Silicon carbide (SiC) has emerged as a pivotal material in advancing high-performance applications across industries such as automotive, electronics, energy, and aerospace. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe, sourcing reliable SiC suppliers is critical to maintaining competitive advantage and ensuring product excellence. The increasing demand for SiC components—driven by their superior thermal conductivity, high voltage resistance, and durability—makes informed supplier selection a strategic priority.

This guide is designed to empower procurement professionals and decision-makers by delivering a comprehensive overview of the global SiC supplier landscape. It covers essential aspects including the various types of silicon carbide materials, manufacturing processes, and quality control standards that differentiate top-tier suppliers. Additionally, it provides insights into cost structures, regional market dynamics, and supplier evaluation criteria tailored to international buyers’ specific needs.

By exploring detailed supplier profiles, understanding production capabilities, and addressing common sourcing challenges, this resource equips buyers from Argentina, Turkey, and other key regions with the knowledge to navigate complexities in cross-border procurement. Whether you are seeking to optimize supply chain resilience or enhance product performance, this guide offers actionable strategies to identify trusted SiC suppliers and negotiate effectively in a competitive global marketplace.

Illustrative Image (Source: Google Search)

Key benefits of this guide include:

With this foundation, international buyers can make confident, data-driven decisions that align with their operational goals and market demands.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Manufacturer Direct | Supplies come straight from the product manufacturer | Large-scale industrial procurement, OEMs | Pros: Lower cost, direct quality control; Cons: Higher MOQ, less flexibility |

| Distributor/Wholesaler | Acts as intermediary, stocking multiple brands/products | Retailers, resellers, regional supply chains | Pros: Variety, smaller order quantities; Cons: Higher unit prices, potential delays |

| Value-Added Reseller (VAR) | Enhances base products with customization or services | Customized solutions, integrated systems | Pros: Tailored offerings, technical support; Cons: Premium pricing, longer lead times |

| Online SIC Marketplaces | Digital platforms aggregating multiple SIC suppliers | SMEs, startups, global sourcing | Pros: Convenience, competitive pricing; Cons: Quality variability, less negotiation leverage |

| Specialized SIC Suppliers | Focus on niche SIC products or advanced tech variants | High-tech industries, R&D, specialized applications | Pros: Cutting-edge products, expert support; Cons: Higher cost, limited availability |

Manufacturer Direct suppliers provide SIC materials straight from the production source, ensuring authenticity and consistent quality. This type is ideal for large enterprises or OEMs requiring bulk orders and strict compliance with technical standards. Buyers should consider minimum order quantities (MOQs) and lead times, as manufacturers typically demand larger commitments. For B2B buyers in regions like Africa or South America, direct sourcing can reduce costs but may require robust logistics planning.

Distributor/Wholesaler suppliers act as intermediaries stocking multiple SIC product lines, which benefits buyers seeking flexibility and variety without committing to large volumes. This model suits regional retailers or companies needing diverse SIC components for varied applications. While unit prices may be higher than direct sourcing, distributors often provide faster delivery and localized support, crucial for buyers in emerging markets with complex supply chains.

Value-Added Resellers (VARs) differentiate themselves by offering customized SIC solutions, integrating additional services such as assembly, testing, or technical consulting. This type appeals to buyers requiring tailored products or integrated systems, especially in sectors like telecommunications or automotive. The trade-off includes premium pricing and longer delivery times, but the added value often justifies the investment for companies needing specialized expertise.

Online SIC Marketplaces have gained traction by aggregating multiple suppliers into a single digital platform, enabling SMEs and startups to access global SIC inventories conveniently. Buyers benefit from competitive pricing and streamlined procurement processes. However, quality assurance can be inconsistent, and negotiation flexibility is limited compared to traditional channels. Buyers should leverage platform reviews and certifications to mitigate risks.

Specialized SIC Suppliers focus on niche or advanced silicon carbide variants, catering to high-tech industries such as renewable energy, aerospace, or semiconductor manufacturing. These suppliers offer cutting-edge products and expert technical support but typically at higher costs and with limited availability. B2B buyers from technologically advanced sectors or R&D departments will find these suppliers essential for innovation-driven projects, where performance outweighs price sensitivity.

| Industry/Sector | Specific Application of sic suppliers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-performance semiconductor devices | Improved energy efficiency, thermal management, and device longevity | Supplier reliability, material purity, compliance with international standards, and lead times for bulk orders |

| Automotive | Electric vehicle (EV) power modules and inverters | Enhanced power density and durability under harsh conditions | Consistency in quality, scalability of supply, and technical support for integration |

| Industrial Manufacturing | Abrasives and cutting tools | Increased tool life, precision, and reduced downtime | Quality certifications, customization options, and shipment logistics for heavy goods |

| Renewable Energy | Components for solar inverters and wind turbine electronics | Higher efficiency and robustness in extreme environments | Supplier innovation capabilities, after-sales support, and compliance with regional regulations |

| Aerospace & Defense | High-temperature and high-voltage components | Reliability under extreme operating conditions, reduced failure rates | Stringent quality assurance, traceability, and adherence to international aerospace standards |

Silicon carbide (SiC) suppliers play a pivotal role in the power electronics industry by providing high-performance semiconductor materials used in devices such as diodes, MOSFETs, and power modules. These components enable improved energy efficiency and superior thermal management, which are critical for industrial power converters and grid infrastructure. For international B2B buyers, particularly in regions with emerging energy sectors like Africa and South America, sourcing from reliable SiC suppliers ensures consistent device performance and longevity, reducing costly downtime.

In the automotive sector, SiC materials are fundamental for electric vehicle (EV) power modules and inverters. SiC-based components allow EVs to achieve higher power density and better thermal endurance, which translates to longer range and enhanced durability under demanding conditions. Buyers from markets such as Turkey and the Middle East should prioritize suppliers offering scalable production and rigorous quality control to meet the growing demand for EV manufacturing, while also ensuring technical collaboration for seamless integration.

SiC is widely used in abrasives and cutting tools within industrial manufacturing, providing superior hardness and wear resistance. This results in longer tool life and greater precision, reducing downtime and maintenance costs. B2B buyers in Europe and South America should focus on suppliers who offer certified quality assurance and customization to match specific manufacturing needs. Efficient logistics and handling of bulk shipments are also crucial for maintaining uninterrupted production lines.

Renewable energy applications, including solar inverters and wind turbine electronics, benefit significantly from SiC components due to their ability to operate efficiently in extreme environmental conditions. This leads to improved system reliability and energy conversion efficiency. Buyers in Africa and the Middle East, regions with expanding renewable infrastructure, must consider suppliers with strong R&D capabilities and compliance with local regulatory frameworks to ensure long-term sustainability and performance.

In aerospace and defense, SiC is essential for high-temperature and high-voltage electronic components that must perform reliably under harsh conditions. The material’s robustness reduces failure rates and enhances operational safety. International buyers, especially from Europe and the Middle East, need to engage with suppliers who adhere to stringent aerospace quality standards and provide full traceability, ensuring compliance with global defense procurement requirements.

Key Properties: Silicon Carbide ceramics exhibit exceptional hardness, high thermal conductivity, and outstanding resistance to thermal shock and wear. They maintain structural integrity at temperatures exceeding 1600°C and offer excellent corrosion resistance, particularly against acidic and alkaline environments.

Pros & Cons: SiC ceramics are highly durable and ideal for abrasive and high-temperature applications. However, their manufacturing complexity can lead to higher costs and longer lead times. The brittleness of SiC ceramics requires careful handling during processing and assembly.

Impact on Application: SiC ceramics are well-suited for components exposed to extreme thermal and mechanical stress, such as seals, bearings, and heat exchangers. Their chemical inertness makes them compatible with aggressive media like molten salts and corrosive chemicals.

International Buyer Considerations: Buyers from regions like Africa, South America, the Middle East, and Europe should verify compliance with ASTM C799 and DIN EN 60672 standards for ceramic materials. In markets such as Argentina and Turkey, adherence to these standards ensures compatibility with local industrial equipment and regulatory frameworks. Additionally, sourcing from suppliers with ISO 9001 certification can assure quality consistency.

Key Properties: SiC composites combine silicon carbide fibers with a SiC matrix, offering enhanced toughness and damage tolerance compared to monolithic SiC ceramics. They maintain excellent thermal stability (up to 1400°C) and have superior resistance to oxidation and corrosion.

Pros & Cons: The composite structure improves fracture resistance and impact strength, making it suitable for dynamic and cyclic loading conditions. However, the production process is more complex and costly, requiring advanced fabrication techniques like chemical vapor infiltration (CVI).

Impact on Application: Ideal for aerospace, automotive, and power generation sectors where lightweight, high-strength materials are critical. Their resistance to oxidation and thermal fatigue makes them suitable for turbine components and heat exchangers.

International Buyer Considerations: For buyers in the Middle East and Europe, compliance with ASTM C1670 and JIS R 1601 ensures material reliability. Given the high cost, buyers should assess total lifecycle value, including maintenance savings. Import regulations and tariffs in South American countries like Argentina may affect pricing and delivery timelines, so engaging suppliers with regional distribution networks is advantageous.

Key Properties: This material involves a metal substrate (often stainless steel or Inconel) coated with a thin layer of silicon carbide to enhance surface hardness, corrosion resistance, and thermal stability. The coating typically withstands temperatures up to 1200°C and provides excellent resistance to wear and chemical attack.

Pros & Cons: Coated metals combine the mechanical strength and ductility of metals with the protective properties of SiC. The coating process can be cost-effective compared to bulk ceramics but may suffer from adhesion issues under extreme mechanical stress or thermal cycling.

Impact on Application: Widely used in pump components, valves, and piping systems where corrosion resistance and mechanical strength are both required. The coating enables metal parts to operate in harsh chemical environments without significant degradation.

International Buyer Considerations: Buyers should ensure coating thickness and quality meet ASTM B487 and DIN 50939 standards. In regions like Africa and the Middle East, where industrial environments can be particularly harsh, verifying supplier testing protocols for adhesion and corrosion resistance is critical. Additionally, compatibility with local welding and fabrication practices should be confirmed.

Key Properties: PC-SiC is a dense, polycrystalline form of silicon carbide with high hardness, excellent wear resistance, and good thermal conductivity. It typically withstands temperatures up to 1600°C and exhibits strong resistance to oxidation and chemical corrosion.

Pros & Cons: PC-SiC offers a balance between cost and performance, being less expensive than single-crystal SiC while maintaining high durability. However, it is more brittle than composites and may not perform as well under impact or cyclic loads.

Impact on Application: Commonly used in mechanical seals, kiln furniture, and abrasive environments. Its chemical resistance makes it suitable for handling corrosive fluids in chemical processing industries.

International Buyer Considerations: Compliance with ASTM C712 and JIS R 1601 standards is essential for buyers in Europe and South America to ensure material performance. For African markets, where supply chain reliability can be variable, selecting suppliers with proven logistics capabilities and after-sales support is beneficial. Also, buyers should consider local environmental regulations impacting material disposal or recycling.

| Material | Typical Use Case for sic suppliers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) Ceramic | High-temperature seals, bearings, wear parts | Exceptional thermal and chemical resistance | Brittleness and higher manufacturing complexity | High |

| Silicon Carbide Composite (SiC/SiC) | Aerospace components, turbine parts | Enhanced toughness and thermal stability | Complex, costly fabrication process | High |

| Silicon Carbide Coated Metals | Pumps, valves, piping in corrosive environments | Combines metal strength with SiC protection | Potential coating adhesion issues | Medium |

| Polycrystalline Silicon Carbide (PC-SiC) | Mechanical seals, kiln furniture, abrasive parts | Balanced cost and high wear resistance | More brittle than composites | Medium |

Silicon Carbide (SiC) manufacturing is a highly specialized process that demands precision and stringent control at every stage. Understanding these stages is crucial for B2B buyers, especially those sourcing internationally from regions such as Africa, South America, the Middle East, and Europe, to assess supplier capabilities and ensure product reliability.

The foundation of quality SiC products lies in the preparation of raw materials. High-purity silicon and carbon sources are carefully selected and mixed. Suppliers often use advanced refining techniques to minimize impurities that could compromise electrical and thermal properties. This stage involves:

SiC components are typically formed using methods that influence microstructure and mechanical properties. Common forming techniques include:

For complex SiC products, especially power electronics or semiconductor devices, assembly involves combining SiC substrates with other materials such as metals or ceramics. This stage requires:

Final finishing ensures the product meets functional and aesthetic standards:

B2B buyers must prioritize suppliers with robust quality assurance (QA) systems aligned to international and industry-specific standards. This assures consistency, safety, and regulatory compliance across global markets.

Depending on the application, suppliers may also adhere to standards such as:

Effective QC involves systematic checks at multiple production phases:

Illustrative Image (Source: Google Search)

For buyers in Africa, South America, the Middle East, and Europe, due diligence is essential to mitigate risks and secure high-quality SiC products.

International buyers face unique challenges due to varying regulatory landscapes and market expectations.

For international B2B buyers sourcing SiC components, a deep understanding of manufacturing processes and quality assurance practices is critical. Prioritize suppliers who demonstrate:

Such diligence ensures procurement of reliable, high-performance SiC products that meet the stringent demands of global industrial applications.

When evaluating SIC (Silicon Carbide) suppliers, a detailed understanding of the cost structure is critical for making informed purchasing decisions. The total price you pay typically comprises several key components:

Pricing is not static and is influenced by several variables that international buyers should carefully assess:

For B2B buyers from Africa, South America, the Middle East, and Europe, strategic approaches can optimize sourcing costs and value:

The prices and cost components discussed are indicative and vary widely depending on supplier, order specifics, and global market conditions. Buyers are advised to request detailed quotations and perform comprehensive due diligence tailored to their unique sourcing scenarios.

By systematically analyzing these cost and pricing factors, international B2B buyers can better navigate the complexities of SIC supplier sourcing, negotiate effectively, and optimize their procurement strategies for long-term success.

When sourcing Silicon Carbide (SiC) materials or components from suppliers, understanding the critical technical properties and common trade terminology is essential for making informed purchasing decisions. This knowledge helps international B2B buyers—particularly from regions like Africa, South America, the Middle East, and Europe—navigate supplier offerings confidently and negotiate effectively.

Material Grade

SiC comes in various grades depending on purity, crystal structure, and intended application. Common grades include alpha (α-SiC) and beta (β-SiC), with alpha being more stable and widely used in industrial applications. The grade affects performance characteristics like thermal conductivity and hardness. For buyers, specifying the correct grade ensures compatibility with your manufacturing process and final product quality.

Particle Size and Distribution

The particle size of SiC powder or grit influences surface finish, machining precision, and sintering behavior. Suppliers often provide size ranges in microns. Uniform particle distribution leads to consistent product performance, while a broad size distribution can affect mechanical properties. Understanding this helps buyers select materials suited for applications such as abrasives, ceramics, or semiconductors.

Tolerance and Dimensional Accuracy

For SiC components like wafers or mechanical parts, tight dimensional tolerances are critical. Tolerance indicates the allowable deviation from specified dimensions, usually measured in micrometers. Accurate tolerances ensure parts fit correctly in assemblies and meet operational requirements, reducing waste and rework.

Thermal Conductivity

SiC’s ability to conduct heat efficiently makes it valuable in high-temperature and electronic applications. Thermal conductivity is measured in watts per meter-kelvin (W/m·K). Buyers should confirm this property matches their application needs, especially when sourcing SiC for heat sinks or power devices.

Illustrative Image (Source: Google Search)

Electrical Resistivity

This property indicates how strongly SiC resists electric current. Depending on whether the SiC is used as a semiconductor or an insulator, resistivity requirements vary. Specifying the correct resistivity ensures functionality in electronic components or devices.

Purity Level

The chemical purity of SiC affects performance, particularly in semiconductor and optical applications. High purity reduces defects and enhances reliability. Buyers should verify purity specifications, often expressed as a percentage or parts per million (ppm) of impurities.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment that may be marketed by another manufacturer. When dealing with SiC suppliers, understanding if they serve OEMs helps gauge product quality and volume capabilities, as OEM-grade SiC typically meets stringent standards.

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier is willing to sell per order. MOQs vary widely based on product type and supplier capabilities. For buyers in emerging markets or smaller businesses, negotiating MOQs can optimize inventory costs and reduce upfront investment.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and terms based on detailed product specifications. Preparing a clear RFQ with technical property requirements accelerates supplier response and ensures accurate quotations.

Incoterms (International Commercial Terms)

Standardized terms defining responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Understanding these terms helps buyers control logistics costs and risks, especially in international trade.

Lead Time

The time from order placement to delivery. SiC products, especially custom grades or components, may have longer lead times. Buyers should factor this into supply chain planning to avoid production delays.

Certification and Compliance

Many suppliers provide certifications (e.g., ISO 9001, REACH compliance) that verify quality management and regulatory adherence. For international buyers, these certifications facilitate customs clearance and ensure product safety standards are met.

By mastering these technical properties and trade terms, B2B buyers can better evaluate SiC suppliers, negotiate contracts, and align product specifications with operational needs. This clarity reduces procurement risks and supports successful long-term supplier partnerships across diverse international markets.

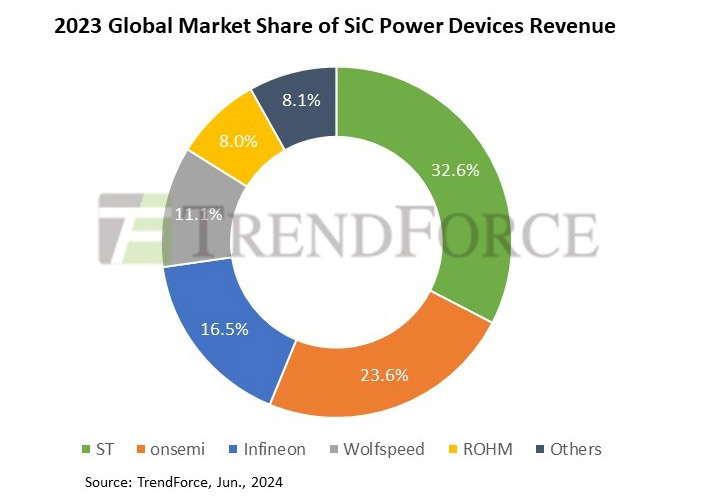

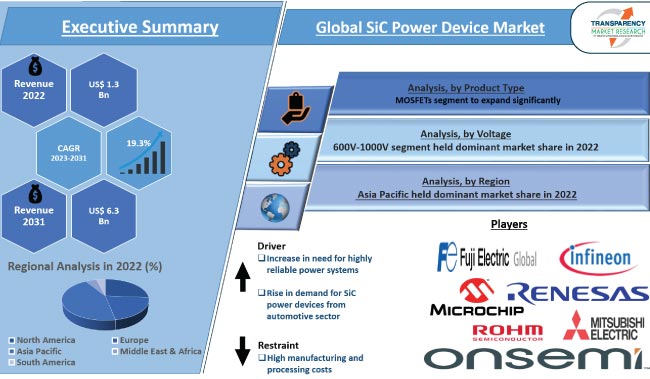

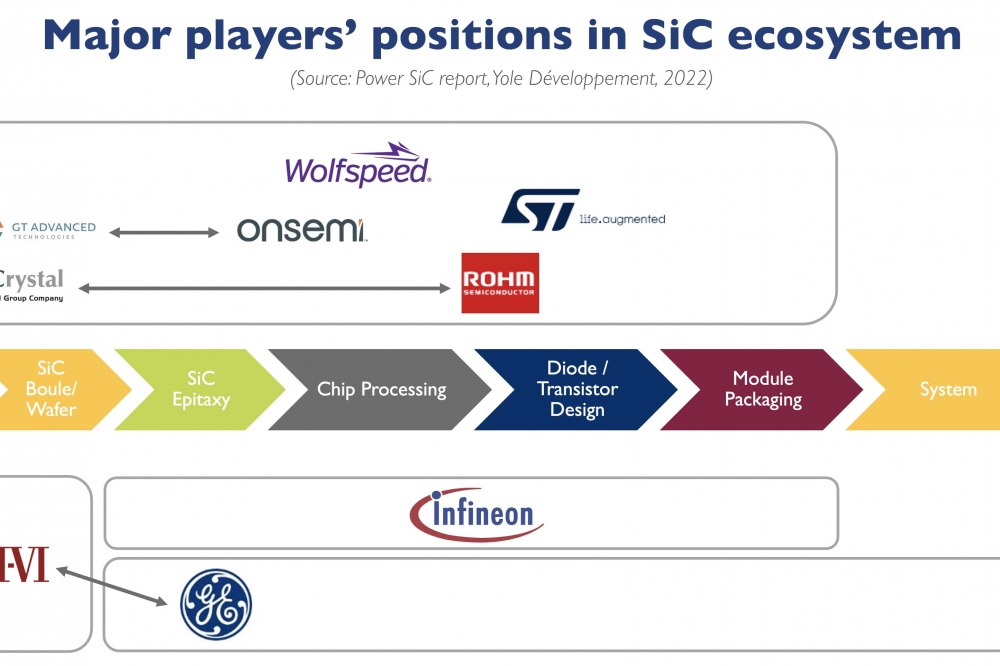

The global market for silicon carbide (SiC) suppliers is experiencing robust growth driven by rapid advancements in electric vehicles (EVs), renewable energy systems, and industrial automation. SiC’s superior properties—such as high thermal conductivity, breakdown electric field strength, and efficiency at high voltages—make it a critical material in power electronics, especially for high-performance applications. This trend is particularly relevant for B2B buyers in regions like Africa, South America, the Middle East, and Europe, where infrastructure modernization and energy transition efforts are gaining momentum.

For international buyers in countries like Argentina and Turkey, sourcing SiC components involves navigating a market characterized by increasing competition among suppliers in North America, Europe, and Asia. Emerging B2B sourcing trends include strategic partnerships with manufacturers to ensure supply chain resilience and access to cutting-edge SiC technologies. Digital procurement platforms and blockchain-based traceability solutions are becoming essential tools to enhance transparency, reduce lead times, and manage costs effectively.

Another significant dynamic is the growing emphasis on customization and technical support. Buyers are seeking suppliers that can offer tailored SiC solutions aligned with specific application requirements, such as power modules for EV chargers or high-frequency devices for telecommunications. This demand is driving suppliers to expand R&D capabilities and invest in flexible manufacturing processes.

Additionally, the geopolitical landscape and trade policies, especially tariffs and export controls, influence sourcing decisions. Buyers from the Middle East and Europe are increasingly focusing on regional sourcing hubs to mitigate risks associated with global supply disruptions. In summary, understanding these market dynamics and leveraging technology-driven sourcing strategies are essential for B2B buyers aiming to secure competitive advantages in the SiC sector.

Sustainability is becoming a pivotal consideration in the SiC supply chain due to the environmental impact associated with raw material extraction and energy-intensive manufacturing processes. For B2B buyers, especially those operating in markets with stringent environmental regulations like the European Union, integrating sustainability criteria into supplier selection is no longer optional but a strategic imperative.

Ethical sourcing in the SiC sector involves ensuring that raw materials, such as silicon and carbon precursors, are obtained without contributing to environmental degradation or social injustices. Buyers should prioritize suppliers who demonstrate compliance with internationally recognized standards like ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety). Moreover, certifications such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) are critical indicators of a supplier’s commitment to safe and sustainable production.

Green materials and energy-efficient manufacturing technologies are gaining traction. For instance, suppliers adopting renewable energy sources in their fabrication plants or utilizing waste heat recovery systems can significantly reduce the carbon footprint of SiC products. Buyers from regions with increasing ESG (Environmental, Social, and Governance) investment mandates, such as Europe and South America, should actively engage suppliers on their sustainability roadmaps.

In practical terms, international buyers can implement sustainability audits and request transparent reporting on carbon emissions and resource usage. Collaborating with suppliers on lifecycle assessments and circular economy initiatives—such as recycling SiC wafers and reducing hazardous waste—further enhances supply chain sustainability while mitigating long-term risks and costs.

The silicon carbide industry has evolved from niche applications in abrasives and refractory materials to becoming a cornerstone of modern power electronics. Initially developed in the early 20th century, SiC technology gained momentum in the 1980s with advancements in crystal growth methods like the physical vapor transport (PVT) process, enabling higher purity and larger wafer sizes.

Over the past two decades, the surge in demand for energy-efficient semiconductors has accelerated innovation and expanded the supplier base globally. Early dominance by Japanese and American firms has been challenged by emerging players in Europe and Asia, creating a more diversified and competitive market. For international B2B buyers, this evolution means greater access to advanced SiC products and a broader range of sourcing options tailored to specific industrial needs.

The continuous improvement in SiC manufacturing technologies, such as epitaxial growth and device fabrication, has driven down costs and improved performance, making SiC increasingly viable for mass-market applications. This historical progression underscores the importance for buyers to stay informed about supplier capabilities and technological advancements to maintain a competitive edge.

How can I effectively vet SiC suppliers to ensure reliability and quality?

Start by verifying the supplier’s certifications, such as ISO 9001 for quality management and any industry-specific accreditations related to silicon carbide production. Request detailed technical datasheets and samples to assess product consistency. Check their production capacity and track record with international clients, especially in your region. Utilize third-party audit services if possible, and seek references or reviews from other B2B buyers in Africa, South America, the Middle East, or Europe. A thorough vetting process reduces risks related to delays, quality issues, and compliance failures.

What customization options are typically available when sourcing SiC materials?

Many SiC suppliers offer customization in terms of particle size, purity levels, shape, and packaging to meet specific industrial requirements. Discuss your technical specifications upfront, including any unique performance criteria or environmental standards. Suppliers with R&D capabilities can often tailor products for enhanced thermal conductivity, electrical properties, or mechanical strength. Customization agreements should clearly outline lead times, costs, and minimum order quantities (MOQs) to avoid misunderstandings during procurement.

What should I know about MOQs, lead times, and payment terms when dealing with international SiC suppliers?

MOQs vary widely depending on the supplier’s production scale and customization level; smaller buyers may face higher MOQs or premium pricing. Lead times typically range from 4 to 12 weeks but can extend during peak demand or customization. Negotiate payment terms carefully—common practices include 30% upfront and 70% upon shipment or letter of credit arrangements. Understanding these terms early helps in cash flow planning and reduces delays, especially when importing to regions like Africa or South America where customs clearance can add complexity.

Which quality assurance measures and certifications should I insist on for SiC products?

Ensure suppliers provide comprehensive quality assurance documentation, including batch test reports, purity analysis, and particle size distribution. Certifications like ISO 9001, ISO 14001 (environmental management), and industry-specific standards such as REACH compliance are critical for international trade. For buyers in Europe or the Middle East, compliance with RoHS and other regional regulations is essential. Regular third-party lab testing and factory audits further safeguard product integrity and regulatory adherence.

What logistics challenges should I anticipate when importing SiC materials internationally?

SiC materials, often shipped in bulk or specialized packaging, require careful handling to prevent contamination or moisture exposure. Anticipate customs clearance delays, especially in countries with stringent import regulations or limited infrastructure. Coordinate with freight forwarders experienced in hazardous or industrial materials shipping to optimize routes and reduce costs. Consider Incoterms carefully (e.g., FOB, CIF) to clarify responsibilities and risks. Planning for warehousing and inland transport is also vital to avoid supply chain disruptions.

How can I manage disputes or quality issues with SiC suppliers across different continents?

Establish clear contractual terms covering quality standards, dispute resolution mechanisms, and penalties before order confirmation. Use internationally recognized arbitration forums or mediation clauses to handle conflicts efficiently. Maintain detailed records of communications, inspections, and test results to support your case. Building a strong relationship with suppliers through regular engagement can often preempt disputes. When issues arise, prompt and documented communication is key to swift resolution without escalating costs or project delays.

What are the key considerations for sourcing SiC suppliers in emerging markets like Africa or South America?

Focus on suppliers with proven export experience and compliance with international quality and environmental standards. Infrastructure challenges may affect lead times, so factor in buffer periods. Verify the supplier’s financial stability and logistics partnerships to ensure consistent supply. Local regulations, tariffs, and import duties can significantly impact landed costs, so engage customs brokers familiar with your target market. Leveraging local trade offices or chambers of commerce can provide valuable insights and facilitate smoother transactions.

How can I ensure sustainable and ethical sourcing of SiC materials from international suppliers?

Demand transparency on raw material origins and production processes to confirm ethical practices and environmental stewardship. Certifications like ISO 14001 or third-party sustainability audits indicate supplier commitment. Incorporate sustainability clauses in contracts, specifying waste management, energy use, and labor standards. Engaging suppliers with corporate social responsibility (CSR) programs aligns your procurement with global ESG goals, which is increasingly important for buyers in Europe and the Middle East. Sustainable sourcing mitigates reputational risks and supports long-term supply chain resilience.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In today’s competitive global marketplace, sourcing from sic suppliers presents a strategic opportunity for international B2B buyers seeking quality, innovation, and cost-efficiency. Key takeaways emphasize the importance of thorough supplier evaluation, risk management, and building collaborative partnerships that align with your company’s long-term goals. For buyers in Africa, South America, the Middle East, and Europe, understanding regional market dynamics and leveraging local supplier strengths can unlock significant value and supply chain resilience.

Strategic sourcing is not merely a transactional process but a critical component of sustainable growth and competitive advantage. Prioritizing transparency, compliance, and continuous communication with sic suppliers ensures adaptability amid evolving market conditions. Furthermore, integrating digital tools and data analytics into your sourcing strategy can enhance decision-making and supplier performance monitoring.

Looking ahead, international buyers are encouraged to adopt a proactive sourcing approach—focusing on innovation, sustainability, and diversification. Building strong, mutually beneficial relationships with sic suppliers across diverse regions will be essential to navigating future challenges and capturing emerging opportunities. Begin today by deepening your market insights, refining supplier criteria, and fostering partnerships that drive long-term success in your supply chain.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina