In today’s interconnected economy, successfully sourcing b4c products demands a strategic, well-informed approach. For international B2B buyers across Africa, South America, the Middle East, and Europe—including dynamic markets such as Thailand and Italy—understanding the complexities of the global b4c supply chain is critical to maintaining competitive advantage and ensuring quality standards.

The significance of b4c lies not only in its diverse applications but also in the variety of types and materials available, each with unique manufacturing processes and quality control requirements. Navigating this landscape requires comprehensive knowledge—from evaluating supplier credibility to managing cost efficiency and compliance with international standards.

This guide offers a detailed roadmap tailored specifically for international buyers who aim to optimize their procurement strategies. It covers:

By leveraging this resource, buyers will gain the confidence to make informed sourcing decisions, reduce operational risks, and capitalize on emerging opportunities in the global b4c market. Whether you are expanding into new territories or refining existing procurement processes, this guide equips you with the actionable intelligence necessary for success in a competitive international environment.

Illustrative Image (Source: Google Search)

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Direct B4C | Straightforward transactions from business to consumer | Consumer goods, electronics, fashion | + Faster delivery, + Lower costs; - Limited bulk deals |

| Platform-based B4C | Uses digital marketplaces connecting businesses and consumers | E-commerce, digital services, FMCG | + Wide reach, + Scalability; - Platform fees, - Competition |

| Subscription B4C | Recurring delivery of goods/services to consumers | SaaS, consumer products, media | + Predictable revenue, + Customer loyalty; - Requires ongoing engagement |

| Customized B4C | Tailored products/services to individual consumer needs | Luxury goods, bespoke manufacturing, healthcare | + High customer satisfaction, + Differentiation; - Higher costs, - Longer lead times |

| Hybrid B4C | Combination of direct and platform approaches | Automotive, appliances, tech gadgets | + Flexibility, + Diverse channels; - Complex logistics, - Coordination challenges |

Direct B4C

This traditional model involves businesses selling directly to end consumers without intermediaries. It is highly suited for companies aiming to maintain control over branding and customer experience. For B2B buyers, sourcing direct B4C suppliers can ensure faster turnaround and cost efficiencies but may limit opportunities for volume discounts. Buyers should evaluate supplier capacity and reliability, especially when targeting diverse markets like Africa or South America where logistics can vary significantly.

Platform-based B4C

Digital marketplaces have transformed how businesses reach consumers globally. This type leverages platforms to expand market access and scale rapidly. B2B buyers benefit from a broad supplier base and simplified procurement but must navigate platform fees and intense competition. Understanding platform policies and local consumer preferences—particularly in regions such as the Middle East and Europe—is crucial for optimizing sourcing strategies.

Subscription B4C

Subscription models focus on recurring deliveries, fostering long-term consumer relationships and predictable revenue streams. This variation is ideal for businesses offering consumables or digital services. From a B2B perspective, buyers should assess supplier commitment to quality, fulfillment reliability, and customer retention tactics. This model suits markets with stable demand patterns, such as urban centers in Europe and South America.

Customized B4C

Customization caters to consumers seeking personalized products or services, enhancing differentiation and customer loyalty. B2B buyers engaging with customized B4C suppliers must consider higher production costs, longer lead times, and the complexity of managing bespoke orders. This type is particularly relevant in luxury, healthcare, and specialized manufacturing sectors, where precise specifications and quality assurance are paramount.

Hybrid B4C

Combining direct sales with platform presence, hybrid B4C models offer flexibility and channel diversification. For B2B buyers, this means navigating more complex logistics and coordination but gaining access to multiple consumer segments. This approach is advantageous in industries like automotive or electronics, where product complexity and after-sales service play critical roles. Evaluating supplier integration capabilities is key to leveraging hybrid models effectively.

Related Video: Heat Pump Thermostat O, B, and C Terminal Variations Explained

| Industry/Sector | Specific Application of b4c | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | High-performance brake components and armor plating | Enhanced durability and lightweight properties improve safety and fuel efficiency | Ensure consistent purity and particle size; supplier capability for bulk orders with certifications for automotive standards |

| Electronics & Semiconductors | Heat dissipation substrates and shielding materials | Superior thermal conductivity and electrical insulation reduce device failure rates | Verify material uniformity and compliance with international electronics standards; consider logistics for sensitive shipments |

| Aerospace & Defense | Wear-resistant coatings and structural composites | Increased component lifespan and resistance to extreme conditions lower maintenance costs | Confirm material traceability and compliance with aerospace quality management systems; prioritize suppliers with export licenses |

| Industrial Cutting Tools | Abrasives and cutting tool inserts | Exceptional hardness and thermal stability extend tool life and improve machining precision | Assess supplier quality control processes and availability of custom formulations; factor in import tariffs and delivery timelines |

| Energy Sector | Protective coatings for turbines and nuclear reactors | Corrosion resistance and thermal stability enhance operational reliability and safety | Source from suppliers experienced in energy-grade materials; ensure documentation for regulatory compliance and hazardous material handling |

In automotive manufacturing, b4c is predominantly used for producing high-performance brake components and armor plating. Its exceptional hardness and lightweight nature contribute to improved vehicle safety and fuel efficiency, addressing the growing demand for durable yet lighter materials. For international buyers, especially from regions like Europe and the Middle East, it is crucial to source b4c that meets stringent automotive industry standards and offers consistent particle size distribution to ensure uniform performance. Reliable suppliers with automotive certifications and the ability to handle large volume orders are preferred.

The electronics sector leverages b4c for heat dissipation substrates and electromagnetic shielding materials. Its excellent thermal conductivity coupled with electrical insulation properties helps mitigate device overheating and electromagnetic interference, which are common challenges in high-density circuit designs. Buyers from Africa and South America should focus on suppliers who guarantee material uniformity and comply with international electronics standards such as RoHS and REACH. Additionally, logistics planning is essential to manage the safe transport of sensitive materials across borders.

In aerospace and defense applications, b4c is utilized in wear-resistant coatings and structural composites. These applications benefit from b4c’s ability to withstand extreme mechanical stress and temperature fluctuations, thereby extending component lifespan and reducing maintenance frequency. For B2B buyers in regions like the Middle East and Europe, sourcing from suppliers with proven traceability, aerospace quality certifications (e.g., AS9100), and export licenses is critical to meet regulatory and operational requirements.

B4c’s superior hardness and thermal stability make it ideal for abrasives and cutting tool inserts used in precision machining. This application enhances tool durability and machining accuracy, leading to lower replacement costs and improved productivity. International buyers should evaluate supplier quality control processes rigorously and consider the availability of custom b4c formulations tailored to specific cutting conditions. Import tariffs and delivery schedules must also be factored into procurement decisions, especially for buyers in Africa and South America.

In the energy industry, b4c is applied as protective coatings for turbines and nuclear reactors due to its outstanding corrosion resistance and thermal stability. These properties help maintain operational reliability and safety under harsh environmental conditions. Buyers from all target regions should prioritize suppliers experienced in energy-grade materials who can provide comprehensive regulatory documentation. Compliance with hazardous material handling and export regulations is essential to ensure smooth cross-border transactions and operational safety.

Related Video: What are all the Laboratory Apparatus and their uses?

Key Properties: Stainless steel offers excellent corrosion resistance, high tensile strength, and good temperature tolerance, typically up to 870°C depending on the grade. It withstands moderate to high pressure environments and resists oxidation and chemical attack, making it versatile for various b4c applications.

Pros & Cons: The durability and longevity of stainless steel are major advantages, especially in harsh or corrosive environments. However, it is relatively expensive compared to other materials and requires more complex manufacturing processes, including precise welding and finishing. Its weight can also be a consideration in applications where lightness is critical.

Impact on Application: Stainless steel is ideal for applications involving aggressive media such as acidic or saline solutions. It maintains structural integrity under fluctuating temperatures and pressures, making it suitable for chemical processing and food-grade b4c products.

International Considerations: Buyers from Europe (e.g., Italy) and the Middle East often require compliance with ASTM A240 or DIN EN 10088 standards, ensuring material traceability and quality. African and South American buyers should verify local availability of certified stainless steel grades to avoid supply chain delays. Preference for specific grades like 304 or 316 depends on corrosion resistance needs and cost constraints.

Key Properties: Carbon steel is known for its high strength and toughness but has limited corrosion resistance unless coated or treated. It performs well under high pressure and moderate temperature conditions, generally up to 400°C.

Pros & Cons: Carbon steel is cost-effective and easier to machine and weld compared to stainless steel. However, its susceptibility to rust and corrosion without protective coatings limits its use in corrosive environments. Maintenance requirements can increase total lifecycle costs.

Impact on Application: Best suited for dry, non-corrosive environments or where protective coatings can be reliably applied. It is commonly used in structural components of b4c where mechanical strength is prioritized over corrosion resistance.

International Considerations: Compliance with ASTM A36 or DIN EN 10025 is critical for international buyers to ensure material quality. African and South American markets often favor carbon steel due to lower cost and local availability. Buyers in regions with humid climates (e.g., Middle East coastal areas) should consider corrosion protection strategies.

Key Properties: Polypropylene is a thermoplastic polymer with excellent chemical resistance, lightweight properties, and a temperature tolerance typically up to 100°C. It is resistant to many acids, bases, and solvents but has limited mechanical strength compared to metals.

Pros & Cons: PP is highly cost-effective, easy to manufacture via injection molding or extrusion, and provides excellent corrosion resistance without additional coatings. Its limitations include lower pressure and temperature ratings and susceptibility to UV degradation unless stabilized.

Impact on Application: Ideal for low-pressure, chemical handling b4c applications where corrosion resistance and cost are primary concerns. PP is commonly used in piping, tanks, and fittings for aggressive chemical media at ambient or slightly elevated temperatures.

International Considerations: Buyers in Africa and South America benefit from PP’s low cost and ease of replacement. European and Middle Eastern buyers should verify compliance with ISO 1873 or ASTM D4101 standards for polymer grade consistency. Consideration of local UV exposure and temperature ranges is important to ensure material longevity.

Key Properties: Titanium boasts exceptional strength-to-weight ratio, outstanding corrosion resistance (especially to chlorides and seawater), and can operate at temperatures up to 600°C. It is highly biocompatible and non-magnetic.

Pros & Cons: Titanium’s durability and corrosion resistance make it premium for high-performance b4c applications. However, it is significantly more expensive and difficult to machine and weld, requiring specialized manufacturing expertise.

Impact on Application: Preferred in highly corrosive environments such as seawater or chemical plants handling aggressive media. Its lightweight nature is advantageous in aerospace or portable b4c systems.

International Considerations: European and Middle Eastern buyers often require adherence to ASTM B265 or DIN 3.7035 standards for titanium. African and South American buyers should assess local supplier capabilities and cost implications. Import duties and supply chain logistics can impact total procurement cost due to titanium’s specialized nature.

| Material | Typical Use Case for b4c | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel | Chemical processing, food-grade applications | Excellent corrosion resistance and strength | Higher cost and complex manufacturing | High |

| Carbon Steel | Structural components, non-corrosive settings | Cost-effective and strong | Prone to corrosion without coatings | Low |

| Polypropylene | Chemical handling at low pressure/temperature | Lightweight, corrosion resistant, low cost | Limited temperature and pressure tolerance | Low |

| Titanium | Highly corrosive environments, aerospace | Superior corrosion resistance and strength-to-weight ratio | Very expensive and difficult to manufacture | High |

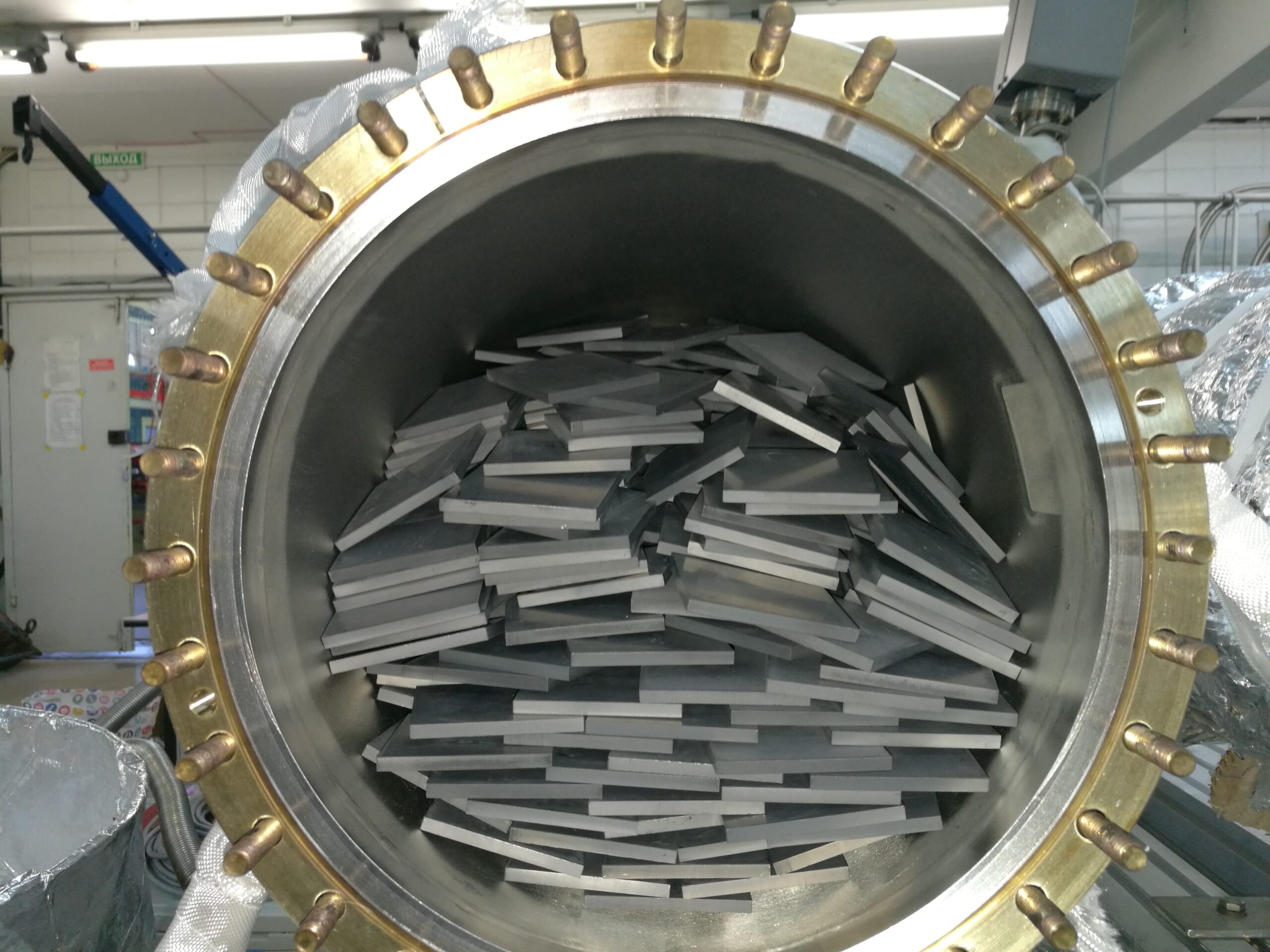

The manufacturing of b4c (boron carbide) products typically involves several critical stages, each tailored to ensure the material’s exceptional hardness and chemical stability are preserved while meeting stringent industry demands. Understanding these stages helps international B2B buyers evaluate supplier capabilities and anticipate product quality.

Raw boron carbide powder, often sourced from highly purified chemical precursors, is the starting point. The powder undergoes grading and sieving to achieve uniform particle size distribution, which is crucial for consistent densification during later stages. Additives or binders may be blended to enhance sintering behavior or mechanical properties.

This stage shapes the material into near-net shapes or components. Common forming techniques include:

Selecting the appropriate forming method depends on product design, volume, and required mechanical properties.

For composite or multi-part b4c products, assembly may involve bonding or mechanical joining. This step requires precision to maintain dimensional tolerances and ensure integrity under operational stresses.

Finishing operations enhance surface quality and dimensional accuracy. Techniques include:

Effective finishing is critical for applications demanding high precision, such as armor plates or abrasives.

Quality assurance (QA) in b4c manufacturing is multi-layered, addressing raw material integrity, in-process control, and final product verification. International B2B buyers must understand these QA mechanisms to ensure suppliers meet both regulatory and application-specific requirements.

Buyers should verify that suppliers hold certifications relevant to their target markets and applications.

Quality control is typically segmented into three main checkpoints:

Each checkpoint serves as a gatekeeper to prevent defective products from progressing through the supply chain.

Buyers should request detailed test reports to validate these parameters.

For B2B buyers from Africa, South America, the Middle East, and Europe, ensuring supplier quality control involves proactive engagement beyond documentation.

Conducting on-site or virtual audits helps verify compliance with manufacturing and QA protocols. Audits should cover:

Third-party audit firms with expertise in ceramics or refractory materials can add impartiality and technical depth.

Request comprehensive quality documentation including:

Detailed documentation enables buyers to assess consistency and risk.

Engaging independent inspection agencies or laboratories provides an additional layer of assurance. These entities can perform:

This is particularly important when sourcing from regions with varying regulatory oversight.

International buyers must consider regional nuances in quality assurance and certification for b4c products.

Understanding these regional differences enables buyers to tailor their QC verification strategies effectively.

By integrating these insights into procurement strategies, international B2B buyers can confidently source high-quality b4c products that meet stringent performance and regulatory demands.

Understanding the cost structure of b4c sourcing is essential for international B2B buyers aiming to optimize procurement budgets and negotiate effectively. The primary cost components include:

Several factors influence the final price when sourcing b4c products internationally:

For buyers from Africa, South America, the Middle East, and Europe, sourcing b4c products requires nuanced strategies to maximize value:

Prices for b4c sourcing are highly indicative and subject to fluctuations based on raw material markets, geopolitical factors, currency exchange rates, and seasonal demand variations. Buyers should conduct thorough market research and request detailed quotations tailored to their specific requirements before finalizing procurement decisions.

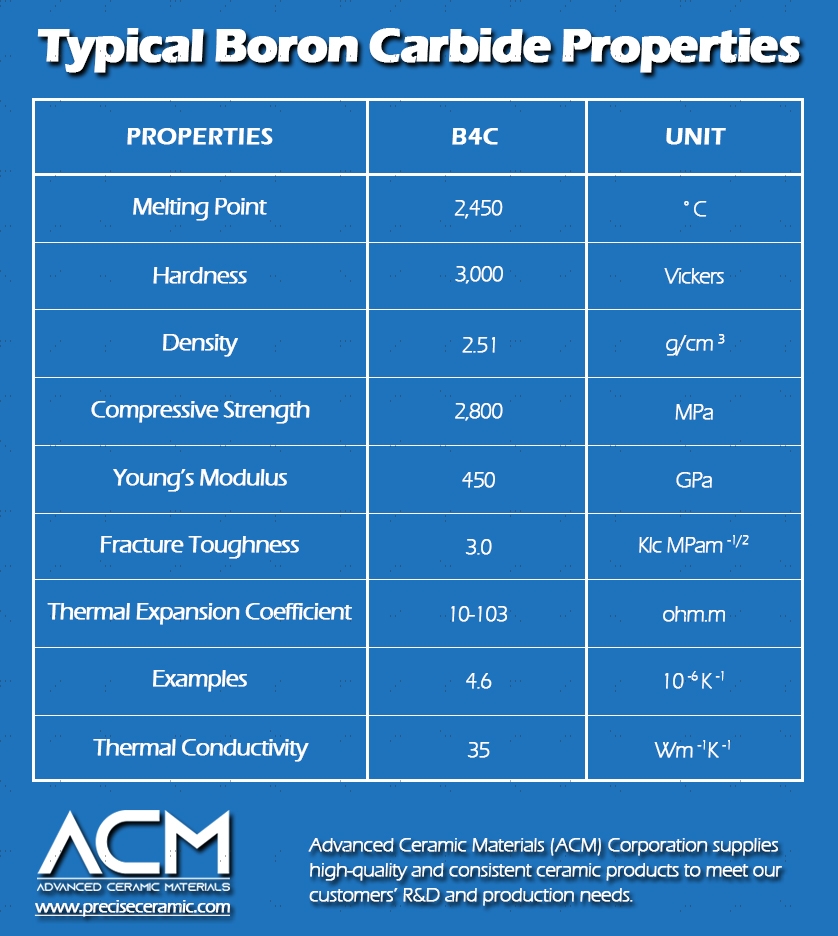

Understanding the technical properties and trade terminology related to b4c (Boron Carbide) is crucial for international B2B buyers aiming to make informed purchasing decisions. This section highlights the most important specifications and commonly used industry terms to streamline communication and optimize procurement strategies.

Material Grade

Boron Carbide is available in various grades depending on purity and particle size. Higher purity grades (e.g., >99%) ensure superior hardness and chemical resistance, essential for demanding applications such as armor plating or abrasives. Knowing the grade helps buyers align product performance with their specific industrial needs.

Particle Size Distribution

This refers to the range and average size of the boron carbide particles, typically measured in microns. Fine powders (<10 microns) are preferred for coatings and precision applications, while coarser grains are suitable for wear-resistant composites. Accurate particle sizing affects product consistency and end-use performance.

Hardness (Mohs Scale)

Boron carbide is one of the hardest materials, typically rated around 9.5 on the Mohs scale. Hardness impacts abrasion resistance and durability. Buyers should confirm hardness values to ensure the material meets operational demands, especially in high-wear environments.

Density

The density of b4c generally ranges between 2.45 to 2.52 g/cm³. Density influences weight and strength characteristics, which are critical for applications such as lightweight armor or structural components. Understanding density assists buyers in optimizing design and cost-efficiency.

Tolerance and Purity Levels

Tolerance refers to acceptable deviations in dimensions or chemical composition. Purity levels impact performance—higher purity reduces impurities like free carbon or oxides, which can affect mechanical properties. Clear specifications help avoid quality issues and ensure compliance with industry standards.

OEM (Original Equipment Manufacturer)

This term refers to companies that produce parts or components used in another company’s end products. For b4c suppliers, working with OEMs often means providing materials that meet strict quality standards and specifications tailored to specific industrial applications.

MOQ (Minimum Order Quantity)

MOQ defines the smallest amount of product a supplier is willing to sell in a single order. Buyers should negotiate MOQs that align with their inventory capacity and project scale, especially when managing logistics across continents like Africa or South America.

RFQ (Request for Quotation)

An RFQ is a formal document sent by buyers to suppliers to solicit pricing and terms for specific quantities and grades of b4c. Clear and detailed RFQs help suppliers provide accurate offers, reducing misunderstandings and speeding up procurement cycles.

Incoterms (International Commercial Terms)

These standardized trade terms define responsibilities for shipping, insurance, and customs between buyers and sellers. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Selecting appropriate Incoterms is vital for cost control and risk management in cross-border transactions.

Lead Time

Lead time is the period between placing an order and receiving the goods. Understanding lead times helps buyers plan production schedules and inventory replenishment, critical for regions with complex logistics such as the Middle East or Europe.

Certificate of Analysis (CoA)

A CoA is a document provided by the supplier that certifies the chemical composition and physical properties of the b4c batch. Requesting a CoA ensures product quality and compliance with buyer specifications, minimizing risks in critical applications.

By mastering these technical properties and trade terms, B2B buyers can effectively evaluate b4c suppliers, negotiate favorable terms, and ensure product quality aligns with their operational needs. This knowledge is especially valuable for buyers in diverse international markets, enabling smoother transactions and stronger supplier relationships.

The b4c sector is experiencing transformative growth driven by rapid technological advancements, evolving consumer demands, and increasingly interconnected global supply chains. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe, understanding these market dynamics is essential for strategic sourcing and competitive advantage.

Global Drivers:

- Digital Transformation: Adoption of AI, IoT, and blockchain technologies is reshaping how b4c products are designed, manufactured, and distributed. These technologies enhance traceability, quality control, and operational efficiency.

- Rising Middle-Class Demand: Emerging economies in Africa and South America are witnessing growing middle-class populations with higher purchasing power, fueling demand for innovative and affordable b4c solutions.

- Geopolitical Shifts: Trade policies, tariffs, and regional trade agreements (e.g., AfCFTA in Africa, Mercosur in South America) influence sourcing decisions, requiring buyers to stay agile and informed.

Sourcing Trends:

- Nearshoring & Regional Hubs: Buyers from Europe and the Middle East increasingly prioritize suppliers closer to home or within regional trade blocs to reduce lead times and mitigate supply chain disruptions. Thailand, for instance, is emerging as a manufacturing hub for b4c components in Southeast Asia.

- Collaborative Innovation: Partnerships between suppliers and buyers are evolving beyond transactional models to co-develop customized solutions, leveraging local expertise and innovation capacity, particularly in Italy’s advanced manufacturing sectors.

- Data-Driven Procurement: Advanced analytics and procurement platforms enable buyers to optimize supplier selection, forecast demand, and manage risks proactively. This is especially critical for buyers managing complex multi-regional supply chains.

Market Dynamics:

- The b4c sector is highly competitive, with pressure to balance cost-efficiency, quality, and innovation. Buyers must navigate a landscape where supplier reliability and compliance are as crucial as price.

- Emerging markets offer growth opportunities but come with challenges such as infrastructure variability and regulatory complexities. Strategic supplier diversification and robust due diligence are vital to mitigate these risks.

Sustainability is no longer optional in the b4c sector; it has become a core criterion for international B2B buyers committed to long-term value creation and regulatory compliance. Environmental impact, social responsibility, and transparency are increasingly scrutinized by stakeholders across Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Environmental Impact:

- The b4c industry faces challenges such as high energy consumption, waste generation, and raw material depletion. Buyers should prioritize suppliers that implement circular economy principles, use renewable energy, and minimize carbon footprints.

- Lifecycle assessments and eco-design principles are critical for reducing environmental impact from product development through end-of-life disposal or recycling.

Ethical Supply Chains:

- Ethical sourcing ensures fair labor practices, safe working conditions, and community engagement. Buyers must conduct rigorous supplier audits and certifications to prevent risks related to forced labor, child labor, and corruption.

- Transparency technologies like blockchain are increasingly used to verify the origin and ethical compliance of materials, reinforcing buyer confidence and consumer trust.

Green Certifications and Materials:

- Recognized certifications such as ISO 14001 (Environmental Management), FSC (Forest Stewardship Council), and Fair Trade are important benchmarks for sustainable sourcing in the b4c sector.

- The adoption of bio-based, recycled, and low-impact materials is gaining traction, especially in European markets where regulatory frameworks incentivize green procurement. Buyers can leverage these certifications as a filter in supplier selection to align with corporate sustainability goals.

The b4c sector has evolved significantly over the past two decades, transitioning from traditional manufacturing to a digitally integrated, innovation-driven industry. Initially characterized by localized production and linear supply chains, the sector has embraced globalization, leading to complex international sourcing networks.

Early growth was fueled by cost arbitrage and volume manufacturing in emerging markets. However, as buyer expectations shifted towards customization, quality, and sustainability, suppliers adapted by integrating advanced manufacturing technologies and adopting responsible sourcing practices. This evolution has been particularly pronounced in regions like Europe, where sustainability and innovation have become key competitive differentiators, and in emerging markets such as Africa and South America, where infrastructure improvements are unlocking new supplier potential.

Today, the b4c sector represents a dynamic intersection of technology, sustainability, and global commerce, requiring buyers to continuously adapt sourcing strategies to remain competitive and responsible.

How can I effectively vet b4c suppliers to ensure reliability and quality?

To vet b4c suppliers, start by verifying their business licenses and certifications relevant to your region (e.g., ISO, CE). Request product samples and conduct quality checks aligned with your standards. Utilize third-party inspection services for on-site audits, especially for large orders. Check references and customer reviews from other international buyers, focusing on those within your region or industry. Establish clear communication channels early to assess responsiveness and transparency. This thorough vetting reduces risk and builds trust for a sustainable partnership.

Is product customization available for b4c, and how do I manage it across international suppliers?

Many b4c suppliers offer customization options, including specifications, packaging, and branding. Clearly communicate your requirements upfront with detailed documentation and technical drawings. Confirm customization capabilities and lead times before finalizing contracts. Consider language barriers and use translators if necessary to avoid misunderstandings. Negotiate minimum order quantities (MOQs) for customized products, as these may differ from standard items. Regularly monitor production progress through updates or third-party inspections to ensure customization meets your expectations.

What are typical MOQs and lead times for b4c orders when sourcing internationally?

MOQs for b4c products vary widely depending on supplier capacity and product complexity but typically range from a few hundred to several thousand units. Lead times can span from 3 to 8 weeks, factoring in production, quality checks, and international shipping. Buyers from Africa, South America, the Middle East, and Europe should plan for additional time due to customs clearance and potential logistical delays. Always clarify MOQs and lead times during negotiations and build buffer periods into your supply chain to avoid stockouts.

Which payment terms are standard for international b4c transactions, and how can I minimize payment risks?

Common payment terms include 30% upfront deposit with the balance paid after inspection or before shipment. Letters of credit (LC) and escrow services offer additional security for buyers. For new suppliers, consider smaller initial orders with secure payment methods to mitigate risk. Use reputable payment platforms and ensure contracts specify payment milestones linked to delivery or quality checkpoints. Maintain clear documentation and communication to resolve any payment discrepancies promptly.

What quality assurance certifications should I require from b4c suppliers to comply with international standards?

Demand certifications such as ISO 9001 for quality management and product-specific standards relevant to your market (e.g., CE for Europe, FCC for electronics). Environmental and safety certifications (e.g., RoHS, REACH) are also crucial if your market has strict regulatory requirements. Ask for test reports from accredited labs and verify their authenticity. These certifications not only ensure compliance but also enhance product reliability and acceptance in your local market.

How can I optimize logistics and shipping when importing b4c products from diverse regions?

Choose suppliers with experience in international shipping and established relationships with freight forwarders. Opt for consolidated shipments if sourcing from multiple suppliers to reduce costs. Understand Incoterms clearly to define responsibilities for shipping, insurance, and customs clearance. Consider multimodal transport to balance speed and cost, especially for buyers in landlocked or remote areas. Plan for customs documentation and possible tariffs in advance to prevent delays. Regularly track shipments and maintain contingency plans for disruptions.

What steps should I take if a dispute arises with a b4c supplier regarding product quality or delivery?

First, document all communications, contracts, and quality reports meticulously. Attempt to resolve disputes amicably through direct negotiation or mediation. If unresolved, refer to the dispute resolution clause in your contract, which may specify arbitration or legal action under a particular jurisdiction. Engaging third-party inspection agencies to provide unbiased quality assessments can strengthen your case. Maintain professionalism and consider long-term supplier relationships before escalating conflicts.

Are there region-specific considerations for B2B buyers from Africa, South America, the Middle East, and Europe when sourcing b4c?

Yes, each region has unique regulatory, logistical, and cultural nuances. For example, African and South American buyers should anticipate longer shipping times and potential customs delays. Middle Eastern buyers may require compliance with halal or other regional certifications. European buyers must ensure strict adherence to environmental and safety standards. Additionally, currency fluctuations and payment infrastructure vary widely; using local banking solutions or international payment services can facilitate smoother transactions. Building relationships with suppliers familiar with your regional market enhances success.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing in the b4c landscape offers international B2B buyers a powerful framework to optimize procurement, reduce costs, and enhance supplier collaboration. For businesses across Africa, South America, the Middle East, and Europe—regions marked by diverse market dynamics and evolving trade environments—leveraging strategic sourcing means more than just cost savings. It drives resilience, innovation, and sustainability in supply chains, crucial for maintaining competitive advantage.

Key takeaways include the importance of thorough market analysis, supplier risk assessment, and building long-term partnerships that align with your company’s goals and values. Embracing digital tools and data analytics can further empower buyers to make informed decisions and anticipate market shifts. Tailoring sourcing strategies to regional contexts, such as navigating local regulations in Italy or leveraging emerging supplier networks in South America, unlocks new growth opportunities.

Looking ahead, B2B buyers should adopt a proactive sourcing mindset—one that continuously evolves with global trends and regional nuances. By prioritizing strategic sourcing, companies can not only mitigate risks but also capitalize on innovation and sustainability initiatives that define the future of global trade. Now is the time for international buyers to deepen their sourcing expertise, foster collaborative supplier ecosystems, and drive measurable business impact across borders.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina