Silicon carbide (SiC) coating stands at the forefront of advanced industrial solutions, offering unparalleled durability, thermal stability, and chemical resistance across a multitude of applications. For international B2B buyers—especially those in dynamic markets such as Africa, South America, the Middle East, and Europe—understanding the nuances of SiC coating is essential for sourcing materials that enhance product performance and operational efficiency.

This guide delves deeply into the critical aspects of SiC coating, equipping buyers with actionable insights to make strategic procurement decisions. It covers the various types of SiC coatings, including their unique properties and suitability for different industrial environments. Additionally, it explores the materials and manufacturing processes, emphasizing quality control measures that ensure consistency and reliability.

Understanding the supplier landscape is crucial for international buyers navigating diverse regional markets. This guide highlights key global and regional suppliers, helping businesses from Saudi Arabia, Argentina, and beyond identify partners who meet stringent quality and compliance standards. We also break down cost factors, enabling buyers to assess value beyond price, considering factors like durability and lifecycle performance.

To streamline your sourcing journey, the guide includes a comprehensive market overview and addresses common questions through a detailed FAQ section. By integrating these elements, this resource empowers international B2B buyers to confidently evaluate options, mitigate risks, and secure SiC coatings that drive innovation and competitive advantage in their industries.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Chemical Vapor Deposition (CVD) SiC Coating | High-purity, uniform coatings with excellent thermal stability | Semiconductor devices, high-temperature industrial parts | Pros: Superior coating uniformity, excellent thermal resistance; Cons: Higher cost, complex equipment requirements |

| Physical Vapor Deposition (PVD) SiC Coating | Thin, dense coatings with controlled thickness and adhesion | Cutting tools, wear-resistant components | Pros: Good adhesion, cost-effective for thin layers; Cons: Limited coating thickness, potential for micro-cracks under stress |

| Plasma Enhanced CVD (PECVD) SiC Coating | Enhanced deposition rate at lower temperatures, amorphous structure | Electronics packaging, protective barrier layers | Pros: Lower temperature processing, good conformality; Cons: Lower crystallinity affecting mechanical strength |

| Slurry-based SiC Coating | Composite coatings with SiC particles in binder matrix | Abrasives, refractory linings | Pros: Cost-effective, easy to apply on complex shapes; Cons: Less uniformity, lower thermal stability compared to vapor deposition |

| Pack Cementation SiC Coating | Diffusion-based process forming SiC layer on substrates | Aerospace components, corrosion-resistant parts | Pros: Strong diffusion bond, excellent corrosion resistance; Cons: Long processing times, limited to specific substrate materials |

CVD SiC coatings are prized for their exceptional purity and uniformity, making them ideal for semiconductor and high-temperature industrial applications. This method deposits silicon carbide atoms from gaseous precursors onto substrates, resulting in dense, highly adherent layers. For B2B buyers, the key considerations include the higher upfront costs and the need for specialized equipment, balanced by superior performance and longevity in demanding environments such as Saudi Arabia’s oil refining or European aerospace sectors.

PVD coatings provide thin, dense SiC layers with excellent adhesion, suitable for wear-resistant tools and precision components. This technique is more cost-effective for applications requiring thinner coatings and is favored in industries like automotive manufacturing in Argentina and tooling sectors across Europe. Buyers should weigh the trade-off between coating thickness limitations and the benefits of controlled deposition, especially when durability under mechanical stress is critical.

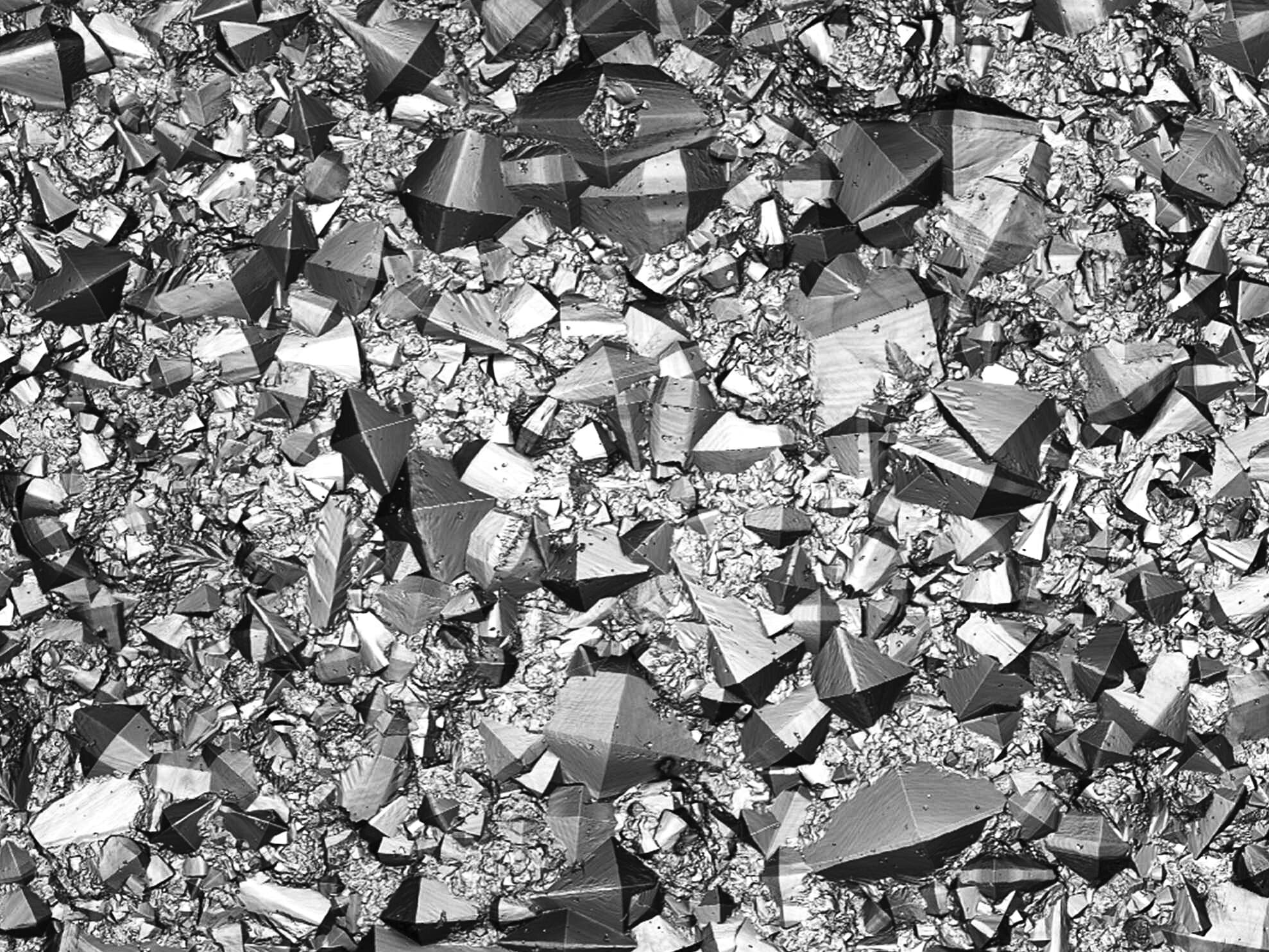

Illustrative Image (Source: Google Search)

PECVD allows SiC coatings to be deposited at lower temperatures, which is advantageous for substrates sensitive to heat. The resulting amorphous SiC films are commonly used in electronics packaging and as protective barriers. B2B buyers targeting high-volume electronics manufacturing in emerging markets should consider PECVD for its scalability and cost benefits, while also noting the slightly reduced mechanical strength compared to crystalline coatings.

This variation involves applying a slurry containing SiC particles onto surfaces, then curing to form composite coatings. It is particularly useful for abrasive and refractory applications where cost-efficiency and ease of application on complex geometries are priorities. Buyers in sectors such as mining equipment manufacturing in South America or refractory linings in Middle Eastern industries will find this approach practical, though with some compromises in uniformity and thermal resistance.

Pack cementation forms SiC layers by diffusing silicon and carbon into substrate surfaces at high temperatures. This process creates a strong diffusion bond and excellent corrosion resistance, ideal for aerospace and chemical processing components. B2B buyers must account for longer processing times and compatibility with substrate materials, but benefit from coatings that withstand harsh environmental conditions, aligning well with high-specification European and Middle Eastern industrial requirements.

Related Video: Silicon carbide coating processing on graphite surface for semiconductor,MOCVD Susceptor

| Industry/Sector | Specific Application of sic coating | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Defense | Thermal barrier coatings on turbine blades and engine components | Enhances heat resistance and durability, reducing maintenance costs and improving engine efficiency | Ensure compliance with aerospace quality standards; supplier capability for consistent coating thickness and adhesion; availability of technical support for customization |

| Automotive | Coating for engine parts, brake components, and exhaust systems | Improves wear resistance and thermal stability, extending component life and reducing downtime | Verify coating uniformity and performance under varying climatic conditions; sourcing from suppliers with automotive industry certifications |

| Electronics & Semiconductors | Protective coatings on semiconductor wafers and power devices | Provides electrical insulation and thermal management, enhancing device reliability and lifespan | Require high purity and defect-free coatings; suppliers with proven cleanroom manufacturing processes and traceability |

| Industrial Machinery | Wear-resistant coatings on cutting tools, pumps, and valves | Increases abrasion resistance, reduces corrosion, and improves operational efficiency | Focus on coating adhesion strength and compatibility with substrate materials; supplier’s ability to deliver coatings suitable for harsh environments |

| Energy & Power Generation | Coatings on gas turbines, solar panels, and nuclear reactor components | Enhances thermal efficiency, corrosion resistance, and longevity under extreme conditions | Prioritize suppliers experienced in energy sector standards; ensure coatings meet environmental and safety regulations |

In aerospace, SiC coatings are primarily applied as thermal barriers on turbine blades and engine parts to withstand extreme temperatures and oxidative environments. This coating reduces wear and thermal degradation, significantly extending component service life and lowering maintenance frequency. For international buyers, especially in Europe and the Middle East, sourcing partners must demonstrate adherence to stringent aerospace certifications and provide technical customization support to meet specific engine designs and operational conditions.

SiC coatings in automotive applications focus on engine components, brake systems, and exhausts where high temperatures and friction are common. The coating enhances wear resistance and thermal stability, resulting in longer-lasting parts and less frequent replacements. Buyers from emerging markets like South America and Africa should prioritize suppliers who offer coatings tested for diverse environmental conditions, ensuring consistent performance despite temperature fluctuations and humidity.

The electronics sector uses SiC coatings to protect semiconductor wafers and power devices by providing excellent electrical insulation and efficient thermal management. This is critical for maintaining device reliability and preventing overheating. Buyers must source from manufacturers with cleanroom environments and stringent quality control to avoid contamination and defects, which is essential for markets in Europe and technologically advancing regions in the Middle East.

In industrial machinery, SiC coatings are applied to cutting tools, pumps, and valves to enhance abrasion resistance and corrosion protection. This improves machine uptime and reduces replacement costs. For international B2B buyers, particularly in Africa and South America, it is important to assess supplier capability in delivering coatings compatible with various substrate materials and suitable for harsh operational environments, ensuring long-term durability.

SiC coatings play a vital role in energy sectors by improving the thermal efficiency and corrosion resistance of gas turbines, solar panels, and nuclear reactor components. These coatings enable equipment to operate reliably under extreme temperatures and aggressive chemical exposure. Buyers from energy-rich regions such as the Middle East and Europe should focus on suppliers with proven experience in energy industry standards and ensure compliance with environmental and safety regulations to support sustainable operations.

Related Video: Industrial Paints, Coatings, and Supplies by NCS | SSI

Key Properties:

Silicon carbide powder is the fundamental raw material for SiC coatings, characterized by exceptional hardness, high thermal conductivity, and outstanding resistance to thermal shock. It can withstand temperatures exceeding 1600°C and exhibits excellent chemical inertness, making it highly resistant to corrosion and oxidation.

Pros & Cons:

The powder form allows for precise control over coating thickness and uniformity, enhancing durability and performance. However, manufacturing complexity is higher due to the need for specialized equipment to apply and sinter the coating. Cost-wise, high-purity SiC powder is moderately expensive but justified by its performance benefits.

Impact on Application:

SiC powder-based coatings are ideal for high-temperature and abrasive environments, such as in petrochemical reactors or power generation equipment. The coating performs well with aggressive media, including acidic and alkaline substances, making it suitable for diverse industrial applications.

Considerations for International Buyers:

Buyers in regions like the Middle East and Europe should verify compliance with ASTM C799 or DIN EN 622 standards for SiC powder quality. In Africa and South America, sourcing from suppliers who provide detailed material certification and batch traceability is crucial due to varying local quality controls. Preference is often given to powders with controlled particle size distribution to ensure consistent coating performance.

Key Properties:

SiC ceramic tiles offer excellent mechanical strength, high wear resistance, and can operate at temperatures up to 1400°C. They provide superior corrosion resistance, especially against molten metals and slags, and maintain structural integrity under high-pressure conditions.

Pros & Cons:

Ceramic tiles are highly durable and provide long service life, reducing maintenance costs. However, their brittleness can be a limitation in applications involving mechanical shocks or vibrations. Manufacturing involves complex sintering processes, which can increase lead times and costs.

Impact on Application:

These tiles are commonly used in lining applications for furnaces, kilns, and reactors where abrasion and corrosion are major concerns. They are particularly effective in industries such as cement manufacturing and metal processing.

Considerations for International Buyers:

Compliance with JIS R 1601 or DIN EN 60672 standards is often required in Asian and European markets. For buyers in South America and Africa, ensuring supplier adherence to ISO 9001 quality management systems helps mitigate risks related to product consistency. Additionally, logistic considerations such as tile fragility during transport to remote locations like Saudi Arabia or Argentina must be planned carefully.

Key Properties:

This composite material combines the toughness and flexibility of carbon steel with the chemical and thermal resistance of SiC coatings. It can handle pressures up to 20 MPa and temperatures around 600–900°C, with excellent resistance to corrosion from acidic and alkaline fluids.

Pros & Cons:

SiC coated carbon steel offers a cost-effective solution with good mechanical strength and corrosion resistance. The main drawback is the potential for coating delamination under extreme thermal cycling or mechanical stress. Manufacturing requires precise surface preparation and coating techniques to ensure adhesion.

Impact on Application:

Widely used in piping, valves, and heat exchangers in chemical plants and oil & gas facilities, this material suits applications involving corrosive fluids and moderate temperatures.

Considerations for International Buyers:

Buyers in the Middle East and Europe should look for products meeting ASTM A105 or DIN EN 10213 standards for steel substrates and coating adhesion tests. In Africa and South America, verifying supplier capabilities in surface treatment and coating application is critical to avoid premature failures. Regional preferences may lean towards materials with documented performance in local environmental conditions, such as high salinity or temperature fluctuations.

Key Properties:

These coatings integrate SiC particles within a metallic binder matrix (commonly nickel or cobalt), enhancing toughness and impact resistance while maintaining high temperature and corrosion resistance. They can operate effectively up to 1200°C and withstand cyclic thermal stresses better than pure ceramic coatings.

Pros & Cons:

The composite nature improves adhesion and reduces brittleness, extending service life in dynamic environments. However, the presence of metal binders can reduce chemical resistance compared to pure SiC coatings and increase cost due to complex manufacturing processes.

Impact on Application:

Ideal for components exposed to mechanical wear combined with corrosive media, such as pump impellers, turbine blades, and chemical reactors.

Considerations for International Buyers:

Compliance with ASTM B733 or DIN EN ISO 14919 standards for thermal spray coatings is important in Europe and the Middle East. For African and South American markets, assessing supplier expertise in metallurgical bonding and quality assurance is essential. Buyers should also consider local environmental regulations that may impact material selection, such as restrictions on cobalt use.

| Material | Typical Use Case for sic coating | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) Powder | High-temperature, corrosion-resistant coatings | Exceptional thermal & chemical stability | High manufacturing complexity | Medium |

| Silicon Carbide Ceramic Tiles | Furnace and kiln linings, abrasion-resistant surfaces | Superior wear and corrosion resistance | Brittle, prone to mechanical shock damage | High |

| SiC Coated Carbon Steel | Piping, valves, heat exchangers in corrosive environments | Combines strength of steel with SiC corrosion resistance | Potential coating delamination under stress | Medium |

| SiC Composite Coatings with Metal Binders | Components exposed to wear and corrosion (e.g., pump impellers) | Improved toughness and thermal cycling resistance | Reduced chemical resistance, higher cost | High |

Silicon Carbide (SiC) coating is a specialized process that enhances the surface properties of substrates, offering superior hardness, thermal conductivity, and chemical resistance. Understanding the manufacturing stages is crucial for B2B buyers to assess supplier capabilities and ensure product reliability.

1. Material Preparation

The process begins with the selection and preparation of raw materials. High-purity silicon and carbon sources are essential to achieve consistent SiC quality. Suppliers typically use fine powders or gas-phase precursors, depending on the coating method. Material preparation includes rigorous purification and particle size optimization to ensure homogeneity and optimal bonding during coating.

2. Forming and Deposition Techniques

SiC coatings are commonly applied using several advanced techniques, each suited for different applications:

3. Assembly and Integration

After coating, components often undergo assembly with other parts. This stage requires careful handling to avoid coating damage. Integration may include bonding coated components into larger assemblies used in high-wear environments, such as pump seals or heat exchangers.

4. Finishing Processes

Finishing enhances surface properties and dimensional accuracy. Techniques include grinding, polishing, and heat treatments to relieve stresses and improve coating density. These steps are vital to achieving the desired mechanical and thermal performance.

For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, a robust Quality Assurance (QA) and Quality Control (QC) framework ensures product reliability and compliance with global standards.

International and Industry Standards

- ISO 9001: The cornerstone standard for quality management systems, ensuring consistent manufacturing processes and continuous improvement.

- CE Marking: Required for products entering the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- API Standards: Relevant for coatings used in oil and gas industries, such as API 6A and API 17D, which specify performance and testing criteria for coatings in harsh environments.

- Other Regional Certifications: Buyers in the Middle East and South America should verify compliance with local standards such as SASO (Saudi Standards, Metrology and Quality Organization) or IRAM (Instituto Argentino de Normalización y Certificación).

QC Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and incoming components to ensure they meet predefined specifications, focusing on purity, particle size, and chemical composition.

- In-Process Quality Control (IPQC): Continuous monitoring during coating application to detect defects like delamination, porosity, or thickness deviations. Techniques include optical microscopy and real-time thickness measurement.

- Final Quality Control (FQC): Comprehensive inspection of finished coated parts, including dimensional checks, adhesion tests, and surface integrity assessments before shipment.

Common Testing Methods

- Adhesion Testing: Methods such as scratch testing or pull-off tests determine the coating’s bond strength to the substrate.

- Hardness and Wear Resistance: Microhardness testers and abrasion testing simulate service conditions to verify durability.

- Thermal Cycling and Corrosion Resistance: Accelerated aging tests expose coatings to temperature fluctuations and corrosive environments to assess long-term stability.

- Surface Characterization: SEM (Scanning Electron Microscopy) and XRD (X-ray Diffraction) analyze microstructure and phase composition, ensuring coating consistency.

For buyers from diverse regions, verifying supplier QC processes is essential to mitigate risks and ensure product performance:

B2B buyers must be aware of regional differences in certification expectations and regulatory environments:

By thoroughly evaluating manufacturing processes and quality assurance practices, B2B buyers can secure high-performance SiC-coated products that meet stringent international standards and perform reliably in demanding applications.

Understanding the cost structure and pricing dynamics of SiC (Silicon Carbide) coatings is crucial for international B2B buyers aiming to optimize procurement strategies and total cost of ownership. This section breaks down key cost components, pricing influencers, and practical buyer tips tailored to markets in Africa, South America, the Middle East, and Europe.

Raw Materials

The primary cost driver is the raw Silicon Carbide powder and binder materials. Purity grade and particle size distribution directly affect material cost. High-purity SiC suitable for advanced applications commands a premium.

Labor

Labor costs vary widely based on the manufacturing location and process complexity. Skilled technicians are required for coating application, curing, and finishing stages. Regions with higher labor costs (e.g., Europe) may reflect this in pricing.

Manufacturing Overhead

Includes energy consumption (high-temperature furnaces), plant maintenance, and depreciation of equipment. SiC coating processes are energy-intensive, influencing overhead significantly.

Tooling and Equipment

Custom tooling for substrate preparation and coating application can add to upfront costs. For specialized or small-batch orders, tooling amortization per unit is higher.

Quality Control (QC)

Rigorous QC ensures coating integrity, adhesion, thickness uniformity, and performance compliance. QC expenses include laboratory testing, certifications, and inspection protocols.

Logistics and Freight

Shipping costs depend on origin, destination, and shipping mode. SiC coatings, often shipped on coated substrates or components, require careful packaging to avoid damage, adding to cost.

Supplier Margin

Profit margins vary by supplier scale, market positioning, and contractual terms. Established suppliers with certifications may price at a premium but offer reliability and warranty.

Order Volume and Minimum Order Quantities (MOQ)

Larger volumes usually reduce unit cost due to economies of scale. Small MOQs or prototyping runs can incur higher per-unit prices.

Specification Complexity and Customization

Customized coatings with specific thickness, multi-layer structures, or tailored properties increase cost. Standard coatings are generally more affordable.

Material Grade and Quality Certifications

Buyers requiring certified materials (e.g., ISO, REACH compliance) or traceability pay higher prices reflecting compliance overhead.

Supplier Location and Capabilities

Proximity to manufacturing hubs or suppliers with advanced technology reduces lead time and logistics costs. Suppliers from Asia may offer lower prices but longer delivery times.

Incoterms and Delivery Conditions

Terms such as FOB, CIF, or DDP affect the final landed cost. Buyers should clarify responsibilities for freight, insurance, and customs duties.

Negotiate Based on Volume and Long-Term Contracts

Consolidate orders across subsidiaries or projects to leverage volume discounts. Long-term contracts can secure stable pricing and priority production slots.

Evaluate Total Cost of Ownership (TCO)

Consider not only unit price but also logistics, customs clearance, quality-related rework, and warranty support. A lower upfront price may lead to higher TCO.

Prioritize Suppliers with Relevant Certifications

For regulated industries or export markets, certified suppliers mitigate risk and support smoother customs clearance.

Understand Regional Pricing Nuances

Buyers in Africa, South America, and the Middle East should account for import tariffs, currency fluctuations, and local distribution costs. Partnering with regional agents can reduce these burdens.

Clarify Incoterms Early

Clearly define shipping responsibilities and costs in contracts to avoid unexpected charges. For example, DDP (Delivered Duty Paid) places maximum responsibility on the supplier, which might simplify procurement but increase price.

Request Detailed Cost Breakdown

Ask suppliers for transparent cost components to identify potential savings, such as alternative materials or process optimizations.

Prices for SiC coatings vary widely depending on application, volume, and supplier specifics. The insights provided here are indicative and should be validated through direct supplier quotations and market research tailored to your sourcing region and technical requirements.

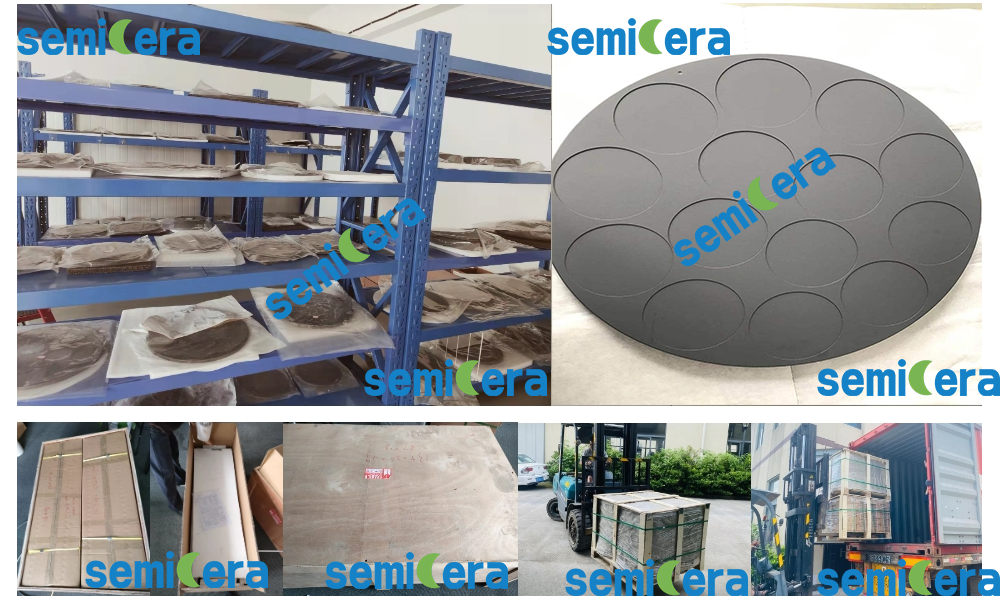

Illustrative Image (Source: Google Search)

By dissecting the cost and pricing elements of SiC coatings, international B2B buyers can make informed decisions, optimize procurement strategies, and enhance overall value, especially when navigating the complexities of cross-border transactions in diverse regions such as Africa, South America, the Middle East, and Europe.

When sourcing silicon carbide (SiC) coatings, understanding critical technical specifications is essential to ensure product performance and compatibility with your applications. Here are the primary properties that international B2B buyers should consider:

Material Grade

SiC coatings come in different grades, typically defined by purity and crystalline structure. Higher-grade SiC offers superior hardness, thermal stability, and corrosion resistance. For buyers in industries such as aerospace or chemical processing, selecting the appropriate grade ensures durability and long service life under extreme conditions.

Coating Thickness

Thickness can range from a few microns to several hundred microns depending on the application. Precise control over coating thickness affects wear resistance and thermal insulation. Buyers must specify thickness tolerance clearly to meet performance criteria and avoid costly rework or failures.

Surface Roughness

The surface finish of SiC coatings impacts friction, adhesion, and aesthetics. Low roughness values are critical for applications requiring smooth surfaces to reduce wear or improve sealing. Understanding the roughness parameter helps buyers align supplier capabilities with end-use needs.

Thermal Conductivity

SiC coatings are valued for their excellent thermal conductivity, which can vary based on formulation and microstructure. This property is vital for heat dissipation in electronics or high-temperature environments. Buyers should request specific thermal conductivity data to ensure compatibility with thermal management requirements.

Chemical Resistance

Resistance to acids, alkalis, and oxidative environments defines SiC’s suitability in harsh chemical applications. Buyers in regions with heavy industrial activity, such as the Middle East, should prioritize coatings with proven chemical resistance to maximize lifespan and reduce maintenance costs.

Dimensional Tolerance

The allowable deviation in coating dimensions directly impacts assembly and function. Strict tolerance adherence is critical for precision industries, including automotive and semiconductor manufacturing. Buyers should negotiate tolerance ranges upfront to avoid supply chain disruptions.

Navigating international trade and procurement for SiC coatings requires familiarity with key industry jargon. Here are essential terms every B2B buyer should know:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment used in another company’s end products. Understanding whether your supplier works with OEMs can signal product quality and compliance with industry standards.

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier is willing to sell in a single order. MOQs can vary widely and impact inventory management and cash flow, especially for buyers in emerging markets like Africa or South America. Negotiate MOQs to align with your operational scale.

RFQ (Request for Quotation)

A formal document sent to suppliers to obtain pricing, lead times, and terms for specific SiC coating requirements. Crafting detailed RFQs helps buyers receive accurate quotes and facilitates transparent supplier comparisons.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, Freight). Clear agreement on Incoterms reduces risks and clarifies cost allocation in international deals.

Lead Time

The period between placing an order and receiving the product. Understanding lead times is crucial for supply chain planning, especially when sourcing from distant suppliers or managing just-in-time inventory systems.

Batch Number / Lot Traceability

Refers to the unique identification assigned to each production batch. Traceability is vital for quality control, regulatory compliance, and managing recalls, which is especially important in industries with strict safety standards.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed decisions, optimize procurement strategies, and establish strong partnerships with SiC coating suppliers. Clear communication of specifications and terms not only reduces risks but also enhances product performance and supply chain efficiency.

The silicon carbide (SiC) coating sector is witnessing robust growth driven by its critical applications in industries such as automotive, aerospace, electronics, and energy. Globally, the demand for SiC coatings is propelled by the need for materials that offer superior thermal resistance, hardness, and chemical inertness. For international B2B buyers, particularly in regions like Africa, South America, the Middle East, and Europe, understanding the evolving market dynamics is crucial to sourcing effectively.

Key market drivers include the rapid expansion of electric vehicle (EV) production in Europe and the Middle East, which leverages SiC coatings for power electronics to improve efficiency and reduce energy losses. Meanwhile, South American industries, especially in Argentina, are increasingly adopting SiC coatings in mining equipment to enhance durability under harsh operational conditions. African markets are gradually scaling up their use of SiC coatings in energy infrastructure projects, aligning with regional industrialization efforts.

Illustrative Image (Source: Google Search)

Emerging sourcing trends emphasize strategic partnerships with manufacturers that offer customization and technical support. Buyers are increasingly favoring suppliers with advanced coating technologies that enable thinner, more uniform SiC layers, enhancing performance while optimizing costs. Digital procurement platforms and AI-driven supplier vetting are gaining traction, improving transparency and reducing lead times. Moreover, geopolitical factors and supply chain disruptions have encouraged diversification of sourcing channels, with buyers exploring suppliers across Asia, Europe, and the Middle East to mitigate risks.

For B2B buyers, staying ahead means prioritizing suppliers who demonstrate innovation in SiC coating processes, such as chemical vapor deposition (CVD) and physical vapor deposition (PVD), and who can adapt to specific industry standards and regulatory requirements across different regions.

Sustainability is becoming a defining factor in the silicon carbide coating sector as global industries align with environmental regulations and corporate social responsibility goals. The production of SiC coatings involves energy-intensive processes and the use of raw materials that may have significant environmental footprints if not managed responsibly.

B2B buyers from regions emphasizing green initiatives—such as the European Union’s Green Deal or Saudi Arabia’s Vision 2030—are increasingly scrutinizing suppliers’ environmental practices. Ethical sourcing includes ensuring that raw materials are procured without contributing to conflict or labor exploitation, and that manufacturing processes minimize emissions, waste, and hazardous by-products.

Certification schemes like ISO 14001 (Environmental Management Systems) and adherence to REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations are increasingly required by buyers to validate sustainability claims. Additionally, suppliers innovating in the use of renewable energy for coating production or implementing recycling of SiC materials gain competitive advantage.

Green materials innovation is also influencing sourcing decisions; for example, the development of SiC coatings with lower environmental impact binders or alternative precursors reduces carbon footprints. Buyers can leverage sustainability as a value proposition in their supply chains, ensuring compliance with evolving regulatory landscapes while meeting growing demand for eco-friendly industrial solutions.

Silicon carbide coatings have evolved from early abrasive and refractory applications to high-tech uses in semiconductor and automotive industries. Initially developed in the early 20th century for wear resistance, SiC coatings have undergone significant advancements in deposition techniques, enabling their integration into power electronics and harsh environment components.

The transition from bulk SiC materials to thin-film coatings marked a pivotal shift, allowing manufacturers to enhance surface properties without compromising base material integrity. This evolution has been driven by continuous innovation in chemical vapor deposition methods and process optimization, aligning with the increasing complexity of industrial applications.

For B2B buyers, understanding this evolution underscores the importance of selecting suppliers with proven expertise and a track record of technological advancement, ensuring access to state-of-the-art SiC coating solutions that meet modern industry demands.

How can I effectively vet suppliers of SiC coating for international sourcing?

When vetting SiC coating suppliers, prioritize those with verifiable manufacturing capabilities and transparent quality control processes. Request detailed documentation such as ISO certifications, material safety data sheets, and third-party testing results. For buyers in Africa, South America, the Middle East, and Europe, it’s crucial to assess the supplier’s export history and compliance with international trade regulations. Conduct virtual or onsite audits if possible, and seek references from other B2B clients. Leveraging platforms with verified supplier credentials and using escrow payment methods can further mitigate risks.

Is it possible to customize SiC coatings to specific industrial requirements?

Yes, customization is a common practice in the SiC coating industry. Suppliers often tailor coating thickness, composition, and application methods to meet diverse industrial needs such as wear resistance, thermal stability, or electrical insulation. When negotiating, provide detailed technical specifications and intended application environments. Ensure the supplier has R&D capabilities and can share prototype samples or performance data. Customization may affect minimum order quantities (MOQ) and lead times, so clarify these aspects upfront to align with your project timelines.

What are typical minimum order quantities (MOQ) and lead times for SiC coating orders?

MOQs vary significantly depending on the supplier’s production scale and the complexity of the SiC coating. Standard MOQs often range from small batch orders suitable for testing (e.g., 50–100 units) to larger industrial volumes. Lead times typically range from 4 to 12 weeks, influenced by customization, raw material availability, and shipping logistics. Buyers should negotiate MOQs and lead times early, especially when ordering from suppliers in different continents, to avoid production delays. Establishing a long-term relationship may help reduce MOQs and expedite future orders.

What payment terms are standard in international B2B transactions for SiC coatings?

Common payment terms include letters of credit (L/C), advance payments (30–50%), and open account terms for trusted partners. Letters of credit provide security for both parties but may involve banking fees and longer processing times. For new suppliers, advance payments combined with escrow services reduce risk. Buyers should clearly outline payment milestones aligned with production stages. Due to currency fluctuations in regions like South America and the Middle East, consider using stable currencies (USD, EUR) or hedging mechanisms to protect against exchange rate volatility.

Which quality assurance certifications should I verify when purchasing SiC coatings internationally?

Key certifications include ISO 9001 for quality management systems and ISO 14001 for environmental management, which indicate robust production and sustainability practices. Additionally, RoHS and REACH compliance confirm that the coatings meet international safety and environmental standards. For certain industrial applications, certifications related to aerospace, automotive, or electronics sectors may be necessary. Always request certificates of analysis (CoA) and batch-specific quality reports to ensure consistency. Verifying these documents helps minimize risks associated with substandard or non-compliant coatings.

What logistics considerations are critical when importing SiC coatings from overseas suppliers?

Due to the specialized nature of SiC coatings, proper packaging to prevent contamination and damage during transit is essential. Confirm that suppliers use internationally recognized hazardous material handling and shipping protocols if applicable. Shipping modes (air, sea, or land) affect lead times and costs; sea freight is cost-effective for bulk orders but slower, while air freight suits urgent smaller shipments. Customs clearance requirements vary by country; ensure all documentation, including certificates and HS codes, is accurate to avoid delays. Collaborate with freight forwarders experienced in chemical or industrial material shipments.

How should I handle disputes or quality issues with international SiC coating suppliers?

First, establish clear contractual terms detailing product specifications, inspection rights, and dispute resolution mechanisms before placing orders. If quality issues arise, document all defects with photos and lab reports, and notify the supplier promptly. Many suppliers offer replacement or refund policies for verified defects. For unresolved disputes, mediation or arbitration through international trade bodies like ICC can be effective. Maintaining open communication and building long-term supplier relationships can reduce the frequency and impact of disputes.

Are there specific trade regulations or tariffs affecting SiC coating imports in Africa, South America, the Middle East, and Europe?

Yes, import duties and trade regulations vary widely across these regions. For example, the European Union applies tariffs under the Combined Nomenclature (CN) system, and many African countries are part of regional trade blocs like the African Continental Free Trade Area (AfCFTA) that may reduce tariffs. The Middle East often has free trade zones but requires compliance with local standards and certifications. South American countries may have import restrictions or anti-dumping duties on certain chemical products. Engage local customs experts and stay updated on trade agreements to optimize costs and ensure compliance.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of SiC coating solutions unlocks significant competitive advantages for international B2B buyers. By prioritizing suppliers who demonstrate technological expertise, quality consistency, and reliable supply chains, companies across Africa, South America, the Middle East, and Europe can ensure optimal performance and durability in their applications. Understanding regional market dynamics and aligning sourcing strategies with long-term operational goals is essential to mitigate risks and enhance cost efficiency.

Key takeaways include:

Looking ahead, the SiC coating market is poised for innovation-driven growth, driven by expanding industrial applications and evolving material science. B2B buyers are encouraged to adopt a proactive sourcing approach—engaging early with suppliers, exploring collaborative development opportunities, and staying attuned to emerging trends. This strategic mindset will empower businesses in Saudi Arabia, Argentina, and beyond to secure resilient supply chains and maintain a competitive edge in their industries.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina