In today’s rapidly evolving industrial landscape, 6H-SiC (6H Silicon Carbide) stands out as a critical material driving innovation across high-performance sectors. Its exceptional thermal conductivity, chemical stability, and wide bandgap make it indispensable for applications ranging from power electronics to advanced semiconductor devices. For international B2B buyers—especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe—understanding the nuances of 6H-SiC is essential to securing reliable supply chains and optimizing product performance.

This comprehensive guide is designed to equip procurement professionals and technical buyers with actionable insights into the global 6H-SiC market. It covers the full spectrum of considerations, including the various types and crystal structures of 6H-SiC, material properties, and manufacturing processes. You’ll gain clarity on quality control standards, supplier evaluation criteria, and pricing dynamics—critical factors that influence sourcing decisions in international trade environments.

Moreover, the guide delves into regional market trends and supplier landscapes, helping buyers from emerging and mature economies alike navigate complexities such as regulatory compliance, logistics, and cost optimization. Whether you are sourcing for high-volume manufacturing or specialized applications, this resource empowers you to make informed, strategic decisions that align with your operational goals and market demands.

Illustrative Image (Source: Google Search)

By leveraging this guide, international B2B buyers can confidently approach 6H-SiC procurement with a clear understanding of technical specifications, market opportunities, and potential challenges—ensuring sustainable partnerships and competitive advantage in a global marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard 6h-SIC | Baseline configuration with balanced performance | General industrial automation, basic sensing | + Reliable and cost-effective – Limited advanced features |

| High-Precision 6h-SIC | Enhanced sensitivity and accuracy | Precision manufacturing, quality control | + Superior accuracy – Higher cost, requires skilled integration |

| Ruggedized 6h-SIC | Reinforced casing and environmental resistance | Harsh environments, outdoor installations | + Durable and long-lasting – Bulkier, increased weight |

| Low-Power 6h-SIC | Optimized for minimal energy consumption | Remote monitoring, IoT applications | + Energy-efficient, longer operational life – Reduced processing power |

| Modular 6h-SIC | Configurable components for customizable setups | Flexible manufacturing, prototyping | + Highly adaptable – Complexity in setup and maintenance |

Standard 6h-SIC

The Standard 6h-SIC serves as the foundational variant, offering balanced performance suitable for a broad range of industrial applications. Its straightforward design ensures reliability and ease of integration, making it a cost-effective choice for buyers focused on general automation and sensing needs. For B2B buyers in regions like Europe and South America, this type supports steady operations without the need for specialized customization. Considerations include verifying compatibility with existing systems and ensuring supplier support for maintenance.

High-Precision 6h-SIC

Designed for environments demanding exceptional accuracy, the High-Precision 6h-SIC excels in quality control and precision manufacturing sectors. Its enhanced sensitivity allows for meticulous measurement and control, vital in high-stakes production lines. Buyers should weigh the increased procurement and integration costs against the benefits of reduced error rates and improved product quality. This type is particularly relevant for European manufacturers and Middle Eastern industries where precision standards are stringent.

Ruggedized 6h-SIC

The Ruggedized variant is engineered for durability, featuring reinforced casings and resistance to extreme environmental conditions such as dust, moisture, and temperature fluctuations. This makes it ideal for African and Middle Eastern markets where equipment often faces harsh outdoor conditions. While the increased robustness adds bulk and weight, the extended lifespan and reduced downtime often justify the investment. Buyers should evaluate installation logistics and potential impacts on system design.

Low-Power 6h-SIC

Optimized for energy efficiency, the Low-Power 6h-SIC is tailored for remote monitoring and IoT deployments where power availability is limited. Its reduced energy consumption prolongs operational life, a critical advantage for applications in remote or off-grid locations common in parts of Africa and South America. However, the trade-off is generally lower processing power, requiring buyers to assess the balance between performance needs and power constraints carefully.

Modular 6h-SIC

The Modular 6h-SIC offers a flexible architecture that allows buyers to customize components according to specific operational requirements. This adaptability supports dynamic manufacturing environments and rapid prototyping, appealing to innovative industries in Europe and technologically evolving markets. While highly versatile, the modular nature introduces complexity in setup and maintenance, necessitating skilled technical support and thorough planning during procurement.

Related Video: Understanding Process Variations in Minitab

| Industry/Sector | Specific Application of 6h-sic | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-frequency power devices and converters | Enhanced efficiency and thermal management for power systems | Ensure supplier can provide high-purity 6h-SiC with consistent crystalline quality; verify compliance with international standards |

| Automotive | Electric vehicle (EV) powertrains and inverters | Improved durability and energy efficiency in EV components | Assess supplier capability for large-scale production and customization to automotive specs; consider lead times and certification processes |

| Aerospace & Defense | High-temperature, high-radiation environment electronics | Reliable performance in extreme conditions, reducing failure rates | Prioritize suppliers with experience in aerospace-grade materials and traceability; review quality assurance protocols |

| Renewable Energy | Solar inverters and wind turbine power modules | Increased conversion efficiency and longer device lifespan | Source from vendors offering scalable solutions and after-sales technical support; check for compatibility with local grid standards |

| Industrial Automation | High-voltage motor drives and robotics controllers | Enhanced power density and operational reliability | Evaluate suppliers’ ability to deliver tailored 6h-SiC wafers or components meeting specific voltage and thermal specs |

Power Electronics:

6h-SiC is pivotal in high-frequency power devices used in converters and inverters, where its superior electrical and thermal properties enable devices to operate more efficiently and reliably at higher voltages and temperatures. For B2B buyers in regions like Europe and the Middle East, where energy efficiency standards are stringent, sourcing 6h-SiC with consistent crystalline quality is critical. Buyers should prioritize suppliers who demonstrate robust quality control and adherence to international standards to ensure long-term device performance.

Automotive:

In the automotive sector, particularly for electric vehicles, 6h-SiC is used in powertrain components and inverters to boost energy efficiency and extend battery life. Its robustness under high-temperature operation enhances the durability of EV systems. International buyers from South America and Africa should focus on suppliers capable of scaling production while customizing materials to automotive industry specifications. Certification and compliance with global automotive quality standards are essential for smooth integration.

Aerospace & Defense:

The aerospace and defense industries demand materials that withstand extreme temperatures and radiation. 6h-SiC’s stability in such harsh environments makes it ideal for critical electronic components. Buyers from Europe and the Middle East must ensure suppliers provide aerospace-grade materials with full traceability and stringent quality assurance, reducing risk of component failure and ensuring mission-critical reliability.

Renewable Energy:

6h-SiC enhances the efficiency and durability of solar inverters and wind turbine power modules by enabling higher switching frequencies and better thermal management. For B2B buyers in regions investing heavily in renewables, such as Spain and South America, sourcing from vendors who offer scalable, technically supported solutions compatible with local grid standards is vital. This ensures smooth deployment and maintenance of renewable energy infrastructure.

Industrial Automation:

In industrial automation, 6h-SiC is used in high-voltage motor drives and robotic controllers to improve power density and operational reliability. Buyers in Africa and Europe should evaluate suppliers based on their ability to provide tailored 6h-SiC wafers or components that meet specific voltage and thermal requirements. Strong after-sales support and customization options are key to optimizing automation system performance.

Key Properties:

Silicon carbide substrates, particularly the 6H polytype, offer exceptional thermal conductivity (up to 490 W/mK) and high breakdown electric field strength. They can withstand temperatures exceeding 1600°C and exhibit excellent chemical inertness, making them ideal for high-power, high-frequency electronic devices. Their mechanical hardness and corrosion resistance are superior to many conventional semiconductor substrates.

Pros & Cons:

The primary advantage of 6H-SiC substrates lies in their ability to maintain performance under extreme thermal and electrical stress, which enhances device reliability and efficiency. However, the manufacturing process is complex and costly due to the need for high-purity raw materials and precision crystal growth techniques. Additionally, substrate defects can impact yield and device performance.

Impact on Application:

6H-SiC substrates are particularly suited for power electronics, high-temperature sensors, and harsh-environment applications such as aerospace and automotive sectors. Their compatibility with harsh chemical environments makes them ideal for use in corrosive media or high-radiation areas.

Considerations for International Buyers:

Buyers from Africa, South America, the Middle East, and Europe should verify compliance with international standards such as ASTM F1285 for SiC substrates and ensure suppliers provide traceability documentation. European buyers, especially in Poland and Spain, often require adherence to RoHS and REACH regulations. Supply chain reliability and local availability of technical support are critical factors for these markets.

Key Properties:

Sintered SiC ceramics exhibit excellent mechanical strength, high thermal shock resistance, and outstanding corrosion resistance against acids and alkalis. They maintain structural integrity at temperatures up to 1400°C and possess low thermal expansion coefficients, reducing thermal stress in applications.

Pros & Cons:

Ceramic SiC is more cost-effective than single-crystal substrates and easier to manufacture in complex shapes. It is highly durable and resistant to wear, making it ideal for seals, bearings, and pump components. However, its electrical properties are inferior to single-crystal SiC, limiting its use in electronic applications.

Impact on Application:

Sintered SiC ceramics are widely used in chemical processing, mechanical seals, and high-temperature furnace components. Their resistance to corrosive media makes them suitable for industries such as oil & gas and chemical manufacturing.

Considerations for International Buyers:

Buyers should ensure that sintered SiC ceramics meet ISO 9001 quality standards and relevant DIN or JIS certifications for mechanical and chemical properties. In regions like the Middle East and South America, where chemical processing is prominent, verifying material compatibility with local process fluids is essential. Logistics considerations include material fragility and packaging for long-distance shipping.

Key Properties:

Epitaxial layers of 6H-SiC are grown on substrates to create high-quality, defect-minimized semiconductor layers. These layers provide excellent electron mobility and can operate at high voltages and temperatures. Thickness control and doping precision enable tailored electrical characteristics.

Pros & Cons:

The epitaxial process enhances device performance and yield but adds complexity and cost to manufacturing. Epitaxial layers require sophisticated equipment and cleanroom environments, which may limit supplier options. The high purity and controlled doping improve device consistency but increase lead times.

Impact on Application:

Epitaxial 6H-SiC is critical in power devices such as MOSFETs and Schottky diodes, enabling efficient energy conversion and thermal management. Applications include renewable energy inverters, electric vehicles, and industrial motor drives.

Considerations for International Buyers:

International buyers should prioritize suppliers with certifications such as ISO/TS 16949 for semiconductor manufacturing. European markets emphasize compliance with CE marking and environmental standards. Buyers in Africa and South America should assess supplier capacity for customized epitaxial layers to meet emerging market demands.

Key Properties:

Polycrystalline 6H-SiC consists of multiple SiC crystals fused together, offering good thermal and chemical stability but with lower electrical uniformity compared to single crystals. It can tolerate temperatures up to 1500°C and exhibits moderate mechanical strength.

Pros & Cons:

Polycrystalline SiC is less expensive and easier to produce in bulk compared to single-crystal forms. However, grain boundaries can reduce electrical performance, making it less suitable for high-frequency electronics. It is robust for structural applications but not ideal for precision semiconductor devices.

Impact on Application:

This material is favored for refractory linings, heating elements, and abrasive components where electrical properties are secondary. Its corrosion resistance supports use in metallurgical and ceramic industries.

Considerations for International Buyers:

Buyers should evaluate polycrystalline SiC suppliers based on ASTM C799 standards for ceramic materials and confirm product consistency. In markets like the Middle East and Africa, where industrial infrastructure is developing, cost-effectiveness and durability are prioritized. European buyers may focus on lifecycle and recyclability aspects aligned with sustainability goals.

| Material | Typical Use Case for 6h-sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide Substrate | High-power electronics, high-temp sensors | Exceptional thermal/electrical performance | High manufacturing complexity and cost | High |

| Silicon Carbide Ceramic | Mechanical seals, chemical processing components | Excellent corrosion and thermal shock resistance | Inferior electrical properties | Medium |

| Epitaxial 6H-SiC Layers | Power devices (MOSFETs, diodes) | Superior electrical quality and doping control | Complex, costly epitaxial growth process | High |

| Polycrystalline 6H-SiC | Refractory linings, heating elements | Cost-effective, good thermal and chemical stability | Lower electrical uniformity and performance | Low |

The production of 6H-Silicon Carbide (6H-SiC) involves a series of highly controlled manufacturing stages, each critical to ensuring the material’s superior properties such as high thermal conductivity, chemical stability, and excellent electronic performance. Understanding these stages equips B2B buyers with the knowledge to assess supplier capabilities and product quality effectively.

1. Material Preparation

The initial stage begins with the sourcing and preparation of raw materials, primarily high-purity silicon and carbon sources. These materials must meet stringent purity requirements to avoid contamination, which can drastically impact the electrical and structural properties of the final 6H-SiC product. Suppliers typically employ advanced purification methods and chemical vapor deposition (CVD) precursors to ensure consistency.

2. Crystal Growth and Forming

The hallmark of 6H-SiC manufacturing is the crystal growth process, often executed via Physical Vapor Transport (PVT) or sublimation methods. This technique involves sublimating high-purity SiC powder at elevated temperatures (approximately 2,400°C) within a graphite crucible under vacuum or inert atmosphere. The vapor then deposits onto a seed crystal, forming large, single-crystal 6H-SiC boules. Precise control of temperature gradients, pressure, and gas flow is essential to control polytype formation, crystal defects, and overall yield.

3. Wafer Slicing and Surface Preparation

Post crystal growth, the boules are sliced into wafers using diamond wire saws, ensuring minimal mechanical stress and surface damage. Subsequent lapping and polishing processes refine the wafer surfaces to achieve the desired flatness and surface roughness critical for semiconductor applications. Advanced chemical mechanical polishing (CMP) techniques are often employed to remove subsurface damage and enhance surface quality.

4. Assembly and Device Fabrication

For applications involving semiconductor devices, wafers undergo further processing steps such as doping, epitaxial layer deposition, photolithography, and metallization. These steps require cleanroom environments and precision equipment to maintain device integrity and performance. Some suppliers specialize in delivering finished devices or wafers ready for integration, while others focus on supplying high-quality raw wafers.

5. Finishing and Packaging

The final stage involves cutting wafers into dies (if applicable), packaging, and labeling. Packaging must provide mechanical protection, thermal management, and electrical connectivity, tailored to specific end-use environments. Advanced packaging solutions may include hermetic sealing or ceramic substrates, especially for high-reliability industrial or automotive applications.

For B2B buyers, particularly those importing from diverse regions such as Africa, South America, the Middle East, and Europe, robust quality assurance (QA) and quality control (QC) systems are vital. They ensure that 6H-SiC materials meet international standards and performance expectations.

International and Industry Standards

- ISO 9001: This is the foundational quality management system standard ensuring consistent manufacturing processes, continual improvement, and customer satisfaction. Suppliers certified under ISO 9001 demonstrate commitment to systematic quality control.

- CE Marking: Important for buyers in Europe, CE certification indicates conformity with EU health, safety, and environmental protection standards. This is particularly relevant when 6H-SiC components are part of larger electrical or electronic systems.

- API Standards: For 6H-SiC used in energy or oil & gas sectors, compliance with American Petroleum Institute (API) standards can be critical, ensuring materials withstand harsh operational conditions.

- RoHS and REACH: These environmental compliance standards restrict hazardous substances and are essential for buyers focused on sustainability and regulatory compliance within Europe and beyond.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Raw materials and components are rigorously inspected upon arrival. Tests include chemical purity analysis and physical inspections to prevent defective inputs from entering production.

- In-Process Quality Control (IPQC): Continuous monitoring during crystal growth, slicing, and polishing stages using tools like X-ray diffraction (XRD) for crystal structure verification, surface profilometry for wafer flatness, and defect microscopy. Real-time adjustments reduce waste and maintain batch consistency.

- Final Quality Control (FQC): Comprehensive testing of finished wafers or devices, including electrical characterization (carrier mobility, resistivity), mechanical strength tests, and visual inspections. Final products must meet customer specifications and international standards before shipment.

Common Testing Methods

- X-ray Diffraction (XRD): Confirms the 6H polytype and identifies crystal defects or impurities.

- Photoluminescence and Raman Spectroscopy: Assess crystal quality and detect stress or defects in the lattice.

- Electrical Testing: Includes Hall effect measurements and resistivity testing to verify semiconductor properties.

- Surface Inspection: Optical microscopy and atomic force microscopy (AFM) to detect surface irregularities or contamination.

For buyers in Africa, South America, the Middle East, and Europe, verifying supplier QC processes is crucial to mitigate risks associated with cross-border procurement of advanced materials like 6H-SiC.

1. Supplier Audits

Conducting on-site or virtual audits allows buyers to evaluate manufacturing capabilities, QC systems, and compliance with standards. Audits should include documentation reviews, process walkthroughs, and interviews with quality managers. For remote buyers, partnering with third-party audit firms can provide unbiased assessments.

2. Requesting Detailed QC Reports

Buyers should insist on comprehensive QC documentation, including batch traceability, material certifications, test results, and compliance certificates. These reports enable verification of product conformity before shipment and support internal quality assurance processes.

3. Third-Party Inspection and Testing

Engaging independent laboratories to perform pre-shipment inspections or sample testing adds a layer of assurance. This is particularly beneficial for buyers unfamiliar with supplier regions or when entering new markets. Third-party labs with international accreditations (e.g., ISO/IEC 17025) ensure credible results.

4. Understanding Regional QC Nuances

- Africa & South America: Infrastructure and regulatory frameworks may vary widely. Buyers should prioritize suppliers with established export experience and certifications recognized globally.

- Middle East: Suppliers often comply with stringent petrochemical industry standards; buyers should leverage this by requesting API or equivalent certifications.

- Europe (Poland, Spain): Emphasis on environmental and safety compliance (RoHS, REACH, CE) is higher. Buyers must ensure suppliers meet these to avoid regulatory issues.

5. Contractual Quality Agreements

Incorporate explicit quality requirements, inspection rights, and penalties for non-compliance within purchase contracts. Clear agreements help align expectations and facilitate dispute resolution.

By adopting these best practices, international B2B buyers can confidently source high-quality 6H-SiC materials that meet both technical and regulatory requirements, ensuring successful integration into their advanced industrial applications.

Understanding the detailed cost structure and pricing dynamics of sourcing 6h-sic (6H Silicon Carbide) is critical for international B2B buyers aiming to optimize procurement strategies and control Total Cost of Ownership (TCO). This analysis breaks down the key cost components, pricing influencers, and strategic buyer tips tailored to markets across Africa, South America, the Middle East, and Europe.

Raw Materials

The base cost heavily depends on the quality and purity of silicon carbide powder. High-purity 6h-sic demands premium raw materials, directly impacting price. Material sourcing from reliable suppliers with consistent specifications is essential to avoid quality variations that increase downstream costs.

Labor Costs

Labor contributes significantly depending on the manufacturing region. Countries with higher labor costs, such as parts of Europe, will reflect this in the final price, whereas regions with lower wages may offer cost advantages but require vigilance on quality standards.

Manufacturing Overhead

This includes energy consumption (notably high in SiC crystal growth processes), equipment depreciation, and facility maintenance. Advanced manufacturing technologies can increase overhead but improve yield and consistency, influencing cost-effectiveness.

Tooling and Equipment

Specialized tooling for crystal slicing, polishing, and finishing 6h-sic wafers represents a substantial upfront and ongoing cost. Buyers should consider amortizing tooling expenses over large volumes to reduce unit costs.

Quality Control (QC)

Rigorous QC processes, including electrical testing and defect analysis, add to costs but are indispensable for ensuring product reliability, especially for critical applications in power electronics and semiconductors.

Logistics and Freight

International shipping costs vary widely based on origin, destination, and shipping mode. Fragility and high value of 6h-sic products necessitate premium packaging and insurance, adding to freight expenses.

Supplier Margin

Supplier pricing strategies incorporate profit margins that reflect market positioning, brand reputation, and after-sales support. Negotiation can influence this component but should be balanced against supplier reliability.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically secure volume discounts, spreading fixed costs over more units. Buyers from emerging markets should align order sizes with MOQ to avoid price premiums.

Product Specifications and Customization

Custom dimensions, doping levels, or wafer finishes increase complexity and cost. Standard specifications tend to benefit from economies of scale.

Material Grade and Certification

Certifications such as ISO, RoHS, and compliance with industry standards (e.g., SEMI standards) add assurance but also cost. Buyers targeting high-reliability sectors must prioritize certified materials despite higher prices.

Supplier Location and Reputation

Established suppliers in Europe or North America may command premium pricing for quality assurance, while emerging suppliers in Asia or other regions might offer cost savings with varying risk profiles.

Incoterms and Payment Terms

The choice of Incoterms (e.g., FOB, CIF, DDP) affects who bears freight, insurance, and customs clearance costs, directly influencing the landed cost. Favorable payment terms can improve cash flow but may increase unit prices.

Negotiate Beyond Price

Engage suppliers on lead times, quality guarantees, and after-sales support. For buyers in Africa and South America, building long-term partnerships can unlock better terms and technical collaboration.

Focus on Total Cost of Ownership (TCO)

Consider all costs, including defects, yield loss, and logistics delays. European buyers, especially in Poland and Spain, often prioritize TCO to balance quality and cost.

Leverage Volume Consolidation

Pooling orders across subsidiaries or partners can achieve higher volume discounts, essential for markets with fragmented demand.

Understand Pricing Nuances for Your Region

Import duties, VAT, and local regulations vary. Middle Eastern buyers should factor in customs procedures and potential tariffs when calculating landed costs.

Certifications as a Non-negotiable Factor

Especially for high-tech sectors, insist on certified materials to mitigate risks. This often justifies premium pricing and reduces warranty claims.

Plan for Logistics Complexity

Consider multimodal shipping options and local distribution hubs to reduce transit times and costs.

Prices for 6h-sic materials are highly variable and influenced by market demand, raw material availability, and technological advancements. The figures and factors discussed are indicative and should be validated with direct supplier quotations and market intelligence before procurement decisions.

By comprehensively analyzing cost drivers and pricing influencers, international B2B buyers can make informed sourcing decisions, tailor negotiations, and optimize the overall procurement strategy for 6h-sic products across diverse global markets.

Understanding the technical specifications of 6H-Silicon Carbide (6H-SiC) is crucial for making informed procurement decisions, especially when sourcing across diverse international markets such as Africa, South America, the Middle East, and Europe. Below are the key properties that directly impact performance, compatibility, and cost-efficiency:

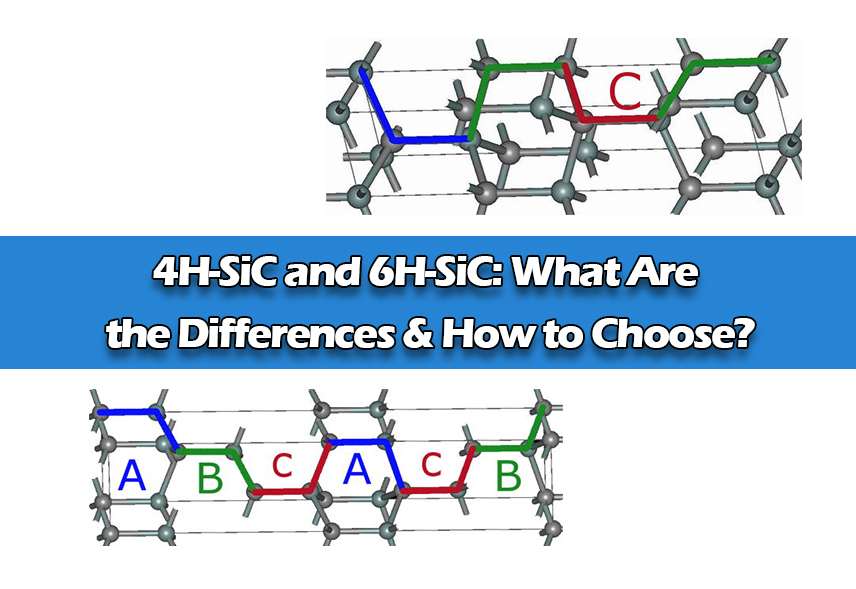

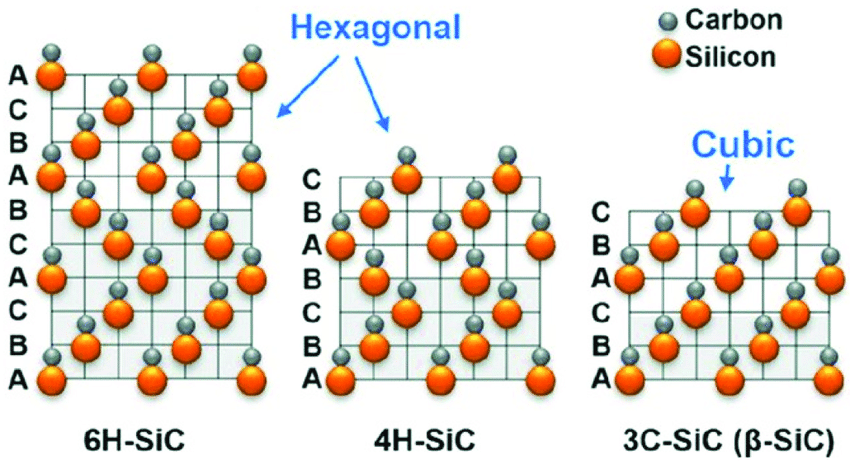

Material Grade (Polytype Purity)

6H-SiC refers to a specific hexagonal polytype of silicon carbide characterized by a particular stacking sequence of silicon and carbon atoms. High polytype purity ensures consistent electrical and thermal properties, critical for applications in power electronics and high-temperature devices. Buyers should verify the polytype grade to avoid performance variability.

Crystal Orientation and Wafer Size

The crystal orientation (commonly c-axis or a-axis) affects the electrical characteristics and mechanical strength of the material. Wafer size also plays a role in manufacturing scalability and cost. Larger wafers generally reduce unit costs but require advanced handling capabilities, which is a key consideration for buyers planning volume production.

Electrical Resistivity

This property indicates how strongly the material opposes the flow of electric current. For 6H-SiC, resistivity values are tailored depending on the application, such as semiconductors or high-power devices. Buyers should specify resistivity ranges to ensure compatibility with their device requirements.

Thermal Conductivity

One of 6H-SiC’s advantages is its high thermal conductivity, which enables efficient heat dissipation. This is essential for high-power and high-frequency applications. Buyers must assess thermal performance to prevent overheating and improve device longevity.

Tolerance and Surface Finish

Precise dimensional tolerances and smooth surface finishes are vital for integration into complex assemblies. Tight tolerances reduce the risk of defects and improve yield rates in manufacturing. Buyers should negotiate acceptable tolerance levels to balance cost and quality.

Doping Concentration

Doping involves adding impurities to modify electrical properties. For 6H-SiC, doping levels affect conductivity and carrier mobility. Buyers must communicate exact doping specifications to suppliers to achieve the desired electrical behavior.

Navigating the global 6H-SiC market requires familiarity with specific trade terms that streamline communication and mitigate risks. Here are essential jargon and their implications for B2B buyers:

OEM (Original Equipment Manufacturer)

Refers to companies that purchase 6H-SiC materials to incorporate into their own products. Understanding if your supplier or customer is an OEM helps clarify quality standards and volume expectations.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs can vary widely and impact inventory planning and cash flow. Buyers should negotiate MOQs that align with their production scale, especially when entering new markets.

RFQ (Request for Quotation)

A formal document sent to suppliers to request pricing and terms for specific quantities and specifications of 6H-SiC. Crafting clear RFQs with detailed technical and commercial requirements improves response accuracy and speeds up procurement cycles.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Selecting appropriate Incoterms reduces misunderstandings and unexpected costs.

Lead Time

The duration from placing an order to receiving the shipment. Lead times for 6H-SiC can be influenced by manufacturing complexity and logistics. Buyers must consider lead times in project planning to avoid production delays.

Batch Number / Lot Traceability

This term refers to the unique identification assigned to a production batch. Traceability is vital for quality control, warranty claims, and regulatory compliance. Buyers should request batch information to ensure consistency and facilitate problem resolution.

By mastering these technical properties and trade terms, international B2B buyers can enhance supplier negotiations, optimize supply chain management, and ensure product quality when sourcing 6H-SiC materials globally. This knowledge is especially important for markets with varying industrial standards and logistical challenges, such as Africa, South America, the Middle East, and Europe.

The 6h-sic sector is experiencing dynamic growth driven by rapid technological advancements and increasing demand across diverse industries such as automotive, electronics, and renewable energy. For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding these market dynamics is critical for optimizing sourcing strategies and capitalizing on emerging opportunities. Regions like Poland and Spain are actively investing in 6h-sic manufacturing capabilities, positioning themselves as key players in the European supply chain.

Globally, the push for higher efficiency and durability in semiconductors is fueling innovation in 6h-sic materials, which offer superior thermal conductivity and breakdown voltage compared to traditional silicon. This has led to a surge in demand for 6h-sic components in power electronics and electric vehicle (EV) infrastructure, sectors that are expanding rapidly in Africa and South America due to urbanization and energy transition initiatives.

Key sourcing trends include the adoption of advanced supply chain digitization tools, enabling real-time visibility and risk mitigation. Buyers increasingly prioritize suppliers who can provide traceability, quality assurance, and flexible production runs to accommodate evolving product specifications. Strategic partnerships and localized manufacturing hubs in emerging markets are also becoming essential to reduce lead times and logistical costs.

Additionally, buyers should monitor geopolitical factors affecting raw material availability, such as silicon carbide wafer supply constraints and export regulations from dominant producers in Asia. Diversification of supplier bases and long-term contract negotiations are recommended strategies to ensure consistent supply and competitive pricing.

Sustainability has become a pivotal consideration in the 6h-sic sector, with environmental impact and ethical sourcing gaining prominence among international buyers. The production of 6h-sic materials involves energy-intensive processes and the use of specialized chemicals, which necessitate stringent environmental management to minimize carbon footprints and hazardous waste.

B2B buyers from Africa, South America, the Middle East, and Europe are increasingly demanding green certifications such as ISO 14001 (Environmental Management) and RoHS (Restriction of Hazardous Substances) compliance to ensure suppliers adhere to global environmental standards. Additionally, certifications like the Responsible Business Alliance (RBA) Code of Conduct can provide assurance of ethical labor practices and responsible sourcing throughout the supply chain.

Illustrative Image (Source: Google Search)

Material innovation is also a key sustainability driver. Suppliers focusing on recycling silicon carbide scrap and reducing water usage during wafer fabrication are gaining competitive advantage. Buyers should evaluate suppliers’ sustainability reports and request transparency on lifecycle assessments to align procurement with corporate social responsibility goals.

Moreover, embedding sustainability into sourcing decisions not only mitigates reputational risks but also often results in cost savings through improved operational efficiencies. Collaborating with suppliers on sustainability initiatives can foster innovation and create resilient supply chains that meet the growing regulatory and consumer demand for environmentally responsible products.

The 6h-sic sector has evolved significantly since its inception in the late 20th century, initially emerging as a niche semiconductor technology primarily used for high-power and high-frequency applications. Early adoption was limited by manufacturing complexities and high production costs. However, advances in crystal growth techniques and wafer fabrication have expanded its commercial viability.

Over the past two decades, 6h-sic has transitioned from specialized industrial uses to mainstream adoption in automotive electronics, renewable energy systems, and telecommunications infrastructure. This evolution has been propelled by increasing demand for energy-efficient and robust semiconductor solutions capable of operating under extreme conditions.

Understanding this historical trajectory helps B2B buyers appreciate the maturity and scalability of 6h-sic technologies today, informing more strategic sourcing decisions that leverage the sector’s technological advancements and global production landscape.

How can I effectively vet suppliers of 6h-SiC to ensure reliability and quality?

Vetting suppliers requires a multi-step approach. Begin by reviewing their business licenses, certifications (such as ISO 9001 or industry-specific standards), and past export records. Request samples to verify product quality and consistency. Check references or client testimonials, particularly from regions similar to yours, to assess their international trade experience. Conduct virtual or on-site audits if possible. Prioritize suppliers who demonstrate transparency in their production processes and quality control systems, as this reduces risks related to counterfeit or substandard 6h-SiC.

What customization options are typically available for 6h-SiC products, and how can I negotiate them?

Many manufacturers offer customization in terms of crystal size, purity, doping levels, and wafer thickness to meet specific application needs. Clearly communicate your technical requirements and intended use cases upfront. Engage technical teams early to explore feasibility and cost implications. Negotiation should focus on balancing customization benefits with minimum order quantities (MOQs) and lead times. Establish clear documentation on specifications to avoid misunderstandings and ensure the supplier can meet your precise standards.

What are the standard MOQ and lead times for international orders of 6h-SiC, and how flexible are suppliers?

MOQs for 6h-SiC can vary significantly based on product type and customization level, often ranging from hundreds to thousands of units or wafers. Lead times typically range from 4 to 12 weeks, factoring in production and quality assurance processes. Suppliers in regions like Europe or the Middle East may offer shorter lead times due to advanced manufacturing capabilities. Flexibility depends on supplier capacity and relationship strength; establishing long-term partnerships can improve negotiation leverage for reduced MOQs and expedited delivery.

What payment terms are common in international 6h-SiC transactions, and how can I protect my investment?

Common payment methods include letters of credit (LC), telegraphic transfers (T/T), and escrow services. Letters of credit are preferred for high-value transactions as they offer security by ensuring payment only upon meeting agreed conditions. Negotiate staged payments tied to production milestones or inspection approvals to minimize risk. Always verify supplier bank details independently to avoid fraud, and consider working with trade finance specialists familiar with your region’s export-import regulations for added security.

Which quality assurance certifications should I look for when sourcing 6h-SiC internationally?

Key certifications include ISO 9001 for quality management and industry-specific standards such as SEMI (Semiconductor Equipment and Materials International) certifications. Additionally, RoHS (Restriction of Hazardous Substances) compliance is critical for environmentally sensitive markets, especially in Europe. Request detailed quality control documentation, including material traceability, batch testing reports, and failure analysis data. Suppliers with transparent QA processes and third-party lab certifications provide greater confidence in product consistency and compliance.

What logistical considerations are critical when importing 6h-SiC from regions like Africa, South America, or the Middle East?

Logistics challenges include customs clearance, transportation mode selection, and managing lead times. Ensure your supplier is experienced with export documentation such as commercial invoices, certificates of origin, and export licenses. Consider air freight for urgent shipments despite higher costs, or sea freight for bulk orders to optimize expenses. Partner with freight forwarders familiar with the regulatory environments of your destination country. Also, plan for potential delays due to geopolitical or seasonal factors affecting these regions.

Illustrative Image (Source: Google Search)

How should I handle disputes or quality issues with international 6h-SiC suppliers?

Establish clear contractual terms specifying dispute resolution mechanisms, such as arbitration in neutral jurisdictions. Maintain detailed records of communications, purchase orders, and quality inspections. In case of quality issues, promptly document and report defects with photographic evidence and third-party inspection reports if possible. Negotiate remediation options such as product replacement, partial refunds, or technical support. Building a collaborative relationship with your supplier often facilitates quicker resolutions than adversarial approaches.

What are best practices for ongoing supplier management to ensure consistent 6h-SiC supply and quality?

Develop a structured supplier evaluation process including periodic performance reviews based on delivery punctuality, product quality, and responsiveness. Foster open communication channels to discuss forecast changes, new requirements, or potential challenges. Invest in joint development projects or technical exchanges to align product innovations. Use digital tools for order tracking and quality reporting to enhance transparency. Cultivating trust and mutual understanding is key to securing a reliable supply chain across diverse international markets.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of 6h-sic offers international B2B buyers a pathway to enhanced operational efficiency, cost optimization, and supply chain resilience. For companies in Africa, South America, the Middle East, and Europe—including markets like Poland and Spain—leveraging 6h-sic’s unique properties can drive innovation in sectors such as electronics, automotive, and industrial manufacturing. Prioritizing partnerships with reliable suppliers who demonstrate quality assurance, scalability, and compliance with international standards is essential for maximizing value.

Key takeaways include the importance of thorough supplier evaluation, understanding regional market dynamics, and integrating advanced procurement technologies to streamline sourcing processes. Embracing strategic sourcing not only mitigates risks but also unlocks competitive advantages by fostering long-term supplier relationships and enabling flexible response to market fluctuations.

Looking ahead, the demand for 6h-sic is poised to grow alongside technological advancements and sustainability initiatives worldwide. International buyers are encouraged to proactively engage with emerging suppliers and invest in supply chain transparency to future-proof their procurement strategies. By doing so, businesses will not only secure access to high-performance materials but also position themselves as leaders in innovation and sustainable growth within their industries.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina