The global abrasives market is a cornerstone of manufacturing, construction, and maintenance industries worldwide. For international B2B buyers—especially those operating in dynamic regions like Africa, South America, the Middle East, and Europe—understanding the various types of abrasive materials is essential to optimizing product quality, operational efficiency, and cost-effectiveness. Selecting the right abrasive can significantly impact everything from surface finish to production speed, making it a critical decision in supply chain management.

This comprehensive guide delves into the full spectrum of abrasive types, including natural and synthetic variants, bonded and coated abrasives, and emerging innovations. It explores key raw materials, production methods, and stringent quality control standards that ensure consistent performance. Additionally, the guide offers actionable insights into global supplier landscapes, pricing trends, and regional market dynamics, empowering buyers to navigate complex sourcing challenges confidently.

For buyers in regions like Spain, France, the Middle East, and emerging African and South American markets, this resource addresses unique logistical considerations, regulatory environments, and demand patterns. It also includes a detailed FAQ section to clarify common queries and troubleshoot sourcing obstacles.

By leveraging this guide, international B2B buyers can make informed, strategic purchasing decisions that align with their operational goals and market demands—ultimately driving competitive advantage in their respective industries. Whether upgrading existing abrasive supplies or entering new markets, the insights provided here will serve as a vital tool for sustainable growth and innovation.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

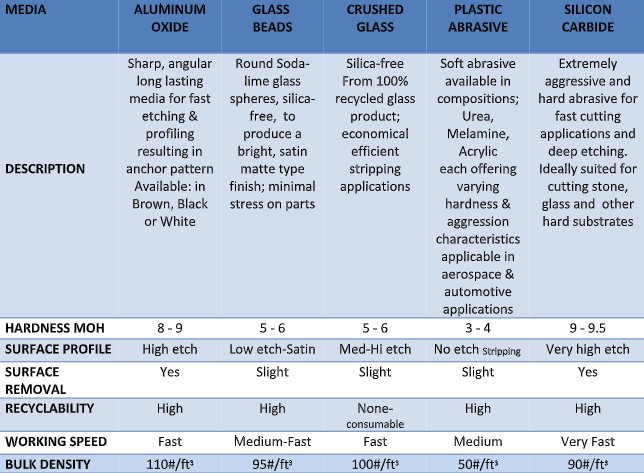

| Aluminum Oxide | Durable, versatile synthetic abrasive with sharp edges | Metal fabrication, woodworking, automotive | Pros: Long-lasting, cost-effective; Cons: Generates heat, less effective on hard metals |

| Silicon Carbide | Extremely hard, sharp, brittle abrasive | Glass, ceramics, stone cutting, electronics | Pros: High cutting efficiency, good for non-metal materials; Cons: Brittle, shorter lifespan on metals |

| Garnet | Natural abrasive, eco-friendly, consistent grain size | Waterjet cutting, surface preparation | Pros: Environmentally friendly, reusable; Cons: Higher cost, limited availability in some regions |

| Zirconia Alumina | Tough, self-sharpening synthetic abrasive | Heavy-duty grinding, stainless steel, aerospace | Pros: High durability, excellent for hard metals; Cons: Higher price point, requires specialized equipment |

| Ceramic Alumina | Ultra-hard, long-lasting synthetic abrasive | Precision grinding, aerospace, tool manufacturing | Pros: Superior performance, long life; Cons: Expensive, sensitive to improper use |

Aluminum Oxide

Aluminum oxide abrasives are among the most widely used due to their durability and versatility. Their sharp edges make them suitable for a broad range of applications, especially in metal fabrication and woodworking. For B2B buyers, aluminum oxide offers a cost-effective solution with good longevity, but it can generate heat during use, which may affect sensitive materials. Buyers should consider their specific material compatibility and operational conditions when selecting this abrasive.

Silicon Carbide

Known for its hardness and sharpness, silicon carbide excels in cutting and grinding non-metal materials such as glass, ceramics, and stone. It is favored in electronics manufacturing and precision applications. However, its brittleness reduces lifespan when used on metals, requiring buyers to evaluate their application needs carefully. Ideal for businesses dealing with hard, brittle materials, silicon carbide offers high cutting efficiency but may increase replacement frequency.

Garnet

Garnet is a natural, eco-friendly abrasive prized for its consistent grain size and recyclability. It is commonly used in waterjet cutting and surface preparation, making it attractive for environmentally conscious companies. Despite its higher cost and regional availability challenges, garnet appeals to buyers prioritizing sustainability and fine finish quality. Procurement teams should assess supply chain reliability and environmental impact in their sourcing decisions.

Zirconia Alumina

Zirconia alumina abrasives are tough, self-sharpening, and designed for heavy-duty grinding tasks, especially in stainless steel and aerospace sectors. Their high durability translates to longer tool life and improved efficiency, justifying the higher upfront investment. Buyers must consider the need for specialized equipment and training to maximize benefits, making it suitable for industries where performance and precision are critical.

Ceramic Alumina

Ceramic alumina abrasives provide ultra-hard, long-lasting performance, ideal for precision grinding and high-end manufacturing like aerospace and tooling. This abrasive type offers superior cutting speed and durability but comes with a premium price and sensitivity to improper handling. B2B buyers should weigh the cost against the enhanced productivity and product quality, ensuring proper application to avoid premature wear or damage.

Related Video: Types of Abrasive Material {हिंदी} || Abrasive material types || Aluminium oxide abrasive | Diamond.

| Industry/Sector | Specific Application of types of abrasive | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Surface finishing and polishing of engine components | Enhances durability and performance of parts | Consistent grit size, quality certification, and supplier reliability |

| Aerospace | Precision grinding of turbine blades and aerospace alloys | Improves safety and efficiency through tight tolerances | High-grade abrasives with uniform particle distribution, compliance with aerospace standards |

| Metal Fabrication | Deburring and smoothing of welded joints | Increases product quality and reduces post-processing time | Abrasive hardness and shape, availability of bulk quantities |

| Construction | Cutting and shaping of concrete, stone, and tiles | Accelerates project timelines and improves finish quality | Abrasive type compatibility with materials, durability under heavy use |

| Electronics | Polishing semiconductor wafers and circuit boards | Ensures precision and defect-free surfaces | Ultra-fine abrasives, contamination control, and traceability |

In the automotive industry, abrasives are crucial for surface finishing and polishing engine components such as cylinder heads and crankshafts. These processes enhance the durability and operational efficiency of parts by removing microscopic surface irregularities. For international buyers, particularly from Africa and South America where automotive manufacturing is growing, sourcing abrasives with consistent grit size and certification ensures compatibility with stringent quality standards and helps maintain production consistency.

Within the aerospace sector, precision grinding of turbine blades and aerospace alloys demands abrasives with exceptional uniformity and hardness. These abrasives enable manufacturers to achieve tight tolerances critical for safety and performance. European and Middle Eastern buyers should prioritize suppliers that comply with aerospace industry certifications and offer traceability to ensure materials meet international safety regulations and performance benchmarks.

In metal fabrication, abrasives are used extensively for deburring and smoothing welded joints, which directly influences product quality and reduces the need for rework. Businesses in regions like South America and the Middle East benefit from abrasives with specific hardness and shape characteristics tailored to their metal types. Bulk availability and reliable supply chains are essential to avoid production downtime.

For the construction industry, abrasives play a vital role in cutting and shaping concrete, stone, and tiles. Using the right type of abrasive can significantly accelerate project timelines and improve the finish quality of architectural elements. Buyers from Africa and Europe must consider abrasives that are compatible with local materials and capable of withstanding heavy-duty use to maximize cost-efficiency and durability on-site.

In the electronics industry, ultra-fine abrasives are indispensable for polishing semiconductor wafers and printed circuit boards, ensuring surfaces are defect-free and meet exacting precision standards. International B2B buyers, especially from tech hubs in Europe and the Middle East, should focus on contamination control and traceability when sourcing abrasives to maintain high yields and product reliability in highly sensitive manufacturing environments.

Related Video: Lec 23: Introduction to Abrasive Process-Grinding

Key Properties: Aluminum oxide is a highly durable abrasive with excellent hardness and toughness, capable of withstanding high temperatures up to approximately 1200°C. It offers good corrosion resistance and maintains its cutting ability under high pressure, making it suitable for heavy-duty grinding and cutting operations.

Pros & Cons: Aluminum oxide abrasives are cost-effective and widely available, with relatively straightforward manufacturing processes. Their durability ensures long tool life, reducing replacement frequency. However, they can be less effective on very hard materials like ceramics or glass, where more specialized abrasives are preferred.

Impact on Application: This abrasive is versatile, compatible with metals, wood, and plastics, making it ideal for general-purpose grinding and finishing. It performs well in both dry and wet environments, which is crucial for industries requiring dust suppression or coolant use.

International B2B Considerations: For buyers in Africa, South America, the Middle East, and Europe, aluminum oxide abrasives typically comply with ASTM and DIN standards, ensuring quality and safety. European buyers, particularly in Spain and France, often require certification for industrial safety and environmental compliance. Availability and cost competitiveness make aluminum oxide a preferred choice for emerging markets in Africa and South America.

Key Properties: Silicon carbide is extremely hard and sharp, with a high thermal conductivity and temperature resistance up to about 1600°C. It is chemically inert and exhibits excellent corrosion resistance, particularly against acids and alkalis.

Pros & Cons: This abrasive excels in cutting and grinding non-ferrous metals, ceramics, glass, and stone. It is more brittle than aluminum oxide, which can lead to faster wear under heavy loads. Manufacturing complexity is higher, contributing to a moderate to high cost.

Impact on Application: Silicon carbide is ideal for precision grinding and finishing applications requiring a fine surface finish. Its chemical resistance makes it suitable for abrasive media in chemical processing industries or environments with corrosive substances.

International B2B Considerations: Compliance with JIS and DIN standards is common, especially for buyers in Europe and Japan-influenced markets. In the Middle East and South America, silicon carbide abrasives are valued for their performance in petrochemical and mining sectors. Importers should verify certification to ensure compatibility with local industrial regulations and environmental standards.

Key Properties: Garnet abrasives are natural, eco-friendly minerals with moderate hardness and good toughness. They have excellent water resistance and low friability, allowing for consistent particle shape and size during use.

Pros & Cons: Garnet is renewable and less dusty compared to synthetic abrasives, which is advantageous for worker safety and environmental compliance. However, its hardness is lower than synthetic abrasives, limiting its use to softer materials or surface preparation tasks. The cost can vary depending on sourcing and purity.

Impact on Application: Garnet is widely used in waterjet cutting, sandblasting, and surface preparation for coatings. Its compatibility with water-based systems makes it popular in industries emphasizing sustainability and reduced environmental impact.

International B2B Considerations: Buyers from Europe, particularly France and Spain, prioritize garnet for its green credentials and compliance with EU environmental directives. African and South American markets are increasingly adopting garnet for infrastructure projects, where natural abrasives are preferred. Verification of origin and purity is critical to meet local and international quality standards.

Key Properties: Ceramic alumina abrasives are engineered for extreme hardness, sharpness, and heat resistance, withstanding temperatures above 1400°C. They maintain cutting efficiency longer than conventional abrasives due to their self-sharpening properties.

Pros & Cons: These abrasives offer superior durability and performance in high-pressure, high-temperature applications. The manufacturing process is complex and costly, resulting in a higher price point. However, their longevity and efficiency can justify the investment in high-volume industrial settings.

Impact on Application: Ceramic alumina is preferred for heavy-duty grinding of hardened steels, aerospace alloys, and other demanding materials. Its ability to perform in dry grinding and high-speed operations makes it invaluable for precision manufacturing.

International B2B Considerations: Compliance with ASTM and DIN standards is standard, with additional certifications often required for aerospace and automotive sectors in Europe. Buyers in the Middle East and South America should consider supply chain reliability and after-sales support due to the premium nature of this abrasive. For African markets, partnerships with established suppliers can mitigate risks related to cost and availability.

| Material | Typical Use Case for types of abrasive | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Oxide | General-purpose grinding and cutting on metals and wood | Durable, cost-effective, widely available | Less effective on very hard materials | Low |

| Silicon Carbide | Precision grinding of non-ferrous metals, ceramics, glass | High hardness, excellent chemical resistance | Brittle, higher manufacturing complexity | Medium |

| Garnet | Waterjet cutting, sandblasting, surface preparation | Eco-friendly, low dust, good water resistance | Lower hardness limits use on hard materials | Medium |

| Ceramic Alumina | Heavy-duty grinding of hardened steels and aerospace alloys | Superior durability, self-sharpening | High cost, complex manufacturing | High |

Understanding the manufacturing process of abrasives is critical for B2B buyers aiming to source high-quality products that meet their application needs. The production of abrasives—whether bonded, coated, or superabrasives—involves several key stages, each contributing to the final product’s performance and durability.

1. Material Preparation

This initial phase focuses on selecting and processing raw materials. Abrasive grains such as aluminum oxide, silicon carbide, diamond, or cubic boron nitride (CBN) are carefully sourced and classified by size and purity. For synthetic abrasives, this includes processes like crystallization or sintering. Material preparation may also involve blending abrasive grains with bonding agents or fillers to achieve desired physical properties.

2. Forming

The forming stage shapes the abrasive into usable forms such as wheels, belts, discs, or powders. Depending on the abrasive type, techniques include:

- Pressing and Molding: For bonded abrasives, abrasive grains are mixed with a binder and pressed into molds under high pressure.

- Coating: For coated abrasives, grains are glued onto backing materials like paper, cloth, or film using resin or adhesive layers.

- Sintering: Superabrasives like diamond or CBN are often sintered at high temperatures to enhance grain bonding and toughness.

- Extrusion or Casting: Some abrasives, especially in powder or slurry form, may be extruded or cast into specific shapes.

3. Assembly and Conditioning

After forming, abrasive components may require assembly, such as mounting abrasive grains onto backing materials or assembling multi-layered grinding wheels. Conditioning steps can include:

- Truing and Dressing: These processes refine the abrasive surface to ensure uniformity and sharpness.

- Impregnation: Adding lubricants or cooling agents to improve performance during use.

- Curing: Heat treatments to harden resins or bonding agents, enhancing durability.

4. Finishing

Finishing ensures the abrasive product meets dimensional and performance specifications. This may involve grinding, balancing, coating with protective layers, and packaging. Surface treatments may also be applied to improve resistance to wear or corrosion.

Quality assurance (QA) and quality control (QC) are essential to guarantee abrasive products perform consistently and safely in demanding industrial applications. For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, understanding supplier QC processes and certifications is vital to mitigate risks and ensure compliance.

Key International and Industry-Specific Standards

- ISO 9001: The foundational global standard for quality management systems, ensuring consistent product quality and continuous improvement.

- CE Marking: Required for abrasives sold within the European Economic Area (EEA), certifying compliance with EU safety, health, and environmental requirements.

- API Standards: For abrasives used in oil and gas sectors, adherence to American Petroleum Institute (API) standards may be critical.

- Other Regional Certifications: Depending on the market, certifications such as INMETRO (Brazil), SASO (Saudi Arabia), or SABS (South Africa) may be relevant.

Typical QC Checkpoints Throughout Production

- Incoming Quality Control (IQC): Verification of raw materials and components to confirm they meet specifications before entering production. This includes grain size analysis, purity tests, and binder quality checks.

- In-Process Quality Control (IPQC): Continuous monitoring during forming and assembly stages. Checks may include dimensional inspections, hardness testing, and surface finish evaluations.

- Final Quality Control (FQC): Comprehensive testing of finished products to validate performance criteria such as abrasive hardness, bonding strength, and safety features like wheel balance and concentricity.

Common Testing Methods

- Microscopic Grain Analysis: To ensure abrasive grain size and distribution meet required tolerances.

- Hardness and Toughness Testing: Using Mohs scale or other mechanical tests to assess abrasive strength.

- Bond Strength Tests: Measuring the adhesion between abrasive grains and bonding agents.

- Dynamic Balancing: Especially for grinding wheels, to reduce vibration and improve safety.

- Performance Testing: Simulated application tests such as cut rate, wear resistance, and heat resistance.

International buyers must adopt rigorous supplier verification strategies to ensure abrasive products conform to their quality and regulatory requirements.

1. Conducting Supplier Audits

On-site audits are the gold standard for QC verification. Buyers should assess the supplier’s manufacturing environment, equipment calibration, staff qualifications, and adherence to documented quality procedures. For buyers unable to visit, virtual audits or third-party inspection agencies can provide credible alternatives.

2. Reviewing Quality Documentation and Certifications

Request comprehensive QC documentation, including:

- Certificates of analysis (CoA) for raw materials and finished products.

- ISO 9001 and other relevant certifications.

- Test reports from independent laboratories.

- Batch traceability records to track production history.

3. Engaging Third-Party Inspection Services

Third-party inspectors offer impartial evaluation of product quality, verifying compliance with international standards and contractual specifications. This is especially important for buyers in Africa, South America, and the Middle East, where local regulatory oversight may vary.

4. Understanding QC and Certification Nuances by Region

- Europe (Spain, France, etc.): Strict regulatory environments require CE certification and compliance with REACH and RoHS directives. Emphasis on environmental impact and worker safety is high.

- Africa and South America: Buyers should focus on supplier capability to meet international standards, as local certification may be less standardized. Using third-party inspections and insisting on ISO 9001 certification is advisable.

- Middle East: Regulatory frameworks vary; buyers should verify compliance with SASO or similar national standards, alongside international certifications.

By thoroughly understanding manufacturing processes and quality assurance measures, B2B buyers can make informed sourcing decisions, ensuring the abrasives they procure deliver optimal performance, safety, and regulatory compliance across diverse international markets.

Understanding the cost and pricing dynamics of abrasives is crucial for international B2B buyers aiming to optimize procurement strategies and ensure competitive advantages. Abrasives, varying widely in type and application, present complex cost structures influenced by multiple factors that must be carefully evaluated.

Abrasive pricing varies widely depending on type, grade, volume, and supplier specifics. The information provided here is indicative and should be verified through direct supplier engagement and market research tailored to your region and application needs.

By thoroughly analyzing these cost components and pricing influencers, international B2B buyers can make informed sourcing decisions that balance quality, cost-efficiency, and supply chain resilience in abrasive procurement.

When sourcing abrasives internationally, understanding the core technical properties and industry-specific terminology is crucial for making informed purchasing decisions. This knowledge helps buyers from Africa, South America, the Middle East, and Europe ensure product suitability, cost-efficiency, and smooth supply chain operations.

Material Composition (Grade)

Abrasives are made from various materials such as aluminum oxide, silicon carbide, or diamond. The grade indicates the hardness and durability of the abrasive. For example, high-grade aluminum oxide is ideal for metal grinding, while silicon carbide suits non-ferrous metals and ceramics. Knowing the grade helps buyers select abrasives that optimize performance and lifespan for specific applications.

Grit Size (Mesh Size)

Grit size defines the particle size of the abrasive material, typically measured by mesh number or micron size. Finer grits (higher mesh) provide smoother finishes, while coarser grits remove material faster but with a rougher surface. Selecting the correct grit size balances efficiency and finish quality, impacting productivity and product standards.

Illustrative Image (Source: Google Search)

Tolerance and Consistency

Tolerance refers to the allowable deviation in abrasive size, shape, and hardness. Tight tolerance levels ensure uniformity and predictable performance, which is critical for automated or high-precision manufacturing processes. Buyers should specify tolerance requirements to avoid quality variations that can lead to rework or scrap.

Bonding Type

Abrasives can be bonded with resin, vitrified (ceramic), metal, or other materials. The bonding affects the abrasive’s strength, heat resistance, and suitability for wet or dry use. Understanding bonding types helps buyers match abrasives to operational conditions and machinery capabilities.

Durability and Wear Rate

This property measures how long an abrasive lasts under specific conditions before it wears out. A more durable abrasive reduces replacement frequency and downtime, offering cost savings. Buyers should evaluate wear rates relative to their production volumes and maintenance schedules.

Illustrative Image (Source: Google Search)

OEM (Original Equipment Manufacturer)

Refers to the company that produces the machinery or equipment for which abrasives are sourced. OEM specifications often dictate abrasive types and grades to ensure compatibility and warranty compliance. Buyers should confirm whether products meet OEM standards to avoid operational issues.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. Understanding MOQ helps buyers plan inventory and budget effectively, especially when dealing with international suppliers where shipping costs and lead times are significant.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, delivery, and terms based on specified requirements. An accurate RFQ with detailed technical specs ensures suppliers provide precise offers, facilitating better price comparison and negotiation.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Clear agreement on Incoterms reduces risks and unexpected costs during international transactions.

Batch Number

An identifier assigned to a specific production lot of abrasives. Tracking batch numbers is essential for quality control, traceability, and managing recalls or warranty claims.

Shelf Life

The period during which abrasives maintain their specified performance characteristics if stored properly. Buyers should consider shelf life to avoid purchasing stock that could degrade before use, especially in regions with variable climate conditions.

By mastering these technical properties and trade terms, international B2B buyers can confidently evaluate abrasive products, negotiate better deals, and maintain consistent production quality. This knowledge is particularly valuable when dealing with diverse suppliers and complex logistics across Africa, South America, the Middle East, and Europe.

The global abrasives market is experiencing robust growth driven by expanding industrialization, infrastructure development, and rising demand from automotive, aerospace, and construction sectors. For international B2B buyers in Africa, South America, the Middle East, and Europe (notably Spain and France), understanding regional market dynamics is crucial. Emerging economies in Africa and South America are increasingly investing in manufacturing and mining, boosting demand for both conventional abrasives like aluminum oxide and silicon carbide, and advanced superabrasives such as diamond and cubic boron nitride (CBN).

Technological advancements are reshaping sourcing strategies. Digital platforms and Industry 4.0 technologies enable buyers to access real-time product data, supplier certifications, and performance analytics. This transparency helps mitigate risks associated with quality and supply chain disruptions. Additionally, there is a notable shift toward customized abrasives tailored for specific applications, driven by precision manufacturing needs in aerospace and electronics.

The market is also witnessing consolidation among suppliers, with larger manufacturers expanding global footprints to serve diverse regional demands. For buyers in Europe and the Middle East, proximity to high-quality suppliers ensures shorter lead times and reduced logistics costs. Meanwhile, buyers in Africa and South America are increasingly leveraging strategic partnerships and local distribution networks to overcome infrastructure challenges.

Key trends include:

- Growing preference for engineered abrasives with enhanced durability and efficiency.

- Increasing adoption of automated grinding and finishing processes.

- Expansion of e-procurement platforms for streamlined ordering and supplier evaluation.

- Rising demand for multi-functional abrasives that combine cutting, grinding, and polishing capabilities.

Understanding these trends enables B2B buyers to optimize procurement, reduce total cost of ownership, and maintain competitive advantage in their respective markets.

Sustainability is rapidly becoming a non-negotiable factor in the abrasives supply chain. The production and disposal of abrasives can have significant environmental impacts, including energy-intensive manufacturing processes and waste generation. B2B buyers across Africa, South America, the Middle East, and Europe are increasingly prioritizing suppliers who demonstrate commitment to eco-friendly practices and ethical sourcing.

Key sustainability considerations include:

- Material sourcing: Preference for abrasives derived from renewable or recycled raw materials reduces dependency on non-renewable mineral extraction. For example, recycled aluminum oxide abrasives lower environmental footprints.

- Energy efficiency: Suppliers adopting cleaner production techniques—such as using renewable energy sources and optimizing manufacturing processes—contribute to lower carbon emissions.

- Waste management: Closed-loop systems that recycle abrasive dust and scrap material help minimize landfill waste.

- Certifications: Buyers should seek suppliers with recognized environmental certifications such as ISO 14001 (Environmental Management), REACH compliance in Europe, and responsible mining certifications for natural abrasives.

Ethical supply chains are equally critical. Transparency in sourcing raw materials, especially those mined in conflict-affected or vulnerable regions, ensures compliance with international labor standards and human rights. Buyers can demand supplier audits and traceability data to verify ethical practices.

Incorporating sustainability criteria into supplier selection not only mitigates regulatory and reputational risks but also aligns with the growing consumer and stakeholder demand for green manufacturing. This approach supports long-term supply resilience and opens opportunities for innovation in eco-friendly abrasive solutions.

The abrasives sector has evolved significantly from its origins in natural mineral use to today’s sophisticated engineered materials. Historically, natural abrasives like emery and garnet were utilized for basic grinding and polishing tasks. The industrial revolution catalyzed the development of synthetic abrasives such as aluminum oxide and silicon carbide, offering higher consistency and performance.

In the mid-20th century, the introduction of superabrasives—diamond and CBN—transformed high-precision machining and finishing processes, enabling manufacturers to meet the stringent tolerances demanded by aerospace and automotive industries. Over time, advancements in bonding technologies and abrasive grain engineering have led to customized abrasives designed for specific materials and applications.

For B2B buyers, this historical progression underscores the importance of selecting abrasives not only based on traditional hardness but also on application-specific attributes such as grain shape, bonding type, and thermal stability. Recognizing the evolution helps buyers appreciate current product innovations and anticipate future market shifts driven by technological and environmental imperatives.

How can I effectively vet suppliers of abrasives for international B2B trade?

To vet abrasive suppliers internationally, start by verifying their business licenses and certifications such as ISO 9001 or industry-specific quality standards. Request samples to assess product quality firsthand. Check references and client testimonials, especially from companies within your region or industry. Use third-party inspection services to audit manufacturing facilities if possible. Prioritize suppliers with transparent supply chains and clear communication channels. This due diligence reduces risks and ensures reliability in supply, which is critical when importing from regions like Africa, South America, or the Middle East.

What customization options are commonly available for abrasives, and how should I approach this with suppliers?

Most suppliers offer customization in grit size, abrasive material (e.g., aluminum oxide, silicon carbide), bonding agents, and product form (e.g., belts, discs, powders). Clearly communicate your technical requirements and end-use applications. Request technical datasheets and discuss potential adjustments to meet your production needs. Negotiate minimum order quantities (MOQs) for custom batches, as customization often requires higher MOQs. Establish prototypes or trial orders before full-scale production to minimize risk. This approach ensures the abrasive products align perfectly with your manufacturing processes.

What are typical MOQs and lead times for abrasive products when sourcing internationally?

MOQs for abrasives vary widely, generally ranging from a few hundred to several thousand units depending on product type and customization. Lead times typically span 3 to 8 weeks, influenced by order size, customization complexity, and supplier location. Buyers from Europe or South America should factor in additional shipping time and customs clearance. Early communication with suppliers about production schedules and shipping logistics helps avoid delays. Negotiate flexible MOQs or phased deliveries where possible to better manage inventory and cash flow.

Which payment terms are standard for international abrasive suppliers, and how can I mitigate payment risks?

Common payment terms include 30-50% advance payment with the balance upon shipment or after inspection. Letters of credit (LCs) are widely used for secure transactions, especially when dealing with new suppliers. Escrow services or trade finance options through banks can further reduce risk. Always ensure contracts specify payment milestones aligned with quality inspections and delivery schedules. For buyers in emerging markets, establishing a track record with partial payments and gradually increasing order size builds trust and improves terms over time.

What quality assurance certifications should I look for when purchasing abrasives from international suppliers?

Look for ISO 9001 certification as a baseline for quality management systems. Industry-specific certifications like OHSAS for occupational health and safety or REACH compliance for chemical safety are important, especially in Europe. Suppliers should provide product test reports, such as hardness, grit size consistency, and bonding strength tests. Request batch traceability documentation to verify quality throughout production. These certifications and documentation ensure compliance with international standards and reduce the risk of receiving substandard abrasives.

How should I plan logistics and shipping for abrasive products to regions like Africa, the Middle East, or South America?

Coordinate with suppliers to optimize packaging for durability and regulatory compliance, as abrasives can be heavy and prone to damage. Choose reliable freight forwarders experienced in your target region’s customs and import regulations. Consider incoterms carefully (e.g., FOB, CIF) to clarify responsibility for shipping risks and costs. Consolidating shipments can reduce freight costs but may increase lead times. Establish clear communication with logistics partners to monitor shipment status and prepare for customs clearance to avoid delays.

What are the best practices for handling disputes or quality issues with abrasive suppliers internationally?

Document all communications and agreements meticulously, including quality specifications and delivery terms. If quality issues arise, notify the supplier immediately with evidence such as photos and test reports. Request a root cause analysis and corrective action plan. Maintain a professional, solution-focused dialogue to preserve long-term relationships. Include arbitration or mediation clauses in contracts to resolve disputes efficiently. Having a contingency plan for alternative suppliers also mitigates risks associated with prolonged disputes.

How can I ensure compliance with environmental and safety regulations when importing abrasives?

Verify that your supplier complies with environmental regulations such as REACH in Europe or local standards in your region. Request Material Safety Data Sheets (MSDS) to understand handling and disposal requirements. Ensure that abrasive products do not contain restricted substances and that packaging complies with waste management laws. Staying compliant reduces legal risks and supports sustainable business practices, which is increasingly important for buyers in Europe and progressive markets in Africa and South America. Partner with suppliers committed to environmental responsibility for long-term success.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

To maximize the benefits of abrasive materials in your industrial applications, it is essential to approach sourcing with a strategic mindset. Understanding the distinct properties and use-cases of various abrasives—from natural to synthetic, bonded to coated—enables more precise alignment with your operational needs, enhancing efficiency and cost-effectiveness. For B2B buyers in Africa, South America, the Middle East, and Europe, this knowledge supports better supplier evaluation and risk mitigation.

Illustrative Image (Source: Google Search)

Key takeaways for strategic sourcing include:

- Prioritizing suppliers with robust quality certifications and transparent supply chains to ensure consistent product performance.

- Leveraging regional market insights to identify cost-competitive options without compromising quality, particularly in emerging economies and mature markets like Spain and France.

- Considering sustainability and regulatory compliance, which are increasingly critical in global procurement decisions.

Looking ahead, the abrasive industry is poised for innovation driven by advancements in materials science and digital supply chain tools. Buyers who proactively invest in strategic partnerships and supply chain resilience will be better positioned to adapt to evolving market demands and geopolitical shifts.

Actionable next step: Engage with trusted abrasive suppliers early, explore tailored solutions that fit your unique manufacturing context, and integrate strategic sourcing frameworks to future-proof your procurement processes. This approach will unlock value and drive competitive advantage across diverse international markets.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina