Guide to Silizium Karbid

Navigating the global landscape of silicon carbide (silizium karbid) sourcing is essential for international B2B buyers seeking to optimize quality, cost-efficiency, and supply chain resilience. As a critical material in sectors such as automotive, electronics, renewable energy, and industrial manufacturing, silicon carbide’s demand continues to surge worldwide. For buyers in regions like Africa, South America, the Middle East, and Europe—such as Egypt and Argentina—understanding the intricacies of this market is vital for making informed procurement decisions.

This comprehensive guide provides an in-depth exploration of silicon carbide’s various forms, raw materials, manufacturing processes, and quality assurance practices. It also offers actionable insights into identifying reliable suppliers across different regions, evaluating cost structures, and navigating international trade considerations. Additionally, the guide addresses frequently asked questions to clarify common concerns about sourcing, certifications, and market trends.

By equipping B2B buyers with authoritative knowledge, this resource aims to empower smarter sourcing strategies that mitigate risks and capitalize on emerging opportunities. Whether you’re seeking to establish new supplier relationships, optimize existing procurement channels, or understand market dynamics, this guide ensures you are well-positioned to succeed in the competitive global silicon carbide market. Ultimately, informed sourcing leads to better product quality, cost savings, and a stronger foothold in your industry’s evolving landscape.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Black Silicon Carbide | Amorphous, darker in appearance, lower purity, cost-effective | Abrasives, refractory linings, grinding wheels | Cost-efficient, good for general abrasives but less suitable for high-performance applications due to lower purity |

| Green Silicon Carbide | Crystalline, higher purity, sharper grains | Cutting tools, precision grinding, ceramics | Superior hardness and sharpness ideal for precision tasks; higher cost may impact margins |

| Coated Silicon Carbide | Silicon carbide grains coated with ceramic or other materials | Wear-resistant coatings, semiconductor components | Enhances durability and thermal stability; coating costs can increase overall procurement expenses |

| Recrystallized Silicon Carbide | Recrystallized for uniform grain structure, high purity | High-temperature furnace linings, kiln furniture | Excellent thermal stability and mechanical strength; often more expensive but reduces maintenance costs |

| Special Grade Silicon Carbide | Custom formulations for specific industrial needs | Specialized electronics, advanced composites | Tailored properties ensure optimal performance; procurement complexity and cost may vary |

Black silicon carbide (SiC) is produced through a less controlled, lower-temperature process resulting in an amorphous, darker material with lower purity levels. Its cost-effectiveness makes it suitable for bulk applications such as abrasives, refractory linings, and grinding wheels. For B2B buyers, it offers a budget-friendly option where ultra-high performance is not critical. However, its lower purity and abrasive qualities mean it may wear faster or produce less precise results in high-performance applications, necessitating careful evaluation of application demands and cost trade-offs.

Green silicon carbide is crystalline and processed at higher temperatures, resulting in a purer and sharper grain structure. Its exceptional hardness makes it ideal for precision grinding, cutting tools, and advanced ceramic manufacturing. B2B buyers should consider its higher cost relative to black SiC but weigh this against its longer-lasting performance and superior finish quality. It is particularly suitable for industries requiring fine tolerances and high durability, such as aerospace and electronics, where performance benefits justify the investment.

This variation involves applying ceramic or other protective coatings to SiC grains, significantly enhancing their thermal stability and wear resistance. Coated SiC is often used in wear-resistant coatings, semiconductor components, and high-temperature environments. Buyers should evaluate the added cost of coatings against the benefits of increased lifespan and thermal performance, especially in demanding applications like aerospace or advanced electronics. This type is suitable where operational longevity and thermal management are priorities.

Recrystallized SiC undergoes a high-temperature process that produces a uniform grain structure with high purity and mechanical strength. Its key applications include high-temperature furnace linings and kiln furniture, where thermal stability and durability are critical. For B2B buyers, this grade offers reduced maintenance and downtime, translating into long-term cost savings. Although it tends to be more expensive upfront, its performance benefits often offset initial procurement costs in high-demand industrial environments.

Custom formulations of SiC are designed to meet specific industry requirements, such as tailored grain sizes, purity levels, or coatings. These grades are used in specialized electronics, composites, or niche industrial processes. B2B buyers should consider the procurement complexity and potentially higher costs associated with custom production but can benefit from optimized performance, efficiency, and product lifespan. Engaging with suppliers early in the sourcing process is essential to ensure specifications align with operational needs and budget constraints.

| Industry/Sector | Specific Application of silizium karbid | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Mining & Mineral Processing | Wear-resistant linings for crushers and grinding equipment | Extends equipment lifespan, reduces maintenance costs, enhances operational efficiency | Material purity, size consistency, local availability, cost competitiveness |

| Automotive & Aerospace | High-performance brake systems and clutches | Improved heat resistance, durability, safety standards compliance | Quality certifications, supply reliability, compatibility with OEM specifications |

| Electronics & Semiconductors | Power devices and high-voltage components | Superior thermal conductivity, high breakdown voltage, energy efficiency | Purity levels, consistent quality, traceability, supplier certifications |

| Oil & Gas | Abrasion-resistant components in drilling and extraction equipment | Increased operational uptime, corrosion resistance, safety compliance | Customization options, material certifications, regional logistics capabilities |

| Steel & Manufacturing | Abrasive tools and cutting edges | Faster processing, reduced tool wear, cost savings | Grain size control, consistency, regional sourcing options, price stability |

Silizium karbid is widely used in the mining sector for manufacturing wear-resistant linings and components within crushers, mills, and conveyors. Its exceptional hardness and durability help withstand the abrasive nature of mineral ores, significantly reducing downtime and maintenance costs. For international B2B buyers from Africa and South America, sourcing high-quality, consistent-grade silizium karbid locally or regionally ensures supply security and cost efficiency. Buyers should prioritize suppliers with proven track records in delivering materials that meet industry standards and specific operational needs.

In the automotive and aerospace industries, silizium karbid is crucial for producing high-performance brake systems and clutches. Its ability to withstand extreme heat and mechanical stress enhances safety and reliability, especially in high-performance vehicles and aircraft. B2B buyers from regions like Europe and the Middle East should seek suppliers offering certified, high-purity materials that meet strict industry standards. Reliable sourcing guarantees consistent quality, which is vital for compliance and safety certifications across international markets.

Silizium karbid plays a vital role in the electronics sector, especially in manufacturing power devices and high-voltage semiconductors. Its excellent thermal conductivity and high breakdown voltage enable more efficient energy management and device miniaturization. For buyers in Europe and South America, sourcing pure, high-quality silizium karbid with traceability is essential to ensure device performance and compliance with environmental standards. Establishing relationships with certified suppliers guarantees supply stability and product consistency.

In the oil and gas industry, silizium karbid is used in abrasion-resistant components such as valve seats, seals, and pump parts. Its resistance to corrosion and wear under extreme pressure and chemical exposure enhances operational safety and reduces costly downtime. Buyers from the Middle East and Africa should consider sourcing suppliers capable of providing customized, certified materials that meet regional safety and environmental regulations. Reliable supply chains and regional logistics are critical for maintaining continuous operations.

Silizium karbid is a key abrasive material in manufacturing tools, cutting edges, and grinding wheels. Its high hardness enables faster processing speeds and longer tool life, translating into significant cost savings. B2B buyers in Europe and South America should focus on sourcing materials with controlled grain sizes and consistent quality to optimize manufacturing efficiency. Regional sourcing options that offer stable pricing and prompt delivery are essential to maintain production schedules and competitiveness.

When selecting materials for silicon carbide (SiC) applications, B2B buyers must consider a range of properties that influence performance, durability, and compliance with international standards. Here, we analyze four common materials used in conjunction with SiC components or as alternatives, focusing on their key properties, advantages, limitations, and implications for international procurement.

Key Properties:

Alumina is renowned for its high hardness, excellent electrical insulation, and good corrosion resistance. It can withstand temperatures up to approximately 1,000°C, making it suitable for high-temperature environments. Its thermal conductivity is moderate, and it offers good chemical stability against many aggressive media.

Pros & Cons:

- Pros: Cost-effective, widely available, easy to machine, and offers high wear resistance. Its electrical insulating properties are advantageous in electronic applications involving SiC semiconductors.

- Cons: Lower mechanical strength compared to SiC and limited fracture toughness, which can lead to brittleness under mechanical stress. Its thermal expansion coefficient differs from SiC, potentially causing stress at interfaces.

Impact on Application:

Alumina’s chemical inertness makes it suitable for corrosive environments, such as chemical processing or electrical insulators in SiC devices. However, its lower thermal conductivity may limit use in high-power, high-temperature applications where heat dissipation is critical.

International Considerations:

Most standards (ASTM, DIN, JIS) recognize alumina’s quality grades, facilitating global procurement. Buyers from Africa, South America, the Middle East, and Europe should verify compliance with local standards and confirm supplier certifications to ensure material consistency, especially for critical applications.

Key Properties:

Graphite offers excellent thermal stability, high thermal conductivity, and good chemical resistance. It can withstand extreme temperatures exceeding 3,000°C in inert atmospheres. Its lubricating properties and low coefficient of thermal expansion are advantageous in high-temperature environments.

Pros & Cons:

- Pros: Superior thermal management, excellent machinability, and cost-effective for high-temperature applications.

- Cons: Susceptible to oxidation at elevated temperatures unless protected or used in inert atmospheres. Mechanical strength is relatively low, and it can cause contamination issues in sensitive environments.

Impact on Application:

Graphite is ideal for high-temperature furnace linings, crucibles, and heat exchangers involving SiC components. Its compatibility with inert gases makes it suitable for specialized industrial processes, but oxidation resistance must be carefully managed.

International Considerations:

Graphite standards vary globally; European and Japanese standards (e.g., JIS) are well established, while ASTM specifications are common in North America. Buyers should ensure suppliers provide certified, high-purity graphite suitable for their specific process conditions, especially in regions with strict environmental regulations.

Key Properties:

Stainless steel offers excellent mechanical strength, corrosion resistance, and moderate high-temperature performance (up to 800°C for some grades). It is widely used for structural components, fittings, and housings in SiC-based systems.

Pros & Cons:

- Pros: Readily available, cost-effective, and easy to fabricate. Its corrosion resistance makes it suitable for diverse media.

- Cons: Thermal expansion mismatch with SiC can cause mechanical stress. Not suitable for high-temperature environments exceeding 800°C, and it may corrode in certain aggressive media unless properly alloyed.

Impact on Application:

Stainless steel components are common in reactors, piping, and support structures involving SiC. Proper design considerations are necessary to accommodate thermal expansion differences to prevent failure.

International Considerations:

Global standards (ASTM, EN, JIS) facilitate procurement. Buyers from regions like Egypt or Argentina should verify material certifications, especially for critical applications, and ensure compatibility with local standards and environmental regulations.

Key Properties:

Silicon nitride is a high-performance ceramic known for excellent toughness, thermal stability (up to 1,400°C), and resistance to thermal shock. It exhibits low thermal expansion and good chemical inertness.

Pros & Cons:

- Pros: Superior mechanical strength, impact resistance, and thermal shock tolerance compared to alumina or graphite.

- Cons: Higher cost and more complex manufacturing processes. Its availability may be limited in certain regions, and machining can be more challenging.

Impact on Application:

Ideal for high-stress, high-temperature environments such as bearings, seals, and structural components in SiC systems. Its durability enhances system longevity, especially in demanding industrial applications.

International Considerations:

Silicon nitride standards are less universally established, requiring careful supplier qualification. Buyers in emerging markets should prioritize suppliers with proven quality certifications and consider import logistics due to higher costs.

| Material | Typical Use Case for silizium karbid | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Oxide (Al₂O₃) | Insulating components, chemical reactors | Cost-effective, good electrical insulation | Lower mechanical strength, brittle | Low |

| Graphite | Furnace linings, heat exchangers | Excellent thermal conductivity, high-temperature stability | Oxidation risk, contamination potential | Med |

| Stainless Steel (e.g., 316L) | Structural supports, piping in SiC systems | Good mechanical strength, corrosion resistance | Thermal expansion mismatch, limited high-temp performance | Low |

| Silicon Nitride (Si₃N₄) | High-stress components, bearings | High toughness, thermal shock resistance | Higher cost, limited regional availability | High |

This material selection guide provides a strategic overview tailored for international B2B buyers. By understanding the properties, advantages, and limitations of each material, buyers from Africa, South America, the Middle East, and Europe can make informed decisions aligned with their specific operational needs, compliance requirements, and budget constraints.

Understanding the manufacturing process of silicon carbide (SiC) is crucial for B2B buyers aiming to establish reliable supply chains and ensure product quality. The production typically involves several key stages: raw material preparation, forming, sintering or reaction bonding, and finishing.

1. Raw Material Preparation

The process begins with sourcing high-purity silica sand and carbon sources such as petroleum coke or charcoal. These raw materials are carefully selected based on their chemical composition, impurity levels, and particle size distribution to meet industry specifications. Proper storage and handling are essential to prevent contamination, especially for buyers from regions with strict import regulations like Europe and the Middle East.

2. Forming

The prepared raw materials are then shaped into desired forms—powders, blocks, or custom shapes—using techniques such as pressing, extrusion, or injection molding. Additives like binders may be used to enhance shape stability during processing. Uniformity in particle size and shape is critical to ensure consistent densification during sintering.

3. Sintering and Reaction Bonding

The shaped green bodies undergo high-temperature sintering in electric arc furnaces or resistance furnaces, typically at temperatures ranging from 2000°C to 2200°C. During sintering, silicon carbide particles bond together, achieving the desired density and mechanical properties. Some manufacturers employ reaction bonding, where silica infiltrates carbon preforms, forming SiC in situ, which is common for large or complex shapes.

4. Finishing and Surface Treatments

Post-sintering, products are subjected to grinding, lapping, or polishing to meet precise dimensional tolerances and surface finish requirements. Additional surface treatments, such as coatings or impregnation, may be applied depending on application-specific needs, like high-temperature insulation or electrical conductivity.

Ensuring SiC product quality involves rigorous quality control (QC) protocols aligned with international standards and industry-specific certifications. B2B buyers should verify that suppliers adhere to these protocols to mitigate risks associated with material inconsistencies, impurities, or non-compliance.

1. International Standards and Certifications

- ISO 9001: Most reputable manufacturers operate under ISO 9001 quality management systems, ensuring consistent process control and product quality.

- CE Certification: For products destined for the European market, CE marking indicates compliance with EU safety and environmental standards.

- Industry-specific Certifications: Depending on application (e.g., aerospace, semiconductor, or chemical industries), certifications like API (American Petroleum Institute) or ASTM standards may be required.

2. Quality Control Checkpoints

- Incoming Quality Control (IQC): Raw materials are inspected upon receipt for purity, particle size, and impurity levels using techniques such as X-ray fluorescence (XRF) and inductively coupled plasma mass spectrometry (ICP-MS).

- In-Process Quality Control (IPQC): During forming and sintering, parameters like temperature, pressure, and density are monitored to ensure process consistency. Non-destructive testing methods, such as ultrasonic inspection, are employed to detect internal defects.

- Final Quality Control (FQC): Finished products undergo comprehensive testing, including mechanical strength (e.g., crush strength, flexural strength), thermal stability, and surface integrity. Optical microscopy and scanning electron microscopy (SEM) are used to assess microstructure and detect surface flaws.

3. Testing Methods

- Hardness Testing: Vickers or Knoop hardness tests evaluate surface durability.

- Density Measurement: Archimedes’ principle or helium pycnometry assesses relative density, indicating sintering effectiveness.

- Thermal Conductivity and Stability: Differential scanning calorimetry (DSC) and thermal gravimetric analysis (TGA) determine performance at high temperatures.

- Impurity Analysis: Ensures impurity levels meet strict thresholds, crucial for electronics or semiconductor applications.

B2B buyers from regions like Africa, South America, the Middle East, and Europe should adopt comprehensive verification strategies to ensure supplier reliability:

Supplier Audits: Conduct on-site audits or engage third-party inspection agencies to review manufacturing facilities, quality management systems, and process controls. For instance, SGS, Bureau Veritas, or TÜV can provide independent assessments tailored to industry standards.

Review Certification Documentation: Request and verify ISO certificates, test reports, and compliance documentation. Ensure certificates are current and issued by accredited bodies.

Sample Testing and Certification: Request product samples for independent testing in recognized laboratories, especially when dealing with critical applications like semiconductors or aerospace components.

Historical Performance and References: Gather references from other B2B clients, particularly those from your region, to assess the supplier’s track record in quality and delivery reliability.

By understanding and scrutinizing manufacturing processes and QC protocols, international B2B buyers can significantly reduce risks, ensure product reliability, and foster long-term supplier relationships in the silicon carbide market.

Understanding the comprehensive cost structure is vital for international buyers seeking competitive pricing on silicon carbide. The primary cost components include raw materials, manufacturing labor, overhead, tooling, quality control, logistics, and profit margins.

Materials:

The raw materials for SiC production—primarily silica sand and carbon sources—constitute a significant portion of the cost. Variations in raw material quality, source location, and market prices can influence overall costs. Buyers should consider suppliers that source high-purity raw materials, which may command a premium but ensure better product performance.

Labor & Manufacturing Overhead:

Labor costs differ markedly across regions. For instance, suppliers in Egypt or South America may offer lower manufacturing wages compared to European producers, impacting final prices. Overhead costs—utilities, maintenance, and plant efficiency—also contribute to pricing and vary depending on the supplier’s technology and scale.

Tooling & Equipment:

Initial tooling and equipment setup costs are usually amortized over large production volumes. For customized specifications, these costs can increase, affecting the unit price, especially for small or medium orders.

Quality Control & Certifications:

Stringent quality assurance processes, such as ISO certifications or industry-specific standards, influence costs. Suppliers with proven certifications typically charge a premium but offer reliability crucial for high-performance applications.

Logistics & Incoterms:

Transportation costs depend on shipment volume, destination, and chosen Incoterms (e.g., FOB, CIF). Buyers in remote regions like parts of Africa or South America should factor in higher freight and customs clearance expenses. Consolidating shipments and choosing cost-effective logistics providers can mitigate these costs.

Several factors shape the final price that international buyers will encounter:

Order Volume & MOQ:

Higher volumes generally secure better unit prices due to economies of scale. Establishing long-term relationships with suppliers and negotiating volume discounts can significantly reduce costs.

Specifications & Customization:

Standard grades of SiC are more affordable. Custom specifications, such as particular grain sizes or purity levels, tend to increase production complexity and cost.

Material & Quality Standards:

Higher purity, specific certifications, or specialized grades (e.g., for electronics or abrasive applications) command premium prices. Buyers should balance quality requirements with budget constraints.

Supplier Factors:

Reputation, production capacity, and supply chain stability influence pricing. Larger, well-established suppliers often offer more consistent pricing but may be less flexible on terms.

Incoterms & Delivery Terms:

Choosing FOB (Free on Board) or CIF (Cost, Insurance, Freight) impacts who bears transportation risks and costs. Buyers should evaluate total landed cost, including customs duties and taxes, especially when sourcing from regions with high import tariffs.

Negotiate for Better Terms:

Leverage volume commitments, long-term contracts, or payment terms to negotiate discounts. Establishing trust can lead to preferential pricing and priority service.

Focus on Total Cost of Ownership (TCO):

Beyond unit price, consider logistics, customs, potential rework, and quality assurance costs. Sometimes, paying a slightly higher price upfront yields savings through reduced rejections and downtime.

Local Sourcing & Regional Suppliers:

In regions like Africa or South America, sourcing from local or nearby suppliers can reduce shipping costs and lead times. However, verify supplier quality and capacity to meet your specifications.

Pricing Nuances & Price Fluctuations:

Raw material volatility and geopolitical factors can cause price fluctuations. Regular market monitoring and flexible procurement strategies are essential to mitigate risks.

Indicative prices for silicon carbide can vary widely depending on grade, quantity, and supplier region. As of late 2023, typical FOB prices for standard SiC grades range from $2.50 to $4.50 per kilogram for bulk orders exceeding 10 metric tons. Premium or specialized grades can cost significantly more. Buyers should conduct current market research and request detailed quotations to obtain accurate, region-specific pricing.

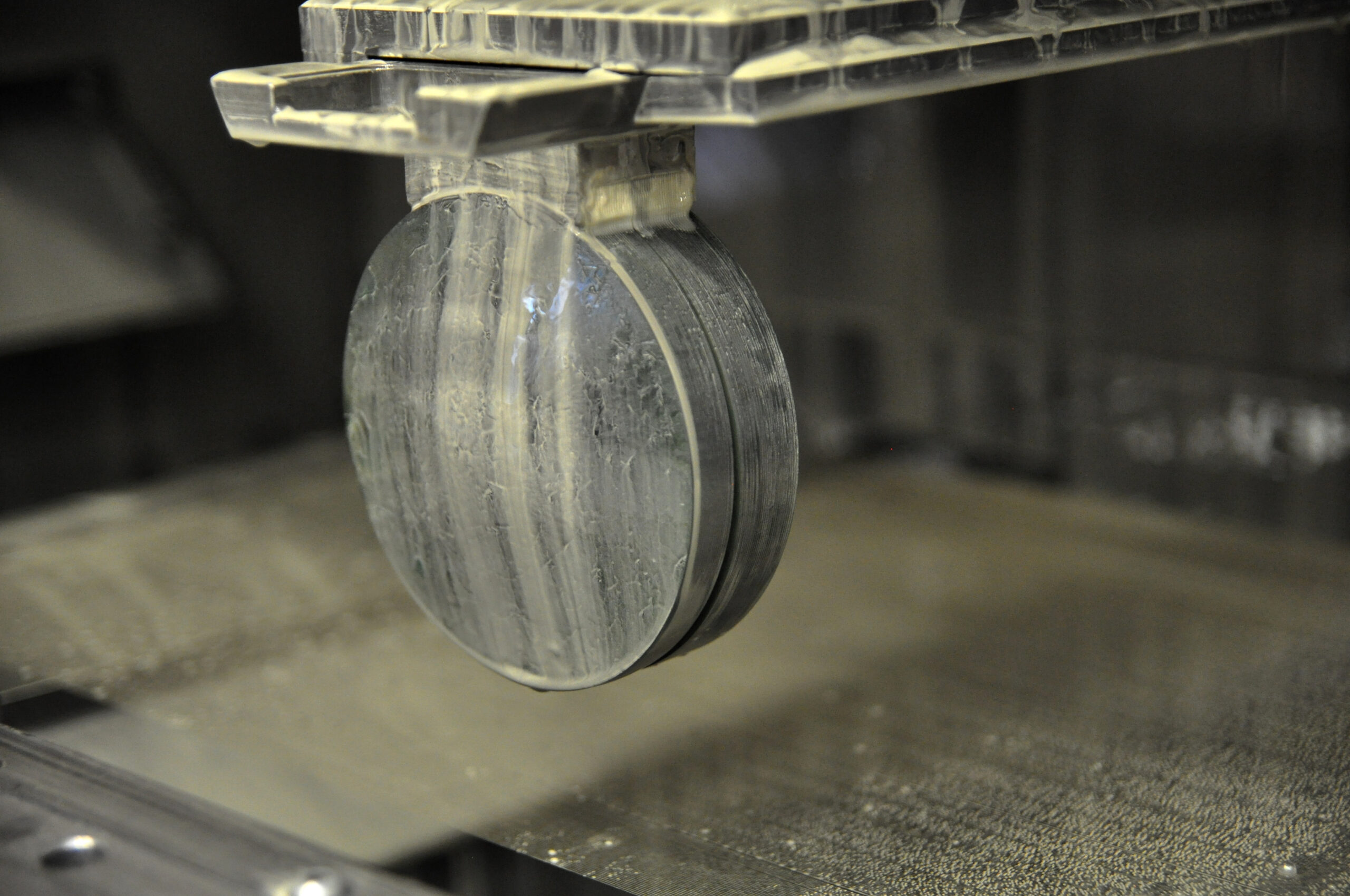

Illustrative Image (Source: Google Search)

By understanding these cost components and influencing factors, international buyers from Africa, South America, the Middle East, and Europe can develop strategic sourcing plans. Effective negotiation, thorough supplier evaluation, and comprehensive cost analysis are essential for securing the best value in silicon carbide procurement.

Understanding the technical specifications of silicon carbide is essential for international B2B buyers to ensure they select the right material for their applications. Here are key properties to consider:

Material Grade: Silicon carbide is classified into various grades based on purity, crystal structure, and application suitability. Common grades include standard, high-purity, and specialty grades designed for electronics, abrasives, or refractory uses. Higher-grade SiC offers better performance but often at a premium price, impacting cost-effectiveness and application quality.

Particle Size & Distribution: The size of SiC particles (measured in micrometers) influences processing and performance. Fine powders (less than 5 micrometers) are preferred in electronic applications, while coarser grains are suitable for abrasives. Consistent particle size distribution ensures uniformity in manufacturing, reducing defects and improving product reliability.

Tolerance & Dimensional Accuracy: For shaped components, specifications on dimensional tolerances are crucial. Tight tolerances (e.g., ±0.1 mm) enable precise assembly and performance in high-tech applications such as semiconductors or cutting tools. Suppliers should provide detailed tolerance charts aligned with industry standards.

Density & Porosity: The bulk density affects thermal conductivity and mechanical strength. Higher density SiC (above 3.2 g/cm³) generally offers better durability and heat resistance. Low porosity levels are critical in electronic applications to prevent leakage currents and ensure electrical stability.

Thermal Conductivity & Stability: SiC’s ability to conduct heat efficiently (up to 490 W/m·K) and withstand high temperatures (up to 2,700°C in inert atmospheres) makes it ideal for high-performance environments. Buyers should verify these specs for applications such as power electronics or high-temperature furnaces.

Electrical Properties: For electronic components, parameters like dielectric strength and resistivity are vital. SiC’s wide bandgap (about 3 eV) provides excellent electrical insulation and high breakdown voltage, essential for power devices and semiconductors.

Familiarity with standard jargon enhances communication and negotiation efficiency in international trade. Here are essential terms for B2B buyers:

OEM (Original Equipment Manufacturer): An OEM produces components or products that are integrated into a final product by another company. In SiC trading, OEMs often specify particular grades or forms tailored for their manufacturing processes.

MOQ (Minimum Order Quantity): The smallest quantity a supplier is willing to accept for a purchase. Understanding MOQs helps buyers plan procurement budgets and avoid overstocking, especially when dealing with specialty grades of SiC.

RFQ (Request for Quotation): A formal request sent by buyers to suppliers seeking detailed price and delivery terms. RFQs are standard in international trade to compare offers, negotiate pricing, and clarify specifications before committing.

Incoterms (International Commercial Terms): Standardized trade terms published by the International Chamber of Commerce defining responsibilities for shipping, insurance, and customs. Common Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight) influence total costs and risk management.

Certification & Quality Standards: Terms like ISO, ASTM, or RoHS refer to internationally recognized standards ensuring product quality, safety, and environmental compliance. Ensuring SiC suppliers meet these standards mitigates risks related to regulatory violations or subpar quality.

Lead Time: The period between order placement and product delivery. For international buyers, understanding lead times is critical to align procurement schedules with production deadlines, especially when sourcing from distant regions like Africa or South America.

By understanding these technical properties and trade terms, international B2B buyers can make more informed decisions, optimize procurement strategies, and establish reliable supply partnerships for silicon carbide.

The global silicon carbide (SiC) sector is experiencing robust growth driven by technological advancements and increasing demand across multiple industries. Key drivers include the expansion of electric vehicle (EV) markets, renewable energy systems, and high-power electronic applications, all of which rely heavily on SiC’s superior thermal conductivity and voltage stability. Emerging trends reveal a shift towards high-purity, customized SiC grades tailored for specific industrial needs, prompting suppliers to innovate in processing and quality control.

For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe, understanding regional sourcing dynamics is crucial. Europe, for instance, remains a major consumer with a focus on sustainable and high-quality SiC, often seeking suppliers who adhere to strict environmental standards. Meanwhile, countries like Egypt and Argentina are increasingly positioning themselves as regional hubs for SiC processing and distribution, driven by government incentives and strategic industry initiatives.

Global supply chains are also adapting to geopolitical factors, trade policies, and raw material availability. China continues to dominate the production landscape, holding a significant share of the global market, but recent efforts in North America and Europe aim to diversify sourcing options. For B2B buyers, this means evaluating supplier reliability, geopolitical stability, and the capacity for technological innovation.

In addition, sourcing trends favor vertical integration and long-term partnerships, especially for high-volume buyers seeking consistency and quality assurance. The rise of digital procurement platforms and blockchain traceability tools further facilitates transparency and trust in international transactions. Buyers should prioritize suppliers with robust quality certifications, sustainable practices, and flexible logistics solutions to navigate these evolving market dynamics effectively.

Sustainability has become a pivotal factor in the silicon carbide supply chain, driven by increasing environmental awareness and stricter regulatory frameworks worldwide. The extraction and processing of raw materials for SiC, primarily silicon and carbon sources, can have significant environmental impacts if not managed responsibly. As such, B2B buyers from Africa, South America, the Middle East, and Europe are progressively demanding suppliers who adhere to high environmental standards and demonstrate commitment to ethical sourcing.

Certifications such as ISO 14001 (Environmental Management) and responsible mining certifications are now critical benchmarks for suppliers. Additionally, eco-labels like Green Seal or specific industry standards that verify low carbon footprints and sustainable practices are gaining importance. Buyers should seek suppliers who transparently report their environmental impact, including energy consumption, waste management, and carbon emissions.

Sustainable sourcing also involves ethical labor practices, fair wages, and community engagement, especially in regions where resource extraction might be linked to social issues. Establishing traceability through blockchain or third-party audits helps ensure supply chains are free from conflict minerals and unethical practices.

Investing in 'green' materials, such as recycled silicon or alternative processing methods that reduce energy consumption, can further enhance sustainability credentials. For B2B buyers, prioritizing suppliers committed to continuous improvement and sustainability innovation not only mitigates reputational risks but also aligns with global corporate social responsibility (CSR) objectives. This strategic approach fosters resilience, attracts eco-conscious clients, and positions buyers as industry leaders in sustainable industrial practices.

The silicon carbide industry has evolved significantly over the past century, initially developed for abrasive applications in the early 20th century. Its transition into high-tech sectors began in the mid-20th century with the advent of semiconductor applications, leveraging SiC’s exceptional electrical properties. The recent surge in demand stems from its critical role in power electronics, electric vehicles, and renewable energy systems, marking a shift from traditional industrial uses to high-value technological applications.

This evolution reflects broader industry trends emphasizing efficiency, sustainability, and technological innovation. For B2B buyers, understanding this history underscores the importance of sourcing from experienced suppliers with a proven track record in both traditional and advanced SiC applications. It also highlights the need for ongoing technological adaptation, quality assurance, and environmental responsibility to meet modern industry standards and future growth trajectories.

To verify supplier credibility, start with comprehensive due diligence: request certifications such as ISO 9001, RoHS, or REACH compliance, and review their quality control processes. Ask for recent third-party inspection reports and sample products for independent testing. Evaluate their production capacity, lead times, and client references, especially from regions similar to yours. Engaging with suppliers via video calls and visiting their facilities (if feasible) can provide deeper insight. Building strong communication channels and establishing clear quality expectations upfront helps mitigate risks and ensures consistent product quality.

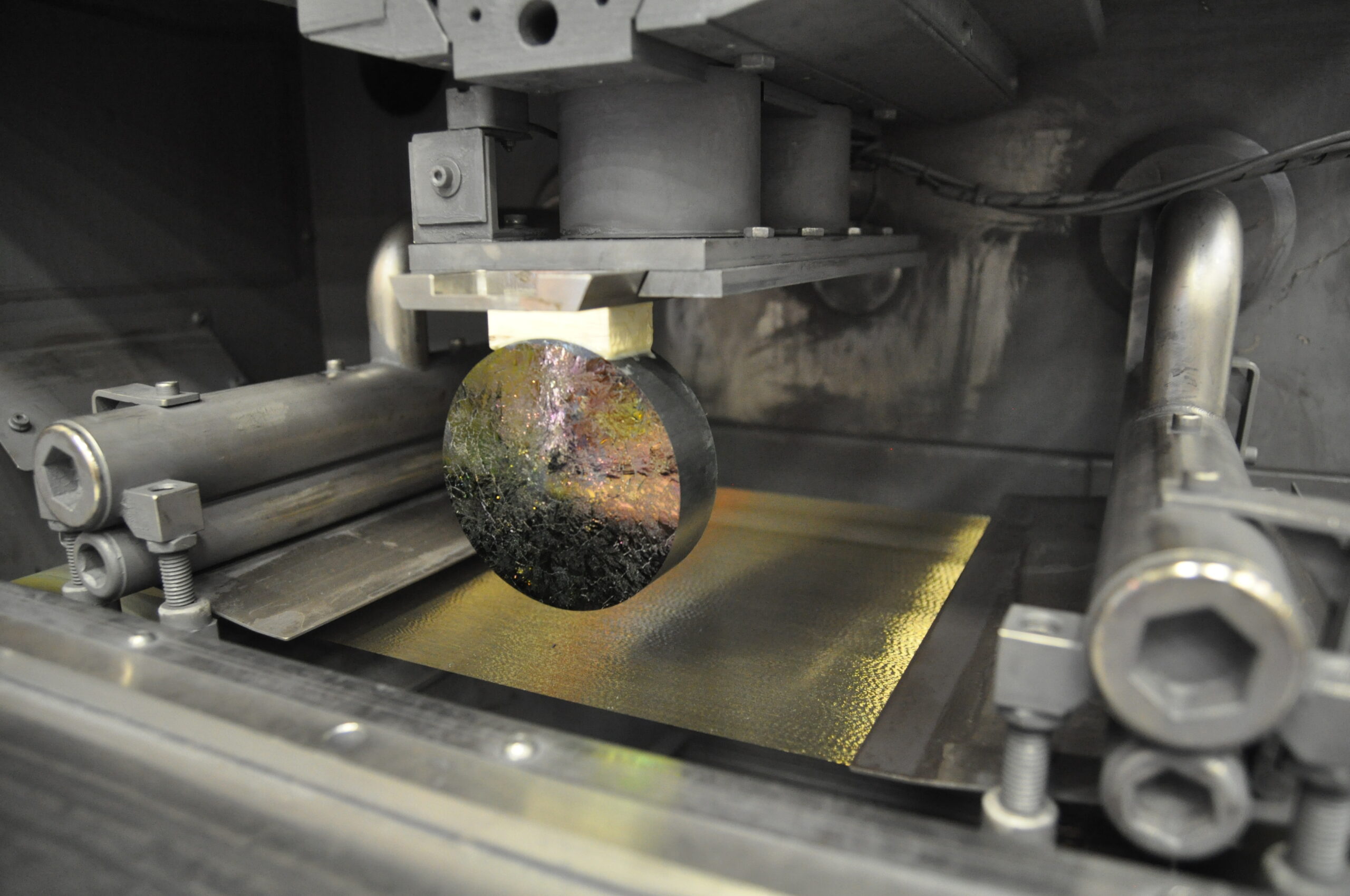

Illustrative Image (Source: Google Search)

Yes, many suppliers offer customization options, including particle size distribution, purity levels, coating finishes, and shape modifications tailored to your application—such as abrasives, semiconductors, or refractory uses. Clearly define your technical specifications and provide detailed drawings or standards during negotiations. Confirm with suppliers their capacity to meet these specifications without compromising delivery schedules. Establishing long-term partnerships with flexible suppliers can facilitate ongoing customization, reduce costs, and improve product performance aligned with your unique industry needs.

MOQs for silicon carbide often range from a few hundred kilograms to several tons, depending on the supplier’s production scale and product complexity. Lead times typically vary from 4 to 12 weeks, influenced by order size, customization, and logistics. Common payment terms include 30% advance payment with the balance payable upon shipment or delivery, but these can be negotiated—especially for trusted buyers or bulk orders. Establish clear contractual terms upfront, including penalties for delays, to ensure smooth transactions and reliable supply continuity.

Request certifications such as ISO 9001 (quality management), ISO 14001 (environmental management), and industry-specific standards like ASTM or IEC certifications relevant to your application. Quality assurance documentation should include test reports, batch traceability, impurity analysis, and compliance certificates. For sensitive applications like electronics, ensure suppliers provide material safety data sheets (MSDS) and conformity declarations. Verifying these documents helps ensure that the product meets your technical and regulatory requirements, reducing the risk of non-compliance or substandard quality.

Coordinate closely with suppliers to understand their preferred logistics partners and shipping methods—air, sea, or land—based on cost, urgency, and volume. For large shipments, sea freight is typically cost-effective but slower, while air freight offers faster delivery at higher costs. Consider incoterms such as FOB (Free on Board) or CIF (Cost, Insurance, and Freight) to clarify responsibilities. Engage experienced freight forwarders familiar with your region’s import regulations and customs procedures. Proper planning ensures timely delivery, minimizes customs delays, and optimizes overall supply chain efficiency.

Disputes often arise over quality, delivery delays, or payment issues. To mitigate risks, include clear contractual clauses on dispute resolution, specifying preferred mechanisms such as arbitration under ICC rules or local jurisdiction. International arbitration is generally favored for its neutrality and enforceability across borders. Ensure your contracts specify language, location, and governing law to reduce ambiguities. Working with legal experts familiar with international trade laws can help draft enforceable agreements, safeguard your interests, and facilitate swift resolution of any disagreements.

Establish transparent communication channels and regularly review supplier performance through audits and feedback. Consider signing long-term supply agreements with favorable terms, including volume discounts and flexible payment options. Diversify your supplier base to reduce dependency on a single source and mitigate geopolitical or logistical risks. Investing in supplier development programs and maintaining open dialogue about future needs fosters mutual trust. Staying proactive about market trends and technological advancements ensures your supply chain remains resilient and responsive to evolving industry demands.

Currency volatility can impact overall costs; negotiating prices in stable currencies like USD or EUR and including clauses for currency adjustment can protect margins. Use secure payment methods such as letters of credit (L/C), bank guarantees, or escrow accounts to minimize payment risks. Establish clear payment schedules aligned with shipment milestones to ensure accountability. Maintaining ongoing communication with your bank and financial advisors can help navigate exchange rate fluctuations and optimize payment strategies, ultimately safeguarding your investment and ensuring smooth financial transactions across borders.

Effective strategic sourcing of silizium karbid offers significant competitive advantages for international B2B buyers, especially those in emerging markets such as Africa, South America, the Middle East, and Europe. By establishing reliable supply chains, diversifying sourcing regions, and partnering with reputable manufacturers, buyers can mitigate risks associated with market volatility, geopolitical tensions, and supply disruptions.

Key takeaways include the importance of evaluating supplier quality, ensuring compliance with industry standards, and leveraging technological innovations for cost efficiency and sustainability. Developing strong supplier relationships and engaging in long-term contracts can also secure better pricing and priority access to critical materials.

Illustrative Image (Source: Google Search)

Looking ahead, the demand for silizium karbid is poised to grow driven by advancements in electronics, automotive, and industrial applications. International buyers should prioritize proactive sourcing strategies, including exploring emerging suppliers and regional hubs, to capitalize on market opportunities and ensure resilient supply chains.

Now is the time for strategic action—by optimizing sourcing approaches today, buyers from Africa, South America, the Middle East, and Europe can strengthen their competitive positioning and sustainably meet future industry needs.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina