The crystal structure of silicon carbide (SiC) plays a pivotal role in defining its exceptional physical and chemical properties, making it a cornerstone material across diverse high-performance industries. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding these structural nuances is essential for sourcing SiC products that meet stringent quality and performance standards.

This guide delivers a comprehensive roadmap to navigating the complexities of SiC’s crystal structures, including the various polytypes and their impact on material behavior. It explores critical aspects such as types of SiC materials, advanced manufacturing techniques, and rigorous quality control processes that ensure consistency and reliability. Furthermore, it provides an in-depth analysis of global supplier landscapes, pricing trends, and market dynamics tailored to the unique challenges and opportunities faced by buyers in emerging and established markets like Vietnam and South Africa.

By consolidating technical insights with practical sourcing strategies, this guide empowers international buyers to make informed decisions that optimize supply chain efficiency, cost-effectiveness, and end-product performance. Whether you are seeking to enhance your product portfolio or establish resilient partnerships, this resource equips you with the knowledge to confidently evaluate SiC suppliers and select materials that align with your specific application requirements.

In addition, a detailed FAQ section addresses common concerns and clarifies technical complexities, further supporting buyers in overcoming barriers to entry in the global SiC market. Ultimately, this guide is designed to be an indispensable tool for international B2B buyers aiming to leverage the full potential of silicon carbide’s crystal structure in their strategic sourcing endeavors.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

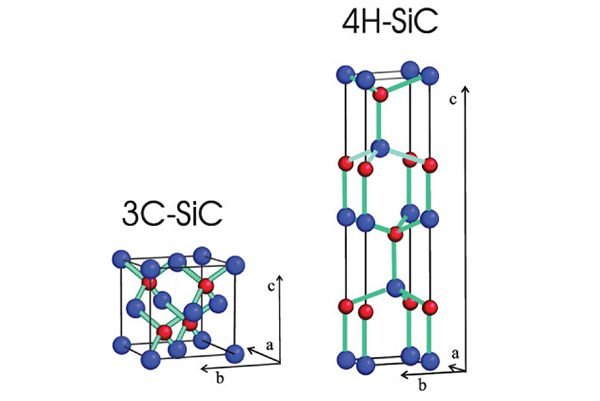

| 3C-SiC (Cubic) | Zinc blende structure, isotropic properties | High-frequency electronics, power devices | Pros: Uniform electrical properties; Cons: Lower thermal stability |

| 4H-SiC (Hexagonal) | Hexagonal crystal with four-layer stacking sequence | High-power devices, automotive electronics | Pros: High electron mobility, thermal conductivity; Cons: Higher cost |

| 6H-SiC (Hexagonal) | Hexagonal crystal with six-layer stacking sequence | Power electronics, LED substrates | Pros: Mature production; Cons: Lower electron mobility than 4H-SiC |

| 15R-SiC (Rhombohedral) | Rhombohedral stacking, less common polytype | Specialized electronics, research | Pros: Unique electrical properties; Cons: Limited availability, higher price |

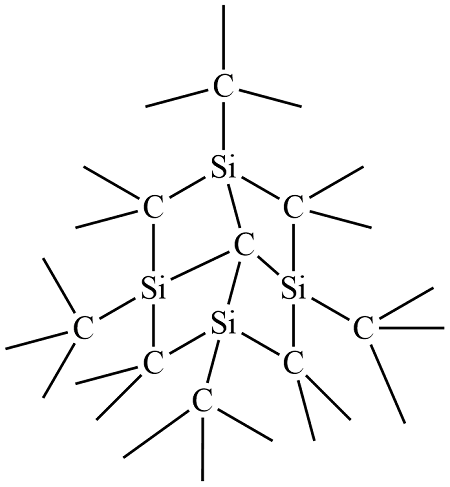

3C-SiC (Cubic) is characterized by its zinc blende crystal structure, offering isotropic electrical properties that are uniform in all directions. This makes it suitable for applications requiring consistent performance, such as high-frequency electronics and certain power devices. For B2B buyers, 3C-SiC can be cost-effective but may present challenges in thermal stability, which is critical for high-temperature environments. Assessing supplier capability in producing high-quality 3C-SiC wafers is essential.

4H-SiC (Hexagonal) is the most widely used hexagonal polytype, known for its high electron mobility and superior thermal conductivity. These features make it ideal for high-power electronics, automotive systems, and harsh environment applications. Buyers should consider the higher cost of 4H-SiC against its performance benefits, especially for industries in Africa and South America where durability under extreme conditions is a priority.

6H-SiC (Hexagonal) features a six-layer stacking sequence and has been traditionally used for power electronics and LED substrates. While it offers mature production processes and reliable supply chains, 6H-SiC has lower electron mobility compared to 4H-SiC, which can affect device efficiency. Buyers should evaluate their specific application needs and supplier expertise, particularly when sourcing from regions with emerging semiconductor markets.

15R-SiC (Rhombohedral) is a less common polytype with a rhombohedral crystal structure, offering unique electrical properties suited for specialized electronics and research applications. Its limited availability and higher price point mean it is generally reserved for niche B2B buyers seeking tailored performance characteristics. Strategic partnerships with manufacturers who can ensure consistent quality and delivery are critical for buyers in Europe and the Middle East exploring advanced SiC solutions.

Related Video: SiC Crystal Structure setup

| Industry/Sector | Specific Application of crystal structure of SiC | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-voltage, high-temperature semiconductor devices | Enhanced efficiency, reduced energy loss, and improved thermal management | Ensure high purity and defect-free SiC crystals; supplier reliability and certification are critical |

| Automotive | SiC-based power modules for electric vehicles (EVs) | Increased battery life, faster charging, and better thermal stability | Consistent crystal quality for mass production; compliance with automotive standards |

| Aerospace & Defense | Radiation-resistant electronics and high-frequency components | Superior durability under extreme conditions and reduced maintenance costs | Source from suppliers with proven quality control and traceability in aerospace-grade materials |

| Renewable Energy | SiC-based inverters for solar and wind power systems | Higher conversion efficiency and longer system lifespan | Focus on crystal uniformity and scalability to meet large-volume demands |

| Industrial Manufacturing | Wear-resistant coatings and abrasives based on SiC crystal structure | Extended tool life and reduced downtime in harsh machining environments | Prioritize supplier capability in producing tailored crystal structures for specific industrial needs |

The crystal structure of silicon carbide (SiC) is pivotal in power electronics, where its wide bandgap and high thermal conductivity enable the production of high-voltage, high-temperature semiconductor devices. International buyers, especially in regions like Europe and the Middle East, should prioritize sourcing SiC crystals with minimal defects and high purity to ensure device reliability and longevity under demanding electrical loads.

In the automotive sector, SiC is transforming electric vehicle (EV) power modules by offering superior thermal management and efficiency. Buyers from emerging markets such as South Africa and Vietnam need to focus on suppliers that can deliver consistent crystal quality at scale, while meeting stringent automotive industry certifications to support large-scale EV production.

Aerospace and defense industries leverage SiC’s radiation resistance and stability at high frequencies for mission-critical electronics. For international procurement, traceability and strict quality control are essential, as these applications demand materials that perform reliably in extreme conditions, reducing maintenance and operational risks.

Renewable energy sectors utilize SiC in solar and wind power inverters, benefiting from its ability to operate efficiently at higher voltages and temperatures. Buyers from Africa and South America should consider suppliers capable of providing uniform crystal structures with scalability to support growing renewable energy infrastructure projects.

In industrial manufacturing, SiC’s crystal structure underpins wear-resistant coatings and abrasives that significantly extend tool life in harsh machining environments. For B2B buyers, especially in heavy manufacturing hubs, sourcing from producers who can tailor crystal properties to specific operational needs ensures reduced downtime and higher productivity.

Related Video: Silicon Carbide Explained - SiC Basics

Key Properties:

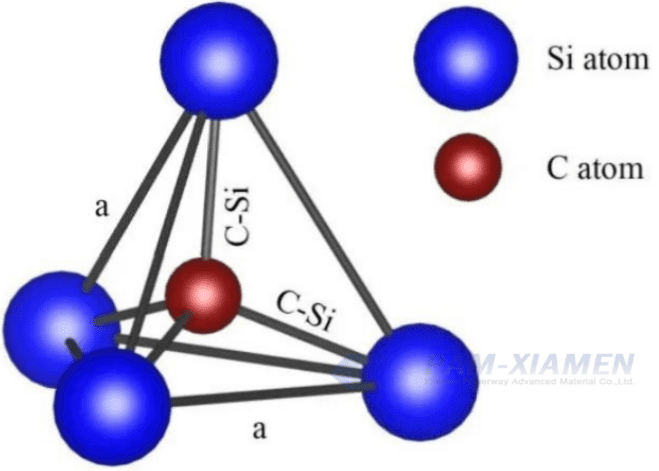

3C-SiC, or cubic silicon carbide, exhibits a zinc blende crystal structure with a lattice parameter of approximately 4.36 Å. It offers excellent thermal conductivity (~490 W/m·K) and high electron mobility, making it suitable for high-frequency electronic devices. Its temperature tolerance can reach up to 1600°C in inert atmospheres, with good chemical inertness against acids and alkalis.

Pros & Cons:

3C-SiC is advantageous for its relatively lower manufacturing complexity compared to hexagonal polytypes, enabling cost-effective production of thin films and wafers. However, it has lower thermal stability and mechanical strength than hexagonal SiC variants, limiting its use in extreme environments. The material's cubic symmetry simplifies device fabrication but may not meet all high-power or high-temperature demands.

Impact on Application:

This polytype is ideal for semiconductor devices requiring high electron mobility and moderate thermal endurance, such as power transistors and sensors. Its compatibility with silicon substrates facilitates integration in microelectronics but may be less suited for harsh chemical processing or high-pressure applications.

Considerations for International B2B Buyers:

Buyers from Africa, South America, the Middle East, and Europe should verify compliance with ASTM F127 or JIS C 6471 standards for electronic-grade SiC wafers. The availability of 3C-SiC is generally higher in regions with advanced semiconductor manufacturing, so logistics and lead times must be considered. Cost sensitivity in emerging markets like Vietnam and South Africa may favor this polytype for entry-level electronic components.

Key Properties:

4H-SiC is a hexagonal polytype characterized by a wide bandgap (~3.26 eV) and outstanding thermal conductivity (~490 W/m·K). It withstands high temperatures up to 1700°C and possesses superior chemical stability, making it highly resistant to oxidation and corrosion. Its high breakdown electric field (~3 MV/cm) supports high-voltage applications.

Pros & Cons:

4H-SiC offers excellent durability and performance in power electronics and harsh environments but is more complex and costly to manufacture due to precise control needed during crystal growth. Its mechanical hardness is high, which can increase machining and processing costs. However, the long-term reliability gains often justify the investment.

Impact on Application:

This polytype is favored for high-power, high-frequency devices such as MOSFETs, Schottky diodes, and high-temperature sensors. Its chemical resistance makes it suitable for corrosive industrial environments, including oil and gas or chemical processing sectors.

Considerations for International B2B Buyers:

Compliance with ASTM B911 and DIN EN standards is critical for buyers in Europe and the Middle East, where regulatory frameworks are stringent. For African and South American markets, ensuring supplier certifications and traceability is vital to meet local import regulations. The higher cost of 4H-SiC may require negotiation for volume discounts or long-term supply contracts.

Key Properties:

6H-SiC features a hexagonal crystal structure with a bandgap of about 3.0 eV and thermal conductivity around 370 W/m·K. It tolerates temperatures up to 1600°C and exhibits good resistance to chemical attack, particularly in oxidizing environments. Its electrical properties are slightly inferior to 4H-SiC but still suitable for many power applications.

Pros & Cons:

6H-SiC is generally easier to produce than 4H-SiC, offering a balance between performance and cost. However, its lower electron mobility and thermal conductivity limit its use in ultra-high-performance devices. It is mechanically robust but less optimized for cutting-edge semiconductor applications.

Impact on Application:

6H-SiC is often used in power devices where moderate performance suffices, such as diodes and thyristors. Its chemical resistance supports applications in moderately corrosive environments, including automotive exhaust systems and industrial heating elements.

Considerations for International B2B Buyers:

Buyers should confirm adherence to JIS C 6471 and IEC 60747 standards, especially in Asian and European markets. The material’s moderate cost and availability make it attractive for emerging markets in South America and Africa, where budget constraints are a factor. Importers should assess supplier quality assurance to mitigate risks associated with batch variability.

Key Properties:

Amorphous silicon carbide lacks long-range crystalline order but maintains high hardness, chemical inertness, and thermal stability up to approximately 1200°C. It provides excellent corrosion resistance and electrical insulation properties, making it suitable for protective coatings and dielectric layers.

Pros & Cons:

The amorphous form is easier and cheaper to deposit via chemical vapor deposition (CVD) or sputtering, allowing scalable production. However, it does not offer the superior electronic properties of crystalline SiC polytypes, limiting its use in semiconductor devices. Mechanical brittleness can be a concern for structural applications.

Impact on Application:

Amorphous SiC is widely used as protective coatings on mechanical parts, in MEMS devices, and as diffusion barriers in electronics. Its chemical resistance suits aggressive environments such as chemical processing plants and wastewater treatment.

Considerations for International B2B Buyers:

For buyers in regions like the Middle East and South America, amorphous SiC coatings provide cost-effective corrosion protection solutions compliant with ASTM B117 salt spray and ISO 9227 standards. Sourcing from suppliers with ISO 9001 certification ensures consistent film quality. The relatively low cost and ease of application make it appealing for infrastructure projects in Africa and Vietnam.

| Material | Typical Use Case for crystal structure of sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| 3C-SiC (Cubic) | Semiconductor wafers for moderate power and frequency devices | Lower manufacturing complexity and cost | Lower thermal stability and mechanical strength | Low |

| 4H-SiC (Hexagonal) | High-power electronics, high-temperature sensors | Superior thermal conductivity and chemical resistance | High production cost and complex manufacturing | High |

| 6H-SiC (Hexagonal) | Power diodes, automotive exhaust components | Balanced performance and cost | Lower electron mobility and thermal conductivity | Medium |

| Amorphous SiC | Protective coatings, MEMS, dielectric layers | Cost-effective corrosion resistance and easy |

The production of silicon carbide (SiC) crystals involves a sequence of highly controlled manufacturing stages, each critical to achieving the desired crystal quality and performance. Understanding these stages can empower B2B buyers to evaluate suppliers effectively and ensure product reliability.

The raw materials for SiC crystals primarily include high-purity silicon and carbon sources. Purity levels directly impact the final crystal quality and must meet stringent specifications. Material preparation typically involves:

Several advanced crystal growth methods are employed to create the SiC crystal structure, each with unique advantages:

Controlling parameters such as temperature gradients, gas flow, and pressure during these processes is crucial for minimizing defects like micropipes and dislocations.

Post-growth, the bulk SiC crystals undergo several processing steps:

Final finishing ensures the product meets exacting specifications:

For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, rigorous quality assurance protocols provide confidence in supplier reliability and product consistency.

Given the complexity of SiC crystal manufacturing and the critical nature of quality, buyers should adopt a proactive approach to supplier evaluation.

Buyers from Africa, South America, the Middle East, and Europe often face unique challenges due to geographic and regulatory differences:

By integrating these insights into their procurement strategies, international buyers can secure high-quality silicon carbide crystals that meet stringent performance criteria and support their technological and industrial objectives.

When sourcing the crystal structure of silicon carbide (SiC), international B2B buyers must carefully analyze the multiple cost components contributing to the final pricing. The primary cost elements include:

Several factors influence the pricing beyond the basic cost structure:

For buyers from Africa, South America, the Middle East, and Europe, including countries like Vietnam and South Africa, the following actionable insights can optimize sourcing outcomes:

Pricing for SiC crystal structures can vary widely depending on specification, volume, and supplier. Indicative prices should be used as a guideline only. Buyers are encouraged to request detailed quotations and perform supplier due diligence to obtain accurate, up-to-date pricing tailored to their specific requirements.

By thoroughly understanding these cost components and price influencers, international buyers can make informed procurement decisions, optimize their budgets, and build resilient supply chains for SiC crystal structures.

Understanding the critical technical properties and common trade terminology related to the crystal structure of silicon carbide (SiC) is essential for making informed purchasing decisions. This knowledge helps international B2B buyers—especially those from Africa, South America, the Middle East, and Europe—secure the right quality and terms that align with their industrial requirements.

Polytype (Material Grade)

Silicon carbide exists in multiple polytypes, such as 3C-SiC (cubic), 4H-SiC, and 6H-SiC (hexagonal). Each polytype has distinct electrical and thermal properties. For instance, 4H-SiC is preferred for high-power electronics due to its superior electron mobility. Understanding polytypes ensures buyers select the appropriate grade for applications like semiconductors, abrasives, or high-temperature components.

Lattice Tolerance

Lattice tolerance refers to the permissible deviation in crystal lattice parameters during manufacturing. Tight lattice tolerances guarantee consistent physical and electronic properties, which is crucial for high-precision applications such as power devices and LEDs. Buyers should specify tolerance ranges to avoid defects that could impair device performance.

Purity Level

Purity is a measure of how free the SiC material is from impurities such as metals or other non-SiC inclusions. Higher purity levels (typically >99.9%) are necessary for semiconductor applications to minimize electrical interference. Industrial abrasives or refractory uses may tolerate lower purity, affecting cost and availability.

Illustrative Image (Source: Google Search)

Crystallographic Orientation

This property defines the alignment of the crystal planes in the SiC material. Different orientations affect mechanical strength, thermal conductivity, and electron mobility. For example, SiC wafers cut along the (0001) plane are widely used in electronics. Buyers should communicate required orientations to suppliers to ensure compatibility with their manufacturing processes.

Defect Density

Defects such as stacking faults, dislocations, or micropipes impact the mechanical and electronic integrity of SiC crystals. Low defect density is critical for high-performance electronics, as defects can cause device failure. Buyers must balance defect density requirements with cost, as ultra-low defect SiC is more expensive.

Thermal Conductivity

SiC’s high thermal conductivity enables efficient heat dissipation in power electronics and high-temperature applications. Specifying thermal conductivity values helps ensure the material meets operational thermal management needs, which is particularly important in harsh environments common in mining, automotive, and aerospace industries.

OEM (Original Equipment Manufacturer)

Refers to companies that produce final products using SiC crystals as components. Understanding OEM requirements helps buyers align material specifications and quality standards with the end-users’ needs, especially when negotiating contracts or certifications.

MOQ (Minimum Order Quantity)

The smallest amount of SiC material a supplier is willing to sell per order. MOQs can vary significantly depending on supplier capabilities and product type. Buyers should assess MOQs carefully to optimize inventory costs and avoid overstocking, particularly in emerging markets with budget constraints.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and technical details. Crafting a precise RFQ with clear technical specifications (e.g., polytype, purity, defect density) is vital for receiving accurate quotes and comparing offers from multiple vendors.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers for shipping, insurance, and customs duties. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Selecting appropriate Incoterms can reduce risks and clarify cost allocation in international transactions.

Lead Time

The period between placing an order and receiving the goods. For SiC crystals, lead times can vary based on production complexity and supplier location. Buyers should negotiate realistic lead times to align with production schedules and avoid costly delays.

Batch Certification

Documentation provided by suppliers certifying that a specific batch of SiC material meets agreed technical standards and specifications. This is especially important for industries with strict quality control, such as aerospace or semiconductor manufacturing.

By mastering these technical properties and trade terms, international buyers can improve supplier communication, optimize procurement strategies, and ensure the SiC crystal materials meet their precise industrial requirements. This knowledge is particularly valuable for emerging markets where informed sourcing directly impacts product quality and competitive advantage.

The global market for silicon carbide (SiC) crystal structures is experiencing robust growth driven by rising demand in high-performance electronics, electric vehicles (EVs), renewable energy systems, and advanced semiconductor applications. SiC’s superior thermal conductivity, high breakdown electric field, and excellent chemical stability make it an indispensable material for power devices and sensors, fueling increased sourcing interest worldwide.

For international B2B buyers, especially in regions such as Africa, South America, the Middle East, and Europe, understanding regional supply chain dynamics is critical. Emerging markets like South Africa and Vietnam are rapidly expanding their industrial base, creating new opportunities for SiC crystal sourcing partnerships. However, these regions also face challenges such as limited local SiC production capacity, dependence on imports from established suppliers in Japan, the US, and Europe, and fluctuating logistics costs influenced by geopolitical factors.

Current sourcing trends highlight a shift toward vertically integrated supply chains, where buyers collaborate closely with crystal growers and device manufacturers to ensure consistent quality and supply reliability. Additionally, there is growing interest in advanced SiC substrates with engineered crystal defects and customized doping profiles tailored to specific industrial applications. These innovations offer enhanced device performance but require buyers to engage in more technically informed procurement processes.

Furthermore, digitalization and Industry 4.0 technologies are transforming B2B sourcing practices. Buyers increasingly leverage data analytics and AI-driven supplier evaluation tools to optimize sourcing decisions, assess supplier risk, and forecast market shifts. For regions with emerging economies, adopting these technologies can bridge gaps in market intelligence and enhance negotiation leverage.

Sustainability considerations are becoming paramount in the SiC crystal sector due to the material’s energy-intensive manufacturing process and the growing regulatory focus on environmental impact. The production of high-purity SiC crystals typically involves significant energy consumption and the use of hazardous chemicals, making environmental stewardship a key concern for responsible buyers.

Illustrative Image (Source: Google Search)

International buyers should prioritize suppliers who demonstrate commitment to green manufacturing practices, such as utilizing renewable energy sources, implementing waste reduction programs, and adhering to strict emissions controls. Certifications like ISO 14001 (Environmental Management Systems) and adherence to the Responsible Minerals Initiative (RMI) standards help verify supplier environmental and ethical compliance.

Ethical sourcing extends beyond environmental factors to include labor practices and supply chain transparency. Buyers from Africa, South America, and the Middle East should seek partners who ensure fair labor conditions, prohibit child labor, and maintain transparent traceability of raw materials. This is especially relevant in regions where supply chains may intersect with conflict minerals or politically unstable zones.

Moreover, the push for circular economy principles is influencing SiC sourcing strategies. Some manufacturers now incorporate recycled silicon carbide materials or develop processes to recover and reuse SiC wafers, reducing environmental footprints and material costs. Buyers aligned with these sustainability initiatives can not only meet increasing regulatory demands but also enhance their corporate social responsibility (CSR) profiles, which is often a decisive factor in B2B partnerships.

The development of silicon carbide as a semiconductor material dates back to the early 20th century, but it was not until the late 20th and early 21st centuries that advances in crystal growth technologies, such as the physical vapor transport (PVT) method, enabled commercial-scale production of high-quality SiC wafers. This evolution has been pivotal for industries requiring high-power and high-frequency electronic components.

For B2B buyers, understanding this historical progression is essential because the maturity of SiC crystal growth directly impacts availability, cost, and quality consistency. Early-stage suppliers often faced challenges in scaling production and controlling crystal defects, but today’s leading manufacturers have established reliable processes that meet stringent industrial standards.

As the SiC sector continues to mature, buyers benefit from improved product offerings, including larger wafer sizes and enhanced crystal uniformity, which translate into better device yields and lower total cost of ownership. This historical trajectory underscores the strategic importance of partnering with experienced suppliers who have evolved alongside the technology to deliver high-performance materials tailored for next-generation applications.

1. How can I effectively vet suppliers of the crystal structure of SiC for international B2B transactions?

Begin by verifying the supplier’s certifications, such as ISO 9001 for quality management and any specific industry-related accreditations. Request detailed technical datasheets and sample analysis reports to confirm the crystal structure quality and purity. Utilize trade platforms with verified supplier programs and seek references from existing international clients, especially those in your region. Conduct background checks on financial stability and export experience, ensuring they understand import regulations relevant to Africa, South America, the Middle East, and Europe. A thorough vetting process reduces risks associated with counterfeit or subpar SiC products.

2. What customization options are typically available for the crystal structure of SiC, and how do I negotiate them?

Customization in SiC crystal structures often includes modifications in polytype (e.g., 4H, 6H), doping levels, wafer size, thickness, and surface finish. Clearly communicate your technical specifications and application requirements upfront. Negotiate minimum order quantities (MOQs) for customized batches, as smaller runs may incur higher costs. Request prototype samples before committing to large orders to verify compliance with your standards. Establish a clear agreement on tolerances, turnaround times, and potential adjustments to avoid misunderstandings. Suppliers experienced in international trade will usually accommodate tailored needs if they align with production capabilities.

3. What are typical MOQs, lead times, and payment terms for international purchases of SiC crystal structures?

MOQs vary depending on the supplier’s production scale and customization level but generally range from hundreds to thousands of wafers or crystals. Lead times can span from 4 to 12 weeks, influenced by manufacturing complexity and shipping logistics. Payment terms commonly include 30% upfront deposit with the balance paid upon shipment or after inspection, often via Letter of Credit (L/C) or secure wire transfer to protect both parties. Negotiating flexible terms is possible with established suppliers, especially when building long-term partnerships. Always factor in additional time for customs clearance and regional compliance checks.

4. How can I ensure quality assurance and certification compliance for SiC crystal structures sourced internationally?

Request comprehensive quality assurance documentation, including crystal structure characterization by X-ray diffraction (XRD), defect density reports, and purity analysis. Confirm that suppliers comply with internationally recognized standards like SEMI or ASTM for semiconductor-grade SiC. Certificates of analysis (CoA) should accompany each shipment, and third-party inspections or audits can be arranged for large or recurring orders. Engage with suppliers who implement rigorous in-process quality controls and batch traceability. Ensuring certifications meet your country’s import regulations will smooth customs processes and reduce the risk of shipment rejection.

5. What logistics considerations should international B2B buyers keep in mind when importing SiC crystal structures?

Due to the fragile and high-value nature of SiC crystals, prioritize suppliers who use specialized packaging to prevent damage during transit. Understand Incoterms clearly—most international SiC shipments operate under FOB, CIF, or DDP depending on negotiation. Factor in customs duties, import taxes, and documentation requirements specific to your country or region. Working with freight forwarders experienced in handling sensitive electronic materials can improve delivery reliability. Plan for potential delays due to regional holidays or geopolitical events, especially when importing to Africa, South America, or the Middle East.

6. How should disputes related to quality or delivery be handled in international SiC crystal structure transactions?

First, establish a clear contract that outlines quality standards, delivery schedules, and dispute resolution mechanisms, such as arbitration clauses under ICC rules. Maintain detailed records of communications, inspection reports, and shipping documents. If quality issues arise, promptly notify the supplier with evidence and request corrective action or replacement. Engage third-party inspectors if necessary to provide unbiased assessments. For delivery delays, assess penalties or renegotiations based on contract terms. Building trust through transparent dialogue often facilitates amicable resolutions without resorting to litigation.

7. Are there regional differences in sourcing SiC crystal structures that B2B buyers should be aware of?

Yes, regional considerations include variations in supplier expertise, certification standards, and export regulations. For instance, European suppliers often emphasize stringent environmental and quality certifications, while suppliers in Asia may offer competitive pricing with rapid turnaround times. Import regulations in Africa and the Middle East might impose additional documentation or testing requirements. Currency fluctuations and trade tariffs can also impact pricing and payment terms. Understanding these nuances enables buyers to select suppliers aligned with their operational priorities and compliance needs.

8. What strategies can help optimize cost and reliability when sourcing SiC crystal structures internationally?

Leverage volume discounts by consolidating orders or partnering with suppliers offering scalable production. Develop long-term contracts to secure stable pricing and priority production slots. Utilize supplier audits and performance metrics to identify reliable partners and reduce risks of defects or delays. Consider nearshoring options where feasible to minimize logistics costs and lead times. Employ technology for real-time shipment tracking and quality monitoring. Lastly, engage in proactive communication to anticipate market shifts, such as raw material shortages or policy changes, enabling agile procurement decisions.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The crystal structure of silicon carbide (SiC) plays a pivotal role in defining its exceptional physical and chemical properties, which translate into high-performance applications across industries. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, understanding these structural nuances enables more informed procurement decisions, ensuring materials meet rigorous quality and performance standards.

Illustrative Image (Source: Google Search)

Key takeaways for strategic sourcing include:

Looking ahead, the increasing demand for SiC in sectors such as electric vehicles, renewable energy, and advanced electronics underscores the importance of forging resilient partnerships with suppliers who innovate around crystal structure optimization. Buyers in emerging and established markets alike should adopt a proactive sourcing strategy that integrates technical insight with market intelligence.

To capitalize on these opportunities, international B2B buyers are encouraged to engage deeply with their supply networks, invest in technical due diligence, and remain agile in adapting to evolving industry trends. This approach will not only secure superior SiC materials but also foster long-term competitive advantage in a rapidly advancing technological landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina