Carbide materials play a pivotal role in modern manufacturing and industrial applications, underpinning the performance and durability of cutting tools, wear-resistant parts, and precision components. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—grasping the precise definition and nuances of carbide is essential to making strategic procurement decisions that drive operational efficiency and cost-effectiveness.

Understanding carbide goes beyond its basic chemical composition; it encompasses a spectrum of types, properties, and manufacturing processes that directly influence product quality and application suitability. This guide delivers a thorough exploration of carbide, covering key aspects such as:

By navigating these topics, buyers from regions like Brazil, Thailand, and the Middle East can confidently evaluate supplier capabilities, optimize sourcing strategies, and mitigate risks associated with quality variability or market fluctuations. This guide empowers procurement professionals to align their purchasing decisions with technical requirements and market realities, ultimately fostering partnerships that enhance competitiveness in their respective industries.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Tungsten Carbide | Extremely hard, high melting point, wear-resistant | Cutting tools, mining machinery, wear parts | Pros: Long lifespan, excellent hardness; Cons: Higher cost, brittle |

| Titanium Carbide | High hardness with good corrosion resistance | Aerospace components, tooling, chemical processing | Pros: Corrosion resistance, lightweight; Cons: Limited availability, higher price |

| Silicon Carbide | High thermal conductivity, chemical inertness | Abrasives, semiconductors, high-temp applications | Pros: Heat resistance, chemical stability; Cons: Brittle, machining difficulty |

| Boron Carbide | Very hard, lightweight, neutron absorber | Armor plating, nuclear industry, abrasives | Pros: Extreme hardness, low density; Cons: Expensive, limited suppliers |

| Vanadium Carbide | High hardness, improves wear resistance in alloys | Tool steels, coatings, cutting tools | Pros: Enhances toughness, wear resistance; Cons: Complex processing, cost variability |

Tungsten Carbide

Tungsten carbide is renowned for its exceptional hardness and resistance to wear and heat, making it a staple in cutting tools and heavy machinery components. For B2B buyers in sectors such as mining or metalworking, its durability translates to longer tool life and reduced downtime. However, its brittleness requires careful handling and proper tooling to avoid fractures. Buyers should balance upfront costs against lifecycle savings, considering supplier reliability and grade specifications.

Titanium Carbide

Titanium carbide offers a unique combination of hardness and corrosion resistance, which is highly valued in aerospace and chemical processing industries. Its relatively lightweight nature benefits applications where weight reduction is critical. B2B buyers should evaluate supplier capacity for consistent quality and consider the premium pricing against performance gains, especially in high-stress environments where corrosion resistance is essential.

Silicon Carbide

Known for its thermal conductivity and chemical inertness, silicon carbide is widely used in abrasives, semiconductors, and high-temperature applications. Buyers targeting electronics or industrial heating sectors will appreciate its stability under extreme conditions. The material’s brittleness and machining challenges require sourcing from experienced manufacturers who can deliver precise tolerances and consistent quality.

Boron Carbide

Boron carbide stands out for its extreme hardness and low density, making it ideal for protective armor and neutron absorption in nuclear applications. Its high cost and limited supplier base necessitate thorough vendor evaluation for B2B buyers in defense or energy sectors. When procuring, assessing batch consistency and certification compliance is crucial due to the critical nature of its applications.

Vanadium Carbide

Vanadium carbide is primarily used to enhance wear resistance and toughness in tool steels and coatings. Its integration improves cutting tool performance and extends service life. Buyers in manufacturing and tooling industries should consider the complexity of processing and price fluctuations, ensuring suppliers provide detailed material data sheets and support for custom alloy formulations.

Related Video: Carbide Definition - What is Carbide ?

| Industry/Sector | Specific Application of carbide definition | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Mining & Construction | Cutting and drilling tools for rock and mineral extraction | Enhanced tool durability and cutting precision, reducing downtime and operational costs | Ensure carbide grade matches geological conditions; verify supplier certifications and delivery reliability |

| Automotive Manufacturing | Precision machining of engine components and molds | Improved wear resistance and dimensional accuracy, leading to higher quality parts and longer tool life | Prioritize carbide with consistent microstructure; consider supplier’s capacity for custom tooling solutions |

| Metalworking & Fabrication | End mills, inserts, and tooling for high-speed machining | Increased productivity through faster machining speeds and extended tool life | Confirm carbide hardness and toughness balance; assess supplier’s technical support for tooling optimization |

| Oil & Gas | Drill bits and wear parts for harsh drilling environments | Superior resistance to abrasion and thermal stress, minimizing equipment failure in extreme conditions | Source carbide with proven heat resistance; check for compatibility with local drilling conditions and standards |

| Aerospace | Precision cutting tools and wear-resistant coatings | Critical for manufacturing high-tolerance components with minimal tool wear and high repeatability | Focus on carbide purity and grain size; ensure supplier complies with aerospace industry quality standards |

Mining & Construction:

In mining and construction, carbide is predominantly used in cutting and drilling tools designed to penetrate hard rock and mineral deposits. The high hardness and toughness of carbide allow tools to maintain sharpness and resist wear, significantly reducing operational downtime. For international buyers in Africa and South America—regions rich in mining activity—selecting carbide with appropriate grades tailored to local geological conditions is essential. Verifying supplier certifications and ensuring reliable logistics is critical to avoid costly delays.

Automotive Manufacturing:

Carbide tools are vital for precision machining in automotive manufacturing, particularly for engine components and molds. Their wear resistance and dimensional stability ensure high-quality parts with tight tolerances, reducing scrap rates and improving production efficiency. Buyers in emerging automotive hubs like Thailand and Brazil should focus on carbide suppliers who can provide consistent microstructure and offer customization to meet specific tooling needs, ensuring seamless integration into production lines.

Metalworking & Fabrication:

High-speed machining in metalworking relies heavily on carbide end mills and inserts. Carbide’s ability to withstand high temperatures and maintain hardness enables faster cutting speeds and extended tool life, boosting throughput. For European and Middle Eastern fabricators, balancing carbide hardness and toughness is critical, as it affects both tool performance and cost-effectiveness. Engaging suppliers that provide technical support for tooling optimization can enhance operational outcomes.

Oil & Gas:

In the oil and gas sector, carbide is essential for drill bits and wear parts exposed to abrasive and high-temperature environments. The material’s resistance to thermal stress and abrasion reduces equipment failures and maintenance frequency. Buyers from regions with active oilfields, such as the Middle East and parts of South America, should prioritize carbide variants with proven heat resistance and ensure compatibility with local drilling standards to maximize equipment lifespan.

Aerospace:

The aerospace industry demands carbide tools that enable precision cutting and wear-resistant coatings for manufacturing components with extremely tight tolerances. High purity and fine grain size in carbide materials contribute to consistent tool performance and repeatability. European aerospace manufacturers and their global partners must source carbide from suppliers adhering to stringent quality standards, ensuring reliability and compliance with industry regulations.

Related Video: How Is Carbide Made?

Key Properties: Tungsten carbide is renowned for its exceptional hardness, high melting point (~2,870°C), and excellent wear resistance. It maintains strength at elevated temperatures and resists abrasion and corrosion moderately well, depending on the binder used (usually cobalt).

Pros & Cons: Its durability and resistance to mechanical wear make it ideal for cutting tools and industrial machinery components. However, tungsten carbide can be brittle under impact and is relatively expensive compared to other carbides. Manufacturing complexity is moderate, requiring specialized sintering processes.

Impact on Application: Tungsten carbide performs exceptionally in high-temperature and high-pressure environments such as mining, metal cutting, and drilling operations. It is compatible with a wide range of media but may require coatings or treatments for aggressive chemical exposure.

Considerations for International B2B Buyers: Buyers from regions like Africa, South America, and the Middle East should verify compliance with ASTM B777 or ISO 4499 standards, ensuring material consistency. Europe and Brazil often require adherence to DIN or ABNT standards, respectively. Supply chain reliability and cobalt price volatility should also be factored into procurement decisions.

Key Properties: Titanium carbide offers high hardness and excellent corrosion resistance, with a melting point around 3,160°C. It exhibits better chemical stability than tungsten carbide, especially in oxidizing environments.

Pros & Cons: TiC is highly durable and less brittle than tungsten carbide, making it suitable for applications requiring toughness and resistance to chemical wear. However, it is more expensive and complex to manufacture due to its reactivity during sintering.

Impact on Application: TiC is preferred in environments with corrosive media, such as chemical processing or aerospace components. Its compatibility with acidic or oxidizing agents makes it a strategic choice for specialized tooling.

Considerations for International B2B Buyers: Compliance with ASTM F305 or ISO 4499 is common. Buyers in the Middle East and Europe should ensure certifications align with local chemical industry standards. Import tariffs and availability can impact cost-effectiveness in Africa and South America, so sourcing from regional suppliers or distributors is advisable.

Key Properties: Silicon carbide is known for its outstanding thermal conductivity, high hardness, and excellent chemical inertness. It withstands temperatures up to 2,700°C and resists oxidation and corrosion in harsh environments.

Pros & Cons: SiC is highly wear-resistant and chemically stable, making it ideal for abrasive and corrosive conditions. It is less dense and lighter than tungsten carbide but more brittle, which limits its use in impact-heavy applications. Manufacturing complexity is relatively high due to sintering and grain growth control.

Impact on Application: Silicon carbide is widely used in high-temperature applications, including semiconductor manufacturing, mechanical seals, and abrasive machining. It excels in media with corrosive chemicals and high thermal stress.

Considerations for International B2B Buyers: Buyers in Europe and the Middle East should look for compliance with JIS or DIN standards. In Africa and South America, ensuring supplier adherence to ISO 9001 quality management systems is critical. Due to its specialized nature, long lead times may occur, so early procurement planning is recommended.

Key Properties: Chromium carbide offers excellent corrosion resistance, good hardness, and a melting point near 1,800°C. It provides a protective layer against oxidation and wear, especially when combined with nickel or cobalt binders.

Pros & Cons: This material is cost-effective and offers good resistance to chemical attack and thermal degradation. However, it has lower hardness compared to tungsten or titanium carbides and is less suitable for extremely high-stress mechanical applications.

Impact on Application: Chromium carbide is often used in coatings for wear and corrosion protection in petrochemical, power generation, and automotive industries. It is well-suited for media involving acids, salts, and high-temperature gases.

Considerations for International B2B Buyers: Compliance with ASTM A262 and EN standards is common in Europe and the Middle East. In South America and Africa, buyers should confirm the availability of local testing certifications to ensure material authenticity. Chromium carbide’s relatively lower cost makes it attractive for large-volume applications where extreme hardness is not critical.

| Material | Typical Use Case for carbide definition | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Tungsten Carbide | Cutting tools, mining bits, wear-resistant parts | Exceptional hardness and wear resistance | Brittle under impact, higher cost | High |

| Titanium Carbide | Chemical processing tools, aerospace components | Superior corrosion resistance and toughness | Expensive, complex manufacturing | High |

| Silicon Carbide | High-temperature seals, abrasives, semiconductors | Excellent thermal stability and chemical inertness | Brittle, manufacturing complexity | Medium |

| Chromium Carbide | Protective coatings in petrochemical and automotive | Good corrosion resistance and cost-effective | Lower hardness, less suitable for high stress | Low |

The production of carbide components involves a series of highly controlled and precise stages to ensure the final product meets stringent performance and durability requirements. Understanding these stages is critical for B2B buyers aiming to select reliable suppliers and optimize procurement strategies.

1. Material Preparation

The process begins with the selection and preparation of raw materials, primarily tungsten carbide powder combined with a metallic binder such as cobalt or nickel. The powder undergoes blending to achieve a uniform mixture, often with the addition of grain growth inhibitors or other additives to enhance properties. This stage requires advanced powder metallurgy techniques to control particle size distribution and chemical composition, directly affecting the hardness and toughness of the finished carbide.

2. Forming (Shaping)

Shaping the carbide mixture is typically done through pressing methods such as uniaxial pressing, isostatic pressing (cold or hot), or extrusion. These techniques compact the powder into a “green” body with a specific shape and density. Hot isostatic pressing (HIP) may also be used to improve density and reduce porosity. Precision in this stage influences dimensional accuracy and mechanical strength.

3. Sintering

Sintering is a high-temperature heat treatment that fuses the powder particles into a solid mass without melting the binder. This process typically occurs in a controlled atmosphere furnace at temperatures ranging from 1400°C to 1600°C. Proper sintering ensures optimal hardness, wear resistance, and structural integrity.

4. Assembly and Secondary Operations

For complex carbide tools or components, assembly may involve brazing carbide tips to steel bodies or integrating carbide inserts. Secondary operations include grinding, polishing, coating, or surface treatments such as chemical vapor deposition (CVD) or physical vapor deposition (PVD) to enhance surface hardness and reduce friction.

5. Finishing

Final finishing involves precision grinding and inspection to achieve tight dimensional tolerances and surface finishes. This stage is crucial for components used in high-precision applications such as cutting tools, mining equipment, or industrial machinery.

For B2B buyers, especially those operating across diverse regions like Africa, South America, the Middle East, and Europe, understanding the quality assurance processes and certifications that underpin carbide manufacturing is vital for risk mitigation and supplier evaluation.

International and Industry Standards

- ISO 9001: The cornerstone of quality management systems worldwide, ISO 9001 certification indicates that a supplier maintains consistent processes for quality assurance, documentation, and continuous improvement.

- CE Marking: Relevant for carbide tools and components marketed within the European Economic Area, ensuring compliance with health, safety, and environmental protection standards.

- API Standards: For carbide products used in the oil and gas sector, adherence to API (American Petroleum Institute) specifications assures suitability for critical applications.

- Other Regional Certifications: Buyers in regions like Brazil and Thailand should verify compliance with local standards, which may include INMETRO in Brazil or TISI in Thailand, reflecting governmental quality and safety requirements.

Key Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and powders upon arrival, including chemical composition analysis and particle size distribution tests.

- In-Process Quality Control (IPQC): Continuous monitoring during pressing, sintering, and assembly phases to detect deviations early. Techniques include dimensional checks, density measurements, and visual inspections.

- Final Quality Control (FQC): Comprehensive testing of finished products, including hardness testing (e.g., Rockwell or Vickers), microstructural analysis, wear resistance tests, and geometric tolerance verification.

Common Testing Methods

- Hardness Testing: Ensures the carbide meets the required hardness specifications critical for performance.

- Microstructural Examination: Using optical or electron microscopy to detect porosity, grain size, and binder distribution.

- Non-Destructive Testing (NDT): Ultrasonic or X-ray inspection to identify internal defects without damaging the component.

- Wear and Impact Testing: Simulates operational conditions to assess durability.

Given the complexity and precision required in carbide manufacturing, B2B buyers should implement a rigorous supplier verification process to ensure compliance with quality standards and minimize supply chain risks.

1. Conducting Supplier Audits

On-site audits allow buyers to assess the manufacturing environment, process controls, and quality management systems firsthand. Audits should cover raw material handling, equipment calibration, process documentation, and employee training programs. For international buyers, partnering with local inspection agencies or third-party audit firms can facilitate these assessments cost-effectively.

2. Requesting Comprehensive Quality Documentation

Suppliers should provide detailed quality reports including material certifications, process control records, inspection results, and certificates of conformity. Documentation transparency enables buyers to trace product quality back to each manufacturing stage.

3. Utilizing Third-Party Inspection and Testing Services

Independent laboratories and inspection agencies offer unbiased verification of product quality and compliance. For international transactions, especially from regions with emerging manufacturing sectors, third-party inspections mitigate risks related to quality discrepancies or counterfeit products.

4. Understanding QC and Certification Nuances Across Regions

- Africa & Middle East: Buyers should be aware of variable local enforcement of standards and may require stricter verification measures, including additional third-party testing.

- South America: Regional certification bodies like INMETRO provide assurance, but buyers should confirm international standards alignment, especially for export-grade products.

- Europe: European buyers often demand CE marking and strict adherence to ISO standards, benefiting from well-established regulatory frameworks.

- Asia (e.g., Thailand): A growing manufacturing hub with increasing compliance to global standards; however, due diligence is required to verify supplier certifications and process maturity.

By mastering the manufacturing and quality assurance intricacies of carbide products, international B2B buyers can secure high-performance components, reduce operational risks, and foster long-term supplier partnerships tailored to their regional market dynamics.

When sourcing carbide products, it is essential for international B2B buyers to grasp the multifaceted cost components that collectively determine the final price. The primary cost components include:

Several factors affect the unit price and overall cost structure beyond raw materials and basic production:

For buyers from Africa, South America, the Middle East, and Europe (including markets like Thailand and Brazil), adopting a strategic approach to pricing and cost management is vital:

It is important to note that carbide product prices fluctuate based on market dynamics, raw material availability, geopolitical factors, and supplier-specific variables. The figures discussed here are indicative and should be validated with current supplier quotations and market intelligence before final procurement decisions.

By understanding the detailed cost components and price influencers of carbide products, and adopting informed negotiation and sourcing strategies, international B2B buyers can optimize procurement costs while ensuring product quality and supply chain reliability.

Understanding the critical technical properties of carbide is essential for international buyers to make informed procurement decisions that align with their operational requirements and quality standards.

Material Grade

Carbide grades indicate the composition and quality of the carbide material, typically a tungsten carbide (WC) and cobalt (Co) binder mixture. Different grades offer varying hardness, toughness, and wear resistance. For example, a higher cobalt content increases toughness but may reduce hardness. Selecting the right grade ensures durability and performance in specific industrial applications such as cutting, drilling, or wear parts.

Grain Size

Grain size refers to the average size of carbide particles within the material. Finer grains generally provide higher hardness and better wear resistance, ideal for precision tools. Coarser grains offer greater toughness, suitable for heavy-duty applications. Buyers must match grain size to the intended use to optimize tool life and efficiency.

Tolerance (Dimensional Accuracy)

Tolerance defines the permissible deviation in the dimensions of carbide components. Tight tolerances (e.g., ±0.01 mm) are crucial for parts requiring precise fits, such as inserts or dies. For B2B buyers, understanding tolerance requirements helps avoid costly rework and ensures compatibility with machinery or assembly lines.

Hardness (HRA or HV Scale)

Hardness measures the resistance of carbide to deformation or abrasion, commonly reported on the Rockwell A (HRA) or Vickers (HV) scales. Higher hardness improves wear resistance but can reduce toughness. Buyers should specify hardness levels based on operational stresses to balance durability and fracture resistance.

Fracture Toughness

This property indicates the material’s ability to resist crack propagation. High fracture toughness is vital in dynamic or impact-heavy applications. Buyers in sectors like mining or metalworking must consider this to prevent premature tool failure.

Density

Density affects the weight and structural integrity of carbide parts. Consistent density ensures uniform performance and machining behavior. For export buyers, understanding density can also influence shipping costs and handling requirements.

Familiarity with standard trade terms and jargon simplifies communication and negotiation with suppliers, ensuring smoother procurement processes.

OEM (Original Equipment Manufacturer)

Refers to companies that produce carbide parts or tools used in the manufacturing of final products. Buyers often seek OEM-certified carbides to guarantee quality and compatibility with existing machinery.

MOQ (Minimum Order Quantity)

The smallest quantity of carbide products that suppliers are willing to sell. MOQ can vary significantly based on product type and customization. International buyers should clarify MOQ upfront to optimize inventory and cash flow management.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and terms for specific carbide products. RFQs are critical for comparing offers and negotiating the best terms, especially when sourcing from multiple countries.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Understanding Incoterms helps buyers avoid unexpected costs and logistical issues.

Heat Treatment

A process applied to carbide parts to enhance hardness and toughness. Buyers should inquire about heat treatment specifications to ensure the supplied carbide meets operational requirements.

Coating

Some carbide tools come with surface coatings (e.g., TiN, TiAlN) to improve wear resistance and reduce friction. Knowing coating options enables buyers to select products tailored to specific cutting or machining conditions.

By mastering these technical properties and trade terms, B2B buyers from Africa, South America, the Middle East, and Europe can confidently navigate the carbide market, ensuring optimal product selection and favorable commercial agreements. This knowledge supports cost-effective purchasing, reduces risk, and enhances operational efficiency across industries.

The carbide sector, pivotal in manufacturing and industrial tooling, is experiencing robust global growth driven by escalating demand across automotive, aerospace, mining, and construction industries. For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding these dynamics is critical to optimizing procurement strategies. Regions like Brazil and Thailand are witnessing increased investment in precision machining and heavy industry, which boosts demand for high-quality carbide tools and components.

Key trends shaping the carbide market include the integration of advanced manufacturing technologies such as additive manufacturing and Industry 4.0-enabled smart tooling. These innovations are enhancing product performance, reducing lead times, and enabling customization to meet specific industrial needs. Buyers should prioritize suppliers that leverage these technologies to ensure access to cutting-edge carbide products.

Supply chain resilience has become a strategic focus, especially for regions with logistical challenges or geopolitical risks. African and Middle Eastern buyers, in particular, are advised to diversify sourcing channels and establish partnerships with suppliers who maintain robust inventory management and transparent communication. Additionally, emerging markets are increasingly adopting digital procurement platforms, facilitating better price discovery and vendor comparison.

The shift towards miniaturization and high-precision applications in electronics and medical sectors also expands carbide usage beyond traditional heavy industries. Buyers from Europe, with their emphasis on advanced manufacturing, benefit from suppliers offering ultra-fine grain carbide and specialized coatings that extend tool life and improve efficiency. Staying informed about these evolving product features enables buyers to make cost-effective decisions aligned with industry advancements.

Sustainability is gaining unprecedented importance in the carbide sector, driven by global regulatory pressures and corporate responsibility commitments. Carbide manufacturing, particularly tungsten and cobalt extraction, involves significant environmental impacts, including energy-intensive processes and potential toxic waste generation. For B2B buyers, especially in regions like Europe and South America where environmental regulations are stringent, prioritizing suppliers with verified sustainable practices is essential.

Ethical sourcing is equally critical due to concerns around cobalt mining, often linked to human rights issues in certain regions. Buyers should seek suppliers with transparent supply chains that provide traceability certifications such as the Responsible Minerals Assurance Process (RMAP) or adherence to the OECD Due Diligence Guidance. Partnering with certified suppliers mitigates risks of reputational damage and ensures compliance with international standards.

Green certifications, including ISO 14001 for environmental management and adherence to circular economy principles, are increasingly common among leading carbide producers. These certifications indicate a commitment to reducing carbon footprints, minimizing waste, and recycling carbide materials. Buyers can leverage these credentials to align procurement with corporate sustainability goals and appeal to environmentally conscious end-users.

Moreover, the adoption of recycled tungsten and cobalt in carbide production is an emerging trend that reduces reliance on virgin raw materials and lowers environmental impact. International buyers should inquire about a supplier’s use of recycled content and their strategies for reducing energy consumption during manufacturing. This focus on sustainability not only supports global ecological goals but often results in cost savings through improved resource efficiency.

Carbide materials have a storied history dating back to the early 20th century when tungsten carbide was first developed to replace steel in cutting tools due to its superior hardness and wear resistance. This breakthrough revolutionized industrial manufacturing by enabling longer-lasting tools capable of machining harder materials with greater precision.

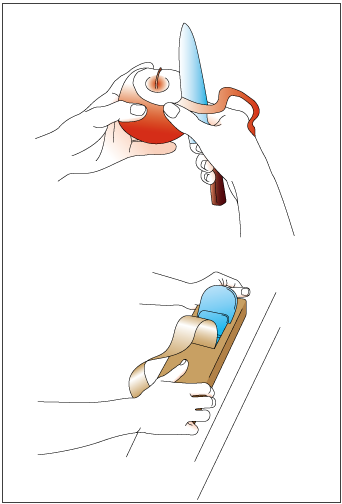

Illustrative Image (Source: Google Search)

Over the decades, continuous advancements in carbide grain refinement, binder materials (notably cobalt), and coating technologies have expanded its applications from heavy industry to precision electronics and medical devices. The globalization of carbide production, with significant growth in Asia and emerging markets, has transformed sourcing patterns and supplier landscapes.

Illustrative Image (Source: Google Search)

Understanding this historical evolution helps B2B buyers appreciate the technological sophistication behind modern carbide products and the importance of sourcing from suppliers who invest in ongoing innovation and quality assurance. This knowledge supports informed decision-making that balances cost, performance, and sustainability considerations in a competitive global market.

Illustrative Image (Source: Google Search)

1. What key factors should I consider when vetting carbide suppliers internationally?

When vetting carbide suppliers, prioritize their certification compliance (ISO, REACH, RoHS), production capacity, and experience with international clients. Verify their financial stability and request references or case studies relevant to your region (Africa, South America, Middle East, Europe). Conduct factory audits or third-party inspections if possible. Assess their responsiveness and communication clarity, as these impact ongoing collaboration. Ensure they can meet your technical specifications and customization needs to avoid costly mismatches.

2. How customizable are carbide products, and what should I specify upfront?

Carbide products can be tailored in terms of grain size, composition, shape, and coating to meet specific industrial applications. Clearly communicate your performance requirements, environmental conditions, and compatibility needs at the outset. Early specification of dimensional tolerances and quality standards helps suppliers propose viable solutions and avoid delays. Request detailed technical datasheets and prototypes where possible to confirm suitability before committing to large orders.

3. What are typical minimum order quantities (MOQs) and lead times for carbide purchases?

MOQs vary widely depending on supplier scale and product type but typically range from a few hundred to several thousand units. Lead times depend on customization complexity and stock availability, often spanning 4 to 12 weeks. For international buyers in emerging markets, plan for additional buffer time for customs clearance and logistics. Negotiate flexible MOQs for initial orders to test supplier reliability without overcommitting capital.

4. What payment terms are common in international carbide transactions, and how can I mitigate risks?

Standard payment terms often include 30-50% upfront deposits with the balance paid upon shipment or delivery. Letters of credit (LC) and escrow services provide added security for first-time transactions. Use verified payment platforms and insist on clear contractual terms covering quality, delivery, and penalties. Building long-term supplier relationships can enable more favorable credit terms over time, reducing upfront capital requirements.

5. Which quality assurance certifications should I look for in carbide suppliers?

Look for suppliers holding ISO 9001 for quality management, ISO 14001 for environmental management, and specific industry-related certifications such as ASTM standards for carbide materials. Compliance with REACH and RoHS regulations is critical for European markets. Request certificates of analysis (CoA) and third-party lab test results for each batch to ensure consistency. Quality certifications reduce risk and streamline approval processes in regulated industries.

6. How should I handle logistics and shipping challenges for carbide imports?

Carbide products are dense and often heavy, impacting freight costs. Choose suppliers experienced with international shipping and familiar with your regional customs regulations. Consolidate shipments to optimize container usage and negotiate Incoterms (e.g., FOB, CIF) that clarify responsibility for freight and insurance. Engage freight forwarders specializing in industrial materials to avoid delays. Plan for potential tariffs or import duties and factor these into your total landed cost.

7. What are best practices for resolving disputes with carbide suppliers internationally?

Establish clear contract terms detailing product specifications, delivery schedules, inspection procedures, and dispute resolution mechanisms. Use arbitration clauses referencing international bodies (e.g., ICC) to avoid costly litigation. Maintain thorough documentation of communications, quality inspections, and shipment records. Early engagement and transparent communication often resolve issues amicably. Leverage local trade chambers or embassies for mediation support if needed.

8. How can I ensure sustainable and ethical sourcing of carbide materials?

Demand supplier transparency regarding raw material sourcing, labor practices, and environmental impact. Prioritize suppliers committed to responsible mining and production, with third-party sustainability certifications (e.g., ISO 14001, conflict-free sourcing). Incorporate sustainability criteria into your supplier evaluation and contract terms. This mitigates reputational risk and aligns with increasing regulatory and customer demands across Africa, South America, the Middle East, and Europe.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The strategic sourcing of carbide is pivotal for international B2B buyers aiming to optimize cost-efficiency, quality, and supply chain resilience. Understanding carbide’s unique properties and diverse applications enables buyers to make informed decisions that align with their operational needs and industry standards. For businesses in Africa, South America, the Middle East, and Europe, leveraging regional supplier strengths while evaluating global market trends is essential to secure competitive advantages.

Key takeaways include:

- Prioritizing suppliers with proven quality certifications and robust technical support to ensure product reliability.

- Emphasizing long-term partnerships to mitigate risks related to price volatility and supply disruptions.

- Incorporating sustainability and compliance factors in supplier evaluation to meet evolving regulatory and corporate responsibility expectations.

Looking ahead, carbide sourcing will increasingly benefit from digital procurement tools and enhanced transparency in the supply chain. Buyers should proactively engage with suppliers embracing innovation and sustainable practices to future-proof their procurement strategies. By adopting a strategic, informed approach, businesses can unlock greater value, enhance operational performance, and position themselves strongly in the competitive global market.

For international buyers, especially in emerging and diverse markets such as Thailand and Brazil, the call to action is clear: invest in deep supplier insights, foster collaborative relationships, and continuously adapt sourcing strategies to navigate the dynamic carbide landscape successfully.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina