Understanding the distinction between aluminium and alumina is fundamental for B2B buyers engaged in global trade, especially within emerging and established markets across Africa, South America, the Middle East, and Europe. Aluminium, a versatile metal widely used in industries such as automotive, construction, and packaging, originates from alumina—an oxide compound extracted primarily from bauxite ore. Recognizing the unique properties, manufacturing processes, and supply chain dynamics of both materials is crucial to optimizing procurement strategies, ensuring product quality, and managing costs effectively.

Illustrative Image (Source: Google Search)

This comprehensive guide delves into the critical differences between aluminium and alumina, offering international buyers a detailed roadmap to navigate complex sourcing decisions. It covers:

Armed with this knowledge, B2B buyers can confidently assess supplier capabilities, optimize supply chain resilience, and align procurement with their operational requirements. Whether sourcing alumina for industrial processing or finished aluminium products, this guide empowers buyers to make strategic, data-driven decisions that enhance competitive advantage in the global marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Primary Aluminium | Pure metallic aluminium, lightweight, ductile, and conductive | Automotive, aerospace, packaging, construction | Pros: Versatile, recyclable, good conductivity; Cons: Prone to corrosion without treatment |

| Aluminium Alloys | Aluminium mixed with elements like copper, magnesium, zinc | Structural components, machinery, transport | Pros: Enhanced strength and corrosion resistance; Cons: Higher cost, complex processing |

| Alumina (Aluminium Oxide) | Ceramic compound (Al2O3), hard, high melting point, electrically insulating | Abrasives, refractory materials, electronics | Pros: High hardness, thermal stability; Cons: Brittle, non-metallic properties limit some uses |

| Activated Alumina | Porous form of alumina used for adsorption | Water purification, desiccants, gas drying | Pros: Effective moisture and contaminant removal; Cons: Requires regeneration, limited mechanical strength |

| Alumina Powder | Fine particulate form of alumina | Catalyst supports, ceramics manufacturing | Pros: High purity, customizable particle size; Cons: Handling dust hazards, requires careful storage |

Primary Aluminium

This is the base metallic form of aluminium, valued for its lightweight and excellent electrical and thermal conductivity. It is widely used in sectors such as automotive and packaging where weight reduction is crucial. B2B buyers should consider its susceptibility to corrosion and may require coated or anodized variants depending on the application environment.

Aluminium Alloys

Alloys are created by combining aluminium with other metals to improve mechanical properties such as strength and corrosion resistance. These are essential in aerospace and heavy machinery industries. Buyers must evaluate alloy composition to meet specific strength and durability requirements and be prepared for higher costs and specialized processing techniques.

Alumina (Aluminium Oxide)

Alumina is a ceramic material known for its hardness and thermal resistance, making it suitable for abrasives and refractory applications. It is electrically insulating, which differentiates it from metallic aluminium. B2B purchasers should note its brittleness and select alumina grades based on thermal and mechanical stress conditions.

Activated Alumina

This porous variation is used primarily for its adsorption capabilities, ideal for drying gases and purifying water. It is widely used in chemical processing and environmental sectors. Buyers should consider regeneration cycles and mechanical handling requirements to maintain performance and cost-efficiency.

Alumina Powder

Fine alumina powder serves as a key input in catalyst supports and advanced ceramics manufacturing. Its purity and particle size distribution are critical for performance. Handling precautions and storage conditions are important for buyers to prevent contamination and health risks associated with fine powders.

Related Video: How Is Aluminium Extruded? - Aluminium Casting and Extrusion

| Industry/Sector | Specific Application of difference between aluminium and alumina | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Aviation | Use of aluminium for lightweight structural components vs alumina for thermal barriers and insulators | Weight reduction, enhanced fuel efficiency, and thermal protection | Ensure high-purity aluminium alloys and high-grade alumina ceramics; compliance with aerospace standards |

| Electronics & Semiconductors | Aluminium as conductive metal in circuits; alumina as substrate and insulator in electronic components | Improved electrical performance and device reliability | Source alumina with precise dielectric properties and aluminium with consistent conductivity; certification for electronic grade materials |

| Construction & Infrastructure | Aluminium for building facades and frameworks; alumina in refractory linings and fire-resistant materials | Durability, corrosion resistance, and enhanced fire safety | Verify aluminium corrosion resistance and alumina refractory quality; consider local climate and regulatory standards |

| Automotive Manufacturing | Aluminium for lightweight body panels; alumina in catalytic converters and spark plug insulators | Fuel efficiency, emissions control, and component longevity | Prioritize aluminium alloys with formability and strength; alumina with thermal stability and purity |

| Chemical & Metallurgical Industry | Aluminium as raw metal input; alumina as catalyst support and abrasive material | Efficient processing, catalyst effectiveness, and wear resistance | Ensure alumina particle size and purity meet process requirements; aluminium sourced for consistent chemical composition |

Aerospace & Aviation

In aerospace, the distinction between aluminium and alumina is critical. Aluminium’s lightweight and high-strength alloys are used extensively for aircraft frames and components, reducing overall weight and improving fuel efficiency. Alumina, on the other hand, serves as a high-performance ceramic for thermal barriers and insulators in engines and avionics, protecting sensitive parts from extreme heat. B2B buyers from regions like Nigeria or Europe must source aluminium alloys certified to aerospace standards and alumina with superior purity and thermal resistance to meet stringent safety and performance criteria.

Electronics & Semiconductors

Aluminium’s excellent electrical conductivity makes it ideal for wiring and circuit components, while alumina is valued for its insulating properties and use as a substrate in semiconductor devices. This difference enables manufacturers to balance conduction and insulation effectively. Buyers from South America and the Middle East should focus on sourcing alumina with precise dielectric constants and aluminium with uniform conductivity to ensure device reliability and longevity in their electronic products.

Construction & Infrastructure

In construction, aluminium is favored for its corrosion resistance and lightweight properties, ideal for facades, window frames, and roofing. Alumina is used in refractory linings and fire-resistant materials, contributing to building safety and durability. For buyers in diverse climates such as Vietnam or Europe, selecting aluminium with appropriate corrosion resistance and alumina refractory materials compliant with local fire safety regulations ensures long-term structural integrity and compliance.

Automotive Manufacturing

Automotive industries leverage aluminium for lightweight body panels and structural parts, enhancing fuel efficiency and reducing emissions. Alumina’s role in catalytic converters and spark plug insulators supports emission control and engine performance. International buyers should prioritize aluminium alloys that balance strength and formability, alongside high-purity alumina that withstands thermal cycling, to meet evolving environmental standards and performance requirements.

Chemical & Metallurgical Industry

Aluminium is a fundamental raw metal in chemical processing, while alumina serves as a catalyst support and abrasive in refining and metallurgical operations. This distinction enables optimized chemical reactions and material wear resistance. Buyers from Africa and South America should ensure alumina’s particle size and purity align with process specifications and source aluminium with consistent chemical composition to maintain operational efficiency and product quality.

Key Properties: Aluminium is a lightweight, ductile metal with excellent thermal and electrical conductivity. It offers good corrosion resistance due to its natural oxide layer and performs well under moderate temperature and pressure conditions. Aluminium alloys can be tailored for enhanced strength and durability.

Pros & Cons: Aluminium is cost-effective and easy to machine or form, making it suitable for a wide range of manufacturing processes. However, it has lower hardness and wear resistance compared to ceramic materials like alumina. It can corrode under highly acidic or alkaline environments if not properly treated.

Impact on Application: Aluminium is ideal for structural components, lightweight enclosures, and heat exchangers where moderate mechanical strength and corrosion resistance are sufficient. It is less suitable for high-wear or high-temperature applications.

Considerations for International B2B Buyers: Buyers from regions such as Africa, South America, the Middle East, and Europe should verify compliance with international standards like ASTM B209 or EN 573 for aluminium products. Availability and cost can vary based on regional supply chains and tariffs. In countries like Nigeria and Vietnam, local fabrication capabilities and import duties should be assessed to optimize cost-efficiency.

Key Properties: Alumina is a ceramic material known for its exceptional hardness, high melting point (~2072°C), excellent electrical insulation, and outstanding chemical inertness. It withstands extreme temperatures and aggressive chemical environments.

Pros & Cons: Alumina offers superior wear resistance and thermal stability, making it ideal for harsh environments. However, it is brittle and prone to fracture under mechanical shock, and manufacturing complex shapes can be costly and time-consuming.

Impact on Application: Alumina is preferred in applications requiring high abrasion resistance, electrical insulation, or chemical inertness, such as cutting tools, insulators, and chemical reactors. It is unsuitable for applications requiring high impact resistance.

Considerations for International B2B Buyers: Compliance with standards such as ASTM C799 or ISO 21066 ensures quality for alumina ceramics. Buyers in emerging markets should consider lead times and logistics for importing high-grade alumina components. Additionally, local availability of specialized machining services for ceramics can influence project timelines and costs.

Key Properties: Aluminium alloys combine aluminium's lightweight nature with enhanced mechanical properties like increased tensile strength and improved corrosion resistance. They perform well under moderate to high stress and temperature conditions.

Pros & Cons: These alloys provide a balance of strength, corrosion resistance, and manufacturability. However, they are more expensive than pure aluminium and may require specialized heat treatment. Some alloys are less corrosion-resistant in marine or highly acidic environments.

Impact on Application: Aluminium alloys are widely used in aerospace, automotive, and structural applications where weight savings and strength are critical. They are less suitable for extreme chemical exposure without protective coatings.

Considerations for International B2B Buyers: Buyers should ensure alloy certification per ASTM B211 or EN 573 and consider regional preferences for specific alloys. For example, European markets often demand compliance with EN standards, while buyers in Africa and South America may prioritize cost and availability. Import tariffs and local fabrication capabilities also affect total cost.

Key Properties: ALON is a transparent ceramic combining alumina’s hardness with optical transparency and high strength. It offers excellent resistance to abrasion, high temperatures, and chemical attack.

Pros & Cons: ALON is ideal for specialized applications requiring transparency and durability, such as armored windows and optical components. The main drawbacks are high material and processing costs and limited availability.

Impact on Application: ALON is used in defense, aerospace, and high-performance optics where both mechanical protection and optical clarity are required. It is not commonly used for general industrial purposes due to cost constraints.

Considerations for International B2B Buyers: Given its niche market, buyers in developing regions should evaluate supplier reliability and total landed cost carefully. Compliance with military or aerospace standards (e.g., MIL-PRF-13830B) is critical for defense applications. Logistics and after-sales support are also important factors.

| Material | Typical Use Case for difference between aluminium and alumina | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminium | Lightweight structural parts, heat exchangers | Lightweight, good corrosion resistance | Lower hardness and wear resistance | Low |

| Alumina | High-wear components, electrical insulators, chemical reactors | Exceptional hardness and chemical inertness | Brittle, costly manufacturing | High |

| Aluminium Alloys | Aerospace, automotive, structural applications requiring strength | High strength-to-weight ratio | Higher cost than pure aluminium, corrosion in harsh environments | Medium |

| Aluminium Oxynitride (ALON) | Transparent armor, optical windows, defense applications | Combines hardness with optical transparency | Very high cost and limited availability | High |

Understanding the distinct manufacturing processes of aluminium and alumina is critical for B2B buyers who aim to source these materials efficiently and ensure product quality.

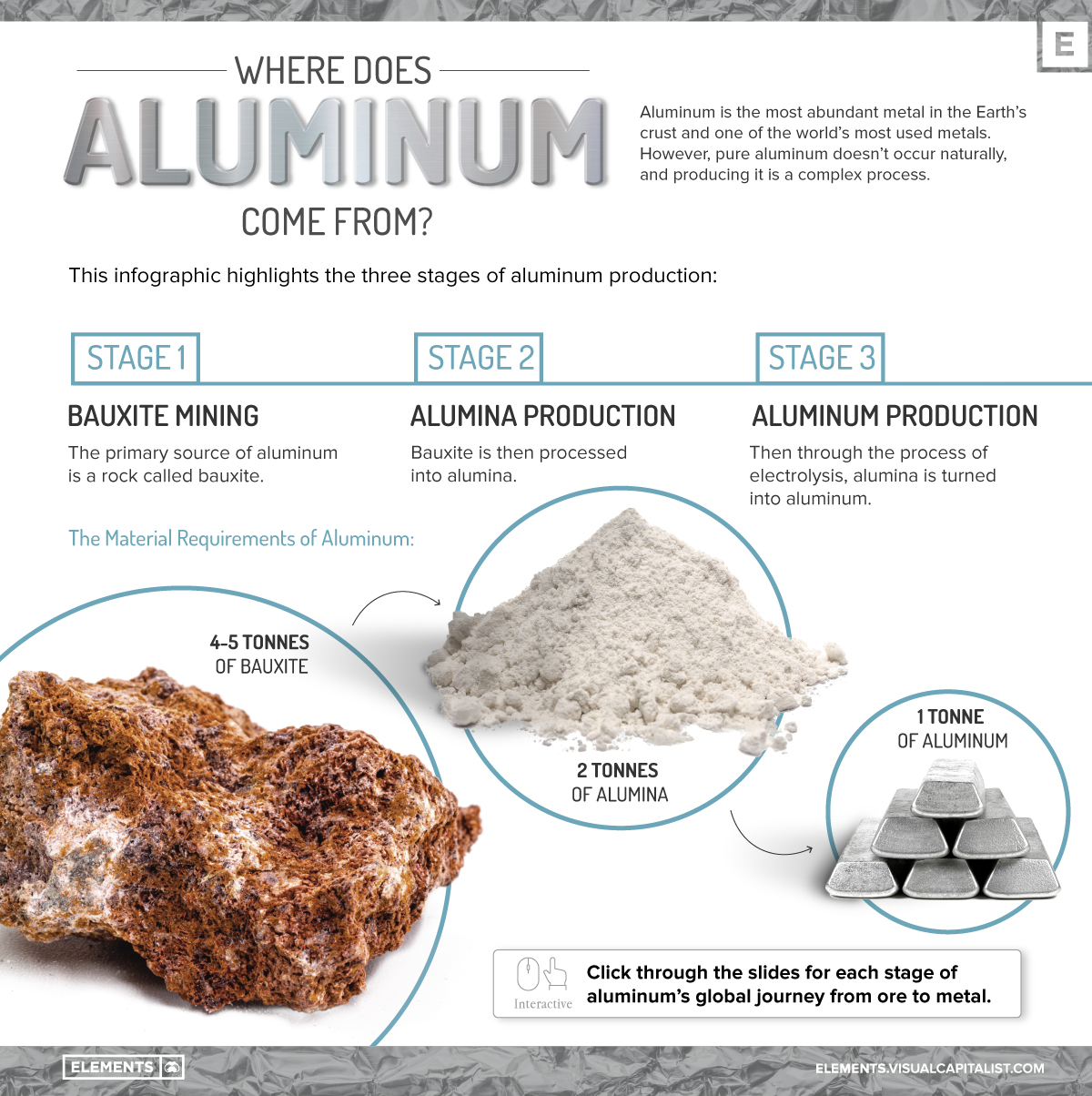

Material Preparation

- Bauxite Mining: Aluminium production starts with bauxite ore extraction, primarily found in regions such as Africa (e.g., Guinea), South America (e.g., Brazil), and Australia.

- Refining to Alumina: Bauxite undergoes the Bayer Process, where it is crushed and digested in caustic soda to extract alumina (Al₂O₃), the intermediate product.

Smelting and Reduction

- Hall-Héroult Process: Alumina is dissolved in molten cryolite and electrolyzed to produce pure molten aluminium. This stage requires high energy input and advanced technological infrastructure.

Forming and Casting

- Molten aluminium is cast into ingots, billets, or slabs, which serve as raw materials for downstream processing.

- Techniques such as rolling, extrusion, and forging transform aluminium into sheets, profiles, or components tailored for specific industrial applications.

Finishing

- Surface treatments like anodizing, powder coating, or painting enhance corrosion resistance and aesthetic appeal, critical for sectors like automotive, aerospace, and construction.

Extraction and Refining

- Alumina is derived from bauxite via the Bayer Process, involving digestion, clarification, precipitation, and calcination steps to yield a white, powdery alumina.

Shaping and Forming

- Alumina powder is formed into shapes using pressing, slip casting, or extrusion, depending on the intended use (e.g., ceramics, refractory linings).

- Advanced methods include isostatic pressing for uniform density and injection molding for complex geometries.

Sintering and Firing

- Formed alumina parts are sintered at high temperatures (typically 1600°C+) to achieve mechanical strength and desired microstructure.

- This stage is crucial for high-performance applications requiring exceptional hardness and thermal stability.

Machining and Finishing

- Post-sintering machining (grinding, polishing) ensures dimensional accuracy and surface quality, especially for precision components in electronics or medical industries.

Robust QA/QC protocols are essential in aluminium and alumina supply chains to ensure product consistency, compliance, and performance—especially important for international buyers across Africa, South America, the Middle East, and Europe.

Incoming Quality Control (IQC)

- Verification of raw materials (bauxite, alumina powder, aluminium ingots) for purity, particle size, and chemical composition.

- Certificates of analysis (CoA) and supplier audits are critical here to prevent quality issues downstream.

In-Process Quality Control (IPQC)

- Continuous monitoring during refining, smelting, forming, and sintering processes.

- Parameters such as temperature, pressure, and process time are tightly controlled to maintain product integrity.

- Non-destructive testing (NDT), such as ultrasonic or X-ray inspection, may be applied to detect internal defects in aluminium castings or alumina ceramics.

Final Quality Control (FQC)

- Comprehensive testing of finished products, including mechanical testing (tensile strength, hardness), chemical analysis, dimensional inspection, and surface finish evaluation.

- For alumina, density, porosity, and thermal conductivity tests are crucial quality indicators.

- Aluminium products undergo corrosion resistance tests, especially for anodized or coated items.

For buyers in emerging and established markets such as Nigeria, Brazil, UAE, and Vietnam, ensuring supplier reliability and product quality involves proactive engagement and verification:

For international B2B buyers, distinguishing between aluminium and alumina goes beyond material composition to understanding their distinct manufacturing processes and rigorous quality assurance protocols. By leveraging international standards, implementing thorough supplier verification, and considering regional certification requirements, buyers can secure high-quality materials that meet their operational and regulatory needs across Africa, South America, the Middle East, and Europe. This strategic approach mitigates risks, enhances supply chain reliability, and supports long-term business success.

When evaluating the cost and pricing differences between aluminium and alumina sourcing, international B2B buyers must consider a complex interplay of factors that extend beyond raw material costs. Understanding these components can drive smarter procurement decisions, especially for businesses operating in regions such as Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Raw Materials:

Aluminium is a finished metal product, while alumina (aluminium oxide) is an intermediate raw material used in aluminium production. Alumina prices are influenced heavily by bauxite availability, refining costs, and energy consumption, whereas aluminium pricing incorporates additional smelting and alloying costs.

Labor and Manufacturing Overhead:

Aluminium production requires extensive smelting operations with high energy and labor inputs, leading to higher manufacturing overhead compared to alumina refining, which is less energy-intensive but still capital and labor-heavy. Regional labor costs and energy prices significantly impact these overheads.

Tooling and Equipment:

While alumina sourcing mostly involves bulk material handling and refining, aluminium products may require specialized tooling for casting, extrusion, or rolling, adding to upfront and maintenance costs. Buyers should factor tooling amortization into cost models, especially for customized aluminium components.

Quality Control (QC):

Aluminium products often undergo stringent QC to meet mechanical and chemical specifications for end-use applications, including certifications like ISO or ASTM. Alumina quality control focuses on purity and particle size distribution, which impacts the efficiency of downstream smelting.

Logistics and Transportation:

Alumina is typically sourced in large volumes and transported in bulk, which can be cost-efficient but demands reliable port and rail infrastructure. Aluminium, often finished or semi-finished, may require more delicate handling and packaging, affecting logistics costs. International buyers should assess freight options, customs duties, and local distribution expenses.

Margins:

Supplier margins vary depending on market positioning, volume commitments, and service levels. Value-added services such as technical support or just-in-time delivery can influence pricing, particularly for aluminium finished goods.

Order Volume and Minimum Order Quantity (MOQ):

Larger volumes usually attract better unit pricing for both alumina and aluminium. However, MOQ requirements may differ; alumina suppliers often require bulk orders, while aluminium can be sourced in smaller, more flexible quantities depending on the product form.

Product Specifications and Customization:

Higher purity alumina or alloy-specific aluminium grades command premium prices. Custom dimensions, finishes, or certifications add to costs but may be necessary for compliance or performance in specific industries.

Material Market Fluctuations:

Aluminium prices are linked to global metal markets (e.g., LME), while alumina pricing is tied to bauxite supply and refining capacity. Buyers should monitor commodity trends and hedge risks accordingly.

Supplier Reliability and Certifications:

Established suppliers with certifications (ISO 9001, environmental standards) often charge premiums but reduce risk. For critical projects, verified suppliers may justify higher costs by ensuring consistent quality.

Incoterms and Payment Terms:

Shipping terms (FOB, CIF, DDP) affect landed costs. Buyers from regions like Nigeria or Vietnam should negotiate Incoterms that optimize customs clearance and reduce unexpected fees. Payment terms can also impact cash flow and overall cost.

Negotiate Beyond Price:

Focus on total value, including delivery reliability, quality guarantees, and after-sales support. Volume discounts and long-term contracts can unlock better terms.

Evaluate Total Cost of Ownership (TCO):

Consider not just purchase price but also logistics, storage, handling losses, and quality-related rework costs. For example, lower-priced alumina with inconsistent purity may increase smelting costs downstream.

Leverage Regional Sourcing Advantages:

Buyers in Africa or the Middle East might benefit from proximity to bauxite sources or alumina refineries, reducing transport costs. Conversely, European buyers should factor in tariffs and environmental regulations impacting pricing.

Understand Pricing Nuances:

Aluminium prices are often quoted per metric ton and fluctuate daily; alumina pricing may be contract-based with fixed terms. Clarify pricing validity periods and escalation clauses to avoid surprises.

Verify Supplier Compliance and Certifications:

Request detailed quality documentation and conduct audits if possible. Compliance with international standards reduces risks and potential costly delays.

Pricing for aluminium and alumina varies widely based on global commodity markets, regional supply-demand dynamics, contract terms, and logistics conditions. The figures and factors discussed herein are indicative and should be validated through direct supplier engagement and market research tailored to your specific sourcing context.

By thoroughly analyzing these cost and pricing factors, international B2B buyers can optimize procurement strategies for aluminium and alumina, achieving cost-efficiency and supply chain resilience tailored to their regional and operational needs.

Understanding the fundamental technical specifications of aluminium and alumina is crucial for international buyers, especially when sourcing from diverse markets such as Africa, South America, the Middle East, and Europe. These properties influence product performance, cost, and compatibility with manufacturing processes.

Material Grade

Aluminium grades (e.g., 1000, 3000, 6000 series) indicate alloy composition and mechanical properties. Alumina grades refer to purity levels (typically 95% to 99.9% Al₂O₃). Higher purity alumina offers superior thermal and electrical insulation. Selecting the appropriate grade ensures compliance with industry standards and end-use requirements.

Tolerance and Dimensional Accuracy

This refers to allowable deviations in dimensions or chemical composition. Aluminium products often require tight tolerances for sheet thickness or extrusion profiles, impacting assembly precision. Alumina powders or ceramics have particle size distributions critical for sintering and final product density. Buyers should specify tolerance levels clearly to avoid quality issues.

Density and Specific Gravity

Aluminium has a density around 2.7 g/cm³, making it lightweight for structural applications. Alumina’s density ranges from 3.9 to 4.1 g/cm³, reflecting its ceramic nature. These differences affect transportation costs and mechanical behavior in end products.

Thermal and Electrical Conductivity

Aluminium is an excellent conductor of heat and electricity, suitable for electrical wiring and heat exchangers. Alumina is an electrical insulator with high thermal resistance, widely used in electronics and refractory components. Understanding these properties helps buyers match materials to functional needs.

Corrosion Resistance

Aluminium naturally forms a protective oxide layer, offering good corrosion resistance in many environments, important for outdoor and marine applications. Alumina is chemically inert and highly resistant to acidic and basic conditions, ideal for harsh chemical processing industries.

Mechanical Strength and Hardness

Aluminium alloys vary in strength; some are malleable while others are heat-treatable for higher strength. Alumina is extremely hard and brittle, used where wear resistance is critical. Buyers must assess mechanical requirements to avoid material failure or over-specification.

Familiarity with common trade terms streamlines communication and negotiation between suppliers and buyers, reducing misunderstandings and enhancing transaction efficiency.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment used in another company's end product. When sourcing aluminium or alumina components, specifying OEM compatibility ensures the materials meet the required quality and design specifications.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs vary by material type and supplier capacity. Understanding MOQ helps buyers plan inventory and cash flow, especially important for businesses in emerging markets with limited storage.

RFQ (Request for Quotation)

A formal document sent to suppliers asking for price, availability, and terms for specified quantities and grades. An effective RFQ includes detailed technical specs and delivery timelines, enabling suppliers to provide accurate offers.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs between buyer and seller. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Correct use of Incoterms clarifies logistics costs and risk transfer, essential for cross-border aluminium and alumina transactions.

Lead Time

The period from order placement to delivery. Aluminium and alumina production can involve long lead times due to processing complexity. Buyers should confirm lead times upfront to align procurement with project schedules.

Certification and Compliance

Documents verifying material standards (e.g., ISO, ASTM) and chemical composition. Certifications assure buyers of product authenticity and suitability for regulated markets, reducing risk of rejection or rework.

By mastering these technical properties and trade terms, B2B buyers can make informed decisions, negotiate effectively, and ensure the right aluminium or alumina products reach their operations on time and within budget. This knowledge is especially valuable in global sourcing contexts where material standards and commercial practices vary widely.

Illustrative Image (Source: Google Search)

The aluminium and alumina sector plays a critical role in global industrial supply chains, with alumina serving as the primary raw material for aluminium production. For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding the distinct market dynamics of these two commodities is essential for strategic sourcing and risk management.

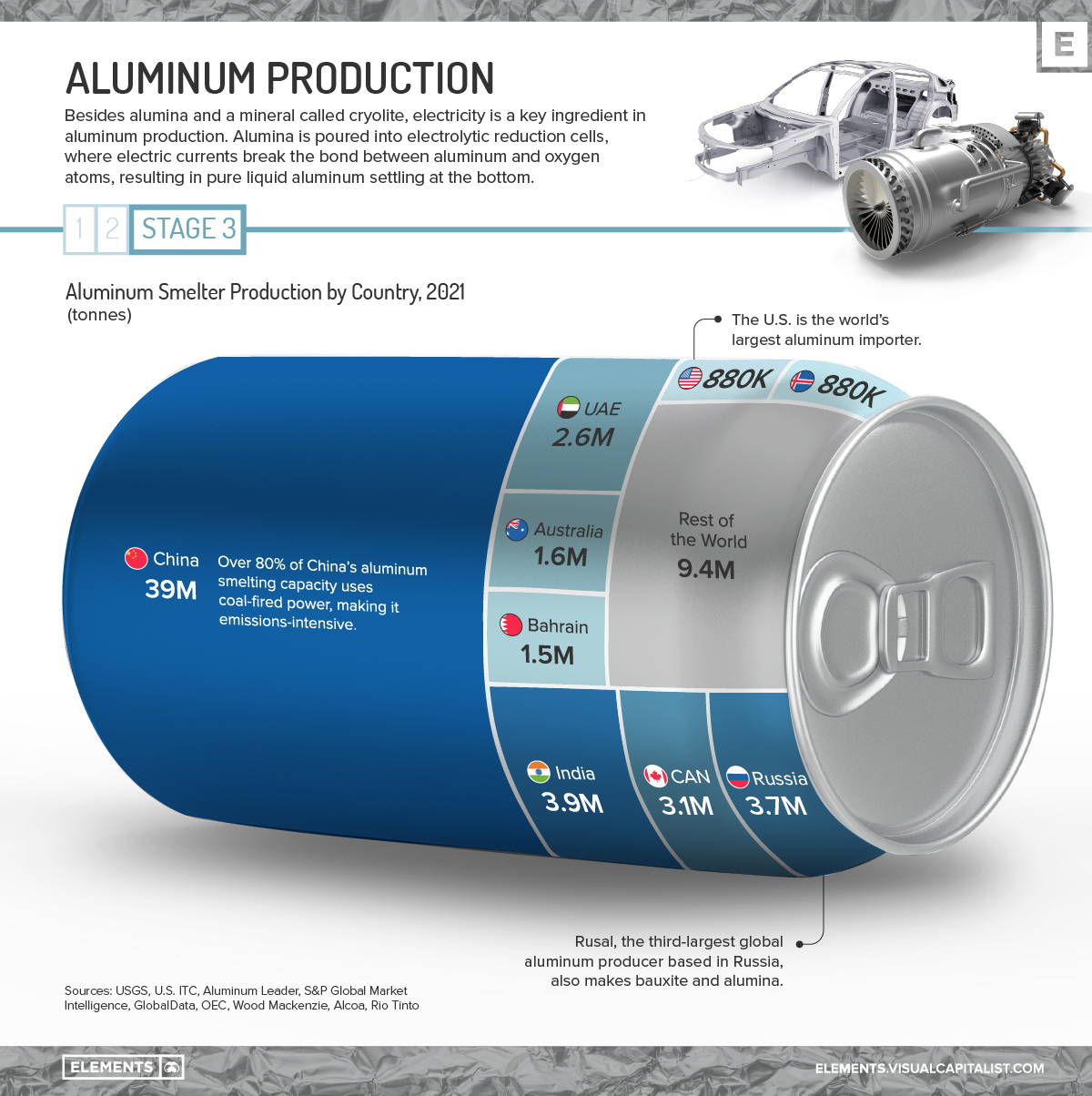

Global Drivers:

- Demand Growth: Aluminium demand is driven by sectors such as automotive, construction, packaging, and aerospace, particularly in emerging markets like Nigeria and Vietnam where infrastructure development is accelerating. Alumina, as the intermediate product refined from bauxite, closely tracks aluminium production capacity and technological advancements in smelting.

- Supply Constraints: Alumina production depends heavily on bauxite mining, which is geographically concentrated in regions such as Guinea (Africa), Brazil (South America), and Australia (Asia-Pacific). Export restrictions, regulatory changes, and geopolitical risks in these regions impact alumina availability and pricing, influencing aluminium supply chains globally.

- Price Volatility: Aluminium prices are influenced by energy costs, as smelting is energy-intensive, and alumina prices are linked to bauxite supply and refining capacity. Fluctuations in energy markets, including rising renewable energy adoption, are reshaping cost structures.

Emerging B2B Sourcing Trends:

- Digital Procurement Platforms: Buyers increasingly leverage digital marketplaces and blockchain for traceability and efficiency in sourcing alumina and aluminium, enabling transparent supplier verification and contract management.

- Nearshoring & Regional Sourcing: To mitigate supply chain risks, companies in Europe and the Middle East are exploring regional suppliers or integrated supply models, reducing dependency on long-haul logistics and tariffs.

- Integrated Supply Agreements: Long-term contracts with integrated producers of both alumina and aluminium are preferred to secure stable supply and pricing, particularly for large industrial buyers in sectors such as automotive manufacturing.

Sustainability considerations are becoming paramount in the aluminium and alumina supply chains, driven by regulatory pressures, investor expectations, and consumer demand for responsible sourcing.

Environmental Impact:

- Energy Consumption: Aluminium production is highly energy-intensive, especially during the smelting phase. Alumina refining also generates significant greenhouse gas emissions. Buyers must evaluate the energy mix of suppliers, favoring those utilizing renewable energy sources or innovative low-carbon technologies such as inert anode smelting.

- Bauxite Mining Concerns: Mining operations can cause deforestation, biodiversity loss, and water pollution, particularly in sensitive regions like the Amazon and West Africa. Responsible sourcing demands adherence to strict environmental management and rehabilitation practices.

Ethical Supply Chains:

- Social Responsibility: Buyers should require suppliers to comply with international labor standards, ensuring no child labor or exploitation occurs in bauxite mining and alumina refining. Transparent audit trails and third-party certifications strengthen supplier accountability.

- Green Certifications: Certifications such as the Aluminium Stewardship Initiative (ASI) provide assurance of sustainable practices across the entire value chain—from bauxite mining to aluminium production. Engaging suppliers with ASI certification or equivalent can reduce reputational risks and align with corporate ESG goals.

Actionable Insight:

International B2B buyers should integrate sustainability criteria into procurement policies, demanding transparent reporting on carbon footprints and social impact. Collaborating with suppliers on sustainability initiatives not only mitigates risks but also opens opportunities for premium pricing and market differentiation.

The aluminium and alumina industry has evolved significantly over the past century. Alumina refining emerged as a critical step after the discovery of the Bayer process in the late 19th century, which enabled efficient extraction of alumina from bauxite. This innovation paved the way for large-scale aluminium production.

Historically, aluminium was a rare and expensive metal until the 20th century when advancements in electrolysis dramatically lowered production costs. Today, the aluminium sector is a cornerstone of modern industrial economies, with alumina acting as the indispensable precursor.

For B2B buyers, understanding this historical development highlights the importance of alumina as a strategic commodity and aluminium’s role in industrial innovation, underscoring the need for informed sourcing decisions aligned with technological and market shifts.

What are the fundamental differences between aluminium and alumina that B2B buyers should understand?

Aluminium is a lightweight, ductile metal widely used in manufacturing, while alumina (aluminium oxide) is a ceramic compound derived from bauxite ore, primarily used as a raw material for aluminium production or as an abrasive and refractory material. For buyers, understanding that alumina is an intermediate product and aluminium is the finished metal is critical for sourcing decisions, especially when specifying product applications such as construction, automotive, or electronics.

How should international B2B buyers vet suppliers of aluminium and alumina to ensure quality and reliability?

Effective supplier vetting involves verifying certifications (ISO 9001, ISO 14001), reviewing product test reports, and assessing production capabilities. Buyers should request sample testing, audit production facilities if possible, and confirm the supplier’s track record in international trade compliance. Engaging with suppliers who have experience exporting to regions like Africa, South America, and the Middle East ensures smoother customs clearance and adherence to local standards.

Can aluminium and alumina products be customized to meet specific industrial requirements?

Yes, customization is common. Aluminium can be tailored in alloy composition, temper, and form (sheets, extrusions, foils), while alumina can be customized by purity levels, particle size, and morphology depending on its intended use (e.g., high-purity alumina for electronics or coarse alumina for abrasives). Buyers should discuss specifications upfront with suppliers and verify the feasibility of custom orders to align with their production needs.

What are typical minimum order quantities (MOQs), lead times, and payment terms for aluminium and alumina in international trade?

MOQs vary widely: aluminium products often have MOQs based on weight or unit counts, ranging from several tons to container loads, while alumina MOQs depend on grade and packaging. Lead times can range from 2 to 8 weeks depending on product complexity and supplier location. Payment terms frequently include letters of credit or 30-60 day net terms, but new buyers may need upfront deposits. Negotiating flexible terms with suppliers experienced in your region can optimize cash flow.

What quality assurance measures and certifications should buyers require for aluminium and alumina imports?

Buyers should require certificates of analysis (CoA), mill test reports for aluminium alloys, and purity certificates for alumina. Internationally recognized standards such as ASTM, EN, or JIS help ensure product conformity. Additionally, environmental and safety compliance certificates are increasingly important due to regulatory scrutiny, especially for shipments to Europe and Middle Eastern markets.

How can buyers optimize logistics and shipping for aluminium and alumina to reduce costs and transit risks?

Aluminium is relatively lightweight but bulky, requiring efficient packaging and containerization to minimize freight costs. Alumina’s bulk density and dust potential necessitate sealed and moisture-resistant packaging. Buyers should work with freight forwarders experienced in handling industrial minerals and metals, utilize consolidated shipments when possible, and plan for customs clearance complexities in target markets like Nigeria or Vietnam to avoid delays.

What are the common dispute risks in sourcing aluminium versus alumina, and how can they be mitigated?

Disputes often arise from quality discrepancies, delayed shipments, or non-compliance with specifications. Aluminium disputes may involve alloy composition or mechanical properties, whereas alumina disputes often relate to purity or particle size. Mitigation includes clear contractual agreements specifying technical parameters, penalties for non-compliance, third-party inspection clauses, and using escrow payment mechanisms to build trust.

Are there specific considerations for sourcing aluminium and alumina from emerging markets in Africa, South America, and the Middle East?

Emerging markets may offer competitive pricing but require due diligence on supplier credibility, infrastructure reliability, and export documentation. Political and economic stability can impact lead times. Buyers should prioritize suppliers with strong local partnerships and export experience, understand regional trade agreements (e.g., AfCFTA in Africa), and factor in potential tariffs or import restrictions to optimize sourcing strategies.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Understanding the fundamental differences between aluminium and alumina is crucial for international B2B buyers aiming to optimize procurement strategies and supply chain resilience. Aluminium, a versatile and lightweight metal, serves as a final product in numerous industries, while alumina, its oxide precursor, is essential for refining and production processes. Recognizing their distinct roles enables buyers to tailor sourcing approaches—whether securing raw materials like alumina for manufacturing or finished aluminium for end-use applications.

Strategic sourcing in this sector demands a clear grasp of market dynamics, including regional production hubs, quality specifications, and logistics capabilities. For buyers across Africa, South America, the Middle East, and Europe, leveraging local and international supplier networks can reduce costs and mitigate risks associated with supply volatility. Prioritizing suppliers with transparent production practices and sustainable sourcing credentials will also enhance long-term value and corporate responsibility.

Looking ahead, the aluminium supply chain is poised for transformation driven by technological innovation and growing environmental regulations. B2B buyers are encouraged to invest in partnerships that emphasize circular economy principles and upstream collaboration with alumina producers. Embracing these trends will not only secure competitive advantage but also position companies as leaders in sustainable industrial development across emerging and established markets.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina