Guide to Siliziumkarbid-Halbleiter

In today’s rapidly evolving semiconductor landscape, siliziumkarbid-halbleiter (silicon carbide semiconductors) have emerged as a game-changer across numerous high-growth industries, including electric vehicles, renewable energy, and industrial automation. Their superior performance in high-temperature, high-voltage, and high-frequency environments makes them indispensable for businesses seeking competitive advantages in efficiency and durability. For international B2B buyers—particularly from regions like Africa, South America, the Middle East, and Europe—understanding the nuances of sourcing these advanced materials is critical to maintaining a technological edge and optimizing supply chains.

This comprehensive guide provides an in-depth overview of the siliziumkarbid-halbleiter market, covering key aspects such as material types, manufacturing processes, quality control standards, and leading global suppliers. It also offers actionable insights into cost considerations, market trends, and strategic sourcing practices tailored to diverse regional needs. Whether you are evaluating new suppliers, assessing quality benchmarks, or navigating import regulations, this resource equips you with the knowledge necessary to make informed, confident procurement decisions.

By leveraging this guide, international B2B buyers will be better positioned to identify reliable partners, ensure product quality, and capitalize on emerging market opportunities. Navigating the complex global landscape of silicon carbide semiconductors has never been more vital—empowering your organization to stay ahead in an increasingly competitive and innovative industry.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 4H-Silicon Carbide (4H-SiC) | Hexagonal crystal structure, high electron mobility, wide bandgap (~3.26 eV) | Power electronics, RF devices, high-voltage inverters | Excellent thermal conductivity and breakdown strength; higher cost and limited supplier options |

| 6H-Silicon Carbide (6H-SiC) | Hexagonal structure with different stacking sequence, moderate electron mobility | Power modules, high-temperature electronics | More mature manufacturing process, slightly lower performance than 4H; suitable for cost-sensitive applications |

| Cubic Silicon Carbide (3C-SiC) | Cubic crystal structure, compatible with silicon substrates, lower bandgap (~2.36 eV) | High-frequency devices, MEMS, optoelectronics | Cost-effective, versatile integration; lower thermal stability and higher defect density |

| Polycrystalline Silicon Carbide | Composed of multiple small crystal grains, less uniform | Abrasives, heating elements, corrosion-resistant coatings | Lower manufacturing costs; inconsistent electrical properties may impact high-precision applications |

| Epitaxial Silicon Carbide Layers | Thin, high-quality crystalline layers grown on substrates | High-performance power devices, high-frequency transistors | Enables advanced device performance; higher fabrication complexity and costs |

4H-Silicon Carbide (4H-SiC) is renowned for its superior electrical properties, notably high electron mobility and wide bandgap, making it ideal for high-voltage, high-temperature power electronics. Its robust thermal conductivity ensures reliability in demanding environments, but its production is complex and costly. B2B buyers should evaluate long-term performance benefits against initial procurement costs, considering supply chain stability from specialized manufacturers.

6H-Silicon Carbide (6H-SiC) offers a more mature manufacturing process with slightly lower performance metrics than 4H variants. It is often favored for applications where cost-efficiency is critical, such as certain power modules and high-temperature electronics. Buyers should assess supplier track records and consistency of quality, especially when scaling production or entering new markets, to avoid costly rework or device failures.

Cubic Silicon Carbide (3C-SiC) stands out for its compatibility with silicon substrates, enabling integration into existing semiconductor fabrication lines. Its lower bandgap limits high-voltage applications but makes it suitable for high-frequency and optoelectronic devices. When sourcing 3C-SiC, buyers must consider its higher defect density and lower thermal stability, which could impact device longevity. Cost-effective options are available, but quality assurance is critical.

Polycrystalline Silicon Carbide is primarily used in non-electrical applications such as abrasives and heating elements due to its lower manufacturing costs. Its electrical properties are inconsistent, making it unsuitable for precision high-power devices. B2B buyers should weigh the lower upfront costs against potential performance limitations, especially for applications requiring high reliability or electrical precision.

Epitaxial Silicon Carbide Layers are essential for high-performance, high-frequency power devices. Their high crystalline quality enhances device efficiency and longevity. However, the epitaxial growth process involves sophisticated technology and higher costs. Buyers targeting cutting-edge applications must consider procurement from specialized suppliers capable of delivering consistent, high-quality epitaxial layers, balancing performance gains with budget constraints.

This nuanced understanding of siliziumkarbid-halbleiter types enables international B2B buyers to make informed sourcing decisions tailored to their specific technical and economic requirements, ensuring optimal value and reliability in their high-power and high-frequency applications.

| Industry/Sector | Specific Application of siliziumkarbid-halbleiter | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Transmission & Distribution | High-voltage power switches and diodes in grid infrastructure | Enables efficient, high-capacity energy transfer with reduced losses | Reliability, certification standards, local supply chain capabilities |

| Electric Vehicle (EV) Manufacturing | Power modules and inverters for EV drivetrain systems | Improves efficiency, thermal management, and compactness of EV components | Quality consistency, scalability, regional manufacturing options |

| Industrial Motor Drives | High-speed, high-temperature motor controllers | Enhances motor performance, reduces downtime, and extends lifespan | Compatibility with existing systems, technical support, lead times |

| Renewable Energy Systems | Inverters and power electronics for solar and wind farms | Facilitates high-efficiency energy conversion under extreme conditions | Certification, local support, cost competitiveness |

| Aerospace & Defense | Power electronics and sensor components for harsh environments | Ensures durability, high performance, and reliability in extreme conditions | Stringent quality standards, traceability, custom sourcing options |

Siliziumkarbid-halbleiter devices are pivotal in high-voltage switches and diodes used in modern power grids. They allow for higher switching speeds and lower conduction losses, making energy transmission more efficient and reliable. For international B2B buyers from regions like Africa and South America, sourcing these components from suppliers with proven certification and local support is critical to meet regional standards and ensure long-term system stability. Efficient power infrastructure is vital for economic growth, especially in developing regions, and siliziumkarbid devices help reduce energy waste and operational costs.

In the rapidly expanding EV sector, siliziumkarbid-halbleiter modules are essential for power inverters and drivetrain components. They enable faster switching, better thermal management, and higher power density, which translates into longer range and improved vehicle performance. Buyers from Europe, Australia, and the Middle East should prioritize suppliers offering high-quality, scalable solutions with regional logistics support. This ensures timely procurement, reduces downtime, and aligns with stringent automotive standards, fostering innovation and competitiveness in local EV markets.

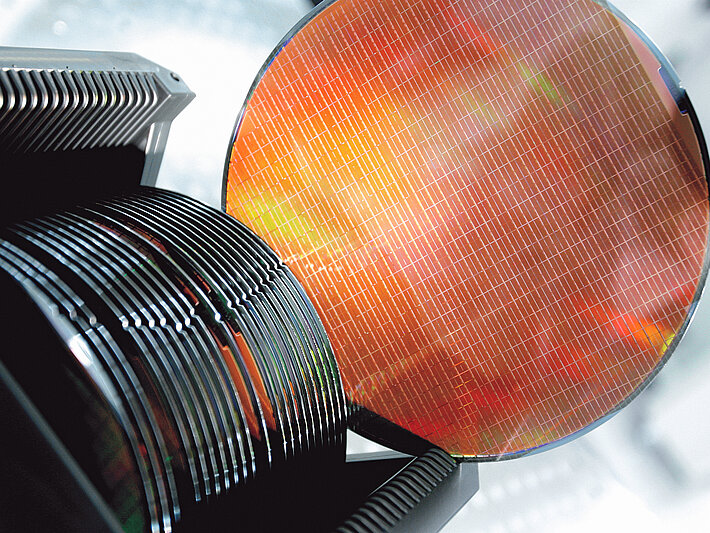

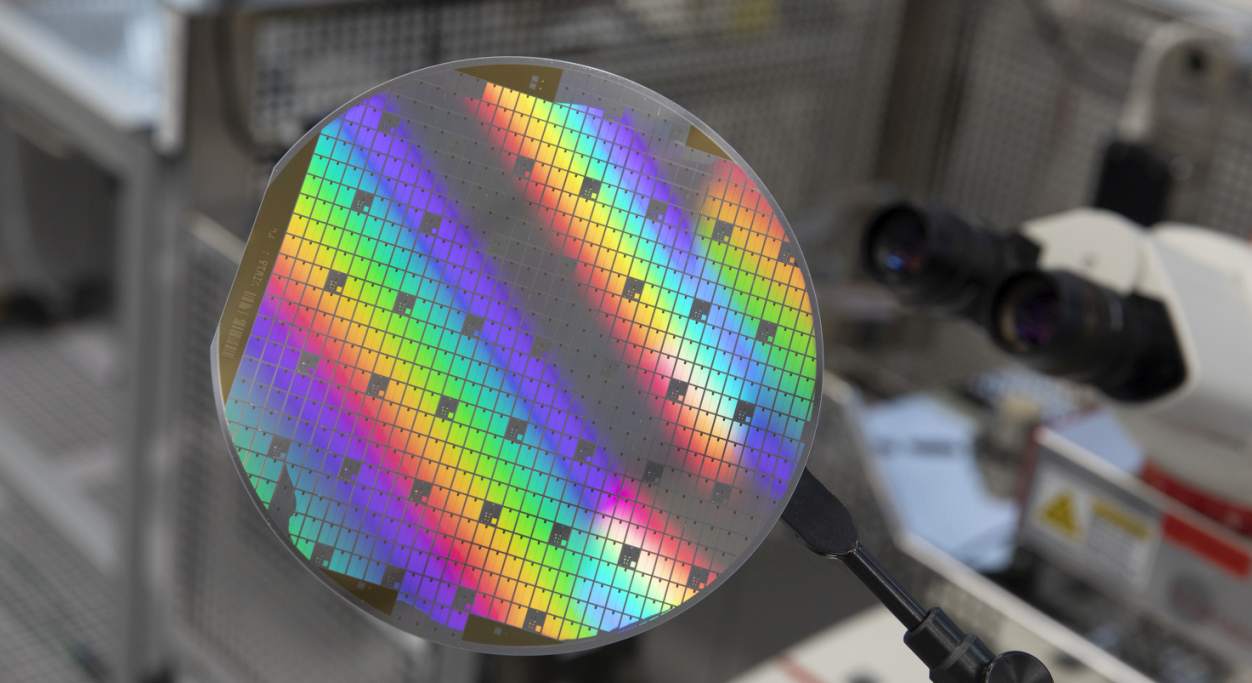

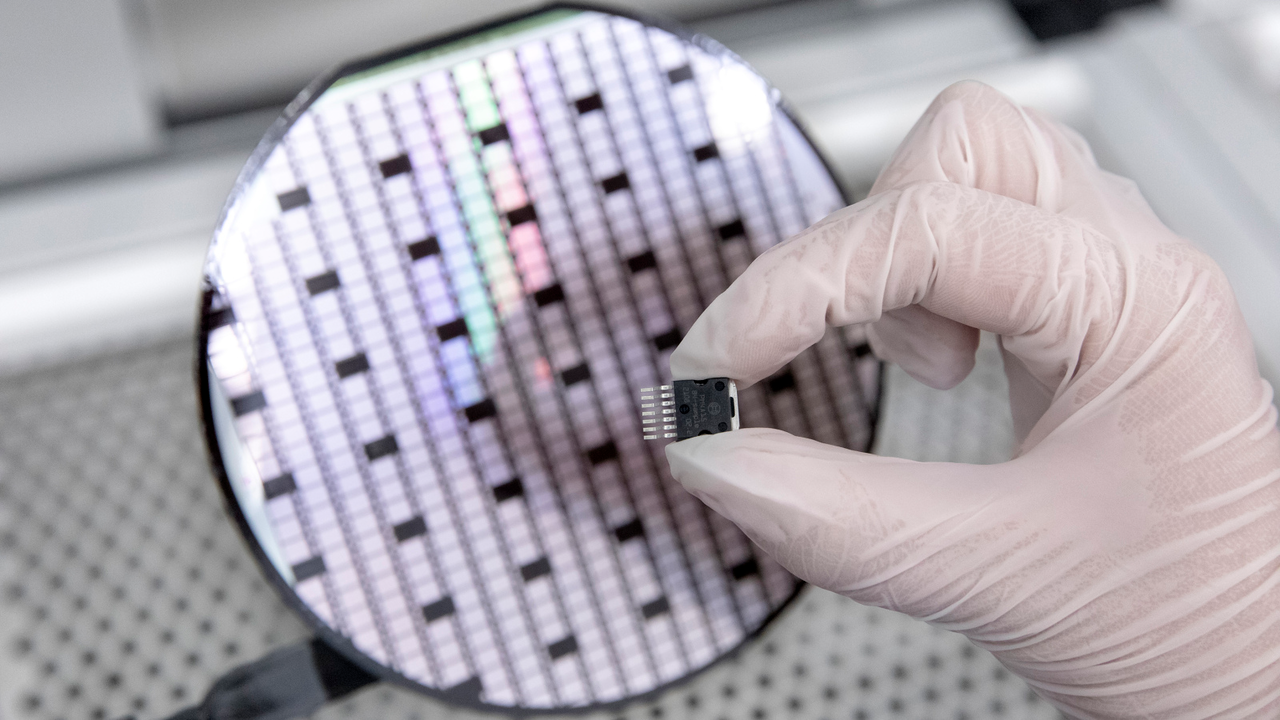

Illustrative Image (Source: Google Search)

High-speed, high-temperature motor controllers utilizing siliziumkarbid-halbleiter technology significantly enhance industrial automation. These devices improve motor efficiency, reduce energy consumption, and extend operational lifespan, especially in demanding environments. For B2B buyers in sectors like manufacturing and mining across Africa and South America, sourcing from trusted suppliers with technical expertise and reliable supply chains ensures seamless integration. Compatibility with existing systems and robust after-sales support are key to maximizing ROI.

Siliziumkarbid-halbleiter components are crucial in inverters for solar and wind power installations, particularly where environmental conditions are extreme. They deliver high efficiency, fast switching, and durability under harsh conditions such as high temperatures and humidity. International buyers from regions like Europe and the Middle East should seek suppliers with proven track records, certifications, and local technical support to ensure project success. Reliable, high-performance components help accelerate renewable energy deployment and optimize energy yields.

In aerospace and defense applications, siliziumkarbid-halbleiter devices are used in power electronics and sensor systems designed to operate reliably in extreme environments. Their high durability, thermal stability, and resistance to radiation make them ideal for mission-critical systems. B2B buyers from Europe and Australia need to source from vendors offering stringent quality assurance, traceability, and custom manufacturing options. Ensuring these factors helps meet regulatory standards and guarantees operational resilience in demanding conditions.

When selecting materials for silicon carbide (SiC) semiconductor applications, B2B buyers must consider properties such as thermal stability, chemical resistance, mechanical strength, manufacturing complexity, and compliance with international standards. Here, we analyze four prevalent materials—Silicon, Silicon Carbide (SiC), Aluminum Oxide (Al₂O₃), and Silicon Nitride (Si₃N₄)—from a strategic procurement perspective, emphasizing their suitability for different global markets.

Key Properties:

Silicon is the foundational material for most semiconductor devices, including SiC-based components. It offers excellent electrical properties, ease of fabrication, and well-established manufacturing processes. Silicon's melting point (~1,414°C) and thermal conductivity (~150 W/m·K) make it suitable for moderate to high-temperature applications, but it falls short compared to SiC in extreme environments.

Pros & Cons:

Advantages include widespread availability, mature supply chains, and lower manufacturing costs. However, silicon's lower thermal conductivity and maximum operating temperature (~150°C) limit its effectiveness in high-power, high-temperature environments typical of SiC applications. Manufacturing silicon-based semiconductors is well-understood, but integrating silicon with SiC can pose compatibility challenges.

Impact on Application:

Silicon's compatibility with existing electronics standards (e.g., ASTM, JEDEC) simplifies integration but may restrict performance in harsh conditions. For international buyers, especially in regions with established silicon industries like Europe and Australia, sourcing high-quality silicon is straightforward, but considerations around purity and doping levels are critical.

International Buyer Considerations:

Silicon is globally abundant, with major production centers in Asia, Europe, and North America. Buyers from Africa and South America should evaluate local suppliers' quality standards and certification compliance, such as ISO 9001. Ensuring adherence to regional standards (e.g., DIN in Europe, JIS in Japan) facilitates smoother integration.

Key Properties:

SiC is renowned for its exceptional thermal stability, high breakdown electric field (~3 MV/cm), and chemical inertness. It withstands temperatures exceeding 2,000°C, exhibits high hardness, and maintains performance under high pressure and corrosive media, making it ideal for power electronics and high-temperature applications.

Pros & Cons:

The primary advantage of SiC is its superior performance in demanding environments, reducing cooling requirements and enhancing device longevity. However, manufacturing SiC semiconductors is complex, involving high-temperature processes and advanced epitaxial growth techniques, which translate into higher costs. Material purity and defect control are critical for device efficiency.

Impact on Application:

SiC's media resistance makes it suitable for applications involving corrosive gases or liquids, such as chemical processing or high-voltage power systems. For international buyers, especially in regions with strict environmental and safety standards (e.g., Europe, Australia), compliance with standards like IEC and RoHS is essential. Local suppliers with certified quality management systems can mitigate supply chain risks.

International Buyer Considerations:

While SiC is increasingly available globally, supply chain stability varies. Buyers from Africa and South America should prioritize suppliers with proven track records and certifications. Given the high manufacturing complexity, establishing long-term partnerships with reliable vendors ensures consistent quality and supply.

Key Properties:

Aluminum oxide (alumina) is a ceramic material known for its excellent electrical insulation, corrosion resistance, and thermal stability up to about 1,750°C. It is often used as an insulating substrate or protective coating in SiC devices.

Pros & Cons:

Al₂O₃ offers high durability, ease of machining, and relatively lower cost compared to SiC. Its main limitation is its insulating nature, which restricts its use as a conductive material. It can be brittle, which may pose handling challenges in certain applications.

Impact on Application:

In SiC devices, alumina substrates support device integration and thermal management. For regions like Europe and Australia, where environmental standards are strict, alumina's inertness aligns well with regulatory requirements. Buyers should verify supplier certifications and ensure material purity to prevent device contamination.

International Buyer Considerations:

Al₂O₃ is widely produced and available from multiple regions. Buyers should focus on sourcing from suppliers adhering to international standards such as ASTM B24 or DIN 7611. Local sourcing in regions with established ceramic industries can reduce logistics costs and lead times.

Key Properties:

Silicon nitride is a high-performance ceramic with excellent mechanical strength, thermal shock resistance, and chemical inertness. It withstands temperatures up to 1,800°C and exhibits low thermal expansion, making it suitable for demanding environments.

Pros & Cons:

Its durability and resistance to wear and corrosion make Si₃N₄ ideal for high-stress applications. Manufacturing complexity and higher costs are notable disadvantages, especially for large-scale production. Material quality can vary based on processing methods.

Impact on Application:

Silicon nitride components are used in high-temperature insulators and protective coatings within SiC devices. For international buyers, particularly in Europe and Australia, sourcing certified Si₃N₄ with traceability is critical. Compatibility with existing standards and environmental regulations enhances market acceptance.

International Buyer Considerations:

Suppliers with ISO 9001 and environmental certifications (e.g., RoHS, REACH) are preferred. Buyers from Africa and South America should evaluate local ceramic manufacturers or import from established international suppliers to ensure quality and compliance.

| Material | Typical Use Case for siliziumkarbid-halbleiter | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon | Base semiconductor material, device substrates | Well-established supply chain, low cost | Limited high-temperature performance | Low |

| Silicon Carbide (SiC) | Power electronics, high-temperature, high-voltage devices | Superior thermal stability, high durability | High manufacturing complexity, cost | High |

| Aluminum Oxide (Al₂O₃) | Insulating substrates, protective coatings | High corrosion resistance, cost-effective | Brittle, limited conductivity | Low to Med |

| Silicon Nitride (Si₃N₄) | High-stress, high-temperature insulators, protective parts | Excellent mechanical and thermal shock resistance | Higher cost, complex manufacturing | High |

This strategic material selection approach enables international B

The production of silicon carbide (SiC) semiconductors involves a complex, multi-stage process that emphasizes precision, material integrity, and stringent quality controls. Understanding each stage enables B2B buyers to better evaluate supplier capabilities and ensure product reliability.

The manufacturing process begins with sourcing high-purity silicon and carbon sources, often in the form of quartz and petroleum coke. Suppliers must adhere to international standards such as ISO 9001 to ensure consistent material quality. For critical applications, buyers should verify the supplier’s raw material certificates, focusing on impurity levels, especially metallic contaminants, which can significantly affect device performance.

The core of SiC manufacturing is crystal growth, typically achieved through methods like the Physical Vapor Transport (PVT) process. High-temperature furnaces facilitate the growth of single-crystal boules, which are then sliced into wafers. Key parameters include crystal uniformity, defect density, and surface finish, all of which are critical for device efficiency. Suppliers should provide detailed process control reports and certifications that confirm adherence to industry standards such as ASTM or JEDEC specifications.

Post-slicing, wafers undergo polishing, cleaning, and doping procedures to tailor electrical properties. Techniques like Chemical Mechanical Polishing (CMP) are used to achieve ultra-smooth surfaces, essential for subsequent device fabrication. Doping processes, often via ion implantation or diffusion, are closely monitored to ensure uniformity. B2B buyers should request process validation documents and inspection reports to verify that wafers meet the required electrical and physical specifications.

The final stages involve die cutting, mounting, wire bonding, and encapsulation. Advanced packaging techniques, such as trench or planar structures, are employed to optimize thermal and electrical performance. Quality assurance during assembly includes inspection for physical defects, proper die alignment, and secure bonding. Suppliers should adhere to industry standards like JEDEC and IPC for packaging quality.

Finished SiC devices undergo a battery of tests to verify compliance with performance specifications. This includes electrical testing (e.g., breakdown voltage, leakage current), thermal cycling, and reliability assessments. Packaging is also inspected for contamination and mechanical integrity. High-quality suppliers often utilize automated optical inspection (AOI) and X-ray inspection to detect internal defects.

Illustrative Image (Source: Google Search)

Ensuring the quality of SiC semiconductors is paramount, given their application in high-power, high-temperature environments. B2B buyers should adopt a comprehensive approach to evaluate supplier quality management systems and product testing.

Leading suppliers typically operate under internationally recognized standards, including ISO 9001, which emphasizes a quality management system capable of consistent product quality. For specific industries, certifications such as CE (European conformity), API (American Petroleum Institute), or IEC standards for electrical safety are relevant. Buyers should request copies of certification and audit reports to verify compliance.

A robust QC process encompasses multiple inspection points:

Common testing methods include:

B2B buyers should request detailed test reports and ensure that testing aligns with industry standards such as JEDEC JESD22 or ASTM standards.

To mitigate risks, buyers should conduct regular audits and inspections of supplier facilities. Engaging third-party inspection agencies (e.g., SGS, TUV) provides an unbiased assessment of manufacturing processes, product quality, and compliance. These inspections can include factory audits, sampling tests, and verification of certifications.

For buyers from Africa, South America, the Middle East, and Europe (including Poland and Australia), understanding local and international QC nuances is crucial:

By comprehensively understanding the manufacturing intricacies and implementing rigorous quality assurance protocols, B2B buyers can confidently select suppliers that deliver high-quality silicon carbide semiconductors tailored to their specific application needs.

Understanding the comprehensive cost structure of silicon carbide (SiC) semiconductors is crucial for international B2B buyers aiming to optimize procurement strategies. The primary cost components include:

Several factors influence the final pricing of SiC semiconductors:

Given the variability in raw material costs, manufacturing complexities, and geopolitical influences, indicative prices for SiC semiconductors can range widely. As of late 2023, typical unit prices for standard SiC MOSFETs or diodes could be from $1 to $10 per piece for moderate volumes, but high-performance or custom solutions may command significantly higher prices. Buyers should conduct specific supplier inquiries and market research to obtain precise quotations tailored to their needs.

By thoroughly analyzing these cost components and market factors, international B2B buyers can develop strategic sourcing plans, negotiate effectively, and optimize their total investment in silicon carbide semiconductor procurement.

1. Material Grade

Material grade refers to the purity and structural quality of silicon carbide (SiC) wafers or devices. Higher grades (e.g., 4H-SiC, 6H-SiC) feature specific crystal structures that influence electrical performance and thermal stability. For B2B buyers, selecting the appropriate grade ensures compatibility with application requirements, such as high-voltage or high-temperature environments, and impacts long-term reliability.

2. Breakdown Voltage

This property indicates the maximum voltage a SiC device can withstand before electrical failure. High breakdown voltages (often exceeding 10 kV) are a hallmark of SiC power semiconductors, enabling efficient handling of high power loads with minimal energy loss. Buyers involved in power electronics should prioritize devices with suitable breakdown ratings to optimize system safety and efficiency.

3. Thermal Conductivity

Silicon carbide boasts excellent thermal conductivity, often above 3 W/cm·K, facilitating effective heat dissipation. This property allows devices to operate at higher voltages and currents without overheating, reducing cooling costs and enhancing device lifespan. For international buyers, understanding thermal performance ensures proper integration into systems with specific thermal management requirements.

4. On-Resistance (Ron)

This measures the resistance when the device is in the 'on' state, directly impacting energy efficiency. Lower Ron values mean less power loss during operation, which translates into reduced energy costs and improved system performance. Selecting SiC devices with optimized Ron is crucial for applications demanding high efficiency, such as renewable energy systems.

5. Tolerance and Fabrication Precision

Tolerance specifications relate to the dimensional and electrical consistency of SiC components. Tight tolerances ensure reliable performance and ease of integration into complex systems. For B2B buyers, verifying manufacturing precision reduces unforeseen delays or compatibility issues during assembly.

6. Operating Temperature Range

Silicon carbide devices typically operate efficiently at temperatures exceeding 150°C, with some models tolerating over 300°C. This high-temperature resilience reduces cooling requirements and enables deployment in harsh environments, such as industrial or automotive sectors. Buyers should match device temperature ratings with their operational conditions to avoid premature failures.

1. OEM (Original Equipment Manufacturer)

Refers to companies that design and produce finished products incorporating SiC components. Understanding OEM relationships helps buyers identify authorized suppliers and ensures product authenticity, quality assurance, and compliance with industry standards.

2. MOQ (Minimum Order Quantity)

This term specifies the smallest quantity a supplier will accept for an order. Recognizing MOQ requirements helps buyers plan procurement strategies, negotiate better terms, and avoid overstocking or supply shortages, especially when sourcing from overseas manufacturers.

3. RFQ (Request for Quotation)

A formal process where buyers solicit detailed price and delivery information from suppliers. Using RFQs enables comparative analysis of costs, lead times, and service levels, facilitating informed decision-making for large or recurring orders.

4. Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs between buyers and sellers. Familiarity with Incoterms (e.g., FOB, CIF) is vital for calculating landed costs, managing risks, and ensuring clarity in international transactions.

5. Lead Time

The period from placing an order to receiving the goods. Shorter lead times are often preferred for project agility, but they may come at higher costs. B2B buyers should evaluate supplier lead times in relation to project timelines and inventory strategies.

6. Certification and Standards

Includes compliance with industry standards such as ISO, RoHS, or specific automotive and aerospace certifications. Ensuring suppliers hold relevant certifications guarantees product quality, safety, and regulatory compliance, especially important for markets with strict standards like Europe and Australia.

Summary:

For international B2B buyers, understanding these technical properties and trade terms is essential for making informed procurement decisions. Accurate knowledge of material specifications, performance metrics, and industry jargon ensures optimal integration of silicon carbide semiconductors into complex systems, reduces supply chain risks, and enhances competitiveness across diverse markets.

The global silicon carbide (SiC) semiconductor sector is experiencing rapid growth driven by increasing demand for high-performance, energy-efficient power electronics across multiple industries. Key drivers include the expansion of renewable energy infrastructure, the electrification of transportation (notably electric vehicles), and the need for more resilient power grids. Emerging markets such as Africa, South America, the Middle East, and parts of Europe—like Poland and Australia—are increasingly investing in SiC technology to modernize their energy and industrial sectors.

For international B2B buyers, understanding sourcing trends is critical. The supply chain is consolidating around a few major producers in China, Europe, and North America, but regional diversification remains a priority for risk mitigation. Buyers from Africa and South America, for instance, are seeking local or regional suppliers to reduce logistical costs and ensure supply stability amid global disruptions. The trend toward vertical integration, where manufacturers control entire segments from raw material extraction to chip fabrication, is also reshaping the landscape.

Technological advancements, such as improved wafer quality and larger diameters, are enabling more efficient production and broader application scopes. Moreover, the push for faster delivery times and customized solutions is prompting suppliers to adopt just-in-time inventory practices and flexible manufacturing processes. For B2B buyers, especially in emerging markets, developing strategic partnerships with reliable suppliers who can offer quality assurance and scalable supply is paramount.

Environmental considerations are increasingly influencing sourcing decisions. Buyers are prioritizing suppliers who demonstrate transparent supply chains, adherence to international standards, and innovative approaches to reduce carbon footprints. As the industry matures, the integration of digital tools like blockchain for traceability and AI for demand forecasting will become essential for navigating complex market dynamics.

Sustainability has become a central concern in the silicon carbide semiconductor supply chain, driven by both regulatory pressures and corporate social responsibility commitments. The environmental footprint of SiC production primarily stems from energy-intensive processes involved in raw material extraction and manufacturing. As such, buyers from Africa, South America, the Middle East, and Europe are increasingly scrutinizing suppliers for sustainable practices.

Ethical sourcing encompasses responsible mining of raw materials, notably silicon and carbon sources, ensuring minimal environmental degradation and conflict-free supply chains. Suppliers who obtain necessary certifications—such as ISO 14001 for environmental management or Responsible Minerals Initiative (RMI) standards—signal their commitment to ethical practices. Incorporating green materials, like recycled silicon or low-impact carbon sources, further enhances sustainability credentials.

Green certifications and eco-labels serve as critical differentiators for B2B buyers seeking to meet their sustainability targets. They also mitigate risks associated with supply chain disruptions linked to environmental regulations or social conflicts. In addition, suppliers adopting renewable energy sources—solar, wind, or hydroelectric power—for manufacturing facilities are viewed more favorably.

Transparency is vital. Buyers should insist on comprehensive supply chain audits and traceability reports, ideally supported by blockchain technology, to verify ethical sourcing. Collaborating with suppliers committed to continuous improvement in environmental and social practices not only aligns with global sustainability goals but also enhances brand reputation and long-term resilience in the marketplace.

The silicon carbide industry has evolved significantly over the past few decades, transitioning from niche applications in abrasives and refractory materials to a cornerstone of high-power electronics. Initially, limited raw material availability and manufacturing challenges constrained growth. However, advancements in crystal growth techniques, such as chemical vapor deposition (CVD), have enabled the production of high-quality SiC wafers at scale.

Illustrative Image (Source: Google Search)

This evolution was catalyzed by the semiconductor industry’s need for materials capable of withstanding higher voltages and temperatures, especially in electric vehicle drivetrains and renewable energy inverters. As demand surged, key players invested heavily in R&D, leading to innovations in wafer size, quality, and fabrication processes.

For B2B buyers, understanding this historical trajectory highlights the importance of sourcing from experienced suppliers who have demonstrated technological maturity and quality consistency. It also underscores the shift toward more sustainable and scalable production practices, which are now integral to industry standards. Recognizing these developments helps buyers make informed decisions about supplier reliability, technological compatibility, and future-proofing their supply chains.

To vet suppliers effectively, start by requesting comprehensive certifications such as ISO 9001, RoHS, and industry-specific quality standards. Conduct thorough background checks on their manufacturing facilities, including visiting sites if possible or requesting detailed factory audits. Review their track record through customer references, testimonials, and case studies. Assess their supply chain stability, capacity, and compliance with international trade regulations. Utilizing third-party inspection services prior to shipment can also mitigate risks. Establish clear quality benchmarks upfront and include quality assurance clauses in your contracts to safeguard your procurement process.

Manufacturers often offer customization in terms of chip sizes, shapes, doping levels, and packaging formats to suit specific applications. To communicate your requirements effectively, provide detailed technical specifications, including datasheets, performance parameters, and end-use conditions. Engage with suppliers early to discuss feasibility, lead times, and associated costs. Consider requesting prototypes or sample batches for validation before bulk orders. Clear communication of your technical needs and desired compliance standards ensures the supplier can deliver tailored solutions that meet your operational demands.

MOQs vary widely depending on the supplier but generally range from 50 to 500 units for high-volume manufacturers. Lead times typically span 4 to 12 weeks, influenced by production complexity and logistics. Payment terms often include options like 30% upfront, with the balance payable before shipment or upon receipt. Some suppliers may offer letter of credit (L/C) or open account terms for established buyers. Negotiating flexible terms and understanding their production schedules are crucial—consider establishing long-term relationships to secure better pricing and more favorable terms.

Key certifications include ISO 9001 for quality management, RoHS and REACH compliance for environmental standards, and industry-specific certifications such as JEDEC or IEC standards. Request test reports, material certificates, and batch traceability documentation to verify consistency and compliance. For critical applications, ask for third-party inspection reports or certificates of conformity. Ensuring these documents are up-to-date and aligned with your regional standards is vital for smooth regulatory approval and to mitigate risks of non-compliance.

Start by selecting experienced freight forwarders familiar with your target markets and product-specific shipping requirements. Use Incoterms that clearly define responsibilities for shipping, insurance, and customs clearance. Prepare all necessary documentation, including commercial invoices, packing lists, certificates of origin, and compliance certificates. Track shipments proactively and maintain communication with logistics providers to anticipate delays. Building relationships with local customs brokers can expedite clearance processes, reduce costs, and ensure timely delivery, especially in complex markets like Africa, South America, or the Middle East.

Disputes are often resolved through negotiation or mediation initially. If unresolved, arbitration under internationally recognized frameworks such as ICC or UNCITRAL is common, providing a neutral venue for resolution. Clearly specify dispute resolution clauses in contracts, including jurisdiction and language. Choosing arbitration can offer confidentiality and enforceability across borders. Engaging legal counsel with expertise in international trade law can help draft enforceable terms and manage disputes efficiently, minimizing operational disruptions and safeguarding your investment.

Assess suppliers’ sustainability practices by requesting environmental impact reports, sustainability certifications, and social compliance documentation such as SA8000. Prioritize suppliers with transparent supply chains, responsible sourcing policies, and commitments to reducing carbon footprints. Building long-term partnerships based on mutual transparency encourages continuous improvement and adherence to ethical standards. Regular audits and supplier evaluations can reinforce compliance and align your procurement strategy with global sustainability goals, especially important for buyers from regions emphasizing corporate social responsibility.

Start by establishing clear communication channels and transparent expectations from the outset. Invest in regular engagement through visits, virtual meetings, and performance reviews. Offer consistent orders and prompt payments to build trust. Share your strategic goals and seek mutual growth opportunities, such as joint development projects or collaborative quality improvements. Developing a supplier scorecard that evaluates quality, delivery, responsiveness, and sustainability can foster continuous improvement. Long-term relationships reduce procurement risks, improve lead times, and often result in better pricing and priority service, vital for maintaining competitiveness in dynamic global markets.

Effective strategic sourcing of silicon carbide (SiC) semiconductors is essential for international B2B buyers aiming to capitalize on the growing demand for high-performance, energy-efficient power solutions. Key considerations include diversifying supply chains, establishing long-term supplier relationships, and prioritizing quality assurance to mitigate risks associated with supply disruptions or quality inconsistencies.

By proactively engaging with emerging manufacturing hubs and fostering partnerships across different regions—such as Europe, Africa, South America, and the Middle East—buyers can secure competitive advantages and ensure supply resilience. Staying informed about technological advancements and market dynamics will also enable better forecasting and strategic planning.

Looking ahead, the SiC semiconductor market is poised for rapid expansion driven by global shifts toward renewable energy, electric vehicles, and industrial automation. International B2B buyers should view strategic sourcing not just as a cost-saving measure but as a critical component of their innovation and sustainability strategies. Act now to build flexible, resilient supply chains that position your organization at the forefront of this transformative industry.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina