The global marketplace for 4h-sic presents a dynamic landscape rich with opportunity but also complexity. As a critical material widely used across industries such as electronics, semiconductors, and advanced manufacturing, 4h-sic’s unique properties—high thermal conductivity, chemical stability, and exceptional durability—make it indispensable for cutting-edge applications. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, understanding the nuances of sourcing 4h-sic is essential to securing competitive advantage and ensuring supply chain resilience.

This comprehensive guide is designed to equip procurement professionals and business leaders with actionable insights into every facet of the 4h-sic market. It covers the diverse types and grades of 4h-sic, the critical raw materials involved, and advanced manufacturing and quality control processes that define product reliability. In addition, the guide offers an in-depth analysis of global supplier landscapes, pricing trends, and regional market dynamics—empowering buyers from emerging and established markets alike to make informed decisions.

By addressing common challenges and answering frequently asked questions, this guide serves as a strategic resource to streamline supplier evaluation, optimize cost-effectiveness, and mitigate risks inherent in international sourcing. Whether you operate in Kenya’s growing tech sectors, Brazil’s industrial hubs, the Middle East’s expanding electronics market, or Europe’s advanced manufacturing corridors, this resource helps you navigate the complexities of 4h-sic procurement with confidence and precision.

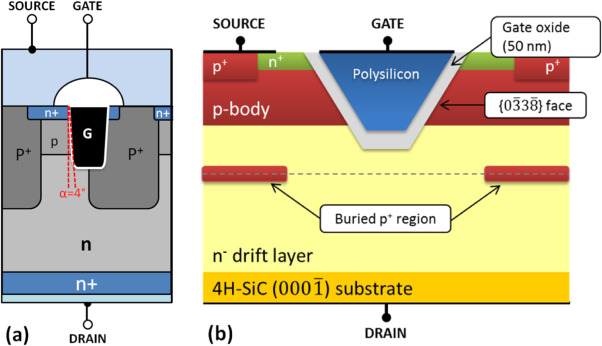

Illustrative Image (Source: Google Search)

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard 4H-SiC | High-purity silicon carbide with uniform crystalline structure | Power electronics, semiconductor substrates | + Reliable performance; - Higher cost compared to variants |

| Doped 4H-SiC | Silicon carbide infused with specific dopants to alter conductivity | High-frequency devices, sensors | + Tailored electrical properties; - Requires precise sourcing |

| Nanostructured 4H-SiC | Enhanced surface area with nanometric features | Catalysis, advanced coatings | + Superior reactivity; - Complex manufacturing processes |

| Porous 4H-SiC | Controlled porosity for lightweight and thermal insulation | Filtration, thermal management | + Lightweight and insulating; - Mechanical strength trade-offs |

| Epitaxial 4H-SiC | Thin, highly controlled layers grown on 4H-SiC substrates | High-power transistors, UV photodetectors | + Exceptional electronic quality; - Higher production costs |

Standard 4H-SiC is the baseline form of silicon carbide characterized by its high purity and consistent crystalline structure. This type is widely used in power electronics and semiconductor substrates due to its excellent thermal conductivity and high breakdown voltage. For B2B buyers, especially in emerging markets like Kenya or Brazil, the main considerations involve balancing cost against reliability and ensuring supplier consistency to meet stringent quality demands.

Doped 4H-SiC involves the intentional addition of impurities to modify electrical properties such as conductivity and carrier concentration. This variant is crucial for high-frequency devices and sensor applications where precise electrical behavior is required. Buyers should focus on sourcing from suppliers with robust doping control processes and certifications to avoid performance variability, a critical factor for industries in the Middle East and Europe aiming for advanced electronics manufacturing.

Nanostructured 4H-SiC features a significantly increased surface area due to its nanometric surface features, making it ideal for catalytic applications and advanced coatings. This type offers superior chemical reactivity and surface interactions but comes with more complex manufacturing and higher costs. B2B buyers should evaluate the technical support and scalability options offered by suppliers, particularly when targeting innovative sectors in South America and Europe.

Porous 4H-SiC is engineered with controlled porosity, providing benefits such as reduced weight and enhanced thermal insulation. It is commonly used in filtration systems and thermal management solutions. While its lightweight nature is advantageous, buyers must assess mechanical strength and durability to ensure suitability for industrial applications, especially in regions with harsh environmental conditions like parts of Africa and the Middle East.

Epitaxial 4H-SiC consists of ultra-thin, precisely grown layers atop standard 4H-SiC substrates, delivering exceptional electronic quality for high-power transistors and UV photodetectors. This type commands premium pricing due to its complex production but is indispensable for cutting-edge electronics. For B2B buyers, particularly in Europe and Australia, prioritizing supplier expertise and after-sales technical support is essential to leverage the full potential of this material in high-tech manufacturing.

| Industry/Sector | Specific Application of 4h-sic | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-frequency, high-voltage power devices | Enhanced efficiency, thermal stability, and durability | Material purity, supplier certification, and compliance with international standards |

| Renewable Energy | Photovoltaic inverters and power converters | Improved energy conversion efficiency and reliability | Supplier capability for customization, lead times, and logistics for remote regions |

| Automotive & EV | Wide bandgap semiconductor components | Increased power density and reduced energy loss | Scalability of supply, quality assurance, and after-sales support |

| Aerospace & Defense | High-temperature, radiation-resistant electronics | Reliability under extreme conditions | Traceability, compliance with stringent aerospace standards, and supply chain security |

| Industrial Automation | Robust sensors and high-power switching devices | Longevity in harsh industrial environments | Supplier’s experience with industrial-grade materials and certifications |

In power electronics, 4H-SiC is crucial for manufacturing high-frequency and high-voltage devices such as MOSFETs and diodes. Its superior thermal conductivity and breakdown voltage enable devices to operate more efficiently and reliably under demanding conditions. For B2B buyers in Africa, South America, and the Middle East, sourcing high-purity 4H-SiC from certified suppliers ensures consistent device performance and longevity, essential for infrastructure projects and industrial growth. Buyers should prioritize suppliers with proven quality management systems and international compliance certifications.

The renewable energy sector leverages 4H-SiC in photovoltaic inverters and power converters to enhance energy conversion efficiency and system reliability. This is particularly beneficial for regions with growing solar installations, such as Kenya and parts of Europe. The material’s ability to withstand high voltages and temperatures translates into longer-lasting and more efficient renewable energy systems. Buyers should focus on suppliers who offer tailored solutions and flexible logistics to navigate complexities of remote installations and fluctuating demand.

4H-SiC is increasingly vital in automotive and EV applications, especially for power modules that demand high power density and low energy loss. This leads to lighter, more efficient electric drivetrains and extended battery life. For international B2B buyers, especially in emerging automotive markets in South America and the Middle East, partnering with suppliers capable of scaling production and providing rigorous quality assurance is critical. After-sales technical support and compliance with automotive industry standards are additional key factors.

In aerospace and defense, 4H-SiC is used to produce electronics that must operate reliably in extreme environments, including high temperatures and radiation exposure. This makes it indispensable for avionics, satellite systems, and defense equipment. Buyers in Europe and the Middle East, with stringent regulatory requirements, should prioritize suppliers offering full traceability, strict quality controls, and compliance with aerospace certifications. Supply chain security and risk management are also vital considerations in this sector.

Industrial automation benefits from 4H-SiC through robust sensors and high-power switching devices that maintain performance in harsh environments such as factories or mining operations. The material’s durability reduces downtime and maintenance costs. B2B buyers from regions with expanding industrial bases, including Africa and Australia, should evaluate suppliers’ experience with industrial-grade materials and certifications like ISO 9001. Reliable delivery schedules and technical support enhance operational continuity in these demanding sectors.

Key Properties:

SiC ceramic is renowned for its exceptional hardness, high thermal conductivity, and excellent chemical inertness. It can withstand temperatures exceeding 1600°C and exhibits outstanding resistance to corrosion and abrasion. Its mechanical strength remains stable under high pressure and thermal shock conditions.

Pros & Cons:

The durability and wear resistance of SiC ceramic make it ideal for harsh industrial environments. However, it is relatively brittle, which can complicate manufacturing processes and increase the risk of fracture during handling. The cost is moderate to high due to complex sintering and machining requirements.

Impact on Application:

SiC ceramic is highly compatible with corrosive media such as acids and alkalis, making it suitable for chemical processing, semiconductor manufacturing, and high-temperature filtration systems. Its thermal stability is advantageous in power electronics and high-voltage devices.

International B2B Considerations:

Buyers from regions like Africa and South America should verify compliance with ASTM C799 and DIN EN 60672 standards to ensure material reliability. European and Middle Eastern markets often require adherence to ISO 9001 quality management systems for sourcing. Logistics and handling protocols must be optimized to prevent damage during transport, especially for fragile ceramic components.

Key Properties:

SiC composites combine SiC ceramic with reinforcing fibers or whiskers, enhancing toughness and fracture resistance while maintaining high thermal and chemical stability. They can operate efficiently at temperatures up to 1400°C and resist oxidation in aggressive environments.

Pros & Cons:

The composite structure improves mechanical resilience and reduces brittleness, allowing for more complex shapes and larger components. Manufacturing complexity and costs are higher due to advanced fabrication techniques like chemical vapor infiltration (CVI). The trade-off is worthwhile for applications demanding durability under cyclic thermal and mechanical stress.

Impact on Application:

Ideal for aerospace, automotive, and energy sectors where components face fluctuating thermal loads and mechanical vibrations. The material’s resistance to oxidation and corrosion supports use in turbine engines and heat exchangers.

International B2B Considerations:

Compliance with ASTM C1275 and ISO 10350 standards is critical for global acceptance. Buyers in the Middle East and Europe should prioritize suppliers with certifications demonstrating environmental and safety compliance. For African and South American markets, assessing supplier logistics capabilities and after-sales support is essential due to infrastructure variability.

Key Properties:

This material involves a metal substrate (typically stainless steel or titanium) coated with a thin layer of SiC. The coating imparts corrosion resistance and thermal stability while leveraging the ductility and toughness of the metal base. Temperature tolerance is generally limited by the substrate, often up to 800–1000°C.

Pros & Cons:

The combination reduces brittleness and improves impact resistance compared to pure ceramics. Coating processes such as chemical vapor deposition (CVD) add manufacturing complexity and cost. The coating thickness and adhesion quality are critical factors influencing longevity and performance.

Impact on Application:

Widely used in piping, valves, and heat exchangers where corrosion resistance is needed without sacrificing mechanical strength. Particularly effective in environments with abrasive fluids or high-pressure steam.

International B2B Considerations:

Buyers should ensure coatings meet ASTM B487 or ISO 20502 standards for thickness and adhesion. In regions like Australia and Europe, environmental regulations may affect the choice of substrate and coating processes. For African and South American buyers, cost-efficiency and local supplier availability may influence material selection.

Key Properties:

SiC fibers embedded in polymer matrices provide high strength-to-weight ratios, excellent fatigue resistance, and good thermal stability up to approximately 400°C. The polymer matrix offers flexibility and ease of fabrication.

Pros & Cons:

This material is lightweight and easier to machine compared to ceramics and composites. However, it has lower maximum temperature tolerance and chemical resistance, limiting its use in extreme environments. Cost is moderate but varies depending on fiber volume and polymer type.

Impact on Application:

Best suited for structural components in aerospace, automotive, and electronics where weight savings are critical. Less appropriate for highly corrosive or ultra-high-temperature applications.

International B2B Considerations:

Compliance with ASTM D4018 and ISO 14125 ensures mechanical property consistency. Buyers in Europe and the Middle East may demand certifications related to environmental impact and recyclability. For African and South American markets, the balance between performance and cost is a key purchasing driver.

| Material | Typical Use Case for 4h-sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) Ceramic | Chemical processing, high-temp filtration | Exceptional hardness and thermal resistance | Brittle, complex manufacturing | High |

| Silicon Carbide Composite | Aerospace, automotive, energy sectors | Improved toughness and thermal stability | High manufacturing complexity and cost | High |

| Silicon Carbide Coated Metals | Corrosion-resistant piping, valves, heat exchangers | Combines corrosion resistance with ductility | Limited max temperature by metal substrate | Medium |

| Silicon Carbide Fiber-Reinforced Polymers (SiC-FRP) | Lightweight structural components in aerospace and electronics | High strength-to-weight ratio and ease of fabrication | Lower temperature and chemical resistance | Medium |

This guide empowers international B2B buyers to make informed decisions on 4H-SiC materials by balancing performance requirements, manufacturing considerations, and regional compliance standards. Prioritizing these factors ensures optimal material selection aligned with specific application demands and market conditions.

The production of 4h-sic involves a meticulous sequence of manufacturing stages designed to ensure product integrity, performance, and longevity. Understanding these stages provides B2B buyers with insight into supplier capabilities and potential customization opportunities.

1. Material Preparation

The foundation of 4h-sic manufacturing begins with sourcing high-purity silicon carbide powders and additives. Material preparation includes precise blending and milling to achieve uniform particle size and composition. Advanced suppliers often employ controlled atmosphere processing to prevent contamination and ensure raw material consistency, a critical factor for end-use reliability.

2. Forming and Shaping

Once the raw materials are prepared, the next step is shaping the components. Common forming techniques include:

- Pressing: Using uniaxial or isostatic presses to compact powders into green bodies with high density and uniformity.

- Extrusion and Injection Molding: For complex geometries, these methods enable intricate shapes with controlled dimensional accuracy.

- Tape Casting: For thin layers or substrates, tape casting produces uniform thickness and surface finish.

3. Assembly and Joining

Post forming, components may require assembly or joining. Techniques such as diffusion bonding, brazing, or adhesive bonding are used depending on the application. This stage demands precision to maintain structural integrity and ensure optimal mechanical and thermal properties.

4. Sintering and Heat Treatment

Sintering consolidates the formed parts by heating them below the melting point, typically in inert or vacuum atmospheres to avoid oxidation. This stage enhances mechanical strength and electrical properties. Heat treatments may follow to relieve internal stresses and fine-tune characteristics such as hardness and thermal conductivity.

5. Finishing Processes

Finishing includes grinding, polishing, and coating to achieve tight tolerances and surface finishes required by industry standards. Advanced finishing can improve wear resistance and reduce surface defects, critical for high-performance applications.

Quality assurance (QA) in 4h-sic manufacturing is structured around internationally recognized standards and rigorous internal controls, ensuring product reliability and compliance with global market requirements.

International and Industry Standards

- ISO 9001: The baseline for quality management systems, ensuring consistent process control and continual improvement.

- CE Marking: Essential for products entering European markets, confirming compliance with EU safety, health, and environmental requirements.

- API (American Petroleum Institute) Standards: Relevant for 4h-sic used in oil and gas sectors, ensuring products meet stringent operational demands.

- Additional certifications such as RoHS or REACH may apply depending on the end-use region and environmental regulations.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and components for chemical composition, particle size, and physical properties before production begins.

- In-Process Quality Control (IPQC): Monitoring during critical manufacturing stages, including dimensional checks, density measurements, and visual inspections to detect defects early.

- Final Quality Control (FQC): Comprehensive testing of finished products covering mechanical strength, thermal conductivity, and surface integrity to ensure compliance with specifications.

Common Testing Methods

- X-Ray Diffraction (XRD): To verify crystalline structure and phase purity.

- Scanning Electron Microscopy (SEM): For microstructural analysis and defect detection.

- Hardness and Flexural Strength Testing: To assess mechanical robustness.

- Thermal Conductivity and Expansion Testing: Critical for applications requiring precise thermal management.

- Dimensional and Surface Roughness Measurements: Ensuring adherence to design tolerances.

For buyers from Africa, South America, the Middle East, and Europe, ensuring supplier quality extends beyond documentation to active verification and due diligence.

1. Conducting Supplier Audits

On-site audits are invaluable for assessing manufacturing capabilities and quality culture. If travel is constrained, remote audits or virtual factory tours can provide insights. Focus areas include process controls, equipment condition, staff qualifications, and traceability systems.

2. Reviewing Quality Documentation

Request comprehensive quality documentation, including:

- ISO 9001 certificates and audit reports

- Material test reports (MTRs) showing batch-level traceability

- Third-party inspection certificates from recognized agencies

- Process validation records

3. Engaging Third-Party Inspection Services

Independent inspection firms can perform sampling, testing, and verification at various production stages or prior to shipment. This is particularly important for buyers in regions where regulatory oversight may differ, ensuring impartial quality validation.

4. Understanding QC and Certification Nuances by Region

- Africa & South America: Importers often face additional scrutiny at customs; verifying CE or equivalent certifications beforehand smooths clearance. Local standards may require supplementary testing.

- Middle East: Compliance with Gulf Cooperation Council (GCC) standards alongside international certifications is critical. Suppliers familiar with regional requirements reduce compliance risks.

- Europe: Emphasis on CE marking, RoHS, and REACH compliance is high. Environmental and safety standards are stringent, necessitating thorough supplier vetting.

- Australia: Australian standards often align with ISO and IEC norms, but buyers should verify any additional local certifications or testing requirements.

By integrating these insights into your supplier evaluation and procurement processes, you can confidently source 4h-sic products that meet rigorous quality and performance standards, supporting sustainable partnerships across global markets.

When sourcing 4h-sic products, understanding the intricate cost structure and pricing dynamics is crucial for international B2B buyers aiming to optimize procurement strategies and manage budgets effectively. The total price is influenced by multiple factors ranging from raw materials to logistics, each demanding careful consideration.

Materials: The primary raw materials for 4h-sic products significantly impact cost. Variations in raw material quality, availability, and market fluctuations can alter pricing. For buyers from regions like Africa or South America, sourcing materials with consistent quality certifications (e.g., ISO, REACH) is vital to ensure product reliability.

Labor: Labor costs vary widely depending on the manufacturing country. Facilities in regions with lower labor costs may offer competitive pricing, but buyers should assess the impact on quality and lead times.

Manufacturing Overhead: This includes utilities, equipment depreciation, and factory maintenance. Overhead costs are typically built into unit prices and may fluctuate with production volume and efficiency levels.

Tooling: Initial tooling and setup costs can be substantial, especially for customized 4h-sic components. These costs are often amortized over the production run, making higher order volumes more cost-effective.

Quality Control (QC): Rigorous QC processes add to costs but reduce risks of defects and returns. For international buyers, ensuring suppliers adhere to stringent QC standards is essential to avoid costly rework or supply disruptions.

Logistics: Freight, customs duties, and insurance form a significant portion of the landed cost. Buyers in Africa, the Middle East, or Europe must factor in variable shipping routes, port handling fees, and potential delays, which can affect overall pricing.

Margin: Supplier profit margins vary depending on market competition, supplier scale, and negotiation leverage. Transparent communication can help buyers understand margin expectations and identify opportunities for cost savings.

Volume / Minimum Order Quantity (MOQ): Higher volumes generally reduce per-unit costs due to economies of scale. Buyers should evaluate their demand forecasts to negotiate better pricing or flexible MOQs.

Specifications and Customization: Tailored specifications or enhanced performance features in 4h-sic products increase costs. Buyers must balance customization benefits against incremental expenses and delivery timelines.

Material Grades: Premium or specialty materials elevate prices. It is critical for buyers to specify exact material requirements aligned with their application needs to avoid overpaying for unnecessary features.

Quality Certifications: Suppliers with recognized certifications often command premium pricing but provide assurance of product standards, which is especially important for regulated markets in Europe or Australia.

Supplier Factors: Supplier reputation, production capacity, and financial stability influence pricing and reliability. Long-term partnerships may unlock volume discounts and priority production slots.

Incoterms: The chosen Incoterm (e.g., FOB, CIF, DDP) dictates who bears shipping and customs responsibilities, impacting the final landed cost. Buyers unfamiliar with Incoterm implications risk unexpected expenses or logistical challenges.

Negotiate Based on Volume and Commitment: Leverage forecasted volumes to negotiate lower unit prices or reduced MOQs. Consider multi-year contracts to secure favorable terms.

Assess Total Cost of Ownership (TCO): Beyond unit price, factor in logistics, customs, potential tariffs, and after-sales support. For example, a slightly higher-priced supplier with faster delivery and better QC may reduce overall costs.

Understand Pricing Nuances by Region: Buyers from Africa or South America should account for longer shipping times and complex customs procedures that can increase costs and risks. European buyers may face stricter regulatory compliance costs.

Request Detailed Cost Breakdowns: Encourage suppliers to provide transparent cost components to identify negotiation levers or potential cost-saving areas.

Verify Certifications and Quality Standards: Especially for critical applications, insist on supplier certifications and perform audits or third-party inspections to mitigate quality risks.

Optimize Incoterm Selection: Choose Incoterms that balance control and cost efficiency based on your logistics capabilities and risk appetite. For example, DDP may simplify import but increase supplier pricing.

All pricing insights provided are indicative and subject to change based on market conditions, supplier negotiations, and regional factors. It is recommended that buyers conduct thorough due diligence and obtain multiple quotes tailored to their specific requirements to ensure accurate cost assessments.

Illustrative Image (Source: Google Search)

By systematically analyzing these cost components and pricing influencers, international B2B buyers can make informed decisions when sourcing 4h-sic, achieving a balance between cost-efficiency, quality, and supply reliability across diverse global markets.

Understanding the essential technical specifications of 4h-sic is crucial for international buyers aiming to secure the right material for their industrial applications. Here are the key properties to focus on:

Material Grade

The grade of 4h-sic defines its purity, composition, and performance capabilities. Higher grades often indicate better thermal conductivity, electrical insulation, and mechanical strength. For B2B buyers, selecting the correct grade ensures compatibility with application demands, impacting product longevity and efficiency.

Dimensional Tolerance

Tolerance refers to the permissible variation in the physical dimensions of 4h-sic components. Tight tolerances are vital in precision engineering sectors such as electronics or aerospace, where even minor deviations can cause failures. Buyers must specify tolerance limits clearly in purchase orders to avoid costly production issues.

Thermal Conductivity

This property measures the ability of 4h-sic to conduct heat. High thermal conductivity is essential for heat dissipation in power electronics and semiconductor devices. International buyers should verify this property when sourcing materials for thermal management solutions to optimize device performance.

Electrical Resistivity

4h-sic’s electrical resistivity determines its suitability for insulating applications. Materials with high resistivity prevent unwanted current flow, crucial in electrical and electronic equipment. Buyers must ensure that the material meets the required resistivity standards for safety and functionality.

Mechanical Strength

This includes hardness, fracture toughness, and compressive strength. Mechanical durability affects how 4h-sic withstands operational stresses such as pressure, vibration, and thermal cycling. Selecting a material with the appropriate mechanical strength extends service life and reduces maintenance costs.

Surface Finish

The surface quality of 4h-sic components can impact assembly and performance, especially in applications involving sealing or bonding. Smooth finishes reduce wear and improve reliability. Buyers should request detailed surface finish specifications to align with their application needs.

Navigating the B2B procurement landscape requires familiarity with common trade terms that streamline communication and set clear expectations between buyers and suppliers:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or components used in another company’s end product. Understanding whether 4h-sic is sourced from an OEM or a third-party supplier affects quality assurance and warranty considerations.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs influence cost-efficiency and inventory management. Buyers from emerging markets or smaller enterprises should negotiate MOQ terms to avoid overstocking or cash flow constraints.

RFQ (Request for Quotation)

A formal document sent to suppliers asking for price, lead time, and terms based on specific requirements. Crafting a precise RFQ for 4h-sic ensures suppliers provide accurate bids, facilitating better price comparisons and procurement decisions.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Common Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) affect pricing and risk management. Buyers should clearly agree on Incoterms to avoid disputes and unexpected costs.

Lead Time

The period from order placement to delivery. Understanding lead times is critical for production planning and inventory control. Buyers should confirm realistic lead times with suppliers to maintain uninterrupted supply chains.

Batch Traceability

The ability to track and verify the origin and production details of a specific batch of 4h-sic. This is important for quality control and compliance, especially in regulated industries. Buyers should request batch traceability documentation to ensure accountability.

By mastering these technical properties and trade terms, B2B buyers from diverse regions such as Africa, South America, the Middle East, and Europe can make informed decisions, negotiate effectively, and establish reliable supply partnerships for 4h-sic materials.

The 4h-sic sector is experiencing dynamic shifts driven by globalization, technological innovation, and evolving buyer demands. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe, understanding these market forces is critical for effective sourcing and partnership strategies.

Global Drivers:

Rapid urbanization, digital transformation, and increased demand for specialized 4h-sic products are key growth drivers. Emerging markets like Kenya and Brazil are witnessing heightened industrial activity, creating new sourcing opportunities. Meanwhile, European and Middle Eastern buyers are focusing on quality, compliance, and supply chain resilience amid geopolitical uncertainties.

Sourcing Trends:

- Digital Procurement Platforms: Adoption of AI-powered marketplaces and blockchain for transparency is streamlining vendor selection and contract management. Buyers benefit from real-time analytics and risk assessment tools to mitigate supply disruptions.

- Localization & Regional Hubs: To reduce lead times and tariffs, companies are establishing regional sourcing hubs, particularly in Africa and the Middle East, facilitating quicker access to raw materials and finished goods.

- Collaborative Supply Networks: Strategic partnerships with local manufacturers and technology providers enhance innovation and customization capabilities, crucial for meeting diverse market requirements.

- Flexible Supply Chains: The COVID-19 pandemic accelerated the shift towards agile supply chains that can pivot quickly in response to demand fluctuations or logistical challenges.

Market Dynamics:

Price volatility in raw materials and fluctuating currency exchange rates remain significant challenges. Buyers must leverage hedging strategies and multi-supplier approaches to maintain cost efficiency. Regulatory compliance across jurisdictions, especially regarding safety and environmental standards, is increasingly complex but essential for market access.

Sustainability has moved from a peripheral concern to a central pillar in the 4h-sic sector’s supply chain management. International buyers are under growing pressure from stakeholders to source responsibly and reduce environmental footprints.

Environmental Impact:

The 4h-sic industry often involves energy-intensive processes and raw material extraction that can lead to deforestation, pollution, and carbon emissions. Implementing cleaner production technologies and circular economy principles reduces waste and conserves resources.

Ethical Supply Chains:

Transparency and accountability are crucial. Buyers must ensure suppliers adhere to fair labor practices, prevent child and forced labor, and provide safe working conditions. This is especially pertinent for sourcing regions in Africa and South America, where regulatory enforcement can vary.

Green Certifications & Materials:

- Certifications: ISO 14001 (Environmental Management), FSC (Forest Stewardship Council), and Fair Trade certifications are increasingly valued as benchmarks of sustainability and ethical compliance.

- Sustainable Materials: Preference is shifting towards biodegradable, recycled, or low-impact raw materials that align with corporate social responsibility (CSR) goals. For example, bio-based composites and eco-friendly coatings are gaining traction in product specifications.

- Supplier Audits & Reporting: Regular third-party audits and sustainability reporting enhance buyer confidence and facilitate compliance with international standards such as the EU’s Green Deal and the UN Global Compact.

By integrating sustainability into procurement strategies, buyers not only comply with regulations but also unlock long-term value through brand differentiation and risk mitigation.

The 4h-sic sector has evolved significantly over the past two decades, transitioning from traditional manufacturing methods to highly specialized, technology-driven production. Initially dominated by localized suppliers, the sector expanded globally with advances in logistics and communication technologies. This globalization enabled buyers to access diverse sourcing markets, particularly in emerging economies.

In recent years, the sector has undergone a paradigm shift towards digitalization and sustainability. Industry 4.0 technologies such as IoT, AI, and automation have optimized production efficiency and quality control. Concurrently, increased regulatory scrutiny and consumer awareness have propelled sustainability to the forefront, reshaping sourcing and supply chain practices worldwide. This evolution offers international B2B buyers enhanced opportunities to engage with innovative, ethical, and resilient suppliers across continents.

How can I effectively vet suppliers of 4h-sic to ensure reliability and quality?

To vet 4h-sic suppliers, start by verifying their business licenses and certifications relevant to your region’s import standards. Request samples to assess product quality and consistency. Check references and customer reviews, especially from buyers in your region (Africa, South America, Middle East, Europe). Consider suppliers who offer transparent production processes and are open to factory audits, either virtually or in person. Using third-party inspection services before shipment can further mitigate risks. Establishing clear communication channels and understanding their after-sales support is also critical for long-term partnerships.

Is customization of 4h-sic products possible, and how should I approach it?

Many manufacturers offer customization options for 4h-sic products, such as varying purity levels, particle sizes, or packaging tailored to industry needs. To initiate customization, clearly specify your technical requirements and intended application. Engage in detailed discussions with suppliers about feasibility, costs, and lead times. Provide samples or technical drawings if applicable. Keep in mind that customization may impact minimum order quantities (MOQs) and price, so negotiate terms upfront. Confirm that quality assurance processes will adapt to your specifications to maintain product integrity.

What are typical minimum order quantities (MOQs) and lead times for 4h-sic shipments to international markets?

MOQs for 4h-sic typically depend on the supplier’s production capacity and customization level but often range from 500 kg to several tons. Lead times vary from 3 to 8 weeks, factoring in manufacturing, quality checks, and international shipping. For buyers in Africa, South America, the Middle East, and Europe, plan for additional customs clearance time. To optimize procurement, discuss MOQs early and explore options for consolidated shipments or staggered deliveries to manage inventory and cash flow effectively. Early order placement is advisable to avoid delays, especially during peak demand periods.

What payment terms are common when purchasing 4h-sic internationally, and how can I secure favorable conditions?

Common payment terms include letters of credit (LC), telegraphic transfers (T/T), or open accounts for established buyers. LCs provide security for both parties but may incur bank fees and processing time. T/T payments often require a deposit upfront (30-50%) with the balance before shipment. To negotiate better terms, build trust through consistent transactions and consider using escrow services or trade finance solutions. Engaging with suppliers who understand the payment practices in your region can facilitate smoother transactions and reduce financial risks.

Which quality assurance certifications should I look for when sourcing 4h-sic from international suppliers?

Seek suppliers with ISO 9001 certification to ensure consistent quality management systems. Depending on your industry, additional certifications like ISO 14001 (environmental management) or specific product compliance certificates (e.g., REACH for Europe) may be relevant. Request material safety data sheets (MSDS) and test reports from accredited laboratories verifying purity, particle size distribution, and physical properties. For critical applications, third-party verification of certificates can protect your investment. Ensuring your supplier adheres to recognized standards helps avoid non-compliance issues during import and use.

What logistics considerations are crucial when importing 4h-sic to regions such as Africa or South America?

4h-sic is typically shipped in bulk packaging, requiring careful handling to prevent contamination or damage. Confirm that your supplier uses appropriate packaging materials that meet your country’s import regulations and climatic conditions. Choose reliable freight forwarders experienced with hazardous or industrial materials if applicable. Plan for customs documentation, tariffs, and potential delays due to local infrastructure challenges. Coordinating with local agents for clearance and last-mile delivery can reduce bottlenecks. Additionally, consider insurance coverage for transit risks and potential demurrage fees.

Illustrative Image (Source: Google Search)

How should I handle disputes or quality issues with 4h-sic suppliers in international trade?

Establish clear contractual terms detailing quality standards, inspection rights, and dispute resolution mechanisms before ordering. If quality issues arise, document discrepancies with photos and test results. Notify the supplier promptly and seek a resolution, which may include replacement, refund, or discount. Utilize mediation or arbitration clauses to resolve conflicts efficiently without escalating to litigation. Maintaining open communication and a collaborative approach often preserves business relationships. Additionally, working with suppliers who offer warranties or after-sales support can mitigate dispute risks.

Are there specific regulatory challenges when importing 4h-sic into the Middle East and Europe?

Yes, importing 4h-sic into these regions requires compliance with strict chemical safety and environmental regulations. In Europe, adherence to REACH and CLP regulations is mandatory, including registration and labeling requirements. The Middle East may require conformity to local standards and import permits depending on the country. It’s essential to work with suppliers familiar with these regulations and ensure all documentation, including certificates of analysis and MSDS, are accurate and up-to-date. Collaborating with customs brokers experienced in these regions can streamline approvals and reduce the risk of shipment delays or penalties.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of sourcing 4h-sic, international B2B buyers must prioritize a strategic approach that balances cost-efficiency, quality assurance, and supply chain resilience. For markets across Africa, South America, the Middle East, and Europe, understanding regional supplier capabilities and compliance standards is critical to unlocking competitive advantages. Leveraging thorough market intelligence and fostering strong supplier relationships will enable buyers to mitigate risks and optimize procurement cycles.

Key takeaways include:

Looking ahead, the landscape for 4h-sic sourcing will increasingly favor buyers who adopt forward-thinking practices and embrace emerging technologies such as AI-driven analytics and blockchain for transparency. International buyers, particularly those from Kenya, Brazil, the UAE, and Germany, are encouraged to invest in strategic sourcing capabilities that not only reduce costs but also build resilient, sustainable supply chains. By doing so, they position themselves to capitalize on evolving market opportunities and secure long-term growth.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina