The electrical conductivity of silicon carbide (SiC) stands at the forefront of advanced materials technology, driving innovation across industries such as power electronics, automotive, aerospace, and renewable energy. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—including regions like Poland and Spain—understanding the nuances of SiC’s electrical properties is critical to securing high-performance, cost-effective components that meet rigorous application demands.

This guide offers a comprehensive exploration of SiC’s electrical conductivity, starting with an overview of its fundamental types and material characteristics. It delves into manufacturing processes and quality control standards that influence conductivity outcomes, ensuring that buyers can assess supplier reliability and product consistency. Additionally, the guide provides detailed insights into global supplier landscapes, cost structures, and market trends, equipping procurement teams with the intelligence needed to navigate complex sourcing environments effectively.

By addressing frequently asked questions and common challenges encountered in selecting SiC materials, this resource empowers international buyers to make informed decisions that optimize performance while minimizing risk. Whether you are sourcing for high-volume production or specialized applications, this guide delivers actionable knowledge to align your purchasing strategy with the evolving demands of the global SiC market. Embrace this opportunity to enhance your supply chain resilience and technological edge through a deeper understanding of electrical conductivity in silicon carbide.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Undoped SiC | High resistivity, intrinsic semiconductor behavior | High-power electronics, high-temperature sensors | + Excellent thermal stability – Low conductivity limits some applications |

| N-type SiC | Doped with nitrogen or phosphorus for electron conduction | Power devices, MOSFETs, high-frequency transistors | + Enhanced conductivity – More expensive than undoped |

| P-type SiC | Doped with aluminum or boron for hole conduction | Semiconductor devices, sensors | + Good for complementary circuits – Lower mobility than N-type |

| Semi-insulating SiC | Contains compensating defects to achieve very high resistivity | Microwave devices, RF applications | + Minimizes parasitic conduction – Complex manufacturing process |

| Polycrystalline SiC | Composed of multiple crystal grains, lower purity | Abrasives, heating elements, some electronic substrates | + Cost-effective for non-electronic uses – Lower electrical performance |

Undoped SiC

Undoped silicon carbide is characterized by its intrinsic, high resistivity and semiconductor nature. It is highly stable at elevated temperatures, making it ideal for high-power and high-temperature applications such as sensors and robust electronics. For B2B buyers in sectors like automotive or aerospace, undoped SiC offers durability but may require additional doping or processing for enhanced conductivity. Cost-effectiveness and thermal performance are key considerations.

N-type SiC

N-type SiC is doped with elements like nitrogen or phosphorus to provide free electrons, significantly increasing electrical conductivity. It is widely used in power electronics, including MOSFETs and high-frequency transistors, which are crucial in renewable energy and industrial automation. Buyers should evaluate the balance between improved electrical performance and higher costs, especially for large-scale manufacturing or precision electronic components.

P-type SiC

P-type SiC uses dopants such as aluminum or boron to create hole carriers, enabling its use in complementary semiconductor circuits and sensors. Although it generally exhibits lower charge carrier mobility than N-type, it is essential for creating full semiconductor devices. B2B buyers should consider its compatibility with N-type materials in device fabrication and its role in specialized sensor applications.

Semi-insulating SiC

This variant achieves very high resistivity through compensating defects, making it ideal for microwave and RF applications where parasitic conduction must be minimized. It supports high-frequency device performance but involves more complex manufacturing processes. Buyers targeting telecommunications or defense sectors should weigh the benefits of superior electrical isolation against procurement complexity and price.

Polycrystalline SiC

Polycrystalline SiC consists of multiple crystalline grains and is less pure than single-crystal forms. It is commonly used in abrasives, heating elements, and as substrates in some electronic applications. While it offers cost advantages for non-electronic or less demanding electrical uses, its lower electrical performance limits its use in high-precision electronics. Buyers focusing on industrial or bulk applications will find it economically advantageous.

Related Video: Semiconductor Physics Session 3 (Conductivity, current density and mobility)

| Industry/Sector | Specific Application of electrical conductivity of SiC | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-efficiency SiC-based power semiconductors and MOSFETs | Increased energy efficiency, reduced heat loss, and longer device lifespan | Purity and doping levels, consistency in electrical properties, supplier certifications |

| Renewable Energy | SiC-based inverters for solar and wind power systems | Enhanced conversion efficiency and reliability under high voltages and temperatures | Compliance with international standards, thermal stability, bulk availability |

| Automotive Industry | SiC components in electric vehicle (EV) powertrains | Improved battery management, faster charging, and reduced power loss | Compatibility with automotive-grade specifications, durability, and supply chain robustness |

| Industrial Heating | SiC heating elements with controlled electrical conductivity | Precise temperature control, energy savings, and longer element life | Material uniformity, electrical resistivity control, and resistance to oxidation |

| Aerospace & Defense | SiC-based sensors and electronic devices requiring stable conductivity | High reliability in extreme environments, weight reduction, and enhanced performance | Traceability, quality assurance, and compliance with aerospace standards |

Power Electronics

In power electronics, silicon carbide’s electrical conductivity is leveraged to produce high-efficiency power semiconductors such as MOSFETs and diodes. These devices operate at higher voltages and temperatures than traditional silicon, enabling significant energy savings and reducing cooling requirements. For international buyers, especially in regions with growing energy infrastructure like Africa and South America, sourcing SiC with consistent electrical conductivity and doping levels is critical to ensure device reliability and performance. Certifications and supplier transparency are essential to mitigate risks in procurement.

Renewable Energy

SiC’s electrical conductivity properties are integral to the manufacturing of inverters used in solar and wind energy systems. These inverters convert DC to AC power with minimal losses, improving overall system efficiency and durability. Buyers in Europe and the Middle East, where renewable energy adoption is accelerating, must prioritize SiC materials that meet stringent thermal stability and voltage endurance standards. Bulk procurement options and adherence to IEC and other relevant standards are important for scaling renewable projects.

Automotive Industry

Electric vehicles rely heavily on SiC components within their powertrains to achieve faster charging times and better battery management through efficient power conversion. The electrical conductivity of SiC allows for smaller, lighter, and more efficient components, directly impacting vehicle range and performance. Automotive manufacturers and suppliers in Poland, Spain, and across Africa should focus on sourcing SiC that complies with automotive-grade certifications (e.g., AEC-Q101) and demonstrates long-term durability under harsh operating conditions.

Industrial Heating

SiC heating elements utilize controlled electrical conductivity to provide precise temperature control in industrial furnaces and processing equipment. This leads to energy savings and extended element lifespan, reducing downtime and maintenance costs. Buyers from heavy industries in South America and Europe need to ensure the SiC heating elements have uniform material properties and stable resistivity to maintain consistent heating performance, especially for applications in metal treatment and ceramics production.

Aerospace & Defense

The aerospace and defense sectors use SiC-based sensors and electronic devices that require stable electrical conductivity for high reliability under extreme environmental conditions. SiC’s ability to maintain performance at high temperatures and radiation exposure makes it ideal for avionics and defense electronics. International buyers must insist on full traceability, rigorous quality assurance processes, and compliance with aerospace material standards such as AS9100 to ensure mission-critical reliability.

Related Video: What is Electrical Conductivity (EC/TDS)?

When selecting materials for applications involving the electrical conductivity of silicon carbide (SiC), understanding the interplay between material properties, performance requirements, and regional standards is critical. Below is an analysis of four common materials used in conjunction with or as alternatives to SiC for electrical conductivity applications, tailored for international B2B buyers in Africa, South America, the Middle East, and Europe.

Key Properties:

SiC is a wide-bandgap semiconductor known for high thermal conductivity, excellent chemical inertness, and outstanding mechanical strength. It operates efficiently at high temperatures (up to 600°C) and withstands high voltages, making it ideal for harsh environments.

Pros & Cons:

SiC offers superior durability and corrosion resistance compared to traditional silicon, but its manufacturing complexity is high, resulting in a higher cost. The material’s brittleness can pose challenges in mechanical handling and machining.

Impact on Application:

SiC’s electrical conductivity is tunable via doping, making it suitable for power electronics, high-frequency devices, and harsh chemical environments. Its resistance to oxidation and thermal shock is advantageous in industrial applications involving corrosive media.

Regional Considerations:

In Europe (e.g., Poland, Spain), compliance with standards like IEC and EN for semiconductor materials is essential. Buyers in Africa and the Middle East should verify availability of SiC components that meet ASTM standards due to import regulations. South American markets often require materials certified under ISO standards for electronics manufacturing.

Key Properties:

Graphite is a form of carbon with high electrical conductivity and excellent thermal stability. It tolerates temperatures above 3000°C in inert atmospheres and offers good chemical resistance, especially in reducing environments.

Pros & Cons:

Graphite is cost-effective and easier to machine than SiC but is prone to oxidation at elevated temperatures in the presence of oxygen. Its mechanical strength is lower than SiC, limiting its use in high-stress environments.

Impact on Application:

Ideal for electrodes, brushes, and components in electrical discharge machining and battery technologies. However, graphite’s susceptibility to oxidation requires protective atmospheres or coatings in certain applications.

Regional Considerations:

Graphite materials often conform to ASTM and DIN standards, facilitating trade in Europe and South America. African and Middle Eastern buyers should ensure supplier adherence to quality certifications due to variable local manufacturing capabilities.

Key Properties:

Doped silicon modifies pure silicon’s electrical conductivity by introducing impurities. It operates effectively at moderate temperatures (up to ~150°C) and is widely used in semiconductor devices.

Pros & Cons:

Doped silicon is less expensive and easier to process than SiC but lacks the high-temperature and high-voltage capabilities of SiC. Its corrosion resistance is moderate, limiting its use in aggressive chemical environments.

Impact on Application:

Common in microelectronics and photovoltaic cells where precise conductivity control is required. Not suitable for high-power or high-temperature industrial applications where SiC excels.

Regional Considerations:

Global semiconductor standards (JEDEC, IEC) apply, with strong adherence in Europe and South America. Buyers from Africa and the Middle East should verify product traceability and compliance with international semiconductor quality benchmarks.

Key Properties:

Silicon nitride is a ceramic with excellent mechanical strength, thermal shock resistance, and moderate electrical conductivity when doped or combined with conductive phases. It withstands temperatures up to 1400°C.

Pros & Cons:

Offers superior toughness compared to SiC and good corrosion resistance. However, its electrical conductivity is lower and less consistent, which may limit its use in precise electrical applications. Manufacturing complexity and cost are relatively high.

Impact on Application:

Used in insulating substrates, high-temperature bearings, and components requiring a balance of mechanical and electrical properties. Suitable for harsh environments where mechanical durability is critical.

Regional Considerations:

Compliance with ASTM and ISO ceramic material standards is common in Europe and South America. Middle Eastern and African buyers should assess supplier capability for custom composite formulations meeting local industrial standards.

| Material | Typical Use Case for electrical conductivity of sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | Power electronics, high-temp semiconductors | High thermal stability and chemical resistance | High manufacturing complexity and brittleness | High |

| Graphite | Electrodes, brushes, battery components | Excellent conductivity and cost-effective | Oxidizes easily at high temperatures | Low |

| Doped Silicon | Microelectronics, photovoltaic cells | Precise conductivity control and low cost | Limited high-temp and corrosion resistance | Medium |

| Silicon Nitride | High-temp substrates, mechanical components | Superior toughness and thermal shock resistance | Lower and inconsistent electrical conductivity | High |

This guide equips international B2B buyers with a clear understanding of material trade-offs for electrical conductivity applications involving SiC, enabling informed procurement decisions aligned with regional standards and application demands.

Understanding the manufacturing workflow for SiC materials tailored for electrical conductivity applications is crucial for B2B buyers aiming for optimal product performance and reliability. The process is highly specialized, involving several critical stages:

Illustrative Image (Source: Google Search)

Quality assurance (QA) and quality control (QC) are paramount for maintaining consistent electrical properties and reliability in SiC components. International B2B buyers should look for suppliers with robust QA/QC systems aligned with global standards.

Illustrative Image (Source: Google Search)

For international buyers—especially those in Africa, South America, the Middle East, and Europe—verifying supplier QC processes is critical to mitigate risks and ensure product integrity.

By thoroughly understanding the manufacturing intricacies and quality assurance frameworks behind SiC electrical conductivity materials, international B2B buyers can make informed decisions that optimize performance, compliance, and supply chain resilience.

Understanding the cost structure behind sourcing electrical conductivity silicon carbide (SiC) is crucial for international B2B buyers aiming to optimize procurement budgets and ensure product quality. The main cost components include:

Raw Materials: High-purity silicon and carbon sources are essential. The quality of raw materials directly influences the electrical conductivity performance, thus commanding a significant portion of the cost. Suppliers using advanced purification processes typically charge premium prices.

Labor: Skilled labor is needed for precise synthesis, sintering, and doping processes that tailor SiC’s electrical properties. Labor costs vary by region, with European manufacturers generally incurring higher wages compared to some Asian or South American counterparts.

Manufacturing Overhead: This includes energy consumption (high-temperature furnaces), facility maintenance, and utilities. SiC production is energy-intensive, making overhead a substantial contributor to final costs.

Tooling and Equipment: Specialized equipment for crystal growth, doping, and finishing impacts initial tooling costs. Amortization of these capital expenses is factored into pricing.

Quality Control (QC): Rigorous testing for electrical conductivity, purity, and structural integrity is mandatory. Advanced QC methods such as four-point probe measurements and microscopy add to the cost but are critical for reliability.

Logistics: Shipping SiC materials involves careful handling to prevent contamination or damage. Logistics costs depend on shipping mode, distance, and customs procedures, which can be complex for African and South American buyers due to variable port infrastructure and import regulations.

Supplier Margin: Profit margins vary by supplier scale, market positioning, and competitive landscape. Premium suppliers with certifications and strong reputations may charge higher margins.

Several factors affect the final pricing of SiC materials with specific electrical conductivity properties:

Order Volume and Minimum Order Quantities (MOQ): Larger orders typically secure better unit pricing. Buyers from regions like Europe or the Middle East should negotiate volume discounts or consider consortia purchasing to meet MOQ requirements economically.

Specifications and Customization: Tailored doping levels or particle sizes drive costs higher than standard grades. Precise electrical conductivity targets require more controlled processes, increasing complexity and price.

Material Quality and Certifications: Compliance with international standards (ISO, RoHS, REACH) and supplier certifications (e.g., IATF 16949 for automotive-grade SiC) command premiums but reduce risk and enhance acceptance in regulated markets.

Supplier Location and Capabilities: Proximity to manufacturing hubs in Asia or Europe can reduce lead times and logistics costs. However, some specialized suppliers in North America or Japan may offer superior quality at higher prices.

Incoterms and Payment Terms: The choice of Incoterms (FOB, CIF, DDP) influences who bears shipping and customs costs, affecting total landed cost. Flexible payment terms or letters of credit can improve cash flow management for buyers.

To maximize cost-efficiency and procurement success, buyers should consider the following:

Negotiate Beyond Price: Engage suppliers in discussions about payment terms, lead times, and after-sales support. For buyers in Africa or South America, negotiating favorable logistics arrangements can offset higher base prices.

Evaluate Total Cost of Ownership (TCO): Consider downstream costs such as rework, scrap rates, and warranty claims that result from lower-quality SiC. Investing upfront in certified, high-quality materials often reduces overall expenses.

Leverage Regional Trade Agreements: Buyers in Europe (e.g., Poland, Spain) and the Middle East should explore sourcing from countries with favorable trade agreements to reduce tariffs and import duties.

Plan for Specification Flexibility: If tight electrical conductivity tolerances are not critical, opting for standard grades can significantly reduce costs without compromising application performance.

Assess Supplier Stability and Capacity: Prioritize suppliers with proven track records and sufficient production capacity to avoid disruptions, especially for large or repeat orders.

Pricing for electrical conductivity SiC materials varies widely based on specifications, supplier capabilities, and market conditions. The information provided serves as an indicative framework to guide international B2B buyers and should be validated with direct supplier quotations and current market analysis.

Understanding the critical technical specifications of silicon carbide (SiC) related to electrical conductivity is essential for B2B buyers to ensure the material meets their application needs. Here are the most important properties to consider:

Material Grade and Purity

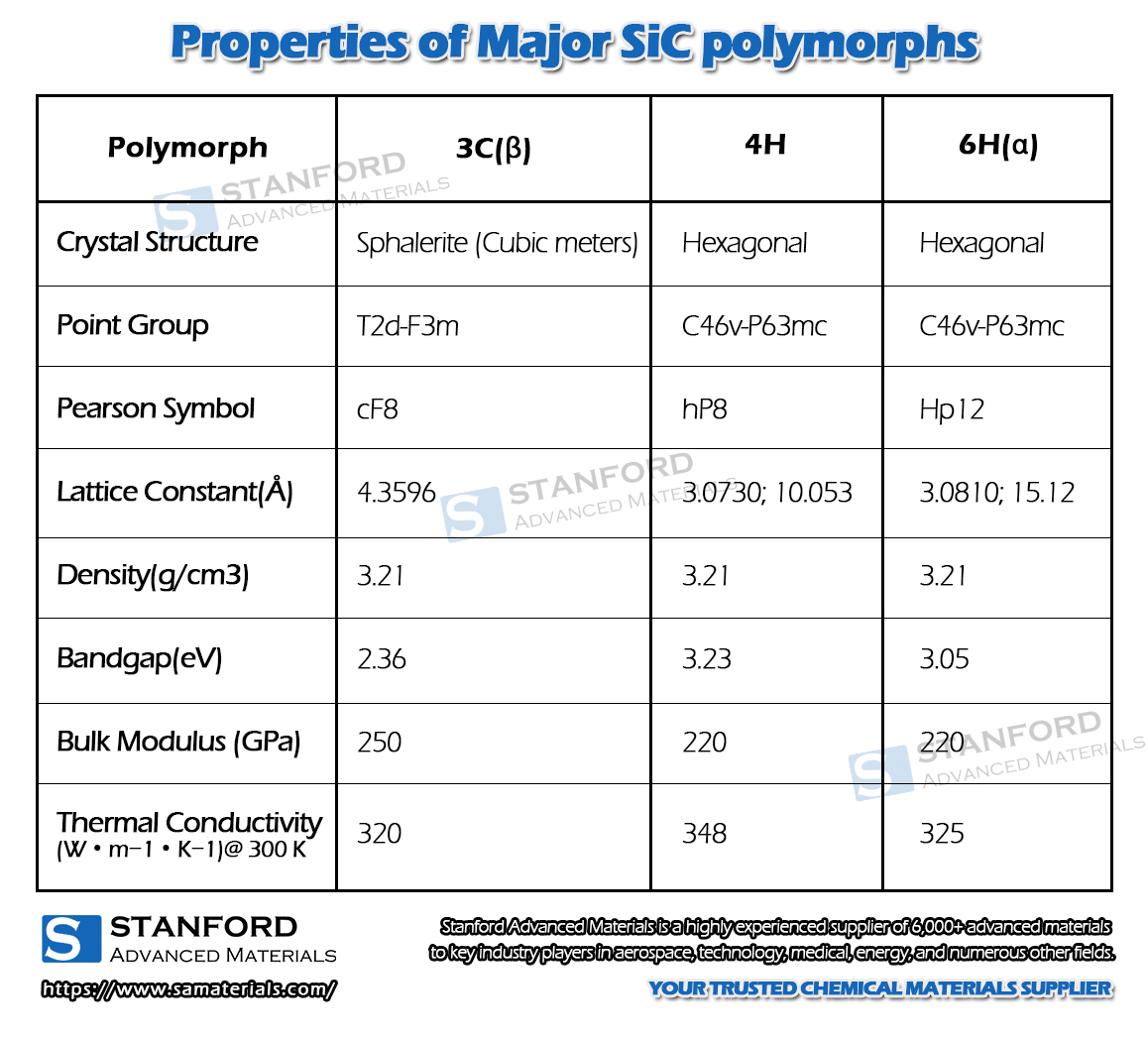

SiC is available in various grades, such as alpha (α-SiC) and beta (β-SiC), each with distinct crystalline structures affecting conductivity and thermal stability. High-purity SiC enhances electrical performance by reducing impurities that can impede conductivity. For buyers, selecting the appropriate grade ensures optimal performance in electronics or power devices.

Electrical Resistivity

This measures how strongly SiC opposes electric current, typically expressed in ohm-centimeters (Ω·cm). Lower resistivity indicates higher conductivity. Buyers need to specify resistivity to match device requirements, as it directly influences efficiency and heat generation in electrical components.

Doping Level

Doping involves adding impurities to SiC to modify its conductivity. Common dopants include nitrogen or aluminum. The doping concentration determines carrier concentration and mobility, impacting the material’s conductive behavior. For procurement, clarity on doping specifications is vital to ensure compatibility with semiconductor manufacturing processes.

Thermal Conductivity

While not directly related to electrical conductivity, thermal conductivity is crucial because SiC’s ability to dissipate heat affects device reliability. High thermal conductivity helps prevent overheating in power electronics. Buyers should balance electrical and thermal properties based on operational environments.

Tolerance and Dimensional Accuracy

Precision in particle size, shape, and bulk density affects packing density and uniformity in composites or sintered parts. Tight tolerances reduce variability in conductivity performance. For international buyers, understanding these specifications can prevent quality issues and ensure seamless integration into manufacturing.

Surface Resistivity and Contact Resistance

These parameters influence how SiC interfaces with metal contacts or other materials in devices. Lower contact resistance improves overall electrical performance. Buyers should request detailed data sheets specifying these values to assess suitability for high-frequency or high-power applications.

Navigating the procurement and negotiation process for SiC products requires familiarity with common industry terms. Here are key terms buyers should know:

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or systems used in another company’s end products. Knowing if the SiC supplier works with OEMs can indicate product quality and reliability. Buyers in Africa, South America, or Europe can leverage this to ensure compatibility with established equipment standards.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQ impacts pricing and inventory decisions. For B2B buyers, especially those in emerging markets, negotiating MOQ can optimize supply chain costs and reduce capital tied in stock.

RFQ (Request for Quotation)

A formal process where buyers solicit price and delivery terms from suppliers. An RFQ should clearly specify technical requirements like electrical resistivity and doping levels to get accurate quotes. Effective RFQ management speeds up sourcing and avoids miscommunication.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers from different regions manage logistics costs and risks confidently.

Lead Time

The period between placing an order and receiving the product. Critical for planning production schedules. Buyers should clarify lead times upfront to avoid delays, especially when sourcing SiC from international suppliers.

Batch Number / Lot Traceability

Identifies the production batch for quality control and warranty claims. Traceability is crucial for high-value SiC materials to ensure consistency and address any defects. Buyers should request batch documentation as part of quality assurance.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed purchasing decisions, negotiate effectively, and secure silicon carbide materials that meet their electrical conductivity requirements with confidence.

The market for silicon carbide (SiC) materials with tailored electrical conductivity properties is witnessing robust growth driven by the expanding demand for high-performance power electronics, electric vehicles (EVs), renewable energy systems, and industrial automation. Globally, SiC’s superior electrical conductivity, thermal stability, and mechanical strength position it as a key enabler in next-generation semiconductor devices and power modules.

Key global drivers include the transition to electrification and energy-efficient technologies, especially in regions like Europe, where stringent energy regulations and aggressive EV adoption (notably in countries like Poland and Spain) fuel demand. The Middle East and South America are increasingly investing in renewable infrastructure, creating new opportunities for SiC-based components. Africa’s growing industrial base and energy sector modernization also open avenues for sourcing advanced SiC materials.

Emerging B2B sourcing trends highlight a move towards integrated supply chains with suppliers offering end-to-end solutions—from raw SiC powders to finished components with controlled electrical conductivity specifications. Buyers emphasize partnerships with manufacturers demonstrating technological innovation in doping processes and surface treatments that optimize electrical properties for specific applications.

Market dynamics show increasing consolidation among key SiC producers, coupled with the rise of specialized startups focusing on niche conductivity grades. International buyers are advised to leverage supplier certifications, technology roadmaps, and regional production capabilities to mitigate supply risks. Additionally, digital procurement platforms and real-time quality analytics are becoming essential tools for efficient sourcing and compliance monitoring.

For buyers in Africa, South America, the Middle East, and Europe, aligning sourcing strategies with regional industrial policies, tariff frameworks, and logistics infrastructure is critical. Establishing local partnerships or regional distribution hubs can reduce lead times and enhance supply chain resilience.

Sustainability considerations are increasingly integral to the procurement of silicon carbide materials, especially regarding their electrical conductivity performance which directly impacts energy efficiency in end-use applications. The environmental footprint of SiC production involves energy-intensive processes such as carbothermal reduction and chemical vapor deposition, highlighting the need for greener manufacturing approaches.

Environmental impact reduction is achievable through adopting renewable energy sources at production facilities, optimizing raw material usage, and recycling SiC scrap and byproducts. Buyers are encouraged to engage suppliers who demonstrate measurable carbon footprint reductions and water conservation initiatives.

Ethical supply chains are paramount, particularly for international B2B buyers sourcing from diverse regions. Transparent sourcing policies that ensure conflict-free raw materials and fair labor practices are vital to maintain brand integrity and comply with global trade regulations. Certifications such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety) serve as important benchmarks.

Furthermore, the market is witnessing the emergence of “green” SiC materials, where doping agents and processing chemicals are selected for minimal toxicity and environmental persistence. This aligns with the increasing demand for sustainable electronics and components compliant with regulations such as the EU’s REACH and RoHS directives.

For buyers in Europe, South America, the Middle East, and Africa, incorporating sustainability criteria into supplier evaluations not only enhances corporate social responsibility but also future-proofs supply chains against evolving regulatory landscapes and consumer expectations.

Silicon carbide’s electrical conductivity has been a subject of extensive research and development since its discovery in the late 19th century. Initially prized for its hardness and thermal properties, the focus on its electrical characteristics gained momentum in the mid-20th century with advances in semiconductor technology.

The evolution from bulk SiC crystals to finely tuned doped materials enabled the creation of power devices capable of operating at higher voltages, frequencies, and temperatures than traditional silicon. Innovations in doping techniques, such as nitrogen and aluminum incorporation, have allowed precise control of conductivity types (n-type and p-type), crucial for device performance.

In recent decades, the surge in electric vehicle and renewable energy applications has accelerated the commercial availability of SiC with customized electrical conductivity profiles. This historical progression underlines the material’s transition from a niche industrial compound to a cornerstone of modern power electronics, shaping sourcing and procurement strategies for global B2B buyers today.

How can I effectively vet suppliers of silicon carbide (SiC) materials based on their electrical conductivity properties?

To vet SiC suppliers, prioritize those with transparent technical datasheets detailing electrical conductivity measurements under various conditions. Request samples for independent lab testing to verify conductivity claims. Check supplier certifications such as ISO 9001 and industry-specific standards, and review their track record with international clients, especially from your region. Engage in direct communication to assess technical support responsiveness. Finally, consider suppliers offering customization and quality assurance guarantees, which demonstrate confidence in their product consistency.

Is it possible to customize the electrical conductivity of SiC materials to meet specific application requirements?

Yes, many manufacturers can tailor the electrical conductivity of SiC by adjusting doping levels, grain size, and purity during production. When sourcing, clearly specify your conductivity range and operating environment to ensure the supplier can meet these requirements. Customization may affect lead times and minimum order quantities (MOQs), so discuss these factors upfront. Collaborating closely with the supplier’s R&D team can optimize material properties for your application, reducing trial costs and enhancing performance.

What should international B2B buyers know about minimum order quantities (MOQs), lead times, and payment terms for SiC with specific electrical conductivity?

MOQs vary widely depending on the supplier and the degree of customization required. Standard SiC batches often have lower MOQs, while specialized conductivity grades may require larger orders. Lead times can range from a few weeks to several months, particularly for custom specifications. Payment terms typically involve upfront deposits or letters of credit, especially for new buyers or large orders. Negotiate terms that balance risk and cash flow, and consider suppliers experienced in exporting to your region to avoid delays.

What quality assurance (QA) certifications and testing should I require from suppliers of SiC materials?

Request suppliers to provide ISO 9001 certification as a baseline for quality management. Additionally, seek evidence of electrical conductivity testing under standardized conditions (e.g., ASTM or IEC standards). Certificates of Analysis (CoA) should accompany shipments, detailing batch-specific conductivity values and material purity. For critical applications, consider third-party verification or factory audits. Ensuring robust QA processes minimizes risks of receiving inconsistent or substandard SiC materials.

How can I manage logistics and shipping challenges when importing SiC materials internationally?

Due to the specialized nature of SiC, ensure your supplier understands international shipping regulations and packaging requirements to prevent contamination or damage. Work with freight forwarders experienced in handling industrial ceramics and hazardous materials if applicable. Plan for customs clearance by preparing accurate HS codes, certificates, and compliance documents. For buyers in Africa, South America, the Middle East, and Europe, select suppliers with established shipping routes to your region to optimize transit times and costs.

What are common dispute scenarios in international SiC transactions, and how can I mitigate them?

Disputes often arise from discrepancies in material specifications, delayed deliveries, or payment disagreements. To mitigate risks, establish clear contracts specifying electrical conductivity tolerances, inspection protocols, delivery schedules, and payment milestones. Use Incoterms to define responsibility for shipping risks. Maintain detailed communication records and consider escrow payment arrangements for large orders. In case of disputes, seek resolution through arbitration or mediation clauses tailored to your jurisdiction and supplier location.

How do regional regulations affect the import and use of SiC materials with specific electrical conductivity?

Import regulations for SiC vary by country and may include restrictions related to chemical composition, safety standards, and environmental compliance. For example, EU countries like Poland and Spain enforce REACH regulations requiring detailed material disclosures. Middle Eastern and African importers should verify customs tariffs and any hazardous material classifications. Engage local trade experts or customs brokers to ensure compliance, avoiding costly delays or fines that could disrupt supply chains.

What payment methods are safest and most efficient for international purchases of SiC materials?

Secure payment methods such as Letters of Credit (LCs) and Escrow services provide protection by ensuring funds are released only after agreed contract terms are met. Wire transfers are common but riskier without a trusted supplier relationship. Digital payment platforms with buyer protection may be available but verify their acceptance in your supplier’s country. For first-time transactions, request partial upfront payments combined with balance upon delivery to minimize financial exposure while establishing trust.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of sourcing silicon carbide (SiC) materials with optimal electrical conductivity, international B2B buyers must prioritize strategic partnerships and thorough supplier evaluation. Key considerations include the material’s purity, doping methods, and manufacturing consistency, all of which significantly impact performance in high-power and high-frequency applications. Buyers from Africa, South America, the Middle East, and Europe should leverage regional expertise and local market dynamics to identify suppliers who can deliver both quality and supply chain resilience.

Strategic sourcing of SiC with tailored electrical conductivity profiles enables businesses to enhance product reliability, reduce operational costs, and accelerate innovation cycles. Emphasizing transparent communication and rigorous quality assurance processes with suppliers will mitigate risks associated with variability in electrical properties.

Looking ahead, the increasing demand for advanced power electronics and sustainable energy solutions will drive further innovation in SiC materials. Buyers are encouraged to actively engage with emerging technology providers and participate in collaborative industry initiatives to stay ahead. By adopting a forward-thinking sourcing strategy, companies can unlock competitive advantages and contribute to the evolving global semiconductor landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina