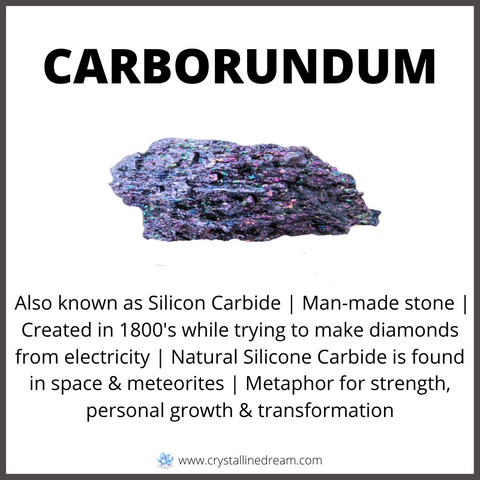

Carborundum crystals stand at the forefront of industrial abrasives and advanced material applications, making them indispensable across diverse manufacturing sectors worldwide. For B2B buyers operating in regions such as Africa, South America, the Middle East, and Europe, understanding the nuances of sourcing these crystals can dramatically influence product quality, operational efficiency, and cost-effectiveness. Whether utilized in cutting, grinding, or polishing, carborundum’s unique properties demand careful consideration of types, purity levels, and manufacturing standards.

This comprehensive guide is designed to equip international buyers—from industrial manufacturers in South Africa to precision toolmakers in Colombia—with critical insights into the carborundum crystal market. It covers a broad spectrum of essential topics including the various types and grades of carborundum crystals, raw materials sourcing, state-of-the-art manufacturing and quality control processes, as well as a detailed analysis of global suppliers. Additionally, the guide delves into pricing structures and market trends to help buyers anticipate fluctuations and negotiate effectively.

By consolidating technical knowledge with practical sourcing strategies, this resource empowers buyers to make informed decisions that align with their specific industrial requirements and regional market conditions. The inclusion of frequently asked questions further clarifies common challenges encountered during procurement, ensuring a smooth and confident purchasing journey. Ultimately, this guide is an essential tool for businesses aiming to secure high-quality carborundum crystals while optimizing supply chain resilience and cost management in a competitive global marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Black Carborundum | High hardness, dark gray to black color, crystalline structure | Abrasive tools, grinding wheels, sandpapers | Pros: Cost-effective, widely available; Cons: Limited thermal resistance |

| Green Carborundum (Silicon Carbide) | Greenish hue, higher purity, better thermal conductivity | High-performance cutting tools, semiconductor industry | Pros: Superior hardness and thermal stability; Cons: Higher cost, specialized handling |

| Brown Carborundum | Brownish tint due to impurities, slightly lower purity | General purpose abrasives, polishing compounds | Pros: Affordable, versatile; Cons: Lower abrasive efficiency compared to green type |

| White Carborundum (Alpha Silicon Carbide) | White or translucent, high purity, crystalline alpha phase | Electronics, high-end polishing, refractory materials | Pros: Excellent purity and chemical stability; Cons: Limited mechanical toughness |

| Nano Carborundum Crystals | Ultra-fine particle size, enhanced surface area | Advanced coatings, nanocomposites, precision abrasives | Pros: Enables precision applications, improved material properties; Cons: Higher manufacturing complexity and cost |

Standard Black Carborundum is the most commonly used type, valued for its hardness and cost-effectiveness. Its dark coloration results from its crystalline silicon carbide structure. This type is ideal for general abrasive applications such as grinding wheels and sandpapers. Buyers should consider its limited thermal resistance when used in high-temperature environments. Its widespread availability makes it a practical choice for bulk industrial use, particularly in regions with cost sensitivity like parts of Africa and South America.

Green Carborundum, often referred to as silicon carbide, offers higher purity and superior thermal conductivity. Its green tint distinguishes it from other types and signals enhanced performance in demanding applications like high-speed cutting tools and semiconductor manufacturing. For B2B buyers in technologically advanced sectors, especially in Europe and the Middle East, investing in green carborundum can yield long-term benefits despite its higher upfront cost and need for specialized handling.

Brown Carborundum contains more impurities, giving it a characteristic brown color. It is typically used in general-purpose abrasive and polishing products where ultra-high performance is not critical. This type is attractive to buyers looking for a balance between cost and versatility, making it suitable for emerging markets or industrial sectors with moderate technical requirements. However, buyers should be aware of its relatively lower abrasive efficiency compared to premium variants.

White Carborundum, or alpha silicon carbide, is prized for its high purity and chemical stability. Its translucent or white appearance indicates the alpha crystalline phase, which is favored in electronics manufacturing, high-end polishing, and refractory materials. Buyers targeting niche, high-precision industries will find this type advantageous for applications requiring chemical inertness and minimal contamination. However, its mechanical toughness may be lower, necessitating careful application matching.

Nano Carborundum Crystals represent the cutting edge of silicon carbide technology, featuring ultra-fine particle sizes that enhance surface area and material interaction. These are increasingly used in advanced coatings, nanocomposites, and precision abrasive applications. While the manufacturing complexity and cost are higher, buyers in innovative sectors such as aerospace, electronics, and specialty manufacturing will benefit from the improved material properties and precision these crystals offer. Selecting reliable suppliers with expertise in nano-scale production is critical for successful procurement.

Related Video: The Genius Behind Bach's Goldberg Variations: CANONS

| Industry/Sector | Specific Application of carborundum crystals | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Abrasives Manufacturing | Production of grinding wheels, cutting tools, and sandpapers | High durability and efficiency in material removal, reducing operational costs | Purity and consistent crystal size; compliance with environmental standards; supplier reliability for bulk orders |

| Electronics & Semiconductors | Use in semiconductor wafer slicing and precision polishing | Enhances precision, reduces wafer breakage, and improves yield | Ultra-high purity grade crystals; traceability and certification; supply chain stability for continuous production |

| Automotive Industry | Surface finishing and machining of engine components | Improves component lifespan and performance through fine finishing | Consistent hardness and particle size; availability of technical support; cost-effectiveness for large volume procurement |

| Construction & Engineering | Abrasive blasting and cutting of stone, concrete, and metals | Efficient surface preparation and cutting, improving project timelines | Abrasive grit size uniformity; compliance with local safety regulations; logistics and timely delivery capabilities |

| Renewable Energy | Manufacturing of solar panel substrates and heat-resistant components | Enhances durability and thermal resistance, increasing energy efficiency | High thermal stability crystals; certification for renewable energy applications; supplier experience in cleanroom-grade materials |

Abrasives Manufacturing

Carborundum crystals are fundamental in producing high-performance abrasives such as grinding wheels and cutting tools. Their exceptional hardness and thermal conductivity enable efficient material removal, extending tool life and lowering production downtime. For international buyers in regions like South Africa and Colombia, sourcing crystals with consistent particle size and purity is critical to ensure uniform product quality. Additionally, compliance with environmental regulations and reliable bulk supply are essential to maintain uninterrupted manufacturing processes.

Electronics & Semiconductors

In semiconductor fabrication, carborundum crystals are used for slicing silicon wafers and precision polishing. Their ultra-fine and pure crystalline structure allows manufacturers to achieve high precision and reduce wafer breakage, directly improving production yield. Buyers from Europe and the Middle East should prioritize ultra-high purity grades with traceability and certification to meet stringent industry standards. Stable supply chains are also vital to support continuous semiconductor production cycles.

Automotive Industry

The automotive sector leverages carborundum crystals for surface finishing and machining of critical engine and transmission components. The crystals’ hardness ensures fine finishing that enhances component durability and performance. For B2B buyers in fast-growing automotive markets like Brazil and South Africa, consistent hardness and particle size distribution are crucial. Additionally, suppliers offering technical support and cost-effective solutions for large volume orders can provide a competitive advantage.

Construction & Engineering

Carborundum crystals are widely used in abrasive blasting and cutting applications for stone, concrete, and metal surfaces. They enable efficient surface preparation, improving project timelines and quality. International buyers, especially in infrastructure-heavy regions of the Middle East and Europe, should focus on abrasive grit size uniformity and suppliers that comply with local safety and environmental regulations. Timely delivery and strong logistics support are also key considerations to avoid project delays.

Renewable Energy

In the renewable energy sector, carborundum crystals contribute to manufacturing solar panel substrates and heat-resistant components. Their thermal stability and durability enhance energy efficiency and product lifespan. Buyers from emerging solar markets in Africa and Europe need crystals with verified thermal resistance and certifications specific to renewable applications. Partnering with suppliers experienced in cleanroom-grade materials ensures product quality and compliance with industry standards.

Related Video: What is Crystallization | Definition, Process, and Industrial Applications

Silicon carbide is the most common material used for carborundum crystals, prized for its exceptional hardness and thermal conductivity. It withstands extremely high temperatures (up to 1600°C) and maintains chemical inertness against most acids and alkalis, making it ideal for abrasive and refractory applications. Its corrosion resistance ensures longevity in harsh environments, including chemical processing and high-wear industrial machinery.

Pros: Excellent thermal stability, superior hardness, and chemical resistance. It is widely available and well-understood in global markets, facilitating compliance with international standards such as ASTM C799 and DIN EN ISO 9001.

Cons: The manufacturing process is energy-intensive, leading to higher costs compared to some alternatives. It can be brittle under mechanical shock, requiring careful handling during integration.

Application Impact: Silicon carbide carborundum crystals are suited for abrasive media, high-temperature filtration, and semiconductor manufacturing. For buyers in Africa and South America, where industrial infrastructure is rapidly developing, SiC offers a balance of durability and performance, though cost considerations are critical. European and Middle Eastern buyers often prioritize compliance with stringent EU REACH regulations and quality certifications, which SiC manufacturers typically meet.

Boron carbide is known for its extreme hardness, second only to diamond, and its low density, making it valuable for lightweight, high-strength applications. It resists corrosion from molten metals and acids, and tolerates temperatures up to around 2400°C, which is higher than silicon carbide. This makes it suitable for ballistic armor, nuclear applications, and high-performance abrasives.

Pros: Exceptional hardness and wear resistance, lightweight, and excellent chemical resistance. It meets several international standards, including JIS and ASTM for advanced ceramics.

Cons: Significantly more expensive than silicon carbide, with a more complex and costly manufacturing process. Its brittleness can limit use in shock-prone environments.

Application Impact: Boron carbide crystals are ideal for specialized applications requiring extreme wear resistance and low weight, such as defense and aerospace industries. For B2B buyers in the Middle East and Europe, where advanced manufacturing sectors demand high-performance materials, boron carbide is attractive despite its premium price. African and South American markets may find it less accessible due to cost but valuable for niche high-tech projects.

Aluminum oxide, or alumina, is a widely used abrasive material with good hardness and excellent chemical stability. It operates effectively under moderate temperature ranges (up to 1700°C) and is resistant to wear and corrosion, making it a versatile choice for grinding, polishing, and refractory applications.

Pros: Cost-effective, readily available, and easier to manufacture compared to carbides. It complies with ASTM B911 and ISO standards, making it a reliable choice for international trade.

Cons: Lower hardness compared to silicon and boron carbides, which may reduce efficiency in high-wear or high-temperature environments.

Application Impact: Alumina-based carborundum crystals are suitable for general-purpose abrasives and industrial processes where cost and availability are priorities. Buyers in South America and Africa often prefer alumina for its affordability and ease of sourcing, while European and Middle Eastern buyers may use it in less demanding applications or as a cost-effective alternative.

Synthetic diamond carborundum crystals offer unmatched hardness and thermal conductivity, making them the premium choice for cutting, grinding, and high-precision applications. They withstand extreme temperatures and chemical exposure, suitable for semiconductor, aerospace, and medical industries.

Pros: Ultimate hardness and wear resistance, excellent thermal properties, and long service life. Synthetic diamonds conform to international standards such as ISO 18323 and ASTM E3 for abrasives.

Cons: Very high cost and complex manufacturing processes limit widespread use. Handling requires specialized equipment and expertise.

Application Impact: Ideal for high-end industrial applications where performance justifies cost. European and Middle Eastern buyers with advanced manufacturing capabilities frequently invest in synthetic diamond crystals. African and South American buyers may consider them for specialized sectors but often face budget constraints.

| Material | Typical Use Case for carborundum crystals | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | Abrasives, high-temp filtration, semiconductor | High thermal stability and chemical inertness | Brittle under shock, higher energy cost | Medium |

| Boron Carbide | Ballistic armor, nuclear, high-performance abrasives | Extreme hardness and low density | Very expensive and brittle | High |

| Aluminum Oxide | General abrasives, polishing, refractory | Cost-effective and widely available | Lower hardness and thermal resistance | Low |

| Synthetic Diamond | Cutting, grinding, precision tools | Unmatched hardness and thermal conductivity | Very high cost and complex manufacturing | High |

Carborundum crystals, widely used in abrasive applications and high-precision industrial components, require meticulous manufacturing and stringent quality assurance to meet the demands of global B2B buyers. Understanding the manufacturing stages and quality control (QC) protocols is crucial for buyers from Africa, South America, the Middle East, and Europe to ensure product reliability and compliance with international standards.

The production of carborundum crystals involves several critical stages, each contributing to the final product’s performance and consistency:

Material Preparation

The process begins with sourcing high-purity raw materials, primarily silicon carbide powders and carbon sources. These materials undergo precise proportioning and blending to achieve the desired chemical composition. For B2B buyers, verifying the origin and quality of raw materials is essential as impurities can affect crystal quality.

Forming and Synthesis

The blended materials are subjected to high-temperature electric arc furnaces or chemical vapor deposition (CVD) methods to synthesize the carborundum crystals.

- Electric Arc Furnace: This traditional method melts raw materials at temperatures above 2,500°C, promoting crystal growth through controlled cooling.

- Chemical Vapor Deposition: Used for high-purity and finely controlled crystal structures, CVD deposits silicon carbide layers on substrates under vacuum and controlled gas environments.

Both methods require precise control of temperature, atmosphere, and time to influence crystal size and morphology.

Assembly and Shaping

Post-synthesis, crystals are crushed and ground to the required size and shape depending on their industrial application. Techniques such as crushing, milling, and sieving ensure consistent particle size distribution. For specific uses, crystals may be formed into blocks or wafers through pressing and sintering under controlled conditions.

Finishing and Surface Treatment

Final finishing includes polishing, coating, or etching to improve surface properties like hardness, thermal stability, and resistance to wear. Some applications require doping or surface functionalization to tailor electrical or chemical properties.

Quality assurance in carborundum crystal manufacturing is multi-layered, combining international standards, in-process controls, and final product verification to guarantee performance and compliance.

Incoming Quality Control (IQC)

- Raw materials are inspected for purity, particle size, and chemical composition using techniques such as X-ray fluorescence (XRF) and scanning electron microscopy (SEM).

- Certificates of analysis (CoA) from raw material suppliers should be reviewed and verified.

In-Process Quality Control (IPQC)

- During synthesis and forming, parameters like temperature, pressure, and atmosphere composition are continuously monitored.

- Crystal morphology and defect rates are examined at various production stages using optical microscopy and spectroscopy methods.

- Process deviations are recorded and addressed immediately to minimize waste and defects.

Final Quality Control (FQC)

- Finished crystals undergo mechanical testing (hardness, fracture toughness), chemical purity analysis, and dimensional accuracy assessments.

- Surface quality is checked for cracks, inclusions, or contamination.

- Batch traceability is maintained through labeling and documentation.

For international buyers, particularly in Africa, South America, the Middle East, and Europe, due diligence on supplier QC practices is vital:

By comprehensively understanding the manufacturing stages and quality assurance mechanisms for carborundum crystals, B2B buyers can make informed decisions, mitigate risks, and establish robust supply chains tailored to their regional requirements and industry standards. This proactive approach ensures the procurement of high-performance, compliant, and reliable carborundum crystals essential for competitive advantage in global markets.

Understanding the detailed cost structure and pricing dynamics for sourcing carborundum crystals is essential for international B2B buyers aiming to optimize procurement strategies and negotiate favorable terms. This analysis breaks down key cost components, pricing influencers, and actionable tips tailored to buyers from Africa, South America, the Middle East, and Europe.

Raw Materials

The primary input is silicon carbide, whose cost fluctuates based on global supply, purity grades, and sourcing origin. Higher purity materials command premium pricing but deliver better performance and longevity.

Labor Costs

Labor varies significantly depending on the manufacturing country. Regions with advanced automation may have lower labor overhead but higher initial tooling investments. For buyers in regions like South Africa or Colombia, understanding the labor cost advantage or premium in supplier countries is crucial.

Manufacturing Overhead

This includes factory utilities, equipment depreciation, and indirect labor. Overhead rates can escalate with complex manufacturing processes, such as custom crystal shaping or precision grinding.

Tooling and Equipment

Initial tooling costs for molds, cutting tools, and polishing equipment are amortized over production runs. Custom tooling for specialized crystal specifications will increase upfront costs but may reduce unit prices at scale.

Quality Control (QC)

Rigorous QC processes—such as particle size analysis, defect inspection, and certification—add to costs but are vital for ensuring compliance with industry standards and buyer requirements.

Logistics and Freight

Shipping costs vary widely based on Incoterms, shipment mode (air vs. sea), and distance. Buyers from Africa, the Middle East, and South America should factor in additional customs duties, port handling fees, and inland transportation.

Supplier Margin

Suppliers price products to cover costs plus profit margin. Margins depend on market competition, product uniqueness, and buyer-supplier relationships.

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically reduce per-unit costs due to economies of scale. However, buyers must balance MOQ requirements against inventory carrying costs.

Product Specifications and Customization

Custom crystal sizes, shapes, or enhanced purity levels increase complexity and cost. Standardized products generally offer better pricing.

Material Quality and Certifications

Certifications such as ISO, REACH compliance, or RoHS can add to price but are often mandatory for international trade, especially in Europe.

Supplier Location and Capabilities

Suppliers in countries with advanced manufacturing infrastructure may charge premiums for quality and reliability. Conversely, emerging market suppliers might offer competitive pricing but require careful due diligence.

Incoterms Selection

Terms like FOB, CIF, or DDP affect who bears shipping, insurance, and customs costs, impacting the total landed cost for buyers.

Negotiate Beyond Price:

Engage suppliers in discussions about payment terms, volume discounts, quality guarantees, and after-sales support to unlock value beyond mere price reductions.

Assess Total Cost of Ownership (TCO):

Consider lifecycle costs including freight, customs duties, storage, and potential product failure rates. For example, a slightly higher-priced crystal with better durability may reduce replacement costs and downtime.

Leverage Regional Trade Agreements:

Buyers in Africa or South America should explore regional trade agreements (e.g., African Continental Free Trade Area, Mercosur) that may reduce tariffs or simplify customs processes.

Understand Pricing Nuances by Region:

Logistics bottlenecks, currency volatility, and import regulations vary by region. Buyers in the Middle East might prioritize suppliers with efficient port access, while European buyers often require strict compliance documentation.

Request Transparent Cost Breakdowns:

Ask suppliers for detailed quotations itemizing raw materials, labor, overhead, and logistics. Transparency aids benchmarking and negotiation.

Plan for MOQ and Inventory Management:

Align order sizes with production runs to avoid premium small-batch pricing while managing inventory costs prudently.

Pricing for carborundum crystals can vary widely based on the aforementioned factors. The figures provided by suppliers should be treated as indicative and subject to verification through direct supplier engagement and market benchmarking.

By thoroughly understanding the cost drivers and leveraging strategic negotiation tactics, international buyers can optimize sourcing of carborundum crystals to achieve cost efficiency, quality assurance, and supply reliability tailored to their regional business environments.

Understanding the essential technical specifications of carborundum crystals is vital for international B2B buyers to ensure product suitability, cost-efficiency, and compliance with industry standards.

Material Grade

Carborundum crystals are available in various purity grades, typically ranging from industrial-grade to electronic-grade. Higher purity levels imply fewer impurities, translating to better performance in abrasive or semiconductor applications. For buyers in sectors like manufacturing or electronics, specifying the correct grade ensures product reliability and longevity.

Particle Size & Distribution

The granularity of carborundum crystals affects cutting, grinding, and polishing efficiency. Particle sizes typically range from fine powders (<10 microns) to coarse granules (>100 microns). Uniform particle distribution is crucial for consistent performance, especially in automated production processes. Buyers should confirm size specifications to match their machinery and end-use requirements.

Hardness (Mohs Scale)

Carborundum crystals rank about 9-9.5 on the Mohs hardness scale, making them extremely abrasive. This property is critical for applications requiring high wear resistance, such as grinding wheels or cutting tools. Buyers must verify hardness to ensure the crystals meet the durability standards demanded by their industries.

Tolerance and Shape Consistency

Tolerance refers to the allowable deviation in crystal size and shape. Tight tolerance levels guarantee uniformity, essential for precision applications. Irregular shapes or size variations can cause inefficiencies or equipment wear. International buyers should request detailed tolerance data to avoid compatibility issues with existing systems.

Thermal Stability

Carborundum crystals exhibit excellent thermal conductivity and stability at high temperatures. This property is essential for applications involving heat dissipation or exposure to extreme temperatures, such as in refractory linings or electronic components. Confirming thermal characteristics helps buyers avoid material degradation in harsh environments.

Chemical Composition and Purity

Typical carborundum crystals consist mainly of silicon carbide (SiC). Trace elements or impurities can affect chemical resistance and electrical conductivity. Buyers should request certificates of analysis (COA) to verify chemical composition, especially when sourcing for sensitive industrial or electronic applications.

Familiarity with common trade terms enhances communication clarity and streamlines procurement processes for international B2B buyers.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or products that are purchased by another company and retailed under that purchasing company’s brand. For carborundum buyers, sourcing directly from OEMs can ensure product authenticity, quality control, and sometimes better pricing through bulk contracts.

MOQ (Minimum Order Quantity)

The smallest quantity of product a supplier is willing to sell. MOQs vary widely based on supplier capabilities and product type. Understanding MOQ helps buyers, especially from emerging markets like Africa or South America, plan inventory and cash flow efficiently.

RFQ (Request for Quotation)

A formal process where buyers request pricing, lead times, and terms from suppliers. RFQs enable buyers to compare offers and negotiate better terms. Including detailed technical specs in RFQs for carborundum crystals ensures accurate and competitive bids.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define the responsibilities of buyers and sellers in international transactions. Common Incoterms include FOB (Free On Board), CIF (Cost Insurance and Freight), and DDP (Delivered Duty Paid). Knowing Incoterms helps buyers from Europe, the Middle East, and Africa manage logistics, costs, and risks effectively.

Lead Time

The time interval between placing an order and receiving the goods. Lead times depend on production schedules, shipping routes, and customs clearance. For buyers in regions with longer shipping times or complex import regulations, understanding lead time is critical for supply chain planning.

Batch Number / Lot Number

A unique identifier assigned to a specific production batch of carborundum crystals. It is crucial for traceability, quality assurance, and resolving any product issues. Buyers should request batch information to maintain compliance and quality control throughout their supply chain.

By mastering these technical properties and trade terms, international B2B buyers can make informed purchasing decisions, negotiate effectively, and ensure that their supply of carborundum crystals meets operational and quality expectations across diverse markets.

Carborundum crystals, primarily composed of silicon carbide, are critical in numerous industrial applications including abrasives, semiconductors, and high-performance ceramics. Globally, demand is fueled by the expansion of automotive manufacturing, electronics, renewable energy sectors, and heavy machinery production. For B2B buyers across Africa, South America, the Middle East, and Europe—regions with growing industrial bases—understanding market dynamics is essential for strategic sourcing.

Illustrative Image (Source: Google Search)

Key market drivers include the rise in electric vehicle (EV) production, which requires advanced semiconductor components where carborundum crystals play a vital role. Additionally, increased infrastructure investments in countries like South Africa and Colombia spur demand for durable abrasives and cutting tools. The Middle East’s diversification from oil to manufacturing also amplifies the need for high-quality silicon carbide materials.

From a sourcing perspective, buyers are witnessing a shift towards integrated supply chains that combine raw material extraction with downstream processing, ensuring better quality control and cost efficiency. Digital transformation is influencing procurement processes, with platforms enabling real-time inventory tracking and predictive analytics to optimize supply reliability. European buyers, particularly in Germany and Italy, are adopting Industry 4.0 technologies to enhance material traceability and reduce lead times.

Moreover, geopolitical factors and raw material availability influence pricing volatility. Buyers in South America and Africa should consider diversifying suppliers to mitigate risks associated with supply disruptions in key producing countries like China and the United States, which dominate silicon carbide production. Collaborative partnerships and long-term contracts are emerging as preferred strategies to secure stable supply.

Sustainability is increasingly integral to the procurement of carborundum crystals. The environmental footprint of silicon carbide production—energy-intensive and reliant on high-temperature processes—raises concerns about carbon emissions and resource consumption. For international B2B buyers, especially in Europe and the Middle East where regulatory frameworks are stringent, sourcing from suppliers with robust environmental management is crucial.

Ethical sourcing encompasses not only environmental considerations but also social responsibility in mining and manufacturing practices. Transparency in the supply chain ensures that raw materials are sourced without exploiting labor or causing ecological harm. Certifications such as ISO 14001 (Environmental Management Systems) and adherence to the Responsible Minerals Initiative (RMI) standards provide buyers with assurance of compliance.

Green initiatives are gaining traction, with some manufacturers investing in renewable energy to power production facilities and adopting circular economy principles, including recycling silicon carbide waste. Buyers from Africa and South America can leverage these sustainability credentials to enhance their own corporate social responsibility profiles and meet the growing demands of environmentally conscious end-users.

Illustrative Image (Source: Google Search)

Integrating sustainability criteria into supplier selection not only mitigates reputational risk but also aligns with long-term cost efficiencies, as energy-efficient processes often reduce operational costs. Collaboration with suppliers on sustainability reporting and continuous improvement initiatives fosters innovation and resilience in the supply chain.

The utilization of carborundum crystals dates back to the late 19th century when Edward G. Acheson invented silicon carbide as an abrasive material. Initially developed to meet the demand for harder, more durable abrasives than natural diamonds, carborundum revolutionized industrial grinding and cutting processes. Over time, advancements in crystal growth techniques expanded its applications into electronics and high-temperature ceramics.

For B2B buyers today, understanding this evolution highlights the material’s adaptability and technological significance. The progression from bulk abrasive use to precision semiconductor substrates underscores the importance of sourcing high-purity crystals with consistent quality. This historical perspective helps buyers appreciate the value-added aspects of modern carborundum crystals beyond their traditional abrasive role, informing smarter procurement decisions aligned with advanced manufacturing needs.

How can I effectively vet suppliers of carborundum crystals for international trade?

To vet suppliers, prioritize those with verifiable certifications such as ISO 9001 or equivalent quality management credentials. Request detailed product datasheets and samples to assess crystal quality. Check their export history, client references, and compliance with international trade regulations, especially concerning your region (Africa, South America, Middle East, Europe). Use third-party inspection services or audits if possible. Transparency in production processes and clear communication channels are critical to minimize risks and ensure consistent supply quality.

Is customization of carborundum crystals available, and how does it impact pricing and lead times?

Many manufacturers offer customization in terms of crystal size, purity, and packaging to meet specific industrial requirements. Custom orders typically require detailed technical specifications upfront and may involve minimum order quantities (MOQs) higher than standard products. Customization can increase lead times by 2-4 weeks and affect pricing due to specialized processing. Engaging with suppliers early to discuss your needs ensures realistic timelines and budget forecasts.

What are typical MOQ and lead time expectations when ordering carborundum crystals internationally?

MOQs vary by supplier but generally range from 500 kg to several tons per order, depending on crystal grade and customization. Lead times typically span 3 to 8 weeks, factoring production, quality checks, and international shipping. For buyers in regions like South Africa or Colombia, additional time may be needed for customs clearance. Negotiating flexible MOQs or phased shipments can help align supply with project timelines and cash flow.

Illustrative Image (Source: Google Search)

What payment terms are common in international B2B transactions for carborundum crystals?

Suppliers often require upfront payments of 30-50%, with the balance payable upon shipment or delivery. Letters of Credit (LC) are preferred for secure transactions, especially with new suppliers. For trusted partners, Net 30 or Net 60 terms may be negotiated. Always clarify currency, payment methods (wire transfer, escrow), and penalties for late payment. Using internationally recognized payment platforms can reduce risks and facilitate smoother transactions.

How can I ensure quality assurance and verify certifications for imported carborundum crystals?

Request quality assurance documentation such as Material Safety Data Sheets (MSDS), Certificates of Analysis (CoA), and third-party lab test reports. Confirm that the crystals meet industry standards relevant to your application (e.g., abrasives, semiconductors). Implement incoming quality inspections at your warehouse or via local testing labs. Working with suppliers who maintain ISO or equivalent certifications helps guarantee consistent quality and traceability.

What are the best logistics practices for importing carborundum crystals into Africa, South America, the Middle East, or Europe?

Choose freight forwarders experienced in handling mineral and industrial goods with knowledge of your destination’s customs regulations. Opt for containerized sea freight for cost efficiency, or air freight for urgent orders. Ensure proper packaging to prevent contamination or damage during transit. Pre-clearance documentation and harmonized system (HS) codes must be accurately prepared to avoid delays. Collaborate closely with customs brokers familiar with regional import tariffs and duties.

How should disputes over product quality or delivery issues be handled in international carborundum crystal contracts?

Include clear dispute resolution clauses in contracts specifying governing law and arbitration venues acceptable to both parties. Document all communications and inspections meticulously. Engage third-party inspection agencies for impartial verification if disagreements arise. Promptly notify suppliers of issues and seek amicable solutions before escalating. Invoicing and payment terms should be linked to quality acceptance to leverage negotiation power.

Are there regional considerations for sourcing carborundum crystals that international buyers should be aware of?

Yes, regional factors such as trade tariffs, import restrictions, and local certification requirements vary widely. For example, African countries may have specific mineral import regulations, while European buyers must comply with REACH and RoHS standards. South American buyers should consider logistics infrastructure and potential customs delays. Understanding these nuances upfront, possibly with local legal or trade advisors, ensures compliance and smoother procurement cycles.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of carborundum crystals presents a compelling opportunity for international B2B buyers aiming to enhance product quality, optimize costs, and secure supply chain resilience. Key takeaways emphasize the importance of partnering with reputable suppliers who demonstrate consistent product quality, compliance with international standards, and flexibility in order volumes to meet diverse industrial demands. For buyers in regions such as Africa, South America, the Middle East, and Europe, understanding regional market dynamics and logistics considerations is crucial to minimizing lead times and ensuring reliable delivery.

Prioritizing strategic sourcing enables buyers to:

Looking ahead, the demand for carborundum crystals is poised to grow, driven by expanding applications in electronics, abrasives, and advanced manufacturing. Buyers who invest in strategic supplier relationships and supply chain intelligence will be best positioned to capitalize on emerging innovations and evolving market conditions. International buyers are encouraged to proactively engage with global suppliers, explore collaborative partnerships, and continuously monitor market trends to sustain competitive advantage and operational excellence.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina