Silicon carbide stands as a cornerstone material in advanced industrial applications, prized for its exceptional hardness, thermal conductivity, and chemical stability. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding the multifaceted uses of silicon carbide is critical to optimizing product performance and competitive advantage. Whether sourcing for manufacturing, engineering, or technology sectors, a nuanced grasp of this material’s capabilities can unlock new opportunities and reduce procurement risks.

This comprehensive guide delivers an authoritative overview tailored to the complex needs of global buyers. It explores the diverse types of silicon carbide and their specific material properties, enabling precise alignment with application requirements. Detailed insights into manufacturing processes and quality control standards help ensure product consistency and reliability. Additionally, the guide navigates the global supplier landscape, cost considerations, and emerging market trends, providing a strategic framework for effective sourcing decisions.

Key features include:

- Material classifications and grades suited for various industrial uses

- Manufacturing techniques impacting quality and performance

- Supplier evaluation criteria for trusted partnerships

- Cost analysis to balance quality and budget constraints

- Market dynamics and regional demand patterns relevant to Africa, South America, the Middle East, and Europe

- Frequently Asked Questions addressing common buyer challenges

By leveraging this guide, international buyers from countries like Kenya, Brazil, UAE, and Germany can confidently navigate the complexities of silicon carbide procurement, ensuring informed decisions that drive innovation and operational excellence.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Abrasive Grade Silicon Carbide | High hardness, sharp edges, granular form | Grinding wheels, sandpaper, blasting media | Pros: Excellent wear resistance, cost-effective; Cons: Brittle, dust generation |

| Recrystallized Silicon Carbide | High purity, dense structure, improved mechanical strength | Mechanical seals, high-performance ceramics | Pros: Superior strength and thermal stability; Cons: Higher cost, complex processing |

| Fused Silicon Carbide | Manufactured by melting raw materials, coarse crystalline form | Kiln furniture, heat exchangers, refractory linings | Pros: Excellent thermal shock resistance, chemical inertness; Cons: Limited machinability |

| Silicon Carbide Fibers | Lightweight, flexible, high tensile strength | Composite reinforcements, aerospace, automotive parts | Pros: Enhances composite strength, lightweight; Cons: Expensive, specialized handling required |

| Silicon Carbide Powders | Fine particle size, high purity grades available | Semiconductor substrates, polishing agents | Pros: High precision polishing, semiconductor compatibility; Cons: Requires controlled environment storage |

Abrasive Grade Silicon Carbide

This type is characterized by its extreme hardness and sharp, angular grains, making it ideal for abrasive applications such as grinding and blasting. It is widely used in industries requiring cost-effective wear resistance, including metal fabrication and construction. Buyers should consider dust control and brittleness during handling and storage, especially in regions with strict environmental regulations.

Recrystallized Silicon Carbide

Known for its superior purity and dense microstructure, recrystallized silicon carbide offers enhanced mechanical strength and thermal stability. It is preferred in high-stress environments such as mechanical seals and advanced ceramic components. B2B buyers should evaluate supplier quality certifications and production consistency to ensure performance in demanding applications.

Fused Silicon Carbide

Produced through a melting process, fused silicon carbide has a coarse crystalline structure that provides excellent thermal shock resistance and chemical inertness. It is commonly employed in refractory linings and kiln furniture in heavy industries. Buyers from regions with high-temperature manufacturing sectors, such as cement or glass production, will benefit from its durability but must be aware of its limited machinability.

Silicon Carbide Fibers

These fibers are valued for their lightweight and high tensile strength, making them ideal for reinforcing composites in aerospace, automotive, and defense sectors. Due to their specialized nature, procurement requires attention to handling protocols and supplier expertise. Buyers should assess compatibility with composite matrices and cost implications for large-scale production.

Silicon Carbide Powders

Fine silicon carbide powders are essential in semiconductor manufacturing and precision polishing applications. Their purity and particle size distribution directly impact the quality of substrates and optical components. Buyers should prioritize suppliers offering controlled packaging and consistent particle characteristics to meet stringent industrial standards, particularly in electronics manufacturing hubs across Europe and Asia.

Related Video: Silicon Carbide Explained - SiC Basics

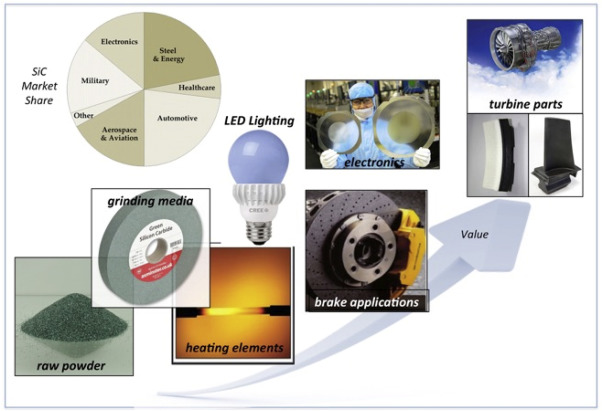

| Industry/Sector | Specific Application of silica carbide uses | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Metallurgical Industry | High-performance kiln furniture and heating elements | Enhances energy efficiency and durability in high-temperature processes | Purity grade, thermal stability, and supplier reliability for bulk orders |

| Abrasives & Cutting Tools | Manufacturing of grinding wheels, cutting discs, and sandpapers | Provides superior hardness and wear resistance, reducing tool replacement frequency | Grain size consistency, bonding agent compatibility, and certification for industrial use |

| Electronics & Semiconductors | Substrates and components for power electronics and LEDs | Improves thermal conductivity and electrical insulation, enabling higher device performance | Material quality, defect rate, and compliance with international standards |

| Automotive Industry | Brake discs and clutch plates | Increases durability and heat resistance, improving vehicle safety and performance | Mechanical properties, supplier capacity, and delivery lead times |

| Chemical Processing | Corrosion-resistant reactor linings and pump seals | Extends equipment lifespan under harsh chemical environments, reducing downtime | Chemical purity, resistance to specific chemicals, and custom sizing options |

Silica carbide’s role in the metallurgical industry is critical for kiln furniture and heating elements used in furnaces operating at extremely high temperatures. Its exceptional thermal stability and resistance to thermal shock improve furnace life and reduce energy consumption. International buyers, especially from emerging industrial hubs in Africa and South America, must prioritize sourcing high-purity grades and ensure supplier consistency to avoid costly process interruptions.

In the abrasives and cutting tools sector, silica carbide is prized for its hardness and wear resistance. It is widely used in grinding wheels and cutting discs, providing longer tool life and better surface finish quality. Buyers from regions like the Middle East and Europe should verify grain size uniformity and bonding agent compatibility to optimize tool performance and meet stringent industrial standards.

For the electronics and semiconductor industry, silica carbide substrates enhance thermal management and electrical insulation in power devices and LEDs. This enables higher power density and reliability. B2B buyers from tech manufacturing centers in Europe and Vietnam should focus on low-defect materials and certification compliance to ensure integration into high-value electronics.

In the automotive sector, silica carbide is utilized in brake discs and clutch plates due to its heat resistance and mechanical strength. This application improves vehicle safety and component longevity. Procurement professionals from automotive suppliers in Africa and Europe should assess mechanical property consistency and supplier capacity to fulfill large-scale production demands.

Finally, in chemical processing, silica carbide linings and seals offer outstanding corrosion resistance, extending the service life of reactors and pumps exposed to aggressive chemicals. Buyers in Middle Eastern chemical plants and South American refineries need to ensure chemical purity and select suppliers capable of providing custom sizes to fit specialized equipment, minimizing operational risks.

Related Video: Silica Sand Unveiled: A Comprehensive Guide to Specifications & Versatile Uses

When selecting materials for silica carbide applications, international B2B buyers must carefully evaluate options based on performance requirements, manufacturing feasibility, and regional compliance standards. Below is an analysis of four common materials used in silica carbide-related products, focusing on their properties, advantages, limitations, and implications for markets in Africa, South America, the Middle East, and Europe.

Key Properties:

Pure silicon carbide ceramics exhibit exceptional hardness, high thermal conductivity, and excellent resistance to thermal shock. They maintain structural integrity at temperatures exceeding 1600°C and withstand corrosive environments, including acidic and alkaline media.

Pros & Cons:

Pros include outstanding wear resistance and chemical inertness, making SiC ceramics ideal for abrasive and corrosive applications. However, their brittleness can lead to fracture under mechanical shock, and manufacturing complexity is high, requiring precise sintering processes. Cost tends to be on the higher side due to these factors.

Impact on Application:

SiC ceramics are well-suited for high-temperature filtration, mechanical seals, and pump components exposed to aggressive fluids. Their resistance to oxidation and corrosion makes them preferred in chemical processing industries.

Regional Considerations:

Buyers in Europe and the Middle East often require compliance with ASTM C799 and DIN EN standards for ceramic materials, ensuring quality and performance consistency. In Africa and South America, where supply chains may be less mature, partnering with suppliers who provide certification and technical support is crucial. Vietnam’s growing industrial sector favors suppliers offering tailored solutions meeting JIS standards.

Key Properties:

These composites combine silicon carbide particles or fibers within a metal or ceramic matrix, enhancing toughness and thermal stability. They offer improved fracture resistance compared to pure SiC ceramics and maintain good corrosion resistance.

Pros & Cons:

Reinforced composites reduce brittleness and improve impact resistance, expanding application scope. The trade-off is a more complex manufacturing process and moderate cost increase. Additionally, composites may have slightly reduced chemical resistance compared to pure ceramics.

Impact on Application:

Ideal for mechanical parts requiring both strength and corrosion resistance, such as valve components, heat exchangers, and wear-resistant linings. Their enhanced toughness suits dynamic environments with mechanical stresses.

Regional Considerations:

In South America and Africa, where equipment may face harsh operational conditions, composites offer a balance of durability and cost. Compliance with ASTM and ISO standards for composites is increasingly demanded. European buyers often seek materials certified under EN ISO 9001 quality management systems, while Middle Eastern markets value suppliers with experience in petrochemical-grade composites.

Key Properties:

Metal substrates coated with silicon carbide provide a combination of metal toughness and SiC’s surface hardness and corrosion resistance. Coatings withstand temperatures up to 1200°C and protect against abrasion and chemical attack.

Pros & Cons:

This option offers cost-effective wear protection and easier machining of the base metal. However, coating adhesion and uniformity can be challenging, potentially leading to delamination under thermal cycling. Coated metals generally have lower maximum temperature ratings than bulk SiC ceramics.

Impact on Application:

Common in pump impellers, valve seats, and piping where surface wear and corrosion are concerns but full ceramic components are cost-prohibitive. The coating extends service life without sacrificing mechanical flexibility.

Regional Considerations:

Buyers in emerging markets such as Kenya and Vietnam benefit from the cost savings and availability of coated metals. Ensuring coatings meet ASTM B487 or equivalent standards is important for longevity. European and Middle Eastern buyers often require detailed testing reports on coating thickness and adhesion strength.

Key Properties:

RBSC is produced by infiltrating porous silicon carbide with molten silicon, resulting in a dense, strong material with good thermal shock resistance and moderate corrosion resistance. It typically withstands temperatures up to 1400°C.

Pros & Cons:

RBSC offers lower manufacturing costs compared to sintered SiC and good machinability. However, its corrosion resistance is inferior to pure SiC ceramics, especially in acidic environments. It is also less dense, which may affect mechanical strength.

Impact on Application:

Suitable for furnace components, kiln furniture, and some chemical processing parts where thermal shock resistance is critical but extreme corrosion resistance is not mandatory.

Regional Considerations:

In regions like South America and Africa, RBSC provides a cost-effective solution for high-temperature applications. Buyers should verify compliance with ASTM C799 and ISO 9001 standards. European purchasers may prefer RBSC for less aggressive environments, while Middle Eastern industries might limit its use to non-corrosive conditions.

| Material | Typical Use Case for silica carbide uses | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Pure Silicon Carbide Ceramics | High-temp filtration, mechanical seals, chemical processing | Exceptional hardness and corrosion resistance | Brittle, high manufacturing complexity | High |

| Silicon Carbide Reinforced Composites | Valve components, heat exchangers, wear-resistant linings | Improved toughness and impact resistance | More complex manufacturing, moderate cost | Medium |

| Silicon Carbide Coated Metals | Pump impellers, valve seats, piping surfaces | Cost-effective wear and corrosion protection | Coating adhesion issues, lower temp rating | Medium |

| Reaction Bonded Silicon Carbide (RBSC) | Furnace components, kiln furniture, moderate corrosion parts | Lower cost, good thermal shock resistance | Lower corrosion resistance, less dense | Low |

This guide equips international B2B buyers with critical insights to align material choice with operational demands and regional standards, optimizing performance and procurement outcomes for silica carbide applications.

Silica carbide (SiC) is a high-performance ceramic material widely used across industrial sectors for its exceptional hardness, thermal conductivity, and chemical resistance. For international B2B buyers, understanding the manufacturing process is essential to assess product quality and supplier capabilities.

1. Material Preparation

The manufacturing process starts with the selection and preparation of raw materials. High-purity silica sand and carbon sources (e.g., petroleum coke) are precisely weighed and mixed. Advanced suppliers often use automated batching systems to ensure consistency. The mixture undergoes carbothermal reduction at high temperatures (around 2000°C) in electric resistance or induction furnaces to form silicon carbide powder.

2. Forming Techniques

Forming shapes silica carbide components involves several key methods:

- Pressing: Uniaxial or isostatic pressing compacts the powder into the desired shape. Isostatic pressing offers more uniform density and is preferred for complex shapes.

- Slip Casting: For intricate geometries, slip casting suspends SiC powder in liquid to pour into molds, followed by drying.

- Extrusion: Used mainly for continuous shapes like tubes or rods, extrusion forces the SiC mixture through dies.

- Injection Molding: For small, detailed parts, injection molding combines SiC powder with binders to inject into molds.

3. Sintering and Assembly

The green bodies formed undergo sintering, a critical stage where particles bond at high temperatures (typically 2100–2200°C). This may be done in inert atmospheres or vacuum to prevent oxidation. Some applications require hot pressing or hot isostatic pressing (HIP) to enhance density and mechanical strength. Post-sintering, components may be assembled into sub-systems, especially for wear parts or mechanical seals.

4. Finishing Processes

Finishing ensures dimensional accuracy and surface quality, vital for silica carbide’s performance in demanding applications. Techniques include:

- Grinding and Polishing: Achieves tight tolerances and smooth surfaces, often using diamond abrasives due to SiC hardness.

- Coating or Surface Treatments: Some products receive protective or functional coatings to improve corrosion resistance or thermal properties.

- Inspection and Cleaning: Final cleaning removes residues, and components are inspected for defects.

For B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe, verifying quality assurance is crucial to mitigate risks associated with material failure or non-compliance.

Key International Standards:

- ISO 9001: This foundational quality management system standard ensures suppliers have robust processes for consistent product quality and continuous improvement.

- Industry-Specific Certifications: Depending on application sectors, additional certifications may apply:

- CE Marking: For silica carbide products used in machinery and equipment within the European Economic Area, demonstrating compliance with EU safety and environmental requirements.

- API (American Petroleum Institute) Standards: For SiC components in oil & gas applications, API certification ensures suitability under extreme conditions.

- ASTM Standards: Widely referenced for mechanical and chemical properties testing of ceramics.

- RoHS Compliance: Particularly for electronics-related uses, ensuring materials are free from hazardous substances.

Quality Control Checkpoints:

- Incoming Quality Control (IQC): Raw materials and powders are inspected for purity, particle size distribution, and moisture content.

- In-Process Quality Control (IPQC): Monitors forming parameters, sintering temperatures, and dimensional tolerances during production. Automated sensors and process controls minimize variability.

- Final Quality Control (FQC): Comprehensive testing of finished products including dimensional inspection, mechanical strength, and surface finish.

To ensure silica carbide meets stringent application requirements, suppliers employ a variety of testing methods:

Density and Porosity Measurements to evaluate material integrity.

Thermal Testing:

Thermal Shock Resistance evaluations for applications involving rapid temperature changes.

Chemical Resistance Testing:

Exposure to acids, alkalis, and corrosive environments to ensure durability.

Microstructural Analysis:

For buyers across diverse regions, verifying supplier quality is imperative before committing to large orders:

For African and South American Buyers:

- Suppliers may need to demonstrate compliance with export regulations and international standards, as local standards may vary.

- Logistics and customs documentation should be meticulously checked to avoid delays related to non-compliance with import regulations.

For Middle Eastern Buyers:

- Emphasis on certifications related to petrochemical and oil & gas industries (e.g., API) is often higher due to regional industrial focus.

- Ensure suppliers understand regional environmental regulations and product safety requirements.

For European Buyers:

- CE marking and REACH compliance are critical for market access.

- Traceability and detailed documentation are often mandatory for suppliers to meet stringent procurement policies.

General Recommendations:

- Prioritize suppliers with multi-standard certifications and a track record of exporting to your region.

- Clarify warranty terms and post-sales support to address quality issues promptly.

- Establish clear communication channels for quality feedback and continuous improvement.

By thoroughly understanding the manufacturing and quality assurance processes for silica carbide products, international B2B buyers can make informed procurement decisions. This ensures acquisition of high-quality, reliable components that meet both technical and regulatory requirements in their respective markets.

When sourcing silica carbide for various industrial applications, understanding the detailed cost structure and pricing dynamics is critical to making informed procurement decisions. This analysis breaks down the key cost components, price influencers, and strategic buyer tips tailored for international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe.

Raw Materials

Silica carbide production primarily involves high-purity quartz and carbon sources (such as petroleum coke). The price and quality of these raw materials significantly impact overall costs, with fluctuations influenced by global commodity markets and regional availability.

Labor Costs

Labor expenses vary widely by manufacturing location. Countries with lower labor costs may offer competitive pricing, but buyers should weigh this against potential quality and lead-time implications.

Manufacturing Overhead

This includes energy consumption (silica carbide synthesis is energy-intensive), plant maintenance, and indirect labor. Efficient production technologies can reduce overhead, affecting final pricing.

Tooling and Equipment

Specialized tooling for shaping and finishing silica carbide components adds to upfront costs. For custom specifications, tooling expenses can be substantial but amortized over large production runs.

Quality Control (QC) and Certifications

Rigorous QC processes and compliance with industry standards (e.g., ISO certifications) increase costs but are essential for reliability in critical applications. Certified suppliers often command premium prices.

Logistics and Freight

Transportation costs depend on shipment size, distance, and mode (sea, air, land). For buyers in Africa, South America, and the Middle East, port handling fees, customs duties, and inland transport can add significantly to landed costs.

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically attract volume discounts. Buyers should negotiate MOQs that align with their consumption patterns to avoid excess inventory costs.

Product Specifications and Customization

Customized grades, particle sizes, or shapes increase manufacturing complexity and cost. Standard grades are usually more economical.

Material Grade and Purity

Higher purity silica carbide commands higher prices but offers superior performance in demanding applications.

Quality Certifications and Testing

Products with third-party certifications or extensive testing reports may cost more but reduce risk and downstream failure costs.

Supplier Reputation and Location

Established suppliers with proven track records may price higher but provide reliability. Proximity to supplier facilities can reduce logistics costs and lead times.

Incoterms and Payment Terms

The choice of Incoterms (e.g., FOB, CIF, DDP) affects who bears shipping, insurance, and customs costs, impacting the total purchase price and risk exposure.

Negotiate Beyond Price

Engage suppliers on payment terms, delivery schedules, and after-sales support. Flexible terms can improve cash flow and reduce operational risks.

Evaluate Total Cost of Ownership (TCO)

Consider quality, durability, and service costs alongside unit price. Lower upfront costs may lead to higher maintenance or replacement expenses.

Leverage Regional Trade Agreements

Buyers in regions like Africa or South America should explore sourcing from countries within free trade zones or bilateral agreements to reduce tariffs and import duties.

Account for Currency Fluctuations

Exchange rate volatility can affect landed costs. Using forward contracts or negotiating prices in stable currencies can mitigate risks.

Assess Logistics and Supply Chain Resilience

Factor in potential delays, customs clearance times, and freight reliability. Diversifying suppliers or holding safety stock may be prudent.

Understand Pricing Nuances by Region

For example, buyers in Kenya or Vietnam may face different import regulations or local taxes compared to European buyers. Local expertise or consultancy can provide valuable insights.

Prices for silica carbide products vary widely based on specifications, volume, and market conditions. The figures and cost factors presented here are indicative to assist in strategic planning and supplier evaluation. Buyers should request detailed quotations and conduct comprehensive cost analyses tailored to their unique requirements.

Illustrative Image (Source: Google Search)

By thoroughly analyzing cost components and price drivers while applying strategic negotiation and sourcing practices, international B2B buyers can optimize procurement of silica carbide products, ensuring competitive pricing without compromising quality or supply chain stability.

Understanding the technical properties of silicon carbide (SiC) is crucial for international B2B buyers to ensure the material fits their specific industrial applications. Here are some essential specifications to consider:

Material Grade

Silicon carbide is available in various grades, typically categorized by purity and particle size. Higher purity grades (above 98%) are preferred for demanding applications such as semiconductor manufacturing and abrasive tools. Selecting the correct grade ensures optimal performance and longevity of the final product.

Particle Size and Distribution

Particle size affects the surface finish, strength, and wear resistance of the end product. Fine particles are used in polishing and refractory materials, while coarser grains suit grinding and cutting applications. Consistent particle size distribution guarantees uniformity and predictable performance.

Density

The density of SiC (usually around 3.1 to 3.2 g/cm³) impacts its mechanical strength and thermal conductivity. Buyers must verify density specifications to meet application requirements, especially in high-temperature or high-stress environments.

Tolerance and Dimensional Accuracy

Precision in size and shape, often measured in microns, is vital for components such as mechanical seals or semiconductor substrates. Tight tolerance levels reduce waste and improve assembly efficiency, which is particularly important for buyers sourcing from multiple suppliers.

Thermal Conductivity

Silicon carbide exhibits excellent thermal conductivity (typically 120-270 W/mK), making it suitable for heat dissipation in electronics and high-temperature applications. Buyers should confirm this property aligns with their thermal management needs.

Hardness

With a Mohs hardness of about 9.5, SiC is one of the hardest materials available, ideal for abrasive and wear-resistant applications. Understanding hardness helps buyers assess the material's suitability for cutting, grinding, and protective coatings.

Navigating international trade requires familiarity with key industry terms. Below are important jargon and terms that B2B buyers from Africa, South America, the Middle East, and Europe should know when sourcing silicon carbide:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment that may be marketed by another manufacturer. Buyers often collaborate with OEMs for customized silicon carbide components tailored to specific machinery or product lines.

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier is willing to sell per order. Understanding MOQ helps buyers balance inventory costs with operational needs, especially when dealing with limited budgets or storage constraints.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, delivery timelines, and terms. An effective RFQ includes detailed technical specifications to ensure accurate and comparable supplier responses.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities between buyers and sellers for shipping, insurance, and tariffs. Common terms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Choosing the right Incoterm impacts logistics costs and risk management.

Lead Time

The time interval between placing an order and receiving the product. Buyers must consider lead times when planning production schedules or inventory replenishment, especially when sourcing from distant regions.

Batch Number / Lot Number

Identifiers assigned to a specific production batch of silicon carbide. This is crucial for quality control and traceability, enabling buyers to track material consistency and address any defects or recalls.

By mastering these technical properties and trade terms, international B2B buyers can confidently select and source silicon carbide products that align with their industrial needs and commercial goals.

Silicon carbide (SiC) is a versatile industrial material widely used for its exceptional hardness, thermal conductivity, and chemical inertness. Globally, demand for SiC is primarily driven by industries such as automotive (especially electric vehicles), aerospace, electronics, renewable energy, and heavy machinery manufacturing. For B2B buyers in regions like Africa, South America, the Middle East, and Europe, understanding the global market dynamics is essential to sourcing competitively and sustainably.

Key Market Drivers:

- Electrification and Energy Efficiency: The surge in electric vehicle production and renewable energy infrastructure (solar and wind power) is expanding SiC demand due to its superior performance in power electronics and semiconductors.

- Industrial Automation and High-Tech Manufacturing: Advanced manufacturing in Europe and emerging markets in Africa and South America is fueling demand for high-quality SiC abrasives and ceramics.

- Infrastructure Development: Rapid urbanization and infrastructure projects in the Middle East and parts of Africa increase the need for durable materials like SiC for cutting, grinding, and wear-resistant applications.

Sourcing Trends:

- Regional Supply Chain Diversification: Buyers increasingly seek to diversify suppliers beyond traditional sources in China and the US to mitigate geopolitical risks and supply disruptions. Emerging suppliers in Southeast Asia (e.g., Vietnam) and Africa are gaining attention for competitive pricing and localized support.

- Technology-Driven Quality Assurance: Adoption of AI and IoT technologies in production and supply chain management ensures consistent product quality and traceability, which is critical for sectors like electronics and aerospace.

- Customization and Value-Added Services: Suppliers offering tailored SiC particle sizes, purity grades, and advanced composites are preferred by B2B customers requiring specialized solutions.

For buyers in Africa, South America, and the Middle East, building strategic partnerships with suppliers who understand local market conditions and regulatory environments can unlock cost efficiencies and innovation opportunities.

Sustainability is becoming a decisive factor in B2B procurement of silicon carbide products. The environmental footprint of SiC production, traditionally energy-intensive and reliant on fossil fuels, is under scrutiny. Buyers are increasingly demanding transparency and accountability from suppliers regarding raw material sourcing, energy consumption, and waste management.

Environmental Impact Considerations:

- The production of SiC typically involves high-temperature processes consuming significant energy, often from non-renewable sources. This contributes to greenhouse gas emissions and environmental degradation.

- Mining for raw materials, such as silica and carbon, must be managed responsibly to avoid habitat destruction and pollution.

Ethical Supply Chains:

- Responsible sourcing policies are vital to ensure that raw materials do not originate from conflict zones or involve exploitative labor practices.

- Certifications such as ISO 14001 (environmental management), Responsible Minerals Assurance Process (RMAP), and industry-specific eco-labels help buyers verify supplier compliance with sustainability standards.

Green Materials & Innovations:

- The industry is witnessing the rise of “green” SiC products manufactured using renewable energy sources or recycled materials, reducing carbon footprints.

- Suppliers investing in cleaner production technologies and circular economy principles provide a competitive edge for buyers prioritizing sustainability.

For B2B buyers in regions like Kenya or Europe, integrating sustainability criteria into procurement decisions not only aligns with global environmental goals but also enhances brand reputation and meets evolving regulatory requirements.

Silicon carbide was first synthesized in the late 19th century as an abrasive material, revolutionizing industrial cutting and grinding processes. Initially produced via the Acheson process, SiC became a staple in heavy industry due to its extreme hardness and thermal stability.

Over the decades, technological advancements expanded SiC’s applications into electronics, particularly power semiconductors, due to its ability to operate at high voltages and temperatures. This evolution has positioned SiC as a critical material in the transition to cleaner energy and advanced manufacturing.

For international B2B buyers, understanding this historical trajectory highlights the material’s proven reliability and growing strategic importance, informing sourcing strategies that balance cost, quality, and innovation.

How can I effectively vet silica carbide suppliers for international B2B purchases?

Begin by verifying the supplier’s business license, certifications (ISO, REACH, RoHS), and export experience, especially for regions like Africa, South America, the Middle East, and Europe. Request detailed product datasheets and samples to assess quality. Check references or reviews from other international buyers. Conduct virtual or on-site factory audits if possible. Prioritize suppliers with transparent communication, proven logistics partnerships, and compliance with international trade regulations to minimize risks.

Is customization of silica carbide products available for specific industrial applications?

Yes, many silica carbide manufacturers offer customization in particle size, purity, grain shape, and packaging to meet diverse industry requirements such as abrasives, refractories, or semiconductors. For B2B buyers, it’s crucial to clearly specify technical parameters and intended use cases upfront. Engage in detailed technical discussions with suppliers and request pilot batches to validate the product fit before large-scale ordering, especially when supplying complex markets like Europe or the Middle East.

What are typical minimum order quantities (MOQs) and lead times when importing silica carbide internationally?

MOQs vary widely depending on product form and supplier capability but typically range from 500 kg to several tons per order. Lead times usually span 3 to 8 weeks, influenced by production capacity, customization, and shipping logistics. Buyers from Africa or South America should account for additional transit times and customs clearance. Negotiate flexible MOQs and staggered deliveries if storage or cash flow is a concern, and confirm lead times explicitly in contracts to avoid delays.

Which payment terms are common and secure for international silica carbide transactions?

Letter of Credit (L/C) and Telegraphic Transfer (T/T) are widely used. L/Cs provide security for both buyer and supplier, particularly for first-time transactions, while T/T is faster but riskier. For trusted suppliers, payment on delivery or open account terms may be negotiable. Use escrow services or trade finance instruments when available. Always clarify payment milestones linked to quality inspection and shipment to protect your investment across diverse markets such as Vietnam or Kenya.

Illustrative Image (Source: Google Search)

What quality assurance measures and certifications should I expect from silica carbide suppliers?

Reliable suppliers provide certificates such as ISO 9001 for quality management, material safety data sheets (MSDS), and test reports verifying chemical composition, particle size distribution, and purity levels. Some markets require compliance with REACH (Europe) or other environmental standards. Insist on third-party lab testing for critical applications. Establish clear quality benchmarks in contracts and consider on-site quality inspections or independent inspections before shipment to ensure consistent product performance.

How can I optimize logistics and customs clearance when importing silica carbide?

Partner with suppliers experienced in international freight forwarding who understand import regulations in your country. Choose appropriate shipping methods (sea freight for bulk, air freight for urgent orders) balancing cost and speed. Prepare all documentation accurately: commercial invoice, packing list, certificate of origin, and any required import licenses. Use Incoterms (e.g., FOB, CIF) to clarify responsibility for shipping costs and risks. Early coordination with customs brokers can prevent delays, especially in regions with complex import policies like the Middle East or Africa.

What steps should I take if I encounter disputes or product quality issues post-import?

First, document all discrepancies with photos, inspection reports, and communication records. Review the contract terms related to quality guarantees and dispute resolution. Engage the supplier promptly to negotiate remediation, which may include replacement, refund, or credit. If unresolved, consider mediation or arbitration through international trade bodies. Maintain professional communication and involve legal counsel familiar with cross-border trade laws to safeguard your company’s interests.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Silica carbide stands out as a critical material in advanced manufacturing, offering exceptional hardness, thermal conductivity, and chemical resistance. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding the diverse applications—from abrasives and refractories to semiconductors and automotive components—is essential for aligning procurement strategies with industry demands. Prioritizing strategic sourcing enables buyers to secure high-quality silica carbide at competitive prices while mitigating supply chain risks linked to geopolitical and logistical factors.

Key sourcing considerations include evaluating supplier reliability, leveraging regional trade agreements, and exploring sustainable production practices to meet evolving regulatory standards. Buyers in emerging markets like Kenya and Vietnam can benefit from partnerships that emphasize innovation and local market adaptability, ensuring both cost-efficiency and supply continuity.

Looking ahead, the growing demand for electric vehicles, renewable energy technologies, and high-performance electronics will further amplify the importance of silica carbide. Proactive sourcing strategies that integrate market intelligence, supplier collaboration, and quality assurance will empower businesses to capitalize on these trends. International buyers are encouraged to engage with global suppliers early, invest in supply chain resilience, and continuously monitor industry developments to maintain a competitive edge in this dynamic landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina