The global market for tabular alumina is a critical component in numerous high-performance industrial applications, from refractory linings in steel manufacturing to advanced ceramics and electronics. For international B2B buyers, especially those operating in dynamic regions such as Africa, South America, the Middle East, and Europe—including emerging markets like Vietnam and established hubs like Spain—understanding the nuances of this specialized material is essential to securing competitive advantages and ensuring supply chain resilience.

This comprehensive guide is designed to equip buyers with in-depth knowledge about tabular alumina’s types, raw materials, manufacturing processes, and rigorous quality control measures that guarantee product performance. It also offers a detailed overview of the global supplier landscape, highlighting key sourcing hubs and market trends that influence pricing and availability. By unpacking cost factors and providing practical insights into vendor selection, this resource enables procurement professionals to optimize their purchasing strategies.

Additionally, the guide addresses frequently asked questions and common challenges faced when navigating international trade in tabular alumina. Whether you are sourcing for industrial-scale production or specialized applications, this guide empowers you to make informed, strategic decisions that align with your operational goals and regional market conditions.

By leveraging this knowledge, buyers from diverse economic environments can confidently engage with suppliers, mitigate risks, and capitalize on emerging opportunities in the evolving tabular alumina market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Tabular Alumina | High purity, dense, angular particles, moderate hardness | Refractory linings, kiln furniture, steel ladles | + Reliable performance, cost-effective; - Limited thermal shock resistance |

| High Purity Tabular Alumina | Ultra-high alumina content (>99.5%), low impurities | Advanced ceramics, electronics, specialty refractories | + Superior chemical stability, high thermal resistance; - Higher price point |

| Fused Tabular Alumina | Produced by electric arc fusion, highly dense, irregular shape | Abrasives, grinding media, wear-resistant coatings | + Exceptional hardness and wear resistance; - Less suitable for molding processes |

| Coated Tabular Alumina | Tabular alumina particles coated with binders or additives | Castables, bonded refractories, composite materials | + Enhanced bonding and mechanical strength; - Additional processing costs |

| Micro-Tabular Alumina | Fine particle size, high surface area, controlled morphology | Precision ceramics, catalyst supports, polishing powders | + Excellent dispersion and reactivity; - Limited bulk applications due to fine size |

Standard Tabular Alumina is the most commonly used variant characterized by its dense, angular particles and moderate hardness. It is widely applied in refractory linings and steelmaking due to its reliable thermal and mechanical properties. For B2B buyers, this type offers a balanced cost-to-performance ratio, making it ideal for industries with standard refractory needs. However, buyers should consider its moderate resistance to thermal shock when selecting it for highly fluctuating temperature environments.

High Purity Tabular Alumina stands out with alumina content exceeding 99.5%, ensuring exceptional chemical stability and thermal resistance. This makes it suitable for advanced ceramics and electronic components where purity is critical. Buyers in Europe and the Middle East, focusing on high-spec industrial applications, will value its superior performance, though they must be prepared for a higher purchase cost. Supplier reliability and consistent quality certifications are key considerations here.

Fused Tabular Alumina is produced by melting alumina under an electric arc, resulting in a highly dense and extremely hard material. Its irregular particle shape and hardness make it ideal for abrasive applications and wear-resistant coatings. B2B buyers from mining and manufacturing sectors in Africa and South America seeking durability and abrasion resistance will find this type beneficial. However, it is less suited for applications requiring molding or shaping due to particle morphology.

Coated Tabular Alumina involves surface treatments or coatings that enhance bonding properties and mechanical strength in castables and bonded refractories. This variation is valuable for industries requiring customized refractory solutions with improved structural integrity. Buyers should weigh the additional cost against the performance gains, especially in sectors like steel production where refractory lifespan impacts operational efficiency.

Micro-Tabular Alumina features fine particle sizes with high surface area, offering excellent dispersion and reactivity. It is preferred in precision ceramics, catalyst supports, and polishing powders where surface chemistry is crucial. For B2B buyers targeting high-tech manufacturing in Europe or specialized chemical industries in the Middle East, this type provides significant advantages. However, its fine size limits bulk refractory use, and handling requires specialized equipment.

Related Video: Tabular alumina production process

| Industry/Sector | Specific Application of tabular alumina | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Refractory Industry | High-performance refractory linings for furnaces | Enhances thermal stability and mechanical strength, reducing downtime and maintenance costs | Purity, grain size, and thermal expansion compatibility with furnace materials; supplier reliability and delivery timelines |

| Abrasives Manufacturing | Production of precision grinding and polishing media | Improves efficiency and quality of abrasive tools, leading to higher yield and product consistency | Consistency in particle size distribution, hardness, and chemical inertness; compliance with environmental standards |

| Ceramic & Electrical | Manufacture of electrical insulators and advanced ceramics | Offers superior electrical insulation and mechanical durability, extending product lifespan | Chemical purity, thermal shock resistance, and compatibility with ceramic matrices; certification for industrial standards |

| Metallurgical Industry | Additive in casting and metallurgy processes | Enhances slag resistance and improves metal purity, boosting overall process efficiency | High alumina content, low impurities, and particle morphology suitable for metallurgical applications |

| Chemical Processing | Catalyst carrier and support material | Provides chemical inertness and thermal stability, optimizing catalytic reactions and reducing contamination | Consistent particle size and surface area; supplier ability to provide technical support for integration |

Refractory Industry

Tabular alumina is extensively used in refractory linings for high-temperature furnaces, such as those in the copper smelting operations prevalent in regions like Zambia’s Copperbelt. Its high alumina content and excellent thermal shock resistance ensure that furnace linings can withstand extreme temperatures and mechanical wear. This reduces downtime and maintenance frequency, critical for continuous industrial operations. Buyers from Africa, South America, the Middle East, and Europe should prioritize sourcing high-purity tabular alumina with consistent particle size to match existing refractory formulations and ensure seamless integration.

Abrasives Manufacturing

In the abrasives sector, tabular alumina serves as a premium raw material for producing grinding wheels and polishing compounds. Its angular particle shape and high hardness improve abrasive efficiency, allowing manufacturers in countries like Spain and Vietnam to deliver superior surface finishes and longer-lasting tools. International buyers must focus on suppliers that guarantee uniform particle size distribution and chemical inertness to maintain product quality and comply with environmental regulations.

Ceramic & Electrical Applications

Tabular alumina is a key component in advanced ceramics and electrical insulators, providing enhanced mechanical strength and electrical insulation properties. This is vital for manufacturers producing components for high-voltage equipment or industrial sensors across Europe and the Middle East. Buyers should ensure the alumina meets stringent purity and thermal shock resistance criteria, and that suppliers can provide certification for electrical and industrial standards compliance.

Metallurgical Industry

In metallurgy, tabular alumina is used as an additive to improve slag resistance and metal purity during casting and refining processes. This application is especially relevant for mining and metal processing hubs in Africa and South America. The material’s high alumina content and low impurity levels help optimize furnace performance and improve the quality of final metal products. Buyers should verify the chemical composition and particle morphology to ensure compatibility with their metallurgical processes.

Chemical Processing

Tabular alumina serves as an effective catalyst carrier in chemical processing industries, offering excellent thermal stability and chemical inertness. This enhances catalyst performance and lifespan in processes such as petrochemical refining and environmental catalysis. For B2B buyers in the Middle East and Europe, sourcing considerations include consistent particle size and surface area, as well as technical support from suppliers to facilitate integration into complex catalytic systems.

Related Video: Uses of metals - IGCSE Chemistry

When selecting materials for tabular alumina production, international B2B buyers must carefully evaluate the properties and performance characteristics of common raw materials to ensure optimal product quality and application suitability. This is especially critical for buyers in diverse regions such as Africa, South America, the Middle East, and Europe, where regulatory standards, environmental conditions, and end-use applications vary significantly.

Key Properties:

High-purity alumina typically contains over 99.5% Al2O3, exhibiting excellent thermal stability (up to 1750°C), outstanding corrosion resistance, and high mechanical strength. It offers low impurity levels, which is critical for high-performance refractory applications.

Pros & Cons:

The primary advantage is its superior durability and chemical inertness, making it ideal for harsh environments such as steel and cement kilns. However, its production involves complex refining and sintering processes, leading to higher costs compared to other alumina grades.

Impact on Application:

High-purity alumina is well-suited for applications requiring resistance to aggressive slags and thermal shock. It performs exceptionally in industries with stringent quality demands, such as metallurgy and glass manufacturing.

Considerations for International Buyers:

Buyers from Africa and South America should verify compliance with ASTM C799 or DIN EN 1094 standards to ensure material consistency. European and Middle Eastern buyers often require certification aligned with ISO 9001 quality management systems. Logistics and import tariffs may also influence cost-effectiveness in regions like Vietnam and Spain.

Key Properties:

This material features a tailored grain size distribution, typically between 3-15 microns, enhancing its mechanical strength and abrasion resistance. It maintains high refractoriness and low thermal expansion.

Pros & Cons:

The controlled grain size improves sintering behavior and end-product density, resulting in longer service life. However, manufacturing requires precise milling and classification, increasing production complexity and cost.

Impact on Application:

Ideal for refractory castables and bricks used in high-wear environments such as cement rotary kilns and petrochemical reactors. Its abrasion resistance reduces maintenance frequency and downtime.

Considerations for International Buyers:

Buyers should request detailed technical datasheets and grain size distribution reports. In regions like the Middle East and Europe, adherence to DIN 51012 or JIS R 1601 standards is common. African and South American buyers should also consider local supplier capabilities and after-sales technical support.

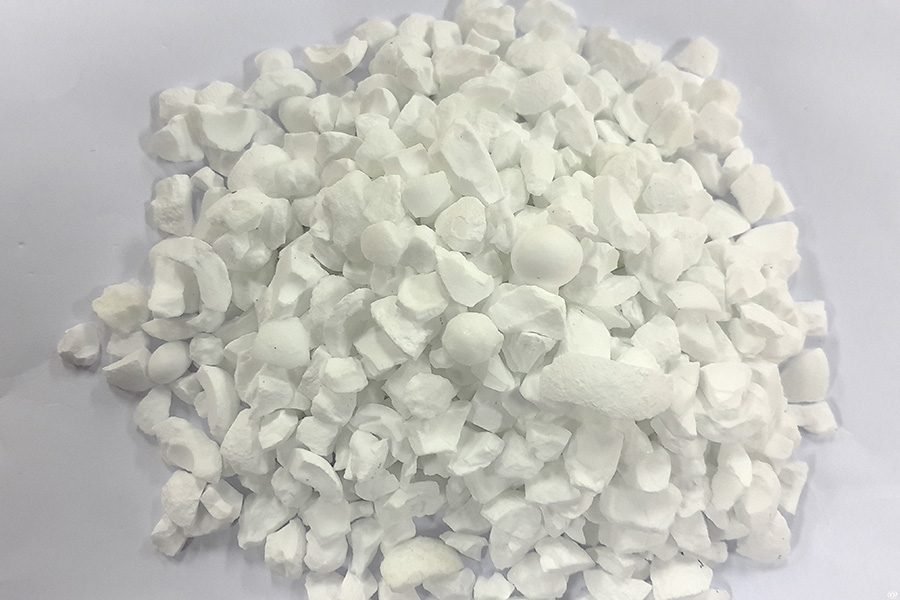

Key Properties:

This grade contains slightly higher impurity levels (around 97-99% Al2O3), which can include silica, iron oxide, and titania. It offers moderate thermal resistance and good mechanical properties but lower corrosion resistance than high-purity alumina.

Pros & Cons:

The main advantage is cost-effectiveness, making it suitable for less demanding applications. However, its reduced purity limits performance in highly corrosive or high-temperature environments.

Impact on Application:

Commonly used in refractory mortars, fillers, and low-stress refractory bricks. Suitable for industries with moderate operating conditions such as general manufacturing and non-critical thermal processes.

Considerations for International Buyers:

This material is attractive for buyers in developing markets across Africa and South America due to its affordability. Compliance with ASTM C799 or equivalent local standards should be confirmed. Buyers in Europe and the Middle East may use this grade for secondary applications but often prefer higher purity for critical uses.

Key Properties:

Produced via advanced synthetic routes such as sol-gel or chemical vapor deposition, synthetic tabular alumina exhibits uniform microstructure, exceptional purity (up to 99.9%), and tailored physical properties like enhanced thermal shock resistance.

Pros & Cons:

These engineered materials provide superior performance and consistency but come at a premium price and require specialized handling. Manufacturing complexity limits availability to select suppliers.

Impact on Application:

Best suited for cutting-edge refractory applications, including aerospace, electronics, and high-tech metallurgy, where performance cannot be compromised.

Considerations for International Buyers:

European and Middle Eastern buyers often demand such high-spec materials for advanced industrial sectors. Buyers from Africa and South America should assess cost-benefit trade-offs and supplier reliability. Import regulations and certification (e.g., ISO/TS 16949) are critical for synthetic alumina procurement.

| Material | Typical Use Case for tabular alumina | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| High-Purity Alumina (Al2O3) | High-performance refractories in steel, cement, glass | Excellent thermal stability and corrosion resistance | High production complexity and cost | High |

| Controlled Grain Size Tabular Alumina | Abrasion-resistant refractory castables and bricks | Enhanced mechanical strength and wear resistance | Increased manufacturing complexity | Medium |

| Technical Grade Tabular Alumina | Refractory mortars, fillers, and general manufacturing | Cost-effective for moderate conditions | Lower purity limits high-temperature performance | Low |

| Synthetic Tabular Alumina | Advanced high-tech refractory applications | Superior purity and tailored microstructure | Premium cost and limited supplier availability | High |

Tabular alumina, a high-density form of aluminum oxide, is valued for its exceptional hardness, thermal stability, and chemical inertness, making it a critical material in refractory, abrasive, and ceramic applications. Understanding its manufacturing process is essential for B2B buyers seeking reliable quality and performance.

The process begins with the selection and preparation of high-purity alumina feedstock. Typically, calcined alumina powder with controlled particle size distribution is used. This step involves:

- Pre-grinding and sieving to ensure uniformity.

- Blending with additives if required to tailor properties.

- Drying to remove moisture content, which is critical to avoid defects during sintering.

The purity and consistency of raw materials directly influence the final product’s mechanical and thermal properties.

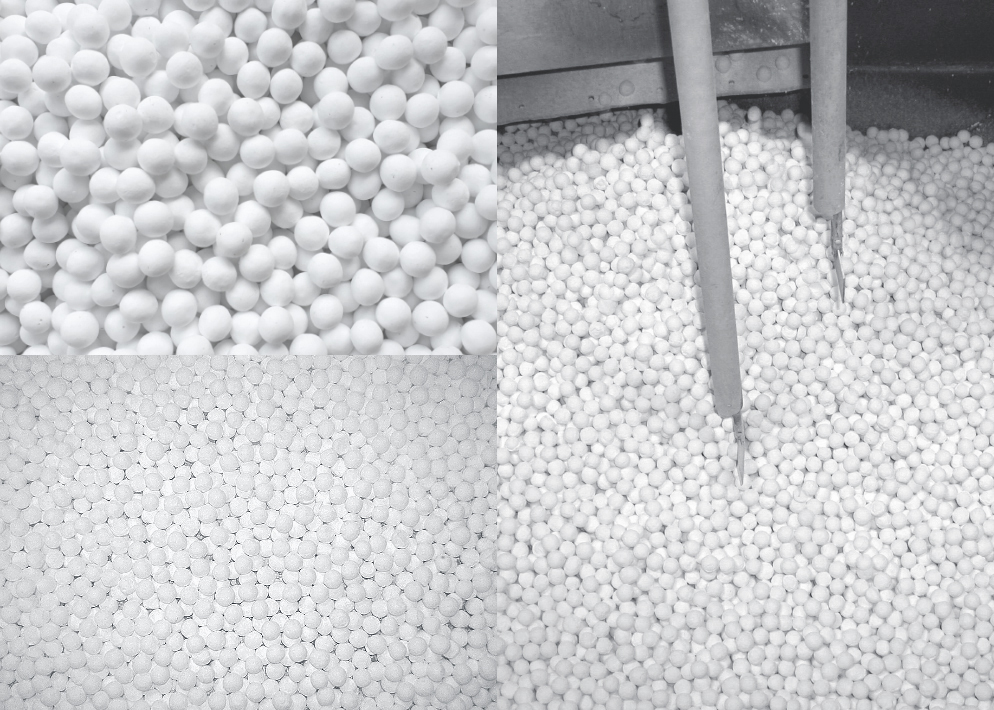

Tabular alumina is formed primarily through a high-temperature sintering process. The common shaping methods include:

- Pressing: Dry or isostatic pressing of alumina powder into the desired shape.

- Pelletizing: Forming granules or pellets that facilitate uniform sintering.

- Casting or extrusion (less common) for specific geometries.

Precision in forming ensures dimensional accuracy and structural integrity, vital for high-performance applications.

The defining stage for tabular alumina production is electric arc or plasma furnace sintering at temperatures exceeding 1800°C. Key aspects:

- Rapid heating to transform alpha-alumina into dense, tabular crystals.

- Controlled atmosphere to prevent contamination.

- Uniform temperature distribution to avoid internal stresses.

This step yields a dense, crystalline structure with low porosity and high mechanical strength.

After sintering, controlled cooling prevents thermal shock and cracking. The cooled blocks or granules are then:

- Broken down or milled into specific size fractions as per customer requirements.

- Assembled or packaged with protective materials to avoid damage during transport.

Proper cooling and handling preserve the microstructure and surface quality essential for end-use performance.

Finishing enhances surface characteristics and dimensional tolerances:

- Grinding and polishing for precise dimensions.

- Screening and grading to ensure particle size uniformity.

- Surface treatments may be applied to improve wear resistance or chemical stability.

Finishing is particularly important for applications demanding tight specifications such as refractory linings or abrasive tools.

Robust quality control is a cornerstone in manufacturing tabular alumina, ensuring consistent product performance that meets international market demands. B2B buyers, especially from diverse regions such as Africa, South America, the Middle East, and Europe, should prioritize suppliers with stringent QA/QC protocols aligned with global standards.

Buyers should verify that suppliers hold certifications and regularly update compliance documents to reflect current standards.

Quality control is integrated throughout the manufacturing cycle, commonly divided into:

These checkpoints ensure traceability and enable early detection of deviations.

To guarantee product integrity, manufacturers employ a range of tests:

B2B buyers should request detailed test reports and certifications for these parameters.

Ensuring supplier reliability and product consistency is paramount, especially for international buyers who face logistical and regulatory complexities.

For buyers in Africa, South America, the Middle East, and Europe, selecting a tabular alumina supplier requires:

By focusing on these actionable insights, international B2B buyers can secure high-quality tabular alumina that meets stringent performance criteria and regulatory requirements, ultimately supporting the success of their industrial operations.

When evaluating the cost structure for tabular alumina, international B2B buyers must consider several key components that cumulatively determine the final price:

Several factors cause price variation beyond basic cost components:

Prices for tabular alumina vary widely based on specification, order volume, and sourcing region. The figures and insights provided here are indicative and should be validated through direct supplier quotations and market research tailored to specific buyer needs and regional contexts.

By thoroughly understanding the multifaceted cost structure and price drivers, international B2B buyers can strategically source tabular alumina, optimize procurement costs, and ensure reliable supply chains aligned with their operational requirements.

Illustrative Image (Source: Google Search)

Understanding the critical technical properties of tabular alumina is essential for international B2B buyers to ensure the material meets application-specific requirements and quality standards. Here are the primary specifications to consider:

Alumina (Al₂O₃) Content

This indicates the purity level of the tabular alumina, usually expressed as a percentage. High-grade tabular alumina typically contains over 99.5% alumina. Purity affects thermal stability, chemical resistance, and mechanical strength, which are vital for refractory applications and high-temperature environments.

Bulk Density

Measured in grams per cubic centimeter (g/cm³), bulk density reflects the material's compactness and influences its thermal conductivity and abrasion resistance. Higher density tabular alumina offers superior mechanical strength and durability, making it preferable for heavy-duty industrial uses.

Particle Size Distribution

Defined by the range and uniformity of particle sizes, this property impacts the packing density and flow characteristics during processing. Buyers should specify particle size to match their manufacturing process requirements, whether for casting, extrusion, or surface coatings.

Apparent Porosity

This measures the volume of open pores relative to the total volume, affecting thermal insulation and resistance to slag penetration. Low porosity tabular alumina ensures better corrosion resistance and longevity in refractory linings.

Phase Composition

Tabular alumina consists primarily of the alpha (α) phase, which is the most thermodynamically stable form of alumina. Ensuring a high alpha phase content is critical for achieving excellent thermal shock resistance and mechanical strength.

Tolerance and Shape Consistency

Tolerances refer to the allowable deviations in particle size and shape. Consistent particle morphology ensures uniform packing and optimal performance in end-use applications. Buyers should request detailed specifications to avoid processing issues or product failures.

Navigating international trade in tabular alumina involves familiarity with common industry jargon and trade terms. These terms streamline communication and contract negotiations between suppliers and buyers:

OEM (Original Equipment Manufacturer)

Refers to companies that use tabular alumina as a raw material to produce finished equipment or components. Understanding if your supplier caters to OEMs can indicate product quality and compliance with industrial standards.

MOQ (Minimum Order Quantity)

The smallest amount of tabular alumina a supplier is willing to sell in one order. MOQ impacts inventory planning and cash flow management. Buyers should negotiate MOQs that align with their operational scale to optimize costs and storage.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, lead time, and terms for tabular alumina. Preparing a detailed RFQ with clear technical specifications helps secure accurate and competitive offers, facilitating informed purchasing decisions.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common Incoterms include FOB (Free on Board), CIF (Cost, Insurance, Freight), and DAP (Delivered at Place). Selecting the right Incoterm clarifies risk and cost distribution, essential for cross-border transactions.

Certification and Compliance

Certifications such as ISO 9001 (quality management) or specific industry standards (e.g., ASTM for refractories) assure buyers of product reliability and supplier credibility. Requesting certificates upfront reduces risk and supports regulatory adherence.

Lead Time

The period between placing an order and receiving the tabular alumina. Lead time affects production scheduling and inventory turnover. Buyers should confirm lead times early to avoid supply chain disruptions, especially when sourcing internationally.

By understanding these technical properties and trade terms, B2B buyers from Africa, South America, the Middle East, and Europe can make informed purchasing decisions, ensuring the tabular alumina procured meets performance expectations and aligns with logistical and financial planning.

The global tabular alumina market is increasingly shaped by industrial demand for high-performance refractory materials, advanced ceramics, and electronics. Key drivers include rapid growth in the steel and cement industries, rising automotive production, and expanding electronics manufacturing hubs, particularly across Asia, Europe, and emerging African markets. For international B2B buyers from regions like Africa, South America, the Middle East, and Europe, understanding these drivers is critical to aligning sourcing strategies with end-market requirements.

Market dynamics reflect a shift towards high-purity, consistent-quality tabular alumina to meet stringent industrial standards. Suppliers with integrated refining and processing capabilities tend to dominate, offering scalability and supply security. Africa, especially regions like Zambia’s Copperbelt, is emerging as a strategic source for raw materials, benefiting from proximity to bauxite and alumina refining operations. Meanwhile, Europe and South America focus on value-added products and innovation in alumina processing technologies.

Sourcing trends reveal a growing preference for long-term supply contracts coupled with collaborative partnerships. Buyers are increasingly leveraging digital platforms and supply chain analytics for enhanced transparency and efficiency. Technology adoption such as blockchain for traceability and AI-driven demand forecasting is gaining traction, helping buyers mitigate risks linked to geopolitical instability and fluctuating commodity prices.

For markets such as Vietnam and Spain, diversification of supply sources is a key trend, balancing cost, quality, and delivery reliability. Strategic sourcing from multiple regions including Africa and the Middle East is becoming common to manage risks and optimize cost structures.

Sustainability is no longer optional in the tabular alumina sector; it is a strategic imperative. The production of tabular alumina involves energy-intensive calcination processes, which contribute significantly to carbon emissions. Buyers are prioritizing suppliers who demonstrate commitment to reducing environmental footprints through energy efficiency, renewable energy integration, and waste minimization.

Ethical sourcing practices are equally important, especially for international buyers concerned with social and governance standards. Transparent supply chains help mitigate risks of labor abuses and environmental violations, which are increasingly scrutinized by global regulatory frameworks and institutional investors. Certifications such as ISO 14001 (Environmental Management), Responsible Minerals Assurance Process (RMAP), and adherence to the Aluminium Stewardship Initiative (ASI) standards are becoming essential benchmarks for suppliers.

Green tabular alumina products, produced with lower carbon emissions or from recycled alumina sources, are gaining market share. Buyers from Europe and South America, in particular, demand these environmentally certified materials to meet their regulatory and corporate sustainability goals. Collaboration with suppliers to improve lifecycle assessments and carbon accounting is a growing trend, facilitating more responsible procurement decisions.

Ultimately, integrating sustainability and ethical sourcing not only enhances brand reputation but also ensures long-term supply chain resilience and compliance in a rapidly evolving regulatory landscape.

Tabular alumina's development dates back to the mid-20th century as a high-density refractory material designed to withstand extreme temperatures in steelmaking and other heavy industries. Its unique crystalline structure, achieved through sintering and calcination of bauxite-derived alumina, offers superior mechanical strength and thermal stability compared to conventional alumina.

Historically, production was concentrated in Europe and North America, but globalization and the discovery of rich bauxite deposits in Africa and South America shifted the supply landscape. The Copperbelt region in Zambia, for instance, has become a notable mineral hub, indirectly supporting alumina and related industries through its mining infrastructure.

The sector has since evolved towards higher purity grades and specialized formulations to cater to advanced ceramics, electronics, and catalytic applications. This evolution underscores the importance for B2B buyers to stay informed about technological innovations and regional supply developments, ensuring procurement aligns with future industry standards and emerging market demands.

How can I effectively vet tabular alumina suppliers for international B2B transactions?

Begin by verifying the supplier’s business licenses, certifications (ISO, REACH, etc.), and manufacturing capabilities. Request product datasheets and quality test reports to confirm material specifications. Conduct background checks through trade references, client testimonials, and third-party audits. For buyers in Africa, South America, the Middle East, and Europe, consider suppliers with proven export experience and compliance with regional regulations. Engaging a local inspection agency or using digital platforms that provide verified supplier data can mitigate risks and ensure reliability.

Is customization of tabular alumina grades and particle sizes possible to meet specific industrial needs?

Yes, many manufacturers offer customization of tabular alumina in terms of purity, particle size distribution, and shape to suit applications like refractory linings, ceramics, or electronics. Discuss your technical requirements upfront and request sample batches to validate performance. Custom orders may require longer lead times and minimum order quantities (MOQs). Buyers should negotiate terms that balance customization benefits with cost-effectiveness, especially when sourcing from diverse regions such as Vietnam or Spain.

What are typical minimum order quantities (MOQs), lead times, and payment terms for international tabular alumina purchases?

MOQs often range from 1 to 5 metric tons depending on supplier scale and customization level. Lead times vary from 2 to 6 weeks, influenced by production schedules and shipping logistics. Payment terms commonly include 30-50% upfront deposit with balance on delivery or via Letter of Credit (L/C) for secure international trade. Buyers should clarify currency, Incoterms (e.g., FOB, CIF), and acceptable payment methods early to avoid delays, especially when dealing with suppliers in regions with different banking norms.

What quality assurance certifications and testing standards should I expect for tabular alumina?

Reputable suppliers typically provide ISO 9001 certification and compliance with relevant industry standards such as ASTM or EN for alumina materials. Quality testing includes chemical composition analysis, bulk density, porosity, and thermal shock resistance. Request third-party lab certificates or factory inspection reports to verify quality. For buyers in regulated markets like the EU or Middle East, ensure the supplier’s documentation meets import and environmental standards to facilitate smooth customs clearance.

How can I optimize logistics and shipping for tabular alumina imports from Africa, South America, or Asia?

Choose suppliers near major ports or industrial hubs to reduce inland freight costs. Consolidate shipments to leverage economies of scale and reduce per-unit shipping expenses. Use reliable freight forwarders familiar with your destination’s import regulations and documentation requirements. Consider multimodal transport options to balance cost and delivery speed. Tracking systems and pre-shipment inspections can help manage risks. For example, sourcing from Zambia’s Copperbelt or Vietnam requires awareness of local infrastructure capabilities and potential customs bottlenecks.

What strategies can I use to handle disputes or quality issues with international tabular alumina suppliers?

Establish clear contractual terms covering product specifications, inspection rights, and dispute resolution mechanisms such as arbitration clauses. Maintain detailed records of communications and quality inspections. Engage third-party inspection agencies for independent verification before shipment. If issues arise, attempt amicable negotiation first; escalate to formal dispute resolution if necessary. Buyers should understand local legal frameworks and international trade laws to protect their interests, especially when dealing with suppliers across continents.

Illustrative Image (Source: Google Search)

Are there specific considerations when importing tabular alumina into regions like Europe or the Middle East?

Yes, compliance with regional chemical safety regulations (e.g., REACH in Europe) is critical. Importers must ensure proper classification, labeling, and safety data sheets accompany shipments. Customs duties, VAT, and import licenses vary by country and must be factored into cost and delivery timelines. Additionally, environmental regulations may restrict certain packaging materials or require waste disposal plans. Partnering with customs brokers experienced in regional requirements can streamline clearance and reduce unexpected delays.

How can I assess the sustainability and ethical sourcing of tabular alumina suppliers?

Request information on the supplier’s environmental policies, energy use, and waste management practices. Certifications such as ISO 14001 (environmental management) or adherence to corporate social responsibility (CSR) standards indicate commitment to sustainable operations. Verify that raw materials are sourced responsibly, avoiding conflict minerals or unethical labor practices, particularly in mining-intensive regions like Zambia’s Copperbelt. Transparent supply chains and third-party audits enhance trust and align with growing global demand for ethical sourcing in B2B procurement.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complex global landscape of tabular alumina sourcing, international B2B buyers must prioritize a strategic, well-informed approach. Key takeaways include the importance of understanding regional production hubs, supply chain dynamics, and quality standards to optimize procurement. Buyers from Africa, South America, the Middle East, and Europe should leverage emerging opportunities in resource-rich areas such as Zambia’s Copperbelt Province, which offers potential access to raw materials and industrial infrastructure.

Strategic sourcing in tabular alumina is not just about price negotiation but encompasses supplier relationship management, risk mitigation against market volatility, and sustainability considerations. Embracing supplier diversification and fostering long-term partnerships can enhance supply security and innovation.

Illustrative Image (Source: Google Search)

Looking ahead, the demand for high-performance refractory materials like tabular alumina will continue to grow, driven by industrial advancements and environmental regulations. Buyers are encouraged to invest in market intelligence, collaborate closely with regional suppliers, and integrate sustainability into their sourcing strategies to stay competitive. By doing so, businesses will not only secure reliable supply chains but also contribute to sustainable industrial development across diverse global markets.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina