The global demand for high-performance gas particulate filters has surged as industries worldwide intensify efforts to comply with stringent environmental regulations and improve air quality standards. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—securing reliable, efficient, and cost-effective gas particulate filters is critical to maintaining competitive operations and meeting sustainability goals.

Understanding the complexities of gas particulate filter technology is essential for informed procurement. This comprehensive guide delves into the diverse types and materials of filters available, highlighting their respective applications and performance characteristics. It also covers the nuances of manufacturing processes and quality control standards, ensuring buyers can evaluate supplier credibility and product durability with confidence.

Further, the guide provides a detailed overview of the global supplier landscape, emphasizing key market trends and pricing considerations tailored to the specific needs of regions like South Africa and Vietnam. By addressing common frequently asked questions, it clarifies technical specifications and logistical challenges unique to cross-border transactions.

Equipped with these insights, international buyers will be empowered to make strategic sourcing decisions that optimize operational efficiency, compliance, and cost management. Whether upgrading existing filtration systems or entering new markets, this guide serves as an authoritative resource to navigate the complexities of the gas particulate filter supply chain and secure solutions that align with both environmental and business objectives.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

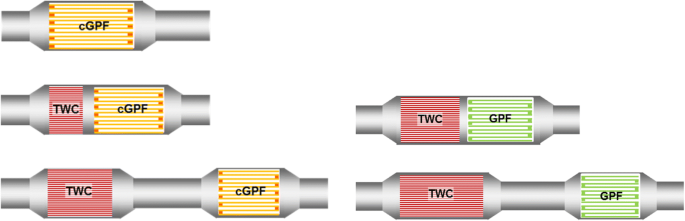

| Catalytic Gas Particulate Filter (CGPF) | Integrates catalytic coating to oxidize particulates and gases | Automotive OEMs, Industrial engines, Power generation | Pros: High efficiency in reducing emissions; dual function (particulates + gases) Cons: Higher upfront cost; sensitive to fuel quality |

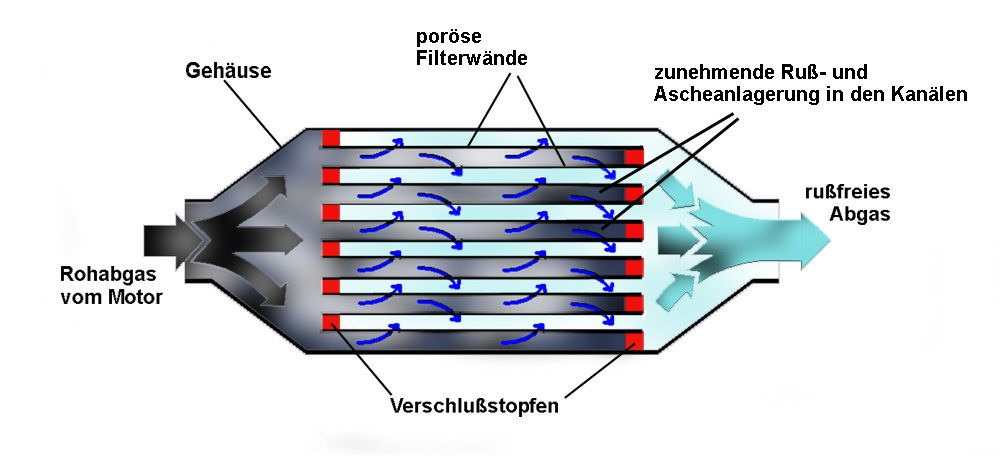

| Wall-Flow Diesel Particulate Filter (DPF) | Porous ceramic honeycomb structure trapping soot particles | Heavy-duty vehicles, mining equipment, marine engines | Pros: Proven technology; significant particulate reduction Cons: Requires periodic regeneration; potential clogging issues |

| Metal Fiber Gas Particulate Filter | Uses metal fibers for filtration, offering durability and heat resistance | Industrial exhaust systems, chemical plants, power stations | Pros: Robust under high temperature; reusable after cleaning Cons: Higher weight; limited filtration efficiency for ultrafine particles |

| Electrostatic Gas Particulate Filter | Employs electrostatic charge to capture fine particulates | Industrial air purification, HVAC systems, manufacturing plants | Pros: Low pressure drop; effective for fine particulate matter Cons: Requires power supply; maintenance of electrodes needed |

| Hybrid Gas Particulate Filter | Combines mechanical filtration with catalytic or electrostatic methods | Advanced automotive systems, industrial processes with mixed pollutants | Pros: Enhanced filtration performance; adaptable to various pollutants Cons: Complex design; higher maintenance complexity |

Catalytic Gas Particulate Filter (CGPF)

CGPFs combine particulate filtration with catalytic oxidation, making them ideal for applications demanding simultaneous reduction of particulate matter and gaseous pollutants such as NOx and CO. This type is particularly suitable for automotive manufacturers and industrial power plants aiming to meet stringent emission standards. Buyers should consider fuel quality and operating temperature ranges, as catalytic coatings can degrade with poor fuel or inconsistent temperatures. The initial investment is higher, but operational benefits and compliance advantages often justify the cost.

Wall-Flow Diesel Particulate Filter (DPF)

DPFs are widely adopted in heavy-duty vehicles and industrial machinery due to their efficient trapping of soot particles within a ceramic honeycomb structure. These filters require regular regeneration cycles to burn off accumulated soot, which can impact operational downtime and maintenance costs. B2B buyers should evaluate regeneration technology compatibility and service support availability, especially in regions with variable fuel standards like Africa and South America. Their proven effectiveness makes them a reliable choice for particulate control.

Metal Fiber Gas Particulate Filter

Metal fiber filters offer excellent durability and resistance to high temperatures, making them well-suited for industrial exhausts and chemical processing plants where harsh conditions prevail. Their reusable nature after cleaning can reduce replacement frequency, a valuable consideration for buyers in cost-sensitive markets. However, these filters tend to be heavier and may not capture ultrafine particulates as effectively as other types. Buyers should assess the balance between durability and filtration efficiency based on their operational requirements.

Electrostatic Gas Particulate Filter

Utilizing electrostatic forces, these filters excel at capturing fine particulate matter with minimal pressure drop, advantageous in HVAC and manufacturing settings requiring clean air without sacrificing airflow. The need for continuous power and periodic electrode maintenance must be factored into total cost of ownership. Buyers in regions with stable electricity supply and access to technical maintenance will find these filters beneficial for long-term air quality management.

Hybrid Gas Particulate Filter

Hybrid filters integrate mechanical filtration with catalytic or electrostatic technologies to address complex pollutant streams. This versatility is attractive for advanced automotive systems and industrial processes with mixed emissions. However, their sophisticated design can lead to increased maintenance complexity and costs. B2B buyers should prioritize suppliers with strong technical support and consider lifecycle costs when investing in hybrid solutions to maximize operational efficiency and regulatory compliance.

Related Video: How It Works - Gasoline Particulate Filter (GPF)

| Industry/Sector | Specific Application of Gas Particulate Filter | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Generation | Emission control in gas turbines and boilers | Compliance with environmental regulations, improved air quality | Filter durability under high temperatures, compatibility with fuel types, and local emission standards compliance |

| Chemical Manufacturing | Filtration of particulate matter from exhaust gases | Protects downstream equipment, ensures product purity | Chemical resistance of filter media, ease of maintenance, and availability of replacement parts |

| Automotive & Transport | Diesel engine exhaust particulate filtration | Reduced emissions, meets stringent vehicle emission norms | Filter efficiency, pressure drop characteristics, and service life suitable for regional fuel quality |

| Cement & Construction | Dust and particulate removal from kiln exhaust gases | Enhances worker safety, reduces environmental impact | Filter capacity for high dust loads, resistance to abrasive particles, and adaptability to harsh operating conditions |

| Oil & Gas Industry | Particulate filtration in gas processing and flaring systems | Minimizes equipment fouling, improves operational reliability | Corrosion resistance, compatibility with volatile gases, and compliance with international safety standards |

Gas particulate filters play a critical role in power generation, particularly in gas turbines and boilers. These filters help control particulate emissions, ensuring compliance with increasingly stringent environmental regulations in regions like Europe and the Middle East. For B2B buyers in Africa and South America, selecting filters that withstand high operating temperatures and are compatible with locally used fuels is essential to maintain efficiency and reduce downtime.

In the chemical manufacturing sector, gas particulate filters remove harmful particulates from exhaust gases, protecting sensitive downstream equipment and maintaining product integrity. Buyers should prioritize filters with strong chemical resistance and easy maintenance features to minimize operational disruptions. Sourcing from suppliers who can provide timely replacement parts is crucial, especially for businesses in emerging markets where supply chains may be less predictable.

The automotive and transport industry relies on gas particulate filters to reduce diesel engine emissions, helping manufacturers meet strict emission standards such as Euro 6 in Europe or emerging regulations in South America and Africa. Buyers need filters that balance high filtration efficiency with low pressure drop to preserve engine performance, while also considering fuel quality variations in different regions to ensure optimal filter lifespan.

In cement and construction, filters are used to capture dust and particulates from kiln exhaust gases, significantly improving workplace air quality and environmental compliance. Given the abrasive nature of cement dust, buyers must focus on filters with high dust load capacity and abrasion resistance. For international buyers, especially in developing economies, adaptability to harsh conditions and ease of installation are key factors to ensure long-term operational success.

The oil and gas industry uses gas particulate filters extensively in gas processing and flaring systems to prevent equipment fouling and enhance operational reliability. Filters must be corrosion-resistant and compatible with volatile gases commonly encountered in this sector. International buyers from regions like the Middle East and Europe should also ensure that the filters meet international safety and environmental standards to avoid regulatory penalties and support sustainable operations.

When selecting materials for gas particulate filters, B2B buyers must carefully evaluate the physical and chemical properties that directly affect filter performance, longevity, and cost-efficiency. The choice of material also influences compliance with international standards and suitability for specific industrial environments, especially across diverse regions such as Africa, South America, the Middle East, and Europe.

Key Properties: Stainless steel, particularly grades 304 and 316, offers excellent corrosion resistance, high tensile strength, and temperature tolerance up to approximately 870°C (1600°F). It withstands high pressures and aggressive chemical environments, making it a reliable choice for harsh industrial applications.

Pros & Cons: Stainless steel filters are highly durable and resistant to oxidation, which reduces maintenance frequency. However, they tend to have a higher upfront cost and require more complex manufacturing processes such as precision welding and surface finishing. Their weight can also be a consideration in mobile or space-constrained applications.

Impact on Application: Ideal for filtering particulate matter in corrosive gases or high-temperature exhaust streams, such as in chemical plants or power generation. Stainless steel’s resistance to acidic gases makes it suitable for environments with sulfur compounds or chlorides.

Regional Considerations: Buyers in Europe and the Middle East often prioritize stainless steel due to stringent environmental regulations (e.g., EU’s EN standards, GCC specifications). In Africa and South America, cost sensitivity may limit widespread use, but stainless steel remains preferred for critical applications requiring durability and compliance with ASTM or ISO standards.

Key Properties: Ceramic filters can endure extremely high temperatures (up to 1400°C or 2550°F) and provide excellent chemical inertness. They have high hardness and abrasion resistance but are brittle and prone to mechanical shock damage.

Pros & Cons: Ceramics offer superior thermal stability and filtration efficiency, especially for fine particulates. However, their brittleness requires careful handling and installation, and they often necessitate specialized manufacturing techniques that increase cost. Their fragility can lead to higher replacement rates if not managed properly.

Impact on Application: Best suited for high-temperature industrial processes such as metal smelting, cement production, and biomass combustion. Ceramic filters excel in environments where thermal shock and chemical corrosion are concerns.

Regional Considerations: In regions like South America and parts of Africa where heavy industries are expanding, ceramics are gaining traction despite cost. Buyers should verify compliance with local standards (e.g., Brazilian NBR, South African SANS) and consider supplier capabilities for replacement parts and technical support.

Key Properties: Polymers such as PTFE (Teflon) and polypropylene offer excellent chemical resistance and low-temperature flexibility but have limited temperature tolerance, generally up to 260°C (500°F) for PTFE and lower for polypropylene.

Pros & Cons: These materials are lightweight, cost-effective, and easy to manufacture into various filter shapes. They are ideal for filtering acidic or alkaline gases at moderate temperatures. However, their lower thermal resistance limits their use in high-temperature applications, and they may degrade under UV exposure or certain solvents.

Impact on Application: Suitable for pharmaceutical, food processing, and chemical industries where gas streams are corrosive but temperatures are moderate. Their hydrophobic properties also make them effective in moisture-laden environments.

Regional Considerations: Polymer filters are widely used in Middle Eastern and European markets for compliance with REACH and other chemical safety regulations. In Africa and South America, their affordability and ease of replacement make them attractive for small-to-medium enterprises, but buyers should ensure material certifications align with ASTM or ISO standards.

Key Properties: Sintered metals like nickel and Inconel exhibit excellent high-temperature resistance (up to 1000°C or 1832°F for Inconel), outstanding mechanical strength, and corrosion resistance, especially against oxidizing and reducing gases.

Pros & Cons: These filters combine durability with fine filtration capabilities and can be cleaned and reused, reducing lifecycle costs. However, they are among the most expensive options and require advanced manufacturing processes. Their weight and rigidity may limit application in some designs.

Impact on Application: Preferred in petrochemical, aerospace, and power generation sectors where extreme conditions demand robust filtration. Their reusability is a significant advantage in continuous operation environments.

Regional Considerations: Buyers in Europe and the Middle East often specify sintered metal filters for compliance with stringent industrial standards (e.g., DIN, ASTM). In Africa and South America, adoption is growing in high-value industries, but cost and supplier availability remain critical factors.

| Material | Typical Use Case for gas particulate filter | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel | High-temp industrial exhaust, corrosive gas streams | Excellent corrosion resistance and durability | Higher upfront cost and manufacturing complexity | High |

| Ceramic Materials | High-temp processes like metal smelting and cement | Superior thermal stability and chemical inertness | Brittle, prone to mechanical damage | High |

| Polymeric Materials (PTFE, Polypropylene) | Moderate-temp chemical and food industry applications | Lightweight, cost-effective, chemical resistant | Limited temperature tolerance, UV sensitivity | Low to Medium |

| Sintered Metal (Nickel, Inconel) | Extreme conditions in petrochemical and power sectors | High strength, reusable, excellent corrosion resistance | High cost and weight | High |

This material guide equips international B2B buyers with a clear understanding of the trade-offs involved in selecting gas particulate filter materials. By aligning material properties with operational demands and regional standards, buyers can optimize performance, compliance, and cost-effectiveness in their specific markets.

Manufacturing gas particulate filters involves a complex, multi-stage process designed to ensure high performance and durability. For international B2B buyers—particularly those operating in Africa, South America, the Middle East, and Europe—understanding these manufacturing stages and the associated quality assurance protocols is essential for selecting reliable suppliers and ensuring compliance with regional and international standards.

1. Material Preparation

The foundation of a gas particulate filter lies in its raw materials, typically including advanced filter media such as ceramic fibers, sintered metals, or specialized polymer composites. Material preparation involves sourcing high-purity components, cutting or shaping filter media sheets, and treating them chemically or thermally to enhance filtration efficiency and thermal stability. For B2B buyers, verifying the origin and certification of raw materials is crucial to ensure consistent filter performance.

2. Forming and Shaping

Once materials are prepared, they undergo forming processes to achieve the desired filter geometry. Common techniques include:

- Molding: Using precision molds to shape filter elements into cartridges or panels.

- Pleating: Increasing the surface area of filter media for improved particulate capture.

- Sintering: For metal or ceramic filters, sintering consolidates powdered material into a solid structure at high temperatures.

The forming stage requires strict control to maintain dimensional accuracy and structural integrity, directly impacting filtration effectiveness.

3. Assembly

This stage integrates various components such as filter media, housings, gaskets, and seals. Automated or semi-automated assembly lines are often used to ensure repeatability and minimize human error. Critical assembly steps include:

- Securing filter media within frames or casings using adhesives or mechanical fasteners.

- Installing sealing components to prevent bypass leakage.

- Adding structural supports to withstand operational pressures.

B2B buyers should inquire about assembly automation levels and traceability systems that enable batch tracking.

4. Finishing and Surface Treatment

Finishing processes may involve coating filter elements with protective layers (e.g., anti-corrosion or hydrophobic coatings) or applying surface treatments to enhance durability and chemical resistance. Additionally, filters undergo cleaning to remove manufacturing residues and are packaged in controlled environments to avoid contamination.

International B2B buyers must prioritize quality assurance systems that align with recognized standards and industry-specific certifications to mitigate risks associated with filter failure or non-compliance.

Key International Standards:

- ISO 9001: Establishes a framework for quality management systems (QMS), emphasizing continuous improvement and customer satisfaction. Suppliers adhering to ISO 9001 demonstrate disciplined process controls and documentation.

- CE Marking: Mandatory for products sold within the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- API Standards: For filters used in oil, gas, and petrochemical industries, compliance with American Petroleum Institute standards ensures suitability for harsh environments.

- Other Regional Certifications: Depending on the target market, certifications such as South African Bureau of Standards (SABS), INMETRO (Brazil), or Gulf Cooperation Council (GCC) conformity marks may apply.

QC Checkpoints in Manufacturing:

- Incoming Quality Control (IQC): Inspects raw materials and components upon arrival to verify specifications and certifications.

- In-Process Quality Control (IPQC): Conducts inspections during forming, assembly, and finishing stages to detect deviations early. Techniques include dimensional checks, visual inspections, and process parameter monitoring.

- Final Quality Control (FQC): Comprehensive testing of finished filters before shipment, including functional performance and packaging integrity.

Common Testing Methods:

- Particle Filtration Efficiency Testing: Measures the filter's ability to remove particulate matter across specified size ranges.

- Pressure Drop Measurement: Assesses airflow resistance to ensure filters meet operational requirements without excessive energy consumption.

- Durability and Thermal Resistance Tests: Evaluate filter performance under simulated operating conditions, including temperature cycling and chemical exposure.

- Leakage Tests: Detect potential bypass paths that could compromise filtration integrity.

- Material Composition Analysis: Confirms the chemical and physical properties of filter media and coatings.

1. Supplier Audits

Conducting on-site or virtual audits allows buyers to evaluate manufacturing processes, quality control systems, and compliance with international standards. Audits should include examination of production lines, raw material storage, testing laboratories, and documentation practices.

2. Review of Quality Documentation

Request detailed quality control records such as:

- Material certificates of conformity

- Inspection reports at each QC checkpoint

- Test result summaries for filtration efficiency and durability

- Non-conformance reports and corrective action documentation

3. Third-Party Inspection and Testing

Engaging independent inspection agencies provides unbiased verification of product quality and compliance. Third-party labs can perform sample testing to validate supplier claims and ensure filters meet contractual and regulatory requirements.

4. Certification Verification

Buyers should verify the authenticity and current status of supplier certifications (ISO, CE, API, etc.) through issuing bodies or recognized registries. This is particularly important for buyers in regions with stringent import regulations or where certification fraud is a concern.

Selecting a gas particulate filter supplier requires thorough due diligence on manufacturing processes and quality assurance. Buyers should:

- Prioritize suppliers with robust material sourcing, precision forming, and controlled assembly processes.

- Demand adherence to recognized international and industry-specific standards with transparent QC checkpoints.

- Utilize audits, document reviews, and third-party inspections to verify quality claims.

- Consider regional certification requirements and logistical factors relevant to their market.

- Establish clear contractual agreements encompassing quality standards, certifications, and after-sales service.

By focusing on these manufacturing and quality assurance insights, international B2B buyers can secure high-performance gas particulate filters that meet their operational needs and regulatory obligations efficiently and reliably.

Understanding the cost and pricing structure of gas particulate filters is crucial for international B2B buyers aiming to optimize procurement strategies and ensure cost-effectiveness. This section breaks down key cost components, price influencers, and actionable buyer tips tailored for markets in Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Materials

The raw materials, primarily high-grade metals, ceramics, and advanced filtration media, constitute the largest portion of the cost. Variations in material quality directly impact filter performance and durability, influencing pricing significantly.

Labor

Skilled labor for manufacturing and assembly affects costs, especially when sourcing from regions with higher labor rates. Automation levels in production can also reduce labor costs but might increase initial tooling expenses.

Manufacturing Overhead

This includes factory utilities, equipment depreciation, and indirect labor. Overhead varies depending on the manufacturing location, with developed regions typically incurring higher overhead costs.

Tooling and Equipment

Initial setup costs for molds, dies, and specialized machinery are capital-intensive. These costs are amortized over production volumes, so lower order quantities can lead to higher per-unit costs.

Quality Control (QC)

Rigorous QC processes ensure compliance with international standards (e.g., ISO, CE, EPA). QC costs include inspection, testing, and certification, which are essential for high-reliability applications but add to the unit price.

Illustrative Image (Source: Google Search)

Logistics and Shipping

Freight charges, customs duties, and import taxes vary significantly by destination. For buyers in Africa, South America, and the Middle East, logistics can represent a considerable portion of total cost due to longer transit times and complex customs procedures.

Supplier Margin

Suppliers include their profit margin, which fluctuates based on market demand, competition, and the exclusivity of technology or materials used.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically unlock economies of scale, reducing the unit price. Buyers should negotiate MOQs that align with their inventory capacity and cash flow while aiming to benefit from bulk discounts.

Specification Complexity and Customization

Customized filters tailored for specific industrial applications or environmental regulations command higher prices due to design complexity and specialized materials.

Material Quality and Certification

Filters certified for stringent emission standards or made from premium materials cost more but offer longer service life and regulatory compliance benefits.

Supplier Reputation and Location

Established suppliers with proven quality records may charge premiums but reduce risk. Additionally, suppliers located closer to the buyer or with efficient export logistics can minimize shipping costs.

Incoterms (International Commercial Terms)

The chosen Incoterms (e.g., FOB, CIF, DDP) significantly affect the buyer’s cost responsibility and risk exposure. Buyers should understand these terms fully to avoid unexpected expenses.

Negotiate Beyond Price

Focus negotiations on payment terms, lead times, warranty conditions, and after-sales support. These factors can have a substantial impact on total cost and operational efficiency.

Evaluate Total Cost of Ownership (TCO)

Consider maintenance, filter lifespan, replacement frequency, and energy efficiency. A lower upfront price may lead to higher long-term expenses if TCO is not accounted for.

Leverage Local Import Knowledge

Buyers from regions such as South Africa, Brazil, or the UAE should engage local customs brokers to optimize import duties and clearance times, reducing logistical overheads.

Request Samples and Certifications

Insist on product samples and verify certifications to ensure compliance with regional emission regulations and quality standards.

Consider Currency Fluctuations and Payment Methods

International transactions expose buyers to currency risk. Negotiating contracts in stable currencies or using hedging strategies can protect margins.

Build Long-Term Supplier Relationships

Cultivating partnerships can lead to better pricing, priority production slots, and improved customization options.

The prices of gas particulate filters vary widely based on specifications, volume, supplier, and market conditions. The figures discussed here serve as indicative guidance and should be validated through direct supplier quotes and market research.

By carefully analyzing these cost components and price influencers, B2B buyers can make informed decisions, negotiate effectively, and achieve optimal value when sourcing gas particulate filters internationally.

Understanding the core technical specifications of gas particulate filters is essential for international B2B buyers to ensure compatibility, performance, and compliance with local regulations. Here are the key properties to focus on:

Filter Material Grade

The filter media is commonly made from ceramic, metallic, or composite materials designed to withstand high temperatures and corrosive gases. For buyers, selecting the correct material grade ensures durability and efficiency, especially in harsh industrial environments typical in mining or petrochemical sectors across Africa, South America, and the Middle East.

Particle Filtration Efficiency (PFE)

This metric defines the filter’s ability to remove particulate matter, usually expressed as a percentage (e.g., ≥ 99%). High PFE is crucial for meeting environmental regulations and protecting downstream equipment. Buyers should verify PFE values aligned with local emission standards such as the European Union’s Stage V or South Africa’s Air Quality Act.

Operating Temperature Range

Gas particulate filters must operate effectively within a specified temperature range, often from -40°C up to 600°C or higher. This property is vital for buyers to confirm compatibility with their process conditions, ensuring filter integrity and longevity under variable thermal stresses.

Pressure Drop (ΔP)

The pressure drop across the filter impacts system energy consumption. A lower ΔP indicates less resistance to gas flow, improving operational efficiency. Buyers should balance pressure drop specifications with filtration performance to optimize overall system costs.

Tolerance and Dimensions

Precise mechanical tolerances and dimensional specifications guarantee proper fit and sealing within existing equipment. For international procurement, confirming these parameters reduces installation issues and costly delays, particularly when dealing with suppliers across different manufacturing standards.

Chemical Resistance

Filters may be exposed to acidic or alkaline gases depending on the application. Chemical resistance of the filter material ensures sustained performance without degradation, which is critical for industries such as chemical manufacturing or oil refining prevalent in the Middle East and Europe.

Navigating the procurement process for gas particulate filters requires familiarity with key trade terms and industry jargon frequently used in international B2B transactions:

OEM (Original Equipment Manufacturer)

Refers to the company that originally designed and manufactures the gas particulate filter. Buyers often seek OEM products to ensure quality and compatibility, or alternatively consider authorized aftermarket suppliers for cost-effective solutions.

MOQ (Minimum Order Quantity)

This is the smallest quantity a supplier is willing to sell in a single order. Understanding MOQ helps buyers plan procurement volumes and negotiate better terms, especially important for SMEs or distributors in emerging markets.

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers asking for pricing, lead times, and terms. Providing detailed RFQs with technical specs facilitates accurate and comparable offers, streamlining supplier selection.

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities for shipping, insurance, and customs clearance between buyer and seller. Common Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, Freight) impact total landed cost and risk management, critical for buyers importing filters into regions like South America or Africa.

Lead Time

The period between placing an order and receiving the product. Buyers must consider lead times in project planning to avoid operational downtime, particularly when sourcing from overseas manufacturers.

Certification and Compliance

Refers to adherence to international or local standards such as ISO, CE marking, or EPA regulations. Certifications assure buyers of product quality and regulatory compliance, simplifying customs clearance and facilitating market acceptance.

By focusing on these technical properties and trade terms, B2B buyers in Africa, South America, the Middle East, and Europe can make informed decisions, ensuring they procure gas particulate filters that meet their operational needs while optimizing cost and delivery.

The gas particulate filter (GPF) sector is experiencing significant growth driven by increasingly stringent global emissions regulations and a rising demand for cleaner air solutions. International B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, are witnessing a surge in adoption due to expanding industrial activities and urbanization paired with environmental concerns. Countries like South Africa and emerging markets such as Vietnam are investing in advanced filtration technologies to comply with international standards and reduce harmful particulate emissions from diesel and gasoline engines.

Key market drivers include regulatory frameworks such as the European Union’s Euro 6 and upcoming Euro 7 standards, which mandate lower particulate matter (PM) emissions, compelling manufacturers and fleet operators to upgrade their filtration systems. In regions like the Middle East and South America, the rapid growth of transportation and heavy industries fuels demand for durable, efficient GPF solutions tailored to harsh operating conditions.

Technological advancements are shaping sourcing trends. Buyers are prioritizing filters with enhanced filtration efficiency, longer service intervals, and compatibility with modern engine management systems. There is a growing preference for modular and retrofit-ready designs that simplify integration into existing fleets. Additionally, digitalization and IoT-enabled monitoring systems are becoming increasingly relevant, offering predictive maintenance and real-time performance data to optimize operational costs.

From a sourcing perspective, B2B buyers are leveraging global supply chains with a focus on reliability and cost-effectiveness. However, geopolitical factors and logistics challenges have heightened interest in regional suppliers who can offer faster turnaround times and localized support. Strategic partnerships and collaborations between manufacturers and distributors are emerging to ensure seamless supply and customization capabilities.

Illustrative Image (Source: Google Search)

Sustainability is a critical consideration for B2B buyers in the gas particulate filter market. The environmental impact of particulate emissions is well-documented, contributing to air pollution and public health risks. As a result, companies are increasingly adopting filters that not only meet emission standards but also align with broader corporate sustainability goals.

Ethical sourcing of materials used in GPFs, such as ceramics and precious metals like platinum and palladium, is gaining prominence. Buyers are scrutinizing supply chains to ensure compliance with environmental regulations and human rights standards. This includes sourcing from suppliers who provide traceability and transparency, minimizing risks associated with conflict minerals and unsustainable mining practices.

Green certifications such as ISO 14001 (Environmental Management) and adherence to the EU’s REACH regulations are becoming standard requirements for suppliers. Moreover, the use of eco-friendly materials and manufacturing processes that reduce waste and energy consumption is a growing trend. Buyers are encouraged to evaluate suppliers based on their lifecycle assessments and end-of-life recyclability of filters to support circular economy principles.

In emerging markets, sustainability considerations also extend to affordability and accessibility. B2B buyers are balancing cost constraints with the need for environmentally responsible products, often seeking innovative solutions that deliver high performance without compromising on sustainability.

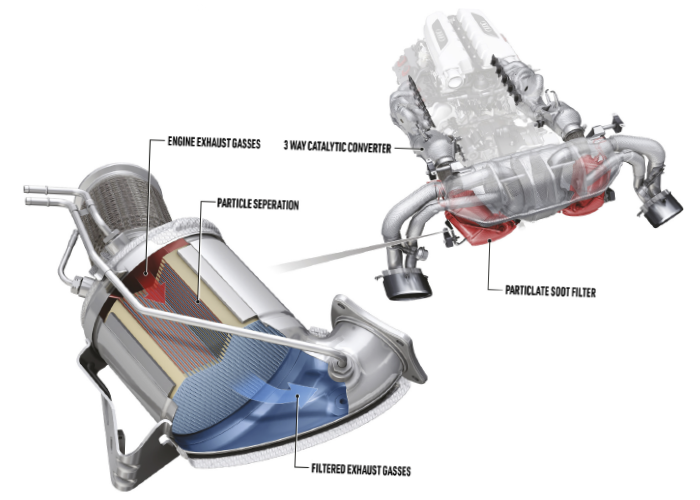

The evolution of gas particulate filters parallels the tightening of global emission standards over the past two decades. Initially developed for diesel engines to capture soot and reduce particulate emissions, GPF technology has expanded to gasoline direct injection (GDI) engines due to their rising prevalence and associated particulate challenges.

Early GPF designs focused on simple filtration media, but advancements have introduced sophisticated substrate materials and catalytic coatings that enhance filter regeneration and durability. The shift from diesel particulate filters (DPFs) to GPFs reflects the automotive industry’s transition toward cleaner gasoline engines while maintaining stringent emission control.

For B2B buyers, understanding this evolution is critical as it informs procurement decisions related to compatibility, performance expectations, and regulatory compliance. The historical trajectory also underscores the importance of continuous innovation and collaboration between filter manufacturers, engine producers, and regulatory bodies to meet evolving environmental requirements.

How can I effectively vet gas particulate filter suppliers internationally?

When sourcing gas particulate filters globally, prioritize suppliers with verifiable certifications such as ISO 9001 and industry-specific standards. Request detailed company profiles, factory audits, and client references. Utilize third-party inspection agencies to validate manufacturing capabilities and quality controls. Pay attention to suppliers’ experience in exporting to your region, as familiarity with local regulations and logistics significantly reduces risks. Additionally, engage in video calls or on-site visits to build trust and ensure clear communication before finalizing contracts.

Is customization of gas particulate filters possible to meet specific industrial needs?

Yes, many manufacturers offer customization to tailor filters to specific gas compositions, particle sizes, or environmental conditions. Discuss your technical requirements early, including flow rates, temperature tolerance, and pressure drops, to ensure compatibility. Customization may affect lead times and costs, so clarify these aspects upfront. Working with suppliers who provide engineering support and prototype testing can improve product fit and performance, crucial for industries such as chemical processing or power generation.

What are typical minimum order quantities (MOQs) and lead times for international orders?

MOQs vary widely depending on the supplier’s production scale and filter complexity, ranging from small batch runs (e.g., 50 units) to larger volumes (several hundreds). Lead times generally span 4 to 12 weeks, influenced by customization, raw material availability, and shipping logistics. For buyers in Africa, South America, the Middle East, and Europe, factor in additional time for customs clearance and inland transportation. Negotiate MOQs and explore phased deliveries to better manage inventory and cash flow.

What payment terms are standard when purchasing gas particulate filters internationally?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and Escrow services, balancing security for both parties. Typically, suppliers require a 30-50% advance payment, with the balance paid upon shipment or after inspection. To mitigate risks, B2B buyers should negotiate terms aligned with supplier reliability and order value. Using trade finance solutions or working through reputable trade platforms can further safeguard transactions, especially when dealing with new suppliers or high-value orders.

What quality assurance and certifications should I expect from reputable gas particulate filter manufacturers?

Quality assurance begins with documented manufacturing processes adhering to ISO 9001 standards. Look for filters certified by recognized bodies such as CE (Europe), UL, or industry-specific certifications relevant to your region and application. Request test reports verifying filtration efficiency, durability, and compliance with environmental regulations. Manufacturers with in-house testing labs and third-party quality audits provide greater confidence. Ensure that warranty terms and after-sales support are clearly defined to address potential defects or performance issues.

How can I optimize logistics and shipping for gas particulate filter imports?

Plan shipments well in advance, considering production lead times and regional customs procedures. Choose between air freight for urgent orders and sea freight for cost efficiency, balancing speed and budget. Work with freight forwarders experienced in handling industrial equipment and knowledgeable about import regulations in your country. Ensure all documentation, including commercial invoices, certificates of origin, and compliance certificates, is complete to avoid delays. Consolidating shipments or partnering with local distributors can also reduce logistics complexity and costs.

What steps should I take if there is a dispute or quality issue with a supplier?

First, maintain clear documentation of all communications, contracts, and quality inspections. Address the issue promptly through formal channels, providing detailed evidence such as photos, test reports, and third-party assessments. Negotiate remediation options including replacement, repair, or refund, referencing agreed warranty terms. If unresolved, leverage dispute resolution mechanisms like mediation, arbitration, or legal action under the contract’s governing law. Engaging local trade chambers or export promotion agencies can also provide support in cross-border disputes.

Are there specific regional considerations when sourcing gas particulate filters from or to Africa, South America, the Middle East, and Europe?

Yes, regional factors such as regulatory standards, import tariffs, and infrastructure impact procurement. For example, African and South American countries may have variable customs clearance times and require compliance with local environmental laws. The Middle East often demands adherence to strict quality and certification standards due to harsh operating environments. Europe enforces rigorous environmental and safety regulations, so products must meet EU directives. Understanding these nuances helps tailor supplier selection, contract terms, and logistics planning to ensure smooth international transactions.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of gas particulate filters is pivotal for businesses aiming to enhance environmental compliance, operational efficiency, and cost-effectiveness. For international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—prioritizing suppliers with proven technological expertise, robust quality standards, and flexible logistics capabilities ensures a reliable supply chain tailored to diverse market needs. Emphasizing long-term partnerships with manufacturers who invest in innovation can drive competitive advantage and sustainability.

Key takeaways include the importance of thorough supplier evaluation, consideration of regional regulatory frameworks, and integration of lifecycle cost analysis in procurement decisions. Leveraging digital tools and market intelligence can further optimize sourcing strategies, reducing risks associated with volatility and geopolitical challenges.

Looking ahead, the demand for advanced gas particulate filters will grow as industries worldwide intensify efforts to meet stricter emissions regulations and sustainability targets. Buyers are encouraged to proactively engage with forward-thinking suppliers, explore collaborative innovation opportunities, and adopt agile sourcing models. By doing so, companies in emerging and established markets alike can secure cutting-edge filtration solutions that support cleaner operations and long-term business resilience.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina