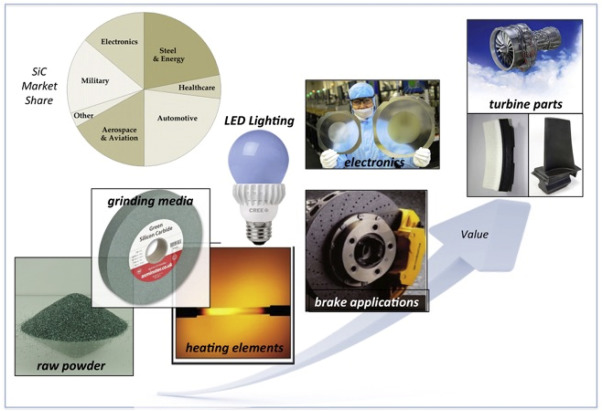

Silicon carbide (SiC) parts have emerged as indispensable components across a broad spectrum of high-performance industrial applications, from power electronics and automotive to aerospace and renewable energy sectors. Their exceptional thermal conductivity, mechanical strength, and resistance to wear and corrosion position them as critical enablers of next-generation technologies. For international B2B buyers—especially those operating in dynamic markets such as Africa, South America, the Middle East, and Europe—the ability to source high-quality SiC parts reliably is a decisive factor in maintaining competitive advantage and operational excellence.

This comprehensive guide delves into every essential aspect of the SiC parts market, equipping buyers with the knowledge needed to make well-informed procurement decisions. You will gain insights into the various types and grades of SiC materials, understand the intricacies of manufacturing processes and quality control standards, and explore key global suppliers and their unique value propositions. Additionally, the guide addresses critical cost considerations and market trends shaping supply chains across diverse regions, including Brazil and Poland.

By navigating this guide, international buyers will be empowered to:

With a focus on actionable intelligence and practical sourcing frameworks, this resource is designed to streamline your journey through the complex global SiC parts landscape and secure sustainable business growth.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard SiC Parts | High purity silicon carbide, consistent grain size | Industrial machinery, automotive components | Pros: Reliable performance, wide availability Cons: Higher cost, limited customization |

| Sintered SiC Components | Formed by sintering SiC powders under heat and pressure | Chemical processing, wear-resistant parts | Pros: Excellent hardness and corrosion resistance Cons: Brittle, machining complexity |

| Reaction Bonded SiC (RBSIC) | Produced by infiltrating porous carbon with silicon | Heat exchangers, semiconductor manufacturing | Pros: Good thermal shock resistance, complex shapes possible Cons: Lower strength than sintered SiC |

| SiC Composite Materials | SiC combined with other ceramics or metals | Aerospace, power electronics | Pros: Enhanced mechanical properties, tailored performance Cons: Higher production complexity and cost |

| Coated SiC Parts | SiC base with protective or functional coatings | Cutting tools, high-temperature seals | Pros: Improved surface durability and lifespan Cons: Coating may degrade under extreme conditions |

Standard silicon carbide parts are characterized by their high purity and uniform grain size, making them the benchmark for consistent performance. They are widely used in industrial machinery and automotive sectors due to their thermal stability and wear resistance. For B2B buyers, these parts offer reliability and ease of sourcing, though the cost can be relatively higher. Buyers should consider their operational environment to justify the investment in standard SiC parts.

Sintered SiC parts are manufactured through a high-temperature sintering process that fuses SiC powders into a dense, hard material. These components excel in applications requiring exceptional hardness and chemical resistance, such as in chemical reactors or abrasion-intensive environments. B2B buyers must be aware of their brittleness and the challenges in machining, which may impact lead times and customization options.

Reaction bonded SiC is produced by infiltrating porous carbon preforms with molten silicon, resulting in parts with good thermal shock resistance and the ability to form complex geometries. This type is popular in heat exchangers and semiconductor manufacturing equipment. Buyers benefit from cost-effective complex shapes but should note that RBSIC generally has lower mechanical strength compared to sintered SiC, influencing its suitability for high-stress applications.

SiC composites combine silicon carbide with other ceramics or metals to enhance mechanical strength, toughness, and thermal properties. These materials are increasingly used in aerospace and power electronics where tailored performance is crucial. For B2B buyers, composites offer advanced functionality but come with increased production complexity and cost, requiring careful evaluation of performance benefits versus budget constraints.

Coated SiC parts feature a silicon carbide base with additional protective or functional coatings to improve surface durability, resistance to oxidation, or reduce friction. They are essential in cutting tools and high-temperature sealing applications. Buyers should consider the operational environment carefully, as coatings may degrade under extreme conditions, potentially affecting the part’s lifespan and maintenance schedules.

Related Video: Silicon Carbide(SiC): micro drilling and parts ultrasonic machining

| Industry/Sector | Specific Application of SiC Parts | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-efficiency power modules for electric vehicles (EVs) | Improved energy efficiency, reduced heat loss, and longer device life | Quality certifications, thermal performance data, and supply chain reliability |

| Renewable Energy | SiC-based inverters for solar and wind energy systems | Higher conversion efficiency and durability in harsh environments | Compliance with international standards, scalability, and lead times |

| Industrial Automation | High-speed switching devices and motor drives | Enhanced operational speed and reduced downtime | Customization options, technical support, and component robustness |

| Aerospace & Defense | High-temperature sensors and power devices | Reliability in extreme conditions and weight reduction | Traceability, compliance with aerospace standards, and supplier stability |

| Semiconductor Fabrication | Wafer handling and processing components | Increased precision and contamination resistance | Cleanroom compatibility, material purity, and batch consistency |

Silicon carbide (SiC) parts are integral to power electronics, particularly in electric vehicle (EV) power modules. These parts enable higher voltage operation and greater thermal conductivity compared to traditional silicon, which directly translates into improved energy efficiency and longer lifespan of power devices. For B2B buyers in regions such as South America and Europe, sourcing SiC parts with verified thermal performance and quality certifications is critical to meet the stringent automotive standards and ensure reliable vehicle operation.

In the renewable energy sector, SiC parts are predominantly used in inverters for solar and wind power systems. Their ability to operate efficiently at high voltages and temperatures boosts energy conversion rates and system durability, reducing maintenance costs. Buyers from the Middle East and Africa should prioritize suppliers who provide components compliant with international standards and offer scalable solutions to support growing renewable infrastructure projects.

Within industrial automation, SiC parts are employed in high-speed switching devices and motor drives that demand rapid response and high reliability. These applications benefit from SiC’s fast switching capabilities and thermal stability, minimizing downtime and enhancing productivity. International buyers, especially in emerging manufacturing hubs like Poland and Brazil, should seek suppliers that offer customization and robust technical support to tailor components to specific automation needs.

The aerospace and defense industries utilize SiC parts in high-temperature sensors and power devices where reliability under extreme conditions is paramount. SiC’s lightweight nature also contributes to overall system weight reduction, a critical factor in aerospace applications. Buyers must ensure strict traceability, adherence to aerospace quality standards, and stable supplier relationships to meet the rigorous demands of these sectors.

Finally, in semiconductor fabrication, SiC parts are used for wafer handling and processing due to their exceptional hardness and chemical inertness. These properties help maintain precision and reduce contamination risks in cleanroom environments. For B2B buyers in technologically advanced markets, sourcing SiC parts with high material purity and consistent batch quality is essential to support high-yield semiconductor manufacturing processes.

Related Video: Introduction to Uses and Gratifications Theory

Silicon carbide (SiC) parts are critical components in industries requiring high-performance materials, especially for applications involving extreme conditions. Selecting the appropriate material for SiC parts depends on the specific operational environment, cost considerations, and regulatory standards relevant to international markets such as Africa, South America, the Middle East, and Europe. Below is an analysis of four common material types used for SiC parts, highlighting their properties, advantages, limitations, and considerations for global B2B buyers.

Key Properties:

RB-SiC is produced by infiltrating porous carbon preforms with molten silicon, resulting in a composite primarily composed of silicon carbide and residual silicon. It offers excellent thermal conductivity, good corrosion resistance, and a moderate temperature rating up to approximately 1400°C. The material has moderate mechanical strength and hardness.

Pros & Cons:

- Pros: Lower manufacturing cost compared to fully sintered SiC; good machinability due to residual silicon; excellent wear resistance and thermal shock resistance.

- Cons: Presence of free silicon reduces corrosion resistance in highly acidic or basic environments; mechanical strength is lower than sintered SiC.

Impact on Application:

RB-SiC is suitable for applications such as mechanical seals, kiln furniture, and wear parts where moderate chemical exposure and high thermal conductivity are required. However, it is less ideal for highly corrosive chemical processing.

International Buyer Considerations:

Buyers in regions like South America and Africa should verify compliance with ASTM C1203 or ISO 19379 standards for RB-SiC. The material’s machinability offers cost advantages in markets with limited advanced manufacturing infrastructure. However, buyers in the Middle East and Europe should consider the chemical compatibility carefully due to aggressive process media common in petrochemical industries.

Key Properties:

SSiC is manufactured by sintering SiC powder at high temperatures without a binding phase, resulting in a dense, pure SiC material with outstanding hardness, high mechanical strength, and excellent chemical inertness. It withstands temperatures exceeding 1600°C and exhibits superior corrosion resistance.

Pros & Cons:

- Pros: Exceptional wear and corrosion resistance; high temperature stability; excellent mechanical properties.

- Cons: Higher production cost; more brittle and difficult to machine; requires specialized manufacturing equipment.

Impact on Application:

Ideal for harsh chemical environments, such as acid pumps, valves, and heat exchangers in chemical processing plants. Its durability extends equipment life in aggressive media, reducing downtime and maintenance costs.

International Buyer Considerations:

European and Middle Eastern buyers often require compliance with DIN EN 60672 or ASTM C799 standards for sintered SiC. The high cost is justified by performance in critical applications. Buyers in Africa and South America should assess total cost of ownership, including logistics and potential local machining capabilities, when selecting SSiC parts.

Key Properties:

PLSSiC is a variant of sintered SiC produced without applied pressure, offering a balance between density and cost. It provides good mechanical strength, moderate corrosion resistance, and temperature resistance up to about 1500°C.

Pros & Cons:

- Pros: Lower cost than fully sintered SiC; good thermal shock resistance; suitable for complex shapes due to pressureless sintering.

- Cons: Slightly lower density and strength compared to hot-pressed SiC; machining challenges remain.

Impact on Application:

Used in applications requiring complex geometries such as nozzles, burner components, and certain mechanical seals. It offers a cost-effective alternative where full sintered SiC is not mandatory.

International Buyer Considerations:

Buyers from emerging markets in Africa and South America may find PLSSiC advantageous due to lower cost and adaptability to local manufacturing constraints. Compliance with JIS R 1620 or ISO 19379 ensures material reliability. European buyers may use PLSSiC for less critical components to optimize cost-performance balance.

Key Properties:

HPSiC is produced by sintering SiC powder under high pressure and temperature, resulting in very dense, high-strength parts with excellent wear resistance and thermal stability. It can operate at temperatures above 1600°C and exhibits superior mechanical toughness.

Pros & Cons:

- Pros: Highest mechanical strength and toughness among SiC materials; excellent thermal shock resistance; superior wear and corrosion resistance.

- Cons: Highest manufacturing cost; limited to simpler shapes due to pressing constraints; requires advanced production technology.

Impact on Application:

Best suited for extreme environments such as aerospace components, high-performance mechanical seals, and turbine parts. Its robustness justifies the premium cost in critical applications where failure is not an option.

International Buyer Considerations:

European and Middle Eastern buyers often demand HPSiC for high-spec industrial applications, with conformity to ASTM C1462 or DIN EN standards. Buyers in Africa and South America should consider the availability of suppliers and after-sales support when investing in HPSiC parts due to their specialized nature.

| Material | Typical Use Case for sic parts | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Reaction Bonded SiC (RB-SiC) | Mechanical seals, kiln furniture, wear parts | Cost-effective, good thermal conductivity | Lower corrosion resistance due to free silicon | Low |

| Sintered SiC (SSiC) | Chemical pumps, valves, heat exchangers | Exceptional corrosion and wear resistance | High cost, brittle, difficult to machine | High |

| Pressureless Sintered SiC (PLSSiC) | Complex shapes like nozzles, burner parts | Balanced cost-performance, good thermal shock resistance | Slightly lower strength than hot pressed SiC | Medium |

| Hot Pressed SiC (HPSiC) | Aerospace, high-performance seals, turbines | Highest strength and toughness | Highest cost, shape limitations | High |

This guide aims to assist international B2B buyers in selecting the optimal SiC material based on operational demands, cost constraints, and regional compliance requirements. Careful consideration of these factors ensures procurement of SiC parts that deliver reliability, longevity, and value across diverse industrial applications.

Silicon carbide (SiC) parts, widely used in high-performance electronics, automotive, and industrial applications, require sophisticated manufacturing and stringent quality assurance to meet the demanding specifications of international B2B buyers. Understanding the typical manufacturing processes and quality control (QC) measures for SiC components is critical for buyers, especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe. This section outlines the key stages of SiC parts production, relevant standards, QC checkpoints, and practical guidance for verifying supplier quality.

The production of SiC parts involves several precise stages, each crucial for achieving the material’s exceptional properties such as high thermal conductivity, hardness, and chemical stability.

Illustrative Image (Source: Google Search)

Robust QC practices are essential to ensure SiC parts meet international performance and reliability standards. B2B buyers should prioritize suppliers with comprehensive quality management systems aligned with global norms.

For buyers from regions such as Africa, South America, the Middle East, and Europe, verifying supplier quality is vital to ensure product reliability and regulatory compliance.

International buyers must navigate diverse regulatory environments and quality expectations.

Understanding these regional nuances helps buyers mitigate risks and ensures smooth customs and market entry.

By mastering the complexities of SiC parts manufacturing and quality assurance, international B2B buyers can confidently select suppliers who deliver high-performance, reliable components. Prioritizing stringent QC, thorough documentation, and region-specific compliance will safeguard investments and foster long-term partnerships in the dynamic global market.

Understanding the detailed cost structure behind Silicon Carbide (SiC) parts is crucial for international B2B buyers aiming to optimize procurement budgets while ensuring quality and reliability. The primary cost components include:

Several factors influence the final pricing of SiC parts and offer negotiation levers for buyers:

For buyers from Africa, South America, the Middle East, and Europe (including markets like Brazil and Poland), the following actionable insights can optimize cost-efficiency and sourcing effectiveness:

Prices for SiC parts vary widely based on technical specifications, order size, market conditions, and supplier terms. The figures and considerations presented here are indicative and should be validated through direct supplier quotations and market research tailored to specific buyer needs.

By understanding the comprehensive cost components and pricing influencers of SiC parts, international B2B buyers can make informed sourcing decisions that balance cost, quality, and delivery reliability—key factors for maintaining competitiveness in high-tech industries.

For international B2B buyers sourcing Silicon Carbide (SiC) parts, understanding key technical properties is essential to ensure product performance, reliability, and compatibility with application requirements. Below are the most important specifications:

Material Grade and Purity

SiC parts vary by grade, which reflects the purity and crystalline quality of the silicon carbide material. Higher-grade SiC exhibits superior electrical, thermal, and mechanical properties, crucial for high-power and high-frequency applications. Buyers should specify grade requirements clearly to match performance needs and compliance standards.

Dimensional Tolerance

This defines the allowable deviation from specified dimensions (length, width, thickness). Tight tolerances are critical for parts used in precision electronics or mechanical assemblies, impacting fit and function. Vendors typically provide tolerance classes; understanding these helps avoid costly rework or integration issues.

Thermal Conductivity

SiC parts are prized for high thermal conductivity, which facilitates efficient heat dissipation in power devices. The specific thermal conductivity value influences cooling system design and overall device reliability. Buyers must verify this property to ensure thermal management goals are met.

Electrical Resistivity

Electrical resistivity affects the part’s behavior in semiconductor and electronic applications. Low resistivity grades are suitable for conductive components, while higher resistivity is preferred for insulating parts. Clear specification of this property aids in correct material selection.

Mechanical Strength and Hardness

SiC’s hardness makes it ideal for abrasive and wear-resistant parts. Mechanical strength parameters, such as fracture toughness, impact durability under stress. Buyers should assess these properties relative to operational environments to prevent premature failure.

Surface Finish and Coating

Surface quality affects part performance, particularly in sealing, optical, or semiconductor contexts. Some SiC parts receive coatings to enhance corrosion resistance or electrical insulation. Understanding surface finish requirements helps in specifying inspection criteria and acceptance standards.

Navigating international B2B trade requires familiarity with common industry terms. Here are essential terms buyers should know:

OEM (Original Equipment Manufacturer)

Refers to companies that design and produce parts or equipment used in another company’s products. Buying directly from or through OEMs often ensures quality and compatibility but may involve minimum order quantities or longer lead times.

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell in one order. MOQs affect inventory planning and cash flow, especially for startups or smaller buyers. Negotiating MOQs can be crucial for market entry in regions like Africa or South America.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, delivery time, and terms for specified parts. An RFQ typically includes detailed technical specs and quantity needs. Clear, precise RFQs accelerate supplier response and improve quotation accuracy.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities for shipping, insurance, and tariffs between buyer and seller. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding Incoterms helps buyers manage risks and logistics costs effectively.

Lead Time

The period from order placement to delivery. Lead times for SiC parts can vary based on material availability and manufacturing complexity. Buyers should factor lead times into project schedules and communicate expected timelines clearly with suppliers.

Batch Traceability

The ability to track production batches of SiC parts through manufacturing and quality control processes. This is vital for quality assurance and regulatory compliance, allowing identification of defects or recalls. Buyers should request traceability documentation for critical applications.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can enhance sourcing decisions, mitigate risks, and build stronger supplier partnerships in the competitive SiC parts market.

The global market for sic parts—critical components in semiconductor and industrial applications—is currently shaped by rapid technological advancements, evolving supply chain structures, and diverse regional demands. For international B2B buyers from Africa, South America, the Middle East, and Europe (notably countries such as Brazil and Poland), understanding these dynamics is essential for strategic sourcing and competitive advantage.

Global Drivers:

Demand for sic parts is primarily driven by the expansion of electric vehicles (EVs), renewable energy systems, and high-performance power electronics. These applications require components with superior thermal conductivity, high voltage tolerance, and efficiency, making silicon carbide (SiC) parts indispensable. Regions investing heavily in green technologies, such as the EU’s Green Deal or Brazil’s growing renewable sector, are fueling increased procurement needs.

Emerging Sourcing Trends:

- Localized Supply Hubs: Buyers in emerging markets are increasingly seeking suppliers with regional presence or partnerships to reduce lead times and mitigate geopolitical risks.

- Digital Procurement Platforms: Adoption of AI-driven sourcing tools and blockchain for traceability is gaining traction, enabling enhanced transparency and supplier risk management.

- Customization and Flexibility: Demand for tailored sic parts specifications to meet unique industrial requirements is rising, pushing suppliers to offer modular and scalable solutions.

Market Dynamics:

- Supply Constraints and Price Volatility: Limited raw material availability and specialized manufacturing processes for sic parts create supply bottlenecks, impacting pricing and delivery schedules.

- Strategic Partnerships: Buyers benefit from forming long-term collaborations with manufacturers to secure priority access and co-develop innovative products.

- Regulatory Compliance: Compliance with regional import/export controls and quality certifications (e.g., ISO 9001, IATF 16949) is increasingly mandatory, especially in regulated markets like the EU.

For B2B buyers in Africa, South America, the Middle East, and Europe, these trends underscore the importance of proactive supplier engagement, investment in digital procurement capabilities, and alignment with regional industrial policies to optimize sourcing strategies.

Sustainability in the sic parts sector is no longer optional but a critical differentiator for B2B buyers committed to responsible procurement and long-term value creation. The environmental footprint of silicon carbide manufacturing—characterized by high energy consumption and use of hazardous chemicals—necessitates stringent sustainability practices.

Environmental Impact Considerations:

- Energy Efficiency: Manufacturers adopting renewable energy sources and energy-efficient production technologies help reduce carbon emissions.

- Waste Management: Proper handling and recycling of silicon carbide waste and by-products minimize environmental contamination.

- Water Usage: Sustainable water management in fabrication processes is vital, especially in water-scarce regions such as parts of the Middle East and Africa.

Ethical Supply Chains:

- Transparency in sourcing raw materials ensures avoidance of conflict minerals and compliance with international labor standards.

- Certification schemes such as ISO 14001 (Environmental Management) and Responsible Business Alliance (RBA) membership signal supplier commitment to ethical practices.

- Buyers increasingly demand supplier audits and sustainability reporting to verify adherence to environmental and social governance (ESG) criteria.

Green Certifications & Materials:

- Use of eco-friendly binders and reduced hazardous substances in sic parts production is gaining market traction.

- “Green” sic parts certified by recognized bodies can enhance corporate sustainability profiles and meet procurement mandates, especially in Europe’s stringent regulatory environment.

By integrating sustainability and ethical sourcing into procurement policies, international buyers not only mitigate risks but also align with growing global expectations for environmental stewardship and social responsibility.

Silicon carbide technology has evolved significantly since its initial discovery in the late 19th century, moving from abrasive applications to critical semiconductor roles. The shift towards wide-bandgap semiconductors in the 21st century marked a turning point, with sic parts gaining prominence due to their superior electrical and thermal properties compared to traditional silicon-based components.

Illustrative Image (Source: Google Search)

Historically, production was concentrated in a few countries with advanced manufacturing capabilities, but globalization and rising demand have diversified the supplier landscape. Emerging markets in South America and Africa are now exploring local manufacturing initiatives, supported by technology transfer and international partnerships, to reduce dependency on imports.

Understanding this historical trajectory helps B2B buyers appreciate the technological maturity and regional opportunities within the sic parts sector, enabling more informed decisions in supplier selection and market engagement.

How can I effectively vet suppliers of SiC parts from international markets like Asia or Europe?

To vet SiC parts suppliers, start by verifying their certifications such as ISO 9001, IATF 16949, or relevant semiconductor industry standards. Request detailed product datasheets and sample parts to assess quality and compatibility. Check their track record through client references and reviews, especially from companies in similar industries or regions. Confirm their financial stability and production capacity to ensure they can meet your volume and delivery needs. Utilize third-party inspection or auditing services for on-site supplier assessments if feasible.

Is customization of SiC parts available, and how should I approach this with international suppliers?

Many SiC parts manufacturers offer customization to meet specific electrical, thermal, or mechanical requirements. Clearly define your technical specifications and application needs upfront. Engage in detailed discussions with the supplier’s engineering team to align on design, testing, and validation processes. Expect longer lead times and possibly higher minimum order quantities (MOQs) for custom orders. Negotiate intellectual property terms and confidentiality agreements to protect proprietary designs during development.

What are typical minimum order quantities (MOQs) and lead times for SiC parts, especially for buyers from Africa or South America?

MOQs for SiC parts vary widely but often start around 500 to 1,000 units for standard products. Custom or specialized parts may have higher MOQs. Lead times typically range from 6 to 12 weeks depending on complexity, order size, and supplier backlog. For buyers in Africa or South America, factor in additional time for logistics and customs clearance. Early communication with suppliers and freight forwarders can help manage timelines and avoid delays.

What payment terms are common in international B2B transactions for SiC parts, and how can buyers protect themselves?

Suppliers often require 30% to 50% upfront payment via wire transfer or Letter of Credit (L/C), with the balance due upon shipment or delivery. Letters of Credit provide secure payment guarantees for both parties. For new suppliers, consider escrow services or payment through trusted intermediaries. Always formalize payment terms in contracts, including penalties for late payment or non-delivery. Verify supplier bank details independently to avoid fraud.

How do I ensure quality assurance and compliance of SiC parts sourced internationally?

Request quality certifications like RoHS, REACH, and compliance with industry standards (JEDEC, SEMI). Insist on supplier-provided inspection reports, including electrical testing and reliability data. Employ third-party quality control inspections at production and pre-shipment stages. Establish clear acceptance criteria in contracts and include clauses for returns or replacements in case of defects. Continuous supplier performance monitoring through KPIs is essential for long-term partnerships.

What logistics considerations should B2B buyers from the Middle East or Europe keep in mind when importing SiC parts?

Choose suppliers with experience exporting to your region and knowledge of local import regulations. Use reliable freight forwarders familiar with semiconductor-grade handling to prevent damage. Consider air freight for urgent shipments despite higher costs, or sea freight for bulk orders to optimize expenses. Plan for customs duties, taxes, and compliance documentation to avoid delays. Establish clear Incoterms (e.g., FOB, CIF) to define shipping responsibilities.

Illustrative Image (Source: Google Search)

How can disputes over SiC parts quality or delivery be effectively managed in international B2B trade?

Include dispute resolution clauses in contracts specifying governing law and arbitration mechanisms (e.g., ICC or UNCITRAL). Maintain detailed documentation of all communications, agreements, and shipment records. Engage promptly with suppliers to address issues collaboratively before escalation. Use third-party inspection reports as objective evidence. For persistent problems, professional mediation or legal counsel with expertise in international trade law may be necessary.

Are there specific certifications or regulatory approvals that SiC parts must have for export to regions like Brazil or Poland?

Yes, compliance with regional regulations is critical. For Brazil, products may require ANATEL certification if used in telecom or electronic applications, and INMETRO approval for safety and quality. In Poland and the broader EU, CE marking and RoHS compliance are mandatory for electronic components. Confirm with suppliers that parts meet these certifications and provide relevant documentation. Understanding local standards helps avoid customs clearance issues and ensures market acceptance.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of SiC parts is a critical lever for businesses aiming to enhance product performance, reduce costs, and secure reliable supply chains in today’s competitive global market. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding the nuances of supplier capabilities, quality certifications, and logistical frameworks is essential. Prioritizing partnerships with manufacturers who demonstrate innovation, compliance with international standards, and strong after-sales support will mitigate risks and drive long-term value.

Key takeaways for international buyers include:

Looking ahead, the growing demand for SiC components in electric vehicles, renewable energy, and industrial applications presents vast opportunities. Buyers who adopt a strategic sourcing mindset—focusing on innovation, risk management, and collaborative partnerships—will secure competitive advantages in evolving markets. Now is the time for international B2B buyers, from Brazil to Poland and beyond, to deepen supplier relationships, invest in supply chain intelligence, and proactively shape their sourcing strategies to meet future challenges and growth.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina