Carborundum, also known as silicon carbide, stands as a cornerstone material in diverse industrial applications worldwide. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding the multifaceted uses of carborundum is critical to making strategic procurement decisions that drive operational efficiency and product quality. From abrasive manufacturing to high-performance ceramics and electronic components, carborundum’s versatility offers significant competitive advantages in sectors ranging from automotive and aerospace to construction and electronics.

This guide delivers an authoritative, end-to-end exploration of carborundum tailored to the needs of international buyers seeking reliable sourcing and optimized supply chains. You will gain insights into the various types and grades of carborundum, their material properties, and how these influence application suitability. Detailed coverage of manufacturing processes and quality control standards will enable you to assess supplier capabilities rigorously. Moreover, the guide evaluates global supplier landscapes, pricing trends, and market dynamics, with a focus on regions including France, Kenya, Brazil, and the Gulf, ensuring relevance to diverse geographic contexts.

By navigating this comprehensive resource, procurement professionals and decision-makers will be equipped to identify the best-fit carborundum products, negotiate effectively with suppliers, and mitigate risks associated with quality and delivery. This empowers buyers to unlock value in their supply chains and maintain a competitive edge in rapidly evolving industrial markets.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Silicon Carbide (Carborundum) Abrasive | Extremely hard, sharp crystalline structure; available in various grit sizes | Industrial grinding, cutting tools, sandblasting, polishing | Pros: High durability, efficient material removal; Cons: Higher cost than some abrasives, requires proper handling equipment |

| Carborundum Heating Elements | High thermal conductivity, resistance to oxidation at elevated temperatures | Electric furnaces, kilns, high-temperature industrial heating | Pros: Long lifespan, energy efficient; Cons: Fragile if mishandled, specialized installation needed |

| Carborundum Coated Tools | Tools coated with silicon carbide particles for enhanced wear resistance | Cutting tools, blades, saws for metal and stone industries | Pros: Extended tool life, improved cutting precision; Cons: Higher upfront investment, coating may degrade under improper use |

| Carborundum Grinding Wheels | Composite wheels embedding carborundum for surface finishing | Precision grinding in automotive, aerospace, and heavy machinery manufacturing | Pros: Consistent finish quality, customizable sizes; Cons: Requires compatible machinery, periodic dressing necessary |

| Carborundum Ceramic Composites | Combination of silicon carbide with ceramic matrices for structural applications | Aerospace components, armor plating, high-performance mechanical parts | Pros: Exceptional strength-to-weight ratio, thermal stability; Cons: Complex manufacturing, higher purchase price |

Silicon Carbide (Carborundum) Abrasive is the most widely used form, prized for its extreme hardness and sharp edges. It is suitable for industries requiring aggressive material removal such as metal fabrication and surface preparation. For B2B buyers, evaluating grit size and purity is crucial to match the abrasive properties with specific operational needs. Its durability reduces replacement frequency, offering long-term cost benefits despite a higher initial price.

Carborundum Heating Elements leverage the material’s excellent thermal and oxidation resistance to deliver reliable high-temperature performance. These elements are integral to electric furnaces and kilns used in ceramics, glassmaking, and metallurgy. Buyers should consider compatibility with existing equipment and ensure proper handling to avoid damage during installation. Their energy efficiency can lead to operational savings in energy-intensive processes.

Carborundum Coated Tools provide enhanced wear resistance by embedding silicon carbide particles on tool surfaces. This variation is valuable in cutting and machining operations involving hard metals and stones, common in construction and manufacturing sectors across Europe and the Middle East. While the upfront cost is higher, the extended tool life and improved precision can significantly reduce downtime and tooling expenses.

Carborundum Grinding Wheels combine the abrasive properties of silicon carbide with binder materials to create versatile finishing tools. They are essential in sectors like automotive and aerospace for achieving precise surface finishes. Buyers must ensure the wheels are compatible with their grinding machines and plan for regular maintenance such as dressing to maintain performance and safety standards.

Carborundum Ceramic Composites represent an advanced application, combining silicon carbide with ceramics to produce components with superior mechanical and thermal properties. These composites are increasingly used in aerospace and defense industries, where lightweight strength and heat resistance are critical. Procurement decisions should factor in manufacturing complexity and cost, balanced against performance gains and lifecycle advantages.

Related Video: Carborundum Mezzotype: Dark Field/Reductive Techniques with Akua Carborundum Gel

| Industry/Sector | Specific Application of uses of carborundum | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing & Metalworking | Abrasive grinding wheels and cutting tools | Enhanced durability and precision in metal shaping | Consistent grit size, purity, and availability for uninterrupted production |

| Electronics & Semiconductor | Silicon wafer polishing and lapping | Superior surface finish critical for chip performance | High-purity grades with controlled particle size distribution |

| Automotive & Aerospace | Heat-resistant brake pads and clutches | Improved thermal stability and wear resistance | Compliance with international safety standards and material certifications |

| Construction & Ceramics | Abrasive blasting and surface preparation | Efficient removal of rust and coatings, improved adhesion | Bulk supply options and compliance with environmental regulations |

| Renewable Energy | Manufacture of solar panel components (e.g., silicon carbide substrates) | Increased efficiency and longevity of solar cells | Reliable supply chain and material quality assurance for high-performance applications |

Manufacturing & Metalworking

Carborundum is extensively used in abrasive grinding wheels and cutting tools within the manufacturing sector. Its exceptional hardness and thermal conductivity enable precise shaping and finishing of metals, which is crucial for industries such as machinery production and tooling. For B2B buyers in Africa, South America, the Middle East, and Europe, ensuring consistent grit size and purity is vital to maintain product quality and reduce downtime. Sourcing from suppliers who guarantee steady availability supports continuous manufacturing operations.

Electronics & Semiconductor Industry

In the semiconductor sector, carborundum’s role in silicon wafer polishing and lapping is indispensable. The material’s fine abrasive qualities deliver the ultra-smooth surfaces needed for high-performance chips, directly impacting device efficiency and yield. Buyers from technology hubs in Europe and emerging markets like Kenya should prioritize high-purity carborundum with tightly controlled particle size to meet stringent semiconductor fabrication standards.

Automotive & Aerospace

Carborundum’s heat resistance and wear properties make it ideal for brake pads and clutch components in automotive and aerospace applications. These industries demand materials that withstand extreme thermal and mechanical stress to ensure safety and longevity. International buyers must verify compliance with global safety certifications and source from suppliers who provide traceability and quality assurance to meet regulatory requirements.

Construction & Ceramics

In construction, carborundum is used for abrasive blasting to prepare surfaces by removing rust, paint, or other contaminants. This application enhances adhesion for coatings and improves the durability of structural elements. Buyers in regions with expanding infrastructure projects, such as South America and the Middle East, should consider suppliers offering bulk quantities and adherence to environmental standards to support sustainable operations.

Renewable Energy

The renewable energy sector relies on carborundum for manufacturing silicon carbide substrates used in solar panels. This application contributes to higher efficiency and longer lifespan of photovoltaic cells, a critical factor for the growing solar markets in Europe and Africa. B2B buyers should focus on securing a reliable supply chain with rigorous quality controls to ensure consistent material performance in high-value energy projects.

Related Video: CNTs | Carbon Nanotubes | Structure, Properties & Applications of CNT

Key Properties: Silicon carbide (SiC) ceramics exhibit exceptional hardness, high thermal conductivity, and outstanding resistance to thermal shock and chemical corrosion. They maintain structural integrity at temperatures exceeding 1600°C and withstand aggressive environments, including acidic and alkaline media.

Pros & Cons: SiC composites offer superior wear resistance and durability, making them ideal for abrasive and high-temperature applications. However, manufacturing complexity is relatively high due to sintering requirements, and costs can be elevated compared to standard ceramics. The brittleness of SiC ceramics requires careful design consideration to avoid catastrophic failure under mechanical stress.

Impact on Application: SiC-based carborundum materials excel in applications such as kiln furniture, mechanical seals, and high-performance grinding wheels, where thermal and chemical resistance are critical. Their compatibility with corrosive media makes them suitable for chemical processing industries prevalent in regions like the Middle East and Europe.

International Buyer Considerations: Buyers from Africa and South America should ensure suppliers comply with ASTM C799 or DIN EN 60672 standards for ceramic materials, which govern thermal and mechanical properties. European buyers, especially in France, often require adherence to ISO 9001 quality management for traceability. Importers in Kenya and neighboring regions must consider local import tariffs and availability of technical support for SiC components.

Key Properties: Steel substrates coated with carborundum provide a combination of mechanical strength and abrasive surface hardness. The base steel offers excellent tensile strength and impact resistance, while the carborundum coating delivers surface wear resistance and corrosion protection.

Pros & Cons: This hybrid material reduces the cost compared to full ceramic components while enhancing durability. Manufacturing involves complex coating processes such as thermal spraying or sintering, which can increase lead times. The steel core may be susceptible to corrosion if the coating is compromised, necessitating careful quality control.

Impact on Application: Ideal for conveyor belts, abrasive rollers, and industrial cutting tools where mechanical load and surface wear coexist. The coated steel’s adaptability to different shapes and sizes suits diverse industrial machinery in mining sectors across Africa and South America.

International Buyer Considerations: Compliance with ASTM A105 or EN 10025 steel standards is critical for mechanical properties. Buyers in the Middle East should verify corrosion resistance levels, especially for coastal or humid environments. European clients often require RoHS compliance due to environmental regulations. For African markets like Kenya, sourcing from suppliers with ISO 14001 environmental certification can facilitate smoother customs clearance.

Key Properties: Polymers embedded with carborundum particles combine flexibility and abrasion resistance. These composites typically operate effectively under moderate temperature ranges (up to 150°C) and offer good chemical resistance, especially against oils and solvents.

Pros & Cons: These materials are lightweight and easier to manufacture with injection molding or extrusion, reducing costs and lead times. However, they have lower thermal stability and mechanical strength compared to ceramics or metal composites, limiting their use in high-stress or high-temperature environments.

Impact on Application: Suitable for seals, gaskets, and protective coatings in automotive and light industrial applications. Their resistance to chemical degradation makes them attractive for the oil and gas sectors in South America and the Middle East.

International Buyer Considerations: Buyers should verify compliance with ASTM D638 or ISO 527 for tensile properties of polymer composites. European buyers, particularly in France, may require REACH compliance for chemical safety. For African markets, availability of local technical support and ease of repair are important factors due to infrastructure challenges.

Key Properties: Pure carborundum powders exhibit extremely high hardness (Mohs scale ~9-9.5) and thermal stability. They are chemically inert and can withstand corrosive environments, making them ideal for abrasive blasting and polishing.

Pros & Cons: These powders provide precise control over grit size and purity, essential for high-quality abrasive applications. However, handling requires specialized equipment to avoid dust inhalation hazards, and packaging must prevent contamination. Cost is moderate but depends on particle size and purity.

Impact on Application: Widely used in precision grinding, polishing, and sandblasting across manufacturing industries. Their versatility supports applications from automotive parts finishing in Europe to heavy equipment maintenance in African mining operations.

International Buyer Considerations: Compliance with ASTM B911 or JIS R6001 standards ensures consistent particle size and purity. Buyers in the Middle East should consider packaging standards for export to minimize moisture ingress. South American buyers benefit from suppliers offering customized grit sizes to match local machinery specifications.

| Material | Typical Use Case for uses of carborundum | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide Ceramic Composites | High-temperature kiln furniture, mechanical seals | Exceptional thermal and chemical resistance | Brittle, high manufacturing complexity | High |

| Carborundum-Coated Steel Substrates | Abrasive rollers, conveyor belts | Combines strength of steel with wear resistance | Corrosion risk if coating is damaged | Medium |

| Carborundum-Embedded Polymer Composites | Seals, gaskets, protective coatings | Lightweight and cost-effective | Limited thermal and mechanical strength | Low |

| Pure Carborundum Abrasive Powders | Precision grinding, polishing, sandblasting | High hardness and chemical inertness | Handling hazards, requires specialized equipment | Medium |

Carborundum, or silicon carbide, is a versatile material extensively used in abrasives, refractories, and semiconductors. For B2B buyers targeting industries such as automotive, construction, and electronics, understanding the manufacturing process ensures informed procurement decisions and supplier evaluation.

1. Material Preparation:

The manufacturing journey begins with raw material selection and preparation. High-purity silica and carbon sources are combined and subjected to high-temperature electric furnace processing (around 2000°C). This step forms the base silicon carbide crystals. The quality of raw materials directly impacts the final product’s performance, making supplier transparency on material sourcing critical.

2. Forming and Shaping:

After synthesis, carborundum is crushed and classified into various grain sizes depending on the application. Forming techniques include:

- Sintering: Powdered silicon carbide is compacted and sintered to create solid shapes such as grinding wheels or cutting tools.

- Hot Pressing: This method applies simultaneous heat and pressure, enhancing density and mechanical strength, crucial for wear-resistant parts.

- Chemical Vapor Deposition (CVD): For semiconductor-grade silicon carbide, CVD allows the formation of thin, uniform layers with controlled properties.

3. Assembly and Integration:

Manufactured carborundum components are often integrated into larger assemblies. For example, abrasive grains are bonded into grinding wheels or coated onto belts. The bonding agents and assembly methods (resin, vitrified, or metal bonds) are tailored to end-use requirements. Precision in assembly impacts both performance and product lifespan.

4. Finishing Processes:

Finishing involves grinding, polishing, or surface treatments to meet specific dimensional tolerances and surface qualities. Consistency here is vital for applications requiring tight tolerances such as precision cutting tools. Some products undergo additional treatments like impregnation or coating to enhance durability or chemical resistance.

Robust quality assurance (QA) is essential for maintaining product integrity and meeting international market expectations. For buyers from Africa, South America, the Middle East, and Europe, understanding these protocols helps mitigate risks related to quality, compliance, and supply chain reliability.

Key International Standards:

- ISO 9001: The foundational quality management standard applicable across manufacturing sectors, ensuring consistent process control and continuous improvement.

- CE Marking: Mandatory for products entering the European Economic Area, indicating conformity with EU safety, health, and environmental requirements.

- API Standards: Relevant for carborundum products used in oil and gas sectors, ensuring materials withstand harsh operational environments.

Quality Control Checkpoints:

- Incoming Quality Control (IQC): Focuses on verifying raw materials and components before production. This step prevents defects originating from substandard inputs. Buyers should request certificates of analysis (CoA) and raw material batch testing reports.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing, including particle size distribution, sintering temperature control, and bonding integrity. This stage ensures the product adheres to process parameters, reducing rework and scrap rates.

- Final Quality Control (FQC): Comprehensive testing of finished products, including dimensional checks, hardness, abrasion resistance, and surface finish. For coated or bonded products, adhesion tests and chemical stability assessments are common.

Common Testing Methods:

- Particle Size Analysis: Using laser diffraction or sieving to ensure abrasive grain consistency.

- Hardness Testing: Mohs or Vickers hardness tests to validate material strength.

- Thermal Shock Resistance: Particularly for refractory-grade carborundum, to confirm durability under rapid temperature changes.

- Chemical Composition Analysis: Employing spectroscopy methods to verify purity and detect contaminants.

- Mechanical Testing: Tensile and compressive strength tests for sintered products.

For international buyers, especially those in Africa, South America, the Middle East, and Europe, verifying supplier quality systems is a critical step toward securing reliable carborundum supplies.

1. Conducting Supplier Audits:

On-site or virtual audits assess the supplier’s adherence to documented processes and quality standards. Focus areas include process controls, equipment calibration, employee training, and record-keeping. Audits provide first-hand insights beyond certificates and reports.

2. Reviewing Quality Documentation:

Request comprehensive quality documentation such as:

- ISO 9001 certification and audit reports

- Material test certificates and CoAs for each batch

- Process flow charts and control plans

- Non-conformance and corrective action records

3. Third-Party Inspections:

Engage independent inspection agencies to conduct sampling and testing at the supplier’s premises or pre-shipment. Third-party verification adds an unbiased layer of assurance, particularly valuable when dealing with new or distant suppliers.

4. Sample Testing:

Before large-scale procurement, obtain product samples for in-house or third-party laboratory testing. This step validates supplier claims on performance and suitability for specific applications.

Africa & South America:

Buyers often face challenges related to inconsistent local regulatory enforcement and variable supplier quality maturity. Emphasizing suppliers with international certifications (ISO 9001, CE) and insisting on third-party inspections helps mitigate risks. Additionally, understanding regional import regulations and customs requirements around certification documentation is vital to avoid clearance delays.

Middle East:

The Middle East market increasingly demands compliance with global standards, especially for energy and infrastructure projects. Suppliers servicing this region often hold API and CE certifications. Buyers should verify compliance with local standards such as SASO (Saudi Standards) and ensure documentation is fully translated and authenticated.

Europe (e.g., France):

European buyers operate under strict regulatory frameworks, including REACH and RoHS for chemical substances. They require traceability and detailed conformity declarations. Suppliers must demonstrate rigorous environmental and safety compliance alongside product quality. Buyers should prioritize suppliers with transparent sustainability practices and robust quality management systems.

By mastering these manufacturing and quality assurance insights, international B2B buyers can confidently source carborundum products that meet stringent performance and compliance standards across diverse markets.

Understanding the cost and pricing dynamics for sourcing carborundum is crucial for international B2B buyers aiming to optimize procurement and ensure competitive product positioning. Carborundum, widely used in abrasives, refractory materials, and semiconductor applications, involves a multifaceted cost structure influenced by manufacturing complexities and global trade considerations.

Illustrative Image (Source: Google Search)

Illustrative Image (Source: Google Search)

Labor Costs

Labor expenses vary considerably by production location. Regions with lower wage standards, such as parts of South America or Africa, may offer cost advantages but require careful evaluation of workforce skill levels and productivity to maintain quality standards.

Manufacturing Overhead

Overhead includes plant maintenance, utilities, and indirect labor. High-tech applications of carborundum, such as in semiconductors, may incur elevated overhead due to cleanroom standards and specialized equipment.

Tooling and Equipment

Initial capital expenditure for specialized furnaces, grinders, and shaping tools impacts unit costs, especially at lower production volumes. Custom tooling for specific applications (e.g., unique abrasive grain sizes) increases upfront costs but can yield long-term efficiencies.

Quality Control (QC)

Rigorous QC processes—ranging from particle size distribution analysis to certification compliance (ISO, REACH)—add to cost but are non-negotiable for buyers targeting high-end markets or regulated industries.

Logistics and Freight

Given carborundum’s weight and bulk, freight costs are substantial. International buyers must factor in shipping mode (sea freight is generally cost-effective but slower than air freight), port handling, customs duties, and inland transport, especially in landlocked or infrastructure-challenged regions.

Supplier Margin

Suppliers set margins based on market positioning, production scale, and risk factors. Margins tend to be tighter in commoditized segments but can widen for specialty grades or custom orders.

Order Volume and Minimum Order Quantities (MOQ)

Larger volumes typically unlock scale economies and price breaks. However, buyers from emerging markets should balance MOQ requirements with inventory carrying costs and working capital constraints.

Product Specifications and Customization

Tailored grain sizes, bonding agents, or packaging specifications raise prices. Buyers must assess if customization justifies incremental costs or if standard grades suffice.

Material Quality and Certifications

Certified products compliant with European REACH, RoHS, or Middle Eastern standards command premium pricing but facilitate smoother market entry and reduce regulatory risks.

Supplier Location and Reliability

Proximity to production hubs (e.g., China, India) can reduce lead times and freight costs but may involve trade tariffs. Established suppliers with proven quality records might charge higher prices but reduce total cost of ownership through reliability.

Incoterms and Payment Terms

The choice of Incoterms (FOB, CIF, DDP) significantly impacts landed cost and risk exposure. For example, DDP (Delivered Duty Paid) shifts customs clearance responsibility to the supplier, which can be advantageous for buyers unfamiliar with local regulations.

Negotiate Beyond Price

Engage suppliers on payment terms, lead times, warranty, and after-sales support to maximize value. For instance, extended payment terms can ease cash flow in markets like Kenya or Brazil.

Consider Total Cost of Ownership (TCO)

Evaluate not only the unit price but also quality-related costs such as rework, scrap rates, and downtime. Higher upfront costs for premium carborundum may yield savings in operational efficiency.

Leverage Group Purchasing or Partnerships

Buyers from smaller markets can consolidate orders or form purchasing consortia to meet MOQs and negotiate better pricing.

Account for Currency Fluctuations and Tariffs

International buyers should hedge against currency risks and stay informed on trade policies, especially in volatile regions like the Middle East or Africa.

Verify Supplier Certifications and Compliance

Insist on documentation to avoid costly non-compliance penalties or shipment rejections in Europe or other regulated markets.

Prices for carborundum products vary widely based on grade, quantity, supplier, and geopolitical factors. The information provided is indicative and should be validated through direct supplier quotations and market research tailored to specific sourcing contexts.

Illustrative Image (Source: Google Search)

By comprehensively analyzing these cost factors and pricing influencers, international B2B buyers can craft strategic sourcing decisions, optimize procurement budgets, and secure reliable supply chains for carborundum-based products across diverse markets.

Understanding the critical technical properties and trade terminology related to carborundum is essential for international B2B buyers aiming to optimize procurement and application strategies. This knowledge ensures clarity in specifications, smooth communication with suppliers, and alignment with industry standards.

1. Material Grade

Carborundum is available in various grades, typically classified by purity and crystalline structure. Higher purity grades offer superior hardness and thermal conductivity, which are vital for abrasive and refractory applications. For B2B buyers, specifying the correct grade ensures product performance aligns with intended industrial use, reducing waste and enhancing durability.

2. Particle Size and Grit

The particle size or grit number defines the coarseness of carborundum particles, ranging from very fine powders to coarse granules. This directly affects cutting, grinding, or polishing efficiency. Buyers should match grit size to specific manufacturing processes—fine grit for precision finishing, coarse grit for heavy material removal—maximizing operational efficiency.

3. Hardness (Mohs Scale)

Carborundum ranks around 9-9.5 on the Mohs hardness scale, making it one of the hardest known materials after diamond. This property is crucial for applications requiring abrasion resistance, such as sandblasting or cutting tools. Understanding hardness helps buyers select carborundum variants that maintain tool longevity under high-stress conditions.

4. Thermal Stability

Carborundum’s ability to withstand high temperatures without degradation is important in refractory uses like kiln linings or furnace components. Buyers in heavy industries must consider thermal stability to ensure material integrity in extreme heat environments, preventing costly downtime due to material failure.

5. Tolerance and Purity Levels

Tolerance refers to the allowable deviation in particle size distribution or chemical composition. Purity levels indicate the presence of impurities that might affect performance. For B2B transactions, stringent tolerance and purity specifications reduce variability in end products and improve process consistency.

6. Bulk Density

Bulk density impacts packaging, shipping costs, and handling requirements. It also influences the application method, such as in abrasive blasting where flow rate matters. Buyers should request bulk density data to optimize logistics and process integration.

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products using carborundum as a raw material. Understanding if the supplier caters to OEMs can signal product quality and compliance with industry standards, which is critical for buyers sourcing for manufacturing operations.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in a single order. MOQ impacts inventory management and cash flow. Buyers from emerging markets or smaller enterprises should negotiate MOQ terms to balance cost-effectiveness with storage capacity.

3. RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for detailed pricing, availability, and terms for carborundum products. A well-prepared RFQ helps buyers obtain competitive bids and clarifies specifications upfront, speeding up the procurement cycle.

4. Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs clearance between buyer and seller. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Understanding these is crucial for international buyers to manage risks and costs effectively.

5. Certification and Compliance Terms

Terms such as ISO certification, REACH compliance, or RoHS adherence indicate conformity to international quality and safety standards. Buyers prioritizing regulatory compliance should request these certifications to ensure legal and environmental standards are met.

6. Lead Time

The period between order placement and product delivery. Lead time affects production schedules and inventory planning. Buyers should confirm realistic lead times to avoid operational delays, especially when sourcing from overseas suppliers.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed decisions, negotiate better contracts, and ensure that carborundum products precisely meet their industrial needs. This strategic approach minimizes risks and maximizes return on investment in global supply chains.

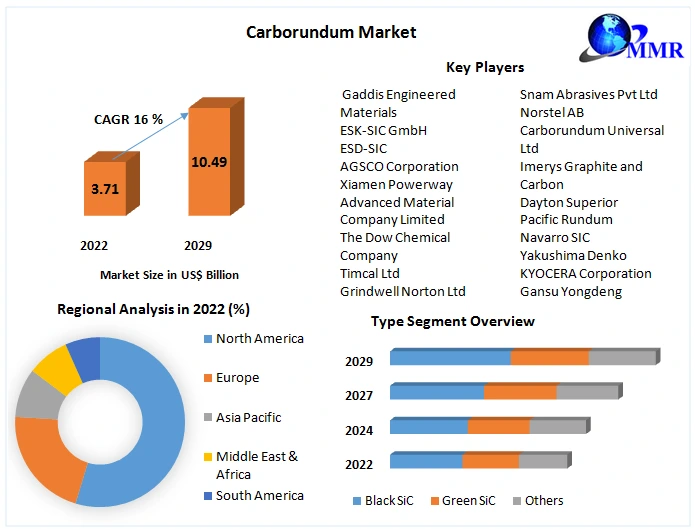

The global market for carborundum, primarily recognized as silicon carbide, is experiencing dynamic growth driven by its diverse industrial applications, including abrasives, refractories, semiconductors, and automotive components. For international B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding these market forces is critical to optimizing procurement and aligning with industry advancements.

Key Market Drivers:

Emerging Sourcing Trends:

Market Dynamics:

For B2B buyers, staying attuned to these trends facilitates smarter sourcing decisions, risk mitigation, and stronger supplier relationships.

Sustainability is increasingly pivotal in the carborundum sector, with environmental and ethical considerations becoming decisive factors for international buyers. Silicon carbide production is energy-intensive, often relying on high-temperature furnaces that contribute to carbon emissions and resource depletion. Consequently, companies across Africa, South America, the Middle East, and Europe are prioritizing suppliers who demonstrate commitment to reducing environmental footprints.

Environmental Impact Mitigation:

Ethical Supply Chain Importance:

Green Certifications and Materials:

For B2B buyers, integrating sustainability criteria into sourcing strategies not only mitigates reputational risks but also aligns with global regulatory trends and customer expectations, fostering long-term value creation.

Carborundum’s journey began in the late 19th century when Edward G. Acheson developed silicon carbide as a synthetic abrasive material, revolutionizing manufacturing processes with its hardness and thermal conductivity. Initially produced in the United States, carborundum quickly became indispensable for industrial grinding and cutting applications.

Over the decades, the material evolved beyond abrasives to critical roles in electronics, especially with the rise of power semiconductors and electric vehicles. This diversification expanded its global footprint, encouraging regional production capabilities and innovation hubs, notably in Europe and Asia.

For B2B buyers today, understanding this historical evolution highlights carborundum’s resilience and adaptability, reinforcing its strategic importance across multiple sectors and geographies.

1. How can I effectively vet suppliers of carborundum for industrial uses?

To vet carborundum suppliers, start by verifying their certifications such as ISO 9001 for quality management and relevant environmental compliances. Request detailed product specifications and test reports to ensure material consistency. Check their industry reputation through client references and reviews, especially from companies in your region. For buyers in Africa, South America, the Middle East, and Europe, ensure the supplier has experience handling international shipments and customs. Conducting factory audits or third-party inspections can provide added assurance of manufacturing capabilities and ethical practices.

2. What customization options are commonly available for carborundum products?

Carborundum products can be customized by grit size, shape (e.g., grains, powders, or blocks), bonding material, and packaging to suit specific industrial applications like grinding, cutting, or polishing. Many suppliers offer tailored solutions to meet particular hardness, thermal resistance, or abrasive performance requirements. When sourcing internationally, clarify your technical specifications upfront and request samples to test performance. Customization may affect lead times and minimum order quantities, so align these factors with your production schedules.

3. What are typical minimum order quantities (MOQs) and lead times for international B2B orders of carborundum?

MOQs vary by supplier and product type but generally range from small batch orders of 500 kg to several tons for bulk industrial uses. Lead times depend on manufacturing complexity and shipping logistics, typically spanning 3 to 8 weeks. For buyers in regions like Kenya or Brazil, factor in additional customs clearance and inland transport time. Establish clear communication with suppliers about order volume flexibility and prioritize those with transparent production schedules to avoid delays.

4. Which payment terms are standard for international purchases of carborundum, and how can I mitigate financial risks?

Common payment terms include Letters of Credit (L/C), Telegraphic Transfers (T/T), and Escrow services. Letters of Credit offer strong security for both parties by ensuring payment only upon fulfillment of contract terms and shipment confirmation, which is advisable for first-time transactions. For trusted suppliers, partial upfront payment combined with balance on delivery is common. Employ trade credit insurance and work with reputable banks to reduce risks associated with currency fluctuations and fraud.

5. What quality assurance measures and certifications should I demand when sourcing carborundum internationally?

Demand certificates of analysis (COA) and material safety data sheets (MSDS) to verify chemical composition and safety compliance. ISO certifications, especially ISO 9001, demonstrate systematic quality control. For applications in Europe or regulated markets, compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) may be necessary. Ensure suppliers provide batch traceability and conduct third-party lab testing if possible to guarantee consistent product performance.

6. How should I manage logistics and shipping considerations for carborundum imports?

Plan shipments by sea freight for cost efficiency on bulk orders, allowing for longer lead times, or air freight for urgent deliveries at higher costs. Understand Incoterms clearly—preferably CFR (Cost and Freight) or CIF (Cost, Insurance, and Freight)—to define responsibility for shipping and insurance. Coordinate with freight forwarders experienced in handling abrasive materials to ensure proper packaging and handling. For buyers in landlocked regions, factor in inland transport from ports and potential customs delays when scheduling deliveries.

7. What steps can I take if there is a dispute regarding product quality or delivery of carborundum?

First, document all communications, contracts, and inspection reports meticulously. Notify the supplier promptly with detailed evidence such as photos and lab test results. Engage in amicable dispute resolution through negotiation or mediation, which is often stipulated in international trade contracts. If unresolved, rely on arbitration clauses under ICC (International Chamber of Commerce) rules or local trade bodies. Having clear contractual terms on product specifications, inspection rights, and dispute resolution mechanisms upfront minimizes risks.

8. Are there region-specific challenges or considerations when sourcing carborundum from or to Africa, South America, the Middle East, and Europe?

Yes, each region has unique logistical, regulatory, and market challenges. African and South American buyers should anticipate longer shipping times and customs complexities, so building buffer time into procurement cycles is critical. The Middle East often requires compliance with specific import regulations and halal certifications if applicable. European buyers must ensure strict adherence to environmental and safety standards like REACH. Establishing local partnerships or agents can help navigate these regional nuances effectively.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The diverse industrial applications of carborundum—from abrasives and cutting tools to advanced electronics and thermal management—underscore its critical role in modern manufacturing and technology sectors. For international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe, understanding these multifaceted uses enables more targeted procurement strategies that align with evolving market demands.

Strategic sourcing of carborundum should prioritize:

Looking ahead, the rising demand for sustainable manufacturing and innovative materials positions carborundum as a key enabler for industrial growth. Buyers are encouraged to foster strong partnerships with suppliers who invest in R&D and sustainable practices, unlocking new value and securing long-term supply advantages. Embracing strategic sourcing now will empower companies across Africa, South America, the Middle East, and Europe to capitalize on the expanding opportunities carborundum presents in both traditional and emerging industries.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina