The global demand for advanced thermal management solutions is rapidly growing, and silicon carbide (SiC) heat exchangers are at the forefront of this technological evolution. Renowned for their exceptional thermal conductivity, chemical inertness, and high-temperature resistance, SiC heat exchangers are critical components in industries ranging from chemical processing to power generation. For international B2B buyers, especially those operating in diverse markets across Africa, South America, the Middle East, and Europe—including dynamic economies such as Thailand and Mexico—securing reliable, cost-effective, and high-performance SiC heat exchangers is essential to maintaining competitive advantage.

This comprehensive guide offers an authoritative roadmap to navigating the complexities of sourcing SiC heat exchangers on a global scale. It delves into the various types of SiC heat exchangers, their material properties, and manufacturing and quality control processes that ensure durability and efficiency. Buyers will gain insights into evaluating suppliers, understanding cost structures, and analyzing market trends that influence procurement decisions.

Illustrative Image (Source: Google Search)

By presenting clear, actionable information—including answers to frequently asked questions—this guide empowers B2B purchasers to make well-informed decisions tailored to their specific operational requirements and regional market conditions. Whether you are expanding your supply chain in emerging markets or optimizing existing partnerships in established economies, understanding the nuances of SiC heat exchanger sourcing will enable you to unlock superior product performance and sustainable value.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Plate Heat Exchanger | Consists of multiple thin, corrugated SiC plates; high surface area | Chemical processing, high-temperature fluid cooling | + Compact design, excellent heat transfer efficiency – Higher upfront cost, sensitive to thermal shock |

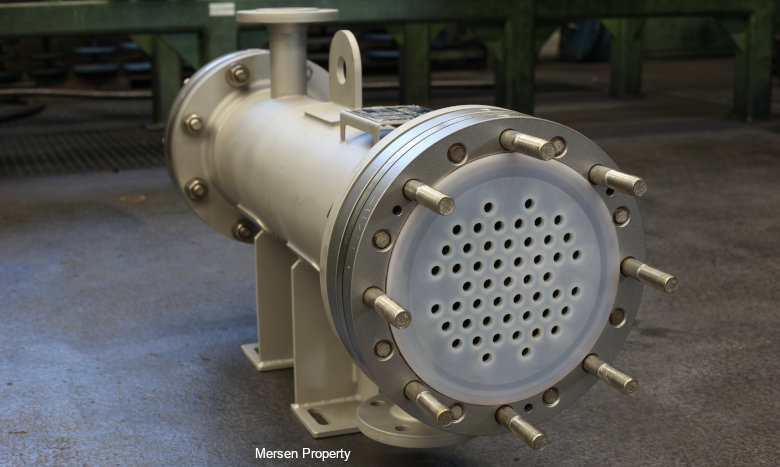

| Shell and Tube Heat Exchanger (SiC Lined) | Traditional shell and tube with SiC ceramic lining for corrosion resistance | Petrochemical, power generation, harsh chemical environments | + Robust, suitable for high pressure – Larger footprint, complex maintenance |

| Monolithic SiC Heat Exchanger | Single-piece SiC ceramic structure with integrated flow channels | Semiconductor manufacturing, ultra-high purity applications | + Superior corrosion resistance, minimal leakage risk – High manufacturing cost, limited size options |

| SiC Foam Heat Exchanger | Porous SiC foam provides high surface area with low pressure drop | Gas-to-gas heat exchange, high-temperature filtration | + Lightweight, excellent thermal shock resistance – Limited mechanical strength, niche applications |

| SiC Microchannel Heat Exchanger | Micro-scale channels etched or formed in SiC for precise thermal control | Aerospace, electronics cooling, advanced chemical reactors | + Extremely efficient heat transfer, compact – Complex fabrication, high cost |

Plate heat exchangers made from silicon carbide feature multiple thin, corrugated plates stacked to maximize surface contact. Their design offers exceptional heat transfer efficiency, making them ideal for chemical processing plants where fluid temperatures are high and corrosive. B2B buyers should consider the upfront investment versus long-term durability and maintenance. These exchangers excel in compactness and thermal performance but require careful handling to avoid thermal shock, which can cause cracking.

This variation adapts the traditional shell and tube design by incorporating a silicon carbide lining on the tubes or shell. It is favored in industries like petrochemical and power generation where fluids are aggressive and operating pressures are high. For B2B buyers, the robustness and pressure tolerance are key benefits, though the larger physical footprint and maintenance complexity may impact facility planning and operational costs.

Monolithic SiC exchangers are fabricated as a single ceramic piece with integrated flow channels, offering unmatched corrosion resistance and leak prevention. These are particularly suited for semiconductor manufacturing and ultra-pure chemical processes where contamination must be minimized. Buyers should weigh the high manufacturing cost against the benefits of longevity and minimal downtime. Size limitations may restrict applications to specialized processes.

Utilizing porous silicon carbide foam, these exchangers provide a high surface area with low pressure drop, making them excellent for gas-to-gas heat exchange and filtration at elevated temperatures. Their lightweight nature and thermal shock resistance benefit applications in harsh environments. However, their limited mechanical strength means they are best suited for niche applications rather than heavy industrial use, a critical factor for procurement decisions.

Featuring micro-scale channels in silicon carbide, these heat exchangers deliver precise thermal management with exceptional heat transfer rates. They are increasingly used in aerospace, electronics cooling, and advanced chemical reactors where space and efficiency are at a premium. The complexity and high cost of fabrication require buyers to carefully assess the return on investment, especially for high-tech or small-batch production environments.

Related Video: Heat Exchangers Types | How Many Types of Heat Exchanger |

| Industry/Sector | Specific Application of sic heat exchanger | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Chemical Processing | High-temperature heat recovery in corrosive environments | Enhances energy efficiency, reduces operational costs, and improves process safety | Material purity, corrosion resistance, thermal shock tolerance, supplier certification |

| Power Generation | Heat recovery steam generators (HRSG) in gas turbines | Maximizes thermal efficiency, reduces emissions, and extends equipment lifespan | Thermal conductivity, mechanical strength, compatibility with existing systems |

| Semiconductor Manufacturing | Precise temperature control in wafer processing equipment | Ensures product quality, reduces downtime, and supports high throughput | Cleanroom compatibility, contamination control, dimensional accuracy |

| Petrochemical Industry | Heat exchangers for cracking furnaces and reformers | Improves catalyst life, reduces coke formation, and increases yield | High temperature resistance, chemical inertness, long-term durability |

| Aerospace & Defense | Cooling systems for high-performance engines and exhaust gases | Enhances engine efficiency, reduces weight, and withstands extreme conditions | Weight-to-strength ratio, thermal expansion compatibility, supplier reliability |

Silicon carbide (SiC) heat exchangers are highly prized in chemical processing for their ability to withstand aggressive corrosive media at elevated temperatures. In applications such as acid recovery or alkali concentration, SiC heat exchangers enable efficient heat transfer while resisting chemical attack, which significantly reduces maintenance downtime. International buyers from regions like Africa and South America should prioritize sourcing units with verified corrosion resistance and certifications ensuring material integrity to handle local chemical compositions.

In the power generation sector, SiC heat exchangers play a critical role in heat recovery steam generators (HRSG) for gas turbines. Their excellent thermal conductivity and resistance to thermal shock enhance overall plant efficiency and reduce emissions. Buyers in the Middle East and Europe must ensure that the heat exchangers are engineered to integrate seamlessly with existing turbine systems, emphasizing mechanical robustness and thermal cycling performance.

The semiconductor manufacturing industry demands stringent temperature control to maintain wafer quality. SiC heat exchangers are utilized in wafer processing equipment for their thermal stability and low contamination risk. For B2B buyers in technologically advanced hubs like Thailand and Mexico, it's essential to source heat exchangers that meet cleanroom standards and offer precise dimensional tolerances to avoid process disruptions.

In petrochemical plants, SiC heat exchangers are employed in cracking furnaces and reformers where extreme temperatures and harsh chemical environments prevail. Their chemical inertness and ability to withstand thermal stress improve catalyst life and process yields. Enterprises in Europe and South America should focus on suppliers offering durable SiC units with proven long-term performance under continuous operation.

Finally, the aerospace and defense sectors utilize SiC heat exchangers in cooling systems for high-performance engines and exhaust gases. These exchangers contribute to engine efficiency by managing heat under extreme conditions while maintaining a lightweight profile. Buyers from regions investing in aerospace manufacturing must carefully evaluate the heat exchanger’s strength-to-weight ratio and thermal expansion properties to ensure reliability in demanding operational environments.

Related Video: Double Pipe Heat Exchanger Basics Explained - industrial engineering

Silicon Carbide (SiC) heat exchangers are prized for their exceptional thermal and chemical resistance, but the choice of complementary materials in their construction critically influences performance, cost, and suitability for various industrial applications. Below is an analysis of four common materials used alongside SiC in heat exchanger components, tailored to the needs of international B2B buyers across Africa, South America, the Middle East, and Europe.

Key Properties:

SiC exhibits outstanding thermal conductivity, high-temperature tolerance (up to 1600°C in inert atmospheres), and exceptional corrosion resistance against acids, alkalis, and oxidizing agents. It also has excellent mechanical strength and wear resistance.

Pros & Cons:

SiC’s durability ensures long service life in harsh chemical environments, minimizing downtime and maintenance. However, it is brittle, making manufacturing complex and costly. Machining requires specialized tools and expertise, which can increase lead times and unit costs.

Impact on Application:

Ideal for aggressive media such as sulfuric acid, hydrochloric acid, and hot gases. Its inertness makes it suitable for chemical, petrochemical, and power generation industries where contamination or corrosion is a concern.

Considerations for B2B Buyers:

Buyers from regions like the Middle East and Europe should verify compliance with ASTM C799 and DIN EN standards for SiC ceramics. In Africa and South America, it’s crucial to source from suppliers with proven quality certifications to ensure performance under local operating conditions. Consider logistics and availability, as SiC components may have longer lead times.

Key Properties:

Stainless steel offers good mechanical strength, moderate corrosion resistance, and excellent weldability. Duplex grades enhance resistance to stress corrosion cracking and pitting, with temperature tolerance up to ~870°C.

Pros & Cons:

Stainless steel is cost-effective and widely available globally, with well-established manufacturing processes. However, it is susceptible to corrosion in highly acidic or chlorinated environments, limiting its use in extreme chemical conditions.

Impact on Application:

Often used for structural parts and shell components in SiC heat exchangers where mechanical strength is critical but direct chemical exposure is limited. Suitable for less aggressive fluids and moderate temperature applications.

Considerations for B2B Buyers:

International buyers should ensure material certifications conform to ASTM A240 or EN 10088 standards. In regions like South America and Africa, local fabrication facilities often have extensive experience with stainless steel, reducing costs and delivery times. For Middle Eastern buyers, duplex stainless steel is preferred for saline or chloride-rich environments.

Key Properties:

Titanium exhibits excellent corrosion resistance to a wide range of chemicals, including chlorides and oxidizing acids, with good strength-to-weight ratio and temperature resistance up to about 600°C.

Pros & Cons:

While titanium offers superior corrosion resistance compared to stainless steel, it is significantly more expensive and challenging to machine and weld. Its use requires specialized fabrication skills and equipment.

Impact on Application:

Preferred in highly corrosive environments involving seawater, chloride solutions, and oxidizing acids. It is suitable for heat exchangers in desalination plants, chemical processing, and offshore applications.

Considerations for B2B Buyers:

Buyers in coastal or saline environments, such as parts of Africa and the Middle East, will benefit from titanium’s durability. Compliance with ASTM B265 and ISO 5832 standards is essential. The high cost may limit its use in budget-sensitive projects common in emerging markets.

Key Properties:

Graphite offers excellent thermal conductivity, chemical inertness, and can withstand temperatures up to 3000°C in inert atmospheres. It is lightweight and has low thermal expansion.

Pros & Cons:

Graphite is highly resistant to corrosion and thermal shock but is mechanically fragile and porous, requiring careful sealing and protective coatings. Manufacturing complexity and fragility can increase maintenance needs.

Impact on Application:

Used in heat exchangers handling highly corrosive fluids at moderate to high temperatures, especially where weight reduction is advantageous. Often paired with SiC for enhanced chemical resistance.

Considerations for B2B Buyers:

European and Middle Eastern buyers often have access to advanced graphite processing technologies ensuring quality. In Africa and South America, verifying supplier expertise is critical to avoid premature failures. Standards like ASTM C561 guide graphite quality assessment.

| Material | Typical Use Case for sic heat exchanger | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | Core heat exchange surfaces in highly corrosive, high-temp environments | Exceptional corrosion and thermal resistance | Brittle, high manufacturing complexity | High |

| Stainless Steel | Structural components, shells, moderate corrosion environments | Cost-effective, widely available, good strength | Limited corrosion resistance in aggressive media | Medium |

| Titanium | Heat exchangers exposed to seawater, chlorides, oxidizing acids | Superior corrosion resistance, lightweight | High cost, difficult fabrication | High |

| Graphite | Heat exchangers for corrosive fluids requiring thermal shock resistance | Excellent chemical inertness and thermal conductivity | Fragile, porous, requires sealing | Medium |

This guide empowers international B2B buyers to make informed decisions based on operational demands, regional standards, and cost considerations, ensuring optimal material selection for SiC heat exchangers tailored to diverse industrial environments.

Silicon carbide (SiC) heat exchangers are prized in industries requiring exceptional thermal resistance, chemical inertness, and mechanical strength. Understanding their manufacturing process is crucial for B2B buyers aiming to source high-quality components tailored to demanding applications across Africa, South America, the Middle East, and Europe.

The foundation of a high-performance SiC heat exchanger lies in the quality of raw materials. The process begins with the selection and preparation of high-purity silicon carbide powders. These powders are carefully graded and sometimes blended with sintering additives to optimize densification and mechanical properties.

Shaping the SiC into the desired heat exchanger components involves advanced ceramic forming methods that balance precision and structural integrity:

SiC heat exchangers often consist of multiple ceramic components assembled into modular units. Joining techniques must maintain structural integrity and thermal conductivity:

Post-assembly finishing ensures dimensional accuracy and surface quality, which are critical for heat exchanger efficiency:

For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, understanding and verifying the quality assurance (QA) framework of SiC heat exchangers is paramount to mitigate supply chain risks and ensure compliance with local and international regulations.

Quality control (QC) for SiC heat exchangers is a multi-stage process designed to detect defects early and ensure product reliability.

Ensuring supplier reliability and product quality requires proactive verification strategies:

International B2B buyers face unique challenges when sourcing SiC heat exchangers due to diverse regulatory environments and logistical considerations:

Selecting SiC heat exchangers demands a thorough grasp of manufacturing intricacies and stringent quality assurance protocols. Buyers across Africa, South America, the Middle East, and Europe should prioritize suppliers who:

By leveraging these insights, international buyers can confidently procure SiC heat exchangers that deliver superior performance, reliability, and value in their respective markets.

When sourcing Silicon Carbide (SiC) heat exchangers, understanding the underlying cost structure and pricing dynamics is crucial for international B2B buyers aiming to optimize procurement and total cost of ownership. The price of SiC heat exchangers is influenced by a complex interplay of material costs, manufacturing processes, supplier capabilities, and logistical considerations.

Materials

Silicon carbide is a premium ceramic material known for its high thermal conductivity, chemical resistance, and durability. The raw material cost is a significant portion of the final price. Variations in SiC purity, grain size, and form (e.g., monolithic blocks, porous substrates) directly impact costs. Additionally, supplementary materials such as bonding agents or coatings may add to expenses.

Labor and Manufacturing Overhead

Fabrication of SiC heat exchangers involves specialized manufacturing techniques such as sintering, precision machining, and assembly under controlled environments. Labor costs reflect the expertise required and can vary based on the manufacturing location. Overhead includes utilities, equipment depreciation, and facility costs, which tend to be higher in regions with advanced manufacturing standards.

Tooling and Equipment

Custom tooling is often necessary to produce complex heat exchanger geometries. Initial tooling investment can be substantial, especially for bespoke or low-volume orders. Amortizing tooling costs over larger production runs reduces unit price but may be a barrier for small or pilot orders.

Quality Control and Certification

Rigorous quality control is essential given the critical applications of SiC heat exchangers in industries like chemical processing and power generation. Costs include testing equipment, inspection labor, and certification fees (e.g., ISO, ASME, or industry-specific standards). Higher certification levels typically command premium pricing but provide assurance on reliability and compliance.

Logistics and Shipping

Due to the fragile and high-value nature of SiC components, specialized packaging and handling are required to prevent damage during transit. Shipping costs can be significant, especially for buyers in Africa, South America, or the Middle East, where freight routes may be less direct or involve multiple customs processes. Tariffs, import duties, and local taxes further affect landed cost.

Supplier Margin

Suppliers factor in profit margins based on market conditions, competition, and service levels. Margins may fluctuate with demand cycles or when offering after-sales support, warranty services, and customization.

Order Volume and Minimum Order Quantity (MOQ)

Larger orders usually benefit from economies of scale, reducing unit costs. Small or sample orders tend to carry premium pricing due to fixed overhead distribution.

Technical Specifications and Customization

Custom designs, tight tolerances, or integration of advanced features (e.g., coatings for extreme environments) increase complexity and cost. Standardized models are generally more cost-effective.

Material Grade and Quality Certifications

Higher-grade SiC or additional certifications for critical industries (pharmaceutical, aerospace) can raise prices substantially.

Supplier Location and Reputation

Established manufacturers with proven track records may charge more but reduce risk. Regional manufacturing hubs in Europe or Asia might offer competitive pricing compared to emerging markets.

Incoterms and Payment Terms

Choice of Incoterms (e.g., FOB, CIF, DDP) affects the buyer’s responsibility for freight and customs, influencing total procurement costs. Favorable payment terms can improve cash flow and negotiating leverage.

Negotiate Based on Total Cost of Ownership (TCO)

Consider not only purchase price but also installation, maintenance, energy efficiency, and lifespan. Investing in a slightly higher-priced, higher-quality SiC heat exchanger can lower TCO.

Leverage Volume Consolidation

Pool orders across subsidiaries or partners to meet MOQ thresholds and unlock better pricing.

Request Detailed Cost Breakdowns

Ask suppliers for transparent cost components to identify negotiation levers such as reducing customization or adjusting logistics.

Assess Supplier Certifications and After-Sales Support

Prioritize suppliers who offer robust quality assurance and responsive technical support, especially critical for buyers in regions with limited local expertise.

Understand Regional Logistics Challenges

Factor in longer lead times, customs delays, and potential tariffs when sourcing from distant manufacturers. Use freight forwarders familiar with your region to mitigate risks.

Be Mindful of Currency Fluctuations

For buyers in Africa, South America, and the Middle East, currency volatility can impact final costs. Negotiate contracts in stable currencies or with clauses to manage exchange risks.

Prices for SiC heat exchangers vary widely depending on specifications, order size, and market conditions. The insights provided here serve as an indicative framework to aid buyer decision-making and should be supplemented with direct supplier quotations and market research tailored to specific sourcing scenarios.

By thoroughly analyzing these cost drivers and price influencers, international B2B buyers can make informed sourcing decisions for SiC heat exchangers that balance quality, reliability, and cost-efficiency across diverse global markets.

Material Grade and Purity

Silicon carbide (SiC) heat exchangers are valued for their exceptional thermal conductivity and chemical inertness. The material grade—often characterized by purity levels exceeding 99%—directly impacts corrosion resistance and mechanical strength. For B2B buyers, specifying high-purity SiC ensures durability in harsh industrial environments such as chemical processing or power generation, minimizing maintenance costs and downtime.

Thermal Conductivity

This property defines the heat exchanger's efficiency in transferring heat. SiC typically exhibits thermal conductivity ranging from 120 to 270 W/m·K depending on fabrication methods. High thermal conductivity translates to improved energy efficiency and faster thermal response, crucial for industries aiming to optimize process temperatures and reduce energy consumption.

Mechanical Tolerance and Dimensional Accuracy

Precision in manufacturing tolerances (often within microns) affects the fit and sealing of heat exchanger components. Tight tolerances ensure leak-free operation and compatibility with existing systems, which is essential for maintaining process integrity and avoiding costly custom modifications. Buyers should confirm tolerance specifications to match their application requirements.

Corrosion and Chemical Resistance

SiC is renowned for its resistance to aggressive chemicals, acids, and high-temperature oxidation. This property is critical for buyers in sectors like petrochemical, pharmaceuticals, or wastewater treatment, where exposure to corrosive fluids is routine. Selecting SiC heat exchangers with proven chemical resistance extends equipment lifespan and reduces replacement frequency.

Operating Temperature Range

SiC heat exchangers can typically operate reliably at temperatures from -40°C up to 1600°C. Understanding the maximum continuous operating temperature is vital for buyers to ensure the heat exchanger performs safely under their specific process conditions, avoiding thermal degradation or failure.

Pressure Rating

The maximum allowable pressure rating defines the operational limits of the heat exchanger under fluid pressure. Buyers must verify pressure ratings to guarantee safe integration into pressurized systems, preventing mechanical failure and ensuring compliance with safety standards.

OEM (Original Equipment Manufacturer)

Refers to the company that originally manufactures a product or component, which may be purchased by other firms for resale or integration. For buyers, understanding whether the SiC heat exchanger supplier is an OEM or a reseller affects pricing, customization options, and after-sales support.

MOQ (Minimum Order Quantity)

The smallest quantity of units a supplier is willing to sell in one order. MOQs impact purchasing decisions, especially for smaller companies or those testing new technologies. Negotiating MOQ can optimize inventory costs and cash flow management.

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers asking for pricing, availability, and terms for specified products. Crafting detailed RFQs for SiC heat exchangers ensures clear communication, enabling suppliers to provide accurate quotes and reducing procurement cycle time.

Illustrative Image (Source: Google Search)

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce defining responsibilities, risks, and costs between buyers and sellers during international shipping. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers clarify logistics, customs duties, and delivery obligations, critical for smooth cross-border transactions.

Lead Time

The period between placing an order and receiving the product. SiC heat exchangers often require specialized manufacturing processes, so lead times can be longer than for conventional materials. Buyers should plan procurement schedules accordingly to avoid operational delays.

Certificate of Compliance (CoC)

A document provided by the manufacturer certifying that the product meets specified standards and regulatory requirements. For international buyers, requesting a CoC ensures product quality and facilitates customs clearance in regulated markets.

By mastering these technical properties and trade terms, international B2B buyers from Africa, South America, the Middle East, and Europe can make informed purchasing decisions. This knowledge helps optimize procurement strategies, ensures compatibility with industrial applications, and fosters successful supplier partnerships in the competitive SiC heat exchanger market.

The silicon carbide (SiC) heat exchanger sector is witnessing robust growth fueled by increasing industrial demand for high-efficiency thermal management solutions. SiC’s exceptional thermal conductivity, chemical inertness, and high-temperature tolerance make it a preferred material in sectors such as chemical processing, power generation, and automotive industries worldwide. For international B2B buyers from Africa, South America, the Middle East, and Europe—including emerging markets like Thailand and Mexico—understanding regional supply chain dynamics and technological advancements is crucial.

Key market drivers include the rising need for durable heat exchangers that can withstand corrosive environments and elevated temperatures, particularly in oil & gas, petrochemical, and renewable energy sectors. Additionally, the global push towards electrification and energy efficiency is accelerating demand for SiC components in power electronics and heat exchange applications. Buyers should note that Asia-Pacific remains a dominant manufacturing hub, but suppliers in Europe are increasingly focusing on advanced customization and integration capabilities.

Emerging sourcing trends emphasize partnerships with manufacturers offering modular SiC heat exchanger designs, which enable scalable deployment and easier maintenance. Digitalization, including the adoption of Industry 4.0 tools for predictive maintenance and real-time monitoring, is gaining traction. This trend enhances operational efficiency and reduces downtime, a significant value proposition for B2B buyers operating in remote or infrastructure-challenged regions.

For buyers in Africa and the Middle East, prioritizing suppliers with strong logistical networks and regional support centers can mitigate risks associated with shipping and customs delays. South American buyers should consider suppliers offering flexible financing and after-sales services to address fluctuating economic conditions. Across all regions, transparency in material sourcing and product certifications is increasingly influencing procurement decisions.

Sustainability has become a pivotal consideration in the procurement of SiC heat exchangers. The production of silicon carbide involves energy-intensive processes and mining activities that can impact local environments if not managed responsibly. International B2B buyers are increasingly demanding suppliers adhere to stringent environmental standards to reduce carbon footprints and promote circular economy principles.

Environmental impact mitigation strategies include sourcing SiC from manufacturers employing renewable energy in production, optimizing raw material usage, and implementing waste recycling programs. Buyers should seek suppliers who provide lifecycle assessments (LCA) to quantify environmental benefits and identify areas for improvement.

Ethical sourcing is equally critical. With global supply chains stretching across multiple continents, ensuring that raw materials are procured without exploitative labor practices or conflict minerals is essential to uphold corporate social responsibility. Certifications such as ISO 14001 (Environmental Management), ISO 45001 (Occupational Health & Safety), and adherence to Responsible Minerals Initiative (RMI) standards are indicators of credible supply chains.

The adoption of ‘green’ certifications and eco-labels specific to SiC products, though still emerging, is expected to become a differentiator. Buyers should prioritize suppliers investing in sustainable innovation, such as developing SiC heat exchangers with longer lifespans or improved recyclability, thereby reducing total environmental impact over product usage.

Silicon carbide’s journey as a material for heat exchangers dates back to the mid-20th century when its unique thermal and chemical properties were first recognized. Initially utilized in abrasive applications, SiC’s high thermal conductivity and resistance to corrosion quickly positioned it as an ideal candidate for industrial heat exchange components, especially in harsh chemical environments.

Over the decades, advancements in manufacturing techniques—such as chemical vapor deposition (CVD) and sintering—have enabled the production of more complex, reliable, and cost-effective SiC heat exchangers. These improvements have expanded its applicability from niche chemical plants to mainstream sectors like power electronics and automotive thermal management.

For B2B buyers, understanding this evolution underscores the material’s proven track record and continual innovation, ensuring confidence in its long-term performance and availability. The historical emphasis on durability and efficiency remains central as global industries increasingly demand sustainable and technologically advanced thermal solutions.

How can I effectively vet suppliers of SiC heat exchangers for international procurement?

To vet suppliers, start by requesting detailed company profiles, including years of experience with SiC materials and heat exchanger manufacturing. Verify certifications such as ISO 9001 and industry-specific standards to ensure quality management. Ask for client references, especially from regions similar to your market (Africa, South America, Middle East, Europe). Conduct factory audits or virtual tours to assess production capabilities and quality control processes. Use third-party inspection services to verify product compliance before shipment. This due diligence minimizes risks and ensures reliable, compliant supply.

What customization options are typically available for SiC heat exchangers, and how do they impact cost and lead time?

SiC heat exchangers can be customized in terms of size, shape, flow configuration, and surface treatment to match specific industrial applications. Customization often involves adapting thermal resistance, corrosion resistance, and mechanical strength. While tailored designs optimize performance, they generally increase costs and extend lead times by 2-4 weeks or more, depending on complexity. Engage suppliers early to clarify technical requirements and negotiate feasible customization scopes. Clear design specifications and early prototyping help control costs and ensure timely delivery.

What are common minimum order quantities (MOQs) and typical lead times for SiC heat exchanger orders in international trade?

MOQs vary by manufacturer but typically range from 5 to 50 units due to specialized production processes. Some suppliers offer lower MOQs for samples or initial trials, especially for new customers. Lead times generally span 6 to 12 weeks from order confirmation, factoring in raw material sourcing, fabrication, and quality testing. For bulk orders, lead times may extend further. Plan procurement schedules accordingly and negotiate partial shipments or stock agreements to maintain supply continuity in your target markets.

Which payment terms are standard for international B2B transactions involving SiC heat exchangers?

Common payment terms include 30% advance payment upon order confirmation and 70% balance before shipment or upon delivery. Letters of Credit (L/C) are widely used to mitigate payment risks, providing security for both buyer and supplier. Open account terms may be available for established partners with strong credit history. Always clarify currency, incoterms (e.g., FOB, CIF), and payment milestones in contracts. Using escrow services or trade finance solutions can further safeguard transactions, especially when dealing with new suppliers from diverse regions.

What quality assurance measures and certifications should I expect for SiC heat exchangers?

Quality assurance typically involves rigorous material testing (e.g., purity of SiC ceramics), dimensional accuracy, pressure resistance, and thermal performance validation. Look for certificates such as ISO 9001 for quality management, ASTM standards for ceramics, and any relevant regional certifications. Suppliers should provide detailed test reports, including non-destructive testing (NDT) and performance data. Ensure the heat exchangers meet your application’s chemical compatibility and durability requirements. Regular third-party inspections and sample validations enhance confidence in product consistency.

How should I plan logistics and shipping for SiC heat exchangers to Africa, South America, the Middle East, or Europe?

Due to their fragile ceramic components, SiC heat exchangers require careful packaging with shock-absorbing materials and sturdy crates. Choose freight forwarders experienced in handling delicate industrial goods and verify transit routes for customs efficiency. Air freight offers faster delivery but at higher cost, while sea freight is economical for bulk orders but slower. Account for customs clearance times and local import regulations, which vary by region. Collaborate with suppliers to consolidate shipments and optimize incoterms to balance cost, risk, and delivery speed.

Illustrative Image (Source: Google Search)

What are best practices for handling disputes or quality issues with international SiC heat exchanger suppliers?

Establish clear contractual terms covering quality standards, inspection rights, and dispute resolution mechanisms before ordering. In case of defects, promptly document and communicate issues with photos and test results. Engage suppliers for remediation—replacement, repair, or compensation—based on agreed terms. Utilize third-party arbitration or mediation services if direct negotiation stalls. Maintaining open, professional communication and keeping detailed records throughout the transaction helps resolve disputes efficiently and preserves long-term partnerships.

How can international buyers from emerging markets ensure competitive pricing without compromising SiC heat exchanger quality?

Leverage multiple supplier quotations and negotiate volume discounts or long-term contracts to reduce unit costs. Prioritize suppliers with transparent cost breakdowns to identify potential savings in materials or processes. Consider sourcing from regions with established ceramic manufacturing clusters, balancing price and quality. Avoid compromising on critical certifications and testing to prevent costly failures. Investing in strong supplier relationships and collaborative planning can unlock better pricing, customized solutions, and reliable supply tailored to your market’s needs.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In today’s competitive industrial landscape, sourcing silicon carbide (SiC) heat exchangers demands a strategic approach that balances cost efficiency, quality assurance, and supplier reliability. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding the unique advantages of SiC—such as superior thermal conductivity, chemical inertness, and durability under extreme conditions—can unlock significant operational benefits. Prioritizing suppliers with proven expertise, robust quality controls, and scalable production capabilities ensures not only product performance but also supply chain resilience.

Key takeaways for international buyers include:

Looking ahead, the SiC heat exchanger market is poised for growth fueled by increasing demand in sectors like energy, chemical processing, and high-performance manufacturing. Buyers who invest in strategic sourcing frameworks today will gain a competitive edge, ensuring access to cutting-edge technology and reliable supply. We encourage international B2B buyers to engage proactively with trusted SiC suppliers and explore tailored sourcing strategies that align with their operational goals and regional market dynamics.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina