Navigating the complexities of sourcing carbide products can be a daunting challenge for international B2B buyers, particularly those operating in regions such as Africa, South America, the Middle East, and Europe. The diverse applications of carbide—from cutting tools to industrial machinery—demand a deep understanding of the material's properties and market dynamics. This guide aims to demystify the global carbide market, equipping buyers with critical insights into various types of carbide, their applications, and the nuances of supplier vetting processes.

By examining factors such as cost structures, quality standards, and the latest technological advancements in carbide manufacturing, this comprehensive resource will empower B2B buyers to make informed purchasing decisions. Whether you are a buyer in Germany seeking high-performance cutting tools or a procurement manager in Colombia looking for reliable carbide suppliers, this guide will serve as a valuable tool in optimizing your procurement strategy.

As we delve into the intricacies of carbide sourcing, we will address key considerations, including the assessment of supplier reliability, understanding the implications of geopolitical factors, and navigating regulatory requirements. By the end of this guide, you will be better positioned to leverage carbide solutions that enhance your operational efficiency and drive sustainable growth in your business.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Tungsten Carbide | High hardness, wear resistance, and toughness | Cutting tools, mining, and drilling | Pros: Excellent durability; Cons: High cost compared to other materials. |

| Silicon Carbide | High thermal conductivity and chemical resistance | Semiconductor manufacturing, abrasives | Pros: Superior thermal properties; Cons: Brittle nature can limit applications. |

| Calcium Carbide | Reacts with water to produce acetylene gas | Chemical synthesis, welding | Pros: Cost-effective; Cons: Hazardous handling due to reactive nature. |

| Boron Carbide | Exceptional hardness and lightweight | Armor materials, abrasive applications | Pros: Lightweight and strong; Cons: Limited availability and high price. |

| Iron Carbide | Forms in steel, improving hardness and strength | Steel production, tool manufacturing | Pros: Enhances material properties; Cons: Requires precise control in manufacturing. |

Tungsten carbide is renowned for its extreme hardness and wear resistance, making it a preferred choice in industries requiring durable cutting tools and drilling equipment. Its toughness allows it to withstand high impact and stress, which is critical in mining and metalworking applications. B2B buyers should consider its higher cost against its longevity and performance benefits, as the initial investment often pays off through reduced tool wear and maintenance.

Silicon carbide stands out due to its excellent thermal conductivity and chemical resistance, making it ideal for semiconductor manufacturing and abrasive applications. Its ability to operate at high temperatures without degrading enhances its value in high-performance environments. However, buyers must be aware of its brittle nature, which can pose challenges during handling and application. Understanding the specific requirements of your project is crucial when considering this material.

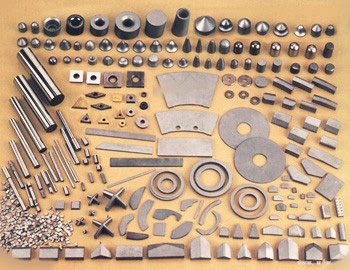

A stock image related to carbide.

Calcium carbide is primarily known for its ability to react with water to produce acetylene gas, which is widely used in chemical synthesis and welding. Its affordability makes it an attractive option for businesses looking to optimize production costs. However, the reactive nature of calcium carbide requires careful handling and storage to prevent hazardous situations. Buyers should prioritize supplier reliability and safety measures when sourcing this material.

Boron carbide is recognized for its exceptional hardness and lightweight properties, making it a valuable material for armor applications and abrasives. Its strength-to-weight ratio is advantageous for industries where weight savings are critical. However, its limited availability and higher price point can be a barrier for some businesses. B2B buyers should evaluate the specific performance requirements of their applications to justify the investment in boron carbide.

Iron carbide is integral to steel production, enhancing the hardness and strength of steel products. Its formation during the steel-making process is essential for producing high-quality tools and components. While it significantly improves material properties, the production of iron carbide requires precise control to avoid compromising the final product's integrity. Buyers should work closely with manufacturers to ensure the correct specifications are met for their steel applications.

Related Video: Carbide Turning Inserts - Tutorial (by engineeringsupplies.co.uk)

| Industry/Sector | Specific Application of carbide | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | Cutting Tools | Enhanced durability and precision in machining processes | Certification of material quality and compliance standards |

| Mining and Construction | Drilling Bits | Increased efficiency and reduced wear during drilling | Availability of specialized designs for specific rock types |

| Automotive | Engine Components | Improved performance and longevity of engine parts | Compatibility with existing manufacturing processes |

| Electronics and Optics | Semiconductor Manufacturing | High thermal stability and electrical conductivity | Supplier's track record in high-purity materials |

| Chemical Processing | Reactor Linings | Resistance to corrosion and high temperatures | Assurance of material integrity under extreme conditions |

In the manufacturing sector, carbide is extensively used for producing cutting tools such as drills, end mills, and inserts. Carbide tools provide exceptional hardness and wear resistance, which significantly extends tool life and maintains precision during machining operations. For international B2B buyers, especially from regions like Europe and South America, sourcing high-quality carbide cutting tools is crucial to ensure operational efficiency. Buyers should consider the certification of materials and compliance with local and international standards to guarantee product reliability.

In the mining and construction industries, carbide is a key component in the production of drilling bits. Carbide-tipped bits offer superior hardness, allowing them to penetrate tough materials like rock and concrete more effectively. This results in increased efficiency and reduced wear, ultimately lowering operational costs. Buyers, particularly in Africa and the Middle East, should focus on sourcing bits designed for specific geological conditions to maximize performance and longevity.

Carbide is increasingly used in automotive engine components, such as valve seats and pistons, due to its remarkable wear resistance and thermal stability. These properties enhance the performance and lifespan of engine parts, leading to improved fuel efficiency and lower emissions. For B2B buyers in Europe, particularly in Germany, it’s essential to ensure that sourced materials meet stringent automotive standards and are compatible with existing manufacturing processes.

In the electronics and optics sector, carbide plays a vital role in semiconductor manufacturing. Silicon carbide (SiC) is particularly valued for its high thermal conductivity and ability to withstand extreme temperatures, making it ideal for high-performance electronic devices. For international buyers, especially in Europe and South America, it is critical to select suppliers with a proven track record in providing high-purity carbide materials, as impurities can significantly affect device performance.

Carbide is also used in the chemical processing industry for reactor linings due to its excellent resistance to corrosion and high temperatures. This application is crucial for maintaining the integrity of reactors that handle aggressive chemicals. Buyers from the Middle East and Africa should prioritize sourcing carbide materials that assure integrity under extreme conditions, focusing on suppliers who can provide detailed specifications and quality assurance documentation.

Related Video: How Is Carbide Made?

The Problem:

B2B buyers often face the challenge of high procurement costs associated with carbide tools and components. This issue is particularly pronounced in industries such as manufacturing, construction, and mining, where the durability and performance of carbide products are crucial. Buyers may find themselves caught between the need for high-quality materials that can withstand harsh conditions and the financial constraints of their budgets. This dilemma can lead to the temptation to opt for cheaper alternatives, which may compromise performance and lead to greater long-term costs.

The Solution:

To effectively manage costs while ensuring quality, B2B buyers should focus on building strategic partnerships with reputable carbide suppliers. By engaging in long-term contracts or bulk purchasing agreements, companies can negotiate better pricing while maintaining the necessary quality standards. Additionally, buyers should conduct thorough research to identify suppliers who offer high-performance carbide tools with proven ROI. Utilizing cost-benefit analysis tools can also help in evaluating the total cost of ownership, including maintenance and longevity, which may justify the initial investment in quality carbide products.

The Problem:

Choosing the appropriate type of carbide for specific applications can be overwhelming due to the vast array of options available. Buyers may struggle with understanding the differences between tungsten carbide, silicon carbide, and other variants, leading to incorrect purchases that hinder productivity. This scenario is particularly relevant for industries such as aerospace and automotive, where precision and material properties are critical. Missteps in selection can result in project delays, increased costs, and potential safety risks.

The Solution:

To mitigate this issue, B2B buyers should invest time in educating themselves about the various types of carbide and their applications. Creating a comprehensive comparison chart that outlines the properties, advantages, and ideal use cases for each carbide type can serve as a valuable resource. Furthermore, buyers should consult with technical experts or suppliers who can provide personalized recommendations based on their specific needs. Engaging in pilot projects with sample materials before large-scale purchases can also help in making informed decisions and ensuring that the chosen carbide meets performance expectations.

The Problem:

Sourcing high-quality carbide products can be a significant pain point for international B2B buyers, particularly in regions like Africa and South America, where local suppliers may not meet global quality standards. This challenge is exacerbated by the complexities of international shipping, customs regulations, and varying material specifications. Buyers may experience delays or receive subpar materials that do not meet their rigorous operational demands, ultimately affecting their production timelines and output quality.

The Solution:

To overcome sourcing challenges, B2B buyers should diversify their supplier base by exploring both local and international options. Establishing relationships with multiple suppliers can provide backup options in case of supply chain disruptions. Buyers should also prioritize suppliers who adhere to international quality standards and certifications, such as ISO 9001, to ensure consistent product quality. Leveraging technology, such as digital platforms that connect buyers with verified suppliers, can also streamline the sourcing process. Conducting regular audits and assessments of suppliers can help maintain quality assurance and foster long-term partnerships built on trust and reliability.

Tungsten carbide (WC) is renowned for its exceptional hardness and wear resistance, making it a preferred choice in various industrial applications. It can withstand high temperatures (up to 1,000°C) and offers excellent corrosion resistance, particularly against acids and alkalis. This material is often used in cutting tools, mining machinery, and industrial wear parts due to its ability to maintain sharpness and resist deformation under stress.

Pros and Cons of Tungsten Carbide

The durability of tungsten carbide is a significant advantage, as it can last longer than many other materials, reducing downtime and replacement costs. However, its high manufacturing complexity and cost can be a drawback for some buyers, particularly in regions where budget constraints are prevalent. Additionally, while its hardness is beneficial, it can also make tungsten carbide brittle, leading to potential failures under certain impact conditions.

Impact on Application

Tungsten carbide is compatible with various media, including water, oil, and many chemicals. Its robustness makes it suitable for high-stress applications, but buyers must ensure that the specific operational conditions do not exceed its mechanical limits.

Silicon carbide (SiC) is another critical material used in the production of carbide products. Known for its high thermal conductivity and resistance to thermal shock, SiC is often utilized in high-temperature applications, such as in semiconductor manufacturing and as a component in high-performance brake systems.

Pros and Cons of Silicon Carbide

One of the primary advantages of silicon carbide is its excellent thermal stability, which allows it to perform reliably in extreme conditions. However, the cost of silicon carbide can be relatively high compared to other materials, which may deter some international buyers. Additionally, while it offers good mechanical strength, its brittleness can be a concern in applications requiring high toughness.

Impact on Application

Silicon carbide is particularly effective in environments where thermal management is critical. Its compatibility with high-temperature media makes it suitable for applications in aerospace and automotive industries, but buyers should consider the specific thermal and mechanical requirements of their applications.

Calcium carbide (CaC2) is primarily known for its role in producing acetylene gas, which is widely used in welding and cutting applications. This material can generate high temperatures when it reacts with water, making it valuable in various chemical processes.

Pros and Cons of Calcium Carbide

The main advantage of calcium carbide is its cost-effectiveness, as it is generally less expensive than other carbide materials. However, its handling requires careful consideration due to its reactivity with water, which can pose safety risks. Additionally, while it is effective in generating acetylene, its applications are limited compared to other carbides.

Impact on Application

Calcium carbide’s ability to produce acetylene makes it suitable for welding and cutting applications, particularly in regions with limited access to alternative fuel sources. However, international buyers must comply with safety regulations regarding its storage and transport.

A stock image related to carbide.

Titanium carbide (TiC) is often used in cutting tools and wear-resistant coatings due to its high hardness and thermal stability. It can withstand temperatures up to 1,600°C and provides excellent resistance to oxidation.

Pros and Cons of Titanium Carbide

The key advantage of titanium carbide is its ability to maintain performance in high-temperature applications, making it ideal for industries like aerospace and automotive. However, the cost of titanium carbide can be a significant barrier for some buyers, particularly in emerging markets. Furthermore, its manufacturing process can be complex, which may affect lead times.

Impact on Application

Titanium carbide is particularly effective in applications requiring high wear resistance and thermal stability. Buyers must ensure that their specific applications align with the material's properties, especially in environments with varying thermal loads.

| Material | Typical Use Case for carbide | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Tungsten Carbide | Cutting tools, mining machinery | Exceptional hardness and durability | High cost and manufacturing complexity | High |

| Silicon Carbide | Semiconductor manufacturing | High thermal conductivity | Brittle and expensive | High |

| Calcium Carbide | Welding and cutting applications | Cost-effective | Reactive with water | Low |

| Titanium Carbide | Cutting tools, wear-resistant coatings | High thermal stability | High cost and complex manufacturing | High |

The manufacturing of carbide involves several key stages that transform raw materials into high-quality carbide products. Understanding these stages is crucial for B2B buyers seeking to ensure that their suppliers adhere to stringent quality standards and deliver reliable products.

The first stage in carbide manufacturing is the preparation of raw materials. This typically involves a mix of carbon and metal powders, such as tungsten or titanium. The chosen materials must be of high purity to avoid contamination that can affect the final product's performance. For instance, the carbon source can be graphite, while tungsten powder is often used for tungsten carbide.

Buyers should inquire about the sourcing and quality control of these raw materials, as they significantly influence the mechanical properties of the final carbide products.

Once the materials are prepared, the next step is forming. This can be achieved through several techniques, including:

Understanding the forming techniques used by suppliers can help buyers evaluate their capability to meet specific design requirements.

After forming, the carbide shapes undergo a sintering process, where they are heated in a controlled atmosphere to fuse the particles together. This step is critical as it significantly affects the density and hardness of the carbide. Typical sintering temperatures range between 1400°C to 1600°C, depending on the specific carbide composition.

B2B buyers should consider the sintering methods employed by their suppliers, such as conventional sintering or advanced techniques like hot isostatic pressing (HIP), which can enhance material properties.

Finishing operations are essential for achieving the desired surface quality and dimensional accuracy. Techniques include grinding, polishing, and coating. For example, grinding is often used to achieve tight tolerances, while coatings can enhance wear resistance.

Buyers should ensure that suppliers have robust finishing capabilities and are equipped to meet specific surface roughness requirements.

Quality assurance (QA) is a vital component of carbide manufacturing, ensuring that products meet international standards and customer specifications.

B2B buyers should be familiar with relevant international quality standards such as ISO 9001, which sets criteria for a quality management system. Additionally, industry-specific certifications like CE marking for European markets or API standards for oil and gas applications may be applicable depending on the end-use of the carbide products.

Quality control in carbide manufacturing typically involves several checkpoints:

Understanding these checkpoints helps buyers assess the thoroughness of a supplier’s quality assurance practices.

Various testing methods are employed to verify the quality of carbide products, including:

Buyers should request documentation of these tests, as they provide valuable insights into product quality.

Verification of a supplier’s quality control processes is crucial for mitigating risks in international B2B transactions. Here are some strategies:

Quality certification can vary significantly across regions and industries. For international buyers, particularly those from Africa, South America, the Middle East, and Europe, it is essential to understand these nuances.

Understanding these aspects can help B2B buyers make informed decisions when selecting carbide suppliers, ensuring that they receive high-quality products that meet their specific needs.

In the competitive landscape of international B2B procurement, sourcing high-quality carbide materials requires a strategic approach. This guide serves as a checklist to help buyers effectively navigate the sourcing process, ensuring they find the right suppliers that meet their technical and business needs.

Clearly outline the technical requirements for the carbide materials you need. This includes understanding the specific type of carbide (e.g., tungsten carbide, silicon carbide) and its intended application, such as cutting tools or wear-resistant components. Having well-defined specifications helps in communicating effectively with suppliers and ensures that you receive products that meet your operational standards.

Conduct thorough research to identify potential suppliers in the carbide market. Utilize online directories, industry-specific platforms, and trade shows to compile a list of manufacturers and distributors. Look for suppliers that have a strong reputation in the industry and positive reviews from other businesses. It’s also beneficial to check their presence in your target regions, such as Africa, South America, the Middle East, and Europe.

Before finalizing a supplier, verify their certifications and compliance with international quality standards, such as ISO 9001. Certifications indicate a commitment to quality management and can help mitigate risks associated with sourcing materials. Additionally, inquire about any industry-specific certifications that may be relevant to your application.

Always request samples of the carbide products before making a bulk purchase. Testing samples allows you to assess the quality and performance of the materials in real-world applications. Evaluate the samples based on your defined specifications and consider conducting comparative tests against other suppliers to ensure you are getting the best product.

Engage in discussions about pricing with potential suppliers. It’s essential to understand not only the unit price but also any additional costs such as shipping, taxes, and potential tariffs, especially when importing from different regions. Request detailed quotes that break down all costs, allowing for easier comparison between suppliers.

Reliability is crucial when sourcing carbide materials, as delays can disrupt your production schedule. Inquire about the supplier's lead times and delivery methods. Check their track record for on-time deliveries and their ability to handle urgent orders. Establishing a reliable supply chain is vital for maintaining operational efficiency.

Once you’ve identified a suitable supplier, negotiate the terms of the contract. Ensure that the contract includes clear terms regarding pricing, delivery schedules, quality standards, and payment terms. A well-defined contract protects both parties and sets clear expectations, minimizing the risk of disputes down the line.

By following this checklist, B2B buyers can streamline their sourcing process for carbide materials, ensuring they find the right suppliers that align with their technical requirements and business goals.

When sourcing carbide, understanding the cost structure is crucial for international B2B buyers. The primary cost components include:

Several factors influence the pricing of carbide products, particularly for international buyers:

For B2B buyers, particularly from Africa, South America, the Middle East, and Europe, adopting a strategic approach to sourcing carbide can lead to significant savings:

Pricing for carbide products is subject to fluctuations based on market conditions, material availability, and changes in labor costs. Buyers should conduct thorough research and obtain multiple quotes to ensure they receive competitive pricing.

When evaluating materials for industrial applications, it's essential to consider alternatives to carbide. While carbide is known for its durability and high-performance capabilities, other materials may offer viable solutions depending on specific project requirements. This section compares carbide with two notable alternatives: tungsten carbide and diamond-based solutions, focusing on their performance, cost, ease of implementation, maintenance, and best use cases.

| Comparison Aspect | Carbide | Tungsten Carbide | Diamond-Based Solutions |

|---|---|---|---|

| Performance | High wear resistance; suitable for cutting tools. | Superior hardness; excellent for heavy-duty applications. | Exceptional hardness and thermal conductivity; ideal for precision cutting. |

| Cost | Moderate; cost-effective for many applications. | Higher; often requires significant investment. | Very high; typically used in specialized applications. |

| Ease of Implementation | Generally straightforward; widely available. | Requires specialized equipment for machining. | Complex; requires skilled operators and specialized tools. |

| Maintenance | Low; minimal upkeep needed. | Moderate; can wear down over time but easy to re-sharpen. | High; susceptible to chipping and requires careful handling. |

| Best Use Case | General machining, tool manufacturing. | Mining, oil drilling, and heavy machinery. | Precision machining, electronics, and high-temperature applications. |

Tungsten carbide is a popular alternative to traditional carbide, known for its exceptional hardness and durability. It is often used in applications requiring high wear resistance, such as mining and oil drilling. The primary advantage of tungsten carbide is its ability to withstand extreme conditions, making it ideal for heavy-duty operations. However, it comes at a higher cost and may require specialized machinery for production and maintenance. B2B buyers should weigh the benefits against their budget and the specific demands of their projects when considering tungsten carbide.

Diamond-based solutions, such as diamond-coated tools, are renowned for their unmatched hardness and thermal conductivity. These materials excel in precision applications, including electronics and high-speed machining. The primary advantage of using diamond is its ability to maintain sharpness longer than other materials, reducing downtime and replacement costs in the long run. However, the high initial investment and the need for specialized handling and maintenance can be a barrier for many businesses. Buyers must assess whether the performance benefits justify the costs for their specific applications.

Selecting the right material for your application requires careful consideration of various factors, including performance needs, budget constraints, and operational capabilities. While carbide offers a balanced solution with moderate costs and good performance, alternatives like tungsten carbide and diamond-based solutions may provide superior characteristics for specialized applications. Buyers should evaluate their project requirements, potential return on investment, and the long-term benefits of each material. Engaging with suppliers and industry experts can also provide valuable insights to make an informed decision tailored to specific business needs.

Understanding the technical properties of carbide is crucial for international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe. Here are several critical specifications that can influence purchasing decisions.

Material grade indicates the composition and quality of carbide, which can vary significantly. For instance, tungsten carbide (WC) is renowned for its hardness and wear resistance, making it ideal for cutting tools and mining applications. Buyers should verify the material grade to ensure it meets the specific requirements of their applications, as this will directly impact durability and performance.

Tolerance refers to the allowable variation in dimensions during the manufacturing process. In industries such as aerospace and automotive, precise tolerances are vital for safety and functionality. A tighter tolerance often indicates higher manufacturing quality, which can lead to better performance and longer lifespan of carbide components. Buyers should specify tolerances in their requests to ensure they receive parts that fit seamlessly into their systems.

Hardness is a measure of a material's resistance to deformation. Carbides are typically measured using the Vickers hardness test, and values can range significantly depending on the type. A higher hardness rating generally correlates with better wear resistance, making it essential for applications such as tooling and wear parts. Buyers must consider the hardness levels required for their specific applications to avoid premature wear and failure.

Density affects the weight and mechanical properties of carbide materials. Higher density often correlates with enhanced strength and wear resistance. For applications where weight is a concern, such as in aerospace, it is critical to balance density with performance characteristics. Buyers should assess the density of carbide materials to ensure they align with the performance needs of their applications.

Thermal conductivity measures a material's ability to conduct heat. For carbide tools used in high-speed machining, good thermal conductivity helps dissipate heat, preventing thermal damage and maintaining cutting efficiency. Buyers in industries like metalworking should prioritize thermal conductivity specifications to ensure optimal performance under heat-generating conditions.

Familiarity with industry jargon is essential for effective communication and negotiation in the carbide market. Here are several commonly used terms:

OEM stands for Original Equipment Manufacturer. This term refers to companies that produce parts or equipment that may be marketed by another manufacturer. In the carbide industry, OEMs often require specific grades and configurations of carbide for their products. Understanding OEM requirements can help buyers align their specifications with manufacturer standards.

MOQ, or Minimum Order Quantity, is the smallest amount of product that a supplier is willing to sell. This can impact cash flow and inventory management for buyers. Understanding the MOQ can assist buyers in negotiating better terms and planning their procurement strategies effectively.

An RFQ, or Request for Quotation, is a document sent to suppliers to solicit price quotes for specific quantities of products. This process is crucial for B2B buyers looking to compare pricing and terms across different suppliers. A well-structured RFQ can lead to better pricing and terms.

Incoterms (International Commercial Terms) are standardized terms that define the responsibilities of buyers and sellers in international transactions. These terms help clarify who is responsible for shipping, insurance, and tariffs, which can significantly affect overall costs. Understanding Incoterms is essential for buyers to avoid unexpected expenses and ensure smooth transactions.

By grasping these technical properties and trade terminologies, B2B buyers can make informed decisions when sourcing carbide products, ultimately leading to better operational efficiency and cost management.

The carbide market is experiencing robust growth driven by several global factors. First, the increasing demand for high-performance materials in industries such as automotive, aerospace, and electronics is propelling the use of various carbide products. Additionally, advancements in manufacturing technologies, including additive manufacturing and precision machining, are enhancing the application scope of carbides. Notably, as B2B buyers from regions like Africa, South America, the Middle East, and Europe (particularly Germany and Colombia) seek to optimize their supply chains, they are increasingly looking towards carbide suppliers that can provide innovative solutions and superior performance.

Emerging trends indicate a shift towards digital sourcing platforms where buyers can access a broader range of suppliers and products. These platforms facilitate transparent pricing, allowing buyers to compare different carbide grades and specifications easily. Furthermore, there is a growing emphasis on customized carbide solutions tailored to specific industrial applications, which enables businesses to enhance their operational efficiency.

Sustainability has become a crucial consideration in the carbide sector, influencing sourcing decisions for B2B buyers. The environmental impact of carbide production, particularly in terms of energy consumption and emissions, has led many companies to prioritize ethical sourcing practices. Buyers are increasingly seeking suppliers that adhere to sustainable manufacturing processes and can provide 'green' certifications for their carbide products.

The shift towards sustainable carbide materials includes the use of recycled raw materials and the development of eco-friendly production methods. This not only reduces the carbon footprint but also aligns with the corporate social responsibility goals of many international companies. Buyers from Africa, South America, the Middle East, and Europe are advised to conduct thorough assessments of their suppliers' sustainability practices, ensuring that their procurement choices contribute positively to environmental conservation.

Carbide, a compound of carbon and a less electronegative element, has a rich history that dates back over a century. Initially, its applications were limited to niche markets; however, the industrial revolution and advancements in material science have transformed carbide into a fundamental component in various sectors. From the development of carbide tools in the early 20th century to its current role in high-tech applications, the evolution of carbide is marked by continuous innovation.

The introduction of synthetic carbide production in the 1930s significantly enhanced its availability and performance characteristics. As a result, carbide has become indispensable in manufacturing processes that require high wear resistance and durability. This historical context is vital for B2B buyers, as it underscores the material's proven track record and reliability in meeting the demands of modern industries.

In conclusion, understanding the market dynamics, sustainability trends, and historical evolution of carbide can provide international B2B buyers with the insights necessary to make informed sourcing decisions that align with their operational goals and ethical standards.

How do I choose the right type of carbide for my application?

When selecting the appropriate carbide, consider the specific requirements of your application, including hardness, wear resistance, and thermal stability. For cutting tools, tungsten carbide is often preferred due to its exceptional hardness and toughness. In contrast, silicon carbide is ideal for high-temperature applications due to its thermal conductivity. Additionally, evaluate the operating environment and expected loads to ensure the carbide can withstand the conditions. Collaborating with suppliers who provide detailed material specifications can also aid in making an informed decision.

What are the key factors to consider when sourcing carbide internationally?

International sourcing of carbide requires attention to several critical factors. First, assess the supplier’s reputation and reliability by checking reviews and certifications. Consider the logistics involved, including shipping costs and times, as these can significantly impact your supply chain. Also, ensure compliance with local regulations and import duties in your region. Lastly, evaluate the supplier's ability to meet your quality standards and any necessary customization requirements, as this can influence your operational efficiency.

What is the typical minimum order quantity (MOQ) for carbide products?

The MOQ for carbide products can vary widely depending on the supplier and the type of carbide being sourced. Generally, standard products may have a lower MOQ, while custom-made items can require higher quantities to justify production costs. It’s advisable to communicate directly with suppliers to understand their specific MOQ policies and negotiate terms that suit your purchasing needs. Additionally, consider the impact of MOQ on your inventory management and cash flow.

What payment terms should I expect when buying carbide internationally?

Payment terms for international carbide purchases typically include options such as advance payment, letters of credit, or net payment terms (e.g., 30, 60, or 90 days). Suppliers may offer discounts for early payments or larger orders. It's important to clarify these terms before finalizing the purchase to avoid unexpected costs. Always consider using secure payment methods to protect your transaction, especially when dealing with new suppliers. Understanding the payment landscape in the supplier’s country can also provide insights into common practices.

How can I ensure quality assurance when purchasing carbide?

To ensure quality assurance in carbide procurement, request material certifications and compliance documentation from suppliers. Consider conducting third-party inspections or audits of the manufacturing facilities to verify their quality control processes. Additionally, establish clear quality standards and specifications in your purchase agreements, including acceptable tolerances and testing methods. Building a strong relationship with your supplier can also facilitate better communication regarding quality expectations and issues.

What logistics challenges should I be aware of when importing carbide?

Importing carbide can present several logistics challenges, such as customs clearance delays, shipping costs, and handling of hazardous materials. It's essential to work with a logistics partner experienced in international trade to navigate these complexities effectively. Ensure that all necessary documentation, such as bills of lading and certificates of origin, are prepared in advance. Additionally, consider the potential impact of geopolitical factors and tariffs on your shipping timelines and overall costs.

What customization options are available for carbide products?

Many suppliers offer customization options for carbide products, allowing you to tailor specifications such as size, shape, and coating based on your application needs. Discuss your requirements directly with suppliers to explore available options, including custom tooling or specialized grades of carbide. Be prepared to share detailed specifications and performance expectations to facilitate the design process. Customization can enhance the effectiveness of the carbide in your specific application, resulting in better performance and longevity.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

As the global demand for carbide continues to rise, international B2B buyers must prioritize strategic sourcing to navigate this complex market effectively. Understanding the diverse applications of carbide—from cutting tools to advanced ceramics—enables buyers to identify the most suitable products for their specific needs. Engaging with reliable suppliers and leveraging market intelligence can significantly enhance procurement strategies, ensuring access to high-quality materials while optimizing costs.

What are the future trends in carbide sourcing? Emerging technologies and innovations in carbide production are paving the way for enhanced performance and sustainability. Buyers should stay informed about these developments, as they may influence pricing and availability. Additionally, exploring partnerships with manufacturers in Africa, South America, the Middle East, and Europe can open new avenues for collaboration and innovation.

In conclusion, the strategic sourcing of carbide is not merely a procurement task but a pivotal factor in achieving competitive advantage. B2B buyers are encouraged to adopt a proactive approach, fostering relationships with suppliers who align with their long-term goals. By doing so, they can position themselves at the forefront of this dynamic market, ready to capitalize on opportunities as they arise.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina