The global market for alumine utilisation presents unique challenges for B2B buyers, especially in regions such as Africa, South America, the Middle East, and Europe. As companies seek to source high-quality alumine for diverse applications—ranging from ceramics and glass to advanced materials—the complexities of supplier selection and cost management become increasingly significant. This guide aims to equip international buyers with the knowledge necessary to navigate these intricacies effectively.

Throughout this comprehensive resource, we will delve into various types of alumine, exploring their specific applications across industries. We will provide actionable insights into supplier vetting processes, ensuring that buyers can identify reputable manufacturers capable of meeting their quality and compliance standards. Additionally, we will discuss cost considerations, highlighting factors that influence pricing in different markets.

By addressing these critical areas, this guide empowers B2B buyers to make informed purchasing decisions. Whether you are a procurement officer in South Africa looking for reliable suppliers or a purchasing manager in Colombia seeking competitive pricing, the insights provided will help you minimize risks and enhance your sourcing strategy. Our goal is to foster a deeper understanding of alumine utilisation, enabling you to achieve your business objectives while maintaining a competitive edge in the global market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Calcined Alumina | High purity, fine particle size, excellent thermal stability | Ceramics, abrasives, and refractory materials | Pros: High performance; Cons: Higher cost |

| Reactive Alumina | Fast reactivity, low impurity levels, versatile in applications | Catalysts, adsorbents, and chemical processes | Pros: Quick response; Cons: Limited shelf life |

| Tabular Alumina | Large particle size, low porosity, high mechanical strength | Foundry, cement, and steel industries | Pros: Durable; Cons: Less versatile |

| Alpha Alumina | Stable crystal structure, high hardness, and thermal resistance | Aerospace, automotive, and electronics | Pros: Excellent durability; Cons: Expensive |

| Fused Alumina | Tough, dense structure, produced through melting alumina | Coatings, grinding wheels, and abrasives | Pros: Versatile; Cons: Energy-intensive production |

Calcined alumina is produced by heating aluminum hydroxide to high temperatures, resulting in a high-purity material. Its fine particle size and excellent thermal stability make it ideal for applications in ceramics and abrasives. B2B buyers should consider the quality and performance requirements of their end products, as calcined alumina can offer superior properties but may come at a higher price point.

Reactive alumina is characterized by its rapid reactivity and low impurity levels, making it suitable for applications in catalysts and adsorbents. Its versatility allows it to be used in various chemical processes. Buyers should evaluate the specific reactivity needs of their applications, as the limited shelf life of reactive alumina can affect inventory management and production schedules.

Tabular alumina features a larger particle size and low porosity, which provides high mechanical strength. It is commonly used in industries such as foundry and cement. B2B purchasers should weigh the durability benefits against the potential lack of versatility compared to other alumina types, depending on their specific application requirements.

Alpha alumina is known for its stable crystal structure, high hardness, and thermal resistance, making it an excellent choice for demanding applications in aerospace and electronics. Buyers should be prepared for the higher costs associated with alpha alumina, as its exceptional durability justifies the investment for high-performance needs.

Fused alumina is created through the melting of alumina, resulting in a tough, dense structure. It is widely used in coatings and grinding wheels due to its versatility. However, the energy-intensive production process can lead to higher prices. Buyers should consider the balance between performance and cost-effectiveness when evaluating fused alumina for their applications.

Related Video: The Genius Behind Bach's Goldberg Variations: CANONS

| Industry/Sector | Specific Application of alumine utilisation | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace | Lightweight materials for aircraft components | Reduces fuel consumption and increases payload capacity | Ensure compliance with aerospace standards and certifications. |

| Construction | Cement and concrete additives | Enhances strength and durability of structures | Look for high purity and specific particle size distribution. |

| Electronics | Insulation and substrate materials in electronic devices | Improves thermal management and electrical insulation | Source alumine with consistent quality and low impurity levels. |

| Automotive | Catalysts in exhaust systems | Reduces emissions and meets environmental regulations | Verify supplier's certifications and sustainability practices. |

| Healthcare | Components in dental and orthopedic implants | Biocompatibility and strength for medical applications | Ensure compliance with medical device regulations and testing standards. |

In the aerospace sector, alumine is primarily used to manufacture lightweight materials for aircraft components. These materials play a critical role in reducing overall aircraft weight, which directly contributes to lower fuel consumption and increased payload capacity. For international B2B buyers, especially in regions like South America and Europe, it is essential to source alumine that meets stringent aerospace standards and certifications to ensure safety and performance.

Alumine is utilized in the construction industry as an additive in cement and concrete formulations. It enhances the strength and durability of concrete, making it ideal for constructing robust structures. Buyers from Africa and the Middle East should prioritize high-purity alumine with specific particle size distributions to optimize performance in construction applications, as this will lead to better long-term structural integrity.

In the electronics industry, alumine serves as insulation and substrate material for various electronic devices. It is valued for its excellent thermal management and electrical insulation properties, which are critical in preventing overheating and ensuring device longevity. B2B buyers in Europe and South America must focus on sourcing alumine with consistent quality and low impurity levels to maintain the integrity of their electronic components.

Alumine is a key component in automotive catalysts, particularly in exhaust systems, where it helps reduce harmful emissions. This application is increasingly vital as automotive manufacturers worldwide strive to meet stringent environmental regulations. Buyers from regions like Africa and the Middle East should ensure that their alumine suppliers have the necessary certifications and sustainable practices in place to comply with these regulations.

In the healthcare sector, alumine is used in the production of dental and orthopedic implants due to its biocompatibility and strength. This makes it a preferred material for applications requiring durability and safety in medical devices. B2B buyers must ensure that their alumine sources comply with medical device regulations and testing standards, particularly in Europe and South America, where regulatory scrutiny is high.

A stock image related to alumine utilisation.

Related Video: Uses Of Metals - Gold, Copper, Aluminium, Steel | Properties of Matter | Chemistry | FuseSchool

The Problem:

B2B buyers often struggle with sourcing high-quality alumine that meets their specific requirements, particularly in emerging markets such as Africa and South America. This challenge can stem from a lack of reliable suppliers, inconsistent quality control, and limited access to advanced materials testing facilities. Buyers may find themselves receiving subpar products that do not meet the necessary specifications, resulting in increased costs and project delays. This situation not only affects production timelines but can also damage the buyer's reputation in their industry.

The Solution:

To overcome sourcing challenges, B2B buyers should develop a robust supplier evaluation process. Begin by researching potential suppliers through industry networks, trade shows, and online platforms that specialize in materials procurement. Look for suppliers who provide detailed certifications and quality assurance documentation for their alumine products. Establish direct communication with suppliers to discuss their production processes, quality control measures, and testing capabilities.

Additionally, consider implementing a pilot program where small quantities of alumine are sourced from multiple suppliers for testing. This strategy allows buyers to assess the quality and performance of the material in their specific applications before committing to larger orders. Engaging in long-term partnerships with trusted suppliers can lead to better pricing, reliability, and improved product quality.

The Problem:

International B2B buyers often face difficulties ensuring that the alumine they utilize complies with the varying regulations and standards across different regions. For instance, buyers from Europe may be accustomed to strict environmental regulations, while those in the Middle East might operate under different compliance frameworks. Failing to adhere to these standards can result in legal issues, financial penalties, and reputational damage.

The Solution:

To navigate compliance challenges effectively, buyers should invest time in understanding the specific regulations applicable to their industry and region. Create a compliance checklist that incorporates local, national, and international standards related to alumine utilization. Collaborate with legal and compliance experts to keep abreast of any regulatory changes that may impact sourcing and usage.

A stock image related to alumine utilisation.

Furthermore, buyers should prioritize suppliers who demonstrate a commitment to compliance and sustainability. Request documentation such as Material Safety Data Sheets (MSDS) and certifications that verify adherence to relevant standards. Establishing a compliance audit process for suppliers can also ensure that all materials are sourced in accordance with the required regulations, thus minimizing risks.

The Problem:

Many B2B buyers face inefficiencies in processing and utilizing alumine in their operations. This inefficiency often stems from a lack of understanding of the material's properties and the best practices for its application. As a result, buyers may encounter issues like improper mixing ratios, leading to suboptimal performance in final products, increased waste, and higher operational costs.

The Solution:

To enhance the processing and utilization of alumine, buyers should invest in training and educational resources for their teams. Conduct workshops or training sessions led by experts in material science or industry-specific applications of alumine. This investment in knowledge will empower staff to understand the material's properties and how they affect processing techniques.

Additionally, buyers should explore partnerships with research institutions or consultants who can provide insights on optimizing alumine utilization for their specific applications. Implementing a continuous improvement program that encourages feedback from production teams can also help identify processing bottlenecks and areas for enhancement. Regularly reviewing performance metrics related to alumine utilization will allow buyers to make data-driven decisions that optimize both quality and efficiency in their operations.

When considering alumine utilisation in various applications, selecting the appropriate material is crucial for ensuring optimal performance and longevity. Here, we analyze four common materials used in conjunction with alumine, focusing on their properties, advantages, disadvantages, and specific considerations for international B2B buyers.

Alumina ceramics are widely used due to their exceptional hardness and thermal stability. They can withstand high temperatures (up to 1600°C) and exhibit excellent corrosion resistance, making them ideal for harsh environments.

These composites combine alumina with silica to enhance thermal shock resistance and mechanical strength. They perform well in applications exposed to rapid temperature changes.

Alumina coatings are applied to various substrates to enhance wear resistance and thermal stability. These coatings can be tailored for specific applications, providing versatility.

These materials incorporate alumina particles into polymer matrices to enhance mechanical properties and thermal stability. They are increasingly used in various industrial applications.

| Material | Typical Use Case for Alumine Utilisation | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alumina Ceramics | Cutting tools, wear-resistant linings | High durability and thermal stability | Brittle; complex manufacturing | High |

| Alumina-Silica Composites | Thermal insulation, refractories | Improved toughness and lower cost | Lower hardness than pure alumina | Medium |

| Alumina Coatings | Automotive and aerospace components | Cost-effective performance enhancement | Coating adhesion issues | Medium |

| Alumina-Modified Polymers | Consumer goods, automotive parts | Lightweight with good flexibility | Limited high-temperature performance | Low |

This guide provides a comprehensive overview of the strategic material selection for alumine utilisation, highlighting critical factors that international B2B buyers should consider when making purchasing decisions.

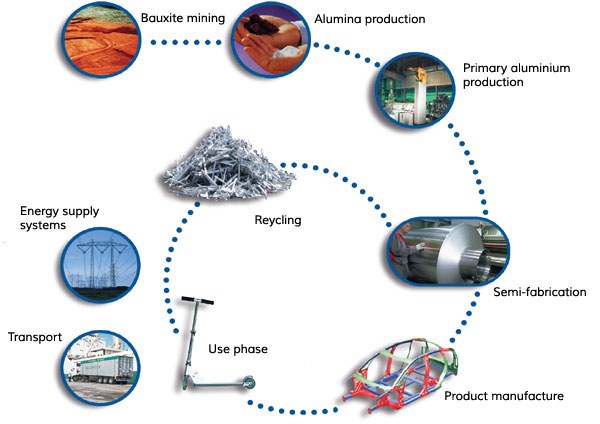

The manufacturing process for alumine, a crucial material in various industries including ceramics, metallurgy, and electronics, involves several well-defined stages. Understanding these stages is essential for international B2B buyers to ensure they partner with suppliers who meet their quality and performance standards.

Material Preparation

The first step in alumine manufacturing is the preparation of raw materials. This typically involves the sourcing of high-purity alumina from bauxite ore or synthetic routes. The raw materials undergo crushing and grinding to achieve the desired particle size. Furthermore, impurities must be removed to ensure the quality of the final product. Buyers should inquire about the supplier’s sourcing practices and the purity levels of the alumina they use.

Forming

Once the raw materials are prepared, the next stage is forming. Techniques such as extrusion, pressing, or casting are commonly used to shape the alumina into the desired forms. For instance, in the ceramic industry, alumina is often pressed into molds to create specific products. Buyers should assess the forming techniques employed by suppliers, as this can significantly impact the mechanical properties of the final product.

Assembly

In some applications, multiple alumina components may need to be assembled. This stage may involve techniques such as sintering, where the formed parts are heated to a temperature that causes them to bond without melting. This step is critical, particularly in industries requiring high-performance materials, as it affects the durability and functionality of the end product. Buyers should verify if the supplier has specific assembly processes and what quality measures are in place during this stage.

Finishing

The finishing stage includes surface treatments and coatings that enhance the properties of alumina products. Techniques such as polishing, coating, or thermal treatment are used to achieve the desired surface characteristics. Buyers should ensure that their suppliers offer suitable finishing options that comply with their industry requirements.

Quality assurance (QA) in the manufacturing of alumine is crucial to ensuring that products meet both international and industry-specific standards. B2B buyers must understand the QA processes that suppliers employ to maintain high-quality standards.

International Standards for Quality Control

Adhering to international standards such as ISO 9001 is essential for manufacturers of alumine. ISO 9001 outlines the criteria for a quality management system, emphasizing customer satisfaction and continuous improvement. Suppliers should provide documentation proving their compliance with these standards, which can reassure buyers about the reliability of their products.

Industry-Specific Certifications

In addition to general standards, certain industries may require specific certifications. For example, the CE mark is crucial for products sold in the European market, while API certifications may be necessary for those in the petroleum industry. B2B buyers should inquire about these certifications and ensure that their suppliers are compliant with relevant regulations.

Quality Control Checkpoints

Quality control in alumine manufacturing typically involves several checkpoints:

- Incoming Quality Control (IQC): This step involves inspecting raw materials upon arrival to ensure they meet predefined specifications.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing helps identify and rectify issues in real-time.

- Final Quality Control (FQC): This final inspection ensures that the finished products meet the required quality and performance standards before shipment.

Common Testing Methods in Quality Assurance

Various testing methods are used to verify the quality of alumina products, including:

- Physical Testing: Assessing properties such as density, porosity, and mechanical strength.

- Chemical Analysis: Ensuring that the chemical composition meets specified standards through techniques like X-ray fluorescence (XRF) or inductively coupled plasma (ICP).

- Thermal Analysis: Evaluating the thermal stability of alumina through differential thermal analysis (DTA) or thermogravimetric analysis (TGA).

For international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe, verifying the quality control processes of suppliers is essential to mitigate risks and ensure product reliability.

Conducting Supplier Audits

One of the most effective methods for verifying supplier quality is through on-site audits. These audits allow buyers to assess the manufacturing processes, quality control measures, and adherence to standards firsthand. It is advisable for buyers to develop a checklist of key quality indicators to evaluate during the audit.

Reviewing Quality Reports

Suppliers should provide detailed quality reports that include results from IQC, IPQC, and FQC processes. These reports should be comprehensive and cover various aspects of the manufacturing process, including any non-conformities and corrective actions taken.

Third-Party Inspections

Engaging third-party inspection services can provide an unbiased assessment of a supplier’s quality control processes. Such inspections can be particularly valuable for buyers who may not have the resources to conduct audits themselves. Third-party inspectors can verify compliance with international standards and provide certification.

Understanding QC Nuances for International Transactions

B2B buyers must be aware of the nuances in quality control that may vary across regions. For instance, specific countries may have additional regulations or standards that need to be adhered to. Buyers should conduct thorough research into the local compliance requirements of their suppliers, especially when sourcing from emerging markets.

In summary, the manufacturing processes and quality assurance measures in alumine utilisation are critical for international B2B buyers. By understanding the key stages of manufacturing, the importance of quality control, and how to verify supplier practices, buyers can make informed decisions that ensure the reliability and performance of alumine products. This knowledge is particularly vital for businesses operating in diverse markets across Africa, South America, the Middle East, and Europe, where quality standards can significantly impact operational success.

In the ever-evolving market for alumine utilisation, international B2B buyers must navigate a complex landscape to ensure they procure the right materials and services. This step-by-step checklist is designed to guide you through the sourcing process, ensuring that you make informed decisions that align with your business objectives.

Before beginning your search for suppliers, clearly outline your technical specifications for alumine utilisation. This includes determining the required grade, purity levels, and any specific applications. Having these specifications will help you communicate effectively with potential suppliers and ensure they can meet your needs.

Start by compiling a list of potential suppliers who specialize in alumine products. Utilize industry databases, trade shows, and online platforms to identify companies that align with your needs.

Once you have a list of potential suppliers, assess their capabilities to ensure they can fulfill your requirements. Request detailed information about their production processes, quality control measures, and capacity to handle your orders.

Before finalizing your supplier choice, verify their certifications and compliance with international standards. This is critical to mitigate risks related to quality and safety.

Prior to placing a large order, request samples of the alumine to conduct your own testing. This step is crucial to ensure that the product meets your specifications and performance criteria.

Once you have identified a suitable supplier, engage in negotiations to establish favorable terms and conditions. This includes pricing, payment terms, delivery schedules, and return policies.

After successfully sourcing alumine, focus on building a long-term relationship with your supplier. This can lead to better pricing, priority service, and improved collaboration in future projects.

By following this comprehensive checklist, B2B buyers can navigate the complexities of sourcing alumine utilisation effectively, ensuring that they make informed and strategic decisions that contribute to their business success.

When sourcing alumine for industrial applications, understanding the cost structure is essential for B2B buyers. The primary cost components include:

Materials: The price of alumine can fluctuate based on market demand, purity levels, and sourcing locations. Buyers should be aware that sourcing from regions with abundant raw materials may yield lower prices.

Labor: Labor costs can vary significantly depending on the region. For instance, labor in South Africa may be more cost-effective compared to Europe. It's crucial to factor in the skilled labor necessary for handling and processing alumine.

Manufacturing Overhead: This includes indirect costs associated with production, such as utilities, equipment maintenance, and facility costs. Buyers should inquire about these costs during negotiations as they can impact the final price.

Tooling: Custom tooling can add significant costs, especially if specialized equipment is required for processing alumine to meet specific specifications.

Quality Control (QC): Ensuring product quality is paramount, particularly when specific certifications are required. QC processes can add to the overall cost, but they are vital for maintaining standards.

Logistics: Shipping and handling costs can vary widely based on the supplier's location and the chosen shipping method. Buyers should consider both domestic and international logistics costs.

Margin: Suppliers will typically add a margin to cover their costs and generate profit. Understanding the typical margins in the alumine market can aid buyers in making informed decisions.

Several factors influence the pricing of alumine, which buyers must consider:

Volume and Minimum Order Quantity (MOQ): Suppliers often provide better pricing for larger orders. Understanding the MOQ can help buyers negotiate more favorable terms.

Specifications and Customization: Tailored products may incur higher costs. Buyers should clearly define their requirements to avoid unexpected charges for modifications.

Materials and Quality Certifications: Higher purity levels and certifications (like ISO or ASTM) can significantly increase costs. Buyers must weigh the benefits of higher quality against their budget.

Supplier Factors: The supplier’s reputation, reliability, and geographic location can affect pricing. Conducting thorough supplier assessments can lead to better deals.

Incoterms: Understanding Incoterms (International Commercial Terms) is crucial for determining responsibility for shipping costs, insurance, and tariffs. This knowledge can prevent misunderstandings and additional expenses.

For international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe, there are several strategies to enhance cost-efficiency:

Negotiate Pricing and Terms: Always engage in negotiations. Suppliers may have flexibility in pricing, especially for larger orders or long-term contracts.

Consider Total Cost of Ownership (TCO): Evaluate not just the purchase price, but also the long-term costs associated with quality, maintenance, and potential downtime due to inferior products.

Research Market Trends: Stay informed about market conditions and trends affecting alumine prices. This knowledge can empower buyers during negotiations and sourcing decisions.

Build Relationships with Suppliers: Establishing strong relationships can lead to better pricing and service. Suppliers may prioritize long-term clients for favorable terms.

Leverage Regional Trade Agreements: Be aware of trade agreements that may reduce tariffs and shipping costs, particularly for buyers in Africa and South America, to enhance competitiveness.

While the costs associated with alumine utilisation can vary based on numerous factors, careful analysis and strategic sourcing can lead to significant savings. Buyers should approach the market with a clear understanding of cost components, price influencers, and negotiation tactics to optimize their sourcing strategy.

When evaluating options for alumine utilisation, international B2B buyers must consider various alternative solutions that can meet their specific operational needs. Below, we present a comparison of alumine utilisation against two viable alternatives: alumina-based composites and synthetic zeolites. Each alternative offers distinct advantages and challenges that can impact decision-making processes.

| Comparison Aspect | Alumine Utilisation | Alumina-Based Composites | Synthetic Zeolites |

|---|---|---|---|

| Performance | High stability and durability | Enhanced mechanical properties | High adsorption capacity |

| Cost | Moderate initial investment | Higher due to manufacturing complexity | Variable based on synthesis method |

| Ease of Implementation | Straightforward application | Requires specialized techniques | Moderate; needs specific conditions |

| Maintenance | Low maintenance requirements | Moderate; can wear over time | Low; stable under most conditions |

| Best Use Case | Industrial applications, ceramics | Aerospace, automotive | Water treatment, catalysis |

Alumina-Based Composites provide enhanced mechanical properties, making them suitable for applications in the aerospace and automotive industries where strength and weight are critical. However, the manufacturing process can be complex, leading to higher costs. Additionally, while they offer exceptional performance, they may require specific handling and processing techniques, complicating implementation in some settings.

Synthetic Zeolites are notable for their high adsorption capacity, making them ideal for applications in water treatment and catalysis. Their synthesis can be tailored to achieve specific properties, which adds versatility to their use. However, the costs can vary significantly based on the synthesis method, and achieving the desired characteristics may require precise conditions. This makes them less straightforward to implement compared to alumine utilisation.

Selecting the right solution for alumine utilisation hinges on understanding the specific requirements of your operations. B2B buyers should evaluate performance metrics, total cost of ownership, and ease of integration into existing systems. Consideration of long-term maintenance and the best use cases for each solution will also guide informed decision-making. By carefully analyzing these factors, businesses can choose the solution that aligns with their strategic objectives and operational capabilities.

When engaging in the procurement of alumine, understanding its technical properties is crucial for B2B buyers to ensure optimal application and performance. Here are some essential specifications to consider:

Material Grade

- Definition: Material grade refers to the classification of alumine based on its chemical composition and purity level.

- Importance: Different grades of alumine serve various industrial applications, from ceramics to aluminum production. Ensuring the correct grade is essential for meeting product specifications and performance requirements.

Particle Size Distribution

- Definition: This specification indicates the range and average size of alumine particles.

- Importance: The particle size can significantly influence the material’s reactivity and strength. Buyers need to specify the desired particle size for applications like refractory materials or abrasives to ensure compatibility with production processes.

Alumina Content

- Definition: This refers to the percentage of aluminum oxide (Al2O3) present in the alumine product.

- Importance: Higher alumina content typically indicates greater purity and enhanced performance in applications. It is essential for buyers to assess the alumina content to ensure that it aligns with industry standards and product requirements.

Tolerance Levels

- Definition: Tolerance levels define the allowable variation in dimensions or properties of alumine materials.

- Importance: Precise tolerances are critical in industries such as aerospace or automotive, where material performance can impact safety and efficiency. Understanding these specifications helps buyers avoid costly production errors.

Bulk Density

- Definition: Bulk density measures the mass of alumine per unit volume, including voids between particles.

- Importance: This property affects shipping costs and storage requirements. Buyers should ensure that the bulk density meets their logistical and operational needs.

Navigating the procurement process requires familiarity with industry-specific terminology. Here are several common trade terms relevant to alumine utilisation:

OEM (Original Equipment Manufacturer)

- Definition: An OEM refers to a company that manufactures products or components that are sold under another company's brand.

- Usage: Understanding OEM specifications is vital for buyers sourcing alumine for manufacturing processes, as it affects quality and compatibility with existing products.

MOQ (Minimum Order Quantity)

- Definition: MOQ is the smallest quantity of a product that a supplier is willing to sell.

- Usage: Knowing the MOQ helps buyers plan their purchasing strategy and manage inventory effectively. It can also influence negotiations and pricing.

RFQ (Request for Quotation)

- Definition: An RFQ is a document used by buyers to solicit price quotes from suppliers for specific products or services.

- Usage: Submitting an RFQ allows buyers to compare costs and terms from different suppliers, facilitating informed decision-making.

Incoterms (International Commercial Terms)

- Definition: Incoterms are a set of international rules that define the responsibilities of buyers and sellers in international trade.

- Usage: Familiarity with Incoterms is crucial for buyers to understand shipping costs, risk transfer, and delivery obligations, which can significantly impact overall procurement costs.

Lead Time

- Definition: Lead time is the amount of time it takes from placing an order to receiving the goods.

- Usage: Buyers must consider lead time in their supply chain management to ensure timely delivery and avoid production delays.

By understanding these technical properties and trade terminology, B2B buyers can make more informed decisions when sourcing alumine, ultimately enhancing operational efficiency and product quality.

The alumine utilisation sector is experiencing significant shifts driven by global economic factors and technological advancements. Key drivers include the growing demand for lightweight materials in industries such as automotive and aerospace, where alumine's properties enhance fuel efficiency and reduce emissions. Furthermore, the push for advanced manufacturing techniques, including additive manufacturing and automation, is reshaping sourcing strategies, enabling buyers from Africa, South America, the Middle East, and Europe to access superior materials more efficiently.

Emerging B2B technologies, such as blockchain and AI-driven analytics, are revolutionizing supply chain transparency and efficiency. These technologies help buyers track the provenance of alumine products, ensuring compliance with international standards and fostering trust among stakeholders. For instance, buyers in Colombia and South Africa are increasingly adopting digital platforms to facilitate real-time sourcing, thereby reducing lead times and improving cost management.

Market dynamics are also influenced by regional variations in supply and demand. In Europe, stringent regulations on environmental impacts are compelling suppliers to innovate, while in Africa, the focus is often on maximizing local resource utilization. Buyers must navigate these complexities by aligning their sourcing strategies with regional market conditions and technological advancements.

Sustainability is becoming a crucial factor in the alumine utilisation sector, with increasing pressure on companies to minimize their environmental footprint. B2B buyers are now prioritizing suppliers who demonstrate a commitment to sustainable practices. This includes using recycled materials, implementing energy-efficient production processes, and reducing waste.

The importance of ethical supply chains cannot be overstated, as consumers and regulatory bodies alike demand transparency in sourcing practices. Companies that obtain 'green' certifications, such as ISO 14001, signal their commitment to environmental management, which can enhance their market position. For buyers in regions like the Middle East and South America, selecting suppliers with robust sustainability credentials can differentiate their offerings in competitive markets.

Moreover, the integration of 'green' materials into alumine utilisation not only meets compliance requirements but also appeals to environmentally conscious consumers. As global markets shift towards sustainability, buyers must evaluate potential suppliers based on their environmental practices and certifications to ensure alignment with their corporate responsibility goals.

The alumine utilisation sector has evolved significantly over the past century, transitioning from traditional extraction methods to advanced processing technologies. Initially, alumine was primarily sourced for its use in aluminum production. However, as industries recognized its beneficial properties—such as high thermal resistance and lightweight characteristics—its applications broadened to include ceramics, refractories, and even pharmaceuticals.

This historical evolution underscores the importance of understanding market trends for B2B buyers today. Companies that leverage historical insights can better anticipate future demands and adapt their sourcing strategies accordingly. For instance, the diversification of alumine applications has led to an increase in specialized suppliers, creating opportunities for buyers to source tailored solutions that meet specific industry needs.

In conclusion, navigating the complexities of the alumine utilisation sector requires a keen understanding of market dynamics, sustainability imperatives, and historical trends. By aligning sourcing strategies with these factors, B2B buyers can enhance their competitive advantage and contribute to a more sustainable future.

How do I choose the right alumine supplier for my business needs?

Choosing the right alumine supplier involves thorough research and evaluation. Start by assessing suppliers’ certifications and compliance with international quality standards such as ISO 9001. Check for their experience in your specific industry and their capacity to meet your volume requirements. Additionally, seek references or testimonials from other businesses in your region, particularly those in Africa, South America, the Middle East, and Europe, to gauge reliability and customer service quality.

What are the typical minimum order quantities (MOQ) for alumine products?

Minimum order quantities for alumine can vary significantly based on the supplier and the specific product. Generally, MOQs can range from a few tons to several hundred tons. It’s crucial to communicate your needs clearly with potential suppliers to negotiate favorable terms. Some suppliers may offer flexibility, especially for first-time buyers or smaller businesses, while others might maintain strict MOQs due to production constraints.

What payment terms should I expect when sourcing alumine internationally?

Payment terms for international alumine transactions typically range from upfront payments to net 30 or net 60 days after delivery. Some suppliers may offer payment via letters of credit for larger orders, ensuring security for both parties. It’s essential to discuss and finalize payment terms in advance to avoid misunderstandings. Additionally, consider the implications of currency fluctuations and transaction fees, especially when dealing with suppliers in different regions.

How can I ensure quality assurance (QA) in my alumine purchases?

To ensure quality assurance in alumine purchases, request detailed product specifications and certifications from suppliers. Implement a quality control plan that includes testing samples before full-scale orders. Establish clear communication regarding your quality standards and expectations. Additionally, consider third-party inspection services to verify product quality upon shipment, particularly when sourcing from regions with varying compliance standards.

What logistics considerations should I be aware of when importing alumine?

When importing alumine, logistics considerations include shipping methods, customs regulations, and local tariffs. Determine the most cost-effective and timely shipping options, whether by sea or air, and ensure you have a clear understanding of the documentation required for customs clearance. Engage a reliable freight forwarder experienced in handling alumine shipments, particularly for your target markets in Africa, South America, the Middle East, and Europe, to streamline the process.

Can alumine be customized to meet specific industry requirements?

Yes, alumine can often be customized to meet specific industry requirements, such as varying particle sizes or chemical compositions. When discussing your needs with suppliers, provide detailed specifications and desired applications. Some suppliers may have the capability to produce tailored formulations, while others may offer standard products that can be adjusted to a certain extent. Engage in discussions early in the procurement process to explore customization options.

What are the environmental considerations when sourcing alumine?

When sourcing alumine, consider the environmental impact of production and transportation. Look for suppliers that adhere to sustainable practices and have certifications related to environmental management, such as ISO 14001. Additionally, inquire about the source of the alumine and whether it is produced in a manner that minimizes ecological damage. Understanding a supplier's environmental policies can enhance your brand's reputation and compliance with regulations in your target markets.

How do trade regulations affect the import of alumine in different regions?

Trade regulations can significantly affect the import of alumine, varying by country and region. Familiarize yourself with import tariffs, quotas, and any trade agreements that may impact your sourcing strategy. For example, some countries may impose stricter regulations on alumine imports due to environmental concerns. Collaborate with customs experts or legal advisors to navigate these regulations effectively and ensure compliance, particularly when sourcing from diverse regions like Africa, South America, the Middle East, and Europe.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

As the global demand for alumine continues to rise, strategic sourcing emerges as a critical factor for businesses aiming to enhance their competitive edge. International B2B buyers, especially from Africa, South America, the Middle East, and Europe, must focus on establishing reliable supply chains that emphasize quality, sustainability, and cost-effectiveness. Leveraging local resources while also exploring international partnerships can lead to significant efficiencies and innovation in alumine utilization.

What Are the Key Takeaways for B2B Buyers in Alumine Sourcing?

Buyers should prioritize transparency and collaboration with suppliers to navigate the complexities of the alumine market. Understanding local regulations and market dynamics is essential for making informed decisions that align with both short-term goals and long-term sustainability. Moreover, investing in technology to monitor supply chain processes can enhance operational efficiency and reduce risks.

Looking Ahead: How Should B2B Buyers Prepare for Future Trends in Alumine Utilization?

As the landscape of alumine utilization evolves, staying ahead of market trends will be vital. Buyers are encouraged to engage in continuous market analysis and foster relationships with innovative suppliers. By doing so, they can not only secure their supply but also contribute to advancements in alumine applications across various industries. Now is the time to act—embrace strategic sourcing to unlock the full potential of alumine for your business.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina