The global market for rock tumbler abrasives is a critical nexus for industries ranging from jewelry manufacturing to geological research and decorative arts. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe—including emerging hubs like Vietnam and Indonesia—understanding the nuances of sourcing high-quality abrasives can significantly impact product quality, operational efficiency, and cost management.

Rock tumbler abrasives serve as the foundation for the polishing process, directly influencing the finish, durability, and overall value of the final product. Selecting the right abrasive type and grade is essential to meet specific application requirements, whether for coarse grinding or fine polishing. Moreover, variations in raw materials, manufacturing standards, and quality control practices across different regions demand a strategic approach to supplier evaluation and procurement.

This guide delivers a comprehensive overview designed to empower buyers with actionable insights. It covers the spectrum of abrasive types—including silicon carbide, aluminum oxide, and ceramic blends—alongside material properties and performance characteristics. Detailed analysis of manufacturing processes and quality assurance protocols will help identify reliable suppliers who adhere to international standards. Additionally, the guide examines cost structures, market trends, and region-specific considerations that influence sourcing decisions.

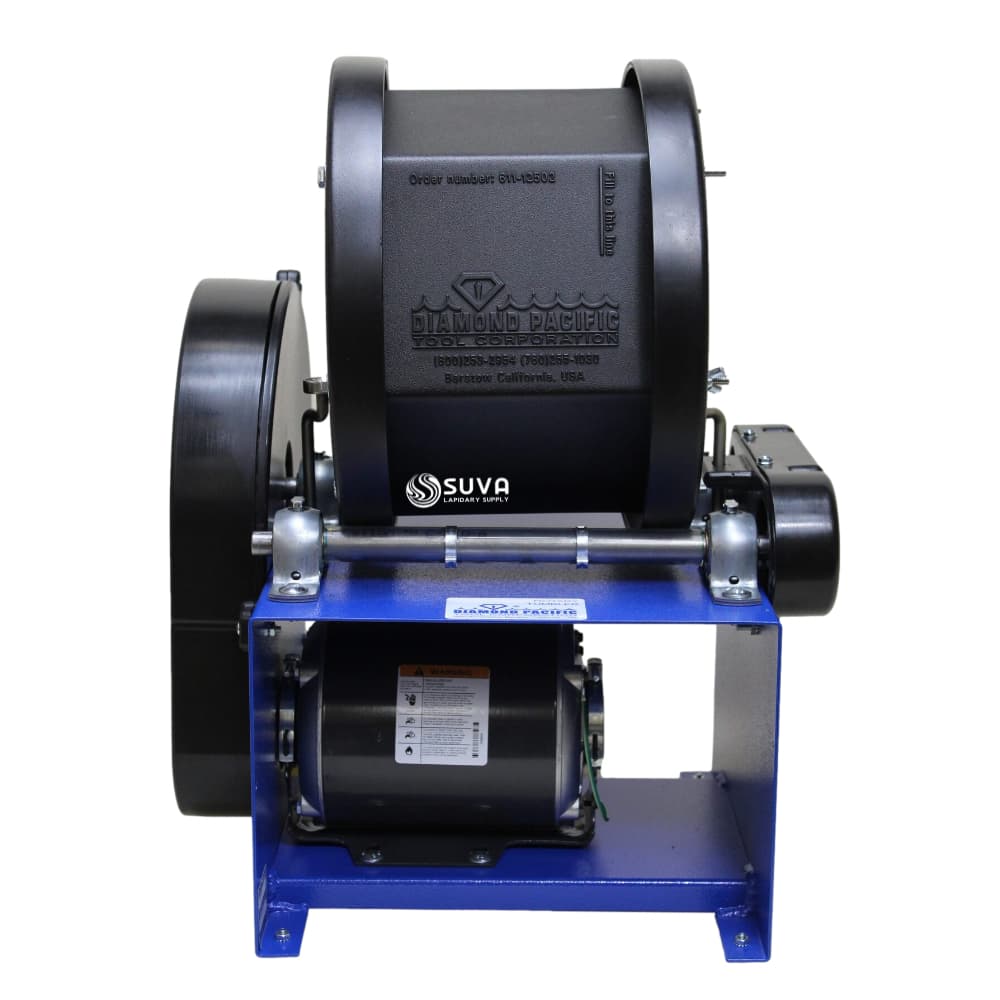

Illustrative Image (Source: Google Search)

By navigating these complexities with informed expertise, B2B buyers can optimize supply chains, reduce risks, and achieve competitive advantages in their respective markets. Whether you are establishing new partnerships or refining existing procurement strategies, this resource equips you to make confident, data-driven decisions tailored to your operational needs and regional dynamics.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Aluminum Oxide | Durable, sharp, available in multiple grit sizes | Industrial polishing, jewelry, lapidary | + Versatile, cost-effective – Can be less effective on softer stones |

| Silicon Carbide | Extremely hard, sharp edges, fast-cutting | Heavy-duty tumbling, coarse grinding | + High efficiency, long-lasting – Higher cost, dust hazard concerns |

| Cerium Oxide | Fine polishing abrasive, excellent for glass & quartz | Final polishing in optics, glass, and stones | + Produces high shine – Not suitable for coarse grinding |

| Tin Oxide | Fine polishing compound, water-soluble | Jewelry polishing, delicate stones | + Gentle on soft materials – Limited abrasive power |

| Garnet Abrasive | Natural mineral abrasive, moderate hardness | General-purpose tumbling, medium grit polishing | + Eco-friendly, moderate cost – Less uniform grit size |

Aluminum Oxide

Aluminum oxide abrasives are widely favored in B2B markets due to their versatility and availability in various grit sizes, making them suitable for both coarse and fine polishing stages. Their durability and sharpness allow efficient material removal, especially on harder stones and metals. Buyers from diverse regions should consider aluminum oxide for cost-effective bulk orders, balancing quality and price. However, it may underperform on softer materials, so selecting the correct grit size is essential to avoid surface damage.

Silicon Carbide

Known for its superior hardness and aggressive cutting ability, silicon carbide is ideal for heavy-duty tumbling and rapid coarse grinding. It excels in industrial applications requiring fast material removal and is preferred for rough shaping of tough stones. B2B buyers should note its higher cost and handle with appropriate dust control measures due to its fine particulate nature. This abrasive is a strategic choice for businesses prioritizing speed and efficiency in their production lines.

Cerium Oxide

Cerium oxide is a premium polishing abrasive, particularly effective on glass, quartz, and similar materials, delivering a high-gloss finish. It is commonly used in the final polishing phase in optics and jewelry manufacturing. For B2B buyers, cerium oxide represents a specialized product that demands precise application knowledge and quality assurance. Its use is less about material removal and more about surface refinement, making it indispensable for high-end finishing processes.

Tin Oxide

Tin oxide is a gentle, water-soluble polishing compound favored for delicate stones and jewelry applications. It provides a smooth polish without risking abrasion damage, making it suitable for soft or porous materials. International buyers should evaluate tin oxide for projects requiring careful surface treatment and fine detail polishing. Its limited abrasive strength means it is not suitable for initial grinding but excels in the finishing stages.

Garnet Abrasive

Garnet abrasives are a natural mineral option offering moderate hardness and eco-friendly appeal. They are used in general-purpose tumbling and medium grit polishing, providing a balance between cost and performance. Buyers interested in sustainable sourcing and natural materials often prefer garnet. However, its less uniform grit size may affect consistency in high-precision applications, so quality control during procurement is critical.

Related Video: Building a Rock Tumbler

| Industry/Sector | Specific Application of Rock Tumbler Abrasives | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Jewelry & Gemstone | Polishing raw gemstones and precious metals | Enhances product quality and market value by achieving superior finish and luster | Consistent abrasive grit size, contamination-free materials, reliable supply chain for timely delivery |

| Manufacturing & Tooling | Deburring and surface finishing of metal parts | Improves component performance and reduces post-processing time | Abrasive hardness and durability, compatibility with tumbling machinery, cost-effectiveness |

| Electronics | Smoothing and cleaning delicate electronic components | Ensures precision and reliability in final product assembly | Fine abrasive grades, low dust generation, compliance with environmental standards |

| Automotive & Aerospace | Surface preparation and finishing of small engine parts | Increases durability and reduces failure rates | High abrasion resistance, uniform particle size, certification for industrial use |

| Ceramics & Glass | Polishing and smoothing ceramic and glass components | Achieves high-quality aesthetics and functional surface properties | Chemical inertness, abrasion consistency, availability in bulk quantities |

Rock tumbler abrasives are essential in the jewelry sector for polishing raw gemstones and precious metals. These abrasives help achieve a smooth, glossy finish that significantly enhances the aesthetic appeal and market value of jewelry pieces. International buyers, particularly from regions like Africa and South America where gemstone mining is prevalent, must prioritize sourcing abrasives with consistent grit size and purity to avoid contamination that could damage delicate stones. Reliable delivery schedules are also critical to maintain uninterrupted production cycles.

In manufacturing, rock tumbler abrasives are widely used for deburring and finishing metal parts, which improves component fit and function while reducing manual labor costs. Buyers in Europe and the Middle East should focus on abrasives with high hardness and durability to withstand intensive tumbling processes. Compatibility with existing tumbling equipment and cost efficiency are key considerations to ensure optimal return on investment and maintain production efficiency.

Delicate electronic components require precise smoothing and cleaning to ensure functionality and reliability. Rock tumbler abrasives used here must be fine-grained to avoid damaging sensitive parts, with low dust generation to maintain cleanroom conditions. Buyers from technologically advanced regions such as Vietnam and Indonesia should verify that suppliers meet environmental and safety standards, ensuring compliance and reducing risks in highly regulated manufacturing environments.

For small engine parts and aerospace components, rock tumbler abrasives provide critical surface preparation and finishing, enhancing part durability and reducing failure rates under stress. Abrasives with uniform particle size and high abrasion resistance are vital for these sectors. B2B buyers from Europe and the Middle East should seek certifications confirming industrial-grade quality and consistency to meet stringent industry standards and ensure product safety.

In ceramics and glass production, rock tumbler abrasives are used to polish and smooth surfaces, improving both aesthetics and functional properties such as scratch resistance. Buyers need abrasives that are chemically inert to avoid reactions with glass or ceramic materials. Bulk availability and consistent abrasion quality are important for manufacturers in all target regions to maintain continuous production and meet diverse customer demands.

Related Video: Convert a Harbor Freight Rock Tumbler to a Professional Rock Tumbler

Key Properties:

Aluminum oxide is a highly durable abrasive known for its excellent hardness and thermal stability, withstanding temperatures up to 1200°C. It offers good corrosion resistance, making it suitable for wet tumbling processes. Its angular grain structure enhances cutting efficiency and surface finish quality.

Pros & Cons:

Pros include high durability, consistent abrasive performance, and relatively low manufacturing complexity. It is cost-effective for medium to large-scale operations. However, it may wear faster when used on extremely hard stones like corundum or quartz, limiting its lifespan in such applications.

Impact on Application:

Aluminum oxide is compatible with a wide range of tumbling media, especially ceramic and plastic pellets. It is ideal for general-purpose tumbling and polishing of semi-hard to hard stones. Its abrasive action is aggressive enough to speed up the tumbling cycle without damaging softer materials.

International B2B Considerations:

Buyers in Africa, South America, the Middle East, and Europe should ensure compliance with ASTM standards related to abrasive grain size and purity. Aluminum oxide abrasives sourced from regions like Vietnam and Indonesia often meet JIS standards, which align well with European DIN requirements. Bulk purchasing options and local availability can reduce lead times and logistics costs.

Key Properties:

Silicon carbide is one of the hardest abrasive materials available, with a Mohs hardness of 9-9.5 and excellent thermal conductivity. It performs well under high pressure and temperature conditions, with superior chemical inertness and corrosion resistance.

Pros & Cons:

Its main advantages are rapid cutting action and suitability for very hard stones such as agate and jasper. However, silicon carbide is more brittle than aluminum oxide, which can lead to faster breakdown in some tumbling environments. Manufacturing complexity is higher, translating to a higher price point.

Impact on Application:

Silicon carbide is best used in initial coarse grinding stages where aggressive material removal is required. It pairs well with plastic media but can be abrasive to ceramic media, potentially causing media degradation. Its sharp edges facilitate quick shaping but may produce rougher finishes if not followed by finer abrasives.

International B2B Considerations:

For buyers in emerging markets, sourcing silicon carbide that complies with ASTM or DIN standards ensures consistent grit size and purity. Importers should verify supplier certifications and consider local regulations on chemical handling and import tariffs. European buyers often require REACH compliance documentation, which suppliers in Southeast Asia increasingly provide.

Key Properties:

Cerium oxide is a rare earth abrasive prized for its fine polishing capabilities rather than cutting. It exhibits excellent chemical stability and is effective at room temperature, with moderate resistance to wear and corrosion.

Pros & Cons:

Its key advantage is producing a high-gloss finish on glass and softer stones like quartz and obsidian. However, it is not suitable for coarse grinding due to its gentle abrasive action. The cost is relatively high because of the rarity of cerium.

Impact on Application:

Cerium oxide is typically used in the final polishing stages of tumbling, often in conjunction with plastic or wooden media to avoid contamination. It enhances clarity and luster without scratching the surface, making it ideal for decorative stone finishing.

International B2B Considerations:

Buyers in Europe and the Middle East should ensure cerium oxide meets purity standards and environmental regulations, including proper waste disposal guidelines. African and South American markets may face supply chain challenges due to limited local availability, emphasizing the need for reliable international suppliers with transparent certification.

Key Properties:

Tin oxide is a fine polishing abrasive with excellent chemical inertness and low toxicity. It operates effectively at ambient temperatures and offers good compatibility with various media types.

Pros & Cons:

Tin oxide provides a brilliant polish on softer stones and glass but has limited cutting power, making it unsuitable for rough grinding. It is easier to handle and less abrasive than cerium oxide, often resulting in lower costs and simpler manufacturing processes.

Impact on Application:

It is widely used in the final polishing phase, especially for stones requiring a mirror-like finish. Tin oxide works well with plastic and wooden media and is favored for its ability to produce a smooth, scratch-free surface.

International B2B Considerations:

For buyers in Vietnam, Indonesia, and other Southeast Asian countries, tin oxide is often locally available, reducing import costs. Compliance with ASTM and JIS standards ensures consistent particle size and purity. European buyers should verify compliance with environmental and safety standards, especially for export-import documentation.

| Material | Typical Use Case for rock tumbler abrasives | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Oxide | General-purpose grinding and polishing of semi-hard stones | High durability and thermal stability | Less effective on extremely hard stones | Low |

| Silicon Carbide | Coarse grinding of very hard stones | Rapid cutting action and high hardness | Brittle, higher manufacturing complexity | High |

| Cerium Oxide | Final polishing for glass and soft stones | Produces high-gloss finish | High cost and not suitable for grinding | High |

| Tin Oxide | Final polishing for softer stones and glass | Low toxicity and excellent polish quality | Limited cutting power | Medium |

The production of rock tumbler abrasives involves several precise stages designed to ensure consistency, durability, and optimal performance. Understanding these stages allows B2B buyers to better evaluate suppliers and align purchasing decisions with quality expectations.

The raw materials for rock tumbler abrasives typically include natural stones (such as silicon carbide, aluminum oxide, or garnet) and synthetic abrasives. In this initial phase, materials are carefully selected for hardness, grain size, and purity. The raw stones undergo crushing and grinding to achieve the desired particle size distribution, which directly influences the abrasive efficiency and finish quality.

Key techniques:

- Crushing and Milling: Using jaw crushers and ball mills to break down raw materials into granules.

- Sieving and Classification: Employing vibrating screens and air classifiers to sort abrasive grains by size.

- Washing and Drying: To remove impurities and moisture that could affect downstream processes.

Once the abrasive grains are prepared, they are shaped into specific forms suited for rock tumblers — typically grit sizes ranging from coarse to fine. Some manufacturers produce abrasives in pelletized forms or coated granules to improve tumbling action.

Key techniques:

- Agglomeration: Binding fine abrasive particles into granules or pellets using organic or inorganic binders.

- Sintering (for synthetic abrasives): Heating shaped abrasive masses below their melting points to improve hardness and durability.

- Coating: Applying chemical or resin coatings to enhance abrasive properties or reduce dust.

For certain abrasive types, especially those that combine multiple grit sizes or materials, assembly involves mixing and layering the abrasives for a balanced tumbling effect. Packaging is tailored to preserve product integrity during shipment and storage.

Key considerations:

- Batch Blending: Ensuring uniformity across batches by mixing different abrasive grades.

- Packaging Materials: Use of moisture-resistant, durable packaging to prevent contamination and degradation.

- Labeling: Clear markings of grit size, batch number, and compliance certifications.

Final steps may include surface treatment to remove sharp edges or dust, and precision sorting to eliminate undersized or oversized particles. This ensures the abrasives meet the performance criteria specified by B2B customers.

Techniques include:

- Electrostatic or air classification: To separate fines and dust.

- Surface polishing or tumbling: To improve grain shape and reduce unwanted sharpness.

- Final Inspection: Visual and instrumental checks before dispatch.

For international B2B buyers, particularly from regions such as Africa, South America, the Middle East, and Europe, understanding the quality assurance mechanisms behind rock tumbler abrasives is crucial to mitigating supply risks and ensuring product reliability.

Manufacturers typically implement a multi-tiered QC approach to ensure product consistency:

International buyers must proactively verify supplier quality systems to ensure compliance and reduce operational risks.

By gaining a comprehensive understanding of manufacturing processes and quality assurance practices, international B2B buyers can make informed decisions, ensuring that rock tumbler abrasives sourced meet performance expectations and regulatory standards globally.

Understanding the cost and pricing dynamics of rock tumbler abrasives is crucial for international B2B buyers aiming to optimize procurement strategies and maximize value. This analysis breaks down the key cost components, price influencers, and practical buyer tips tailored especially for businesses sourcing from regions such as Africa, South America, the Middle East, and Europe, including emerging markets like Vietnam and Indonesia.

Raw Materials

The primary cost driver is the choice of abrasive media, commonly silicon carbide, aluminum oxide, or ceramic blends. Quality and purity of these materials directly impact the abrasive effectiveness and lifespan, influencing price variability.

Labor Costs

Labor expenses vary by manufacturing location and automation levels. Facilities in Southeast Asia or parts of South America often offer competitive labor costs, which can reduce overall pricing but may require careful quality control.

Manufacturing Overhead

Overhead includes utilities, equipment depreciation, and factory maintenance. Efficient production lines and scale economies help lower this component, benefiting buyers through more competitive pricing.

Tooling and Equipment

Specialized molds and processing machinery are necessary for shaping abrasives to precise sizes and grit grades. Initial tooling investments are amortized over production runs, affecting unit costs, especially for smaller orders.

Quality Control (QC)

Rigorous QC processes, including particle size analysis and durability testing, add to costs but ensure product consistency. Certifications such as ISO or REACH compliance often require higher QC standards, adding to pricing but improving buyer confidence.

Logistics and Shipping

International freight, customs duties, and local distribution costs must be factored in. Bulk shipments typically yield better freight rates, but remote or less developed regions may face higher last-mile delivery costs.

Supplier Margin

Suppliers incorporate profit margins based on market demand, competition, and risk factors. Transparent negotiation can sometimes reveal room for margin adjustments.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes usually secure better unit prices. However, some suppliers enforce MOQs that may be challenging for smaller buyers, especially in emerging markets. Negotiating flexible MOQs or consolidated orders can mitigate this.

Specifications and Customization

Custom grit sizes, shapes, or special coatings add complexity and cost. Standard product lines tend to be more cost-effective and faster to deliver.

Material Quality and Certifications

Abrasives with certifications (e.g., environmental, safety) command premium pricing but reduce regulatory risks and improve market acceptance, particularly in Europe and the Middle East.

Supplier Location and Reliability

Proximity to manufacturing hubs affects logistics costs and lead times. Established suppliers with proven track records may charge more but reduce risks of delays or quality issues.

Incoterms and Payment Terms

Incoterms such as FOB, CIF, or DDP influence who bears shipping and insurance costs. Understanding these terms helps buyers avoid unexpected expenses and better compare supplier quotes.

Negotiate Beyond Price

Emphasize total value including payment terms, lead times, and after-sales support. For buyers in Africa or South America, negotiating flexible payment schedules or partial shipments can improve cash flow management.

Calculate Total Cost of Ownership (TCO)

Factor in not just the purchase price but also shipping, customs, storage, and potential rework costs. Cheaper abrasives with inconsistent quality may incur higher operational expenses.

Leverage Local Expertise

Engage local agents or consultants familiar with regional logistics and regulations to streamline import processes and avoid delays or penalties.

Consider Consolidated Shipments

Pooling orders with other buyers or suppliers can reduce freight costs, especially relevant for buyers in remote locations or smaller markets.

Evaluate Supplier Certifications and Compliance

Prioritize suppliers with recognized quality and environmental certifications to minimize compliance risks, especially when selling to regulated markets like the EU.

Be Aware of Pricing Fluctuations

Material costs and freight rates can be volatile due to geopolitical factors or supply chain disruptions. Locking in prices via contracts or forward purchasing may offer cost stability.

Prices for rock tumbler abrasives vary widely based on the factors outlined above. Typical FOB pricing can range from USD 1.00 to USD 5.00 per kilogram, depending on material type, grade, and order size. Buyers should treat these figures as directional and seek detailed quotations tailored to their specific sourcing requirements.

By understanding these cost drivers and pricing influences, international B2B buyers can make informed decisions, negotiate effectively, and optimize procurement strategies to secure high-quality rock tumbler abrasives at competitive prices.

When sourcing rock tumbler abrasives, understanding the key technical properties is essential to ensure product quality, operational efficiency, and cost-effectiveness. Here are the most important specifications that international B2B buyers should consider:

Material Grade (Grit Size)

This defines the abrasive particle size, typically measured in mesh numbers. Coarse grits (e.g., 60-90 mesh) are used for initial shaping, while finer grits (e.g., 220-600 mesh) are for polishing. Selecting the correct grit size affects the finish quality and tumbling cycle duration. For buyers, aligning grit size with end-product requirements helps optimize performance and reduce waste.

Hardness and Durability

The hardness rating, often indicated by Mohs scale or relative hardness metrics, determines how effectively the abrasive can wear down rocks without degrading quickly. Durable abrasives reduce replacement frequency, lowering operational costs. Buyers from regions with longer supply chains should prioritize abrasives with proven longevity to avoid downtime.

Tolerance and Consistency

This refers to the uniformity in particle size and shape within a batch. Tight tolerances ensure predictable tumbling results and minimize equipment wear. For bulk buyers, consistent tolerances mean fewer quality issues and streamlined production processes.

Chemical Composition and Purity

Abrasives may vary in chemical makeup—common materials include silicon carbide, aluminum oxide, and ceramic blends. Chemical purity affects abrasive performance and compatibility with specific rock types. Buyers should verify material certifications to avoid contamination that could compromise the finish or damage tumblers.

Moisture Content

Excess moisture in abrasives can cause clumping, uneven tumbling, and reduced effectiveness. Dry, properly stored abrasives ensure smooth processing and longer shelf life. This is particularly critical for buyers in humid climates or those relying on sea freight.

Packaging and Bulk Density

Bulk density impacts shipping costs and storage requirements. Understanding packaging options—from small bags to bulk totes—helps buyers manage logistics efficiently. Dense packaging reduces freight expenses but may require specialized handling equipment.

Navigating the global trade of rock tumbler abrasives requires familiarity with common industry terms. These terms facilitate clear communication, streamline procurement, and help avoid misunderstandings:

OEM (Original Equipment Manufacturer)

Refers to suppliers who produce abrasives under another company’s brand. OEM partnerships can offer customized formulations and packaging. Buyers seeking private labeling or exclusive product lines should inquire about OEM capabilities.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs vary widely and impact inventory management and cash flow. Buyers in emerging markets or smaller businesses should negotiate MOQs to align with demand and storage capacity.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specific abrasive products. An effective RFQ includes detailed specs and volume estimates, enabling suppliers to provide accurate, comparable quotes.

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities for shipping, insurance, and customs between buyers and sellers. Common Incoterms like FOB (Free on Board) and CIF (Cost, Insurance, Freight) clarify who bears risks and costs at each stage, essential for budgeting and logistics planning.

Lead Time

The period from order confirmation to delivery. Understanding lead times helps buyers plan production schedules and inventory replenishment, especially when dealing with international suppliers and variable shipping conditions.

Batch Number / Lot Number

A unique identifier for a production run of abrasives. This is critical for quality control, traceability, and warranty claims. Buyers should request batch documentation to ensure product consistency and compliance with regulatory standards.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed sourcing decisions, negotiate effectively, and maintain high-quality production standards for rock tumbling operations.

The global market for rock tumbler abrasives is experiencing steady growth, driven by rising demand from both industrial and hobbyist segments. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe—including emerging manufacturing hubs like Vietnam and Indonesia—understanding the evolving market dynamics is essential for strategic sourcing. Key growth drivers include increased interest in jewelry and gemstone polishing, advancements in abrasive materials, and expanding access to affordable, high-quality tumbling equipment.

Current and Emerging Trends:

Understanding these trends allows B2B buyers to optimize procurement strategies, balance cost and quality, and position themselves competitively in their respective markets.

Sustainability is becoming a critical factor in the procurement of rock tumbler abrasives, reflecting broader global trends towards responsible supply chains. The environmental impact of abrasive production—particularly mining of raw materials and energy-intensive manufacturing processes—poses challenges that buyers must address.

Key Considerations for B2B Buyers:

By integrating sustainability criteria into sourcing decisions, international buyers not only reduce environmental risks but also enhance brand reputation and comply with tightening regulations across African, South American, Middle Eastern, and European markets.

The rock tumbler abrasives sector has evolved significantly from its early days when natural materials like sand and crushed quartz were used in rudimentary polishing processes. Over time, the industry transitioned to manufactured abrasives such as silicon carbide and aluminum oxide, which offered superior consistency and efficiency.

Illustrative Image (Source: Google Search)

In the mid-20th century, the hobbyist market expanded, driving demand for smaller, consumer-friendly abrasive products. Industrial applications concurrently benefited from technological advancements that introduced synthetic abrasives tailored for specific polishing and grinding tasks.

Today, the sector is characterized by a blend of traditional materials and cutting-edge engineered abrasives, catering to a diverse global clientele. This historical progression underscores the importance of innovation and quality assurance for B2B buyers navigating international supply chains.

How can I effectively vet suppliers of rock tumbler abrasives to ensure reliability and quality?

Start by requesting detailed product specifications, quality certifications, and samples to verify abrasive grit consistency and material purity. Investigate the supplier’s manufacturing processes and quality control systems through audits or third-party inspections. Check references and reviews from other international buyers, particularly those within your region, to assess delivery reliability and after-sales support. Confirm their compliance with international standards such as ISO or ASTM to mitigate risks of subpar products. Establish clear communication channels early to gauge responsiveness and professionalism.

Is it possible to customize rock tumbler abrasives to meet specific industrial or regional requirements?

Yes, many manufacturers offer customization options, including abrasive grit size, material composition (e.g., aluminum oxide, silicon carbide), and packaging tailored to your production needs. Custom abrasives can optimize tumbling efficiency and final product quality. When negotiating, clarify your technical requirements and expected outcomes upfront. Be prepared for potential minimum order quantities (MOQs) for custom batches, and request performance data or trial runs to validate effectiveness before committing to large orders.

What are typical minimum order quantities (MOQs) and lead times for international shipments of rock tumbler abrasives?

MOQs vary widely depending on the supplier and product type but generally range from 500 kg to several tons per order. Lead times commonly span 3 to 8 weeks, influenced by production schedules, customization needs, and shipping logistics. To minimize delays, align order quantities with your inventory turnover and negotiate flexible MOQs if possible. Confirm lead times in writing and include buffer periods for customs clearance and inland transportation, especially when importing to regions with complex regulatory environments like Africa or South America.

Which payment terms are advisable when sourcing abrasives from international suppliers, especially from Asia or the Middle East?

Secure payment terms that balance trust and risk mitigation, such as an initial deposit (20-30%) with the remainder payable upon shipment or after satisfactory inspection. Letters of credit (LCs) are a common secure method for large transactions, protecting both buyer and supplier. For new suppliers, consider escrow services or trade assurance platforms. Always verify supplier banking details to avoid fraud, and clarify currency and payment methods to prevent unexpected fees. Negotiating payment terms can also provide leverage for better pricing or faster delivery.

What quality assurance certifications should I look for when selecting rock tumbler abrasive suppliers?

Prioritize suppliers with internationally recognized certifications like ISO 9001 (quality management systems) and ISO 14001 (environmental management), which demonstrate a commitment to consistent product quality and sustainable practices. Certifications specific to abrasive materials, such as ASTM standards, can confirm abrasive grit size and hardness. Additionally, compliance with REACH or RoHS regulations is important for buyers in Europe. Request documentation of batch testing, traceability records, and third-party lab reports to ensure product consistency.

How should I manage logistics and shipping challenges when importing rock tumbler abrasives to regions like Africa or South America?

Plan for extended transit times and potential customs delays by working with experienced freight forwarders familiar with your destination’s import regulations. Opt for consolidated shipments when possible to reduce costs, but ensure packaging protects abrasives from moisture and contamination. Verify whether the supplier handles export clearance or if you need to coordinate it. Consider Incoterms carefully—terms like FOB or CIF define responsibilities for shipping costs and risk transfer. Establish contingency plans for disruptions such as port congestion or local transport strikes.

What steps can I take to resolve disputes or quality issues with international abrasive suppliers?

Document all communications, agreements, and product inspections thoroughly. If quality issues arise, initiate a formal complaint with clear evidence such as photos, test results, and batch numbers. Engage the supplier in dialogue to negotiate solutions such as replacement shipments, refunds, or discounts. Utilize dispute resolution clauses in contracts, including arbitration or mediation in neutral jurisdictions. Maintain a professional tone and aim for amicable resolutions to preserve long-term partnerships, but be prepared to escalate through legal channels if necessary.

Are there any regional considerations or regulations that impact sourcing rock tumbler abrasives for Africa, South America, or the Middle East?

Yes, import regulations, tariffs, and product standards vary significantly across regions. For example, some African countries impose strict import documentation or require local certifications, while South American nations may have fluctuating tariffs under trade agreements. The Middle East often mandates conformity with GCC standards or Halal certifications if applicable. Stay updated on local customs requirements, hazardous material classifications, and environmental restrictions affecting abrasives. Collaborate with local agents or consultants to navigate regulatory landscapes and avoid costly compliance issues.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Effective sourcing of rock tumbler abrasives is pivotal for businesses aiming to optimize product quality, cost-efficiency, and supply chain resilience. International buyers, especially those in Africa, South America, the Middle East, and Europe—including emerging manufacturing hubs like Vietnam and Indonesia—must prioritize suppliers with proven material consistency, compliance with environmental standards, and robust logistical capabilities. Leveraging regional trade agreements and developing strategic partnerships can unlock competitive pricing and reduce lead times.

Key considerations for buyers include thorough supplier vetting, understanding abrasive grit specifications, and aligning sourcing strategies with long-term sustainability goals. Embracing digital procurement platforms and real-time market intelligence tools will further enhance negotiation power and transparency.

Looking ahead, the rock tumbler abrasives market is poised for innovation driven by eco-friendly materials and automation in finishing processes. Buyers who proactively engage in strategic sourcing, continuously monitor market trends, and invest in supplier development will secure a decisive advantage.

Illustrative Image (Source: Google Search)

Actionable next steps:

- Conduct comprehensive supplier audits focusing on quality and compliance

- Explore multi-regional sourcing to mitigate geopolitical risks

- Collaborate closely with suppliers to co-develop customized abrasive solutions

By adopting these strategies, international B2B buyers can not only meet current operational demands but also position themselves for sustainable growth in a dynamic global marketplace.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina