The demand for the hardest ceramic materials is rapidly growing across industries that require exceptional durability, wear resistance, and thermal stability. For international B2B buyers, particularly those operating in Africa, South America, the Middle East, and Europe, sourcing these advanced ceramics presents both remarkable opportunities and complex challenges. Understanding the diverse types of hardest ceramic materials, their manufacturing processes, quality control standards, and global supplier landscape is essential to making strategic procurement decisions that drive competitive advantage.

This guide offers a comprehensive roadmap to navigating the global market for hardest ceramic materials. It covers key material classifications such as silicon carbide, boron carbide, and alumina-based ceramics, detailing their unique properties and ideal applications. Additionally, it delves into critical manufacturing and quality assurance methodologies that impact performance and reliability. Buyers will also find an in-depth analysis of leading suppliers across multiple regions, cost considerations, and emerging market trends shaping supply and demand.

By equipping B2B buyers with actionable insights and practical knowledge, this guide empowers informed sourcing strategies tailored to regional market dynamics and industry requirements. Whether you are a procurement specialist in Saudi Arabia seeking high-performance ceramics for industrial tooling or a South African manufacturer prioritizing cost-effective, robust components, this resource provides the clarity needed to optimize supplier selection and negotiate favorable terms. Embracing this holistic understanding will enable buyers to minimize risks, enhance product quality, and capitalize on the growing global demand for the hardest ceramic materials.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Alumina (Aluminum Oxide) | High hardness, excellent wear resistance, good thermal stability | Cutting tools, wear parts, electrical insulators | Pros: Cost-effective, widely available, versatile Cons: Moderate toughness, limited chemical resistance in acidic environments |

| Silicon Carbide (SiC) | Exceptional hardness, high thermal conductivity, chemical inertness | Abrasives, armor plating, semiconductor manufacturing | Pros: Superior wear resistance, high-temperature performance Cons: Brittle, higher cost than alumina |

| Boron Carbide (B4C) | One of the hardest ceramics, very low density, excellent neutron absorption | Armor, abrasives, nuclear industry | Pros: Extremely hard, lightweight Cons: Expensive, difficult to machine |

| Zirconia (ZrO2) | High fracture toughness, good wear resistance, thermal shock resistance | Medical implants, cutting tools, sensors | Pros: Tougher than most ceramics, biocompatible Cons: Lower hardness than SiC and B4C, higher cost than alumina |

| Titanium Diboride (TiB2) | High hardness, good electrical conductivity, corrosion resistant | Armor, cutting tools, electronic components | Pros: Combines hardness with conductivity, corrosion resistant Cons: Limited availability, processing complexity |

Alumina (Aluminum Oxide)

Alumina is the most commonly used hardest ceramic material in industrial applications due to its balance of hardness, wear resistance, and cost efficiency. It is suitable for a wide range of environments, especially where moderate toughness and thermal stability are required. For B2B buyers, alumina offers a versatile choice for manufacturing cutting tools, wear parts, and electrical insulators. Its availability and cost-effectiveness make it ideal for large-scale production, though buyers should consider its limited chemical resistance in acidic or highly corrosive conditions.

Silicon Carbide (SiC)

Silicon carbide stands out for its exceptional hardness and thermal conductivity, making it indispensable in high-performance abrasives and armor plating. It also plays a critical role in semiconductor manufacturing due to its chemical inertness. Buyers targeting industries such as defense, electronics, or heavy machinery will benefit from SiC’s superior wear resistance and ability to perform under extreme temperatures. However, its brittleness and relatively higher price point require careful cost-benefit analysis during procurement.

Boron Carbide (B4C)

Known as one of the hardest ceramics available, boron carbide combines extreme hardness with a very low density, making it highly desirable for lightweight armor and abrasive applications. It is particularly valued in the nuclear industry for its neutron absorption properties. For B2B buyers, the primary considerations include its high cost and machining challenges, which can impact lead times and production costs. Nonetheless, its performance advantages justify its use in specialized, high-value sectors.

Zirconia (ZrO2)

Zirconia ceramics offer a unique combination of high fracture toughness and good wear resistance, along with thermal shock resistance. These properties make it suitable for medical implants, cutting tools, and precision sensors. Buyers from medical device manufacturers or precision engineering sectors will appreciate zirconia’s biocompatibility and durability. While it is less hard than SiC or B4C, its toughness and cost profile position it well for applications requiring reliability under mechanical stress.

Titanium Diboride (TiB2)

Titanium diboride is a hard ceramic known for its excellent electrical conductivity and corrosion resistance, making it a preferred choice in armor, cutting tools, and electronic components. For B2B buyers, TiB2 offers the advantage of combining hardness with conductivity, which is rare among ceramics. However, its limited availability and the complexity of processing can increase procurement challenges and costs. Buyers should assess supply chain reliability and production capabilities when considering TiB2 for high-performance applications.

Related Video: Basics of Ceramic Glazing: Types & Techniques

| Industry/Sector | Specific Application of hardest ceramic material | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Defense | Wear-resistant components in turbine engines and cutting tools | Enhances durability and performance under extreme conditions | Compliance with international aerospace standards; material certification; reliable supply chain for high-purity ceramics |

| Mining & Drilling | Drill bits and wear parts for heavy machinery | Increases operational lifespan and reduces downtime | Availability of custom sizes and shapes; resistance to abrasion; logistics for remote mining locations in Africa and South America |

| Electronics & Semiconductors | Substrates and insulators in high-frequency devices | Improves thermal stability and electrical insulation | Quality consistency; compatibility with semiconductor manufacturing processes; adherence to RoHS and environmental regulations in Europe and Middle East |

| Medical Devices | Surgical tools and implants requiring extreme hardness | Provides biocompatibility and long-lasting wear resistance | Certification for medical-grade ceramics; traceability; compliance with health regulations in Europe and Middle East markets |

| Automotive | Engine components and sensors exposed to high wear and heat | Enhances fuel efficiency and component longevity | Heat resistance specifications; supplier capability for large volume orders; cost-effectiveness for emerging markets in South America and Africa |

In aerospace and defense, the hardest ceramic materials are critical for manufacturing wear-resistant components such as turbine engine parts and precision cutting tools. These materials withstand extreme temperatures and mechanical stresses, significantly extending component life and improving overall engine efficiency. For B2B buyers in regions like Saudi Arabia and Europe, sourcing must prioritize suppliers who meet strict aerospace certifications and provide traceability to ensure compliance with international standards. Reliable logistics and quality assurance are essential to maintain uninterrupted production cycles.

Mining operations, especially in Africa and South America, rely on hardest ceramic materials for drill bits and wear parts that endure abrasive conditions and heavy mechanical loads. Utilizing these ceramics reduces equipment downtime and maintenance costs, boosting productivity in challenging environments. Buyers should focus on sourcing ceramics with proven abrasion resistance and the ability to customize sizes to fit specific machinery. Additionally, logistical considerations for delivering materials to remote mining sites must be factored into supplier selection.

Hardest ceramic materials serve as substrates and insulators in advanced electronics and semiconductor devices, where thermal stability and electrical insulation are paramount. This is particularly important for manufacturers in Europe and the Middle East, where adherence to environmental and safety regulations like RoHS is mandatory. Buyers need to ensure that ceramic materials are compatible with existing semiconductor fabrication processes and maintain consistent quality to prevent defects in high-frequency applications.

In the medical field, hardest ceramics are used for surgical tools and implants that demand exceptional hardness and biocompatibility. These materials help improve patient outcomes by providing durable, wear-resistant instruments and implants. For B2B buyers in Europe and the Middle East, sourcing must comply with stringent medical certifications and regulatory standards. Traceability and quality control are critical to meet the safety requirements of healthcare providers and regulatory bodies.

Automotive manufacturers utilize hardest ceramic materials in engine components and sensors that operate under high temperature and wear conditions. These ceramics contribute to improved fuel efficiency and longer-lasting parts, reducing overall maintenance costs. Buyers from emerging markets in South America and Africa should consider suppliers who can deliver heat-resistant ceramics at scale and competitive prices, ensuring cost-effectiveness without compromising on quality or performance.

Related Video: Ceramic Material(properties, Application) | Civil Mantraa

Key Properties:

Silicon Carbide is renowned for its exceptional hardness, thermal conductivity, and high-temperature resistance up to approximately 1600°C. It exhibits excellent corrosion resistance against acids and alkalis, and outstanding wear resistance under abrasive conditions. SiC can withstand high mechanical stress and thermal shock, making it suitable for harsh industrial environments.

Pros & Cons:

- Pros: High durability, excellent thermal and chemical stability, and good electrical conductivity.

- Cons: Manufacturing complexity is moderate to high due to sintering requirements; relatively brittle compared to some other ceramics. Cost is medium to high depending on purity and form.

Impact on Application:

SiC is ideal for applications involving abrasive slurries, high-temperature filtration, and mechanical seals. It performs well in corrosive media such as acidic or alkaline environments, common in chemical processing plants.

Considerations for International Buyers:

Buyers from regions like the Middle East (Saudi Arabia) and South Africa should verify compliance with ASTM C799 and DIN EN standards for SiC ceramics. Given the prevalence of chemical and petrochemical industries in these regions, SiC’s corrosion resistance aligns well with local operational demands. European buyers benefit from JIS and ISO certifications that ensure quality and consistency. Supply chain logistics should be considered, as SiC components are often sourced from specialized manufacturers in Asia and Europe.

Key Properties:

Alumina is one of the most widely used ceramics due to its high hardness (Mohs scale ~9), excellent electrical insulation, and good thermal stability up to about 1700°C. It offers moderate chemical resistance but is less resistant to alkalis compared to SiC.

Pros & Cons:

- Pros: Cost-effective, widely available, excellent wear resistance, and easy to machine relative to other ceramics.

- Cons: Lower corrosion resistance in alkaline environments, moderate brittleness, and lower thermal shock resistance than SiC.

Impact on Application:

Alumina is commonly used in wear parts, cutting tools, and electrical insulators. It is suitable for dry or mildly corrosive environments but less ideal for aggressive chemical media.

Considerations for International Buyers:

For buyers in South America and Africa, alumina’s affordability and availability make it attractive for large-scale industrial applications. Compliance with ASTM C799 and ISO 9001 standards is typical. European buyers often require adherence to DIN and EN standards for quality assurance. Alumina’s widespread use means local distributors and manufacturers are more common, reducing lead times and logistics costs.

Key Properties:

Boron Carbide is among the hardest known ceramics, with extreme hardness (Mohs ~9.5) and low density. It has excellent neutron absorption properties, making it useful in nuclear applications. It withstands high temperatures (~1400°C) and offers good chemical resistance, especially against acids.

Pros & Cons:

- Pros: Exceptional hardness and abrasion resistance, lightweight, and good chemical stability.

- Cons: Very high cost, difficult to machine, and brittle nature limits impact resistance.

Impact on Application:

Boron Carbide is preferred in ballistic armor, abrasive blasting nozzles, and nuclear shielding. Its chemical resistance suits acidic environments but is less effective in alkaline media.

Considerations for International Buyers:

Due to its high cost and specialized applications, buyers from Europe and the Middle East should ensure procurement aligns with strict ASTM and ISO nuclear and industrial standards. Import regulations and certifications for nuclear-grade materials can be complex, especially for South American and African markets. Long lead times and limited suppliers necessitate early planning and strategic sourcing.

Key Properties:

Zirconia is known for its high fracture toughness among ceramics, good thermal insulation, and resistance to wear and corrosion. It operates effectively up to 1200°C and offers excellent chemical inertness.

Pros & Cons:

- Pros: Superior toughness reduces brittleness, good wear resistance, and chemical stability.

- Cons: Higher cost than alumina, lower hardness than SiC and B₄C, and sensitive to thermal shock.

Impact on Application:

Zirconia is widely used in dental implants, cutting tools, and oxygen sensors. Its toughness makes it suitable for applications requiring mechanical shock resistance and moderate chemical exposure.

Considerations for International Buyers:

Buyers in Europe and the Middle East should verify compliance with ASTM F2187 for biomedical applications or ISO 13356 for technical ceramics. In Africa and South America, the cost and availability may be limiting factors, but zirconia’s mechanical properties justify its use in high-value precision components. Local standards and certifications should be checked to ensure import and application compliance.

| Material | Typical Use Case for hardest ceramic material | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) | Abrasive wear parts, chemical processing seals | High thermal and chemical resistance | Brittle, moderate manufacturing complexity | Medium to High |

| Alumina (Al₂O₃) | Wear-resistant components, electrical insulators | Cost-effective, widely available | Lower corrosion resistance in alkalis | Low to Medium |

| Boron Carbide (B₄C) | Ballistic armor, abrasive nozzles, nuclear shielding | Exceptional hardness and lightweight | Very expensive, difficult to machine | High |

| Zirconia (ZrO₂) | Dental implants, cutting tools, oxygen sensors | High toughness, good wear resistance | Sensitive to thermal shock, higher cost | Medium to High |

This guide provides international B2B buyers with a strategic framework to evaluate the hardest ceramic materials based on performance, cost, and regional compliance considerations. Selecting the optimal ceramic depends on balancing application demands with supply chain realities and local standards adherence.

The production of the hardest ceramic materials, such as silicon carbide (SiC), boron carbide (B4C), and alumina (Al2O3), involves a series of carefully controlled stages to achieve the desired mechanical strength, hardness, and thermal stability. Understanding these stages is crucial for B2B buyers to assess supplier capabilities and ensure product consistency.

The foundation of high-quality ceramic components lies in the careful selection and preparation of raw materials. This stage typically includes:

This phase demands stringent control to avoid contamination and to maintain consistent particle morphology, which directly impacts sintering behavior and final material hardness.

The shaping of ceramic powders into green bodies (unsintered parts) is achieved through various forming methods, each suited to different product types and volumes:

B2B buyers should inquire about the forming technique used, as it influences mechanical properties and dimensional tolerances.

In cases where multi-component assemblies are required, green bodies may be joined mechanically or by using binders before sintering. Pre-sintering treatments such as debinding remove organic additives to prevent defects during final sintering.

Sintering is the critical stage where the ceramic powder particles fuse at high temperatures, resulting in densification and strength development:

Post-sintering finishing includes:

For B2B buyers, understanding the sintering technology and finishing capabilities helps assess product performance and suitability for demanding applications.

Quality assurance (QA) and quality control (QC) in the production of hardest ceramic materials are paramount to ensure reliability, especially for critical industrial applications in sectors like aerospace, defense, oil & gas, and electronics.

B2B buyers must ensure suppliers provide documentation demonstrating adherence to these standards, as this guarantees material suitability and regulatory compliance.

Implementing these checkpoints helps identify defects early, reducing scrap rates and ensuring consistent product quality.

Buyers should request test reports and certificates of analysis (CoA) to verify these parameters.

For buyers in Africa, South America, the Middle East, and Europe, ensuring supplier QC reliability involves multiple verification strategies:

Buyers should be aware of regional nuances such as differing regulatory environments and certification recognition. For instance, CE marking is mandatory for Europe but may not be recognized in some African or Middle Eastern markets, where local compliance marks or additional certifications may be required.

By integrating these insights into supplier evaluation and procurement strategies, B2B buyers can secure the highest quality hardest ceramic materials, optimized for their regional market demands and application requirements.

Understanding the cost and pricing dynamics of the hardest ceramic materials is crucial for international B2B buyers aiming to optimize procurement strategies and ensure cost-efficiency without compromising quality. This analysis breaks down the key cost components, price influencers, and strategic buyer considerations relevant to markets in Africa, South America, the Middle East, and Europe.

Raw Materials

The foundation of cost, raw materials include high-purity powders such as alumina, silicon carbide, or boron carbide. Prices fluctuate based on global availability, purity requirements, and sourcing origin. Buyers should be aware that premium-grade raw materials significantly increase overall costs but are essential for performance-critical applications.

Labor and Manufacturing Overhead

Labor costs vary widely by region, impacting total pricing. Manufacturing overhead includes energy consumption (high-temperature sintering processes), facility maintenance, and indirect labor. Regions with advanced automation may offer cost advantages but could have higher base labor rates.

Tooling and Equipment

The fabrication of hardest ceramics requires specialized tooling, molds, and presses. Initial tooling costs can be substantial, particularly for customized or small-batch orders, affecting the unit price significantly at lower volumes.

Quality Control and Certification

Rigorous QC processes, including dimensional checks, hardness testing, and certification (ISO, ASTM standards), add to the cost but are non-negotiable for reliability. Buyers sourcing for regulated industries must factor in these certification costs.

Logistics and Import Duties

Shipping ceramics demands careful packaging to avoid damage, increasing logistics costs. International buyers must consider freight charges, insurance, customs duties, and taxes, which vary by destination country and Incoterms used.

Supplier Margin

Margins vary depending on supplier size, market positioning, and exclusivity of materials. Established suppliers with advanced R&D capabilities may command higher margins justified by superior product performance.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically reduce per-unit costs due to economies of scale. However, many suppliers impose MOQs, which can be challenging for smaller businesses or those testing new materials.

Specifications and Customization

Custom shapes, sizes, or composite formulations increase complexity and cost. Standardized products generally offer better pricing.

Material Grade and Quality Certifications

Certified high-grade ceramics for aerospace or medical applications cost more than general-purpose grades. Buyers must balance quality needs against budget constraints.

Supplier Location and Reliability

Proximity to production hubs (e.g., Europe or China) can reduce lead times and freight costs. Supplier reputation affects pricing flexibility and risk premiums.

Incoterms Selection

Terms like FOB, CIF, or DDP influence which party bears shipping and insurance costs, impacting total landed price. Clarity on Incoterms prevents unexpected expenses.

Negotiate Based on Total Cost of Ownership (TCO)

Beyond unit price, consider factors like durability, replacement frequency, and maintenance. Investing in higher-quality ceramics may reduce long-term costs.

Leverage Volume Consolidation

Coordinate orders across departments or partners to meet MOQs and unlock bulk discounts.

Understand Regional Logistics Nuances

For buyers in Africa and the Middle East, port handling times and customs clearance can add delays and costs. Engage local freight forwarders familiar with regulations.

Request Detailed Cost Breakdowns

Transparency helps identify negotiable elements such as tooling amortization or QC fees.

Factor Currency Fluctuations and Payment Terms

Volatile currencies in South America and parts of Africa necessitate flexible payment arrangements or currency hedging to manage risks.

Prioritize Suppliers Offering Technical Support and After-Sales Service

This can reduce hidden costs related to installation and troubleshooting.

Prices for hardest ceramic materials vary significantly based on technical specifications, order size, and market conditions. The insights provided here serve as a general framework and do not represent fixed or guaranteed prices. Buyers should engage directly with suppliers for tailored quotations reflecting their unique requirements.

By thoroughly evaluating these cost components and price influencers, international B2B buyers can make informed decisions that align with their operational needs and financial goals, ensuring a competitive edge in sourcing the hardest ceramic materials.

Understanding the critical technical properties and common trade terminology related to the hardest ceramic materials is essential for B2B buyers to make informed purchasing decisions. This knowledge ensures alignment with supplier capabilities, quality standards, and logistical requirements across diverse international markets.

Material Grade

The grade indicates the purity and composition of the ceramic material, which directly affects hardness, durability, and performance. Higher grades typically mean fewer impurities and better resistance to wear and thermal shock. For buyers, specifying the correct grade ensures the material meets the operational demands of applications such as cutting tools, wear parts, or electronic insulators.

Hardness (Mohs or Vickers Scale)

Hardness measures a ceramic’s resistance to surface deformation or scratching. The hardest ceramics, like silicon carbide or boron carbide, score high on these scales, indicating superior wear resistance. In B2B contracts, clearly defining hardness requirements helps prevent premature failure and costly downtime in industrial processes.

Tolerance and Dimensional Precision

This refers to the allowable deviation from specified dimensions during manufacturing. Tight tolerances are critical in high-precision applications such as aerospace or medical devices. Understanding tolerance capabilities aids buyers in assessing whether a supplier can meet the exacting standards required without excessive cost.

Thermal Stability

Thermal stability defines the ceramic's ability to maintain mechanical integrity under high temperatures. For industries in the Middle East or South America, where operating conditions can be extreme, selecting ceramics with high thermal stability ensures consistent performance and longer service life.

Fracture Toughness

This property measures resistance to crack propagation and mechanical shock. Hard ceramics are brittle by nature, but improved fracture toughness reduces breakage risk during handling or operation. Buyers should evaluate this property to balance hardness with durability depending on the application environment.

Density and Porosity

Density affects the material’s strength and weight, while porosity impacts permeability and mechanical strength. Low porosity ceramics are preferred in applications requiring high strength and chemical resistance. For B2B buyers, these specs influence product longevity and compatibility with other system components.

OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts or materials used in another company’s end product. Understanding whether a ceramic supplier is an OEM or a distributor helps buyers assess product authenticity, customization options, and warranty terms.

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier will accept for an order. Buyers from smaller markets or those testing new materials should negotiate MOQs that align with their project scale to avoid excess inventory and capital tie-up.

RFQ (Request for Quotation)

An RFQ is a formal inquiry sent to suppliers requesting pricing, lead times, and terms for specific products. Clearly defining technical specs and volume in the RFQ streamlines supplier responses and facilitates accurate cost comparisons.

Incoterms (International Commercial Terms)

Incoterms are standardized trade terms that define responsibilities for shipping, insurance, and tariffs between buyers and sellers. Familiarity with common Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight) enables buyers to manage logistics risks and control landed costs effectively.

Lead Time

Lead time is the period from order confirmation to product delivery. For critical ceramic components, understanding lead times is vital to coordinate production schedules and avoid operational delays.

Certification and Compliance

Certifications such as ISO 9001 (quality management) or specific industry standards (e.g., ASTM for ceramics) assure buyers of consistent quality and regulatory compliance. Verifying certifications is crucial for buyers in regulated sectors or those exporting to regions with strict import controls.

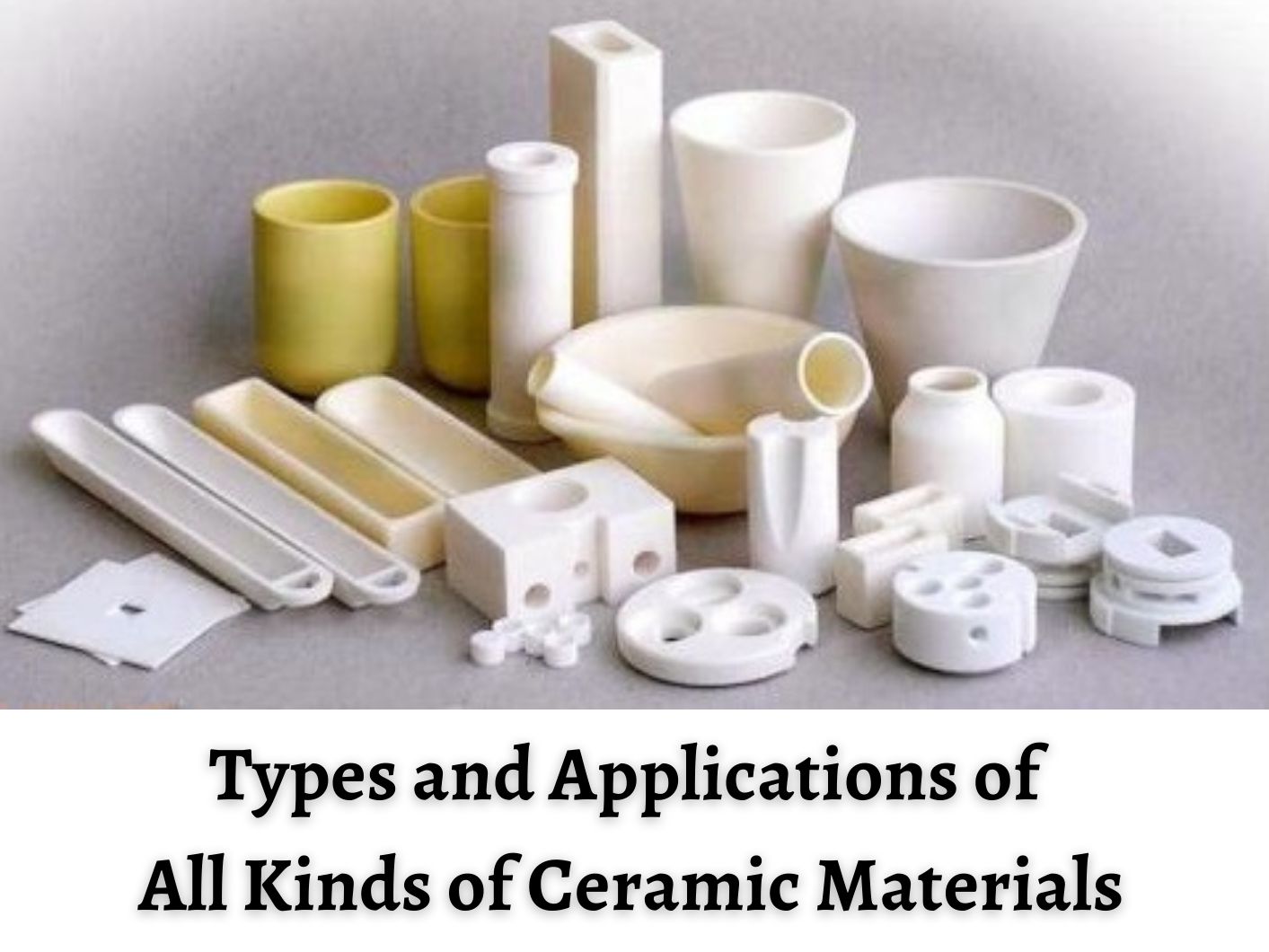

Illustrative Image (Source: Google Search)

By mastering these technical properties and trade terms, international B2B buyers—from South Africa to Saudi Arabia and beyond—can optimize supplier selection, negotiate better contracts, and ensure the hardest ceramic materials meet their operational and commercial needs. This foundational knowledge supports smarter procurement strategies and long-term supplier partnerships in the competitive global marketplace.

The global market for the hardest ceramic materials, including advanced ceramics such as silicon carbide, boron carbide, and alumina, is experiencing robust growth driven by demand across diverse industries such as aerospace, automotive, defense, electronics, and industrial manufacturing. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe, understanding regional drivers is crucial. In the Middle East, for example, investments in high-tech manufacturing and energy sectors are increasing demand for wear-resistant and thermal-insulating ceramic components. Similarly, South Africa’s mining and heavy industry sectors require durable ceramics for cutting tools and protective equipment, while Europe’s advanced manufacturing hubs focus heavily on innovation and precision applications.

Key sourcing trends include the rise of digital procurement platforms that facilitate direct engagement with global suppliers, enhancing transparency and reducing lead times. Buyers are increasingly leveraging data analytics and AI-driven market intelligence tools to forecast demand and optimize inventory management. Additionally, modular and customizable ceramic components are gaining traction, enabling buyers to specify materials tailored to unique operational conditions.

Market dynamics also reflect a growing emphasis on supply chain resilience. Recent geopolitical shifts and logistical challenges have prompted buyers to diversify sourcing portfolios and seek suppliers with strong regional footprints or capabilities for local manufacturing partnerships. For African and South American buyers, this presents opportunities to collaborate with emerging suppliers in Asia and Europe who offer flexible manufacturing scales and technical support.

Sustainability is becoming a non-negotiable factor in the procurement of hardest ceramic materials. The production of advanced ceramics typically involves energy-intensive processes and the use of raw materials sourced from mining operations, which can have significant environmental footprints. B2B buyers are urged to prioritize suppliers who demonstrate commitment to reducing carbon emissions, minimizing waste, and adhering to responsible mining practices.

Illustrative Image (Source: Google Search)

Ethical sourcing goes beyond environmental considerations. Ensuring that raw materials are procured without exploitation or conflict is critical, particularly for buyers in regions sensitive to supply chain transparency. Certifications such as ISO 14001 (Environmental Management), Responsible Minerals Assurance Process (RMAP), and cradle-to-gate lifecycle assessments provide verifiable assurances of sustainability credentials.

Moreover, the industry is witnessing a surge in the development and adoption of “green” ceramic materials. These include ceramics produced using recycled content, bio-based binders, or innovative sintering techniques that reduce energy consumption. For international buyers, integrating sustainability criteria into supplier evaluations not only mitigates risk but also aligns with growing regulatory requirements and end-customer expectations in their respective markets.

The evolution of hardest ceramic materials has been closely linked to advances in material science and industrial needs. Initially, ceramics were primarily used for their insulating properties and hardness in simple applications. However, breakthroughs in powder processing and sintering technologies during the late 20th century enabled the production of ceramics with exceptional toughness, thermal stability, and wear resistance.

Illustrative Image (Source: Google Search)

For B2B buyers, understanding this progression highlights the increasing complexity and specialization within the sector. Modern hardest ceramics are now engineered at the microstructural level to meet stringent performance criteria, offering significant advantages over traditional materials such as metals or polymers in extreme environments. This historical context underscores the importance of partnering with suppliers who possess deep technical expertise and can provide bespoke solutions tailored to specific industrial challenges.

How can I effectively vet suppliers of the hardest ceramic materials for international B2B transactions?

To vet suppliers thoroughly, start by verifying their certifications such as ISO 9001 for quality management and industry-specific standards like ASTM or DIN. Request detailed product datasheets and sample materials to assess quality firsthand. Evaluate their production capacity and track record with international clients, especially within your region. Use third-party audits or inspections if possible. Additionally, check references and reviews from other B2B buyers in Africa, South America, the Middle East, or Europe to ensure reliability and compliance with export regulations.

What customization options are typically available for hardest ceramic materials, and how can I specify them to suppliers?

Customization often includes dimensions, shapes, surface finishes, and doping elements to enhance properties like hardness or thermal resistance. Clearly communicate your technical requirements using detailed drawings, tolerances, and performance criteria. Engage early with suppliers to understand their capabilities and lead times for custom orders. For international buyers, consider specifying packaging and labeling needs to meet local regulatory standards and facilitate customs clearance.

What are common minimum order quantities (MOQs) and lead times for hardest ceramic materials, and how can I negotiate them?

MOQs vary widely depending on the material complexity and supplier scale but typically range from a few hundred to several thousand units. Lead times can span from 4 to 12 weeks or more, especially for customized products. To negotiate favorable terms, leverage your order volume potential, establish long-term relationships, or consolidate orders with partners. Buyers from emerging markets should factor in additional lead time for customs and logistics and confirm these timelines upfront with suppliers.

Which payment terms are standard in international B2B transactions for hardest ceramic materials, and how can I mitigate financial risks?

Common payment terms include Letter of Credit (L/C), Telegraphic Transfer (T/T) with deposits and balance on delivery, or open account for trusted partners. To reduce risk, negotiate partial upfront payments and use secure payment methods. Consider trade finance options like export credit agencies or factoring. Always ensure contract clarity regarding payment milestones, penalties for delays, and dispute resolution mechanisms tailored to cross-border transactions.

What quality assurance measures should I expect from suppliers of hardest ceramic materials?

Suppliers should provide comprehensive quality assurance including batch traceability, material composition analysis, hardness and wear resistance testing, and dimensional inspection reports. Third-party certifications or independent lab testing add credibility. Request documentation such as Material Test Reports (MTRs) and compliance certificates. Implement your own incoming inspection protocols upon receipt, especially for critical applications, to verify conformity with specifications.

Which certifications and standards are crucial for hardest ceramic materials in global B2B trade?

Key certifications include ISO 9001 for quality management and industry-specific standards like ASTM C1554 or DIN EN 60672 for ceramic materials. For export to regions like Europe or the Middle East, compliance with REACH or RoHS directives may be necessary. Additionally, certifications related to environmental management (ISO 14001) and occupational health and safety (ISO 45001) can indicate responsible manufacturing. Verify that suppliers hold valid and current certificates to ensure market acceptance and regulatory compliance.

How should I plan logistics and shipping for hardest ceramic materials to minimize risk and costs?

Hardest ceramics are often brittle and sensitive to handling; use robust packaging with shock-absorbing materials. Choose reliable freight forwarders experienced in fragile goods and customs procedures in your destination country. Consider Incoterms carefully to clarify responsibility and risk transfer. Consolidate shipments to optimize freight costs but balance against lead time requirements. Plan for customs clearance by preparing all necessary documentation, including certificates of origin and compliance, to avoid delays.

What steps should I take if a dispute arises regarding product quality or delivery with a ceramic material supplier?

Begin with clear communication and documentation review to identify the issue. Reference the purchase agreement’s dispute resolution clause, often specifying mediation or arbitration in a neutral jurisdiction. Engage third-party inspections or testing to objectively verify claims. Maintain detailed records of correspondence, delivery notes, and quality reports. For international disputes, leverage trade bodies or chambers of commerce relevant to your region (e.g., AfCFTA, ICC) for support and guidance on enforcement and legal recourse.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of the hardest ceramic materials demands a nuanced understanding of both the technical specifications and the dynamic global supply landscape. For B2B buyers across Africa, South America, the Middle East, and Europe, prioritizing suppliers with proven quality certifications and robust supply chain resilience is essential to mitigate risks related to geopolitical shifts and logistical challenges. Leveraging regional expertise and fostering partnerships with manufacturers that emphasize innovation can unlock superior material performance and cost efficiencies.

Key takeaways include the importance of comprehensive supplier evaluation, focusing on material consistency, sustainable sourcing practices, and adaptable contract terms that accommodate market volatility. Additionally, integrating digital tools for real-time supply chain visibility can enhance decision-making and responsiveness.

Looking ahead, international buyers should actively engage in collaborative sourcing strategies and invest in continuous market intelligence to anticipate emerging trends in ceramic technology and raw material availability. By doing so, businesses in Saudi Arabia, South Africa, and beyond can secure competitive advantages and drive long-term value creation in industries reliant on the hardest ceramic materials.

Take decisive action now: prioritize strategic partnerships and innovation-led sourcing to future-proof your supply chain and capitalize on evolving market opportunities in this critical materials segment.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina