Silicon carbide (SiC) has emerged as a cornerstone material in advanced industrial applications, offering unparalleled performance in high-temperature, high-power, and high-frequency environments. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the nuanced properties of SiC is critical to securing competitive advantages in sectors ranging from electronics and automotive to energy and aerospace.

This comprehensive guide delivers an authoritative overview of SiC material properties, encompassing the diverse polytypes, doping mechanisms, and electrical characteristics that define its functionality. Buyers will gain insights into manufacturing processes and stringent quality control measures that ensure material reliability and consistency. Additionally, the guide provides a detailed analysis of leading global suppliers, cost structures, and regional market dynamics, enabling procurement teams to optimize sourcing strategies tailored to their specific operational contexts.

Key benefits for B2B buyers include:

By integrating these elements, this guide empowers buyers in France, Argentina, and beyond to make well-informed, risk-mitigated decisions that drive innovation and operational excellence. Whether sourcing for scalable production or niche high-performance components, understanding SiC’s material properties is essential for leveraging its full potential in a competitive global marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

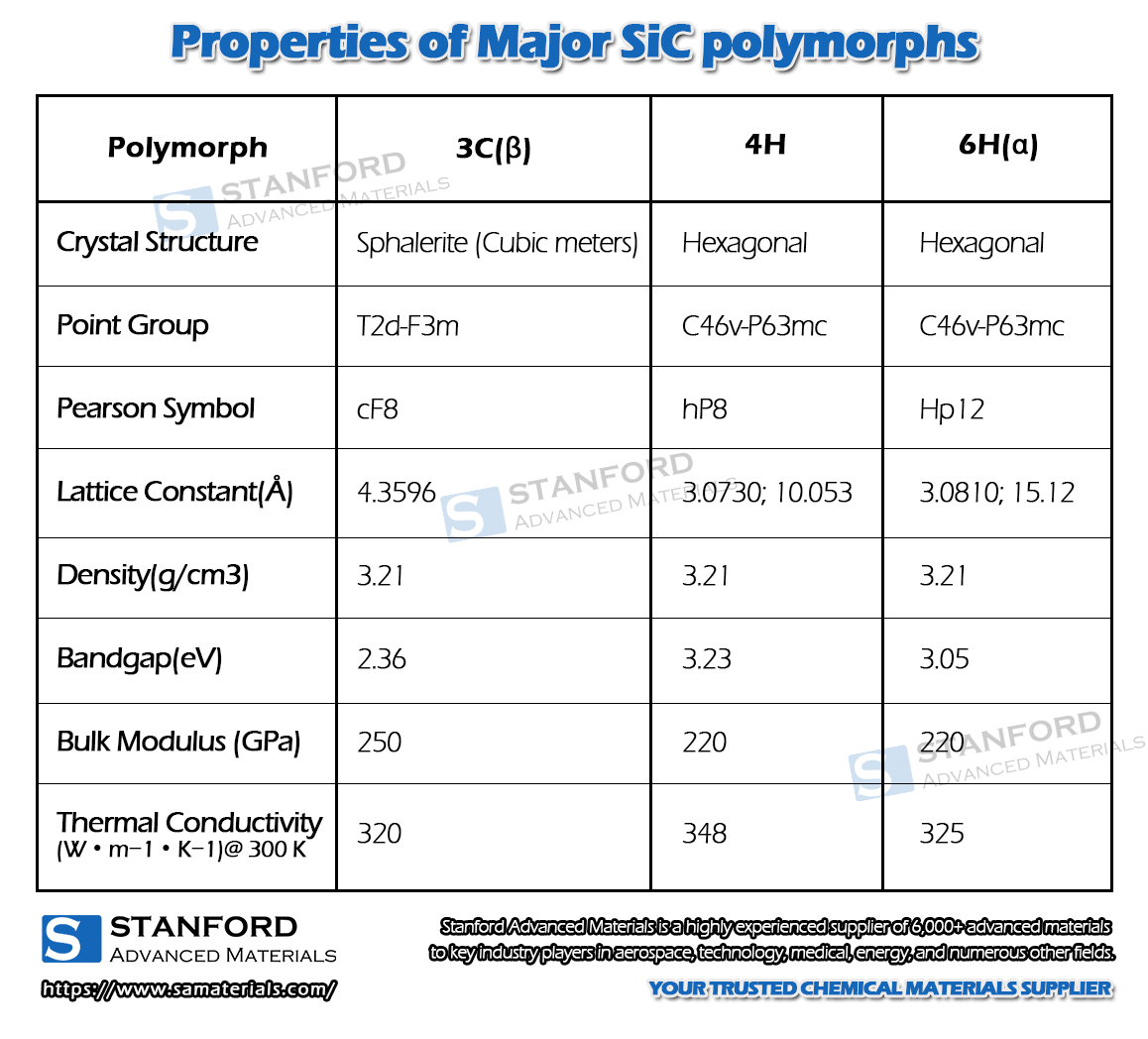

| 4H-Silicon Carbide | Hexagonal crystal structure with wide bandgap (~3.26 eV), high electron mobility | Power electronics, high-frequency devices, automotive | + High thermal conductivity and efficiency – Higher cost and processing complexity |

| 6H-Silicon Carbide | Hexagonal polytype with slightly narrower bandgap (~3.02 eV), lower electron mobility | High-temperature electronics, sensors | + Cost-effective and stable at high temps – Lower electron mobility than 4H-SiC |

| β-Silicon Carbide (3C-SiC) | Cubic crystal structure, narrower bandgap (~2.36 eV), easier to grow on silicon substrates | MEMS, optoelectronics, and low-power devices | + Compatibility with silicon tech and lower cost – Lower thermal conductivity and power handling |

| Doped SiC Variants | SiC doped with nitrogen (n-type) or aluminum/boron (p-type) to tailor conductivity | Semiconductor devices, power modules | + Customizable electrical properties – Requires precise doping control and quality assurance |

| Polycrystalline SiC | Aggregates of small SiC crystals, lower purity and uniformity | Abrasives, refractory materials, mechanical parts | + Economical for non-electronic applications – Not suitable for high-performance electronics |

4H-Silicon Carbide (4H-SiC)

4H-SiC is the most widely used polytype in high-performance power electronics due to its superior electron mobility and wide bandgap, enabling devices that operate efficiently at high voltages and temperatures. B2B buyers targeting automotive, renewable energy, or industrial power applications should prioritize 4H-SiC for its balance of thermal conductivity and electrical performance. However, its higher cost and complex fabrication demand reliable suppliers with advanced manufacturing capabilities.

6H-Silicon Carbide (6H-SiC)

6H-SiC offers robust performance in high-temperature environments with good chemical stability, making it suitable for sensors and electronics exposed to harsh conditions. It is generally more cost-effective than 4H-SiC but has lower electron mobility, which limits its use in ultra-high-speed applications. Buyers in sectors like aerospace or petrochemicals may find 6H-SiC a practical choice where cost and durability outweigh maximum performance.

β-Silicon Carbide (3C-SiC)

The cubic form, 3C-SiC, is distinguished by its compatibility with silicon substrates, enabling integration with existing silicon-based technologies. This makes it attractive for MEMS devices and optoelectronics where cost efficiency and scalability are priorities. However, its lower thermal conductivity and narrower bandgap restrict use in high-power or high-temperature applications. Buyers should assess application requirements carefully when considering 3C-SiC.

Doped SiC Variants

Doping SiC with elements like nitrogen (n-type) or aluminum/boron (p-type) allows precise control over electrical properties, essential for semiconductor devices and power modules. For B2B buyers, the key considerations include supplier expertise in doping processes and quality control to ensure device reliability. Custom doping enables tailored solutions but requires close collaboration with manufacturers for specification alignment.

Polycrystalline Silicon Carbide

Polycrystalline SiC is typically used in abrasive, refractory, and mechanical applications due to its lower purity and less uniform crystal structure compared to single-crystal forms. It is significantly more affordable and widely available, making it a go-to material for industrial buyers focused on durability and cost rather than electronic performance. It is not suitable for semiconductor or high-frequency applications.

Related Video: Thin Silicon Carbide Explained - SiC Basics

| Industry/Sector | Specific Application of SiC Material Properties | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-voltage, high-frequency semiconductor devices for energy conversion | Enhanced efficiency, reduced energy loss, and improved thermal management | Quality certification, supplier reliability, and compliance with international standards |

| Automotive | Electric vehicle (EV) powertrain components and inverters | Higher power density, longer lifespan, and better thermal stability | Availability of advanced SiC wafers, customization options, and delivery timelines |

| Renewable Energy | SiC-based power modules for solar inverters and wind turbine converters | Increased conversion efficiency and system reliability | Supplier expertise in renewable energy applications and scalability of supply |

| Aerospace & Defense | High-temperature electronics and sensors for harsh environments | Superior durability, radiation resistance, and weight reduction | Compliance with aerospace quality standards and traceability of materials |

| Industrial Manufacturing | Abrasives and cutting tools utilizing SiC hardness and thermal properties | Extended tool life and improved precision in machining | Consistency in material grade and supplier capacity to meet bulk demands |

Silicon Carbide (SiC) finds critical use in power electronics, especially for high-voltage and high-frequency semiconductor devices such as MOSFETs and Schottky diodes. Its wide bandgap and high thermal conductivity enable devices that operate efficiently at elevated temperatures and voltages, reducing energy losses. International B2B buyers from regions like Europe and the Middle East should prioritize sourcing from suppliers with robust quality certifications and proven reliability to ensure device performance in demanding power conversion systems.

In the automotive sector, SiC is increasingly pivotal in electric vehicle (EV) powertrains and inverter modules. SiC components offer higher power density and thermal stability, which translate to lighter, more efficient EV systems with longer operational lifespans. Buyers from emerging markets in Africa and South America, including countries like Argentina, should focus on suppliers that can provide advanced SiC wafers with customization capabilities and reliable delivery schedules to support local EV manufacturing growth.

The renewable energy industry leverages SiC-based power modules in solar inverter and wind turbine converter applications. SiC’s superior efficiency enhances energy conversion and system reliability under variable environmental conditions. For international procurement, it is essential to collaborate with suppliers experienced in renewable energy solutions who can scale production to meet the increasing demand in regions expanding their clean energy infrastructure.

In aerospace and defense, SiC’s ability to withstand high temperatures, resist radiation, and reduce weight makes it ideal for electronic components and sensors operating in harsh environments. Buyers, particularly in Europe and the Middle East, must ensure their suppliers comply with stringent aerospace quality standards and provide full traceability to guarantee component integrity and mission-critical reliability.

Finally, in industrial manufacturing, SiC is valued for its hardness and thermal stability in abrasives and cutting tools. These properties extend tool life and improve machining precision, which is crucial for high-volume production environments. B2B buyers should evaluate material grade consistency and supplier capacity to meet large-scale orders, especially for industrial hubs in Africa and South America aiming to boost manufacturing efficiency.

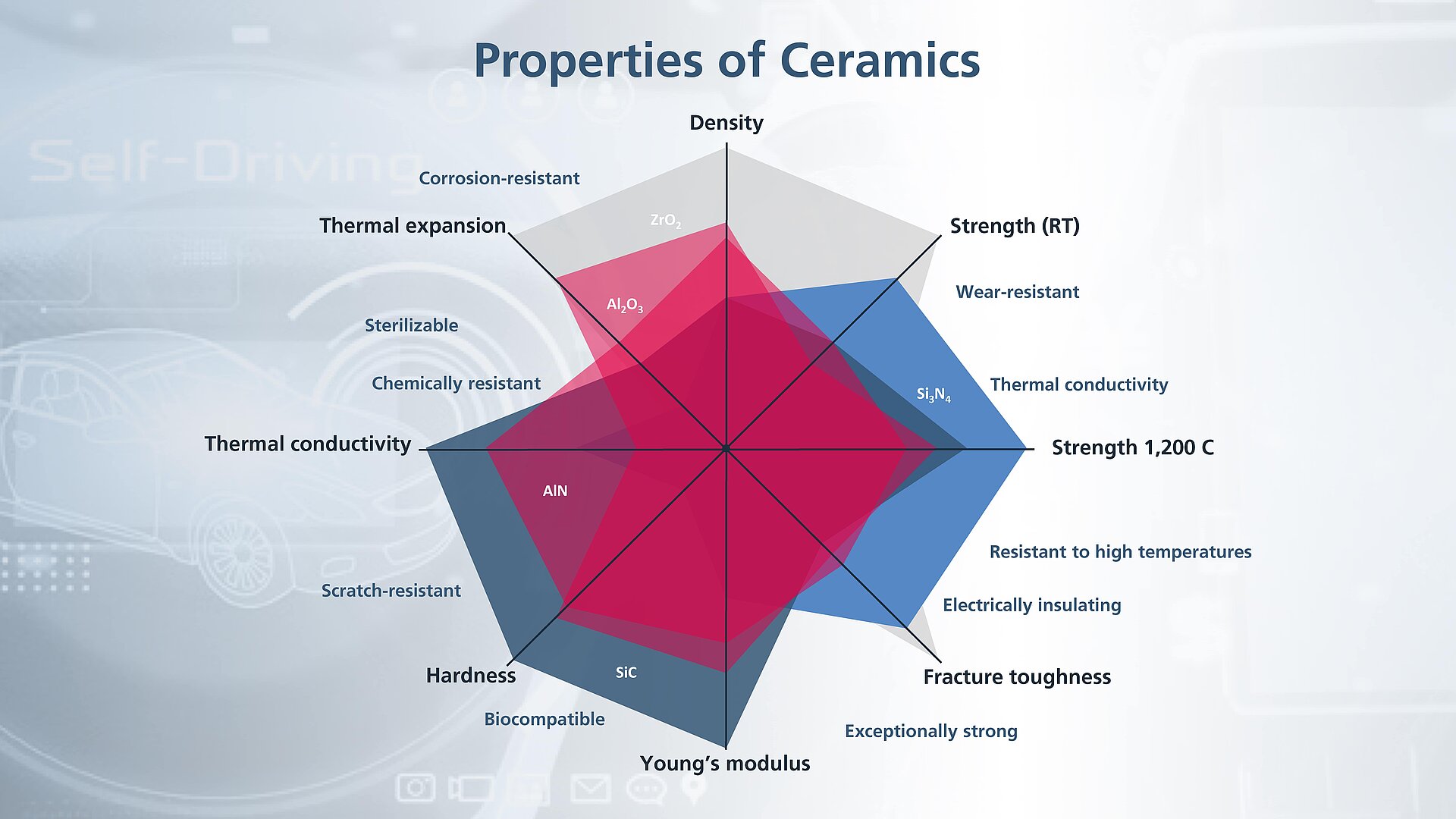

Silicon carbide (SiC) materials are critical in high-performance industrial applications due to their exceptional physical and chemical properties. Selecting the appropriate SiC material variant requires understanding their key characteristics, manufacturing considerations, and regional compliance standards to optimize product performance and supply chain efficiency.

Key Properties:

4H-SiC is known for its wide bandgap (~3.26 eV), high thermal conductivity (~4.9 W/cm·K), and excellent electron mobility, making it ideal for high-power and high-frequency electronic devices. It withstands high temperatures up to 600°C and exhibits strong chemical inertness against acids and alkalis.

Pros & Cons:

Its superior electrical properties and thermal stability make it highly durable and efficient for power electronics. However, 4H-SiC substrates are relatively expensive and require complex manufacturing processes, which can increase lead times.

Impact on Application:

Ideal for power devices, high-temperature sensors, and harsh environment electronics. Its chemical resistance suits applications involving corrosive media, common in oil & gas and chemical processing industries.

Considerations for International Buyers:

European markets (e.g., France) often require compliance with IEC and DIN standards for semiconductor materials, which 4H-SiC readily meets. Buyers in Africa and South America should consider local availability and import tariffs, as well as ASTM standards for material certification. The Middle East’s growing petrochemical sector favors 4H-SiC for its corrosion resistance and thermal stability.

Key Properties:

6H-SiC has a slightly smaller bandgap (~3.0 eV) and lower electron mobility compared to 4H-SiC but offers excellent mechanical strength and thermal conductivity (~4.7 W/cm·K). It tolerates temperatures up to 500°C and demonstrates good resistance to oxidation.

Pros & Cons:

6H-SiC is generally less costly than 4H-SiC and easier to manufacture, making it suitable for bulk applications. However, its lower electron mobility limits its use in high-frequency electronics.

Impact on Application:

Commonly used in high-temperature structural components, abrasives, and refractory linings. Its robustness makes it suitable for wear-resistant parts in mining and heavy machinery industries.

Considerations for International Buyers:

Buyers in South America (e.g., Argentina) appreciate 6H-SiC for cost-effective industrial applications. Compliance with ASTM and ISO standards is crucial for export to Europe and the Middle East. The material’s mechanical strength aligns well with infrastructure projects prevalent in Africa.

Key Properties:

β-SiC or cubic SiC features a bandgap of ~2.36 eV and exhibits high electron mobility but lower thermal conductivity (~3.7 W/cm·K) than hexagonal polytypes. It has excellent chemical resistance and can operate under moderate temperature conditions (~400°C).

Pros & Cons:

Its cubic crystal structure allows for easier epitaxial growth on silicon substrates, reducing manufacturing costs. However, it has lower thermal stability and mechanical strength compared to 4H and 6H polytypes.

Impact on Application:

Widely used in MEMS devices, optoelectronics, and moderate power electronics. Its compatibility with silicon substrates makes it attractive for integrated circuits and sensors.

Considerations for International Buyers:

European buyers benefit from the mature supply chain and compliance with RoHS and REACH directives. African and Middle Eastern buyers should evaluate the trade-off between cost and performance for applications in moderate temperature environments. South American markets may leverage β-SiC for emerging electronics manufacturing sectors.

Key Properties:

SSiC is a polycrystalline form of SiC with excellent hardness, high thermal shock resistance, and outstanding corrosion resistance, especially against strong acids and alkalis. It can operate continuously at temperatures exceeding 1400°C.

Pros & Cons:

SSiC is highly durable and ideal for harsh chemical and thermal environments. However, it is brittle and challenging to machine, increasing manufacturing complexity and cost.

Impact on Application:

Extensively used in pump seals, valve components, and kiln furniture in chemical, petrochemical, and power generation industries.

Considerations for International Buyers:

Buyers in the Middle East and Africa involved in petrochemical and energy sectors prioritize SSiC for its durability under extreme conditions. European buyers expect compliance with ASTM C1464 and ISO 9001 quality standards. South American industries benefit from its corrosion resistance in mining and chemical processing applications.

| Material | Typical Use Case for sic material properties | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| 4H-SiC | High-power electronics, high-temp sensors | Superior electrical & thermal properties | High cost and complex manufacturing | High |

| 6H-SiC | Structural components, abrasives, refractory linings | Strong mechanical properties, cost-effective | Lower electron mobility | Medium |

| β-SiC (3C-SiC) | MEMS, optoelectronics, moderate power electronics | Compatible with silicon substrates, lower cost | Lower thermal stability & strength | Low |

| Sintered SiC (SSiC) | Pump seals, valves, kiln furniture in harsh environments | Exceptional corrosion & thermal shock resistance | Brittle, difficult to machine | High |

This guide equips international B2B buyers with actionable insights to select the most suitable SiC material variant based on application requirements, cost considerations, and regional compliance standards. Understanding these factors helps optimize procurement strategies and product performance across diverse industrial sectors.

Silicon Carbide (SiC) manufacturing is a highly specialized process that demands precision and stringent control to ensure the superior material properties required for high-performance industrial applications. Understanding the main stages of SiC production helps B2B buyers evaluate supplier capabilities and product consistency.

The foundation of high-quality SiC begins with raw material synthesis, typically involving the carbothermal reduction of silica (SiO₂) with carbon at elevated temperatures (around 2000°C). This produces bulk SiC powder of varying polytypes (4H, 6H, β-SiC), depending on the target application. Purity at this stage is critical, as contaminants can adversely affect electrical and thermal properties.

Illustrative Image (Source: Google Search)

SiC crystals are grown primarily by Physical Vapor Transport (PVT), a sublimation-condensation method that produces large, single-crystal boules. This stage demands precise temperature gradients and controlled atmospheres to avoid defects such as micropipes or stacking faults.

Polytype control during growth is crucial, impacting electrical characteristics. For instance, 4H-SiC is preferred for power electronics due to its wide bandgap and high electron mobility.

Key Insight for Buyers: Verify crystal quality via supplier-provided X-ray diffraction (XRD) or Raman spectroscopy data, which confirm polytype and crystalline integrity.

Post-growth, SiC wafers undergo slicing, grinding, and polishing to achieve precise thickness and surface finish. This stage influences device performance, especially in semiconductor applications where surface defects or roughness can degrade electron mobility.

Doping processes (n-type or p-type) are applied through ion implantation or diffusion to tailor electrical properties.

Key Insight for Buyers: Ensure suppliers follow cleanroom assembly protocols and provide wafer flatness and surface roughness specifications.

Final stages include wafer inspection, passivation, and packaging designed to protect SiC devices from environmental factors and mechanical stress. Packaging standards vary based on end-use, whether in automotive electronics, power devices, or abrasive components.

Illustrative Image (Source: Google Search)

Quality assurance (QA) is integral to maintaining the reliability and performance of SiC materials, especially for international B2B buyers who require consistent standards across borders.

RoHS and REACH: Compliance with hazardous substances restrictions, critical for markets in Europe and increasingly in other regions.

Key Insight for Buyers: Verify that suppliers maintain current certifications relevant to your target markets and applications, with documentation available in multiple languages when necessary.

Quality control in SiC production is segmented into three main checkpoints, each with specific objectives:

Robust testing validates SiC material properties and ensures compliance with specifications demanded by high-tech applications.

Thermal Conductivity Testing: Critical for power electronics to confirm heat dissipation capability.

Key Insight for Buyers: Engage suppliers who provide comprehensive test reports with traceability to international standards. Independent lab validation can be requested for critical orders.

For buyers from Africa, South America, the Middle East, and Europe, navigating supplier quality assurance requires proactive engagement and due diligence.

For international B2B buyers, especially those sourcing from diverse regions, understanding the intricacies of SiC manufacturing and quality assurance is critical to securing materials that meet stringent performance criteria. By focusing on detailed production stages, adherence to international and industry-specific standards, comprehensive quality control procedures, and rigorous supplier verification strategies, buyers can mitigate risks and ensure supply chain excellence.

Investing time in supplier audits, demanding transparent documentation, and leveraging third-party inspections empowers buyers in Africa, South America, the Middle East, and Europe to confidently integrate SiC materials into their high-value industrial applications.

When sourcing silicon carbide (SiC) materials and components, it is essential for international B2B buyers to grasp the underlying cost components that influence final pricing. These costs are multifaceted and interdependent:

Pricing is not static and varies based on several factors that buyers should evaluate carefully:

For buyers in Africa, South America, the Middle East, and Europe, optimizing cost-efficiency and ensuring supply chain resilience is paramount:

Due to the dynamic nature of the silicon carbide materials market — influenced by technological advances, geopolitical factors, raw material availability, and supply chain conditions — all price indications should be considered as approximations. Buyers are advised to conduct direct inquiries with suppliers to obtain tailored quotations reflecting current market conditions and specific requirements.

By understanding the detailed cost components and pricing influencers in SiC material sourcing, international B2B buyers can make more informed procurement decisions, negotiate effectively, and optimize their supply chains for both cost and quality in diverse global markets.

For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe, understanding the essential technical properties of SiC is crucial to sourcing the right material for high-performance applications. Here are the key specifications to evaluate:

Polytype and Crystal Structure

SiC exists in multiple polytypes (e.g., 4H, 6H, 3C), each with distinct electrical and thermal properties. The 4H-SiC polytype is preferred for power electronics due to its superior electron mobility and high breakdown voltage. Selecting the correct polytype affects device efficiency and durability, making it a critical factor for buyers targeting advanced semiconductor or high-temperature applications.

Material Grade and Purity

SiC materials are graded based on purity levels and defect density. High-purity grades with minimal structural defects ensure better electrical performance and longer service life. Buyers must specify grades aligned with their application’s sensitivity, such as high-purity wafers for semiconductor manufacturing versus lower grades for abrasive or refractory uses.

Dimensional Tolerance and Surface Finish

Precise dimensional control (thickness, diameter, flatness) and surface finish quality are vital for compatibility with downstream processing equipment. Tighter tolerances reduce waste and improve assembly yield, which is particularly important for OEMs requiring exact fit and performance consistency.

Doping Type and Concentration

SiC can be doped n-type (commonly with nitrogen or phosphorus) or p-type (with boron, aluminum, or gallium), altering its conductivity. Buyers must specify doping requirements to ensure the material matches the electronic characteristics needed for devices such as power transistors or sensors.

Thermal Conductivity and Breakdown Electric Field

One of SiC’s standout properties is its high thermal conductivity and ability to withstand high electric fields before breakdown. These factors determine how well the material performs under extreme thermal and electrical stress, essential for power electronics and harsh environment applications.

Carrier Mobility

Electron and hole mobility influence the speed and efficiency of SiC-based electronic devices. Higher mobility enhances device switching speeds and reduces energy losses, which are critical parameters for power device manufacturers and energy sector buyers.

Understanding key trade terms helps international buyers navigate negotiations, contracts, and logistics smoothly:

OEM (Original Equipment Manufacturer)

Refers to companies that integrate SiC materials into their products or devices. Buyers working with OEMs should align material specifications closely with OEM requirements to ensure seamless integration and certification compliance.

MOQ (Minimum Order Quantity)

The smallest amount of SiC material a supplier is willing to sell. MOQ impacts inventory planning and cost efficiency, especially for smaller buyers or startups in emerging markets. Negotiating MOQ terms can optimize cash flow and reduce storage burdens.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting detailed pricing, lead times, and terms for specified SiC materials. A clear and detailed RFQ expedites supplier responses and ensures competitive, transparent pricing, which is vital for budget planning.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Selecting appropriate Incoterms reduces disputes and clarifies risk transfer, crucial for cross-border transactions.

Lead Time

The period from order confirmation to material delivery. Lead time affects project timelines and inventory management. Buyers should confirm realistic lead times upfront, particularly when sourcing from overseas suppliers to avoid production delays.

Traceability

The ability to track the origin and processing history of SiC material batches. Traceability assures quality control and compliance with international standards, which is especially important for buyers in regulated industries like aerospace or medical devices.

By mastering these technical specifications and trade terms, B2B buyers can make informed purchasing decisions, negotiate effectively, and establish reliable supply chains for silicon carbide materials tailored to their market demands.

Silicon carbide (SiC) materials have rapidly ascended as critical enablers in high-performance electronics, power devices, and advanced industrial applications. Globally, demand is driven by sectors such as electric vehicles (EVs), renewable energy infrastructure, aerospace, and high-frequency telecommunications. For B2B buyers in regions including Africa, South America, the Middle East, and Europe, understanding these drivers is key to capitalizing on growth opportunities. In Europe, countries like France are investing heavily in EV and renewable tech, increasing SiC demand for power electronics that offer superior thermal conductivity and efficiency compared to silicon. Similarly, South American markets such as Argentina are expanding their energy grids and industrial automation, creating new sourcing requirements for robust, high-temperature tolerant SiC components.

Current sourcing trends emphasize diversification and reliability. Buyers are increasingly looking beyond traditional suppliers in North America and East Asia to emerging manufacturers that offer competitive pricing and regional support. This is particularly relevant for African and Middle Eastern buyers seeking to mitigate supply chain risks exacerbated by geopolitical tensions and logistics challenges. Additionally, there is a growing preference for suppliers who can provide tailored SiC polytypes (e.g., 4H-SiC, 6H-SiC) with precise doping profiles to meet specific performance criteria in power devices and semiconductors.

Technological advances such as enhanced crystal growth methods and defect reduction techniques are making SiC wafers more accessible and cost-effective. This trend supports broader adoption in mid-tier industrial applications, enabling buyers to source materials that balance performance with cost-efficiency. Furthermore, integration of digital procurement platforms and real-time quality analytics is streamlining B2B transactions, offering buyers greater transparency and faster turnaround times.

Sustainability considerations are increasingly pivotal in the SiC supply chain, reflecting global commitments to reduce environmental impact and promote responsible sourcing. The production of SiC materials involves energy-intensive processes such as high-temperature crystal growth and chemical vapor deposition, which contribute to carbon emissions. For buyers in environmentally conscious markets like the European Union, prioritizing suppliers with robust energy management practices and low-carbon footprints is essential.

Ethical sourcing extends to the raw materials used in SiC manufacturing, such as silicon and carbon precursors, where traceability and conflict-free certifications are gaining prominence. Buyers from Africa and South America, regions rich in raw material deposits, have an opportunity to foster partnerships that emphasize fair labor practices and environmental stewardship. Adopting suppliers certified under recognized standards such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety) ensures compliance with international best practices.

Moreover, the rise of “green” SiC materials — produced using renewable energy sources or recycled feedstocks — is an emerging trend. These innovations resonate strongly with B2B buyers targeting sustainable product portfolios, particularly in the automotive and energy sectors. Transparent reporting on lifecycle assessments and carbon intensity metrics enables buyers to align procurement strategies with corporate sustainability goals, reducing reputational risks and meeting regulatory requirements.

The evolution of silicon carbide as a material dates back over a century, originally discovered as a synthetic abrasive due to its exceptional hardness and thermal stability. Over time, advancements in crystal growth technologies, particularly the development of high-quality 4H-SiC and 6H-SiC polytypes, transformed it from a niche industrial material into a cornerstone for power electronics and semiconductor devices. This transition was fueled by SiC’s wide bandgap, high breakdown electric field, and superior thermal conductivity, which enable devices to operate at higher voltages, temperatures, and switching frequencies than traditional silicon.

For B2B buyers, recognizing this history underscores the material’s maturity and reliability in critical applications. The continuous improvements in SiC production quality and scalability have lowered costs and expanded availability, making it a viable choice across diverse industries and geographies. Understanding these developments helps buyers anticipate future innovations and position themselves strategically within the global SiC supply ecosystem.

How can I effectively vet SiC material suppliers for international B2B transactions?

When sourcing SiC materials globally, especially from regions like Africa, South America, the Middle East, and Europe, start by verifying supplier certifications such as ISO 9001 for quality management and industry-specific approvals. Request detailed material datasheets and third-party test reports to confirm compliance with technical specifications. Conduct background checks on the supplier’s reputation through trade references and platforms like international trade directories. Visiting the supplier’s production facility or requesting virtual tours can provide additional assurance. Ensuring transparent communication and a clear understanding of terms reduces risks associated with quality and delivery.

What customization options are available for SiC material properties, and how should I negotiate them?

SiC materials can be customized in terms of polytype (4H, 6H, or β-SiC), doping elements (e.g., nitrogen for n-type or boron for p-type), surface finishing, and wafer thickness. International buyers should clearly specify their technical requirements upfront and discuss achievable tolerances with suppliers. Negotiate minimum order quantities (MOQs) and pricing based on customization complexity. For emerging markets like Africa or South America, inquire about suppliers’ flexibility to produce smaller batches or prototypes. Always request samples to validate material performance before committing to large-scale orders.

What are typical MOQs, lead times, and payment terms when purchasing SiC materials internationally?

MOQs for SiC materials often depend on the supplier’s production capacity and customization level, typically ranging from hundreds to thousands of units. Lead times can vary from 4 to 12 weeks, influenced by processing complexity and logistics. Buyers in regions with developing logistics infrastructure should plan for potential delays. Payment terms usually include a 30%-50% upfront deposit with the balance paid upon shipment or delivery. Use letters of credit or escrow services to safeguard transactions, especially when dealing with new suppliers in different continents.

Which quality assurance measures and certifications should I expect from reputable SiC material suppliers?

Reputable suppliers provide comprehensive quality assurance, including adherence to ISO 9001 and often ISO/TS 16949 (automotive) or ISO 13485 (medical devices) depending on application. Certificates of Analysis (CoA) detailing electrical properties, doping levels, and defect density are standard. Advanced suppliers may also offer traceability documentation and compliance with environmental standards like RoHS and REACH. For critical applications, third-party testing and audits can be requested. Buyers should integrate quality checkpoints into contracts to ensure materials meet agreed-upon standards before shipment.

What logistical challenges should international B2B buyers anticipate when importing SiC materials, and how can they be mitigated?

SiC materials are sensitive to contamination and mechanical damage, requiring specialized packaging and handling. Shipping from Europe, the Middle East, or South America to Africa or vice versa may involve complex customs procedures and variable transit times. Engage freight forwarders experienced in handling semiconductor-grade materials and use temperature-controlled or anti-static packaging when necessary. Plan for customs duties, import taxes, and compliance with local regulations. Proactively communicate with logistics partners to track shipments and resolve delays promptly.

How can I resolve disputes related to SiC material quality or delivery delays in international trade?

To manage disputes, include clear terms in purchase agreements specifying quality criteria, inspection procedures, and remedies for non-conformance. Employ third-party inspection services to verify goods before shipment. In case of discrepancies, document all communications and evidence such as photos, test reports, and delivery records. Utilize international arbitration bodies like the International Chamber of Commerce (ICC) for conflict resolution. Maintaining transparent, respectful communication with suppliers often facilitates amicable solutions, preserving long-term partnerships.

Are there regional considerations for SiC material sourcing specific to Africa, South America, the Middle East, or Europe?

Yes, regional factors such as trade agreements, currency fluctuations, and regulatory environments impact sourcing. For example, European buyers benefit from EU trade frameworks facilitating smoother customs clearance, while South American buyers should consider Mercosur tariffs. African importers may face infrastructure and logistics constraints requiring longer lead times. Understanding local market dynamics, supplier reliability, and geopolitical stability is crucial. Collaborating with regional agents or distributors can help navigate these complexities and enhance supply chain resilience.

What payment security practices are recommended for international B2B purchases of SiC materials?

Secure payment methods reduce financial risks in cross-border transactions. Letters of credit (LC) are widely used, guaranteeing payment upon fulfillment of contract terms. Escrow accounts provide neutral holding of funds until both parties confirm satisfaction. For trusted suppliers, open account terms with credit insurance might be negotiated. Always verify the supplier’s bank details independently to prevent fraud. Employing payment platforms with buyer protection and ensuring clear contractual payment milestones strengthen transaction security for buyers in all regions.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Silicon carbide (SiC) stands as a transformative material for industries demanding superior thermal, electrical, and mechanical performance. For international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—understanding the nuanced properties of SiC, such as its wide bandgap, high thermal conductivity, and robust electron mobility, is essential to unlocking its full potential in high-power and high-frequency applications. These properties translate directly into enhanced device reliability, energy efficiency, and operational longevity, factors that are critical in competitive global markets.

Illustrative Image (Source: Google Search)

Strategic sourcing of SiC materials requires a focus on quality consistency, supplier innovation, and logistical agility. Buyers should prioritize partnerships with suppliers who demonstrate cutting-edge R&D capabilities and a proven track record in delivering polytype-specific SiC variants tailored to application requirements. Regional market dynamics, including infrastructure maturity and regulatory frameworks, must also guide sourcing decisions to mitigate risks and optimize supply chain resilience.

Looking ahead, the expanding adoption of SiC across electric vehicles, renewable energy, and aerospace sectors signals growing demand and evolving material innovations. B2B buyers are encouraged to engage proactively with suppliers to co-develop solutions that address emerging technological challenges and sustainability goals. By embracing strategic sourcing principles and fostering collaborative supplier relationships, buyers from France to Argentina and beyond can secure a competitive edge in this rapidly advancing materials landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina