In an increasingly competitive global marketplace, sourcing high-quality siliziumcarbid (silicon carbide) can be a daunting task for international B2B buyers, particularly those based in Africa, South America, the Middle East, and Europe. The challenge lies not only in identifying reliable suppliers but also in understanding the diverse applications and types of silicon carbide, which range from industrial abrasives to semiconductor materials. This guide aims to demystify the complexities of the siliziumcarbid market by providing comprehensive insights into supplier vetting, cost considerations, and application-specific uses.

Buyers will benefit from an in-depth exploration of the various forms of siliziumcarbid, including its crystalline structures and their respective functionalities. Additionally, the guide will address critical factors for evaluating suppliers, such as certifications, quality control processes, and logistical considerations. By equipping B2B buyers with actionable knowledge, this resource empowers them to make informed purchasing decisions that align with their specific operational needs and market demands.

Whether you are a manufacturer in Saudi Arabia seeking durable materials for high-temperature applications or a distributor in South Africa looking to enhance your product offerings, this guide serves as a vital tool for navigating the global siliziumcarbid landscape. Embrace the opportunity to streamline your sourcing process and foster partnerships that can propel your business forward in this dynamic industry.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 4H-SiC | High thermal conductivity, high breakdown voltage | Power electronics, RF devices | Pros: Excellent performance in high-power applications. Cons: Higher cost compared to other types. |

| 6H-SiC | Good thermal conductivity, lower defect density | Automotive, aerospace | Pros: Better thermal stability. Cons: Limited availability in some regions. |

| SiC MOSFETs | Integrated gate drive, high switching frequency | Electric vehicles, renewable energy | Pros: Efficient switching, reduces energy losses. Cons: Requires careful design integration. |

| SiC Schottky Diodes | Low forward voltage drop, fast recovery time | Power supplies, inverters | Pros: Enhances efficiency, compact design. Cons: Sensitive to overvoltage conditions. |

| SiC Power Modules | Integrated package of multiple devices, compact design | Industrial automation, rail systems | Pros: Space-saving, simplified assembly. Cons: Complexity in thermal management. |

4H-SiC is known for its exceptional thermal conductivity and high breakdown voltage, making it ideal for high-temperature and high-voltage applications. It is predominantly used in power electronics and RF devices, where performance under extreme conditions is paramount. B2B buyers should consider the higher cost associated with 4H-SiC, but its long-term performance benefits often justify the investment, especially in sectors requiring reliability and efficiency.

6H-SiC features good thermal conductivity and a lower defect density, which enhances its reliability in demanding environments. It is commonly applied in the automotive and aerospace industries, where thermal stability is critical. Buyers should assess the availability of 6H-SiC in their region, as it may not be as widely produced as other types. Its benefits in high-performance applications can offset potential supply challenges.

SiC MOSFETs offer integrated gate drive capabilities and high switching frequencies, making them essential in electric vehicles and renewable energy systems. Their efficient switching reduces energy losses, which is crucial for cost-saving in large-scale implementations. However, B2B buyers must ensure proper design integration to maximize the benefits, as the complexity of these devices can pose challenges during deployment.

SiC Schottky diodes are characterized by a low forward voltage drop and fast recovery times, making them suitable for power supplies and inverters. Their ability to enhance efficiency while maintaining a compact design is a significant advantage for manufacturers. However, buyers need to be cautious of their sensitivity to overvoltage conditions, which can lead to failures if not properly managed in circuit designs.

SiC power modules integrate multiple devices into a single compact package, which is advantageous for industrial automation and rail systems. This space-saving design simplifies assembly and reduces the overall footprint of electronic systems. However, the complexity of thermal management in these modules can pose challenges, requiring careful planning and engineering to ensure optimal performance in operational environments.

| Industry/Sector | Specific Application of siliziumcarbid | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electronics | Power Electronics | Increased efficiency and reduced thermal losses | Quality certifications, supplier reliability, and scalability |

| Automotive | Electric Vehicle Components | Enhanced performance in high-voltage applications | Compatibility with existing systems and regulatory standards |

| Renewable Energy | Solar Inverters | Improved energy conversion efficiency | Technical support, warranty terms, and local availability |

| Aerospace | High-Temperature Components | Weight reduction and high thermal stability | Material certifications, sourcing from reputable suppliers |

| Industrial Equipment | Abrasive and Cutting Tools | Longer tool life and superior cutting performance | Tool design specifications and customization options |

Siliziumcarbid (SiC) is utilized extensively in power electronics, particularly in devices such as MOSFETs and diodes. These components are crucial for managing electrical energy efficiently, especially in high-power applications. SiC's ability to operate at higher voltages and temperatures allows businesses to reduce energy losses and enhance overall system performance. For international buyers, especially in regions like Africa and the Middle East, sourcing SiC components requires attention to quality certifications and supplier reliability to ensure consistent performance in diverse environmental conditions.

In the automotive industry, SiC is integral to electric vehicle (EV) technology, particularly in power conversion systems. Its high thermal conductivity and efficiency make it ideal for applications such as inverters and onboard chargers, allowing for faster charging and improved range. Buyers from South America and Europe should consider compatibility with existing vehicle systems and adherence to local regulatory standards when sourcing SiC components, ensuring they meet performance expectations while enhancing vehicle efficiency.

Siliziumcarbid is increasingly used in solar inverters, where it boosts energy conversion efficiency by minimizing losses during the DC to AC conversion process. This application is particularly valuable for businesses in renewable energy sectors, as it enables higher output from solar panels, thereby maximizing return on investment. For buyers in Africa, where solar energy adoption is growing rapidly, technical support from suppliers and favorable warranty terms are crucial for ensuring reliable performance in diverse climatic conditions.

In the aerospace industry, SiC is employed in high-temperature components due to its exceptional thermal stability and lightweight properties. These characteristics are vital for improving fuel efficiency and performance in aircraft engines and other critical systems. When sourcing SiC materials, international buyers should prioritize suppliers that provide material certifications and have a proven track record in the aerospace sector, ensuring compliance with stringent safety and performance standards.

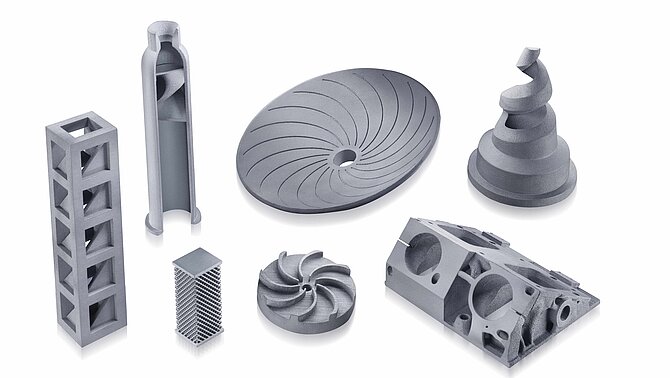

A stock image related to siliziumcarbid.

Siliziumcarbid is also utilized in the manufacturing of abrasive and cutting tools, where its hardness and wear resistance lead to longer tool life and superior cutting performance. This application is essential for industries that rely on precision machining and fabrication. Buyers should focus on tool design specifications and the availability of customization options when sourcing SiC-based tools, ensuring they meet specific operational requirements and enhance productivity.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

The Problem: B2B buyers in industries such as automotive or electronics often face the challenge of high production costs when sourcing siliziumcarbid (SiC) components. The price volatility of raw materials, combined with the advanced technology required for manufacturing SiC, can lead to significant financial strain. For companies in regions like South Africa or Brazil, where economic conditions can fluctuate, this poses a serious challenge in maintaining competitive pricing while ensuring product quality.

The Solution: To mitigate these costs, B2B buyers should consider establishing long-term partnerships with reliable suppliers who can offer stable pricing agreements. Furthermore, investing in advanced procurement technologies can help streamline sourcing processes and reduce costs. Buyers should also explore bulk purchasing options or cooperative buying groups that can leverage collective purchasing power to negotiate better terms. By assessing the total cost of ownership rather than just the initial purchase price, companies can identify opportunities for savings in the long run.

The Problem: Another pain point for B2B buyers arises from the complexity of technical specifications associated with siliziumcarbid applications. Buyers may struggle to accurately define their requirements for SiC components, leading to mismatches between product capabilities and application needs. This is particularly evident in sectors such as renewable energy and industrial automation, where precise specifications are critical for performance and reliability.

The Solution: To address this issue, buyers should invest in comprehensive training for their technical teams on the properties and applications of siliziumcarbid. Collaborating with manufacturers during the design phase can also ensure that the specifications align with operational requirements. Additionally, utilizing simulation software can help visualize how different SiC components will perform in real-world applications, reducing the risk of costly errors. Engaging in forums or industry-specific workshops can further enhance knowledge sharing and foster relationships with experts who can provide insights into best practices.

The Problem: International B2B buyers, especially those operating in Africa and the Middle East, often encounter supply chain disruptions that can severely impact their operations. The reliance on global suppliers for siliziumcarbid can lead to delays due to geopolitical tensions, natural disasters, or logistical challenges. This unpredictability can result in production halts and loss of customer trust, affecting the bottom line.

The Solution: To build a more resilient supply chain, buyers should diversify their supplier base to include local manufacturers as well as international partners. Establishing contingency plans, such as maintaining safety stock or creating alternative sourcing strategies, can help buffer against unexpected disruptions. Additionally, implementing supply chain management software can enhance visibility across the supply chain, allowing for better tracking of material flows and faster response to potential issues. Engaging in regular risk assessments and maintaining open communication with suppliers will also ensure that buyers are prepared to adapt to changing circumstances.

By addressing these common pain points with actionable solutions, international B2B buyers can better navigate the complexities of sourcing and utilizing siliziumcarbid, ultimately leading to improved operational efficiency and profitability.

When selecting materials for siliziumcarbid (silicon carbide), it is essential to consider various factors that influence performance, cost, and application suitability. This guide analyzes four common materials used in conjunction with siliziumcarbid, providing actionable insights for international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe.

Silicon carbide is renowned for its exceptional hardness, thermal conductivity, and resistance to thermal shock. These properties make it suitable for high-performance applications, including abrasives, semiconductors, and high-temperature components. Understanding the specific materials that complement siliziumcarbid can enhance product performance and longevity.

Key Properties: Alumina exhibits high hardness and excellent wear resistance, making it suitable for abrasive applications. It has a melting point of approximately 2050°C and is chemically stable under various conditions.

Pros & Cons: The durability of alumina is a significant advantage, particularly in harsh environments. However, it can be brittle, which may limit its use in applications requiring flexibility.

Impact on Application: Alumina is compatible with many media, including water and various chemicals. Its resistance to corrosion makes it ideal for applications in the chemical processing industry.

Considerations for International Buyers: Buyers should ensure compliance with ASTM standards for alumina products. In regions like Europe and the Middle East, certifications may also be required for specific applications.

Key Properties: Zirconia is known for its high fracture toughness and thermal stability, with a melting point around 2700°C. It also offers excellent resistance to corrosion and wear.

Pros & Cons: The primary advantage of zirconia is its ability to withstand extreme conditions without degrading. However, it is generally more expensive than alumina, which can impact budget considerations.

Impact on Application: Zirconia is particularly effective in applications involving high temperatures and corrosive environments, such as in the aerospace and automotive industries.

Considerations for International Buyers: Compliance with international standards like DIN and JIS is crucial for zirconia products. Buyers from South America and Africa should also consider local sourcing options to reduce costs.

Key Properties: Silicon nitride is characterized by its high strength, toughness, and thermal shock resistance. It can operate at temperatures exceeding 1200°C and is resistant to oxidation.

Pros & Cons: Its high-performance capabilities make silicon nitride ideal for demanding applications. However, the complexity of manufacturing can lead to higher costs.

Impact on Application: Silicon nitride is often used in high-load applications such as bearings and cutting tools, where durability is paramount.

Considerations for International Buyers: Buyers should be aware of the specific manufacturing processes and quality standards required for silicon nitride components, especially in regions with stringent regulations.

Key Properties: Titanium carbide is known for its hardness and high melting point (approximately 3150°C). It exhibits excellent wear resistance and is often used in coatings and cutting tools.

Pros & Cons: The main advantage of titanium carbide is its ability to enhance the wear resistance of tools and components. However, its high cost and complex manufacturing processes can be a barrier for some applications.

Impact on Application: Titanium carbide is particularly effective in metalworking applications, where tool longevity is critical.

Considerations for International Buyers: Buyers should consider the availability of titanium carbide products in their region and ensure compliance with relevant industry standards.

| Material | Typical Use Case for siliziumcarbid | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alumina | Abrasives, chemical processing | High durability and wear resistance | Brittle, limited flexibility | Medium |

| Zirconia | Aerospace, automotive components | High fracture toughness | Higher cost | High |

| Silicon Nitride | Bearings, cutting tools | Excellent thermal shock resistance | Complex manufacturing | High |

| Titanium Carbide | Metalworking tools | Enhanced wear resistance | High cost, complex manufacturing | High |

This strategic material selection guide provides a comprehensive overview of materials commonly associated with siliziumcarbid, equipping international B2B buyers with the necessary insights to make informed decisions tailored to their specific application needs.

Siliziumcarbid (SiC), known for its exceptional thermal conductivity, hardness, and chemical resistance, undergoes several critical stages during its manufacturing process. Understanding these stages can empower B2B buyers to make informed decisions when sourcing this material.

The first step in SiC manufacturing is the preparation of raw materials, primarily silicon and carbon. These raw materials must be of high purity to ensure the quality of the final product. The materials are usually sourced from reputable suppliers who provide certificates of analysis confirming their purity levels.

The initial mixing of silicon and carbon is crucial, as the ratio impacts the properties of the final SiC product. This mixture is often processed in a controlled environment to prevent contamination, which can compromise the material's integrity.

Once the raw materials are prepared, they undergo various forming techniques. The most common methods include:

Sintering: This involves compacting the mixture into a desired shape and heating it below its melting point, allowing the particles to bond without liquefying. This technique is widely used in producing SiC components, ensuring high-density and low-porosity materials.

Chemical Vapor Deposition (CVD): CVD is employed for producing high-purity SiC layers. In this process, gaseous precursors react and deposit a thin film of SiC on a substrate. This technique is essential for applications in semiconductor devices and high-performance coatings.

Reaction Bonding: This method combines silicon powder with carbon in a controlled atmosphere, leading to the formation of SiC. This approach is particularly beneficial for large components that require complex geometries.

After forming, the next step involves assembling SiC components into finished products. This stage may include additional processes like machining, where precision cutting and shaping are performed to achieve exact specifications.

The assembly can also involve integrating SiC components with other materials, such as metals or ceramics, to enhance performance in applications like power electronics and abrasives.

Finishing processes are vital for improving the surface quality and enhancing the properties of SiC components. Techniques such as polishing, coating, and surface treatment are commonly employed.

Polishing: This process smooths the surface, reducing friction and wear, which is crucial for applications in high-performance environments.

Coating: Applying protective coatings can enhance corrosion resistance and thermal stability, extending the lifespan of SiC products.

Quality assurance (QA) is paramount in the manufacturing of SiC to meet international standards and ensure product reliability. The QA process typically involves several checkpoints and testing methods.

B2B buyers should be aware of the international standards that govern the quality of SiC products. The most relevant include:

ISO 9001: This standard outlines the requirements for a quality management system (QMS), ensuring that organizations consistently provide products that meet customer and regulatory requirements.

CE Marking: In Europe, the CE mark indicates conformity with health, safety, and environmental protection standards. For SiC products, particularly in electronics, this certification is crucial.

API Standards: For SiC used in the oil and gas industry, adherence to American Petroleum Institute (API) standards is essential, particularly for components that withstand extreme conditions.

The quality control process involves several critical checkpoints:

Incoming Quality Control (IQC): This initial stage assesses the quality of raw materials before they enter the production process. Suppliers should provide documentation, including certificates of analysis.

In-Process Quality Control (IPQC): Throughout the manufacturing process, ongoing checks ensure that each stage meets predefined quality criteria. This may involve monitoring temperature, pressure, and other parameters.

Final Quality Control (FQC): At this stage, finished products undergo rigorous testing to verify their performance and compliance with specifications. Common tests include hardness, thermal conductivity, and electrical properties.

For international B2B buyers, verifying a supplier's quality control processes is crucial to mitigate risks. Here are effective methods to assess supplier QC:

Regular audits of suppliers' facilities can provide insights into their manufacturing processes and quality assurance practices. Buyers should prepare a checklist based on relevant standards and ensure that the supplier complies with them.

B2B buyers should ask suppliers for detailed quality reports that outline testing methods and results. These reports should include data on IQC, IPQC, and FQC, demonstrating the supplier's commitment to maintaining high standards.

Utilizing third-party inspection services can add an extra layer of assurance. These independent entities can perform audits and testing, providing unbiased evaluations of product quality.

When sourcing SiC products internationally, especially from regions like Africa, South America, the Middle East, and Europe, buyers should be aware of several nuances in quality control:

Cultural Differences: Understanding local manufacturing practices and business cultures can aid in effectively communicating quality expectations.

Regulatory Compliance: Different regions may have varying regulations regarding product standards. Buyers should ensure that suppliers comply with the regulations applicable in their respective markets.

Logistics and Supply Chain Risks: Transportation can affect product quality. Buyers should consider the logistics involved and work with suppliers who have established protocols to minimize risks during shipping.

By comprehensively understanding the manufacturing processes and quality assurance practices for siliziumcarbid, B2B buyers can enhance their sourcing strategies, ensuring they procure high-quality materials that meet their specific application needs.

This practical sourcing guide is designed to assist international B2B buyers in navigating the procurement of siliziumcarbid (silicon carbide). Given its importance in various applications, including electronics, automotive, and renewable energy sectors, understanding how to source this material effectively is crucial. This checklist will provide actionable steps to ensure a successful procurement process.

Before you begin sourcing, clearly define your technical specifications for siliziumcarbid. This includes parameters such as purity levels, grain size, and physical dimensions.

Conduct thorough research to identify potential suppliers of siliziumcarbid. Utilize industry directories, trade shows, and online platforms such as Alibaba or Global Sources.

Ensure that potential suppliers hold relevant certifications and comply with international standards such as ISO 9001 or RoHS.

Before finalizing any orders, request samples of siliziumcarbid from shortlisted suppliers.

Once you have selected a supplier, engage in negotiations to establish pricing, payment terms, and delivery schedules.

Develop a communication plan with your chosen supplier to ensure smooth collaboration throughout the procurement process.

After the procurement is complete, continuously review and monitor the supplier's performance against agreed-upon standards.

By following this step-by-step checklist, you can effectively source siliziumcarbid tailored to your business needs, ensuring quality and reliability in your supply chain.

When sourcing siliziumcarbid (SiC), understanding the cost structure is essential for effective budgeting and negotiation. The primary cost components include:

Materials: The raw material cost of siliziumcarbid can fluctuate based on market demand and availability. Prices are influenced by the source of silica and carbon, which are the primary inputs for SiC production.

Labor: Labor costs encompass the workforce required for manufacturing, quality control, and logistics. Regions with lower labor costs, such as certain areas in Africa or South America, might offer competitive pricing, but may also impact the quality and efficiency of production.

Manufacturing Overhead: This includes the indirect costs associated with production, such as utilities, maintenance, and depreciation of equipment. Efficient manufacturing processes can help mitigate these costs.

Tooling: Investment in specialized tooling for SiC production can be significant. The complexity of tooling depends on the specifications required by the buyer, which can impact overall pricing.

Quality Control (QC): Ensuring high-quality standards often requires rigorous QC processes. The costs associated with testing and certification can add to the overall expense but are crucial for maintaining product integrity, especially in high-stakes industries like automotive or aerospace.

Logistics: Shipping and handling costs vary based on the geographical location of the supplier and the destination. International buyers should consider freight costs, customs duties, and potential tariffs, which can significantly affect the total cost.

Margin: Suppliers typically apply a profit margin that reflects their operational costs and market conditions. This margin can vary widely depending on the supplier's position within the market.

Several factors can influence the pricing of siliziumcarbid, including:

Volume and Minimum Order Quantity (MOQ): Larger orders often lead to discounts due to economies of scale. Buyers should negotiate MOQs to ensure they are getting the best price per unit.

Specifications and Customization: Customized SiC products that meet specific industry standards may incur higher costs. It's essential for buyers to clearly communicate their requirements to avoid unexpected charges.

Materials Quality and Certifications: Higher quality materials and certifications (such as ISO or RoHS compliance) can elevate costs but are necessary for certain applications. International buyers should verify the certifications relevant to their market.

Supplier Factors: The supplier's reputation, production capacity, and location can affect pricing. Established suppliers with a proven track record may charge a premium but can provide reliability and quality assurance.

Incoterms: Understanding the terms of delivery can impact total costs. Incoterms define responsibilities for shipping, insurance, and tariffs, which can affect the final price. Buyers should clarify these terms during negotiations to avoid hidden fees.

International B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, can adopt several strategies to enhance cost-efficiency:

Negotiate Effectively: Establishing a strong relationship with suppliers can lead to better pricing and terms. Buyers should be prepared to negotiate on volume, payment terms, and delivery schedules.

Consider Total Cost of Ownership (TCO): Evaluate not just the purchase price, but also the long-term costs associated with the product, including maintenance, operational efficiency, and potential downtime. This holistic approach can reveal more cost-effective options.

Understand Pricing Nuances: Different markets may have varying pricing structures for siliziumcarbid. Buyers should research regional price trends and factor in local economic conditions when making purchasing decisions.

Leverage Local Partnerships: Establishing relationships with local distributors or agents can provide insights into market dynamics and help navigate logistical challenges, potentially reducing costs.

While this analysis provides a framework for understanding costs and pricing in siliziumcarbid sourcing, actual prices may vary based on market conditions, supplier negotiations, and specific buyer requirements. Buyers are encouraged to conduct thorough market research and engage directly with suppliers for the most accurate pricing information.

In the rapidly evolving landscape of materials and technologies, international B2B buyers must consider various alternatives when evaluating solutions like siliziumcarbid (silicon carbide). This section will provide a comparative analysis of siliziumcarbid against two viable alternatives: Gallium Nitride (GaN) and traditional Silicon. Understanding the strengths and weaknesses of these options is essential for making informed purchasing decisions tailored to specific operational needs.

| Comparison Aspect | Siliziumcarbid | Gallium Nitride (GaN) | Traditional Silicon |

|---|---|---|---|

| Performance | High thermal conductivity, excellent power efficiency | Superior efficiency in high-frequency applications | Good but less efficient at high temperatures |

| Cost | Higher initial investment | Moderate cost, increasing with demand | Generally lower cost |

| Ease of Implementation | Requires specialized processes | Relatively easy to implement in new designs | Widely established technology |

| Maintenance | Low maintenance needs | Low maintenance, but sensitive to thermal management | Moderate maintenance requirements |

| Best Use Case | High-performance applications in automotive and industrial sectors | Fast-switching applications in RF and power electronics | General-purpose applications in consumer electronics |

Gallium Nitride has emerged as a strong competitor to siliziumcarbid, particularly in applications that require high-frequency performance. GaN devices excel in efficiency, especially in RF and power electronic applications, making them ideal for telecommunications and power conversion systems. However, the moderate cost and the need for careful thermal management can be drawbacks for businesses looking for a straightforward solution. Moreover, while GaN is easier to implement in newer designs, it may not be as compatible with existing silicon infrastructure, necessitating further investment.

Traditional silicon technology is the most widely used semiconductor material, offering a well-established supply chain and lower costs. It is suitable for a wide array of applications, particularly in consumer electronics and general-purpose devices. However, its performance lags in high-temperature and high-frequency scenarios compared to siliziumcarbid and GaN. While silicon's maintenance needs are moderate, its inability to handle extreme conditions limits its application in more demanding sectors such as automotive and industrial settings.

Selecting the appropriate material or technology depends on specific application requirements, performance expectations, and budget constraints. For high-performance applications where efficiency and thermal management are critical, siliziumcarbid or GaN may be the better choice despite higher costs. Conversely, for general-purpose applications with budget limitations, traditional silicon remains a viable option. B2B buyers should carefully evaluate their operational needs, potential for scalability, and long-term maintenance requirements to determine the most suitable solution for their unique context.

Understanding the technical properties of siliziumcarbid (silicon carbide) is crucial for B2B buyers, especially those involved in sectors like electronics, automotive, and energy. Here are some essential specifications:

Siliziumcarbid is available in various material grades, typically denoted by purity levels and crystal structure (e.g., 3C, 4H, 6H). The material grade affects thermal conductivity, hardness, and overall performance in high-temperature applications. Buyers must select the appropriate grade to ensure compatibility with their specific industrial needs.

Tolerance refers to the permissible limit of variation in a material's dimensions. In the context of siliziumcarbid, this is critical for applications requiring precision, such as semiconductor manufacturing. A tighter tolerance often results in higher costs but ensures better performance and reliability, which is essential for B2B contracts where specifications are strict.

Siliziumcarbid exhibits high thermal conductivity, which is vital for heat dissipation in electronic devices and high-power applications. This property allows for efficient energy use and can lead to longer product lifespans. Buyers should assess thermal conductivity values to match their cooling requirements, especially in high-performance environments.

The hardness of siliziumcarbid is significantly higher than that of traditional materials like silicon. This property makes it ideal for abrasive applications and cutting tools. Understanding the hardness level is essential for buyers in the manufacturing and machining sectors, as it directly impacts tool longevity and operational efficiency.

Siliziumcarbid has a wide band gap (approximately 3.0 eV), making it suitable for high-voltage and high-temperature applications. This property is particularly important for power electronics, where efficient switching and reduced energy loss are critical. Buyers in the electronics sector should consider band gap energy when evaluating materials for new technologies.

Navigating the trade landscape for siliziumcarbid requires familiarity with specific jargon. Here are some common terms that can help international buyers make informed decisions:

An OEM refers to a company that produces parts or equipment that may be marketed by another manufacturer. Understanding the role of OEMs is crucial for buyers looking to source components or systems that integrate siliziumcarbid.

MOQ is the smallest amount of product that a supplier is willing to sell. This term is particularly important for B2B buyers as it affects inventory management and cash flow. Buyers should negotiate MOQs that align with their purchasing capabilities and project timelines.

An RFQ is a standard business process where buyers request pricing and terms from suppliers. This practice is essential for obtaining competitive quotes and ensuring that all potential suppliers are evaluated on the same criteria, which is vital for cost control in B2B transactions.

Incoterms define the responsibilities of buyers and sellers in international trade, including shipping, insurance, and tariffs. Familiarity with these terms can help B2B buyers from Africa, South America, the Middle East, and Europe navigate logistics and reduce potential disputes in cross-border transactions.

Lead time is the amount of time between the initiation of an order and its delivery. Understanding lead times can help buyers plan their production schedules and manage inventory effectively, which is critical for maintaining a competitive edge in fast-paced markets.

By comprehensively understanding these technical properties and trade terminologies, B2B buyers can make more informed decisions regarding siliziumcarbid, ensuring that they select the right materials and suppliers for their specific needs.

The siliziumcarbid (silicon carbide) sector is currently experiencing substantial growth driven by the rising demand for energy-efficient and high-performance materials across various industries. The global shift towards electrification, particularly in the automotive and power sectors, has been a significant catalyst. As countries, especially in Africa, South America, the Middle East, and Europe, invest in renewable energy and electric vehicles (EVs), the need for semiconductors and power electronics made from silicon carbide is surging.

Emerging B2B technology trends include the integration of advanced manufacturing processes such as additive manufacturing and automation, which enhance the production efficiency of silicon carbide components. Moreover, international buyers are increasingly seeking suppliers that can provide high-quality materials at competitive prices, leading to a more interconnected supply chain. As sourcing strategies evolve, many companies are leveraging digital platforms to streamline procurement processes and reduce lead times.

Additionally, the competitive landscape is being shaped by collaborations and partnerships among manufacturers and technology firms, aiming to innovate and optimize silicon carbide applications. For B2B buyers, understanding these dynamics is crucial for making informed sourcing decisions that align with their organizational goals.

Sustainability is becoming a core consideration for B2B buyers in the siliziumcarbid sector. The environmental impact of sourcing and manufacturing processes is under scrutiny, prompting companies to adopt more ethical practices. The extraction of raw materials for silicon carbide can have significant ecological consequences, making it imperative for businesses to prioritize suppliers who adhere to sustainable practices.

Ethical sourcing involves ensuring that materials are obtained with minimal environmental degradation and under fair labor conditions. Buyers should seek out suppliers that possess 'green' certifications, such as ISO 14001 for environmental management or specific certifications related to sustainable mining practices. These certifications not only demonstrate a commitment to sustainability but can also enhance brand reputation and customer trust.

Moreover, the demand for 'green' silicon carbide materials is rising, especially in applications related to renewable energy technologies. By prioritizing sustainable sourcing, B2B buyers can contribute to a circular economy, reduce their carbon footprint, and meet the growing consumer demand for environmentally responsible products.

The history of siliziumcarbid dates back to the late 19th century when it was first synthesized as an abrasive material. However, its application has evolved significantly, particularly in the semiconductor industry since the 1970s. The transition from traditional silicon to silicon carbide for high-temperature and high-voltage applications has marked a pivotal moment for the industry.

The advancement of manufacturing techniques, such as the development of bulk crystal growth methods, has enabled the production of high-quality silicon carbide wafers. This evolution has opened up new opportunities for B2B buyers, who can now source materials that offer superior performance and efficiency.

Understanding this historical context allows buyers to appreciate the technological advancements that have shaped the market. As the demand for innovative solutions continues to grow, being aware of the evolution of siliziumcarbid can inform better sourcing strategies and partnership decisions in today's competitive landscape.

How do I solve quality assurance issues when sourcing siliziumcarbid?

To address quality assurance issues while sourcing siliziumcarbid, it is crucial to establish stringent quality control protocols with your suppliers. Request detailed product specifications and certifications, such as ISO or other relevant standards. Conduct on-site audits or third-party inspections to verify manufacturing processes. Additionally, consider implementing a sample testing phase before placing bulk orders to ensure that the product meets your specifications and performance requirements.

What is the best way to vet suppliers of siliziumcarbid for international trade?

Vetting suppliers for siliziumcarbid involves several critical steps. Start by researching the supplier's reputation through industry reviews and references. Verify their business credentials, such as registration and compliance with international trade regulations. Conduct background checks and request financial statements to assess stability. Engaging in direct communication can also provide insights into their reliability and customer service responsiveness. Attending trade shows or industry conferences can facilitate personal connections and further evaluation.

What are the minimum order quantities (MOQ) for siliziumcarbid?

Minimum order quantities for siliziumcarbid can vary significantly depending on the supplier and the specific product type. Typically, MOQs can range from a few kilograms to several tons. It's essential to discuss these terms upfront with potential suppliers. If your requirements are lower than their MOQ, consider negotiating for a trial order or collaborating with other buyers to meet the MOQ collectively. This approach can also help establish a relationship for future purchases.

How can I customize siliziumcarbid products to meet my specific needs?

Customization of siliziumcarbid products often requires direct communication with your supplier to discuss your specific requirements. Many manufacturers can modify particle size, purity levels, or even the formulation to suit your application. Be clear about your technical specifications and intended use. Collaborating closely during the development phase can lead to better outcomes and ensure that the final product aligns with your operational demands.

What payment terms should I expect when sourcing siliziumcarbid internationally?

When sourcing siliziumcarbid internationally, payment terms can vary widely based on supplier policies and the buyer's creditworthiness. Common terms include advance payments, letters of credit, or net payment options (e.g., net 30 or net 60 days). It's advisable to clarify these terms before finalizing any contracts. Always ensure that payment methods are secure and consider using escrow services for large transactions to mitigate risks.

What logistics considerations should I keep in mind when importing siliziumcarbid?

Logistics for importing siliziumcarbid involve several key considerations. First, ensure compliance with local import regulations and tariffs in your country. Work with a reliable freight forwarder familiar with handling chemical materials to facilitate transportation and customs clearance. Additionally, consider the storage requirements upon arrival, as siliziumcarbid may have specific temperature and humidity conditions to maintain its quality. Planning for these factors can help avoid delays and additional costs.

How do I handle potential delays in shipping siliziumcarbid?

Handling potential shipping delays requires proactive communication with your supplier and logistics partners. Establish clear timelines for production and shipping, and inquire about contingency plans for unforeseen delays. Consider using tracking systems to monitor your shipment's progress in real-time. It's also wise to build buffer time into your project schedules to accommodate possible disruptions, ensuring that your operations remain uninterrupted.

What certifications should I look for when sourcing siliziumcarbid?

When sourcing siliziumcarbid, look for certifications that demonstrate compliance with industry standards and quality assurance. Key certifications include ISO 9001 for quality management systems, ISO 14001 for environmental management, and RoHS compliance for hazardous substances. Additionally, check for specific industry-related certifications that may apply to your sector, such as those related to electronics or automotive industries. These certifications not only assure product quality but also enhance your credibility as a responsible buyer.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In conclusion, siliziumcarbid (silicon carbide) presents a transformative opportunity for international B2B buyers, especially in sectors such as electronics, automotive, and energy. Strategic sourcing of siliziumcarbid is crucial for maximizing operational efficiency and ensuring product quality. By leveraging advanced procurement strategies and establishing strong supplier relationships, businesses can mitigate risks associated with supply chain disruptions and fluctuating prices.

B2B buyers from Africa, South America, the Middle East, and Europe should focus on understanding market dynamics, such as emerging technologies and regional regulations, that influence siliziumcarbid sourcing. Collaborating with suppliers who prioritize sustainability and innovation will not only enhance product offerings but also align with global trends toward eco-friendly practices.

Looking forward, the demand for siliziumcarbid is expected to rise, driven by advancements in electric vehicles and renewable energy applications. Buyers are encouraged to stay informed on market trends and proactively adjust their sourcing strategies. Engaging in long-term partnerships with suppliers will be pivotal for securing a competitive advantage in this evolving landscape. Embrace the future of sourcing siliziumcarbid, and position your business at the forefront of this dynamic industry.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina