In today’s fast-evolving industrial landscape, castable powder stands as a pivotal material enabling precision, durability, and efficiency across sectors such as aerospace, automotive, electronics, and advanced manufacturing. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, understanding the nuances of castable powder is essential to secure competitive advantages and optimize supply chain resilience.

This comprehensive guide delves into the multifaceted world of castable powders, covering key types and material compositions, from ceramic-based to metal-infused variants, tailored to diverse industrial applications. It offers an in-depth examination of manufacturing processes and stringent quality control measures that ensure consistency and performance standards, critical for high-stakes production environments.

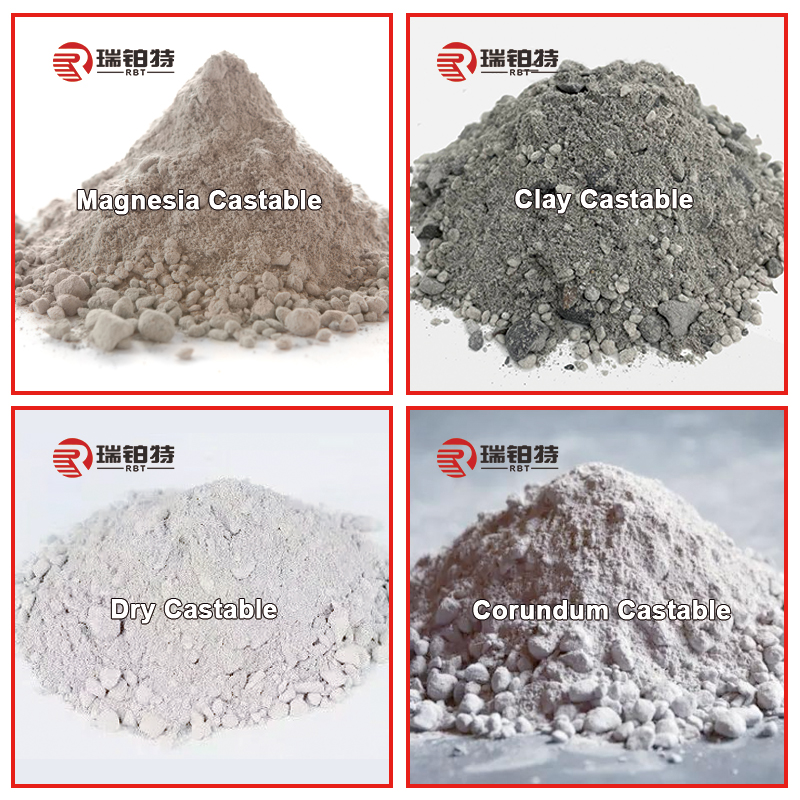

Illustrative Image (Source: Google Search)

Moreover, this resource navigates the global supplier landscape, highlighting reputable manufacturers and distributors across continents, and addresses critical cost considerations, including pricing dynamics, logistics, and import regulations relevant to different regions. By unpacking market trends and emerging innovations, the guide equips buyers with actionable intelligence to anticipate shifts and capitalize on growth opportunities.

To support informed procurement decisions, the guide also features a detailed FAQ section addressing common challenges and technical queries faced by international buyers. Whether sourcing from established hubs in Europe or emerging markets in Africa and the Middle East, this guide empowers B2B buyers with the knowledge to evaluate product quality, negotiate effectively, and build sustainable supplier partnerships.

Unlock the full potential of castable powders by leveraging this authoritative guide to streamline sourcing strategies, mitigate risks, and drive operational excellence on a global scale.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Refractory Castable Powder | High-temperature resistance, dense microstructure | Industrial furnace linings, kilns, incinerators | Pros: Superior thermal stability; Cons: Higher cost, requires skilled handling |

| Ceramic Castable Powder | Fine particle size, excellent flowability | Precision casting, dental molds, electronics | Pros: High precision and surface finish; Cons: Limited high-temp use, brittle |

| Alumina-Based Castable Powder | High alumina content, excellent abrasion resistance | Steel manufacturing, petrochemical reactors | Pros: Durable and wear-resistant; Cons: Heavier, moderate thermal shock resistance |

| Calcium Aluminate Castable Powder | Rapid setting, good corrosion resistance | Cement plants, waste treatment facilities | Pros: Fast installation, good chemical resistance; Cons: Lower high-temp limit |

| Zirconia Castable Powder | Exceptional thermal shock resistance, chemical inertness | Aerospace, high-tech ceramics, nuclear reactors | Pros: Outstanding durability and chemical stability; Cons: Premium pricing, specialized supply |

Refractory Castable Powder

This type is designed to withstand extreme temperatures, making it ideal for heavy industrial environments such as furnace linings and incinerators. Its dense microstructure enhances thermal stability but demands precise mixing and skilled application. For B2B buyers in sectors like steel and energy, investing in refractory castables ensures long service life but may require supplier partnerships for technical support and quality assurance.

Ceramic Castable Powder

Known for its fine particle size and excellent flowability, ceramic castables are tailored for applications requiring precision, such as dental molds and electronics manufacturing. They deliver superior surface finish but are less suited for high-temperature operations due to brittleness. Buyers focusing on precision casting should prioritize suppliers with consistent quality control and customization capabilities.

Alumina-Based Castable Powder

With a high alumina content, this powder offers robust abrasion resistance and durability, making it a preferred choice in steel production and petrochemical reactors. While heavier than other types, its wear resistance justifies the trade-off in demanding environments. B2B purchasers should evaluate suppliers on alumina purity and particle size distribution to ensure optimal performance.

Calcium Aluminate Castable Powder

Characterized by rapid setting and good corrosion resistance, calcium aluminate castables are well-suited for applications like cement plants and waste treatment. Their quicker installation time can reduce downtime, appealing to buyers with tight project schedules. However, their lower maximum temperature tolerance necessitates careful consideration of operating conditions during procurement.

Zirconia Castable Powder

Zirconia variants offer exceptional thermal shock resistance and chemical inertness, making them indispensable in aerospace, nuclear, and high-tech ceramic industries. Despite premium pricing, their durability and stability deliver long-term cost benefits. For B2B buyers, sourcing from specialized suppliers with robust certification processes is critical to meet stringent industry standards.

Related Video: PowerResin Burn & Dark Castable Resin, How Does it Cast?

| Industry/Sector | Specific Application of Castable Powder | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Steel & Metallurgy | Refractory linings for furnaces and ladles | Enhances thermal resistance and durability, reducing downtime and maintenance costs | High purity, thermal stability, and consistent particle size; compliance with international refractory standards |

| Cement & Construction | Heat-resistant molds and formworks | Improves heat endurance and structural integrity in high-temperature environments | Availability of customized formulations adapted to regional raw materials and climate conditions |

| Glass Manufacturing | Casting molds and kiln furniture | Provides superior thermal shock resistance and dimensional stability | Supplier reliability and ability to provide certifications for thermal performance |

| Petrochemical & Refining | Insulating linings for reactors and heat exchangers | Protects equipment from extreme temperatures, extending service life | Chemical inertness and resistance to corrosion; compliance with environmental regulations |

| Power Generation | Thermal insulation components in boilers and turbines | Increases energy efficiency and reduces operational costs through improved insulation | Consistent quality and supply chain resilience to meet large-scale industrial demands |

Steel & Metallurgy

In steel production, castable powder is critical for creating refractory linings in furnaces and ladles that withstand extreme temperatures and corrosive environments. These linings protect equipment integrity, minimizing unplanned shutdowns and costly repairs. Buyers, especially in Africa and the Middle East where high operational temperatures are common, should prioritize suppliers offering high-purity materials with proven thermal stability and adherence to international refractory standards to ensure longevity and performance.

Cement & Construction

Castable powder is utilized to manufacture heat-resistant molds and formworks that endure the high-temperature curing process in cement production. This application enhances the structural integrity of molds, leading to consistent product quality and longer mold life. For B2B buyers in South America and Europe, sourcing should focus on suppliers capable of customizing formulations to local raw material availability and climatic conditions, ensuring optimal performance and cost-efficiency.

Glass Manufacturing

In glass manufacturing, castable powders are employed to produce casting molds and kiln furniture that endure rapid temperature changes without cracking. This ensures dimensional stability and high-quality glass products. International buyers, particularly in regions like Australia and the UAE, must assess supplier reliability and demand certifications for thermal shock resistance to maintain production consistency and reduce downtime.

Petrochemical & Refining

Castable powders serve as insulating linings in reactors and heat exchangers within petrochemical plants, providing protection against extreme thermal and chemical stress. This extends equipment lifespan and enhances operational safety. Buyers should prioritize chemical inertness and corrosion resistance in sourcing decisions, alongside ensuring suppliers comply with stringent environmental and safety regulations prevalent in Europe and the Middle East.

Power Generation

Thermal insulation components made from castable powder improve the efficiency of boilers and turbines by minimizing heat loss. This leads to reduced fuel consumption and operational costs. For large-scale power generation projects, particularly in Africa and South America, buyers must ensure consistent quality and a resilient supply chain to meet high-volume demands without interruption, while also considering the supplier’s capacity to support technical customization.

Related Video: Conventional Press-and-Sinter Powder Metallurgy

Alumina (Al2O3) is one of the most widely used materials in castable powders due to its excellent thermal stability and chemical resistance. It typically withstands temperatures up to 1750°C and offers good resistance to acidic and neutral slags. This makes alumina-based castables ideal for high-temperature industrial applications such as furnace linings and refractory components in steel manufacturing.

Pros: Alumina castables are highly durable, exhibit good mechanical strength, and resist thermal shock effectively. They are relatively easy to manufacture and widely available globally, which benefits supply chain reliability for international buyers.

Cons: The cost of high-purity alumina powders can be moderate to high, and the material may be less effective against highly basic slags. Additionally, manufacturing complexity increases with higher purity grades, potentially impacting lead times.

Application Impact: Alumina castables perform best in environments with neutral to acidic slags and where high-temperature resistance is critical. They are less suitable for environments dominated by calcium-rich or highly basic slags.

International Considerations: Buyers in Africa, South America, the Middle East, and Europe should verify compliance with ASTM C799 and DIN EN 993-14 standards, which govern refractory castables. Regions like the UAE and Australia often require certification confirming thermal and chemical resistance due to their industrial sectors’ stringent quality demands. Alumina’s global availability eases procurement, but buyers should assess local supplier capabilities for consistent quality.

Silica (SiO2) castable powders are prized for their excellent thermal shock resistance and high refractoriness, withstanding temperatures up to approximately 1650°C. They are commonly used in glass furnaces and kiln linings where thermal cycling is frequent.

Pros: Silica castables offer superior resistance to thermal shock and are cost-effective compared to alumina-based alternatives. Their manufacturing process is relatively straightforward, enabling faster production cycles.

Cons: Silica castables are vulnerable to chemical attack by basic slags and have limited corrosion resistance in highly alkaline environments. They also exhibit lower mechanical strength compared to alumina or magnesia-based castables.

Application Impact: These castables are best suited for applications involving rapid temperature changes but less aggressive chemical environments. Their use is common in industries such as glass production and ceramics.

International Considerations: Compliance with JIS R 2216 and ASTM C71 standards is often required, especially in Asian-European trade contexts. Buyers from South America and Africa should consider local environmental regulations affecting silica dust handling and worker safety. The relatively low cost and ease of sourcing silica castables make them attractive for emerging markets with budget constraints.

Magnesia (MgO) castables are known for their high melting point (up to 2800°C) and excellent resistance to basic slags, making them ideal for steelmaking and cement kiln linings. Their chemical inertness in alkaline environments ensures long service life in aggressive conditions.

Pros: Magnesia castables offer outstanding corrosion resistance against basic slags and have excellent thermal conductivity. They provide superior durability in harsh environments and are favored in heavy industrial applications.

Cons: These castables are generally more expensive and complex to manufacture due to the need for high-purity magnesia and precise formulation. They also require careful handling during installation to avoid hydration issues.

Application Impact: Magnesia castables excel in steelmaking, cement production, and other industries where basic slag corrosion is prevalent. Their performance in acidic environments is limited, so material selection must align with the specific chemical exposure.

International Considerations: Buyers should ensure adherence to ASTM C610 and DIN 51068 standards for magnesia refractories. In the Middle East and Europe, certification for thermal shock resistance and slag corrosion is often mandatory. Given the higher cost, buyers in Africa and South America should evaluate total lifecycle costs versus upfront investment.

Zirconia (ZrO2) castables are premium materials offering exceptional thermal stability (up to 2400°C) and excellent corrosion resistance against both acidic and basic slags. They are commonly used in high-performance applications such as glass melting furnaces and chemical reactors.

Pros: Zirconia castables provide superior mechanical strength, thermal shock resistance, and chemical inertness. Their ability to maintain integrity under extreme conditions makes them highly reliable for critical industrial processes.

Cons: Zirconia powders are significantly more expensive and require advanced manufacturing techniques, which can increase lead times and complexity. Their cost often limits use to specialized applications where performance justifies investment.

Application Impact: Ideal for environments demanding extreme durability and chemical resistance, such as specialty glass production and high-temperature chemical processing. Not typically used for general refractory needs due to cost.

International Considerations: Compliance with ASTM C133 and ISO 17872 standards is critical for quality assurance. Buyers in Europe and the UAE often require detailed technical documentation and traceability. For African and South American markets, cost-benefit analysis is crucial before committing to zirconia castables, considering local industrial demands and budget constraints.

| Material | Typical Use Case for castable powder | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alumina | Furnace linings, steel industry refractory components | High thermal stability and chemical resistance | Moderate to high cost; less effective against basic slags | Medium |

| Silica | Glass furnaces, kiln linings with thermal cycling | Excellent thermal shock resistance; cost-effective | Vulnerable to basic slags; lower mechanical strength | Low |

| Magnesia | Steelmaking, cement kilns with basic slag exposure | Outstanding corrosion resistance to basic slags | Higher cost and manufacturing complexity | High |

| Zirconia | Specialty glass production, chemical reactors | Exceptional thermal and chemical resistance | Very high cost; complex manufacturing | High |

The production of castable powder—a critical raw material used extensively in refractory linings, molds, and precision casting—relies on precise and controlled manufacturing stages to ensure optimal performance. Understanding these stages helps B2B buyers assess supplier capabilities and product consistency.

1. Material Preparation

This foundational phase involves selecting and processing raw materials such as alumina, silica, magnesia, or zirconia powders. Suppliers typically employ high-grade, purified minerals to achieve required chemical compositions. The powders are milled, sieved, and blended to attain uniform particle size distribution and homogeneity, which directly impacts the castable’s fluidity and strength.

2. Forming (Mixing and Slurry Preparation)

In this stage, powders are combined with binders, additives, and liquid media (water or specialized solvents) to produce a slurry or dry mix. The mixing process is carefully controlled using high-shear mixers or ball mills to prevent agglomeration and ensure consistent rheology. For castable powders intended for precision applications, rheological properties like viscosity and thixotropy are critical and must be closely monitored.

3. Assembly and Shaping

Though castable powders are primarily supplied as loose powders or premixed slurries, some manufacturers offer semi-formed shapes or blocks for easier handling. In such cases, the slurry is poured into molds or extruded, followed by controlled drying to remove moisture without inducing cracks or defects.

4. Finishing and Packaging

The final phase includes drying, sieving to remove oversized particles, and quality checks before packaging. Packaging is designed to protect against moisture and contamination during transit, often using sealed polyethylene bags or moisture-barrier containers, which is vital for maintaining product integrity, especially during long international shipments.

Quality assurance (QA) in castable powder manufacturing is non-negotiable, given the critical roles these materials play in high-temperature industrial processes. B2B buyers must prioritize suppliers with robust QA systems aligned with international and industry-specific standards.

Key International Standards:

Quality control (QC) is systematically implemented at various production stages to guarantee product reliability:

Incoming Quality Control (IQC): Verifies raw materials against chemical and physical specifications before entering production. Common tests include X-ray fluorescence (XRF) for chemical composition and laser diffraction for particle size analysis.

In-Process Quality Control (IPQC): Monitors slurry viscosity, moisture content, and particle dispersion during mixing and forming. Techniques like rheometry and thermogravimetric analysis (TGA) are frequently used to ensure process consistency.

Final Quality Control (FQC): Conducts comprehensive checks on the finished product, including bulk density, refractoriness under load (RUL), cold crushing strength (CCS), and thermal expansion tests. These parameters confirm the castable powder’s performance characteristics.

For international buyers—especially from Africa, South America, the Middle East, and Europe—ensuring supplier QC integrity is paramount. Here are actionable strategies:

Request Certification Documentation: Always verify ISO 9001 certification and any relevant industry-specific approvals. Certificates should be current and issued by accredited bodies.

Conduct Factory Audits: On-site or virtual audits provide direct insight into manufacturing practices, QC labs, and equipment maintenance. For buyers unable to travel, reputable third-party inspection agencies can perform these audits.

Review QC Reports and Batch Testing: Suppliers should provide detailed batch-wise test reports. Buyers can cross-check these with independent laboratory analyses to verify consistency.

Third-Party Inspection and Testing: Engaging independent inspection companies to test samples before shipment reduces risk. This is particularly important for buyers in regions with strict import regulations or where supplier oversight is challenging.

International buyers must navigate regional regulatory landscapes and import requirements:

Africa and South America: Buyers often face challenges related to infrastructure and logistics. Prioritizing suppliers who offer robust packaging and moisture protection is critical. Additionally, certifications aligned with local standards or recognized international standards streamline customs clearance.

Middle East (including UAE): The region’s emphasis on quality and safety means suppliers must comply with Gulf Cooperation Council (GCC) regulations alongside ISO and CE standards. Buyers should verify that suppliers understand local environmental and safety requirements.

Europe and Australia: These markets demand strict adherence to CE marking and environmental regulations. Traceability and sustainability certifications may also be essential, reflecting growing green procurement policies.

To secure high-quality castable powder suited for demanding industrial applications, international buyers should:

By leveraging these insights, buyers from Africa, South America, the Middle East, and Europe can confidently select castable powder suppliers that deliver reliability, performance, and value in their industrial supply chains.

Illustrative Image (Source: Google Search)

Understanding the cost and pricing dynamics of castable powder is crucial for international B2B buyers aiming to optimize procurement strategies and enhance supply chain efficiency. This analysis breaks down the key cost components, price influencers, and practical buyer tips tailored to markets in Africa, South America, the Middle East, and Europe.

Raw Materials

The primary input costs derive from raw materials such as refractory aggregates, binders, and additives. Prices fluctuate based on the quality and source of minerals, with high-purity or specialty materials commanding premiums. Regional availability can significantly impact costs, especially for buyers in Africa and South America where import dependency may be higher.

Labor and Manufacturing Overhead

Labor costs vary widely by country and production scale. Manufacturing overhead includes energy consumption (often significant in refractory production), facility maintenance, and indirect labor. Efficient production processes can reduce these costs, but buyers should assess the supplier’s operational efficiency and labor standards.

Tooling and Equipment

Initial tooling for custom formulations or specialized casting methods can add to unit costs, particularly for low-volume orders. Suppliers investing in advanced mixing, blending, and quality assurance equipment tend to have higher upfront costs but deliver consistent product quality.

Illustrative Image (Source: Google Search)

Quality Control and Certification

Rigorous QC processes ensure compliance with technical specifications and certifications such as ISO, ASTM, or industry-specific standards. While essential for reliability, these add to the cost base, especially if third-party testing or certification is involved.

Logistics and Freight

Logistics costs encompass packaging, freight forwarding, customs duties, and insurance. For buyers in remote or less-developed regions, these costs can be substantial. Sea freight is common for large volumes but slower, whereas air freight, though expensive, suits urgent smaller shipments.

Supplier Margin

Supplier profit margins reflect market competition, brand positioning, and after-sales service levels. Margins may be negotiable, especially for repeat or high-volume buyers.

Order Volume and Minimum Order Quantities (MOQ)

Larger orders typically attract volume discounts. However, MOQs may limit flexibility for smaller buyers, necessitating careful demand forecasting.

Product Specifications and Customization

Custom formulations tailored to specific refractory applications increase cost due to R&D and specialized raw materials.

Material Quality and Certifications

Certified products with guaranteed performance and traceability command higher prices but reduce operational risks.

Supplier Reputation and Reliability

Established suppliers with proven track records may price at a premium but offer value through reliability and technical support.

Incoterms and Delivery Terms

The choice of Incoterms (e.g., FOB, CIF, DDP) affects who bears the cost and risk during transportation, impacting landed costs for the buyer.

Negotiate Beyond Price

Engage suppliers on payment terms, lead times, and after-sales support. Flexible terms can improve cash flow and reduce inventory costs.

Calculate Total Cost of Ownership (TCO)

Factor in not just the unit price but logistics, customs clearance, potential delays, and quality risks. TCO analysis helps avoid hidden expenses.

Leverage Local Partnerships

In regions like the Middle East or Africa, collaborating with local distributors or agents can reduce import complexities and improve responsiveness.

Demand Transparent Cost Breakdown

Request detailed pricing to identify cost drivers and areas for negotiation, such as reducing packaging or consolidating shipments.

Account for Currency Fluctuations

Currency volatility can affect landed costs. Consider forward contracts or multi-currency invoicing options where feasible.

Understand Regulatory and Certification Requirements

Compliance with local standards can influence supplier selection and pricing. Prioritize suppliers who proactively manage these aspects.

Prices for castable powder vary widely depending on formulation, supplier, volume, and geopolitical factors. The figures discussed here are indicative and should be validated through direct supplier engagement and market research.

By comprehensively analyzing these cost components and price influencers, international B2B buyers can strategically source castable powder to balance cost efficiency with product quality and supply chain reliability.

Understanding the critical technical properties of castable powder is essential for international buyers to ensure product quality, performance, and compatibility with their manufacturing processes. Below are the most important specifications to consider:

Material Grade

This defines the purity and composition of the castable powder, often indicating the type of refractory or ceramic material used (e.g., alumina, silica). Material grade affects durability, thermal resistance, and chemical stability. For B2B buyers, selecting the correct grade ensures the powder meets the operational requirements of high-temperature industrial applications.

Particle Size Distribution (PSD)

PSD refers to the range and average size of powder particles. A uniform particle size promotes consistent packing density and smooth surface finish in the final cast product. Buyers should verify PSD specifications to optimize flowability and minimize defects in casting.

Chemical Composition

The precise elemental makeup influences the powder’s behavior under heat, including expansion, sintering, and corrosion resistance. Buyers dealing with harsh environments must ensure the chemical composition aligns with their product’s exposure conditions.

Tolerance and Purity Levels

These indicate the allowable deviation in particle size, chemical content, and impurities. Strict tolerances and high purity reduce variability in manufacturing outcomes, which is critical for OEMs or industries where precision is paramount.

Bulk Density

This measures the mass of powder per unit volume and impacts handling, packaging, and casting density. Understanding bulk density helps buyers calculate shipping weights and storage requirements, especially when importing in bulk.

Moisture Content

Excess moisture can affect powder flow and the quality of the final cast. Buyers should confirm moisture specifications to avoid issues during mixing and curing stages.

Navigating international B2B transactions requires familiarity with essential trade terms to ensure clear communication and smooth procurement processes:

OEM (Original Equipment Manufacturer)

Refers to companies that use castable powder as a component in their own finished products. For buyers, OEM partnerships often involve strict quality and compliance standards, making supplier reliability a key consideration.

MOQ (Minimum Order Quantity)

The smallest amount of castable powder a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory and budget effectively, especially when dealing with multiple suppliers or new product lines.

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers requesting detailed pricing, delivery, and technical information. Crafting precise RFQs can expedite supplier responses and improve negotiation outcomes.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Selecting appropriate Incoterms clarifies cost allocation and risk during transport.

Lead Time

The total time from placing an order to receiving the goods. Lead times impact production schedules and inventory management, so buyers must align supplier capabilities with their operational timelines.

Certificate of Analysis (CoA)

A document provided by the supplier detailing the technical specifications and test results for a batch of castable powder. Reviewing CoAs ensures product consistency and compliance with buyer requirements.

By mastering these technical properties and trade terms, international buyers from regions such as Africa, South America, the Middle East, and Europe can make informed purchasing decisions, streamline supplier negotiations, and optimize supply chain efficiency for castable powder procurement.

The global castable powder market is experiencing steady growth driven by rising demand in industries such as aerospace, automotive, electronics, and construction. These powders, essential for creating complex refractory shapes and components, are increasingly sought after for their precision and durability. International B2B buyers from Africa, South America, the Middle East, and Europe—regions with expanding manufacturing bases—are capitalizing on this trend to enhance their production capabilities and meet rising quality standards.

Key market drivers include technological advancements in powder formulation and processing, which improve thermal stability and mechanical strength. The adoption of additive manufacturing (3D printing) techniques with castable powders is also gaining momentum, enabling more efficient and customized production. For buyers, this means greater flexibility in sourcing powders tailored to specific performance requirements.

Sourcing trends highlight a shift towards strategic partnerships with suppliers who can offer consistent quality, scalability, and compliance with international standards. Buyers in emerging markets often prioritize suppliers with strong logistics networks and local support to mitigate supply chain risks. Moreover, digital procurement platforms and data analytics tools are becoming integral in streamlining supplier evaluation, price benchmarking, and order tracking—especially relevant for cross-border transactions involving Africa, South America, and the Middle East.

Price volatility in raw materials such as alumina and silica remains a challenge, prompting buyers to explore long-term contracts or diversified sourcing strategies. Additionally, geopolitical factors and trade policies influence availability and lead times, urging buyers to maintain flexible sourcing channels. Europe and Australia’s mature markets emphasize innovation-driven procurement, focusing on powders with enhanced properties to meet stringent environmental and safety regulations.

Sustainability has become a critical consideration in the castable powder sector, as environmental regulations tighten globally and corporate responsibility gains prominence. The production of castable powders traditionally involves energy-intensive processes and raw materials that may have significant environmental footprints. For B2B buyers, especially in regions like Europe and the UAE where regulatory compliance is strict, prioritizing suppliers with sustainable practices is essential.

Ethical sourcing involves ensuring raw materials are extracted and processed without causing undue harm to communities or ecosystems. Buyers should seek suppliers who demonstrate transparency in their supply chains, from mining operations to final processing. Certifications such as ISO 14001 (Environmental Management), REACH compliance (chemical safety in the EU), and Responsible Minerals Initiative (RMI) are valuable indicators of a supplier’s commitment to sustainability and ethical standards.

Green alternatives in castable powder production are emerging, including the use of recycled materials and lower-carbon footprint binders. These innovations help reduce waste and energy consumption, aligning with buyers’ sustainability goals and corporate social responsibility mandates. Implementing life cycle assessments (LCA) to evaluate environmental impacts across the supply chain can also guide procurement decisions towards greener options.

For B2B buyers in Africa and South America, engaging with suppliers who invest in community development and environmental stewardship can enhance brand reputation and reduce operational risks. Collaborative initiatives between buyers and suppliers to improve sustainability performance are becoming a differentiator in supplier selection, fostering long-term partnerships grounded in shared values.

The castable powder industry has evolved significantly from its origins in traditional refractory manufacturing. Initially, castable powders were basic mixtures designed primarily for heat resistance in furnaces and kilns. Over the decades, advancements in material science have led to highly engineered powders with precise particle size distribution, enhanced chemical purity, and tailored thermal properties.

This evolution reflects the broader industrial shift towards high-performance materials capable of meeting the demands of modern manufacturing processes, such as aerospace and electronics, where precision and reliability are paramount. For international B2B buyers, understanding this progression underscores the importance of partnering with suppliers who leverage cutting-edge research and development to deliver consistent, high-quality castable powders.

Today’s market demands not only superior material properties but also adherence to environmental and ethical standards, illustrating how the sector has matured into a complex, innovation-driven industry responsive to global economic and sustainability imperatives.

How can I effectively vet suppliers of castable powder for international B2B transactions?

To vet suppliers, start by verifying their business licenses and certifications relevant to quality and safety standards, such as ISO 9001. Request product samples and technical datasheets to assess quality firsthand. Check references or reviews from other international buyers, especially those within your region or industry. Engage in direct communication to evaluate responsiveness and transparency. Additionally, consider third-party inspection or audits to ensure compliance with your specifications and regulatory requirements. This thorough vetting minimizes risks and ensures a reliable supply chain.

Is customization of castable powder formulations available for different industrial applications?

Yes, many suppliers offer customization to meet specific performance criteria such as thermal resistance, particle size distribution, or binder compatibility. When negotiating, clearly specify your technical requirements and intended application to ensure the formulation matches your needs. Customization may affect minimum order quantities (MOQs) and lead times, so discuss these factors upfront. Working closely with R&D or technical teams at the supplier’s end can also facilitate product optimization, ensuring the castable powder delivers optimal performance in your manufacturing process.

What are typical minimum order quantities (MOQs) and lead times for castable powder from international suppliers?

MOQs vary widely depending on supplier capacity, customization level, and packaging. Standard MOQs typically range from 500 kg to several tons. Lead times depend on production schedules, customization, and shipping logistics but usually span 3 to 8 weeks. For buyers in Africa, South America, the Middle East, and Europe, additional time may be required for customs clearance and transportation. Early engagement and clear communication with suppliers help manage expectations and align delivery schedules with your production plans.

Which payment terms are most common and secure for international castable powder purchases?

Common payment terms include Letters of Credit (LC), Telegraphic Transfers (TT), and open account with credit terms. LCs provide a secure mechanism by involving banks to guarantee payment upon fulfillment of contract terms, reducing risk for both parties. TT is faster but carries more risk, so it is often used with trusted suppliers. Negotiate payment terms that balance cash flow and risk, and consider escrow services or trade finance solutions to protect your transactions. Always confirm the supplier’s banking details and use formal contracts to avoid fraud.

What quality assurance certifications should international buyers look for in castable powder suppliers?

Look for certifications such as ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and industry-specific approvals like ASTM standards or REACH compliance for chemical safety. Certifications ensure consistent product quality and adherence to environmental and safety regulations, crucial for global markets. Request certificates of analysis (CoA) for each batch to verify compliance with agreed specifications. Suppliers with strong QA processes reduce the risk of receiving substandard materials, which can disrupt production and increase costs.

How can logistics challenges be managed when importing castable powder to regions like Africa, South America, or the Middle East?

Plan logistics carefully by selecting suppliers with experience in your target region and reliable freight forwarders familiar with local customs procedures. Consider factors like packaging durability, shipping mode (sea, air, or land), and transit times. Anticipate possible delays due to customs inspections or regulatory checks and include buffer time in your supply chain. Use tracking systems and maintain open communication with suppliers and logistics partners to promptly address any issues. Proper planning reduces downtime and ensures timely delivery.

What steps should be taken if a dispute arises regarding the quality or delivery of castable powder?

Immediately document the issue with photos, test results, and shipping records. Notify the supplier formally and request a resolution according to your contract terms—this might include replacement, refund, or compensation. Engage a third-party inspection or arbitration if necessary. Maintain clear communication and negotiate in good faith to preserve long-term business relationships. Including dispute resolution clauses in contracts, such as jurisdiction and arbitration processes, helps manage conflicts efficiently and protects your interests.

Are there specific regulatory or import restrictions B2B buyers should be aware of when sourcing castable powder internationally?

Yes, regulatory requirements vary by country and can include import licenses, chemical safety data sheets (SDS), and compliance with local standards such as the EU’s REACH or Middle East’s Gulf Conformity Mark. Ensure your supplier provides all necessary documentation to facilitate customs clearance. Some countries may restrict certain chemical components or require specific labeling. Engage customs brokers or legal advisors familiar with your region’s import regulations to avoid delays or penalties. Staying compliant safeguards your supply chain and market access.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In today’s competitive industrial landscape, strategic sourcing of castable powder is critical for international B2B buyers aiming to optimize quality, cost-efficiency, and supply chain resilience. Key considerations include selecting suppliers with proven technical expertise, consistent quality certifications, and robust logistics capabilities to navigate regional challenges across Africa, South America, the Middle East, and Europe.

For buyers, leveraging strategic partnerships and adopting a data-driven sourcing approach can unlock significant advantages, including:

Looking ahead, the castable powder market is poised for innovation driven by sustainability demands and advanced manufacturing technologies. Buyers are encouraged to engage proactively with suppliers who prioritize eco-friendly formulations and digital integration in their production processes.

Taking decisive action now—whether through supplier audits, technology adoption, or cross-regional collaboration—will position your business to capitalize on emerging opportunities and maintain competitive agility. Embrace strategic sourcing as a dynamic, ongoing process to secure reliable supply chains and drive sustained growth in your industrial operations.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina