Navigating the global market for Sic polytypes presents unique challenges for international B2B buyers. As industries increasingly rely on silicon carbide (SiC) materials for their superior thermal and electrical properties, sourcing the right Sic polytypes becomes critical. This guide addresses key considerations, including the various types of Sic polytypes available, their applications across sectors such as electronics and automotive, and essential supplier vetting processes to ensure quality and reliability.

For B2B buyers from Africa, South America, the Middle East, and Europe—regions with burgeoning technology and manufacturing sectors—understanding the nuances of Sic polytypes can significantly impact purchasing decisions. This guide empowers buyers by providing actionable insights into cost considerations, market trends, and supplier evaluations tailored to their specific regional contexts, such as Brazil’s growing semiconductor market and Italy’s advanced manufacturing capabilities.

By the end of this comprehensive guide, you will be equipped with the knowledge to make informed decisions that enhance operational efficiency and drive innovation in your business. Dive in to explore how to effectively navigate the Sic polytypes market and leverage these materials to gain a competitive edge in your industry.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 2H-SiC | Hexagonal crystal structure; high thermal conductivity | Power electronics, high-temperature applications | Pros: Excellent thermal properties; Cons: Limited availability in some regions. |

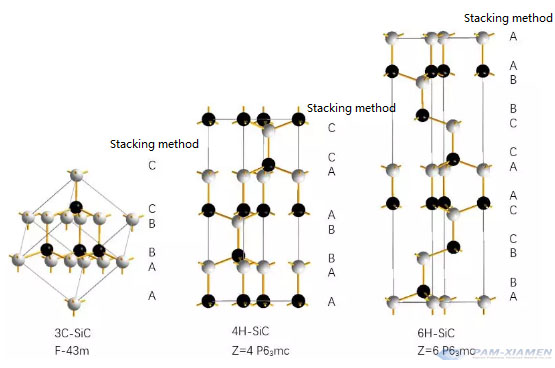

| 3C-SiC | Cubic crystal structure; easier to process | Optoelectronics, RF devices | Pros: High electron mobility; Cons: Lower thermal stability compared to 2H-SiC. |

| 4H-SiC | Mixed hexagonal and cubic structure; good balance of properties | High-voltage applications, automotive | Pros: Good thermal conductivity; Cons: More complex manufacturing process. |

| 6H-SiC | Similar to 4H but with different stacking sequence; high breakdown voltage | Power transistors, high-frequency applications | Pros: Superior breakdown voltage; Cons: Higher cost due to processing complexity. |

| 15R-SiC | Rhombohedral structure; unique electrical properties | Specialized sensors, niche electronics | Pros: Unique electrical characteristics; Cons: Limited use cases and market presence. |

2H-SiC, characterized by its hexagonal crystal structure, exhibits exceptional thermal conductivity and high breakdown voltage, making it suitable for high-power and high-temperature applications. Its robust thermal properties allow for efficient heat dissipation, which is crucial in power electronics. When considering a purchase, B2B buyers should evaluate the availability of 2H-SiC substrates and the specific requirements of their applications, as sourcing can vary significantly by region, particularly in Africa and South America.

3C-SiC features a cubic crystal structure, which simplifies the manufacturing process compared to its hexagonal counterparts. This polytype is particularly advantageous in optoelectronics and radio frequency (RF) devices due to its high electron mobility. Buyers should consider the trade-off between processing ease and thermal stability when selecting 3C-SiC, as it may not perform as well in extreme thermal environments as 2H-SiC. The growing demand for RF devices in Europe and the Middle East highlights the need for reliable suppliers of 3C-SiC materials.

4H-SiC offers a balanced combination of the desirable properties found in both cubic and hexagonal structures. This makes it particularly suitable for high-voltage applications, such as automotive power devices and industrial electronics. When purchasing 4H-SiC, buyers should assess the complexities involved in its manufacturing process, which can impact lead times and costs. The demand for efficient power management solutions in South America and Europe suggests a growing market for 4H-SiC substrates.

6H-SiC is known for its superior breakdown voltage, making it an excellent choice for high-frequency applications and power transistors. Its unique properties stem from its specific stacking sequence, which enhances its performance in demanding environments. B2B buyers should weigh the benefits of 6H-SiC against its higher manufacturing costs and complexity. As industries in the Middle East focus on advanced power systems, understanding the advantages of 6H-SiC can provide a competitive edge.

15R-SiC, with its rhombohedral structure, presents unique electrical properties that make it suitable for specialized sensors and niche electronic applications. While its market presence is limited, the distinct characteristics of 15R-SiC can offer advantages in specific use cases. Buyers should consider the potential for innovation in their applications and the importance of sourcing from specialized suppliers. The niche market for 15R-SiC in Europe and Africa may present unique opportunities for forward-thinking companies.

Related Video: Sicilian Defense ALL Variations Explained [Chess Opening Crash Course]

| Industry/Sector | Specific Application of sic polytypes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electronics | High-Power Semiconductor Devices | Enhanced thermal conductivity and efficiency | Supplier reliability, material purity, and certification |

| Aerospace | Structural Components | Lightweight, high-strength materials for reduced weight | Compliance with aerospace standards, testing protocols |

| Automotive | Electric Vehicle Components | Improved performance and energy efficiency | Cost-effectiveness, scalability, and customization options |

| Renewable Energy | Photovoltaic Cells | Higher energy conversion rates and durability | Quality assurance, compatibility with existing systems |

| Medical Devices | Biocompatible Implants | Increased patient safety and device longevity | Regulatory compliance, biocompatibility testing |

In the electronics sector, sic polytypes are critical in the production of high-power semiconductor devices. Their unique properties, such as high thermal conductivity and electric field strength, enable these devices to operate efficiently at elevated temperatures. This is particularly beneficial for international B2B buyers in regions with growing electronics markets, such as Africa and South America, where demand for reliable energy solutions is increasing. Buyers should consider the supplier's reliability and ensure that the materials meet the required purity and certification standards to avoid performance issues.

In aerospace, sic polytypes are utilized in structural components due to their lightweight and high-strength characteristics. These materials help reduce the overall weight of aircraft, leading to fuel savings and enhanced performance. Buyers from Europe and the Middle East, where aerospace technology is rapidly advancing, must focus on compliance with strict aerospace standards and testing protocols. This ensures that the materials can withstand the rigorous conditions of flight while maintaining safety and performance.

The automotive industry is increasingly adopting sic polytypes for electric vehicle components, where their enhanced performance and energy efficiency are vital. These materials contribute to the development of advanced battery systems and power electronics, crucial for the transition to electric mobility. B2B buyers in South America and Africa should prioritize cost-effectiveness and scalability in sourcing these materials, as the automotive market in these regions is expanding. Customization options can also be a key factor in meeting specific design requirements.

In the renewable energy sector, particularly in photovoltaic cells, sic polytypes enhance energy conversion rates and durability. This results in more efficient solar panels that can withstand harsh environmental conditions, making them ideal for diverse climates in Africa and South America. Buyers should focus on quality assurance and compatibility with existing systems when sourcing these materials, as they play a significant role in maximizing the overall efficiency of renewable energy installations.

Sic polytypes are increasingly being used in biocompatible implants within the medical devices industry. Their properties contribute to increased patient safety and device longevity, which are critical factors in the healthcare sector. International buyers, especially from Europe, must ensure that sourced materials comply with regulatory standards and undergo thorough biocompatibility testing. This is essential to mitigate risks associated with implantable devices and to enhance patient outcomes.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

The Problem: For B2B buyers sourcing sic polytypes, especially those operating in diverse regions like Africa and South America, navigating the complexities of global supply chains can be a significant hurdle. Issues such as fluctuating tariffs, varying import/export regulations, and unreliable shipping timelines can lead to delays and increased costs. Buyers often find it challenging to determine which suppliers can meet their specific needs while ensuring compliance with regional regulations.

The Solution: To effectively navigate these complexities, international buyers should conduct thorough due diligence on potential suppliers before making commitments. Establishing relationships with suppliers who have a proven track record of reliability in your region is essential. Utilize platforms that specialize in connecting B2B buyers with reputable manufacturers of sic polytypes. Additionally, consider engaging a local logistics partner with expertise in international shipping to facilitate smoother operations. They can provide insights on customs regulations and help streamline the import process, mitigating potential delays.

The Problem: A common pain point for B2B buyers is the technical complexity surrounding sic polytypes. Many buyers may lack the technical expertise required to assess the specifications and quality of these materials, leading to potential misalignment between product capabilities and project requirements. This can result in costly production errors or project delays, particularly in industries such as semiconductors and high-power electronics.

The Solution: To address this knowledge gap, buyers should invest in training or consult with technical experts who can provide insights into the specific properties and applications of various sic polytypes. Creating a collaborative environment where engineers and procurement teams communicate effectively will ensure that the right specifications are established from the outset. Additionally, suppliers often provide detailed technical documentation; therefore, requesting samples or pilot batches can help assess material performance before full-scale orders are placed. Engaging with industry webinars and forums can also enhance understanding of the latest advancements in sic polytypes, enabling informed decision-making.

The Problem: Price volatility in the sic polytype market can create budgeting challenges for B2B buyers. Factors such as market demand, changes in production costs, and geopolitical events can lead to sudden price increases, impacting project budgets and financial forecasts. Buyers, particularly in Europe and the Middle East, often struggle to secure stable pricing over time, leading to uncertainty in their procurement strategies.

The Solution: To mitigate the impact of price volatility, buyers should explore long-term contracts with suppliers that include fixed pricing agreements. These contracts can provide predictability and stability in costs, allowing for better financial planning. Additionally, implementing a strategic sourcing approach can help identify alternative suppliers and materials that offer comparable performance at lower costs. Buyers should also keep abreast of market trends and economic indicators that affect pricing, leveraging this knowledge to make timely purchasing decisions. Utilizing procurement management software can aid in tracking market prices and optimizing purchasing strategies to take advantage of favorable conditions.

By addressing these common challenges with actionable strategies, B2B buyers can enhance their procurement processes and ensure successful sourcing of sic polytypes tailored to their specific needs.

Silicon carbide (SiC) polytypes are known for their exceptional properties, making them suitable for a variety of applications, particularly in high-temperature and high-power environments. The choice of material for SiC polytypes can significantly impact performance, durability, and cost. Below, we analyze four common materials used in SiC polytypes, focusing on their properties, advantages and disadvantages, and considerations for international B2B buyers.

Key Properties: SiC exhibits high thermal conductivity, excellent thermal shock resistance, and a wide bandgap, making it suitable for high-temperature applications up to 1600°C. Its hardness contributes to wear resistance.

Pros & Cons: The primary advantage of SiC is its ability to operate at high temperatures and voltages, making it ideal for power electronics. However, the manufacturing process can be complex and costly, which may limit its use in some applications.

Impact on Application: SiC is compatible with harsh environments, including those involving corrosive media. It is often used in semiconductor devices, power modules, and high-performance sensors.

Considerations for International Buyers: Buyers from regions like Africa and South America should be aware of local standards for SiC products, such as compliance with ASTM and JIS. In Europe, adherence to RoHS directives is crucial.

Key Properties: AlN has excellent thermal conductivity and electrical insulation properties, with a thermal expansion coefficient similar to that of SiC, which helps in reducing thermal stress.

Pros & Cons: AlN is less expensive than SiC and easier to manufacture, making it a cost-effective option for many applications. However, it lacks the same high-temperature performance as SiC, limiting its use in extreme conditions.

Impact on Application: AlN is often used in electronic packaging and substrates, particularly where thermal management is critical. Its electrical insulation properties make it suitable for high-voltage applications.

Considerations for International Buyers: Buyers in the Middle East may prefer AlN for its cost-effectiveness, while European buyers must ensure compliance with local environmental regulations.

Key Properties: GaN is known for its high electron mobility and saturation velocity, allowing for efficient power conversion and high-frequency applications.

Pros & Cons: The main advantage of GaN is its efficiency in power electronics, particularly in RF applications. However, it can be more expensive than SiC and has a more limited temperature range.

Impact on Application: GaN is widely used in RF amplifiers and power conversion systems, particularly in telecommunications and automotive applications.

Considerations for International Buyers: Buyers from Europe and South America should consider the availability of GaN components and their compliance with international standards, as well as the potential for higher costs.

Key Properties: Silicon is the most commonly used semiconductor material, known for its good electrical properties and availability.

Pros & Cons: The primary advantage of silicon is its low cost and ease of manufacturing. However, it has lower thermal conductivity and can only operate at lower temperatures compared to SiC and GaN.

Impact on Application: Silicon is widely used in consumer electronics and low-power applications. Its limitations in high-temperature environments restrict its use in more demanding applications.

Considerations for International Buyers: Buyers in Africa and South America may find silicon components readily available and cost-effective, but they should be cautious about performance limitations in high-temperature applications.

| Material | Typical Use Case for Sic Polytypes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) | Power electronics, high-performance sensors | High temperature and voltage tolerance | Complex and costly manufacturing | High |

| Aluminum Nitride (AlN) | Electronic packaging, thermal management | Cost-effective, good thermal properties | Limited high-temperature performance | Medium |

| Gallium Nitride (GaN) | RF amplifiers, power conversion systems | High efficiency in power applications | Higher cost, limited temperature range | High |

| Silicon (Si) | Consumer electronics, low-power applications | Low cost, easy to manufacture | Poor performance at high temperatures | Low |

This strategic material selection guide provides international B2B buyers with valuable insights into the properties, advantages, and limitations of different materials used in SiC polytypes. Understanding these factors can help in making informed purchasing decisions that align with specific application needs and regional compliance requirements.

Manufacturing Sic polytypes involves a series of intricate processes that ensure the production of high-quality materials suitable for various applications, such as semiconductors and high-power electronics. The main stages of manufacturing Sic polytypes include material preparation, forming, assembly, and finishing.

The first stage of the manufacturing process begins with the careful selection of raw materials, primarily silicon carbide (SiC). High-purity SiC powders are sourced, often requiring rigorous quality checks to ensure minimal impurities. This step is crucial as the quality of the raw materials directly influences the final product's performance.

Once the materials are selected, they undergo a process known as powder processing, where the SiC is milled and granulated to achieve the desired particle size. This is followed by a mixing phase, where additives may be incorporated to enhance properties such as sintering behavior and thermal conductivity. The resulting mixture is then screened to eliminate any oversized particles before moving on to the forming stage.

Forming is a critical stage where the prepared SiC powder is shaped into the desired polytype configuration. Common techniques used in this stage include:

Uniaxial Pressing: This method involves applying pressure to the SiC powder in a single direction, forming it into a compact shape.

Isostatic Pressing: In contrast to uniaxial pressing, isostatic pressing applies pressure uniformly from all directions, resulting in a more homogeneous density distribution and improved mechanical properties.

Extrusion: For specific applications, extrusion may be used to create continuous shapes, such as rods or tubes, by forcing the SiC mixture through a die.

Injection Molding: This technique is suitable for producing complex shapes with high precision. It involves injecting the SiC mixture into a mold and allowing it to cure.

After forming, the shaped materials are typically subjected to a preliminary drying process to remove excess moisture before proceeding to assembly.

In the assembly stage, the formed components are combined to create the final product. This may involve processes such as sintering, where the components are heated to a temperature below their melting point to bond the particles together. The sintering atmosphere can vary, often requiring controlled environments to prevent oxidation and other reactions that could degrade material quality.

Following sintering, additional assembly processes may include the application of coatings or the integration of electronic components, depending on the intended application of the Sic polytypes.

Finishing is the final stage of the manufacturing process, where the products undergo several treatments to enhance their properties. Common finishing techniques include:

Grinding and Polishing: These processes are essential for achieving the required surface finish and dimensional tolerances. Precision grinding ensures that the components fit together seamlessly in their final application.

Coating: Depending on the application, coatings may be applied to enhance properties such as corrosion resistance or electrical conductivity.

Quality Inspection: Before packaging, each component undergoes rigorous quality inspections to ensure compliance with specifications.

Quality assurance (QA) is paramount in the manufacturing of Sic polytypes, particularly for international B2B buyers who require stringent compliance with industry standards.

Manufacturers of Sic polytypes must adhere to international quality standards such as ISO 9001, which outlines criteria for a quality management system (QMS). Compliance with ISO 9001 ensures that manufacturers consistently produce products that meet customer and regulatory requirements.

In addition to ISO standards, industry-specific certifications such as CE marking for products sold in the European Economic Area (EEA) and API standards for oil and gas applications may also be relevant. These certifications often require adherence to specific technical regulations and quality benchmarks.

Quality control (QC) in Sic polytype manufacturing typically involves several checkpoints, including:

Incoming Quality Control (IQC): This initial checkpoint assesses the quality of raw materials upon arrival at the manufacturing facility. Suppliers are often required to provide documentation and test results to verify material quality.

In-Process Quality Control (IPQC): During the manufacturing stages, IPQC measures ensure that processes are operating within defined parameters. Regular sampling and testing help identify any deviations early in the production cycle.

Final Quality Control (FQC): Before products are packaged and shipped, FQC involves comprehensive testing of the finished products against specifications. This may include mechanical testing, thermal analysis, and electrical performance assessments.

For international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe, verifying a supplier's quality control processes is essential to mitigate risks associated with purchasing Sic polytypes.

Supplier Audits: Conducting regular audits of suppliers allows buyers to assess compliance with quality standards and their QMS. This includes reviewing documentation, observing manufacturing practices, and evaluating QC checkpoints.

Quality Reports: Requesting detailed quality reports from suppliers can provide insight into their QC processes and any corrective actions taken in response to non-conformities.

Third-Party Inspections: Engaging independent third-party inspection services can offer an unbiased evaluation of a supplier's manufacturing processes and product quality. This can be especially valuable for buyers unfamiliar with the supplier's operational standards.

Understanding the nuances of QC and certification is crucial for international B2B buyers. Variations in standards and regulations across regions can impact product compliance. For instance, while CE marking is mandatory in Europe, other regions may have different certification requirements.

B2B buyers should also consider the implications of local regulations and trade agreements when sourcing Sic polytypes. Establishing clear communication with suppliers regarding their certifications and quality assurance processes can help ensure compliance and foster long-term partnerships.

The manufacturing processes and quality assurance for Sic polytypes are complex and require meticulous attention to detail. By understanding the stages of manufacturing and the importance of quality control, international B2B buyers can make informed decisions when sourcing these critical materials. Ensuring compliance with international standards and effectively verifying supplier quality will ultimately lead to better procurement outcomes and enhanced product performance.

This practical sourcing guide aims to assist international B2B buyers in navigating the procurement process for silicon carbide (SiC) polytypes. Given the diverse applications of SiC in industries such as electronics, automotive, and energy, it is essential to approach sourcing with a clear strategy to ensure quality and reliability.

Begin by clearly defining your technical requirements for SiC polytypes. This includes determining the type (e.g., 4H, 6H, or 3C), crystal structure, and intended application. Precise specifications help in identifying the right suppliers and products that meet your operational needs.

Conduct thorough research to identify potential suppliers specializing in SiC polytypes. Look for companies with a strong reputation in the industry and experience in supplying to your specific market.

Before proceeding, it is critical to verify the certifications and quality standards of potential suppliers. ISO certifications, RoHS compliance, and other relevant certifications ensure that the supplier adheres to industry standards.

Request samples of SiC polytypes from shortlisted suppliers to assess their quality. Conduct tests to evaluate their performance against your specifications and industry standards.

Compare pricing structures among different suppliers while considering the total cost of ownership. Evaluate payment terms and conditions, ensuring they align with your financial capabilities.

Once you have selected a supplier, engage in negotiations to establish clear contract terms. This should cover delivery schedules, warranties, and penalties for non-compliance.

Finally, set up a communication plan with your chosen supplier to facilitate smooth interactions. Regular communication helps in addressing issues proactively and maintaining a strong business relationship.

By following this checklist, B2B buyers can streamline the sourcing process for SiC polytypes, ensuring they partner with reliable suppliers that meet their technical and operational requirements.

When sourcing SiC (Silicon Carbide) polytypes, understanding the comprehensive cost structure and pricing dynamics is crucial for international B2B buyers, especially from Africa, South America, the Middle East, and Europe. This analysis will break down cost components, price influencers, and provide actionable buyer tips to navigate the complexities of SiC polytypes sourcing.

Materials: The primary cost driver for SiC polytypes is the raw material itself. Silicon and carbon, the base materials for SiC, can fluctuate in price based on market demand and geopolitical factors. Buyers should be aware of these fluctuations and consider sourcing agreements that lock in prices.

Labor: Labor costs can vary significantly depending on the manufacturing location. Regions with lower labor costs, such as parts of Asia, may offer competitive pricing, but this can sometimes come at the expense of quality. Buyers should assess the trade-off between cost and quality when selecting suppliers.

Manufacturing Overhead: This includes costs associated with the production facilities, utilities, and administrative expenses. Efficient manufacturers may have lower overhead costs, which can translate into better pricing for buyers.

Tooling: Custom tooling can be a significant upfront cost, especially for specialized SiC polytypes. Buyers should inquire about tooling costs upfront and explore options to share tooling expenses with the supplier.

Quality Control (QC): Investing in quality control processes is essential to ensure the performance and reliability of SiC polytypes. Buyers may find that suppliers with robust QC procedures charge a premium, but this can reduce long-term costs associated with defects and failures.

Logistics: Shipping and handling costs can vary based on the supplier's location and the chosen Incoterms. Understanding logistics costs is vital for calculating the total landed cost of the product.

Margin: Suppliers typically apply a margin on top of their costs, which can vary based on their market position, demand, and competition. Buyers should negotiate to ensure that the margins are reasonable and in line with industry standards.

Volume/MOQ: Minimum Order Quantities (MOQs) can significantly influence pricing. Larger orders often lead to lower per-unit costs. Buyers should evaluate their demand and consider consolidating orders to achieve better pricing.

Specifications and Customization: Custom specifications can increase costs due to the need for specialized processes or materials. Buyers should balance the need for customization with cost implications, opting for standard products when feasible.

Materials and Quality Certifications: Higher quality materials and certifications (like ISO or RoHS compliance) can increase costs but also enhance product reliability. Buyers in regions like Europe may prioritize certified products due to stringent regulatory requirements.

Supplier Factors: The reputation and reliability of suppliers can affect pricing. Established suppliers with a track record may charge higher prices but offer better service and reliability, which can justify the cost.

Incoterms: The choice of Incoterms affects shipping responsibilities and costs. Understanding these terms can help buyers negotiate better pricing and manage logistics more effectively.

Negotiation Strategies: Always approach negotiations with a clear understanding of your requirements and market prices. Consider leveraging multiple quotes to drive competitive pricing.

Focus on Cost-Efficiency: Evaluate suppliers not just on price but on the total cost of ownership, which includes purchase price, logistics, and potential quality issues. This holistic view can lead to better long-term savings.

Understand Pricing Nuances for International Buyers: Different regions have varying standards, certifications, and market dynamics. Buyers from Africa or South America should be aware of import tariffs and local regulations that can affect overall costs.

Consider Local Partnerships: Forming partnerships with local distributors or agents can reduce logistics costs and improve communication with suppliers.

Disclaimer on Indicative Prices: Pricing for SiC polytypes can be volatile. It is advisable for buyers to request updated quotes regularly and be prepared for potential fluctuations in costs.

By understanding these components and influences, international B2B buyers can make informed decisions when sourcing SiC polytypes, optimizing their costs while ensuring quality and reliability.

In the realm of semiconductor materials, silicon carbide (SiC) polytypes stand out due to their superior thermal, electrical, and mechanical properties. However, international B2B buyers must explore alternative solutions that may also meet their operational needs while considering factors such as performance, cost, and ease of implementation. This section provides a comprehensive comparison of SiC polytypes with two viable alternatives: Gallium Nitride (GaN) and traditional Silicon (Si) solutions.

| Comparison Aspect | Sic Polytypes | Gallium Nitride (GaN) | Traditional Silicon (Si) |

|---|---|---|---|

| Performance | High thermal conductivity, robust under high temperatures and voltages | Excellent efficiency at high frequencies, lower power losses | Adequate for many applications, but limited in high-temperature environments |

| Cost | Higher initial investment | Moderate to high investment | Generally lower cost, widely available |

| Ease of Implementation | Requires specialized fabrication techniques | Needs advanced manufacturing processes | Well-established processes, easier to source |

| Maintenance | Low maintenance, stable performance | Moderate maintenance, sensitive to thermal issues | High reliability, easier to manage |

| Best Use Case | Power electronics, automotive applications, high-temperature settings | RF devices, LED technology, power converters | General-purpose electronics, consumer devices |

Gallium Nitride is known for its exceptional efficiency, particularly in high-frequency applications. It offers lower power losses compared to traditional silicon, making it ideal for RF devices and power converters. However, GaN typically involves a higher cost and requires advanced manufacturing techniques, which can pose challenges for companies looking to scale production. Additionally, while its performance is outstanding, it can be sensitive to thermal management, requiring careful design considerations to avoid overheating.

Silicon remains the most widely used semiconductor material due to its established manufacturing processes and lower costs. It is suitable for a broad range of applications, including consumer electronics. While traditional silicon solutions are reliable and easier to maintain, they fall short in high-temperature and high-efficiency scenarios compared to SiC and GaN. Buyers looking for cost-effective solutions for less demanding applications may find silicon to be a viable option, but it may not meet the performance requirements of advanced sectors.

When evaluating semiconductor materials, B2B buyers should consider their specific operational requirements, budget constraints, and the technical capabilities of their teams. SiC polytypes are ideal for high-performance applications where temperature and efficiency are critical, while GaN offers advanced efficiency for high-frequency needs. On the other hand, traditional silicon may suffice for general applications where cost is a dominant factor. By understanding the strengths and weaknesses of each option, buyers can make informed decisions that align with their strategic goals and operational demands.

Sic polytypes, or silicon carbide polytypes, are critical materials in various industries, particularly in electronics and semiconductor manufacturing. Understanding their technical properties is vital for B2B buyers looking to make informed purchasing decisions. Here are some key specifications to consider:

Material Grade

- Material grade indicates the specific type of silicon carbide used in the manufacturing process. Grades can vary based on purity levels, crystal structure, and intended application. For example, 4H-SiC and 6H-SiC are commonly used polytypes, with 4H being preferred for high-power applications due to its superior electrical characteristics. Knowing the material grade helps buyers select the right product for their specific needs.

Tolerance

- Tolerance refers to the allowable deviation from specified dimensions in the manufacturing of Sic polytypes. High precision is often required in applications such as power electronics and RF devices. For instance, tighter tolerances can lead to better performance and reliability, making it essential for buyers to understand the tolerance specifications when sourcing components.

Thermal Conductivity

- Thermal conductivity measures the material's ability to conduct heat. Sic polytypes exhibit high thermal conductivity, which is crucial for applications that generate significant heat, like power devices. Buyers should evaluate this property to ensure that the Sic polytypes can effectively manage thermal loads in their applications.

Bandgap Energy

- Bandgap energy is a critical parameter that determines the electrical properties of Sic polytypes. Silicon carbide has a wide bandgap, which makes it suitable for high-temperature and high-voltage applications. Understanding the bandgap can help buyers assess the material's suitability for specific electronic applications, particularly in harsh environments.

Defect Density

- Defect density refers to the number of crystal defects per unit area in the material. Lower defect densities typically lead to improved performance and reliability in electronic devices. Buyers should inquire about defect density when sourcing Sic polytypes, as it can significantly affect the quality and longevity of the final product.

Understanding industry jargon is essential for effective communication and negotiation in B2B transactions. Here are several important trade terms relevant to Sic polytypes:

OEM (Original Equipment Manufacturer)

- OEM refers to companies that produce parts or equipment that may be marketed by another manufacturer. In the context of Sic polytypes, OEMs often provide customized solutions tailored to specific applications, making it vital for buyers to identify reliable OEM partners.

MOQ (Minimum Order Quantity)

- MOQ is the smallest quantity of a product that a supplier is willing to sell. For Sic polytypes, understanding the MOQ is crucial for buyers to manage inventory effectively and ensure they meet production requirements without overcommitting resources.

RFQ (Request for Quotation)

- An RFQ is a standard business process where buyers invite suppliers to submit price proposals for specific products or services. When sourcing Sic polytypes, issuing an RFQ allows buyers to compare costs and specifications, facilitating informed decision-making.

Incoterms (International Commercial Terms)

- Incoterms are internationally recognized rules that define the responsibilities of sellers and buyers in international transactions. Familiarity with Incoterms can help B2B buyers navigate shipping and logistics more effectively, ensuring clarity around costs, risks, and delivery responsibilities.

Lead Time

- Lead time is the period between the initiation of an order and its delivery. For Sic polytypes, understanding lead times is essential for project planning and ensuring that production schedules are met without delays.

By grasping these essential technical properties and industry terminology, international B2B buyers can make more informed decisions regarding Sic polytypes, enhancing their procurement strategies and fostering successful business relationships.

The sic polytypes market is experiencing significant growth driven by various global factors. Increased demand for silicon carbide (SiC) in semiconductor applications, particularly in electric vehicles (EVs) and renewable energy sectors, is reshaping market dynamics. As industries shift towards greener technologies, SiC's superior thermal conductivity and efficiency make it an ideal choice. B2B buyers from regions such as Africa and South America can leverage these trends to source high-quality materials that meet the growing need for energy-efficient solutions.

Emerging technologies, including advanced manufacturing techniques and automation, are also transforming the sourcing landscape. International buyers should consider partnerships with suppliers who utilize cutting-edge processes to ensure product quality and consistency. Furthermore, the rise of digital platforms for B2B transactions is enhancing market accessibility, allowing buyers from Europe and the Middle East to connect with diverse suppliers globally. Staying abreast of these trends is crucial for making informed purchasing decisions and optimizing supply chain efficiency.

Sustainability is becoming a cornerstone of sourcing strategies in the sic polytypes sector. The environmental impact of sourcing practices is under increasing scrutiny, prompting buyers to prioritize suppliers that adhere to ethical standards and sustainable practices. Incorporating sustainability into the supply chain not only mitigates risks but also enhances brand reputation, particularly in markets like Europe, where consumers demand accountability.

B2B buyers should seek out suppliers who can provide certifications for sustainable practices, such as ISO 14001 for environmental management and other green certifications relevant to sic polytypes. These certifications indicate a commitment to reducing environmental impact and promoting responsible sourcing. Additionally, materials that are recyclable or produced using renewable energy sources can further support sustainability goals. By aligning sourcing strategies with sustainability initiatives, international buyers can not only fulfill regulatory requirements but also meet the growing consumer demand for environmentally responsible products.

The evolution of sic polytypes is rooted in the broader development of silicon carbide technology. Initially discovered in the late 19th century, SiC gained traction in the 1970s as a semiconductor material due to its unique properties, including high thermal conductivity and wide bandgap. This made it particularly valuable in high-power and high-temperature applications.

Over the decades, advancements in crystal growth techniques and manufacturing processes have expanded the application range of sic polytypes, making them integral to modern electronics and energy solutions. For B2B buyers, understanding this historical context is essential as it highlights the reliability and performance advantages of SiC materials. This knowledge can guide purchasing decisions and foster strategic partnerships with suppliers who have a proven track record in the industry.

How do I ensure the quality of sic polytypes before purchasing?

To ensure the quality of sic polytypes, request detailed product specifications and certifications from suppliers. Conduct a thorough supplier audit, including a review of their production processes and quality control measures. It’s also advisable to request samples for testing before placing a bulk order. Engaging third-party quality assurance firms can provide additional oversight, especially for international transactions where regulations may differ.

What are the common applications of sic polytypes in various industries?

Sic polytypes are widely used in semiconductor applications, including power devices and high-frequency electronics. They are also utilized in the production of high-temperature materials, abrasives, and ceramics. Industries such as automotive, aerospace, and renewable energy increasingly leverage sic polytypes for their thermal conductivity and mechanical strength, making them essential for next-generation technologies.

What is the minimum order quantity (MOQ) when sourcing sic polytypes?

Minimum order quantities (MOQ) for sic polytypes can vary significantly depending on the supplier and the specific product type. Typically, MOQs range from a few kilograms to several tons. When negotiating with suppliers, consider your production needs and discuss flexible arrangements if you anticipate varying demand. Building a good relationship with your supplier may also lead to better terms.

How can I find reliable suppliers of sic polytypes in Africa, South America, the Middle East, and Europe?

Start by researching industry directories and trade associations specific to your region. Attend trade shows and exhibitions to network with potential suppliers. Utilize online platforms like Alibaba or ThomasNet, but ensure to verify supplier credentials through customer reviews and references. Additionally, consider engaging local trade representatives who understand the regional market dynamics.

What payment terms should I negotiate when purchasing sic polytypes?

When sourcing sic polytypes, common payment terms include letter of credit, advance payment, or payment upon delivery. Always negotiate terms that minimize your risk while ensuring supplier trust. For larger orders, consider escrow services that release payment upon successful delivery and inspection of goods. Clear communication about payment schedules can help prevent misunderstandings.

How do I handle logistics and shipping when importing sic polytypes?

Effective logistics management is crucial for importing sic polytypes. Collaborate with freight forwarders who specialize in handling industrial materials to navigate customs regulations and optimize shipping routes. Ensure your supplier is aware of the shipping terms (e.g., FOB, CIF) to avoid unexpected costs. Additionally, consider insurance for high-value shipments to protect against loss or damage.

What customization options are available for sic polytypes?

Many suppliers offer customization in terms of size, shape, and purity levels of sic polytypes. Discuss your specific application requirements with potential suppliers to see how they can tailor their offerings. Customization may also involve specific packaging solutions or modifications to meet unique operational needs. Always confirm the lead time and costs associated with custom orders.

A stock image related to sic polytypes.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In summary, strategic sourcing of silicon carbide (SiC) polytypes offers international B2B buyers a significant competitive edge. By understanding the unique properties and applications of various SiC polytypes, buyers can align their sourcing strategies with specific project requirements, ensuring optimal performance and cost-efficiency. Key considerations should include supplier reliability, technological advancements, and regional market trends that influence pricing and availability.

Investing in strategic sourcing not only streamlines procurement processes but also fosters long-term partnerships with suppliers. This approach enables buyers to stay ahead of market fluctuations and gain access to cutting-edge innovations in SiC technology. By leveraging data analytics and market intelligence, businesses can anticipate future needs and mitigate risks associated with supply chain disruptions.

Looking ahead, it is crucial for buyers from Africa, South America, the Middle East, and Europe to remain agile and informed. Engaging in collaborative networks and participating in industry forums can provide valuable insights into emerging trends and technologies. As the demand for SiC polytypes continues to rise, now is the time to refine your sourcing strategies and explore new opportunities for growth. Take action today by evaluating your current suppliers and considering diversification to enhance resilience in your supply chain.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina