Guide to Sic Manufacturing Process

In today’s interconnected global economy, the silicon carbide (SiC) manufacturing process stands as a critical pillar underpinning advanced industries—from electronics and automotive to renewable energy and industrial machinery. For international B2B buyers, especially those based in Africa, South America, the Middle East, and Europe, understanding the nuances of SiC production is essential to making informed sourcing decisions that balance quality, cost, and reliability.

This comprehensive guide offers an in-depth exploration of the SiC manufacturing landscape, covering key aspects such as types of SiC products, raw materials, manufacturing techniques, quality control standards, and supplier landscapes. It also delves into cost considerations, market trends, and frequently asked questions, equipping buyers with the insights needed to navigate complex supply chains confidently.

By leveraging this knowledge, B2B buyers can identify reputable suppliers, assess product specifications, and optimize procurement strategies tailored to regional market conditions. Whether sourcing from emerging markets like Egypt and Turkey or established players in Europe and beyond, this guide aims to empower you with actionable intelligence that enhances sourcing efficiency, mitigates risks, and fosters long-term partnerships in the global SiC market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Conventional Sintered SIC | Uses traditional powder metallurgy sintering; high purity and density | Abrasive tools, refractory linings, seals | Pros: High thermal stability, consistent quality. Cons: Higher production costs, longer lead times. |

| Hot-Pressed SIC | Combines powder pressing with high-temperature pressing for enhanced density | Wear-resistant components, industrial machinery | Pros: Superior mechanical strength, low porosity. Cons: Complex manufacturing, higher initial investment. |

| Coated SIC (Surface-Treated) | Surface modifications for enhanced corrosion or wear resistance | Chemical processing, advanced electronics | Pros: Improved durability in aggressive environments. Cons: Increased cost, potential coating delamination issues. |

| Recrystallized SIC | Involves controlled thermal treatments to refine microstructure | High-performance ceramics, precision components | Pros: Improved toughness and machinability. Cons: Additional processing steps, higher costs. |

| Composite SIC Materials | Incorporates other materials (e.g., binders, fibers) to modify properties | Specialized industrial applications, composites | Pros: Tailored properties for specific needs. Cons: Complex fabrication, potential variability in quality. |

This traditional manufacturing process involves blending high-purity SIC powders, compacting them under pressure, and then sintering at elevated temperatures. It produces dense, homogeneous materials suitable for standard industrial uses. B2B buyers should consider its proven reliability and consistent quality, especially for applications like refractory linings and abrasive tools. However, it tends to be more expensive and has longer lead times, which can impact project timelines, particularly in regions like Egypt or Turkey where supply chain flexibility is crucial.

Hot pressing combines powder compaction with simultaneous high-temperature treatment, resulting in materials with superior density and mechanical strength. This process is ideal for demanding industrial applications such as wear-resistant machinery parts. For international buyers, especially in markets with high operational stresses, hot-pressed SIC offers durability but requires significant capital investment in equipment and expertise. Procurement strategies should account for longer production cycles and potentially higher costs.

Surface treatments involve applying specialized coatings or surface modifications to enhance corrosion resistance, reduce wear, or improve chemical stability. Suitable for aggressive environments like chemical processing plants or electronics manufacturing, coated SIC components offer extended service life. B2B buyers need to evaluate coating compatibility with their operational conditions and consider the potential for coating delamination or damage during handling and installation, which could increase maintenance costs.

This variation involves controlled thermal treatments to refine the microstructure, improving toughness and machinability without sacrificing high-temperature stability. Recrystallized SIC is favored in high-performance applications where precision and durability are critical. For buyers, this process offers a balance between performance and cost, but additional processing steps can increase lead times. It’s particularly relevant for markets demanding high-quality ceramics, such as Europe’s advanced manufacturing sectors.

By integrating SIC with other materials like binders or fibers, composite variants allow customization of properties such as toughness, thermal expansion, and electrical conductivity. These are suitable for niche applications requiring tailored solutions, like specialized industrial equipment or electronics. Buyers should consider the complexity of manufacturing and potential variability in material properties. Ensuring supplier expertise and consistent quality control is vital to avoid costly project delays or failures.

| Industry/Sector | Specific Application of sic manufacturing process | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | High-temperature, corrosion-resistant pipe linings and valve components | Ensures durability under extreme conditions, reducing maintenance costs | Material certification, adherence to international standards (API, ISO) |

| Automotive & Rail | Brake systems, clutches, and heat shields | Superior thermal conductivity and wear resistance, extending component lifespan | Customization capabilities, supply chain reliability |

| Electronics & Semiconductors | Heat sinks, insulators, and electronic substrates | Excellent thermal management, electrical insulation properties | Purity levels, compliance with industry-specific certifications |

| Power Generation & HVAC | Kiln linings, heating elements, and insulation panels | High thermal stability and resistance to thermal shock | Consistent quality control, availability of bulk quantities |

| Construction & Infrastructure | Abrasion-resistant tiles, bricks, and architectural elements | Long-lasting, low-maintenance building materials | Local availability, cost-effectiveness, compliance with building codes |

The SIC manufacturing process is crucial in producing components such as pipe linings and valve parts that operate reliably under high pressure and temperature conditions typical in oil and gas exploration and refining. For international B2B buyers from regions like North Africa or the Middle East, sourcing high-quality SIC components ensures operational safety and minimizes costly downtime. Buyers should prioritize suppliers with proven certifications (e.g., API standards) and reliable supply chains to meet rigorous industry specifications.

In the automotive and rail sectors, SIC is used to manufacture heat shields, brake components, and clutches that require exceptional thermal resistance and durability. For B2B buyers in emerging markets like Turkey or South America, sourcing SIC parts can significantly improve vehicle safety and longevity. It is essential to verify supplier capabilities for customizations and to ensure consistent quality for large-scale production, reducing warranty claims and maintenance costs.

SIC’s excellent thermal conductivity and electrical insulation make it ideal for electronic heat sinks and substrates used in high-power semiconductors. For European or Middle Eastern electronics manufacturers, integrating SIC components can enhance device performance and reliability. Buyers should focus on sourcing materials with high purity levels and certifications to meet industry standards, ensuring compatibility with sensitive electronic systems and preventing failures.

In power plants and HVAC systems, SIC is employed in kiln linings, heating elements, and insulation panels that withstand extreme thermal cycles. For industrial operators in Africa or South America, reliable SIC sourcing ensures long-term operational stability and energy efficiency. It is critical to select suppliers with consistent quality control practices and the ability to provide bulk quantities to meet large infrastructure project demands.

SIC’s abrasion-resistant properties are leveraged in manufacturing durable tiles, bricks, and architectural elements for infrastructure projects. For B2B buyers involved in large-scale construction in regions like Egypt or Turkey, sourcing high-quality SIC products guarantees longevity and reduces maintenance costs of building materials. Local sourcing options should be evaluated for cost-effectiveness, and suppliers must meet regional building standards for structural integrity and safety.

Selecting the appropriate raw materials for silicon carbide (SiC) manufacturing is critical for ensuring product quality, operational efficiency, and compliance with international standards. Different materials offer varying benefits and limitations, which must be carefully evaluated from a B2B perspective, especially considering the diverse needs of buyers from Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Key Properties:

Graphite is widely used as a crucible and refractory material in SiC manufacturing due to its excellent thermal stability, high melting point (~3,600°C), and good electrical conductivity. It offers good chemical inertness at high temperatures, making it suitable for high-temperature processes.

Pros & Cons:

Advantages include ease of fabrication, relatively low cost, and good thermal shock resistance. However, graphite is susceptible to oxidation at elevated temperatures unless properly protected, which can limit its lifespan in oxidative environments. It also tends to produce carbon emissions during high-temperature processing, which may require environmental controls.

Impact on Application:

Graphite’s inertness and thermal properties make it ideal for high-temperature furnaces and reaction vessels. Its compatibility with various media, including inert gases, is advantageous in controlled atmospheres.

International Buyer Considerations:

Buyers from regions like Egypt and Turkey often prefer graphite due to its cost-effectiveness and availability. Compliance with ASTM standards for graphite materials is common, but buyers should verify supplier certifications for purity and environmental standards. Environmental regulations concerning carbon emissions are increasingly relevant in Europe.

Key Properties:

High purity SiC raw materials are fundamental for consistent product quality. They possess excellent thermal conductivity, high hardness, and resistance to chemical corrosion. SiC raw materials typically come in granular or powder form, depending on the process.

Pros & Cons:

Using high-grade SiC raw materials ensures superior end-product performance, especially for applications requiring high wear resistance. However, high-purity SiC can be costly and may involve complex handling and storage requirements. Variability in raw material quality can impact process consistency.

Impact on Application:

The choice of SiC raw material directly influences the final product’s mechanical strength, thermal stability, and corrosion resistance. For industries like electronics or high-performance ceramics, purity and particle size are critical.

International Buyer Considerations:

Buyers from South America and the Middle East often seek suppliers compliant with international standards like DIN or JIS. Cost sensitivity is high, so balancing quality with affordability is essential. Import regulations and quality certifications (ISO, ASTM) are vital for smooth cross-border transactions.

Key Properties:

Refractory metals such as tungsten and molybdenum are used in specialized SiC manufacturing applications requiring extreme temperature resistance and structural integrity. They withstand temperatures above 2,000°C with minimal deformation.

Pros & Cons:

These metals provide excellent high-temperature stability and corrosion resistance but are significantly more expensive than graphite or raw SiC. Manufacturing complexity increases due to their hardness and difficulty in machining.

Impact on Application:

Refractory metals are suitable for niche applications like high-temperature crucibles, electrodes, or furnace components. They enable processes that demand maximum thermal stability and longevity.

International Buyer Considerations:

European and Middle Eastern buyers often prefer refractory metals for specialized applications, with a focus on high purity and compliance with international standards. Import duties and sourcing challenges may influence procurement, so establishing reliable supply chains is crucial.

Key Properties:

Alumina is a ceramic material known for its high melting point (~2,050°C), excellent hardness, and chemical inertness. It is often used as a refractory lining or in composite materials within SiC manufacturing.

Pros & Cons:

Alumina offers good thermal stability and corrosion resistance, but it can be brittle and prone to cracking under thermal shock. Its cost varies depending on purity and grain size.

Impact on Application:

Alumina’s properties make it suitable for lining furnaces, reaction chambers, and as a component in composite SiC products. Its media compatibility includes acids and alkalis, depending on purity.

International Buyer Considerations:

Buyers from Africa and Europe often prefer high-purity alumina conforming to DIN or ASTM standards. Environmental considerations, such as sourcing from sustainable suppliers, are increasingly important, especially in Europe.

| Material | Typical Use Case for SIC Manufacturing Process | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Graphite | Crucibles, reaction vessels, furnace linings | High thermal stability, cost-effective | Susceptible to oxidation, environmental concerns | Low |

| Silicon Carbide Raw Material | Raw input for SiC production | High purity, excellent thermal and wear resistance | Costly, handling complexity | Med |

| Refractory Metals (e.g., Tungsten, Molybdenum) | High-temp furnace components | Extreme temperature resistance, durability | High cost, manufacturing complexity | High |

| Alumina (Aluminum Oxide) | Furnace linings, ceramic components | Chemical inertness, high melting point | Brittle, thermal shock susceptibility | Med |

This comprehensive analysis enables B2B buyers from diverse regions to make informed decisions aligned with their operational needs, budget constraints, and compliance requirements. Understanding the specific properties and limitations of each material ensures optimal material selection, leading to improved process efficiency and product quality in SiC manufacturing.

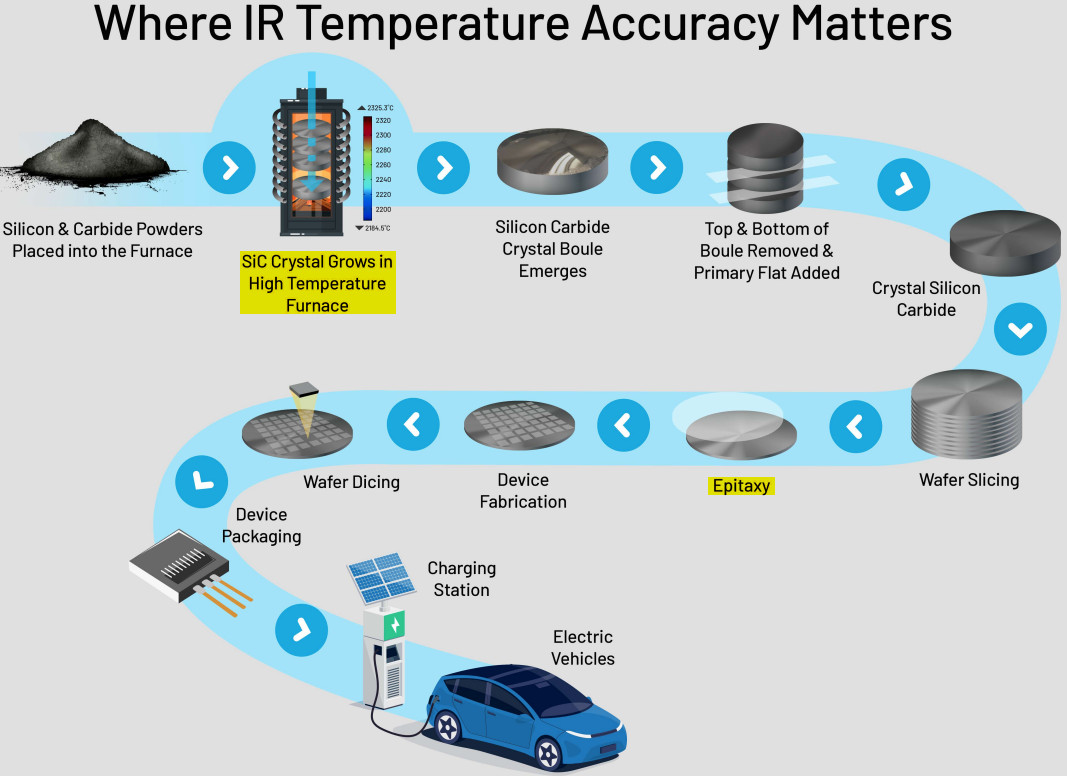

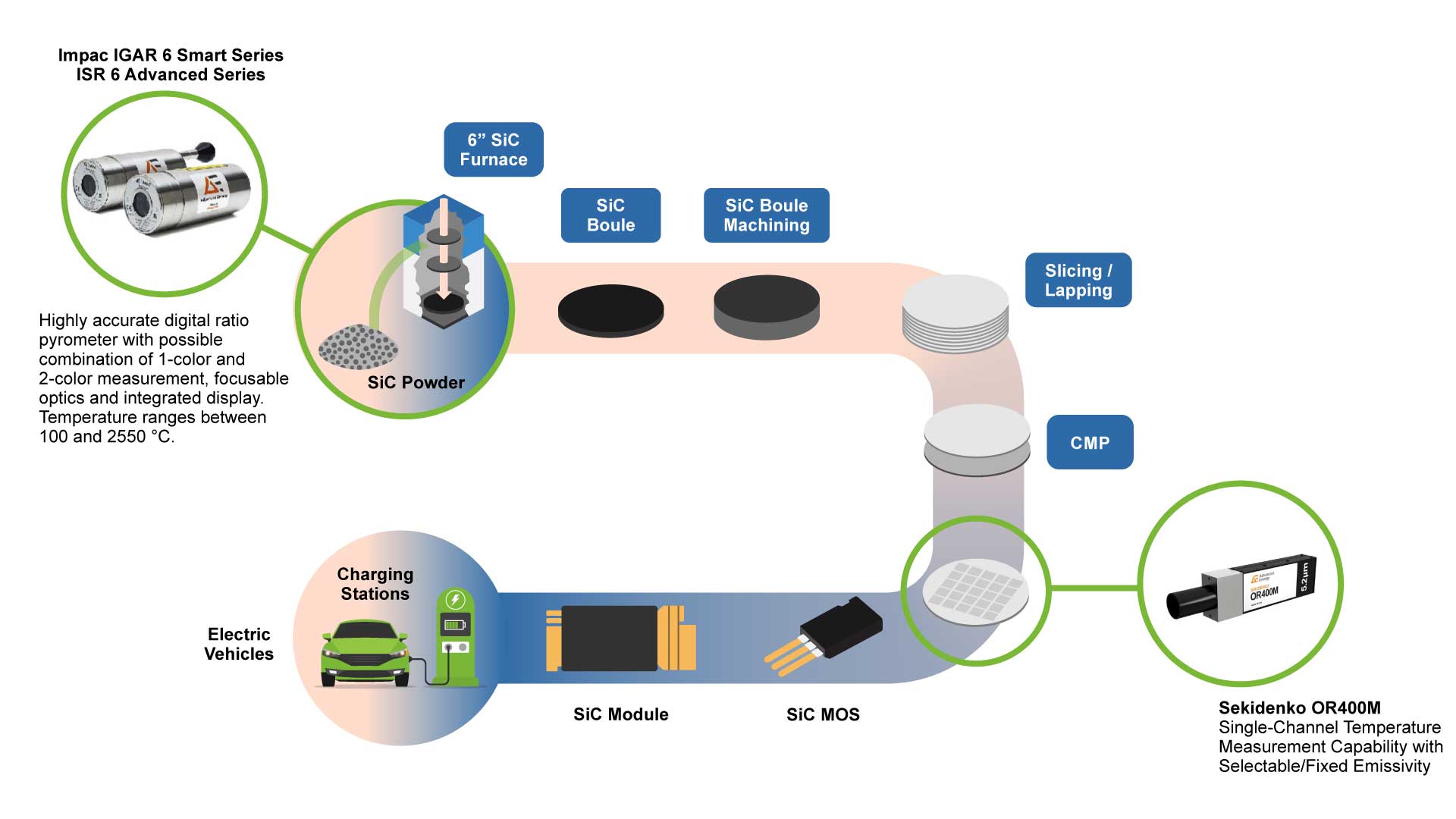

The manufacturing of Silicon Carbide (SiC) is a complex, multi-stage process designed to produce high-purity, high-performance materials suitable for demanding industrial applications. For international B2B buyers, understanding these stages helps in evaluating supplier capabilities and ensuring product quality aligns with project specifications.

Illustrative Image (Source: Google Search)

The process begins with sourcing high-quality raw materials: silica (SiO₂) and carbon (C). These are typically in the form of quartz and petroleum coke or graphite. Precise control over the purity and particle size of these inputs is essential, as impurities can compromise the final product's performance. Suppliers adhering to international standards like ISO 9001 demonstrate rigorous raw material inspection and traceability protocols.

Two primary manufacturing techniques dominate:

Lely Process (Abrasive or Reaction Bonded SiC): Involves mixing raw materials with binders, forming green compacts, and then sintering at high temperatures (~2000°C) in a controlled atmosphere. This process yields dense SiC with excellent mechanical properties.

Sintered and Crystal Growth Methods: High-temperature sintering or sublimation processes (e.g., the Lely process or PVT—Physical Vapor Transport) are used to produce crystalline SiC with high purity and specific crystal orientations, vital for electronic or semiconductor applications.

Forming techniques include pressing, extrusion, or casting, depending on the final product form—blocks, tubes, or powders. The goal is to achieve uniform density and minimal porosity. Advanced forming methods like isostatic pressing or hot pressing are often employed to enhance density and dimensional accuracy.

Post-forming, SiC components undergo machining, grinding, and polishing to meet tight dimensional tolerances. Surface finishing is crucial for applications like semiconductor substrates or high-power electronic devices. Some manufacturers incorporate chemical vapor deposition (CVD) or physical vapor deposition (PVD) for surface coatings, enhancing properties like corrosion resistance or electrical insulation.

Robust quality assurance is fundamental to SiC manufacturing, especially for international B2B transactions where product specifications are critical.

ISO 9001: Most reputable suppliers operate under ISO 9001, ensuring consistent quality management systems. This includes documented procedures, supplier audits, and continuous improvement initiatives.

Industry-Specific Certifications:

Incoming Quality Control (IQC): Raw materials are inspected upon receipt for purity, particle size, and impurity levels using techniques like X-ray fluorescence (XRF), inductively coupled plasma (ICP), or spectroscopy.

In-Process Quality Control (IPQC): During manufacturing, critical parameters such as temperature, pressure, and sintering atmosphere are monitored. Non-destructive testing methods like ultrasonic inspection or radiography verify internal integrity.

Final Quality Control (FQC): Completed products undergo comprehensive testing, including:

Ensuring supplier reliability is crucial, especially when dealing with international manufacturers from regions like Africa, South America, the Middle East, and Europe. Here are actionable steps:

International B2B buyers face unique challenges related to manufacturing and QC:

A thorough understanding of SiC manufacturing processes and rigorous quality assurance practices are essential for B2B buyers seeking reliable suppliers across regions such as Africa, South America, the Middle East, and Europe. By focusing on certified manufacturing protocols, comprehensive QC checkpoints, and third-party validation, buyers can mitigate risks and ensure the delivery of high-quality SiC products tailored to their specific industrial needs. Maintaining open communication and clear documentation throughout the procurement process further enhances trust and product integrity in international trade.

Understanding the comprehensive cost framework for sourcing silicon carbide (SiC) manufacturing is crucial for international buyers. The primary cost components include:

Several factors significantly impact the final pricing for SiC sourcing:

While actual prices vary significantly based on specifications, order size, and supplier location, typical ranges for standard SiC products are approximately $5 to $15 per kilogram for bulk orders. Premium grades with specialized certifications or customizations can exceed this range. It’s important to note that these figures are indicative; actual prices require direct supplier quotations, and negotiations can substantially influence final costs.

By thoroughly analyzing these cost components and factors influencing pricing, international buyers from Africa, South America, the Middle East, and Europe can develop strategic sourcing plans. Emphasizing negotiation, understanding regional advantages, and considering the total cost picture will ensure more cost-effective procurement of SiC manufacturing services.

1. Material Grade

SIC (Silicon Carbide) is classified into various grades based on purity, grain size, and crystallinity. Common grades include coarse, fine, black, and green SIC, each suited for specific industrial applications. For B2B buyers, selecting the appropriate grade ensures optimal performance in thermal, mechanical, or electronic applications, reducing costly rework or failures.

2. Purity Level

Purity, often expressed as a percentage (e.g., 99.9%), directly impacts SIC’s electrical and thermal conductivity. Higher purity grades are essential for high-performance electronics or semiconductor components, while lower purity grades may suffice for abrasives. Understanding purity requirements helps buyers specify the right product for their end-use, avoiding overpaying for unnecessary quality levels.

3. Tolerance and Dimensional Accuracy

Tolerance specifications define the allowable variation in dimensions (e.g., ±0.1 mm). Precise tolerances are critical for components requiring tight fits or high-performance assemblies. Clear tolerance agreements prevent manufacturing delays and ensure compatibility with existing systems, especially important for international projects with strict quality standards.

4. Grain Size and Distribution

Grain size influences SIC’s hardness, surface finish, and processing behavior. Fine grain sizes (sub-micron to a few microns) are preferred in electronic applications, while coarser grains are used for abrasives. Consistent grain size distribution ensures uniform performance and predictable machining or sintering processes, vital for large-scale manufacturing.

5. Mechanical Properties

Key mechanical properties include hardness, fracture toughness, and compressive strength. These determine SIC’s durability and suitability for high-stress environments like kilns or wear-resistant parts. Buyers should specify required mechanical thresholds to match their operational demands, ensuring longevity and reliability.

6. Thermal Conductivity

Thermal conductivity measures how efficiently SIC conducts heat, a crucial property in high-temperature applications such as heat exchangers or semiconductors. Higher conductivity can improve device efficiency but may also influence manufacturing methods. Accurate thermal property data allows buyers to optimize system design and performance.

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce equipment or components branded and sold by other firms. In SIC procurement, understanding OEM specifications ensures suppliers meet the exact technical standards required for integration into larger systems, particularly in sectors like electronics or industrial machinery.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell in a single order. Recognizing MOQ helps buyers plan procurement budgets and inventory levels, especially for niche or high-quality SIC grades. Negotiating MOQ can also facilitate smaller initial orders for testing or pilot projects.

3. RFQ (Request for Quotation)

A formal request sent by buyers to suppliers asking for price quotes, lead times, and terms for specific SIC products. An RFQ streamlines the procurement process and enables comparative analysis, crucial for international buyers seeking cost-effective and reliable suppliers.

4. Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce, defining responsibilities for shipping, insurance, and tariffs. Familiarity with Incoterms (e.g., FOB, CIF) ensures clarity in contractual obligations, reduces misunderstandings, and helps buyers manage logistics and costs across borders.

5. Lead Time

The period between order placement and product delivery. Understanding lead times is vital for supply chain planning, especially when sourcing SIC for time-sensitive projects. Longer lead times may require early ordering or inventory buffers, particularly in regions with logistical constraints.

6. Certification and Compliance Terms

Includes ISO standards, RoHS, REACH, and other certifications verifying product quality, environmental safety, and compliance with regional regulations. Confirming certifications helps international buyers mitigate risks associated with non-compliance, ensuring smooth customs clearance and market acceptance.

By mastering these technical properties and trade terms, B2B buyers from Africa, South America, the Middle East, and Europe can make informed decisions, optimize procurement processes, and foster stronger supplier relationships in the SIC manufacturing industry.

Illustrative Image (Source: Google Search)

The global sic (silicon carbide) manufacturing sector is experiencing rapid evolution driven by advancements in technology, increasing demand across various industries, and geopolitical shifts influencing supply chains. Traditionally rooted in regions like China, the sector is now witnessing diversification, with emerging markets in Africa, South America, the Middle East, and Europe playing pivotal roles. For instance, Turkey and Egypt are investing heavily in local production facilities, aiming to reduce reliance on imports and capitalize on regional demand for high-performance materials.

Current B2B sourcing trends emphasize digital transformation, including the adoption of supply chain management platforms, real-time tracking, and data analytics. These tools enable buyers from Africa and South America to optimize sourcing, ensure quality, and mitigate risks associated with geopolitical instability or logistical disruptions. Additionally, there’s a notable shift toward integrating vertical supply chains—manufacturers are increasingly controlling raw material sourcing and processing to ensure consistency and quality.

Market dynamics are also influenced by technological innovations such as improved furnace designs and eco-friendly production methods, which lower costs and environmental impact. International buyers are prioritizing suppliers with scalable production capacities and flexible delivery options, especially given the supply chain uncertainties caused by geopolitical tensions and global economic fluctuations. For African, Middle Eastern, and European companies, establishing local partnerships or joint ventures can provide strategic advantages, including reduced lead times and better market responsiveness.

Emerging B2B tech trends include blockchain-based certification for traceability and sustainability, which are becoming critical differentiators. As global industries—particularly electronics, automotive, and renewable energy—continue to expand their use of silicon carbide, sourcing strategies must adapt to these market drivers to stay competitive.

Sustainability is increasingly central to the sic manufacturing process, driven by environmental regulations, consumer demand, and corporate responsibility commitments. The production of silicon carbide involves high-temperature processes that can generate significant carbon emissions and waste. Therefore, ethical sourcing and environmentally conscious practices are vital for international buyers aiming to meet compliance standards and enhance brand reputation.

Buyers from Africa, South America, the Middle East, and Europe should prioritize suppliers with recognized environmental certifications such as ISO 14001, REACH compliance, and green manufacturing certifications. These attest to a manufacturer’s commitment to reducing environmental impact through measures like energy-efficient kiln operations, waste recycling, and use of renewable energy sources.

Moreover, transparent supply chains are crucial. Ethical sourcing involves ensuring raw materials are obtained without contributing to environmental degradation or social injustices. For instance, verifying that raw silicon sources do not involve harmful mining practices or conflict minerals is essential. Certification schemes like Fair Trade or Forest Stewardship Council (FSC) can serve as benchmarks for responsible sourcing.

Implementing 'green' materials—such as recycled silicon or low-carbon production additives—can significantly reduce the environmental footprint. Buyers should also consider suppliers’ investments in R&D for sustainable production methods and their ability to provide detailed traceability reports. These efforts not only align with global sustainability goals but can also open access to markets that favor environmentally responsible products, giving buyers a competitive edge.

The sic manufacturing process has evolved considerably since its inception in the early 20th century. Originally developed for abrasive and refractory applications, technological advancements have expanded its use into high-tech sectors like semiconductors, electric vehicles, and renewable energy systems. The shift toward more sustainable and energy-efficient production methods has been a defining trend over the past two decades, driven by stricter environmental regulations and global sustainability commitments.

For B2B buyers, understanding this evolution underscores the importance of engaging with suppliers who are innovating toward greener, more efficient processes. Companies that have adapted early—investing in cleaner manufacturing technologies and responsible sourcing—are often more reliable and better positioned to meet evolving regulatory standards. Recognizing these historical shifts can help buyers identify forward-thinking partners capable of supporting long-term growth in the dynamic sic market.

To ensure supplier reliability, conduct comprehensive due diligence by verifying certifications (ISO, industry-specific standards), requesting references from previous clients, and reviewing their production capabilities via factory visits or virtual tours. Leverage third-party inspection agencies for audits, especially when dealing with new suppliers. Establish clear communication channels and request detailed documentation on quality control processes. Additionally, consider engaging local trade associations or chambers of commerce to validate supplier credentials and reputation within their region.

Most Sic manufacturers offer customization in terms of grade, shape, size, and surface finish. To guarantee your specifications are met, provide detailed technical drawings, samples, and clear quality standards upfront. Engage in early discussions to confirm the manufacturer’s capabilities and lead times for customization. Request prototypes or samples before bulk production to verify conformity. Establish a quality agreement that includes inspection procedures, tolerances, and testing methods to mitigate risks of deviation from your requirements.

MOQs for Sic products vary widely but generally range from a few hundred to several thousand units, depending on the manufacturer’s scale and complexity. Lead times can range from 4 to 12 weeks, influenced by order volume and customization level. Payment terms often include a deposit (30-50%) before production, with the balance payable before shipment or upon delivery. Negotiating flexible terms, such as letters of credit or escrow arrangements, can mitigate risks. Always clarify these terms in advance and factor them into your supply chain planning.

Reliable Sic suppliers should possess internationally recognized QA certifications such as ISO 9001 for quality management systems, ISO 14001 for environmental management, and industry-specific standards like ASTM or CE marking, depending on the target market. Certifications demonstrate adherence to consistent quality practices and regulatory compliance. Request recent audit reports and inspection records. Additionally, inquire about internal QA procedures, testing methods, and whether they conduct third-party testing to ensure product consistency and safety.

Effective logistics management involves selecting reliable freight forwarders experienced in handling industrial materials. Consider options like sea freight for cost efficiency or air freight for urgent needs. Clarify Incoterms (e.g., FOB, CIF) to understand responsibilities and costs. Ensure proper packaging to prevent damage during transit and coordinate customs clearance procedures in your country. Building relationships with local logistics providers can streamline processes, reduce delays, and provide real-time tracking. Always include contingency plans for potential disruptions such as port delays or customs issues.

Address disputes promptly through clear communication, referencing contractual agreements and documented quality standards. Initiate a formal complaint process, including detailed evidence like inspection reports, photos, and correspondence. Engage third-party inspectors or mediators if necessary to facilitate resolution. Negotiation and arbitration clauses in your contract can provide a structured dispute resolution pathway. Maintain a professional tone and focus on mutually beneficial solutions, such as product replacements, refunds, or corrective actions, to minimize supply chain disruptions.

Research your country’s import regulations, product standards, and certification requirements before procurement. Work with suppliers familiar with international standards or those who hold relevant certifications recognized locally. Engage customs brokers or legal advisors to navigate import tariffs, duties, and compliance documentation. Conduct pre-shipment inspections and request compliance certificates to avoid delays or penalties. Staying updated on changes in regulations ensures continuous compliance, reducing risks of shipment holds or rejection at customs.

Focus on building transparent, communicative relationships based on mutual trust. Prioritize suppliers with proven quality records, flexible production capabilities, and stable financial health. Regularly review performance metrics, including quality, delivery, and responsiveness. Invest in supplier development through technical collaboration and feedback. Long-term partnerships benefit from consistent quality, negotiated favorable terms, and shared innovation efforts. Additionally, maintain open dialogue about market changes, capacity planning, and potential risks to ensure a resilient, sustainable supply chain.

Effective strategic sourcing in the SIC manufacturing process offers international B2B buyers a pathway to optimize costs, enhance supply chain resilience, and access innovative production capabilities. By prioritizing reliable suppliers, fostering long-term partnerships, and leveraging global sourcing hubs, buyers from regions such as Africa, South America, the Middle East, and Europe can mitigate risks and secure competitive advantages.

As the industry evolves, embracing technological advancements—such as digital procurement platforms and quality assurance protocols—will be critical for maintaining supply chain agility. Additionally, considering emerging markets and local manufacturing centers can reduce lead times and foster sustainable practices.

Looking ahead, proactive engagement with diversified suppliers and continuous market analysis will be essential for staying ahead in the competitive SIC landscape. International buyers are encouraged to explore strategic collaborations, invest in supplier development, and leverage regional strengths to capitalize on growth opportunities. Embracing these approaches will position buyers to navigate future market shifts confidently and sustainably.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina