Silicon carbide (SiC) stands as a cornerstone material in numerous high-performance industrial applications, from abrasives and refractories to semiconductors and automotive components. For international B2B buyers, particularly those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding the complexities of the global silica carbide supply chain is essential to securing reliable, cost-effective, and quality-driven sourcing.

This comprehensive guide is designed to equip procurement professionals and technical buyers with deep insights into the diverse types and grades of silica carbide, including their chemical and physical properties. It delves into manufacturing processes and quality control standards that influence product performance and consistency—critical factors when evaluating suppliers. Additionally, the guide offers a granular analysis of global supplier landscapes, highlighting key players, regional market trends, and pricing benchmarks that reflect current economic conditions and trade dynamics.

Illustrative Image (Source: Google Search)

By navigating through the sections on material specifications, production methodologies, supplier evaluation, and cost considerations, buyers will gain actionable knowledge to mitigate risks such as supply disruptions, quality variability, and cost overruns. The inclusion of frequently asked questions further clarifies common challenges and practical solutions encountered in international transactions.

For businesses in regions like Nigeria, Brazil, the UAE, or the UK, where infrastructure development and industrial growth demand stringent material standards, this guide provides a strategic framework to make informed sourcing decisions. Ultimately, it empowers buyers to optimize their procurement strategies, enhance supply chain resilience, and foster long-term partnerships in the evolving silica carbide market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Alpha Silicon Carbide (α-SiC) | Hexagonal crystal structure, high thermal conductivity | Abrasives, refractories, automotive components | Pros: High hardness, thermal stability; Cons: More brittle, higher cost |

| Beta Silicon Carbide (β-SiC) | Cubic crystal structure, finer grain size | Electronic devices, semiconductors, coatings | Pros: Better toughness, easier to sinter; Cons: Lower thermal stability |

| Reaction Bonded Silicon Carbide (RB-SiC) | Produced by infiltrating carbon with silicon | Mechanical seals, pump components, kiln furniture | Pros: Near-net shape capability, corrosion resistant; Cons: Lower purity, moderate mechanical strength |

| Sintered Silicon Carbide (SSiC) | High purity, fully dense polycrystalline material | High-performance mechanical parts, heat exchangers | Pros: Excellent wear resistance, chemical stability; Cons: High production cost |

| Silicon Carbide Fibers | Fine fibers with high tensile strength | Composite reinforcements, aerospace, defense | Pros: Lightweight, high strength; Cons: Expensive, specialized handling |

Alpha Silicon Carbide (α-SiC)

Alpha silicon carbide is characterized by its hexagonal crystal structure and exceptional thermal conductivity. It is widely used in industries requiring high hardness and thermal stability, such as abrasives and automotive parts. For B2B buyers, especially in sectors like manufacturing and heavy industry, α-SiC offers durability but can be more brittle and costly compared to other types. Evaluating supplier quality and consistency is critical to avoid performance issues in demanding applications.

Beta Silicon Carbide (β-SiC)

Beta silicon carbide features a cubic crystal structure with a finer grain size, making it tougher and easier to sinter than α-SiC. This type is favored in electronics, semiconductor manufacturing, and protective coatings. For international buyers, especially in tech-driven markets, β-SiC provides cost-effective toughness but with lower thermal resistance. Careful consideration of the application environment ensures the right balance between performance and cost.

Reaction Bonded Silicon Carbide (RB-SiC)

RB-SiC is produced by infiltrating porous carbon with molten silicon, resulting in near-net shape components that are corrosion resistant. It is commonly used in mechanical seals, pump parts, and kiln furniture. B2B purchasers benefit from its cost-effectiveness and ease of manufacturing complex shapes, but should be aware of its moderate mechanical strength and lower purity compared to sintered variants. Supplier capabilities in precision casting and quality control are essential factors.

Sintered Silicon Carbide (SSiC)

Sintered SiC is a fully dense, high-purity form known for superior wear resistance and chemical stability. It is ideal for high-performance mechanical parts and heat exchangers in harsh environments. Though more expensive, SSiC’s durability can reduce long-term maintenance costs, making it attractive for buyers in industries like chemical processing and power generation. Assessing supplier expertise in sintering technology and material certifications is vital.

Silicon Carbide Fibers

Silicon carbide fibers are fine, high-tensile-strength reinforcements used in composites for aerospace, defense, and advanced engineering applications. They offer lightweight strength advantages but come with higher costs and require specialized handling. B2B buyers should evaluate the fiber compatibility with matrix materials and supplier reliability to optimize composite performance and supply chain stability.

Related Video: INTERESTING MATERIALS: Silicon carbide

| Industry/Sector | Specific Application of silica carbide | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Brake discs and clutches | Enhanced wear resistance and thermal stability leading to longer component life and improved safety | Consistent quality and particle size, certifications for automotive standards, reliable delivery schedules |

| Electronics & Semiconductors | Substrates for high-power, high-frequency devices | Superior thermal conductivity and electrical insulation improve device performance and reliability | Purity levels, precise dimensional tolerances, compliance with international electronic materials standards |

| Abrasives & Cutting Tools | Grinding wheels, sandpapers, and cutting tools | High hardness and thermal shock resistance increase efficiency and tool lifespan | Grain size uniformity, bonding material compatibility, availability of custom formulations |

| Refractories & Ceramics | Furnace linings and kiln furniture | High temperature resistance and chemical inertness reduce maintenance costs and downtime | Thermal stability certifications, resistance to chemical corrosion, supplier expertise in refractory-grade materials |

| Renewable Energy | Components in solar inverters and wind turbine parts | Improved durability and heat dissipation support longer operational life and energy efficiency | Material traceability, compliance with renewable energy sector standards, cost-effectiveness for large-scale procurement |

Silica carbide plays a critical role in automotive manufacturing, especially in brake discs and clutches. Its exceptional wear resistance and ability to withstand high temperatures ensure that these components maintain performance under stress, reducing replacement frequency and enhancing safety. For international buyers, particularly in regions like Africa and South America where climate and road conditions vary greatly, sourcing silica carbide with consistent particle size and quality is crucial to meet local automotive standards and ensure reliable supply chains.

In the electronics and semiconductor industry, silica carbide is widely used as a substrate material for high-power and high-frequency devices. Its outstanding thermal conductivity combined with electrical insulation properties helps manage heat dissipation, leading to enhanced device reliability. Buyers in the Middle East and Europe must prioritize suppliers who provide materials with strict purity levels and dimensional precision, as even minor deviations can impact device performance and certification compliance.

For abrasives and cutting tools, silica carbide’s high hardness and resistance to thermal shock make it indispensable in grinding wheels, sandpapers, and cutting applications. This translates into faster processing times and extended tool life, which directly improves operational efficiency. International B2B buyers should focus on grain size uniformity and compatibility with different bonding agents, ensuring the abrasive material meets specific industrial requirements and can be customized as needed.

In the refractories and ceramics sector, silica carbide is used to manufacture furnace linings and kiln furniture due to its ability to withstand extremely high temperatures and resist chemical corrosion. This reduces maintenance downtime and extends the lifecycle of industrial furnaces. Buyers from emerging markets like Nigeria or Brazil should seek suppliers with proven expertise in refractory-grade silica carbide and verify thermal stability certifications to guarantee performance in harsh operating environments.

Finally, the renewable energy industry benefits from silica carbide components in solar inverters and wind turbine parts, where durability and efficient heat dissipation are essential for prolonged operation and energy efficiency. For international buyers, sourcing considerations include material traceability and adherence to renewable energy standards, as well as cost-effectiveness when procuring in bulk for large-scale energy projects across Europe, the Middle East, or Africa.

Related Video: Industrial Pipe Insulation Installation: Thermo-12 Gold Calcium Silicate vs Silica Aerogel

Key Properties: Silicon carbide ceramics exhibit exceptional hardness, high thermal conductivity, and excellent resistance to thermal shock. They maintain structural integrity at temperatures exceeding 1600°C and withstand pressures typical in high-performance mechanical applications. Their chemical inertness makes them highly resistant to corrosion by acids and alkalis.

Pros & Cons: The durability and wear resistance of SiC ceramics are outstanding, making them ideal for abrasive environments. However, manufacturing complexity is high due to the material’s brittleness and the precision required during sintering. Cost is relatively high compared to conventional ceramics but justified by performance in demanding applications.

Impact on Application: SiC ceramics are preferred in applications involving high temperatures and corrosive media, such as chemical reactors, pump seals, and heat exchangers. Their resistance to oxidation and erosion suits aggressive chemical processing environments common in the Middle East and Europe.

Considerations for International Buyers: Buyers in Africa and South America should verify compliance with ASTM C799 or ISO 8009 standards for SiC ceramics to ensure quality and performance. European and UK buyers often require adherence to DIN EN standards for industrial ceramics. Availability may vary regionally, so sourcing from certified suppliers with traceable quality documentation is crucial.

Key Properties: RBSC combines silicon carbide particles with a silicon binder, resulting in a material with good mechanical strength and moderate thermal conductivity. It operates effectively up to approximately 1400°C and has good corrosion resistance, especially against acidic environments.

Pros & Cons: RBSC offers a cost-effective alternative to fully sintered SiC with easier machinability and lower manufacturing costs. However, it has lower hardness and wear resistance compared to sintered SiC, limiting its use in highly abrasive conditions.

Impact on Application: RBSC is well-suited for applications such as kiln furniture, burner nozzles, and chemical processing components where moderate temperature resistance and corrosion resistance are required. Its ability to be machined to tight tolerances benefits complex part geometries.

Considerations for International Buyers: In regions like Nigeria and South America, RBSC is attractive due to its balance of cost and performance. Buyers should ensure products meet ASTM C1205 or equivalent standards and confirm supplier capabilities in machining and quality control. Import regulations may require certification of chemical composition and mechanical properties.

Key Properties: Sintered SiC is characterized by its high density, superior hardness, and excellent thermal shock resistance. It can withstand temperatures up to 1700°C and exhibits outstanding corrosion resistance to nearly all chemicals except hydrofluoric acid.

Pros & Cons: SSiC offers the best mechanical and chemical performance among SiC materials, making it ideal for extreme environments. The downside includes high production costs and limited machinability, often requiring diamond grinding. Lead times can be longer due to complex manufacturing.

Impact on Application: SSiC is preferred for high-end applications such as semiconductor manufacturing equipment, high-pressure valves, and wear-resistant parts in the oil and gas industry. Its robustness is advantageous in the Middle East’s harsh industrial conditions and Europe’s precision manufacturing sectors.

Considerations for International Buyers: Compliance with stringent standards like JIS R 1630 or EN 60672 is often necessary for European and Middle Eastern markets. Buyers should consider supplier certifications and the availability of after-sales technical support. Logistics planning is critical due to the material’s fragility during shipping.

Key Properties: SiC composites combine silicon carbide fibers or whiskers within a SiC matrix, offering enhanced toughness and damage tolerance compared to monolithic SiC. They maintain excellent thermal stability and corrosion resistance under extreme conditions.

Pros & Cons: These composites provide superior fracture toughness and fatigue resistance, extending component life in cyclic loading environments. However, they are the most expensive SiC option and require highly specialized manufacturing processes. Availability is limited and often geared towards aerospace or high-tech industries.

Impact on Application: Ideal for aerospace, nuclear reactors, and advanced automotive components where weight savings and mechanical resilience are critical. In B2B sectors within Europe and the Middle East, these materials support cutting-edge innovation but may be over-specified for general industrial uses in Africa and South America.

Considerations for International Buyers: Buyers should evaluate the cost-benefit ratio carefully and seek suppliers with proven experience in composite SiC production. Compliance with aerospace or nuclear industry standards (e.g., AMS, ASTM) may be required. Import/export controls and intellectual property rights can affect procurement strategies.

| Material | Typical Use Case for silica carbide | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide Ceramics | Chemical reactors, pump seals, heat exchangers | High thermal shock resistance and corrosion resistance | Brittle, high manufacturing complexity | High |

| Reaction Bonded Silicon Carbide (RBSC) | Kiln furniture, burner nozzles, chemical processing parts | Cost-effective, good machinability | Lower hardness and wear resistance | Medium |

| Sintered Silicon Carbide (SSiC) | Semiconductor equipment, high-pressure valves, oil & gas parts | Superior mechanical and chemical performance | High cost, limited machinability | High |

| Silicon Carbide Composite Materials | Aerospace components, nuclear reactors, advanced automotive | Enhanced toughness and fatigue resistance | Very high cost, limited availability | High |

Silicon carbide (SiC) is a highly durable and versatile ceramic material widely used in industries such as automotive, aerospace, electronics, and abrasives. Understanding its manufacturing process is critical for B2B buyers aiming to source high-quality SiC products that meet specific performance criteria.

The manufacturing of SiC begins with the preparation of raw materials, primarily silica (SiO₂) and carbon sources such as petroleum coke. These raw materials must be of high purity to ensure the final product’s performance and reliability. The carbon and silica powders are precisely weighed and mixed to achieve the desired stoichiometric ratio. Advanced mixing techniques, including ball milling or attrition milling, are employed to ensure homogeneity at a fine particle level, which is crucial for consistent chemical reactions and uniform microstructure.

Once the raw materials are prepared, the mixture undergoes a high-temperature reaction known as the Acheson process or alternative synthesis methods like chemical vapor deposition (CVD):

After synthesis, the SiC powder is shaped into the desired form using various techniques such as:

In applications requiring composite materials or multi-component assemblies, SiC parts may be joined with other ceramics or metals through techniques like brazing or diffusion bonding. This stage requires precise control to avoid contamination or structural weaknesses.

Finishing processes enhance the mechanical and surface properties of SiC components:

For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, verifying the quality assurance (QA) and quality control (QC) mechanisms of SiC suppliers is essential to mitigate risks related to product failure, non-compliance, or supply chain disruptions.

Quality control is embedded at multiple stages of the manufacturing process to ensure product integrity:

For buyers sourcing SiC internationally, especially from diverse regions such as Nigeria, Brazil, UAE, or the UK, due diligence on supplier QC capabilities is crucial:

By thoroughly understanding the manufacturing processes and quality assurance frameworks behind silicon carbide production, international B2B buyers can make informed decisions, ensuring they partner with suppliers who deliver consistent, high-performance products tailored to their market and application needs.

Understanding the cost structure behind silica carbide production is essential for international B2B buyers aiming to optimize procurement budgets. The primary cost components include:

Several factors can cause price fluctuations and affect final sourcing costs:

For B2B buyers across Africa, South America, the Middle East, and Europe, optimizing silica carbide sourcing requires strategic approaches:

Silica carbide pricing varies widely based on grade, form, and order specifics. As a guideline, industrial-grade silica carbide powders might range from $5 to $15 per kilogram, while specialized engineered blocks or customized materials can exceed this range. Buyers should treat these figures as indicative and seek multiple quotes tailored to their exact requirements.

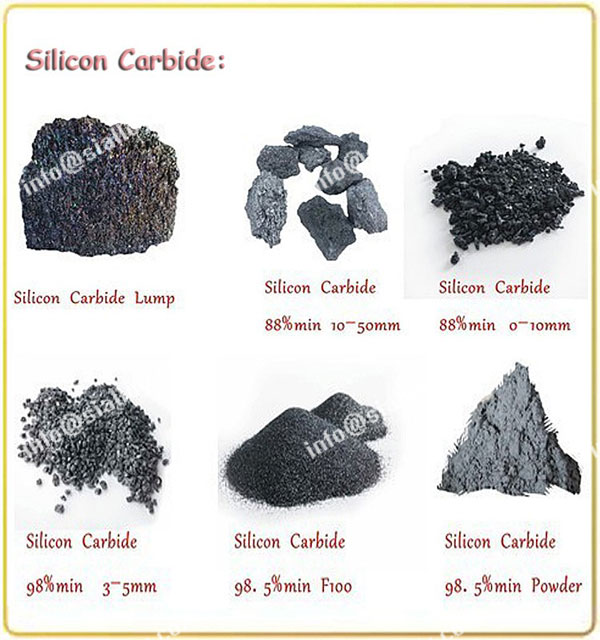

Illustrative Image (Source: Google Search)

By carefully analyzing cost components, understanding key price influencers, and applying strategic procurement practices, international B2B buyers can secure silica carbide supplies that balance cost-efficiency with quality and reliability.

Silicon carbide (often abbreviated as SiC) is a highly valued industrial material known for its exceptional hardness, thermal conductivity, and chemical stability. For international B2B buyers, especially those sourcing from regions like Africa, South America, the Middle East, and Europe, understanding the technical properties and common trade terminology associated with silicon carbide is crucial for making informed purchasing decisions and negotiating effectively.

1. Material Grade

Silicon carbide is available in various grades, typically categorized by purity and particle size. Higher purity grades (often 99%+ SiC) deliver superior performance in applications such as abrasives or refractory materials. Buyers should specify the grade to ensure compatibility with their intended use, whether for metallurgical, electronic, or mechanical applications.

2. Particle Size / Mesh Size

This property refers to the granularity of the silicon carbide powder or grit. Particle size affects surface finish, cutting efficiency, and sintering behavior. For example, finer particle sizes (measured in microns or mesh numbers) are preferred for precision grinding, whereas coarser sizes are used in heavy-duty abrasive processes. Accurate specification of particle size helps avoid production inefficiencies.

3. Hardness (Mohs Scale)

Silicon carbide ranks approximately 9-9.5 on the Mohs hardness scale, making it one of the hardest materials after diamond. This hardness is critical for applications requiring wear resistance and durability, such as cutting tools and abrasives. Buyers should confirm hardness levels when durability is a key performance requirement.

4. Bulk Density

Bulk density indicates the mass of silicon carbide per unit volume and affects packing, transport costs, and material handling. Knowledge of bulk density is important for logistics planning and cost estimation, especially for large-volume orders.

5. Thermal Conductivity

SiC exhibits excellent thermal conductivity, often exceeding 120 W/mK, which makes it ideal for heat dissipation in electronic components or high-temperature environments. Buyers in sectors like electronics or automotive manufacturing should prioritize this property to ensure product reliability under thermal stress.

6. Tolerance and Purity Levels

Tolerance refers to the allowable deviation in particle size or chemical composition. High tolerance levels can lead to inconsistent product performance. Purity levels impact the presence of impurities such as free carbon or silica, which can affect the material's mechanical and chemical properties. Precise tolerance and purity specifications are essential for quality control and regulatory compliance.

OEM (Original Equipment Manufacturer)

This term refers to companies that produce parts or equipment that may incorporate silicon carbide components. Understanding OEM requirements can help buyers align their specifications with industry standards and secure contracts with manufacturers needing SiC materials.

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier is willing to sell. Knowing the MOQ is vital for budgeting and inventory planning, especially for small or medium-sized enterprises in emerging markets. Negotiating MOQs can sometimes secure more flexible purchase terms.

RFQ (Request for Quotation)

An RFQ is a formal inquiry sent to suppliers to obtain pricing, delivery timelines, and technical details. A well-prepared RFQ that clearly states silicon carbide specifications (grade, particle size, purity) leads to accurate and comparable supplier responses, facilitating efficient procurement.

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding these terms helps buyers from different regions manage risks and control logistics costs effectively.

Lead Time

Lead time is the duration between placing an order and receiving the product. For silicon carbide, lead time can vary based on supplier location, production capacity, and shipping method. Buyers should factor lead time into project schedules to avoid production delays.

Certification and Compliance

Many industries require silicon carbide to meet certain certifications (e.g., ISO 9001, REACH compliance). Verifying certifications ensures that the product adheres to international quality and safety standards, minimizing risks in regulatory environments across different regions.

By mastering these technical properties and trade terms, international B2B buyers can enhance their negotiation power, optimize supply chain management, and ensure the silicon carbide they procure meets their specific industrial needs. This knowledge is especially valuable for buyers operating in diverse markets with varying regulatory frameworks and logistical challenges.

Silicon carbide (SiC) has become a critical material across various industrial sectors, driven by its exceptional hardness, thermal conductivity, and chemical inertness. The global demand for SiC is largely fueled by its applications in automotive (notably electric vehicles), electronics, abrasives, and refractory industries. For B2B buyers in Africa, South America, the Middle East, and Europe, understanding regional supply dynamics and emerging trends is key to strategic sourcing.

Global Drivers: The transition to renewable energy and electric vehicles is accelerating SiC demand, particularly for power electronics and semiconductors. Europe’s aggressive green energy policies and the Middle East’s investments in solar power infrastructure are notable growth catalysts. In Africa and South America, expanding mining operations and industrial manufacturing are increasing demand for abrasives and refractory-grade SiC.

Sourcing Trends:

- Vertical Integration & Direct Sourcing: Buyers increasingly prefer direct partnerships with manufacturers or vertically integrated suppliers to ensure supply security and cost control amid geopolitical uncertainties.

- Digital Procurement Platforms: Adoption of e-sourcing platforms and AI-driven analytics allows buyers to assess supplier reliability, price trends, and quality certifications more efficiently.

- Customization & Technical Collaboration: Suppliers offering tailored SiC grades or particle sizes are favored, especially in high-tech sectors like semiconductor fabrication. Collaborative R&D initiatives between buyers and producers are becoming more common to innovate materials with superior performance.

Market Dynamics:

- Price Volatility: SiC prices fluctuate with raw material availability (silicon and carbon sources) and energy costs, which are significant in production. Buyers in energy-importing regions such as parts of Africa and South America should factor energy price volatility into procurement strategies.

- Regional Supply Hubs: Europe, particularly the UK and Germany, hosts advanced SiC processing facilities, while China remains a dominant raw SiC supplier. Middle Eastern buyers benefit from proximity to emerging manufacturing hubs in the UAE and Saudi Arabia, reducing lead times.

- Regulatory Environment: Compliance with international quality and safety standards (ISO, REACH) is critical for cross-border transactions, especially for European buyers who face stringent regulations.

Sustainability considerations in the silica carbide sector are gaining momentum as industrial buyers increasingly prioritize environmental impact and ethical sourcing to meet corporate social responsibility (CSR) goals and regulatory requirements.

Environmental Impact: The production of SiC is energy-intensive, involving high-temperature processes that contribute to greenhouse gas emissions. Regions with cleaner energy sources can offer suppliers with lower carbon footprints, an advantage for buyers targeting sustainability certifications or green labeling. Water usage and waste management are also critical environmental factors, particularly in arid regions like the Middle East.

Ethical Supply Chains:

- Conflict-Free Sourcing: While SiC raw materials are not typically conflict minerals, buyers should verify the traceability of carbon sources and silicon feedstock to avoid ethical concerns related to mining practices.

- Supplier Audits & Transparency: Leading B2B buyers demand rigorous supplier audits focusing on labor practices, environmental compliance, and governance. Transparent supply chains help mitigate risks associated with reputational damage and supply disruptions.

Green Certifications & Standards:

- Buyers should seek suppliers certified under recognized environmental standards such as ISO 14001 (Environmental Management) and adhere to industry-specific frameworks like the Responsible Minerals Initiative (RMI).

- Emerging certifications for “green” SiC, emphasizing reduced carbon emissions and sustainable manufacturing processes, can differentiate suppliers and add value for environmentally conscious buyers.

By integrating sustainability into sourcing strategies, B2B buyers not only fulfill regulatory and customer expectations but can also unlock cost efficiencies through energy savings and waste reduction.

Silicon carbide was first synthesized in the late 19th century as an abrasive material, revolutionizing grinding and cutting technologies. Its discovery as a synthetic compound led to widespread industrial adoption due to its unmatched hardness and thermal properties. Over the decades, SiC evolved from a niche abrasive to a critical semiconductor material, especially with the rise of power electronics in the late 20th century.

This evolution is particularly relevant for international buyers, as the material’s applications have diversified dramatically, requiring a nuanced understanding of grade specifications and manufacturing techniques. The ongoing shift towards high-purity SiC wafers for electronics underscores the sector’s innovation trajectory, with implications for sourcing strategies that emphasize quality, reliability, and supplier technological capabilities.

How can I effectively vet silica carbide suppliers for international trade?

When sourcing silica carbide globally, especially from diverse regions like Africa, South America, the Middle East, and Europe, prioritize suppliers with verifiable certifications (ISO, REACH compliance). Request detailed company profiles, product samples, and references from existing clients. Utilize third-party inspection services for factory audits and quality checks. Ensure the supplier has experience handling international logistics and customs documentation to minimize delays. Building a strong communication channel early on helps clarify expectations on quality, lead times, and after-sales support, which is critical for long-term partnerships.

What customization options are typically available for silica carbide products?

Silica carbide can be tailored in terms of particle size, purity, shape (powder, grains, or blocks), and bonding materials to suit specific industrial applications. International buyers should clearly specify their technical requirements upfront, including thermal conductivity, mechanical strength, and grain size distribution. Many suppliers offer bespoke formulations for industries like abrasives, refractories, and semiconductors. Always confirm customization capabilities during supplier negotiations and request technical datasheets to ensure the product matches your application needs.

What are common minimum order quantities (MOQs) and lead times for silica carbide shipments?

MOQs vary widely depending on the supplier and product form but typically range from 500 kg to several tons. Lead times often span 3 to 8 weeks, influenced by production capacity, customization, and shipping logistics. Buyers from regions like Nigeria or Brazil should factor in additional transit times and customs clearance. Early planning and clear communication with suppliers can help negotiate MOQs and optimize delivery schedules. Consider suppliers with local warehouses or distribution centers in your region to reduce lead times.

Which payment terms are standard for international silica carbide transactions?

International B2B transactions usually involve payment terms such as Letters of Credit (L/C), Telegraphic Transfers (T/T), or open account terms after establishing trust. For first-time buyers, L/Cs provide security for both parties, though they may incur higher banking fees. Negotiating partial upfront payments followed by balance upon shipment or delivery is common. Buyers should confirm currency options and consider exchange rate risks, especially when dealing with suppliers from different continents to avoid unexpected costs.

Illustrative Image (Source: Google Search)

What quality assurance certifications should I expect from silica carbide suppliers?

Reliable suppliers should provide quality certifications like ISO 9001 for quality management and test reports confirming product purity and physical properties. Compliance with environmental and safety standards such as REACH (Europe) or local equivalents is essential, particularly for buyers in regulated markets like the UK or EU. Request independent lab test results or third-party inspection certificates to verify consistency. Regular quality audits and batch traceability are critical for maintaining product integrity across multiple shipments.

How should I plan logistics and shipping for silica carbide imports?

Silica carbide is generally shipped in bulk packaging such as bags or containers, requiring careful handling to prevent contamination or moisture exposure. Choose Incoterms that clearly define responsibilities; for example, FOB or CIF terms are common for international B2B trade. Work with freight forwarders experienced in chemical or mineral shipments to navigate customs regulations, especially in countries with complex import rules like Nigeria or Saudi Arabia. Consider multimodal transport options to optimize cost and delivery time, and always factor in buffer periods for customs clearance.

What are best practices for resolving disputes with silica carbide suppliers?

To minimize disputes, maintain transparent communication and document all agreements, including product specifications, delivery schedules, and payment terms. If quality or delivery issues arise, promptly notify the supplier with evidence (photos, lab reports). Most suppliers prefer negotiation or mediation before escalation. International buyers should understand the governing law and arbitration clauses in contracts, which often specify jurisdiction or international arbitration bodies. Establishing a dispute resolution framework upfront can save time and cost in cross-border transactions.

How can I ensure sustainable and ethical sourcing of silica carbide?

Increasingly, buyers in Europe and other regions demand suppliers adhere to environmental and social responsibility standards. Request supplier disclosures on raw material sourcing, energy consumption, and labor practices. Certifications like ISO 14001 (environmental management) and SA8000 (social accountability) indicate commitment to sustainability. Partnering with suppliers who invest in eco-friendly production and waste reduction can enhance your company’s ESG profile. Regular audits and supplier engagement programs help ensure ongoing compliance and mitigate risks associated with unethical sourcing.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of silica carbide presents a significant opportunity for international B2B buyers aiming to optimize cost, quality, and supply chain resilience. For businesses in Africa, South America, the Middle East, and Europe, understanding regional supplier landscapes and leveraging diversified sourcing strategies can mitigate risks related to geopolitical shifts and fluctuating raw material availability. Prioritizing suppliers with strong certifications, transparent production processes, and sustainable practices ensures long-term value and compliance with increasingly stringent industry standards.

Key takeaways for successful sourcing include:

Looking ahead, the demand for high-performance silica carbide products is expected to rise, driven by advancements in automotive, electronics, and renewable energy sectors. Buyers who proactively engage with forward-thinking suppliers and integrate sustainability into their procurement frameworks will secure competitive advantages. Now is the time for international buyers to deepen their market insights and forge resilient supply chains that support growth and innovation in a dynamic global environment.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina