to remove contaminants that could affect crystal growth. Precursor gases such as silane (SiH4) and hydrocarbons (e.g., propane, methane) are prepared with precise purity levels to ensure consistent deposition quality.

The core stage is the Chemical Vapor Deposition process where SiC films or epitaxial layers are formed on substrates inside a reaction chamber at high temperatures (typically 1200–1600°C).

Post-deposition, wafers may undergo further processing to prepare them for device fabrication or integration.

Final steps include surface inspection, packaging for safe transport, and integration with other components.

Quality assurance (QA) in CVD SiC manufacturing is multifaceted, encompassing raw material inspection, process control, and final product verification. For B2B buyers, aligning supplier quality systems with international and industry-specific standards is crucial.

Quality control is typically structured into three main inspection stages:

Incoming Quality Control (IQC):

- Verification of raw materials and gases for purity and compliance.

- Supplier material certifications and traceability documentation are reviewed.

In-Process Quality Control (IPQC):

- Real-time monitoring of CVD parameters (temperature, gas flow, pressure).

- Surface morphology inspections using optical microscopy or scanning electron microscopy (SEM).

- Thickness and doping uniformity checks via ellipsometry or secondary ion mass spectrometry (SIMS).

Final Quality Control (FQC):

- Electrical testing such as carrier lifetime and resistivity measurements.

- Defect density analysis using photoluminescence or X-ray diffraction.

- Dimensional inspection and surface roughness testing.

B2B buyers should be familiar with the following testing methods to assess supplier quality and product performance:

International B2B buyers, especially those from Africa, South America, the Middle East, and Europe, should adopt rigorous supplier evaluation protocols to mitigate risks and ensure product compliance.

Buyers from diverse regions face unique challenges and considerations when sourcing CVD SiC:

Confirm certifications are recognized locally and by regional regulatory bodies.

Middle East:

Consider suppliers experienced in serving oil & gas sectors due to regional industrial focus.

Europe (including Turkey):

By integrating these insights into supplier evaluation and procurement strategies, international B2B buyers can secure high-quality CVD SiC products that meet stringent performance and regulatory requirements.

Understanding the cost and pricing dynamics of sourcing chemical vapor deposition silicon carbide (CVD SiC) is crucial for international B2B buyers aiming to optimize procurement strategies and manage budgets effectively. The pricing structure is multifaceted, influenced by several interrelated components and market factors that vary significantly across regions such as Africa, South America, the Middle East, and Europe.

Raw Materials: The cost of high-purity silicon and carbon precursors directly impacts the base price of CVD SiC. Fluctuations in raw material markets, often tied to global supply chains, can affect pricing volatility.

Labor and Manufacturing Overhead: Skilled labor for precision manufacturing, energy consumption, and facility maintenance contribute substantially to production costs. Regions with higher labor costs or stricter environmental regulations may see elevated overhead expenses.

Tooling and Equipment: Specialized CVD reactors and deposition equipment require significant capital investment. Tool wear and maintenance cycles add to ongoing costs, often factored into unit pricing through amortization.

Quality Control (QC): Rigorous inspection, testing, and certification processes ensure product reliability. QC costs vary depending on the complexity of specifications and the stringency of quality standards demanded by different industries.

Logistics and Shipping: Due to the delicate nature of CVD SiC components, secure packaging and reliable transport are essential. International shipping costs, customs duties, and insurance premiums significantly influence the landed cost, especially for buyers in remote or less-connected regions.

Supplier Margin: Suppliers incorporate profit margins that reflect market positioning, competitive landscape, and order volume. Margins may be negotiated depending on buyer-supplier relationships and purchase scale.

Order Volume and Minimum Order Quantity (MOQ): Larger volumes typically unlock economies of scale, reducing per-unit costs. However, buyers must balance volume discounts against inventory carrying costs.

Specifications and Customization: Tailored material properties, dimensions, and surface finishes increase complexity and cost. Custom orders may require dedicated process runs, elevating prices.

Material Grades and Certifications: Higher-grade CVD SiC with certifications for aerospace, automotive, or medical applications command premium pricing due to stricter compliance and traceability requirements.

Supplier Location and Reputation: Established suppliers with advanced manufacturing capabilities and certifications might price higher but offer reliability and consistent quality. Conversely, emerging suppliers may offer competitive prices but require thorough vetting.

Incoterms and Payment Terms: The choice of Incoterms (e.g., FOB, CIF, DDP) affects which party bears shipping and customs costs, impacting the total procurement expense. Favorable payment terms can also improve cash flow management.

Negotiate Beyond Price: Engage suppliers in discussions about payment terms, delivery schedules, and quality assurances. A comprehensive agreement can yield better overall value than focusing solely on unit price.

Evaluate Total Cost of Ownership (TCO): Consider lifecycle costs including storage, handling, potential rework, and downtime caused by material defects. Sometimes paying a premium upfront reduces long-term expenses.

Leverage Volume Consolidation: For buyers in regions like Africa or South America where logistics costs are high, consolidating orders or collaborating with regional partners can reduce shipping expenses.

Understand Regional Import Regulations: Stay informed about tariffs, import duties, and certification requirements specific to your country (e.g., Turkey’s customs policies or Argentina’s import restrictions) to avoid unexpected costs.

Assess Supplier Stability and Support: Prioritize suppliers with proven track records and local support networks to mitigate risks associated with supply chain disruptions.

Clarify Incoterm Responsibilities: Clearly define who manages freight, insurance, and customs clearance to prevent hidden costs and delays.

Prices for CVD SiC materials and components vary widely depending on supplier capabilities, order specifics, and global market conditions. The figures referenced in market reports or supplier quotes should be considered indicative. Buyers are encouraged to conduct direct negotiations and obtain multiple quotations to secure the most competitive and transparent pricing.

By carefully analyzing these cost factors and pricing influencers, international B2B buyers can develop more effective sourcing strategies for CVD SiC, ensuring cost efficiency and supply chain resilience across diverse geographic markets.

Understanding the essential technical properties of Chemical Vapor Deposition Silicon Carbide (CVD SiC) is vital for making informed purchasing decisions, ensuring compatibility with your application, and optimizing supply chain efficiency.

Material Grade

CVD SiC is available in various grades, often classified by purity and crystalline structure (e.g., 3C-SiC, 4H-SiC, 6H-SiC). Higher purity grades are crucial for semiconductor and high-performance electronic applications, while lower grades may suit abrasive or mechanical uses. Selecting the correct grade affects product performance and longevity, directly impacting ROI.

Thickness and Uniformity

Thickness typically ranges from a few micrometers to several hundred micrometers. Uniform thickness across the wafer or substrate ensures consistent electrical and mechanical properties, reducing defects in downstream manufacturing. Tighter thickness tolerances reduce waste and rework costs.

Surface Roughness

Surface finish is measured in nanometers (nm) and influences device fabrication quality. Smooth surfaces (low roughness) are preferred for high-frequency electronics and optical applications, as they minimize scattering and improve device efficiency.

Electrical Resistivity

Resistivity values indicate how well the material conducts electricity. For power electronics and sensors, precise resistivity control is essential to meet design specifications and ensure device reliability.

Thermal Conductivity

CVD SiC exhibits excellent thermal conductivity, critical for applications involving high power density and heat dissipation, such as power modules and LED substrates. Buyers should specify thermal conductivity requirements to avoid overheating issues.

Dimensional Tolerance

This defines the acceptable deviation in size and shape, often expressed in microns. Tight dimensional tolerances are essential for integration into complex assemblies, reducing the need for additional machining and ensuring interoperability with other components.

Navigating the CVD SiC market requires familiarity with common trade terms and industry jargon. These terms impact negotiation, contract formulation, and logistics.

OEM (Original Equipment Manufacturer)

Refers to companies that produce final products using CVD SiC components. Understanding whether your supplier works directly with OEMs can indicate quality standards and reliability.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. For buyers in emerging markets or smaller enterprises in Africa, South America, or the Middle East, negotiating MOQ is crucial to managing inventory costs and cash flow.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting pricing, delivery times, and terms for specified quantities and specifications. Crafting detailed RFQs with clear technical requirements helps avoid misunderstandings and accelerates procurement cycles.

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) that define responsibilities for shipping, insurance, and customs clearance. Choosing the right Incoterm protects buyers from unexpected costs and delays, especially important when importing to diverse regions like Turkey or Argentina.

Lead Time

The period between order placement and product delivery. Understanding lead times allows buyers to plan production schedules and avoid costly downtime, particularly when sourcing from distant suppliers.

Certification and Compliance

Certifications such as ISO 9001, RoHS, or REACH indicate adherence to quality and environmental standards. Compliance with international standards is often mandatory for market entry in Europe and can be a differentiator when selecting suppliers.

By mastering these technical properties and trade terms, international B2B buyers can more confidently evaluate suppliers, negotiate contracts, and ensure their CVD SiC purchases meet both technical and commercial expectations. This strategic approach minimizes risks and maximizes value across diverse markets.

The chemical vapor deposition (CVD) of silicon carbide (SiC) is a rapidly evolving sector driven by increasing demand for high-performance materials in power electronics, automotive, aerospace, and semiconductor industries. Global market growth is propelled by SiC’s superior thermal conductivity, chemical stability, and ability to operate under extreme conditions, making it essential for next-generation devices.

For B2B buyers from regions such as Africa, South America, the Middle East, and Europe (including emerging markets like Turkey and Argentina), understanding the global supply chain dynamics is critical. The sector is witnessing consolidation among leading manufacturers, with key production hubs in Asia, Europe, and North America. However, increasing geopolitical complexities and trade policies have led to a renewed focus on diversifying sourcing strategies to mitigate supply risks.

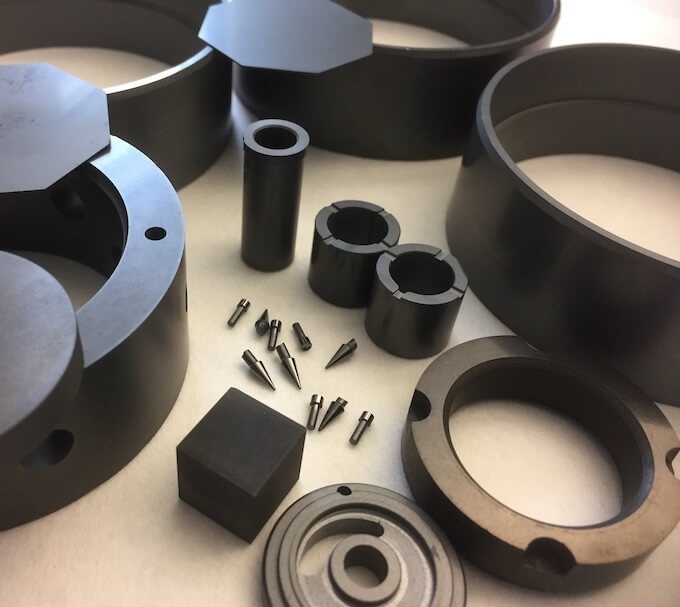

Illustrative Image (Source: Google Search)

Technological advancements are shaping the sourcing landscape. Innovations in CVD equipment and process optimization have reduced costs and improved SiC layer uniformity, enabling wider adoption. Buyers should prioritize suppliers investing in cutting-edge technologies that ensure consistent quality and scalability.

Emerging B2B sourcing trends include:

- Localized partnerships: To overcome logistics challenges and tariffs, buyers are forming regional alliances or joint ventures with local manufacturers, particularly in Europe and the Middle East.

- Digital procurement platforms: These platforms facilitate real-time tracking, quality verification, and transparent pricing, empowering buyers from diverse regions to make informed decisions.

- Custom-tailored solutions: Increasingly, suppliers offer bespoke SiC coatings to meet specific client requirements, emphasizing flexibility and collaboration.

For buyers in Africa and South America, where industrial infrastructure is developing, building relationships with suppliers who offer technical support and training can ensure smoother integration of CVD SiC materials into manufacturing processes.

Sustainability is becoming a non-negotiable factor in the procurement of CVD SiC materials. The CVD process, while technologically advanced, can be energy-intensive and involves hazardous gases, which necessitates stringent environmental controls.

International buyers must prioritize suppliers committed to reducing carbon footprints through:

- Adoption of renewable energy sources in manufacturing facilities.

- Implementation of waste gas treatment systems to minimize emissions.

- Use of closed-loop recycling to recover and reuse process materials, reducing raw material consumption.

Ethical sourcing extends beyond environmental concerns to include transparent supply chains and responsible labor practices. Buyers should seek suppliers with third-party certifications such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety), which demonstrate adherence to global sustainability standards.

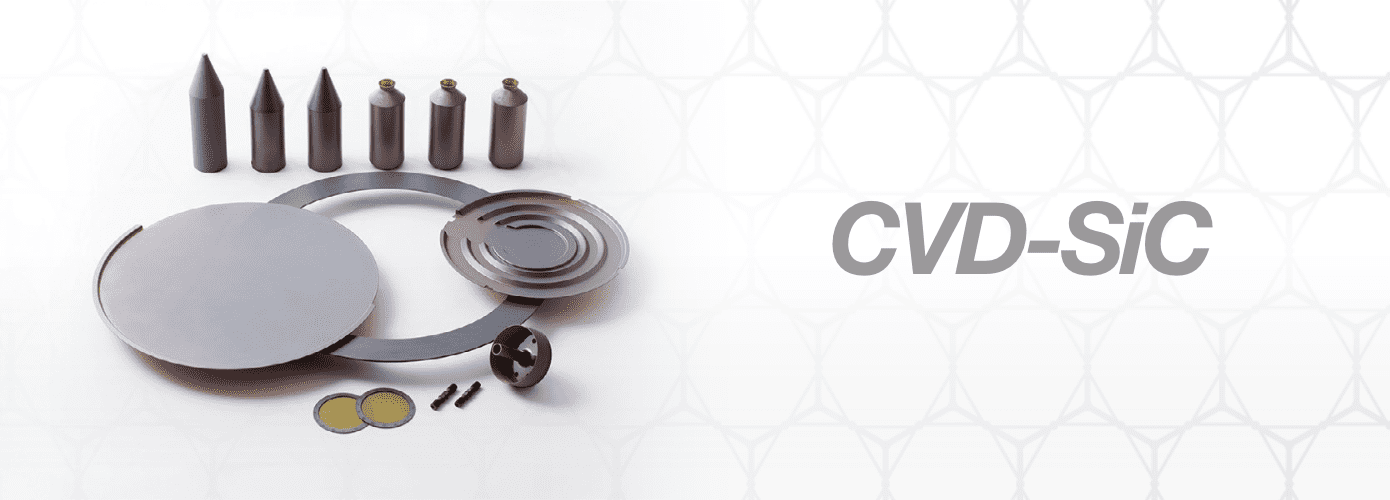

Illustrative Image (Source: Google Search)

Green certifications specific to SiC and CVD processes are emerging, such as “EcoVadis” ratings and specialized material traceability audits, which help verify the origin and environmental impact of raw materials.

Furthermore, demand for “green SiC”—produced with minimized environmental impact—is rising, especially among European and Middle Eastern buyers driven by stringent regulatory environments and corporate social responsibility mandates.

For B2B buyers, embedding sustainability criteria into supplier evaluations not only aligns with global ESG commitments but also enhances brand reputation and ensures compliance with evolving import regulations in their home markets.

Illustrative Image (Source: Google Search)

The development of CVD SiC dates back to the mid-20th century when silicon carbide was first synthesized for industrial applications. Initially, the technology was confined to niche markets due to high production costs and complex processing requirements.

Over the past three decades, advancements in CVD technology have transformed SiC from a specialty material into a mainstream solution for power electronics and semiconductor substrates. This evolution was driven by growing demands for energy-efficient electronics and the rise of electric vehicles, which require robust, high-temperature components.

For international B2B buyers, understanding this historical progression highlights the importance of partnering with suppliers who have deep technical expertise and a proven track record in scaling production while maintaining quality standards. This ensures access to reliable, cutting-edge SiC materials capable of meeting future industry demands.

How can I effectively vet suppliers of CVD SiC for international B2B transactions?

To vet CVD SiC suppliers, start by verifying their certifications such as ISO 9001 and industry-specific standards like SEMI or RoHS compliance. Request samples to assess product quality firsthand. Evaluate their production capacity, lead times, and after-sales support by speaking with existing clients or checking third-party reviews. For buyers in Africa, South America, the Middle East, and Europe, ensure the supplier has experience with international shipping and customs to avoid delays. A thorough background check combined with a trial order can minimize risks associated with new partnerships.

Is it possible to customize CVD SiC products to meet specific industrial requirements?

Yes, many CVD SiC manufacturers offer customization in terms of size, purity, doping levels, and crystal orientation to fit unique industrial applications. When negotiating customization, clarify technical specifications early, including tolerance levels and testing methods. Expect longer lead times and potentially higher costs for bespoke orders. For international buyers, confirm the supplier’s capability to provide detailed product datasheets and certifications that align with your local regulatory requirements to ensure smooth integration into your supply chain.

What are typical minimum order quantities (MOQ) and lead times for CVD SiC shipments internationally?

MOQ for CVD SiC varies significantly depending on the supplier and product type but typically ranges from a few kilograms to several hundred units for specialized wafers. Lead times can span from 4 to 12 weeks, influenced by customization, production backlog, and shipping logistics. Buyers from regions like Africa or South America should factor in additional transit times and customs clearance delays. To optimize procurement, negotiate MOQs that align with your inventory needs and request supplier forecasts to plan orders well in advance.

Which payment terms are common when sourcing CVD SiC from international suppliers?

Standard payment terms include 30-50% upfront deposits with the balance paid upon shipment or delivery. Letters of credit (LC) are frequently used in international trade to mitigate risk, especially for first-time transactions. For buyers in emerging markets, establishing a reliable payment history can help negotiate more favorable terms over time. Always verify the supplier’s banking credentials and use secure payment platforms. Consider currency fluctuations and transaction fees when budgeting for payments across different regions.

What quality assurance measures and certifications should I expect from a reputable CVD SiC supplier?

Reputable suppliers provide comprehensive quality assurance protocols including in-process inspections, final product testing, and traceability documentation. Key certifications to look for include ISO 9001 for quality management, SEMI standards for semiconductor materials, and environmental compliance certificates such as RoHS. Suppliers should also offer detailed material analysis reports like XRD, SEM, or Raman spectroscopy data. For international buyers, ensure all certifications are recognized or can be validated by your local regulatory authorities to avoid compliance issues.

How should I approach logistics and shipping for international orders of CVD SiC?

CVD SiC is a high-value, delicate material requiring careful packaging and handling. Engage freight forwarders experienced in handling semiconductor-grade products to ensure proper customs documentation and secure transport. Consider Incoterms carefully—DDP (Delivered Duty Paid) or DAP (Delivered at Place) terms can reduce surprises in import duties and taxes. For buyers in remote or developing regions, factor in potential customs delays and plan buffer times. Establish clear communication channels with both supplier and logistics providers to track shipments in real-time.

What steps can I take to resolve disputes or quality issues with CVD SiC suppliers?

Start by documenting all communications, order details, and quality discrepancies thoroughly. Request a formal investigation and root cause analysis from the supplier. Most reputable manufacturers will offer replacement, repair, or credit for verified defects. If disputes escalate, engage third-party inspection agencies or mediators specializing in international trade. Clear contractual terms covering warranties, return policies, and dispute resolution mechanisms are essential before placing orders. For cross-border issues, understanding applicable trade laws and arbitration venues can expedite conflict resolution.

Are there specific regulatory or import considerations for CVD SiC in Africa, South America, the Middle East, and Europe?

Yes, import regulations vary widely across these regions. Some countries require detailed documentation on material composition, safety data sheets (SDS), and compliance with local environmental laws. Tariffs and import duties can significantly impact landed costs, so consult local trade authorities or customs brokers beforehand. Additionally, some regions enforce strict controls on semiconductor materials due to dual-use concerns. Proactively engaging with suppliers to ensure all paperwork is accurate and complete will facilitate smoother customs clearance and avoid costly delays.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of CVD SiC presents a compelling opportunity for international B2B buyers aiming to optimize supply chain resilience and product quality. Key takeaways emphasize the importance of partnering with suppliers who demonstrate advanced technical capabilities, consistent quality assurance, and scalable production capacities. For buyers in Africa, South America, the Middle East, and Europe, aligning sourcing strategies with regional market dynamics and logistics considerations can significantly enhance cost efficiency and delivery reliability.

Critical factors for successful sourcing include:

Looking ahead, the CVD SiC market is poised for growth driven by increasing demand in electronics, automotive, and energy sectors. International buyers are encouraged to adopt a proactive sourcing approach—investing in supplier due diligence and market intelligence—to capitalize on emerging opportunities and mitigate risks. By doing so, businesses from Turkey to Argentina, and beyond, can secure competitive advantage and drive sustainable growth in their supply chains.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina