In today’s rapidly evolving electronics and semiconductor industries, silicon carbide (SiC) substrates have emerged as a critical material driving advancements in power devices, electric vehicles, and renewable energy solutions. For international B2B buyers, especially those operating in dynamic markets such as Africa, South America, the Middle East, and Europe, understanding the complexities of sourcing high-quality SiC substrates is essential to maintaining competitive advantage and ensuring product reliability.

This guide offers a comprehensive roadmap to mastering the global SiC substrate market. It covers everything from the fundamental types and materials of SiC substrates to advanced manufacturing processes and rigorous quality control standards. Moreover, it provides an in-depth analysis of leading suppliers worldwide, pricing trends, and key market dynamics that influence sourcing decisions.

By leveraging this resource, buyers from regions like Brazil and Italy can navigate challenges such as supply chain variability, certification requirements, and cost optimization strategies with confidence. The guide also addresses frequently asked questions, empowering procurement teams to evaluate technical specifications and vendor capabilities effectively.

Ultimately, this guide is designed to equip international B2B buyers with actionable insights and practical knowledge—enabling informed sourcing decisions that align with their strategic objectives, operational requirements, and regional market conditions. Whether you are expanding your supplier base or seeking to deepen your expertise in SiC substrates, this resource will serve as a vital tool in your global procurement arsenal.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 4H-SiC Substrate | High hardness, low defect density, semi-insulating | High-power electronics, RF devices | Pros: Excellent thermal conductivity, high breakdown voltage; Cons: Higher cost, limited wafer sizes |

| 6H-SiC Substrate | Hexagonal crystal structure, moderate resistivity | Power devices, LEDs, sensors | Pros: Good electrical properties, cost-effective; Cons: Slightly lower electron mobility than 4H-SiC |

| 3C-SiC Substrate | Cubic crystal structure, lower bandgap | MEMS, high-frequency devices, optoelectronics | Pros: Compatible with silicon, lower production cost; Cons: Higher defect density, less mature technology |

| Semi-Insulating SiC | High resistivity, electrically isolating | RF amplifiers, microwave devices | Pros: Reduces parasitic capacitance, improves device isolation; Cons: More complex fabrication, higher price |

| Epitaxial SiC | Thin SiC layer grown on substrate | High-performance power devices, sensors | Pros: Tailored electrical properties, improved device performance; Cons: Additional processing step, cost impact |

4H-SiC Substrate

4H-SiC is the most widely used polytype for high-power and high-frequency applications due to its superior electron mobility and thermal conductivity. Its low defect density ensures high device reliability, making it ideal for demanding environments such as electric vehicle power modules and industrial inverters. Buyers should prioritize wafer size availability and supplier quality certifications to ensure consistency in high-volume manufacturing.

6H-SiC Substrate

6H-SiC offers a balance between performance and cost, with moderate resistivity and stable electrical characteristics. It is commonly used in power electronics and LED manufacturing. For B2B buyers, 6H-SiC can be a cost-effective choice when the highest electron mobility is not critical. Evaluating supplier capacity for consistent doping and wafer uniformity is essential.

3C-SiC Substrate

The cubic 3C-SiC substrate is unique for its compatibility with silicon substrates, enabling integration with existing silicon-based processes. This makes it attractive for MEMS and optoelectronic applications. However, its higher defect density and less mature production technology require buyers to carefully assess vendor expertise and quality control, especially for applications demanding high reliability.

Semi-Insulating SiC

Semi-insulating SiC substrates provide high resistivity, which is crucial for isolating device components in RF and microwave applications. This reduces parasitic capacitance and enhances device performance. Buyers should consider the trade-off between improved electrical isolation and the increased complexity and cost of fabrication when selecting this substrate type.

Epitaxial SiC

Epitaxial SiC involves a thin, high-quality SiC layer grown on a substrate, enabling precise control over electrical properties tailored to specific device requirements. This is particularly valuable in advanced power devices and sensor applications. B2B purchasers should factor in the additional processing steps and associated costs, while also considering the performance gains in their end products.

Related Video: Infineon: Experience the difference of Si / SiC / GaN technology

| Industry/Sector | Specific Application of sic substrate | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-power semiconductor devices | Enhanced thermal management and efficiency, longer device lifespan | High purity and defect-free substrates; consistent thickness and size; supplier capability for large wafers |

| Automotive Electronics | Electric vehicle (EV) power modules | Improved energy efficiency, reliability under harsh conditions | Compliance with automotive quality standards; supply chain reliability; certifications for export/import |

| Renewable Energy | Photovoltaic (solar) power converters | Increased conversion efficiency and thermal stability | Customization options for substrate doping and size; scalability of supply; cost-effectiveness for large volumes |

| Telecommunications | RF and microwave devices | Superior high-frequency performance and signal integrity | Precision in electrical properties; availability of substrates with low defect density; lead times and logistics efficiency |

| Industrial Automation | High-temperature sensors and power devices | Robustness in extreme environments and improved operational uptime | Ability to meet strict thermal and mechanical specifications; supplier flexibility for tailored solutions |

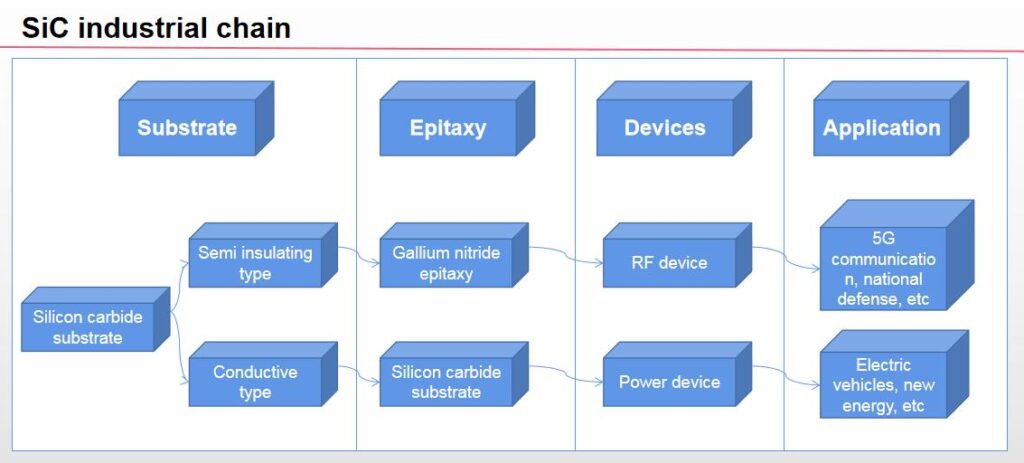

Power Electronics

Silicon carbide (SiC) substrates play a crucial role in manufacturing high-power semiconductor devices such as MOSFETs and diodes. These devices require substrates with excellent thermal conductivity and electrical properties to handle high voltages and currents efficiently. For B2B buyers in regions like Europe and South America, ensuring substrate purity and consistency is essential to maintain device performance and longevity. Buyers should prioritize suppliers offering large-diameter wafers and low defect densities to meet stringent industrial standards.

Automotive Electronics

In the rapidly growing electric vehicle (EV) market, SiC substrates are integral to power modules that improve energy efficiency and thermal management. This application demands substrates that perform reliably under extreme temperature variations and mechanical stress. B2B buyers from the Middle East and Africa must verify suppliers’ compliance with automotive quality standards such as IATF 16949, and evaluate supply chain resilience to avoid production delays in this competitive sector.

Renewable Energy

SiC substrates enhance the performance of photovoltaic power converters by enabling higher switching frequencies and better thermal handling. This results in improved energy conversion efficiency and system reliability. For international buyers, especially in Brazil and Italy, sourcing should focus on substrate customization capabilities, including doping levels and wafer size, to align with specific solar inverter designs. Cost-effectiveness and scalability are also critical due to the large volumes required in renewable energy projects.

Telecommunications

High-frequency RF and microwave devices benefit significantly from SiC substrates due to their superior electrical properties and thermal stability. These substrates support enhanced signal integrity and reduce losses in communication equipment. Buyers in Europe and the Middle East should emphasize precision in substrate electrical characteristics and low defect density to ensure optimal device performance. Additionally, evaluating lead times and logistics capabilities is vital to maintain consistent production schedules.

Industrial Automation

SiC substrates are increasingly used in sensors and power devices operating in harsh industrial environments where high temperatures and mechanical stress are common. Their robustness improves equipment uptime and reduces maintenance costs. B2B buyers from Africa and South America should seek suppliers capable of meeting strict thermal and mechanical specifications and offering flexible, tailored solutions to adapt to diverse industrial automation requirements.

Silicon carbide (SiC) substrates are critical components in high-performance electronics, power devices, and harsh environment applications. Selecting the right SiC substrate material involves balancing performance attributes, cost, and compliance with regional standards. Below is an analysis of four common SiC substrate materials, emphasizing their properties, advantages, limitations, and considerations for international B2B buyers from regions such as Africa, South America, the Middle East, and Europe.

Key Properties:

4H-SiC is the most widely used polytype for power electronics due to its wide bandgap (~3.26 eV), high electron mobility, and excellent thermal conductivity (~490 W/m·K). It supports high temperature operation (up to 600°C) and high breakdown voltage, making it ideal for high-power and high-frequency devices.

Pros & Cons:

- Pros: Superior electrical performance, high thermal stability, and well-established manufacturing processes.

- Cons: Higher manufacturing complexity and cost compared to other polytypes; requires precise crystal growth techniques.

Impact on Application:

4H-SiC is preferred for power semiconductor devices such as MOSFETs and Schottky diodes, especially in automotive, renewable energy, and industrial automation sectors. Its robustness against high voltages and temperatures makes it suitable for harsh environments and demanding applications.

International B2B Considerations:

Buyers in Europe and the Middle East often demand compliance with ASTM and IEC standards, ensuring reliability in critical infrastructure. In South America and Africa, where cost sensitivity is higher, buyers should negotiate volume pricing or explore partnerships with manufacturers offering tailored specifications. Italy and Brazil’s growing semiconductor industries may prioritize 4H-SiC for advanced power modules, emphasizing traceability and quality certifications.

Key Properties:

6H-SiC has a slightly narrower bandgap (~3.0 eV) than 4H-SiC and lower electron mobility, but it offers good mechanical strength and thermal conductivity (~490 W/m·K). It exhibits good chemical inertness and is stable under high pressure and temperature.

Pros & Cons:

- Pros: Easier to grow with fewer defects, lower cost than 4H-SiC, and excellent mechanical properties.

- Cons: Lower electrical performance limits its use in cutting-edge power electronics.

Impact on Application:

6H-SiC is often used in high-temperature sensors, substrates for LEDs, and niche power devices where extreme electrical performance is not critical. It is also favored in applications requiring robust mechanical durability.

International B2B Considerations:

For buyers in Africa and the Middle East, 6H-SiC offers a cost-effective alternative for industrial applications with moderate performance needs. Compliance with DIN and JIS standards may be required for certain export markets, especially in Europe and Japan-influenced regions. Brazil’s industrial sectors might leverage 6H-SiC for sensor and LED applications due to its balance of cost and durability.

Key Properties:

Semi-insulating SiC substrates are doped to achieve high resistivity (>10^9 Ω·cm), essential for RF and microwave device isolation. They maintain excellent thermal conductivity and mechanical strength while minimizing parasitic capacitance.

Pros & Cons:

- Pros: Enables high-frequency device performance, excellent isolation properties, and stable under high power.

- Cons: More complex doping processes increase cost and manufacturing lead time.

Impact on Application:

SI-SiC substrates are crucial in RF amplifiers, radar systems, and satellite communications. Their ability to isolate devices electrically while dissipating heat efficiently makes them indispensable in aerospace and defense industries.

International B2B Considerations:

European and Middle Eastern buyers involved in aerospace and defense sectors prioritize SI-SiC for compliance with stringent MIL-STD and IEC standards. African and South American markets may find SI-SiC suitable for emerging telecommunications infrastructure, though cost and supply chain reliability are key considerations. Buyers in Italy and Brazil should verify supplier certifications and material traceability to meet local quality assurance requirements.

Key Properties:

Epi-SiC substrates feature a thin epitaxial layer grown on a bulk SiC wafer, providing a defect-free, uniform surface for device fabrication. This enhances carrier mobility and device performance, especially for high-frequency and high-power applications.

Pros & Cons:

- Pros: Superior surface quality, improved device yield, and enhanced electrical characteristics.

- Cons: Higher production complexity and cost; requires advanced epitaxial growth equipment.

Impact on Application:

Epi-SiC substrates are preferred in high-end power electronics, RF devices, and emerging quantum computing applications. They enable devices with higher efficiency and reliability in automotive, renewable energy, and aerospace sectors.

International B2B Considerations:

Buyers from Europe and the Middle East often require epitaxial substrates for cutting-edge applications and expect compliance with ISO and IEC standards. In South America and Africa, the focus may be on balancing performance with cost; thus, buyers should assess supplier capabilities and after-sales support. Italy and Brazil’s semiconductor manufacturers may invest in Epi-SiC to enhance domestic production capabilities, emphasizing local partnerships and technology transfer.

| Material | Typical Use Case for sic substrate | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| 4H-Silicon Carbide | High-power electronics, automotive, renewable energy | High electron mobility and thermal conductivity | High manufacturing complexity and cost | High |

| 6H-Silicon Carbide | High-temperature sensors, LEDs, mechanical applications | Easier growth, good mechanical strength | Lower electrical performance | Medium |

| Semi-Insulating SiC | RF/microwave devices, aerospace, defense | Excellent electrical isolation and thermal stability | Complex doping process and higher cost | High |

| Epitaxial SiC Substrates | High-frequency power devices, quantum computing | Superior surface quality and device performance | High production complexity and cost | High |

This guide equips international B2B buyers with a clear understanding of SiC substrate materials, enabling informed decisions tailored to regional market demands, compliance requirements, and application-specific performance needs.

The production of silicon carbide (SiC) substrates involves several critical stages designed to ensure the material’s superior electrical, thermal, and mechanical properties. Understanding these stages is essential for B2B buyers to assess supplier capabilities and product quality.

The process begins with the synthesis of high-purity SiC powder. This raw material undergoes rigorous purification to eliminate metallic and non-metallic impurities that can compromise substrate performance. Suppliers often employ advanced chemical vapor deposition (CVD) or physical vapor transport (PVT) methods to grow bulk SiC crystals, with PVT being the most common technique for high-quality wafer production.

SiC substrates are typically formed by sublimation epitaxy, where SiC crystals grow from a source powder under high temperature (around 2500°C) in a controlled environment. This method produces large, defect-free single crystals known as boules. The boule is then sliced into thin wafers using diamond wire saws or laser cutting, ensuring precise thickness and minimal surface damage.

Post-slicing, wafers undergo multiple polishing stages to achieve an ultra-flat, defect-free surface with controlled roughness. Chemical-mechanical polishing (CMP) is the industry standard, balancing mechanical abrasion and chemical etching. This step is crucial for semiconductor device fabrication, as surface quality directly impacts device yield and performance.

Some suppliers offer additional assembly services, such as bonding the SiC substrate onto carriers or integrating it into device-ready packages. This step requires cleanroom conditions and precise handling to maintain the integrity of the substrate.

Quality assurance (QA) and quality control (QC) are integral to delivering SiC substrates that meet stringent industry requirements. For international B2B buyers, especially in Africa, South America, the Middle East, and Europe, understanding QC protocols and standards is key to selecting reliable suppliers.

For buyers sourcing SiC substrates internationally, robust QC verification mitigates risk and ensures product consistency.

International B2B buyers should be aware of regional regulatory and certification nuances to avoid compliance issues:

By thoroughly understanding SiC substrate manufacturing and QC practices, international B2B buyers can confidently select suppliers that deliver high-quality substrates tailored to their specific application and market needs.

When sourcing silicon carbide (SiC) substrates, understanding the underlying cost structure is critical for informed decision-making. The primary cost components include:

Several factors influence the final pricing of SiC substrates in the B2B market:

For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, the following actionable insights can optimize sourcing outcomes:

Pricing for SiC substrates can vary widely based on specifications, volumes, and supplier terms. Typical prices may range from several hundred to several thousand USD per wafer, depending on size and quality. Buyers should request detailed quotations and conduct thorough cost analyses tailored to their unique requirements.

By thoroughly understanding the cost drivers and pricing influencers, international B2B buyers can make strategic sourcing decisions that balance cost, quality, and supply chain reliability in the evolving SiC substrate market.

When sourcing silicon carbide (SiC) substrates, understanding key technical specifications is essential to ensure compatibility and performance in your applications. Here are the most important properties to consider:

Material Grade

SiC substrates come in different polytypes, most commonly 4H-SiC and 6H-SiC. The 4H polytype offers superior electron mobility and is preferred for high-frequency, high-power devices. Knowing the grade helps match substrate characteristics with device requirements, impacting efficiency and reliability.

Dimensional Tolerance

This refers to the allowable variation in substrate thickness, diameter, and flatness. Tight tolerances (e.g., ±0.01 mm in thickness) are crucial for ensuring proper device fabrication and minimizing waste. For B2B buyers, specifying tolerance ensures consistency across production batches.

Surface Finish

The substrate’s surface roughness affects epitaxial layer growth and device performance. Common finishes include polished and epi-ready surfaces. Buyers should specify surface quality based on end-use, as smoother finishes typically command higher prices but enable better device yields.

Resistivity

Resistivity defines the electrical resistance of the substrate material. Low resistivity substrates are ideal for power devices requiring high conductivity, while high resistivity substrates suit RF and microwave applications. Understanding this property helps tailor substrate choice to your product’s electrical needs.

Crystal Defect Density

This metric indicates the number of dislocations or defects per unit area in the crystal lattice. Lower defect density translates to higher device reliability and performance. Buyers should request defect density data from suppliers to assess substrate quality.

Wafer Size

SiC substrates are available in various diameters, commonly from 2 inches up to 6 inches or more. Larger wafers can reduce per-unit costs but may require compatible processing equipment. Confirm wafer size compatibility with your manufacturing capabilities before purchase.

Navigating international SiC substrate procurement involves understanding several common trade and industry terms that facilitate clear communication and smooth transactions:

OEM (Original Equipment Manufacturer)

Refers to companies that produce devices or equipment using SiC substrates. Knowing whether you are buying directly from an OEM or a supplier affects pricing, warranty, and support options.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. MOQs can vary widely and impact inventory management and cash flow. Buyers from emerging markets should negotiate MOQs to align with their production scale.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing and terms for specific SiC substrates. Crafting a detailed RFQ with technical specs and volume expectations leads to more accurate and competitive quotes.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Clarifying Incoterms upfront avoids misunderstandings and unexpected costs.

Epi-ready

A trade term describing SiC substrates prepared with a surface finish suitable for epitaxial layer growth. This term is critical for buyers involved in semiconductor manufacturing, as it impacts device quality and processing steps.

Lead Time

The duration from order placement to delivery. SiC substrates often have longer lead times due to complex manufacturing. Understanding supplier lead times helps buyers plan production schedules and manage customer expectations.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, optimize procurement strategies, and build stronger supplier relationships for SiC substrates. This knowledge is particularly valuable for businesses in diverse regions such as Africa, South America, the Middle East, and Europe, where market dynamics and logistical challenges vary significantly.

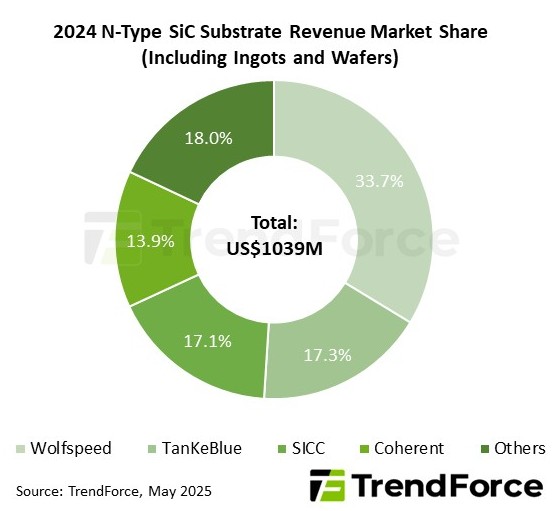

The global silicon carbide (SiC) substrate market is experiencing robust growth, driven by escalating demand in high-performance electronics, electric vehicles (EVs), and renewable energy sectors. SiC substrates offer superior thermal conductivity, high breakdown voltage, and excellent efficiency in power devices, making them indispensable for advanced applications across industries. For international B2B buyers from regions like Africa, South America, the Middle East, and Europe—especially countries such as Brazil and Italy—understanding these dynamics is critical to optimizing sourcing strategies.

Key market drivers include the accelerating adoption of EVs, where SiC-based power devices significantly improve battery efficiency and reduce energy losses. Additionally, the renewable energy sector’s shift towards more efficient power conversion systems fuels SiC substrate demand. Europe’s green energy policies and South America’s expanding solar and wind infrastructure are notable regional growth accelerators. Meanwhile, the Middle East’s increasing investment in smart grid technologies and Africa’s gradual electrification efforts also contribute to emerging demand.

Illustrative Image (Source: Google Search)

In terms of sourcing trends, B2B buyers are increasingly prioritizing suppliers offering high-quality, defect-free substrates with scalable production capabilities. The rise of automation and Industry 4.0 in SiC manufacturing enhances yield consistency and reduces lead times, a crucial factor for buyers aiming to minimize supply chain disruptions. Furthermore, strategic partnerships between SiC substrate producers and semiconductor manufacturers are shaping supply chain ecosystems, providing buyers with integrated solutions and improved cost efficiencies.

Another emerging trend is diversification of supply sources. Buyers in Africa and South America, for example, are exploring partnerships beyond traditional East Asian manufacturers, considering European and Middle Eastern suppliers to mitigate geopolitical risks and tariffs. This diversification also aligns with regional initiatives to develop local semiconductor supply chains, enhancing resilience.

Sustainability has become a pivotal consideration in the SiC substrate sector, reflecting broader global commitments to environmental stewardship. The production of SiC substrates involves energy-intensive processes, including high-temperature crystal growth and wafer slicing, which can contribute significantly to carbon emissions. For B2B buyers, particularly in regions like Europe and the Middle East where regulatory frameworks are stringent, prioritizing suppliers with robust environmental management systems is essential.

Ethical sourcing extends beyond environmental impact to include responsible labor practices and transparent supply chains. Many leading SiC substrate manufacturers are now adopting certifications such as ISO 14001 for environmental management and ISO 45001 for occupational health and safety, which provide assurance of sustainable operational standards. Buyers seeking to align with corporate social responsibility (CSR) goals should demand these certifications and audit supplier compliance regularly.

Green materials and processes are gaining traction. Innovations include using renewable energy sources in manufacturing facilities and recycling process byproducts to minimize waste. Some suppliers are also developing substrates with reduced defect densities, enhancing device efficiency and extending product lifespan, which indirectly supports sustainability by lowering replacement rates.

B2B buyers from Africa, South America, and the Middle East can leverage these sustainability credentials to meet increasing demands from end-users and regulators for environmentally responsible products. Engaging suppliers with transparent sustainability reporting and ethical sourcing policies not only mitigates reputational risks but also strengthens long-term supply chain resilience.

The evolution of SiC substrates traces back to the mid-20th century when silicon carbide was first recognized for its exceptional physical properties. Initially, SiC was used primarily as an abrasive material, but advances in crystal growth technologies during the 1980s and 1990s enabled its application in semiconductor devices. The development of high-quality, large-diameter SiC wafers was a significant milestone, facilitating their integration into power electronics.

Over the past two decades, the rise of power electronics and the shift towards energy-efficient solutions have propelled SiC substrates from niche applications to mainstream use. Continuous improvements in manufacturing processes, such as chemical vapor deposition (CVD) and physical vapor transport (PVT), have enhanced substrate quality and reduced costs, making SiC an attractive alternative to traditional silicon wafers.

For B2B buyers, understanding this historical progression underscores the technological maturity and reliability of SiC substrates today. It also highlights the ongoing innovation trajectory, suggesting that early engagement with leading suppliers can provide competitive advantages in rapidly evolving markets.

How can I effectively vet SiC substrate suppliers from diverse regions such as Africa, South America, the Middle East, and Europe?

Start by evaluating suppliers’ industry certifications (ISO 9001, IATF 16949), production capacity, and track record in international markets. Request detailed technical specifications and sample materials to verify quality firsthand. Check references or case studies related to similar B2B clients in your region. Use digital platforms and trade shows to connect and gather feedback. Prioritize suppliers with transparent communication, compliance with export regulations, and a proven ability to handle cross-border logistics efficiently.

What customization options are typically available for SiC substrates, and how should I communicate my technical requirements?

SiC substrates can be customized in terms of wafer size, thickness, doping levels, crystal orientation, and surface finish. Clearly define your end-use applications to align these parameters with performance needs. Provide detailed technical drawings, standards, or sample parts to suppliers. Engage in early technical discussions to ensure feasibility and cost implications. For international buyers, explicitly specify measurement units and tolerances to avoid misunderstandings, especially when working across different industrial standards.

What are the common minimum order quantities (MOQs) and lead times for SiC substrates, and how can I negotiate terms suitable for my market?

MOQs typically range from a few hundred to several thousand wafers depending on substrate specifications and supplier capacity. Lead times can vary from 6 to 12 weeks, influenced by customization and supply chain conditions. Buyers from emerging markets should discuss flexible MOQs and staggered deliveries to reduce inventory risks. Negotiating partial upfront payments linked to milestone deliveries can mitigate financial exposure. Establishing long-term relationships often opens doors to better pricing and lead time concessions.

Which quality assurance certifications and testing protocols should I require from SiC substrate suppliers to ensure product reliability?

Insist on suppliers holding internationally recognized certifications such as ISO 9001 for quality management and ISO/TS 16949 for automotive-grade substrates if applicable. Request documentation of electrical, mechanical, and surface characterization tests (e.g., resistivity, surface roughness, defect density). Auditing the supplier’s manufacturing process, including cleanroom standards and wafer inspection techniques, is crucial. For critical applications, consider third-party lab testing or on-site visits to validate supplier claims and ensure compliance with your quality standards.

What are the best practices for managing international logistics and shipping risks when sourcing SiC substrates?

Choose suppliers with experience in exporting to your region and who can provide reliable Incoterms (e.g., FOB, DDP) suited to your logistics capabilities. Ensure packaging protects wafers from moisture, electrostatic discharge, and mechanical damage during transit. Use reputable freight forwarders and track shipments closely. Consider customs clearance complexities, including import duties and documentation accuracy, to avoid delays. Incorporate contingency plans for potential disruptions like port congestions or geopolitical factors affecting your supply chain.

How should payment terms be structured to protect both buyer and supplier interests in international SiC substrate transactions?

Common payment methods include letters of credit, escrow accounts, or milestone-based payments to balance trust and cash flow. For first-time transactions, use secure payment channels with partial upfront deposits and balance upon delivery or inspection. Long-term buyers can negotiate net payment terms or volume discounts. Ensure contracts clearly define payment schedules, penalties for late payments, and currency exchange considerations to minimize financial risks related to currency fluctuations and international banking fees.

What steps can I take to resolve disputes or quality issues with SiC substrate suppliers in different jurisdictions?

Establish clear contract terms including dispute resolution mechanisms such as arbitration or mediation under recognized international frameworks (e.g., ICC). Maintain thorough documentation of communications, quality inspections, and delivery records. Early engagement with suppliers to discuss issues often leads to amicable solutions like rework, replacements, or refunds. Engage local trade chambers or export promotion agencies to assist with mediation if necessary. Understanding local legal environments and incorporating jurisdiction clauses in contracts are essential for enforceability.

Illustrative Image (Source: Google Search)

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of SiC substrates demands a nuanced understanding of both market dynamics and technological specifications. For B2B buyers across Africa, South America, the Middle East, and Europe, key takeaways include prioritizing supplier reliability, ensuring compliance with international quality standards, and leveraging regional partnerships to optimize cost and logistics. Given the critical role SiC substrates play in high-performance electronics and power devices, aligning procurement strategies with long-term innovation roadmaps is essential.

Value of Strategic Sourcing:

- Mitigates supply chain risks by diversifying sources and fostering transparent supplier relationships.

- Enhances cost efficiency through volume negotiation and regional sourcing hubs.

- Supports technological advancement by selecting suppliers with proven R&D capabilities and capacity for customization.

Looking ahead, the SiC substrate market is poised for robust growth, driven by increasing demand in electric vehicles, renewable energy, and 5G infrastructure. International buyers should proactively engage with emerging suppliers and invest in collaborative partnerships that emphasize sustainability and innovation. By adopting a forward-thinking sourcing strategy today, businesses in Brazil, Italy, and beyond can secure competitive advantage and resilience in this evolving landscape.

Call to Action:

Evaluate your current SiC substrate supply chain with a strategic lens—prioritize agility, quality, and supplier collaboration to unlock value and future-proof your operations in a rapidly transforming market.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina