The global trade landscape for alumina and aluminum presents both immense opportunities and complex challenges for international B2B buyers. As foundational materials in industries ranging from automotive and aerospace to construction and packaging, understanding the nuanced differences between alumina and aluminum is crucial for strategic sourcing and supply chain optimization. For buyers in dynamic markets such as Africa, South America, the Middle East, and Europe—including key hubs like Kenya and Spain—making informed decisions can significantly impact cost efficiency, product quality, and competitive advantage.

This comprehensive guide is designed to demystify the alumina versus aluminum conundrum by offering a deep dive into their distinct types, production processes, and quality control standards. It also navigates the global supplier ecosystem, highlighting regional considerations and sourcing strategies tailored to diverse market conditions. Cost analysis and market trends are unpacked to help you anticipate price fluctuations and negotiate effectively.

By equipping you with actionable insights and answers to frequently asked questions, this guide empowers you to optimize procurement decisions, mitigate risks, and foster resilient supplier relationships. Whether you’re evaluating raw materials for manufacturing or refining supply chains for export, a clear grasp of alumina and aluminum’s roles and market dynamics will enhance your ability to source competitively and sustainably across international borders.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| High-Purity Alumina (HPA) | Ultra-high purity (99.99%+), fine white powder or crystals | LED manufacturing, electronics, aerospace coatings | Pros: Superior quality for sensitive applications; Cons: Higher cost, limited suppliers |

| Calcined Alumina | Produced by heating alumina hydrate, granular or powder form | Refractories, abrasives, ceramics | Pros: Versatile and widely available; Cons: Variable quality grades, requires specification clarity |

| Primary Aluminum (Ingots) | Raw aluminum metal, high purity, cast into ingots or billets | Automotive parts, construction, packaging | Pros: High demand, recyclable; Cons: Price volatility, energy-intensive production |

| Aluminum Alloys | Aluminum mixed with other metals (e.g., copper, magnesium) | Aerospace, automotive, machinery | Pros: Enhanced mechanical properties; Cons: Alloy composition complexity affects pricing and sourcing |

| Alumina Trihydrate (ATH) | Hydrated alumina, white powder, flame retardant properties | Flame retardants, fillers in plastics and rubbers | Pros: Cost-effective, multifunctional; Cons: Lower purity limits use in high-tech sectors |

High-Purity Alumina (HPA)

HPA is characterized by its exceptional purity, typically exceeding 99.99%, making it indispensable in high-tech industries such as LED manufacturing and aerospace coatings. Its fine particle size ensures excellent performance in optical and electronic applications. For B2B buyers, especially in technologically advanced sectors in Europe and the Middle East, verifying supplier certification and purity levels is crucial to meet stringent quality standards. However, the premium price and limited global production capacity require careful supplier vetting and long-term contract planning.

Calcined Alumina

Calcined alumina is created by heating alumina hydrate to remove water content, resulting in a granular or powder form with diverse particle sizes. This type is widely used in refractory linings, abrasives, and ceramic products, making it highly relevant for manufacturers in construction and heavy industry sectors across Africa and South America. Buyers should focus on specifying the exact grade and particle size to ensure compatibility with their production processes. Its broad availability offers competitive pricing but demands quality consistency checks.

Primary Aluminum (Ingots)

Primary aluminum is raw aluminum metal cast into ingots or billets, serving as the foundational material for various downstream industries including automotive, packaging, and construction. Given its energy-intensive production and price sensitivity to global markets, buyers from regions like Spain and Kenya must monitor market trends and consider sourcing from suppliers with sustainable production practices. The metal’s recyclability is a strong selling point, aligning with increasing environmental regulations and corporate social responsibility goals.

Aluminum Alloys

Aluminum alloys combine aluminum with elements such as copper, magnesium, or zinc to enhance strength, corrosion resistance, and machinability. These alloys are critical in aerospace, automotive, and machinery manufacturing sectors seeking materials tailored to specific performance requirements. For B2B buyers, understanding alloy composition and certification is essential to meet technical specifications and ensure product reliability. The complexity of alloy varieties demands thorough supplier collaboration and quality assurance processes.

Alumina Trihydrate (ATH)

ATH is a hydrated form of alumina used primarily as a flame retardant and filler in plastics, rubbers, and paints. Its cost-effectiveness and multifunctionality make it attractive for manufacturers in emerging markets and industrial applications across South America and Africa. Buyers should consider purity levels and particle size distribution to optimize performance in their formulations. Although ATH is less suitable for high-purity applications, its role in enhancing fire safety and material properties is increasingly valued in regulatory-conscious markets.

Related Video: Common Abrasive Grain Types: Ceramic Alumina, Zirconia Alumina, Aluminum Oxide - Cascade Abrasives

| Industry/Sector | Specific Application of alumina vs aluminum | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Aviation | Alumina: Ceramic coatings for engine components; Aluminum: Aircraft structural parts | Alumina provides heat resistance and durability; Aluminum offers lightweight strength | Ensure alumina purity and consistent particle size; Aluminum must meet aerospace-grade alloy standards and certifications |

| Automotive | Alumina: Brake pads and insulators; Aluminum: Body panels and engine blocks | Alumina enhances wear resistance and thermal insulation; Aluminum reduces vehicle weight, improving fuel efficiency | Source alumina with high thermal stability; Aluminum should have corrosion resistance and comply with automotive quality norms |

| Electronics & Electrical | Alumina: Substrates for electronic circuits; Aluminum: Heat sinks and casings | Alumina offers excellent electrical insulation; Aluminum provides efficient heat dissipation | Alumina must have high dielectric strength; Aluminum sourcing should focus on thermal conductivity and surface finish quality |

| Construction & Infrastructure | Alumina: Abrasive materials and refractory linings; Aluminum: Window frames and roofing | Alumina improves durability and wear resistance; Aluminum ensures lightweight, corrosion-resistant building materials | Alumina must be sourced with consistent hardness; Aluminum alloys should comply with regional building codes and environmental standards |

| Chemical & Industrial Processing | Alumina: Catalyst support and adsorbents; Aluminum: Chemical tanks and piping | Alumina supports catalytic efficiency and chemical stability; Aluminum offers corrosion resistance and structural integrity | Verify alumina’s surface area and purity; Aluminum must be compatible with chemicals and meet pressure vessel certifications |

Alumina and aluminum serve distinct yet complementary roles across various industries, each bringing unique benefits tailored to specific industrial needs.

In Aerospace & Aviation, alumina is primarily used as a ceramic coating on engine components, offering exceptional heat resistance and mechanical durability under extreme conditions. This helps extend engine life and improve safety. Aluminum, conversely, is favored for structural parts due to its high strength-to-weight ratio, reducing overall aircraft weight and enhancing fuel efficiency. For international buyers, especially from regions like Europe and the Middle East, sourcing aerospace-grade aluminum with certified alloy compositions and traceability is critical to meet stringent safety regulations.

Within the Automotive sector, alumina’s role in brake pads and electrical insulators is pivotal for thermal management and wear resistance. Aluminum’s lightweight nature is exploited in body panels and engine blocks to lower vehicle mass, which directly contributes to better fuel economy and lower emissions. Buyers from Africa and South America should prioritize suppliers offering alumina with consistent thermal stability and aluminum alloys that comply with regional automotive quality standards to ensure durability and performance.

The Electronics & Electrical industry relies on alumina substrates for circuit boards due to their excellent electrical insulation and thermal stability, enabling reliable device operation. Aluminum is widely used for heat sinks and protective casings, efficiently dissipating heat to prevent component failure. B2B buyers must verify alumina’s dielectric strength and aluminum’s thermal conductivity, especially when sourcing for high-tech manufacturing hubs in Europe or emerging markets like Kenya, where quality control impacts product longevity.

In Construction & Infrastructure, alumina’s abrasive properties are utilized in refractory linings and cutting tools, enhancing wear resistance in heavy-use environments. Aluminum’s corrosion resistance and light weight make it ideal for window frames, roofing, and façade elements, contributing to sustainable building designs. International buyers should focus on alumina hardness consistency and aluminum alloys that meet local building codes and environmental regulations, particularly in regions with harsh climates such as the Middle East.

Lastly, in Chemical & Industrial Processing, alumina acts as a catalyst support and adsorbent, critical for chemical reactions and purification processes. Aluminum is employed in the fabrication of chemical tanks and piping due to its corrosion resistance and structural reliability. Buyers must assess alumina’s surface area and purity to optimize catalytic activity, while aluminum must be sourced with certifications ensuring compatibility with aggressive chemicals and pressure conditions, crucial for industrial buyers in South America and Africa aiming to enhance operational safety and efficiency.

Related Video: Uses of metals - IGCSE Chemistry

Key Properties: Alumina (Al₂O₃) ceramics exhibit exceptional hardness, high thermal stability (up to ~1700°C), excellent wear resistance, and outstanding corrosion resistance against acids and alkalis. They have excellent electrical insulation properties and can withstand high pressures without deformation.

Pros & Cons: Alumina is highly durable and chemically inert, making it ideal for harsh environments. However, it is brittle, which limits its use in applications requiring impact resistance. Manufacturing complexity is higher due to sintering processes, leading to longer lead times and higher costs compared to metals.

Impact on Application: Alumina is preferred in applications involving abrasive media, high temperatures, or corrosive chemicals, such as pump components, valve seats, and electrical insulators. Its chemical inertness suits chemical processing industries common in Europe and the Middle East.

International Buyer Considerations: Buyers in Africa and South America should consider local manufacturing capabilities and availability of alumina ceramics, as import costs can be significant. Compliance with ASTM C799 or DIN EN 60672 standards is common in Europe and the Middle East, ensuring quality and consistency. Spain-based buyers often require materials meeting EU REACH regulations, while Kenyan buyers may focus on durability and cost-efficiency due to infrastructure challenges.

Key Properties: Aluminum offers excellent strength-to-weight ratio, good corrosion resistance (especially with anodizing), and excellent thermal and electrical conductivity. It performs well at moderate temperatures (up to ~200°C) but is less suitable for high-temperature applications.

Pros & Cons: Aluminum is lightweight, easy to machine, and relatively low cost, making it versatile for many industrial applications. However, it has lower hardness and wear resistance compared to alumina and can corrode in highly acidic or alkaline environments without proper surface treatment.

Impact on Application: Aluminum is widely used in structural components, heat exchangers, and lightweight machinery parts. It suits applications where weight reduction is critical, such as automotive and aerospace sectors prevalent in Europe and South America.

International Buyer Considerations: Compliance with ASTM B209, DIN EN 485, or JIS H4000 standards is typical. Buyers in the Middle East and Africa should consider local corrosion conditions, such as saline environments, and may require anodized or coated aluminum. Cost sensitivity is crucial in emerging markets like Kenya, where aluminum offers a cost-effective alternative to more expensive metals.

Key Properties: These composites combine aluminum’s lightweight and ductility with alumina’s hardness and thermal stability. They offer improved wear resistance, higher strength, and better thermal conductivity than pure aluminum.

Pros & Cons: MMCs provide a balanced solution for applications requiring both toughness and durability. Manufacturing is more complex and costly due to the composite processing techniques, such as powder metallurgy or stir casting.

Impact on Application: Ideal for automotive engine components, aerospace parts, and industrial machinery where enhanced mechanical properties and thermal management are needed. They perform well under moderate to high temperatures and abrasive conditions.

International Buyer Considerations: Buyers in Europe and the Middle East often seek MMCs for advanced engineering applications, requiring compliance with ISO 9001 and automotive-specific standards like IATF 16949. African and South American buyers should evaluate cost-benefit trade-offs, as MMCs can be expensive but offer longer service life, reducing total cost of ownership.

Key Properties: Alumina coatings provide a hard, corrosion-resistant surface on aluminum substrates, combining the benefits of both materials. Coatings can be applied via anodizing or thermal spray techniques, enhancing surface hardness and chemical resistance.

Pros & Cons: Coatings extend aluminum’s lifespan in corrosive or abrasive environments without significantly increasing weight. However, coating processes add manufacturing steps and costs, and coatings can wear or chip under extreme mechanical stress.

Impact on Application: Widely used in marine, chemical processing, and electrical industries where aluminum’s lightweight is needed but surface durability must be enhanced. Coatings improve resistance to saline environments common in Middle Eastern and African coastal regions.

International Buyer Considerations: Compliance with ASTM B580 (anodizing) or ISO 2063 (thermal spray) standards is important. Buyers from Spain and Europe often require environmentally friendly anodizing processes compliant with EU directives. In Africa and South America, buyers must balance coating benefits against added costs and maintenance requirements.

| Material | Typical Use Case for alumina vs aluminum | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alumina Ceramic | High-wear, high-temp, and corrosive environments | Exceptional hardness and chemical inertness | Brittleness and higher manufacturing complexity | High |

| Aluminum Metal (Pure/Alloys) | Lightweight structural and thermal applications | Lightweight and easy to machine | Lower wear resistance and corrosion in harsh media | Low |

| Alumina-Enhanced Aluminum MMCs | High-performance automotive, aerospace, and industrial parts | Balanced toughness and wear resistance | Complex and costly manufacturing | High |

| Alumina Coatings on Aluminum | Corrosion and wear protection for aluminum substrates | Combines aluminum’s lightness with alumina’s hardness | Coating wear and added processing cost | Medium |

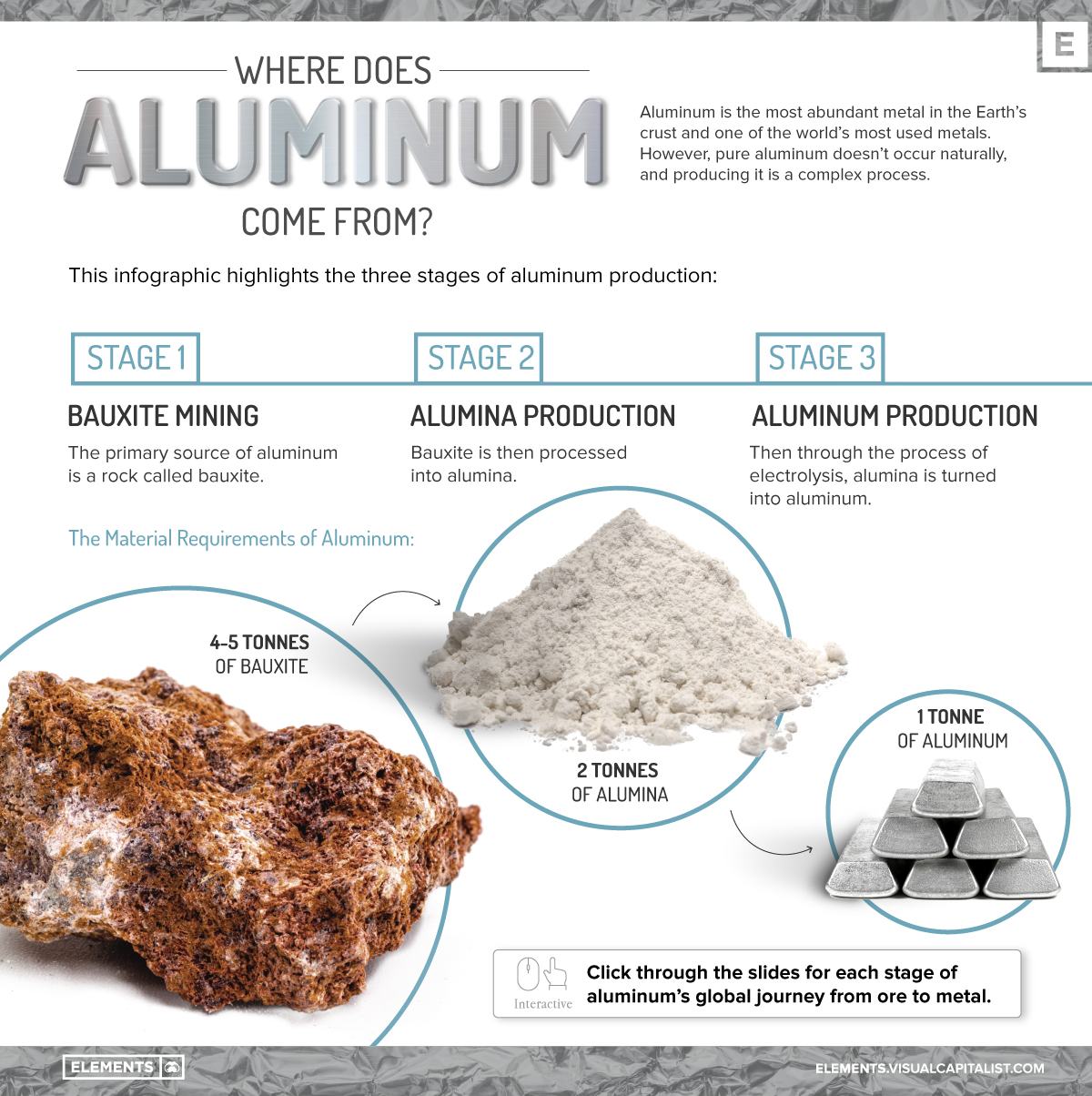

Understanding the manufacturing processes for alumina and aluminum is critical for B2B buyers aiming to source high-quality materials tailored to their specific industrial needs. Both materials undergo distinct production pathways, reflecting their different physical and chemical properties.

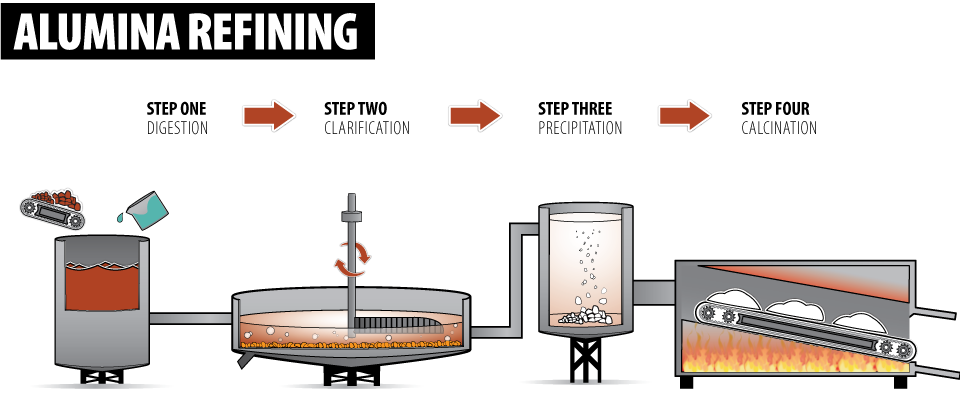

Raw Material Preparation:

Alumina (Al₂O₃) production begins with bauxite ore extraction, primarily sourced from regions such as Africa and South America. The bauxite is crushed and washed to remove impurities before chemical processing.

Refining (Bayer Process):

The most common method, the Bayer Process, involves digesting crushed bauxite in a hot sodium hydroxide solution, which dissolves the alumina content. Insoluble impurities are filtered out, producing a solution from which alumina hydrate is precipitated.

Calcination:

The alumina hydrate is then heated at temperatures above 1000°C in rotary kilns or fluidized bed calciners to remove water, yielding pure alumina powder. This stage is crucial for achieving the required purity and particle size.

Forming and Shaping:

Depending on the application, alumina powder may be pressed, cast, or sintered into shapes such as ceramics, refractories, or catalyst supports. Techniques include cold isostatic pressing or extrusion.

Finishing:

Final treatments like surface grinding, machining, or coating are applied to meet dimensional and performance specifications.

Raw Material Preparation:

Aluminum production starts with alumina derived from bauxite. High-purity alumina is critical for efficient aluminum smelting.

Electrolytic Reduction (Hall-Héroult Process):

Alumina is dissolved in molten cryolite and subjected to electrolysis to extract pure aluminum metal. This energy-intensive process is typically conducted in large smelters.

Casting:

Molten aluminum is cast into ingots, billets, or slabs. Continuous casting or direct chill casting are common methods, influencing downstream processing quality.

Forming:

Aluminum is shaped via rolling, extrusion, forging, or drawing depending on the final product requirements. Rolling produces sheets and foils, while extrusion creates profiles for construction and automotive sectors.

Heat Treatment and Finishing:

Treatments such as annealing improve mechanical properties. Surface finishing processes include anodizing, painting, or powder coating to enhance corrosion resistance and aesthetics.

For B2B buyers, especially those operating across Africa, South America, the Middle East, and Europe, rigorous quality assurance (QA) ensures materials meet international and industry-specific standards.

ISO 9001:

A foundational quality management system standard applicable to both alumina and aluminum manufacturers. Compliance ensures consistent product quality and continuous improvement.

CE Marking:

Relevant for aluminum products used within the European Economic Area (EEA), indicating conformity with EU safety, health, and environmental requirements.

API Standards:

Particularly important for aluminum components used in oil and gas industries, ensuring performance under extreme conditions.

ASTM and EN Standards:

Widely referenced for material composition, mechanical properties, and testing methods, crucial for validating supplier claims.

Incoming Quality Control (IQC):

Inspection of raw materials such as bauxite or alumina powder to verify chemical composition, moisture content, and contaminant levels.

In-Process Quality Control (IPQC):

Monitoring critical parameters during refining, smelting, or forming stages. For example, alumina purity during calcination or aluminum alloy composition during casting.

Final Quality Control (FQC):

Comprehensive testing of finished products including dimensional accuracy, surface finish, mechanical strength, and corrosion resistance.

Chemical Analysis:

X-ray fluorescence (XRF) and inductively coupled plasma (ICP) spectroscopy confirm elemental composition.

Physical Testing:

Hardness, tensile strength, and impact resistance tests assess mechanical properties.

Microstructural Examination:

Metallography and scanning electron microscopy (SEM) detect defects or inconsistencies.

Surface Quality Inspection:

Visual and non-destructive testing (NDT) methods such as ultrasonic or dye penetrant testing ensure integrity.

Ensuring supplier reliability and product quality is paramount in international trade. Buyers from regions like Kenya, Spain, Brazil, or the UAE can adopt the following strategies:

Conduct Supplier Audits:

Arrange on-site or virtual audits focusing on process controls, equipment condition, and workforce competency. Audits aligned with ISO 9001 requirements provide comprehensive insights.

Request Quality Documentation:

Insist on certificates of analysis (CoA), material test reports (MTR), and compliance certificates (e.g., CE, API). Verify their authenticity through recognized certification bodies.

Engage Third-Party Inspections:

Employ independent inspection agencies to perform random sampling, testing, and factory assessments, reducing risks of supplier misrepresentation.

Understand Regional QC Nuances:

For example, European buyers might prioritize CE compliance and REACH regulations, while African and Middle Eastern buyers may focus more on API standards for industrial applications. South American buyers should consider local environmental and import regulations impacting material standards.

Leverage Digital Quality Platforms:

Utilize supplier quality management software and blockchain-based traceability solutions to enhance transparency and traceability across the supply chain.

By mastering these manufacturing and QA intricacies, international buyers can make informed sourcing decisions, ensuring reliable supply and optimal material performance for their industries.

When evaluating alumina versus aluminum sourcing, understanding the nuanced cost structures and pricing dynamics is critical for international B2B buyers aiming to optimize procurement strategies. This analysis highlights key cost components, pricing influencers, and practical buyer tips tailored for diverse markets including Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Labor and Manufacturing Overhead

Aluminum manufacturing involves intensive smelting and alloying processes, requiring higher skilled labor and energy consumption, contributing to greater overhead costs compared to alumina, which is primarily refined but not heavily processed. Labor rates and operational efficiencies vary significantly across regions, impacting final pricing.

Tooling and Quality Control (QC)

Aluminum products often require specialized tooling for shaping and finishing, adding to upfront costs. QC standards for aluminum can be more stringent due to its end-use in structural and transport applications, necessitating certifications such as ISO or ASTM. Alumina suppliers focus QC on chemical purity and particle size distribution, which is critical for downstream aluminum quality.

Logistics and Transportation

Alumina is typically shipped in bulk, which can reduce per-unit transport costs but requires efficient port and rail infrastructure. Aluminum products, being finished or semi-finished goods, often demand more protective packaging and handling, increasing logistics costs. Geographic considerations, such as inland locations in Africa or South America with limited infrastructure, can elevate shipping expenses.

Supplier Margin

Margins differ based on product complexity and market demand. Alumina suppliers may operate on thinner margins due to commoditization, whereas aluminum producers can command higher premiums owing to value addition and customization.

Illustrative Image (Source: Google Search)

Order Volume and Minimum Order Quantities (MOQ)

Larger volumes typically reduce unit prices via economies of scale. Bulk buyers from industrial clusters in Europe or the Middle East can negotiate better terms. For smaller buyers in emerging markets, higher MOQs may pose challenges, necessitating careful demand forecasting.

Specifications and Customization

Aluminum alloys with specialized properties or custom dimensions attract price premiums. Conversely, standard-grade alumina tends to have more stable pricing but limited customization options.

Material Quality and Certifications

Products certified for aerospace, automotive, or food-grade applications command higher prices. Buyers in regulated markets like Europe must prioritize certification compliance, affecting sourcing costs.

Supplier Reputation and Reliability

Established suppliers with consistent quality and on-time delivery can justify premium pricing, a critical consideration for buyers in regions with volatile supply chains.

Incoterms and Payment Terms

The choice of Incoterms (e.g., FOB, CIF, DDP) influences cost allocation between buyers and sellers. For instance, CIF terms might simplify logistics for buyers in Africa but increase landed costs. Favorable payment terms such as deferred payment or letters of credit can improve cash flow management.

Leverage Total Cost of Ownership (TCO)

Beyond unit price, consider factors like transportation, tariffs, storage, and potential wastage. For example, aluminum’s higher upfront cost may be offset by lower processing requirements downstream.

Negotiate on Volume and Terms

Engage suppliers early to discuss flexible MOQs or phased deliveries, especially when entering new markets or scaling production.

Assess Local Infrastructure and Logistics

Factor in port capabilities, inland transport, and customs efficiency in regions like Kenya or Brazil to avoid hidden costs and delays.

Prioritize Quality Certifications Relevant to Your Market

Ensure alumina or aluminum products meet regional regulatory standards to prevent costly rejections or compliance issues.

Monitor Market Trends and Raw Material Prices

Stay informed on global bauxite and aluminum price fluctuations, as these directly impact sourcing costs.

Consider Supplier Diversification

Mitigate risks by sourcing from multiple regions or suppliers, balancing cost with supply security.

Prices for alumina and aluminum vary widely based on global commodity markets, geopolitical factors, and local economic conditions. The figures discussed are indicative and should be validated through direct supplier quotations and market research tailored to your specific sourcing region and requirements.

By integrating these insights, international B2B buyers can make informed decisions that balance cost, quality, and supply chain resilience when sourcing alumina or aluminum. This strategic approach is essential for competitive advantage in diverse markets spanning Africa, South America, the Middle East, and Europe.

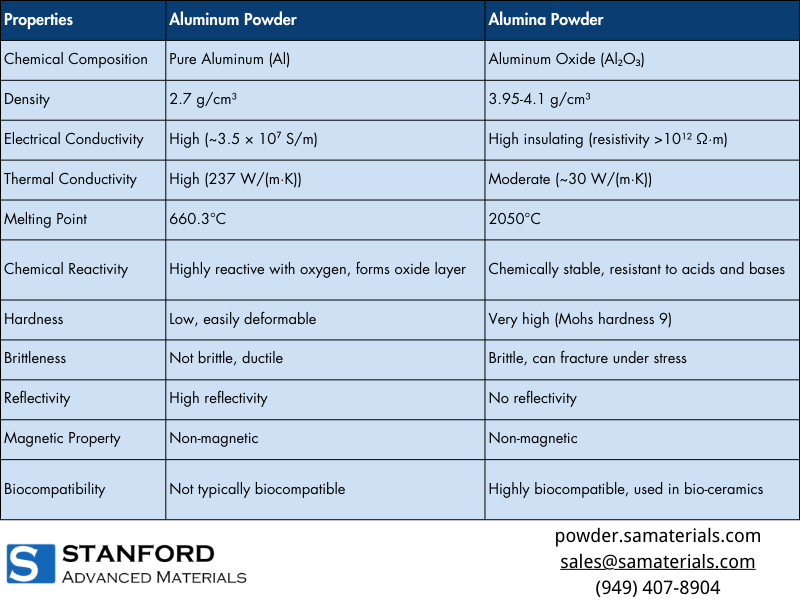

Understanding the essential technical properties of alumina and aluminum is critical for making informed purchasing decisions and ensuring product suitability in your supply chain. Here are the most important specifications to consider:

Material Grade

Alumina grades vary based on purity levels, typically ranging from 85% to 99.9% alumina content. Higher purity alumina is preferred for advanced ceramics and electronics due to better thermal and electrical properties. Aluminum grades (e.g., 1000, 6000 series) define alloy composition and mechanical characteristics. Choosing the correct grade impacts product performance, cost, and compliance with industry standards.

Particle Size (for Alumina)

In powder form, alumina particle size affects surface area, reactivity, and sintering behavior. Fine particles enable superior quality in ceramics and coatings but may increase cost. For B2B buyers in manufacturing, specifying the correct particle size ensures compatibility with your production process and final product quality.

Tolerance and Dimensional Accuracy (for Aluminum products)

Aluminum components often require tight dimensional tolerances, especially for OEM applications in automotive or aerospace sectors. Tolerances specify allowable deviations in size and shape, affecting assembly fit and performance. Clear communication of tolerance requirements helps avoid costly rework or rejects.

Thermal Conductivity

Aluminum is prized for its high thermal conductivity (~205 W/m·K), making it ideal for heat exchangers and electronics housings. Alumina, conversely, is an excellent electrical insulator with moderate thermal conductivity (~30 W/m·K), suited for insulating components. Understanding these differences guides material selection aligned with functional needs.

Mechanical Strength and Hardness

Aluminum alloys offer a balance of strength and ductility, with tensile strength varying from 70 MPa (pure aluminum) to over 500 MPa (high-strength alloys). Alumina is much harder and more brittle, with exceptional wear resistance. Buyers must align mechanical property requirements with end-use conditions to optimize durability and cost-efficiency.

Corrosion Resistance

Aluminum naturally forms a protective oxide layer, offering good corrosion resistance in many environments. Alumina is chemically inert and highly resistant to corrosion and abrasion, making it ideal for harsh chemical or abrasive conditions. This property is crucial when sourcing materials for outdoor or industrial applications.

Navigating international B2B transactions requires familiarity with key trade terms and jargon that streamline communication and negotiation. Here are essential terms to know when dealing with alumina and aluminum suppliers:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or components used in another company’s finished products. When sourcing aluminum or alumina for OEM applications, specifying OEM standards ensures material quality and traceability meet rigorous production requirements.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in a single order. MOQs can vary widely depending on material type, grade, and supplier capabilities. Understanding MOQ helps buyers, especially SMEs in Africa or South America, plan inventory and manage cash flow effectively.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specific materials or products. An RFQ should clearly specify alumina or aluminum grades, quantities, and technical requirements to receive accurate and comparable offers.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce (ICC) that define responsibilities between buyers and sellers for shipping, insurance, and customs duties. Common terms include FOB (Free on Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Selecting the right Incoterm reduces risk and clarifies cost allocation, crucial for cross-border trade between Europe, the Middle East, and emerging markets.

Certificate of Analysis (CoA)

A document provided by the supplier detailing the chemical and physical properties of the batch supplied. For alumina and aluminum, a CoA verifies compliance with agreed specifications, helping buyers ensure quality control and regulatory compliance.

Lead Time

The time between placing an order and receiving the goods. Lead times for alumina and aluminum can be affected by production complexity, shipping routes, and customs clearance, particularly relevant for buyers in regions with logistical challenges like parts of Africa and South America.

By mastering these technical specifications and trade terms, international B2B buyers can optimize supplier selection, negotiate better contracts, and ensure product quality aligns with operational requirements. This knowledge ultimately supports efficient procurement strategies across diverse markets.

The global alumina and aluminum markets are intricately linked yet exhibit distinct dynamics that international B2B buyers must navigate carefully. Alumina, primarily derived from bauxite, serves as the critical raw material for aluminum production. The demand for aluminum has been steadily increasing, driven by its lightweight, corrosion resistance, and recyclability, making it essential across automotive, aerospace, packaging, and construction sectors.

Key Market Drivers:

- Infrastructure and Automotive Growth: Emerging economies in Africa (e.g., Kenya) and South America are investing heavily in infrastructure and vehicle manufacturing, boosting aluminum demand. Europe, especially Spain, remains a major consumer focusing on high-quality aluminum for automotive and aerospace industries.

- Technological Advancements: Innovations such as improved electrolytic processes and digital supply chain management are enhancing production efficiency and transparency. Buyers benefit from better traceability and lower lead times.

- Supply Chain Diversification: Geopolitical tensions and trade tariffs have encouraged companies to diversify alumina and aluminum sourcing. African bauxite producers are becoming increasingly attractive due to proximity and cost advantages, while Middle Eastern buyers leverage integrated refining capabilities.

Emerging Sourcing Trends:

- Nearshoring and Regional Partnerships: Buyers in Europe and the Middle East prefer sourcing closer to end markets to reduce logistics costs and carbon footprint. Collaborative ventures with African mining firms are on the rise to secure stable alumina supplies.

- Digital Procurement Platforms: Adoption of AI-driven marketplaces and blockchain for provenance verification is growing, enabling buyers to assess supplier reliability and sustainability credentials in real time.

- Focus on Value-Added Products: Rather than raw alumina or primary aluminum, there is a shift towards semi-finished and alloyed aluminum products tailored to specific industrial needs, enhancing supply chain efficiency.

For international buyers, understanding these evolving dynamics is critical to optimizing procurement strategies, balancing cost, quality, and sustainability demands in a volatile global market.

Sustainability is no longer optional in the alumina and aluminum sectors; it is a core strategic imperative for B2B buyers globally. The environmental footprint of alumina refining and aluminum smelting is significant, involving high energy consumption and greenhouse gas emissions. Buyers from regions like Europe and the Middle East, where regulatory frameworks are stringent, increasingly demand suppliers demonstrate robust environmental stewardship.

Environmental Impacts to Consider:

- Energy Intensity: Aluminum production is energy-intensive, often relying on fossil fuels. Sourcing from suppliers using renewable energy (e.g., hydropower in parts of Africa and South America) can substantially reduce carbon footprints.

- Bauxite Mining Effects: Mining operations can lead to deforestation, biodiversity loss, and water contamination if not managed responsibly. Ethical sourcing requires transparent impact assessments and community engagement.

Importance of Ethical Supply Chains:

- Buyers must insist on traceability from bauxite extraction through alumina refining to aluminum production. This includes verification of labor standards, land rights, and local community benefits.

- Certifications such as the Aluminium Stewardship Initiative (ASI) and Chain of Custody standards offer assurance of responsible sourcing and production practices.

Green Certifications and Materials:

- Aluminum products labeled as “low-carbon” or “recycled content” are gaining preference, especially in European and Middle Eastern markets. Recycled aluminum requires up to 95% less energy than primary production, making it a key lever for sustainability.

- Buyers should collaborate with suppliers to prioritize materials certified under globally recognized schemes, aligning procurement with corporate ESG goals and regulatory compliance.

Adopting sustainability criteria not only mitigates risk but also enhances brand reputation and opens access to markets with strict environmental standards.

The alumina and aluminum industries have undergone significant transformation since aluminum’s commercial production began in the late 19th century. Initially, aluminum was a rare and costly metal due to the complexity of extracting it from bauxite through the Bayer process (for alumina) and the Hall-Héroult process (for aluminum smelting).

Over the decades, technological innovations have improved extraction efficiency and reduced costs, making aluminum widely accessible. The mid-20th century marked a surge in aluminum use driven by aerospace and automotive sectors, setting the stage for the modern global supply chains connecting bauxite-rich regions in Africa and South America with processing hubs in Europe and the Middle East.

Today, the focus has shifted from volume to value—integrating sustainability, digitalization, and strategic sourcing partnerships. For B2B buyers, understanding this evolution helps anticipate future market shifts and align procurement strategies with long-term industry trajectories.

1. How can I effectively vet suppliers of alumina and aluminum in international markets like Africa, South America, and Europe?

Thorough supplier vetting is critical to ensure quality and reliability. Start by verifying the supplier’s business licenses and certifications, such as ISO 9001 or industry-specific standards. Request samples to evaluate product quality firsthand. Check references and reviews from other B2B buyers, especially those in your region. Additionally, assess the supplier’s production capacity and financial stability to avoid supply disruptions. For regions like Africa or the Middle East, consider local trade associations or chambers of commerce to validate supplier legitimacy and gain regional insights.

2. What customization options are typically available when sourcing alumina vs aluminum for industrial applications?

Customization varies between alumina and aluminum suppliers but commonly includes particle size distribution, purity levels for alumina, and alloy composition or form factors (sheets, billets, extrusions) for aluminum. International buyers should discuss specific technical requirements upfront, as customization can affect lead times and costs. Suppliers in Europe often offer advanced customization due to technological capabilities, while suppliers in emerging markets may provide more flexible MOQ options. Ensure your supplier can provide technical datasheets and support to align the product with your manufacturing needs.

3. What are common minimum order quantities (MOQs) and lead times for alumina and aluminum shipments to regions like South America or the Middle East?

MOQs for alumina and aluminum can vary widely based on supplier scale and product form. Alumina MOQs often start around 1-5 metric tons, while aluminum MOQs depend on product type—ranging from small batch extrusions to bulk ingots of 10+ metric tons. Lead times typically span 3-8 weeks, influenced by production schedules, customization, and shipping logistics. Buyers in South America and the Middle East should factor in additional transit times and customs clearance. Negotiating flexible MOQs with suppliers can be advantageous for testing new markets or scaling gradually.

4. Which payment terms are standard in international alumina and aluminum B2B transactions, and how can buyers mitigate financial risks?

Payment terms commonly include Letters of Credit (LC), Telegraphic Transfers (TT), and open account with credit insurance. LCs are preferred for higher-value transactions, offering security for both parties. Buyers should negotiate payment milestones aligned with production and shipment stages. To mitigate risks, conduct due diligence on supplier financial health, and consider trade credit insurance or escrow services. For buyers in emerging markets, working with reputable banks and leveraging international trade finance tools can enhance trust and cash flow management.

5. What quality assurance certifications should I require from alumina and aluminum suppliers to ensure compliance and product integrity?

Request certifications such as ISO 9001 for quality management, ISO 14001 for environmental standards, and specific industry-related certificates like ASTM or EN standards relevant to alumina and aluminum products. For alumina, ensure compliance with chemical purity standards; for aluminum, verify alloy specifications and mechanical properties certifications. Suppliers servicing European markets often adhere to stringent REACH and RoHS compliance, which is crucial for buyers concerned with sustainability and regulatory adherence. Independent third-party lab testing results further bolster trustworthiness.

6. How can international B2B buyers optimize logistics and shipping when importing alumina or aluminum from distant suppliers?

Efficient logistics planning involves selecting the right shipping mode—bulk sea freight for large volumes or air freight for urgent, smaller shipments. Understand port capabilities in your country, especially in Africa and South America, to avoid bottlenecks. Collaborate closely with freight forwarders experienced in handling alumina (bulk powders) and aluminum (heavy, often bulky items) to ensure proper packaging and customs documentation. Consider incoterms carefully to clarify responsibility for shipping costs, insurance, and risk transfer. Consolidated shipments can reduce costs but require coordination with multiple suppliers.

7. What dispute resolution mechanisms are advisable in international contracts for alumina and aluminum procurement?

Including clear dispute resolution clauses in contracts is essential. Arbitration under international bodies like the International Chamber of Commerce (ICC) or regional arbitration centers offers a neutral, enforceable solution. Mediation is another cost-effective option for resolving conflicts amicably. Ensure contracts specify governing law, jurisdiction, and timelines for dispute resolution. Buyers from regions such as the Middle East or Europe should adapt dispute clauses to local legal frameworks and consider including escalation procedures. Transparent communication and regular contract reviews minimize risks of disputes.

8. How can buyers from Africa or South America ensure sustainable and ethical sourcing of alumina and aluminum?

Sustainability is increasingly important in B2B procurement. Request suppliers’ environmental impact reports, certifications like ISO 14001, and compliance with responsible mining and production standards. Engage suppliers that demonstrate traceability in their supply chain, including ethical labor practices and reduced carbon footprints. Partnering with suppliers committed to circular economy principles or recycled aluminum can enhance your company’s ESG profile. Buyers should also leverage regional trade initiatives or sustainability platforms to connect with verified ethical suppliers aligned with global best practices.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Alumina and aluminum each play pivotal roles in global supply chains, but their distinct characteristics demand tailored sourcing strategies. For international B2B buyers in Africa, South America, the Middle East, and Europe, understanding the nuances between these materials is critical to optimizing cost, quality, and supply reliability. Alumina, as the essential raw material for aluminum production, requires a focus on stable upstream sourcing and geopolitical risk management, especially given its concentrated production hubs. Conversely, aluminum sourcing emphasizes finished product availability, alloy specifications, and sustainability credentials.

Illustrative Image (Source: Google Search)

Key takeaways for strategic sourcing include:

Looking ahead, buyers should proactively invest in collaborative supplier relationships and leverage digital procurement tools to enhance agility. As global demand shifts and environmental standards tighten, those who integrate strategic sourcing with market intelligence will secure competitive advantage. For companies in Spain, Kenya, Brazil, or the UAE, now is the time to deepen expertise in alumina and aluminum sourcing—transforming challenges into long-term growth opportunities.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina