Silicon carbide (SiC) substrates are rapidly becoming a cornerstone in advanced electronics and power device manufacturing, driving innovation across industries such as automotive, telecommunications, and renewable energy. For international B2B buyers, especially those operating in emerging and diverse markets like Africa, South America, the Middle East, and Europe, understanding the complexities of sourcing high-quality SiC substrates is essential to maintaining competitive advantage and ensuring product reliability.

This guide delivers a thorough exploration of the global SiC substrate landscape, offering actionable insights into various substrate types, material properties, and manufacturing processes. Buyers will gain clarity on critical quality control standards and how these impact long-term performance and yield. Beyond technical details, the guide navigates the global supplier ecosystem, highlighting key regional players and sourcing strategies tailored to different market conditions and logistical challenges.

Illustrative Image (Source: Google Search)

Cost considerations and market trends are also examined, enabling procurement teams to forecast pricing dynamics and identify optimal purchasing windows. Additionally, a dedicated FAQ section addresses common concerns, from certification requirements to compatibility questions, providing practical answers that support confident decision-making.

By leveraging this comprehensive resource, B2B buyers from regions such as Mexico, Argentina, the Middle East, and beyond will be empowered to make informed sourcing decisions that align with their operational goals and supply chain realities. Whether scaling production or entering new markets, this guide serves as an indispensable tool to navigate the evolving global SiC substrate market with precision and strategic insight.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard SiC Substrates | Single-crystal silicon carbide wafers, typically 4-6 inches diameter | Power electronics, high-temperature devices | Pros: High thermal conductivity, excellent electrical properties. Cons: Higher cost, limited wafer size availability. |

| Epitaxial SiC Substrates | SiC wafers with epitaxial layers for enhanced surface quality | High-performance semiconductor devices | Pros: Superior surface for device fabrication, improved device performance. Cons: Increased processing complexity, premium price. |

| Polycrystalline SiC | Aggregated SiC grains, lower purity than single-crystal | Substrates for abrasive, refractory applications | Pros: Cost-effective, good mechanical strength. Cons: Lower electrical performance, not suitable for high-end electronics. |

| 4H-SiC and 6H-SiC | Different polytypes of single-crystal SiC with varying electrical properties | Power devices, RF applications | Pros: Tailored electrical properties for specific applications. Cons: Requires precise selection based on device needs, availability varies. |

| SiC-on-Silicon Substrates | SiC layers grown on silicon wafers, combining benefits of both materials | Cost-sensitive power electronics, MEMS | Pros: Lower cost, compatibility with existing silicon processing. Cons: Thermal mismatch issues, limited high-power performance. |

Standard SiC Substrates

These are single-crystal silicon carbide wafers commonly used in high-power and high-temperature applications. Their excellent thermal conductivity and wide bandgap make them ideal for power electronics manufacturing. For international B2B buyers, especially from regions like Africa and South America where robust power solutions are critical, the key considerations include supplier reliability and wafer size availability. While cost is relatively high, the performance benefits justify the investment for industrial-grade applications.

Epitaxial SiC Substrates

Epitaxial substrates feature an additional high-quality SiC layer grown on the base wafer, enhancing surface smoothness and electrical uniformity. This type is crucial for semiconductor manufacturers targeting high-performance devices such as MOSFETs and diodes. Buyers should evaluate the epitaxial layer thickness and uniformity, which directly impact device yield. The premium pricing demands careful sourcing strategies, particularly for European and Middle Eastern buyers focusing on advanced electronics sectors.

Polycrystalline SiC

Polycrystalline substrates consist of multiple SiC grains, offering a more cost-effective alternative for non-electronic applications like abrasives or refractory materials. While they lack the electrical performance required for semiconductor devices, their mechanical robustness and lower price point make them attractive for industrial buyers with budget constraints. South American and African buyers in heavy industries may find this variation particularly advantageous for large-scale, non-electronic uses.

4H-SiC and 6H-SiC Polytypes

These are distinct single-crystal SiC polytypes, each with unique electrical properties. 4H-SiC is preferred for high-frequency and high-power devices due to its superior electron mobility, whereas 6H-SiC is used in applications with less stringent performance demands. Buyers must align polytype selection with their device specifications and ensure supplier capability for polytype consistency. This is especially relevant for European and Middle Eastern companies targeting specialized power and RF markets.

SiC-on-Silicon Substrates

This hybrid substrate combines a SiC layer grown on a silicon wafer, offering cost advantages and compatibility with existing silicon fabrication infrastructure. It suits cost-sensitive applications such as MEMS and lower-power electronics. However, buyers should be aware of thermal expansion mismatches that can affect device reliability. This type is ideal for markets in Mexico and other regions seeking a balance between performance and cost-effectiveness in power electronics manufacturing.

| Industry/Sector | Specific Application of sic substrates | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-efficiency power modules for electric vehicles and industrial drives | Enhanced thermal management and energy efficiency leading to longer device lifespan and reduced operational costs | Ensure substrate quality with high thermal conductivity and compatibility with power semiconductor devices; consider supplier certifications and lead times |

| Renewable Energy | Components in solar inverters and wind turbine converters | Improved durability and performance under high temperature and voltage conditions, enabling reliable renewable energy conversion | Source substrates with proven high-voltage insulation and thermal stability; assess supplier's capacity for volume scalability and export compliance |

| Telecommunications | RF and microwave devices for 5G infrastructure | Superior frequency performance and heat dissipation, supporting higher data throughput and network reliability | Verify substrate uniformity and low defect rates; prioritize suppliers with experience in telecom-grade materials and international logistics capabilities |

| Aerospace & Defense | High-reliability sensors and power devices for avionics | Robustness under extreme environmental conditions, reducing maintenance and failure risks | Focus on substrates with strict quality control, traceability, and compliance with aerospace standards; consider supplier's export licenses and customs expertise |

| Industrial Automation | High-temperature sensors and motor controllers in harsh environments | Increased operational reliability and reduced downtime through superior thermal and electrical performance | Evaluate substrate material consistency and supplier's technical support for customization; ensure compliance with regional industrial standards |

In power electronics, SiC substrates are pivotal for manufacturing high-efficiency power modules used in electric vehicles and industrial motor drives. Their superior thermal conductivity and ability to operate at higher voltages and temperatures solve critical challenges related to heat dissipation and energy loss. For B2B buyers in Africa, South America, the Middle East, and Europe, it is essential to source substrates that meet stringent quality standards and are compatible with the specific semiconductor devices used in these sectors. Reliable supply chains with certifications and timely delivery are key to maintaining production schedules.

SiC substrates play a crucial role in renewable energy systems, especially in solar inverter and wind turbine converter applications. Their high breakdown voltage and thermal stability enable devices to withstand harsh operating environments, ensuring consistent energy conversion efficiency. International buyers should prioritize substrates that demonstrate proven performance under fluctuating temperature and voltage conditions. Additionally, suppliers must be capable of scaling production to meet growing demands while adhering to export regulations relevant to regions like Mexico and Argentina.

The deployment of 5G infrastructure demands advanced RF and microwave components where SiC substrates provide excellent frequency performance and efficient heat dissipation. These features support higher data rates and enhanced network reliability. Buyers targeting telecommunications markets should focus on substrate uniformity and low defect levels to avoid performance degradation. Partnering with suppliers experienced in telecom-grade materials and capable of managing complex international logistics will facilitate smoother cross-border procurement.

In aerospace and defense, SiC substrates are utilized in high-reliability sensors and power devices that must perform under extreme environmental stresses such as temperature fluctuations and mechanical vibrations. These substrates enhance the robustness and longevity of avionics equipment, reducing maintenance costs and failure risks. For international B2B buyers, verifying supplier compliance with aerospace quality standards and ensuring traceability is critical. Export licenses and customs expertise are also important to navigate regulatory requirements in different regions.

SiC substrates are integral to high-temperature sensors and motor controllers employed in harsh industrial environments. Their electrical and thermal properties improve system reliability and minimize downtime. Buyers should assess substrate consistency and seek suppliers offering technical support for customization to meet specific industrial standards. Understanding regional certification requirements and ensuring supplier capability to comply with these standards will streamline procurement processes for buyers in diverse markets such as Europe and the Middle East.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

Key Properties:

Monocrystalline SiC substrates exhibit exceptional thermal conductivity (up to 490 W/m·K) and high breakdown electric field strength, making them ideal for high-power, high-frequency applications. They maintain mechanical strength at elevated temperatures (up to 1600°C) and offer excellent chemical inertness against corrosive environments.

Pros & Cons:

The uniform crystal structure ensures superior electronic performance and device reliability. However, monocrystalline SiC substrates are costly due to complex manufacturing processes like physical vapor transport (PVT) growth. Their brittleness requires careful handling and specialized machining.

Impact on Application:

These substrates are preferred in power electronics, such as high-voltage MOSFETs and Schottky diodes, where efficiency and thermal management are critical. Their resistance to harsh chemical media suits applications in chemical processing industries.

Considerations for International B2B Buyers:

Buyers from Africa, South America, the Middle East, and Europe should verify compliance with international standards like ASTM F1472 and JEDEC JESD22 for electrical and mechanical properties. In regions like Mexico and Argentina, sourcing monocrystalline SiC substrates may involve longer lead times and higher import duties, so establishing relationships with certified suppliers and understanding local customs regulations is essential.

Key Properties:

Polycrystalline SiC substrates have lower thermal conductivity (around 120-200 W/m·K) than monocrystalline but still offer high hardness and thermal stability. Their grain boundaries influence electrical characteristics, typically resulting in higher resistivity.

Pros & Cons:

These substrates are more affordable and easier to manufacture at scale, with less stringent growth conditions. However, the presence of grain boundaries can limit their use in high-performance electronic devices. They are mechanically robust but less uniform in properties.

Impact on Application:

Polycrystalline SiC is suitable for applications where cost-efficiency outweighs the need for peak electronic performance, such as in abrasive components, heating elements, or substrates for less demanding power devices.

Considerations for International B2B Buyers:

For buyers in emerging markets, polycrystalline SiC offers a balance between performance and cost. Compliance with DIN EN 61373 and ISO 9001 quality standards is common. Buyers should assess supplier certifications carefully, especially in regions with less mature supply chains, to ensure consistent product quality.

Key Properties:

This composite substrate combines a thin SiC layer epitaxially grown on a sapphire base, offering excellent electrical insulation and thermal stability. Sapphire provides high mechanical strength and chemical resistance, while the SiC layer supports device fabrication.

Pros & Cons:

SiC-on-sapphire substrates exhibit low parasitic capacitance and high-frequency performance, ideal for RF and microwave devices. The sapphire base reduces thermal conductivity compared to bulk SiC, which may limit heat dissipation. Manufacturing complexity and cost are moderate.

Impact on Application:

Ideal for RF power amplifiers, microwave circuits, and optoelectronics where insulation and frequency response are paramount. Their chemical resistance makes them suitable for harsh environments, but thermal management must be carefully designed.

Considerations for International B2B Buyers:

Buyers should ensure that sapphire substrates meet JIS R 1601 or ASTM C1503 standards, particularly in Asia-Pacific and European markets. Import regulations for sapphire materials vary, so understanding regional trade agreements can optimize procurement costs. In the Middle East and South America, local technical support for sapphire-based devices may be limited, necessitating supplier partnerships with global service networks.

Key Properties:

Epitaxial SiC substrates feature a high-quality SiC layer grown on a bulk SiC wafer, providing superior surface uniformity and controlled doping profiles. This enhances device performance in power electronics and high-temperature sensors.

Pros & Cons:

Epi-SiC substrates enable precise electronic properties and high breakdown voltages, essential for advanced semiconductor devices. However, the epitaxial growth process adds cost and requires sophisticated manufacturing infrastructure. Substrate thickness and defect density can impact yield.

Impact on Application:

Widely used in high-power transistors, diodes, and sensor applications where performance and reliability are critical. Their compatibility with existing SiC wafer sizes facilitates integration into established production lines.

Considerations for International B2B Buyers:

Buyers should prioritize suppliers adhering to JEDEC standards and ISO/TS 16949 for semiconductor materials. In Europe and the Middle East, certification for RoHS and REACH compliance is often mandatory. For African and South American markets, evaluating supplier logistics capabilities and after-sales technical support is crucial to mitigate risks associated with advanced epitaxial materials.

| Material | Typical Use Case for sic substrates | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Monocrystalline SiC | High-power electronics, high-frequency devices | Superior thermal conductivity and uniformity | High cost and brittleness | High |

| Polycrystalline SiC | Abrasive components, cost-sensitive power devices | Lower cost and easier manufacturing | Grain boundaries reduce electrical performance | Low |

| SiC-on-Sapphire | RF/microwave devices, optoelectronics | Excellent electrical insulation and frequency response | Lower thermal conductivity, moderate cost | Medium |

| Epitaxial SiC | Advanced power transistors, sensors | Precise doping and surface uniformity | Complex growth process, higher cost | High |

Silicon carbide (SiC) substrates are critical components in high-performance power electronics, demanding precise manufacturing to meet stringent industrial standards. The production of SiC substrates involves several main stages, each incorporating advanced techniques to ensure the material’s structural and electrical integrity.

1. Material Preparation

The process begins with the preparation of ultra-pure silicon carbide material. High-quality SiC powder is synthesized typically through chemical vapor deposition (CVD) or sublimation techniques, ensuring minimal impurities. Purity levels directly impact substrate performance, so suppliers invest in raw material sourcing and purification processes to maintain consistency.

2. Forming and Crystal Growth

SiC substrates are commonly produced via bulk crystal growth methods such as the Physical Vapor Transport (PVT) technique, also known as sublimation growth. This method grows large, single-crystal SiC boules under controlled temperature gradients within specialized furnaces. Precise control over temperature and ambient conditions is critical to minimize defects such as micropipes and dislocations.

3. Wafer Slicing and Assembly

Once the boule is grown, it is sliced into wafers using diamond wire saws or laser cutting tools. This stage requires careful handling to avoid introducing mechanical stresses or surface damage. Wafers then undergo lapping and grinding to achieve uniform thickness and flatness. Subsequent cleaning removes residual contaminants to prepare for further processing.

4. Finishing and Surface Treatment

Final finishing processes involve polishing the wafer surfaces to achieve nanometer-scale smoothness, essential for device fabrication. Chemical mechanical polishing (CMP) is widely used to reduce surface roughness and eliminate subsurface damage. Additional surface treatments may include epitaxial layer deposition to enhance substrate properties for specific semiconductor applications.

For international B2B buyers, understanding the quality assurance (QA) frameworks governing SiC substrates is crucial to mitigate risks and ensure product reliability.

International and Industry Standards:

- ISO 9001: The foundational quality management system standard, requiring suppliers to maintain consistent production processes, document controls, and continuous improvement practices.

- CE Marking: Relevant for substrates integrated into electronic devices sold within the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- API Standards: For industries like oil and gas, American Petroleum Institute (API) certifications may be necessary, especially if substrates are part of equipment exposed to harsh environments.

Quality control (QC) is embedded throughout the manufacturing lifecycle with distinct checkpoints:

For buyers from Africa, South America, the Middle East, and Europe, verifying supplier QC processes is essential to reduce supply chain risks and ensure compliance with local regulations.

Regional Regulatory Considerations:

- Buyers in Europe and the Middle East should prioritize suppliers compliant with CE marking and local electrical safety standards.

- In South America and Africa, where regulatory frameworks may vary, buyers should seek suppliers who can provide internationally recognized certifications and demonstrate robust traceability systems.

- For countries like Mexico and Argentina, customs and import regulations may require additional documentation such as certificates of origin and compliance declarations.

Supply Chain Transparency:

Given the complexity of SiC substrate manufacturing, international buyers must insist on clear communication regarding production lead times, batch traceability, and QC deviations. This transparency helps manage expectations and supports compliance with local quality mandates.

Risk Mitigation:

Building long-term partnerships with suppliers who invest in continuous quality improvements and have proven international audit histories reduces the risk of receiving substandard substrates. Buyers should also consider multi-source strategies to mitigate supply disruptions.

For B2B buyers targeting SiC substrates, particularly across emerging and established markets in Africa, South America, the Middle East, and Europe, a deep understanding of manufacturing processes and rigorous quality assurance frameworks is vital. Prioritizing suppliers with certified management systems, transparent QC practices, and proven testing protocols ensures procurement of substrates that meet demanding industrial applications. Leveraging audits, third-party inspections, and thorough documentation review empowers buyers to make informed sourcing decisions and secure reliable supply chains in this highly specialized sector.

Understanding the detailed cost structure behind silicon carbide (SiC) substrates is crucial for effective budgeting and negotiation. The primary cost components include:

Pricing for SiC substrates is dynamic and influenced by multiple factors beyond base costs:

For buyers in Africa, South America, the Middle East, and Europe, optimizing procurement costs while ensuring quality involves strategic considerations:

Due to market fluctuations, technological advancements, and regional economic factors, prices for SiC substrates can vary widely. The figures referenced here serve as a guideline and should be validated through direct supplier quotations tailored to your specific requirements. Always request detailed cost breakdowns and consider hidden expenses in your procurement strategy.

Illustrative Image (Source: Google Search)

When sourcing silicon carbide (SiC) substrates, understanding the core technical specifications is vital for ensuring product performance and compatibility with your manufacturing processes. Here are the key properties to consider:

Material Grade

This refers to the purity and crystalline quality of the SiC substrate. Higher grades indicate fewer defects and impurities, which directly affect the electrical performance and reliability of semiconductor devices. For B2B buyers, selecting the appropriate grade ensures product consistency and reduces failure rates in downstream applications.

Thickness and Diameter

SiC substrates come in various thicknesses and diameters, commonly ranging from 100mm to 150mm in diameter and 300 to 1000 micrometers in thickness. These dimensions must match the manufacturing equipment and design requirements. Tighter tolerances in thickness improve wafer uniformity, impacting device yield and process efficiency.

Surface Flatness and Roughness

The flatness and surface roughness impact epitaxial growth and device fabrication. Superior flatness reduces defects during layer deposition, while low roughness enables better electrical characteristics. Buyers should specify these parameters to avoid costly rework or yield loss.

Doping Type and Concentration

SiC substrates can be doped as n-type or p-type, influencing their electrical conductivity. The doping concentration affects device behavior such as breakdown voltage and carrier mobility. Accurate specification ensures compatibility with the intended semiconductor device design.

Crystal Orientation

The crystallographic orientation (e.g., 4H-SiC or 6H-SiC) affects the electrical and mechanical properties of the substrate. 4H-SiC is most common for power devices due to its superior electron mobility. Confirming the correct orientation helps optimize device performance.

Tolerance Levels

Manufacturing tolerances for dimensions and properties must be tightly controlled. Buyers should request detailed tolerance specifications to ensure substrates meet their quality standards and integrate seamlessly into production.

Navigating international B2B transactions requires familiarity with key trade terms frequently used in the semiconductor substrate market:

OEM (Original Equipment Manufacturer)

Refers to companies that produce the final products using SiC substrates. Understanding whether your supplier works directly with OEMs can indicate product quality and reliability.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. For international buyers, especially from emerging markets, negotiating MOQ can help manage inventory costs and reduce financial risk.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and terms. Preparing a detailed RFQ with technical specs and volume expectations helps suppliers provide accurate and competitive offers.

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities for shipping, insurance, and customs duties. Familiarity with Incoterms like FOB (Free on Board) or DDP (Delivered Duty Paid) is crucial for clear contract negotiation and cost management.

Lead Time

The period from order placement to delivery. SiC substrates may have long lead times due to complex manufacturing, so understanding and negotiating realistic lead times is key for supply chain planning.

Yield

The percentage of usable substrates from a production batch. High yield rates reduce costs and improve supply reliability. Buyers should inquire about supplier yield performance to assess quality consistency.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, optimize procurement strategies, and build stronger supplier partnerships in the competitive SiC substrate market.

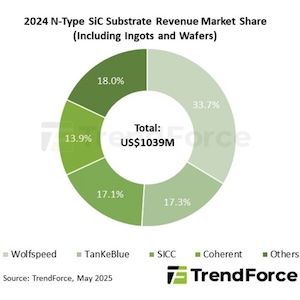

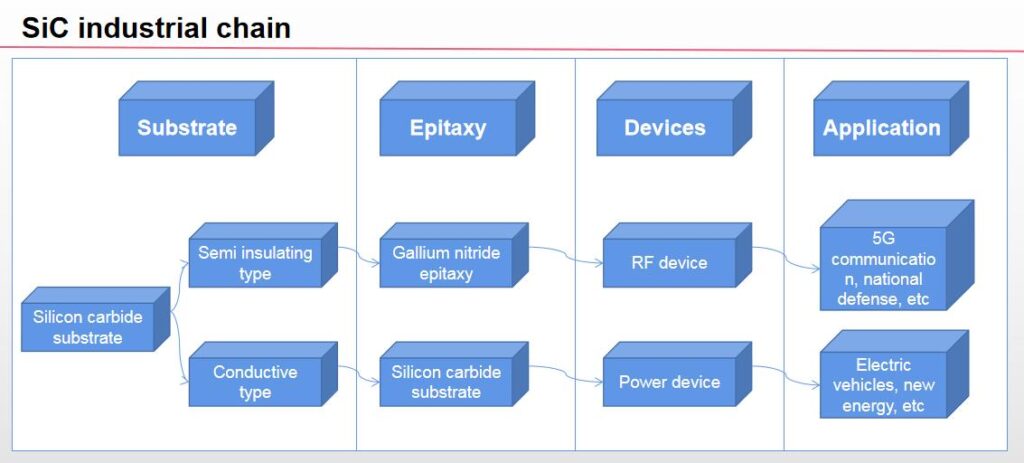

The silicon carbide (SiC) substrates market is experiencing robust growth driven by increasing demand across high-performance electronics, electric vehicles (EVs), renewable energy systems, and industrial power devices. SiC substrates offer superior thermal conductivity, high breakdown voltage, and efficiency at high temperatures, making them essential for next-generation power semiconductors. For international B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding these global drivers is critical for strategic sourcing and supply chain optimization.

Key market dynamics include a shift toward localized manufacturing and diversification of suppliers to reduce dependency on traditional hubs in Asia and North America. Countries like Mexico and Argentina are emerging as promising markets due to their growing semiconductor manufacturing capabilities and favorable trade policies. Additionally, buyers are increasingly prioritizing suppliers that can offer customization and technical collaboration to meet specific application requirements in automotive, industrial, and telecom sectors.

Emerging sourcing trends highlight digital integration in procurement processes, with platforms enabling real-time inventory visibility, quality certifications, and logistics tracking. This is particularly valuable for buyers operating in regions with complex import regulations or logistical challenges. Furthermore, long-term supplier partnerships are favored over transactional engagements to ensure supply continuity amid geopolitical uncertainties and raw material price volatility.

Sustainability is becoming a pivotal consideration in the SiC substrates supply chain, driven by regulatory pressures and corporate responsibility commitments worldwide. The environmental impact of SiC substrate production—particularly energy consumption and waste management—requires attention from B2B buyers aiming to align with global sustainability goals.

Ethical sourcing practices encompass ensuring transparency in raw material extraction, minimizing hazardous waste, and adopting energy-efficient manufacturing processes. Buyers from Africa, South America, the Middle East, and Europe increasingly demand certifications such as ISO 14001 (Environmental Management), RoHS (Restriction of Hazardous Substances), and emerging “green” labels specifically tailored to semiconductor materials. These certifications provide assurance of compliance with environmental standards and social responsibility.

Furthermore, some suppliers are investing in circular economy initiatives, including recycling scrap SiC material and reducing carbon footprints via renewable energy use in fabs. For B2B buyers, partnering with suppliers that demonstrate verifiable sustainability practices can enhance brand reputation, meet regulatory requirements, and mitigate risks associated with environmental non-compliance.

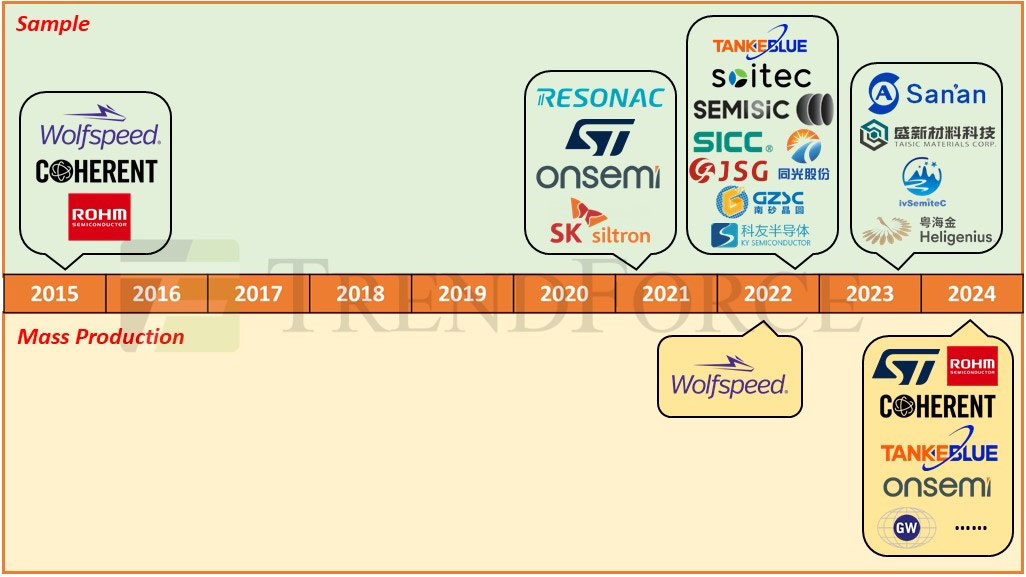

The development of SiC substrates has evolved significantly since the 1980s, originally limited by high production costs and technical challenges in crystal growth and wafer fabrication. Advances in chemical vapor deposition (CVD) and sublimation techniques have dramatically improved yield, wafer size, and quality, enabling mass production.

Historically, SiC substrates were niche products used primarily in military and aerospace applications. However, the rise of power electronics and renewable energy technologies in the 21st century expanded their commercial relevance. For B2B buyers, understanding this evolution highlights the increasing maturity and reliability of SiC substrates, supporting their integration into mainstream industrial applications and justifying the investment in these advanced materials.

How can I effectively vet suppliers of SiC substrates from diverse international markets?

To vet SiC substrate suppliers, start by verifying their certifications such as ISO 9001 and industry-specific quality standards. Request detailed product datasheets and inquire about their R&D capabilities. Cross-check references from existing international clients, especially those in your region or industry. Conduct factory audits or third-party inspections if feasible. Evaluate their supply chain resilience, including raw material sourcing and manufacturing capacity. For buyers in Africa, South America, the Middle East, and Europe, understanding local trade compliance and import regulations tied to the supplier’s country is crucial to avoid logistical or customs delays.

What customization options are typically available for SiC substrates, and how should I communicate my technical requirements?

SiC substrates can be customized by dimensions, doping levels, crystal orientation, and surface finish to suit specific electronic applications. Clearly define your technical specifications in detail, including tolerances and intended use cases, to ensure the supplier understands your needs. Providing drawings, reference samples, or industry standards can help minimize miscommunication. Establishing a technical liaison or engineering contact at the supplier’s end is beneficial for iterative feedback. For international buyers, clarify expectations upfront to avoid costly redesigns or delays due to differences in technical standards across regions.

Illustrative Image (Source: Google Search)

What are the typical minimum order quantities (MOQs) and lead times for SiC substrates, and how can I negotiate favorable terms?

MOQs for SiC substrates vary widely depending on supplier scale and customization level, often ranging from a few hundred to several thousand units. Lead times can extend from 6 to 16 weeks due to complex crystal growth and processing. To negotiate better terms, consider consolidating orders with other buyers or committing to longer-term contracts. Discuss flexible MOQs or phased deliveries, especially if entering new markets like Africa or South America. Transparent communication about your demand forecast helps suppliers optimize production schedules, potentially reducing lead times and costs.

What payment terms and methods are commonly accepted in international SiC substrate transactions?

Suppliers usually accept payment methods such as wire transfers, letters of credit (LC), and increasingly, escrow services for added security. Payment terms often include a deposit (30-50%) upfront with the balance upon shipment or delivery. For buyers in emerging markets, negotiating partial payments tied to milestone achievements (e.g., sample approval, production start) can mitigate risk. Utilizing internationally recognized payment platforms and ensuring compliance with foreign exchange regulations in your country facilitates smooth transactions. Establish clear contract terms regarding currency fluctuations and payment timelines to avoid disputes.

How can I ensure the quality of SiC substrates before finalizing large international orders?

Request product samples and third-party test reports covering parameters such as crystal purity, defect density, and electrical properties. Insist on witnessing or reviewing results of in-line quality control processes like wafer mapping and surface inspections. For significant orders, consider third-party inspection services or on-site audits. Establish clear quality acceptance criteria in contracts to hold suppliers accountable. Additionally, working with suppliers that have certifications like IATF 16949 or compliance with automotive or semiconductor standards adds confidence. Pre-shipment inspections reduce the risk of costly rejections or returns upon arrival.

What certifications should I look for to verify the reliability and compliance of SiC substrate suppliers?

Look for internationally recognized certifications such as ISO 9001 for quality management and ISO 14001 for environmental management. Specific certifications like IATF 16949 (automotive quality) or compliance with JEDEC standards demonstrate suitability for high-reliability electronics. Suppliers compliant with RoHS and REACH directives ensure chemical and environmental safety, which is critical for European buyers. For markets like the Middle East and South America, verify if suppliers meet local regulatory or industry-specific standards. Request documentation for all certifications and periodically audit compliance to maintain supply chain integrity.

What are the best practices for managing logistics and customs when importing SiC substrates internationally?

Partner with freight forwarders experienced in handling sensitive semiconductor materials and familiar with your region’s import regulations. Ensure proper packaging to prevent damage from moisture, static, or mechanical stress. Understand tariff classifications and applicable duties to accurately estimate landed costs. Prepare all necessary documentation, including commercial invoices, certificates of origin, and compliance declarations, to expedite customs clearance. For buyers in Africa or South America, anticipate longer customs processing times and consider bonded warehousing solutions. Establish clear Incoterms in contracts to define responsibilities and risk transfer points.

How should I approach dispute resolution if quality or delivery issues arise with an international SiC substrate supplier?

Include detailed dispute resolution clauses in contracts specifying governing law, jurisdiction, and preferred arbitration bodies. Promptly document and communicate issues with evidence such as inspection reports or photos. Engage in direct negotiation or mediation to seek amicable solutions before escalating to formal procedures. Leverage trade credit insurance or payment holdbacks to mitigate financial exposure. Building strong relationships with suppliers often facilitates faster resolution. For cross-border disputes, understanding local legal frameworks and working with trade experts or legal counsel familiar with international B2B contracts is essential to protect your interests.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Effective sourcing of SiC substrates is a critical enabler for companies seeking to excel in power electronics, automotive, and renewable energy sectors. For B2B buyers in Africa, South America, the Middle East, and Europe, adopting a strategic sourcing approach unlocks multiple benefits: access to high-quality materials, cost optimization, supply chain resilience, and alignment with emerging technology standards. Prioritizing suppliers with proven expertise, robust quality certifications, and strong logistical capabilities will mitigate risks and ensure consistent product performance.

Key takeaways for international buyers include:

- Conduct thorough supplier due diligence focusing on quality, lead times, and scalability.

- Leverage regional trade agreements and logistics hubs to reduce costs and improve delivery reliability.

- Engage in long-term partnerships to foster innovation and secure preferential pricing.

- Stay informed on technological advancements and evolving market dynamics to anticipate future demand shifts.

Looking ahead, the SiC substrate market is poised for significant growth driven by expanding electric vehicle adoption and renewable energy investments globally. Buyers who proactively integrate strategic sourcing principles will not only optimize procurement outcomes but also position their businesses for sustainable competitive advantage. We encourage international buyers to deepen supplier collaborations and continuously refine sourcing strategies to capitalize on upcoming opportunities in this dynamic sector.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina